Beauty retail is an industry at a crossroads. A sector resilient to crisis and change compared to other retail categories, cosmetic brands are beginning to feel the effects of the pandemic and ongoing industry changes.

In recent years, apparel and sports retailers have undergone digital transformations to stay competitive, and now beauty brands have an opportunity to follow suit. Read this eBook to discover how and why beauty retailing is set to transform into the industry of the future.

Beauty retail: An industry at a Crossroads

The apparel and sports retail industry have undergone mass change over recent years. Such retailers have undertaken digital transformation journeys in their store and distribution networks to adapt to digital-first customers and eCommerce competition. The beauty sector, however, is still behind the curve.

In most major beauty-industry markets, in-store shopping accounted for up to 85 per cent of beauty product purchases before the COVID-19 crisis – (McKinsey&Co) making the level of eCommerce penetration lower than in other retail sectors. While retailers in other categories have been forced to innovate and adapt in the face of falling brick-and-mortar sales, competition from eCommerce and direct-to-consumer models, brick-and-mortar beauty sales were more resilient.

But this is changing. Not only are eCommerce levels steadily increasing year-on-year, but the COVID-19 pandemic has accelerated this drastically, driving five years of change in a single year, according to

IBM. This leaves brick-and-mortar beauty retailers on unsteady ground. Beyond this, brands will have to navigate a more digital-centric environment and optimise margins to cope with reduced sales.

The good news is many of the challenges that are now facing beauty have been facing apparel or CPG for years. The digital solutions and strategies that have allowed apparel to adapt are well established and ready to deploy to the sector. The digital transformations that many apparel and sports retailers were forced to undergo will not only fit beauty retailers but will also help them solve older challenges. Beauty retailers may need to go on a similar journey to apparel, but the tracks are there to follow.

What is in the eBook?

- Beauty retailing at a crossroads

- Bringing beauty operations up-to-speed

- Accuracy redefining margins

- Fixing beauty’s shrinkage problem

- Catching up with the omnichannel trend

- Countering the Gray Market

- Becoming digital and analytics leaders

Radiofrequency identification (RFID) is one of the leading technologies in retail, helping brands transform their business while maximizing revenue. With COVID-19 accelerating the digitization of retail and meaning stores need to be as profitable as possible to survive, RFID is a must.

Register now and learn from some of the best in the industry: Detego, and the experts in retail IT integrations, Spencer technologies.

Main Takeaways:

- Why are Retailers implementing RFID?

- Common challenges for Retailers and how to tackle them

- How to select partners (Hardware, Software, Services)

- What do you need to run a pilot?

Meet the Speakers:

Lauren Hines – Lauren is a Senior Business Operations Manager. She’s a former Head of Global Networks at BT.

Umesh Cooduvalli – Umesh is a tech-driven VP of Sales for America. He’s using his extensive network within the Supply chain industry with a hunger for new challenges

Nate Strickler – Formely project and Marketing Manager, Nate is currently working closely with partners and network to develop opportunities with Spencer Technologies.

We are a year on from the start of the global Coronavirus (COVID-19) pandemic, and the world is still firmly in the grips of the crisis. But with vaccinations being rolled out globally things are certainly improving, and the end may well be in sight.

For retail, the outlook is similar. While more than 30 major retailers filed for bankruptcy last year (almost double that of 2019), the first green shoots are starting to appear. Most major brands have successfully pivoted to stay afloat during the crisis, and across both the US and Europe the rebound of the brick-and-mortar store seems imminent.

But what will post-pandemic retailing look like? How has the industry shifted in both the long and short term, and what can brands do to prepare for and capitalise on the beginning of retail’s recovery?

Early Signs of Retail’s Recovery from the USA and Europe

While nothing is for certain, most signs point towards this current period being the latter/final stage of the pandemic, particularly for Europe and the USA. With vaccinations beginning to roll-out at scale and many European countries beginning to ease restrictions and lockdowns, many experts are hopeful regarding the outlook for retail over the next few months.

Europe’s recovery: a mixed bag

Across Europe, the outlook is mixed. According to analysis from Business of Fashion and McKinsey & Co, whilst demand for struggling categories like fashion is predicted to increase, the ongoing effect of lockdowns is cause for concern. So, whilst recovery is expected, it will likely be to a lesser extent than other markets.

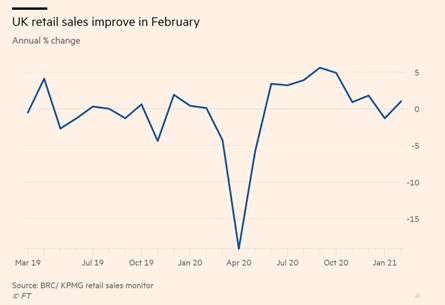

However, we have seen some encouraging signs despite lockdowns, as the BRC-KPMG retail sales monitor found that in February UK sales increased by 1% year-on-year. As stores are allowed to open back up the numbers will continue to improve, H&M said sales in the March 1st to March 13th period were up 10 per cent in local currencies as many countries, including single-biggest market Germany, began allowing some stores to reopen.

US recovery: encouraging signs for fashion and brick-and-mortar stores

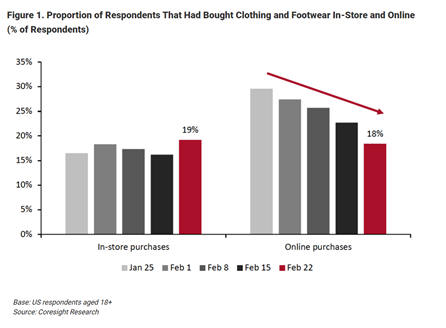

For the United States, the signs are fairly positive, with retail sales in 2021 expected to perform significantly better than in 2020, according to McKinsey and BoF. Additionally, recent findings from Coresight Research’s US Consumer Tracker found that, for fashion retail, the proportion of consumers that are purchasing clothing and footwear in-store was higher than those buying online for the first time since the pandemic – a major milestone for the sector’s recovery.

The report found several reasons for the US apparel industry to be optimistic, as 13% of respondents reported buying more clothing and footwear than pre-crisis, the highest level surveyed so far this year. Meanwhile, the apparel category witnessed the largest decline, of almost 6%, in consumers that are buying less than pre-crisis. Sales in apparel and other ‘discretionary’ categories were the worst affected by the pandemic, so these early signs of recovery are encouraging.

How have brands have shifted in the last year?

It’s been well reported how the global pandemic has affected shopping habits and caused a major increase in eCommerce penetration. According to data from IBM’s U.S. Retail Index (2020), the pandemic accelerated the growth of digital shopping by roughly five years.

This paradigm shift is reflected in the strategies of major retailers since the pandemic. With online becoming, at least temporarily, the primary shopping channel many retailers leant into and reinforced their eCommerce operations. But for the majority of retailers with significant physical store footprints, this was not enough, and the most successful brands developed their omnichannel offerings to better leverage their stores in the new digital-first world:

Buy Online, Pick Up in Store (BOPIS) is here to stay

Many retailers were investing in omnichannel services like BOPIS/Click and Collect well before the pandemic, but since then it has become something of a must-have and may remain so well beyond the pandemic. Retailers that had invested in Omnichannel before last year have reaped the benefits, as BOPIS saw YoY growth of 130% in June 2020. These retailers include US powerhouse Target who saw their curbside delivery service grow 500% year-on-year.

Stores as fulfilment centres

Similarly, brands with the infrastructure and agility to do so have been investing and leaning into in-store fulfilment throughout the pandemic. The advantages of this are considerable as it allows retailers to leverage their stores to service online customers. Target again made massive gains from this last year, reporting fulfilling 90% of their online orders directly from their stores, cutting fulfilment costs by 90% and contributing to a 100% increase in online sales compared to 2019.

Major fashion retailers are betting on Direct to Consumer (DTC)

Another major strategic shift that we have seen accelerated by the pandemic is the direct-to-consumer model. Although this model is nothing new, the fact that major global fashion retailers like Nike, adidas and Levi’s are evolving their strategy to become DTC-first is hugely significant. At the height of the pandemic, adidas saw their eCommerce sales increase by 93% but don’t think of this as a temporary shift – adidas recently announced that they’re aiming for DTC to account for 50% of their sales by 2025.

Long-term strategies taking shape?

So, what can we learn from these changes? Are these simply temporary shifts to navigate unprecedented times, or are they indicative of long-term industry change? The answer seems somewhere in the middle. Although the huge increase in digital sales that were seen at the height of the pandemic is already starting to fall away, the consensus is that a proportion of this change will be ‘sticky’ and digital sales will permanently remain higher than pre-pandemic levels.

As for brands exploring new models like DTC and Omnichannel, there is no doubt that these strategies will continue and remain relevant well beyond the pandemic. The demand and benefits of such models were there pre-COVID, and these changes have simply been accelerated.

The fact that many of these examples of omnichannel success come from the US is no accident. With the states having had fewer full lockdowns than their European counterparts, the success of these strategies could make a valuable lesson for European retailers looking to navigate the coming year – as consumer sentiment remains unstable and may well be signs of a more long-term shift in retail globally.

Preparing for Retail’s recovery: Short-term priorities

Taking Stock: Inventory Control will be Vital for Reopening Stores

As stores come out of lockdown across Europe, taking control of inventory will be a top priority. The first step will be taking stock and ensuring brands know exactly what they have in their inventories. For some stores, inventory management may have broken down due to lockdowns, particularly if stores have been used to fulfil online orders but do not have the IT infrastructure to keep effectively manage this.

Beyond this, the question of older or out-of-season products will present a challenge. Stores will already be dealing with bloated inventories due to lower sales and shutdowns, so maintaining optimal inventory levels and potentially selling marked-down products to make room for new stock will be a priority.

Continue to leverage online

Retailers should have invested in their digital channels at the start of the pandemic (and ideally before this). Even with stores opening back up, the increase in digital sales will remain high initially, and some will be sticky post-pandemic – just how much remains to be seen.

Retailers who continue to invest and develop in their digital and omnichannel offerings will profit post-pandemic. We have seen plenty of evidence supporting this from both the US and Chinese markets, so European retailers should follow suit and continue to offer flexible options to customers, many of whom may remain sceptical about returning to stores for some months to come.

Mastering fulfilment

With this consumer uncertainty and ongoing eCommerce penetration – making sure retailers deliver on fulfilment remains a priority. We can again look to target as an example, their same-day delivery sales went up 218% this quarter, showing the opportunity is there for retailers who can go the extra mile with their fulfilment, and even dare to compete with the eCommerce powerhouse of Amazon.

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Detego Store is a cloud-hosted RFID solution which digitises stock management processes, making them more efficient and more accurate. Implemented within hours, our multi-user app can provide intelligent stock takes and a smart in-store replenishment process. Later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

If you’re always reading about item-level data or item-level inventories but aren’t sure what all the fuss is about, we’re here to explain. It’s not just another retail tech buzzword, it tells the story of an industry transforming, the first step in a global shift from analogue to digital retailing (and we aren’t just talking about Ecommerce here).

When a retailer’s IT systems work on an item-level, they can identify, count, track and trace each individual product. While it sounds simple enough, in theory, it’s harder to do in practice and has only recently been made possible by new technology like RFID.

The benefits are huge, and while we will explore them in more detail, they include running leaner and more efficient stores, stronger supply chains and powerful data and insights.

Before we do that, lets briefly cover the current (or old, arguably) alternative to this: a stock keeping unit or (SKU).

What is a stock keeping unit?

A Stock Keeping Unit uses a basic code that specifies the identity of a product – for example, a plain white t-shirt, size L.

One of the main differences here is that an SKU can (and should be) logged and counted multiple times, for example, if you are counting those 10 white t-shirts, you are counting the same SKU 10 times.

Barcodes tend to operate on SKU’s, and you can scan the same barcode over and over.

- Specifies the product type and size

- Is counted multiple times

What does item-level data mean?

For retailers, working on an item-level simply means treating each item as a unique, identifiable piece of merchandise.

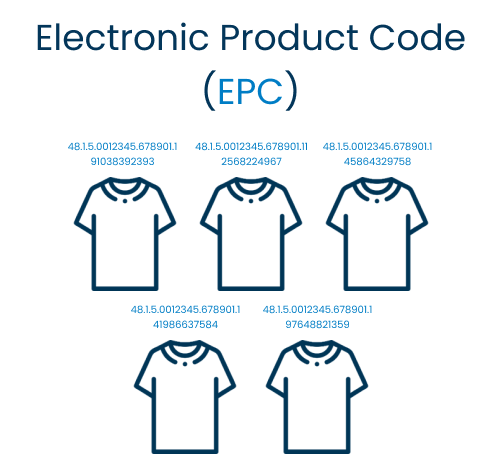

On the technical side, that means each item must have a unique code – called an Electronic Product Code (EPC).

Effectively, item-level data means being able to tell the difference between 10 medium white t-shirts. With EPCs, you could replace one of those 10 with another of the same item and be able to identify the new one from its unique code.

This might seem arbitrary, but it is one of the key drivers of transformation and change in the way retailers manage their stores and supply chains in recent years. Removing the human error element is one thing, but the unique ID’s open the door to much more.

These unique product codes are what makes RFID possible, as hundreds of radio signals can be emitted and read at once. Since each item has a unique ID there is never any risk of counting something twice. This means its possible to do store stocktakes in a matter of minutes, and verify items going through the supply chain without even opening up the box!

Additionally, the item-level data makes the world of difference when it comes to the supply chain.

If you were to track items on an SKU level within the supply chain, it would only tell you how much of each product passes through. Even this is too time-consuming, however, as it would require opening boxes and scanning individual bar codes, so instead DC’s and factories scan boxes, and operate on a carton level.

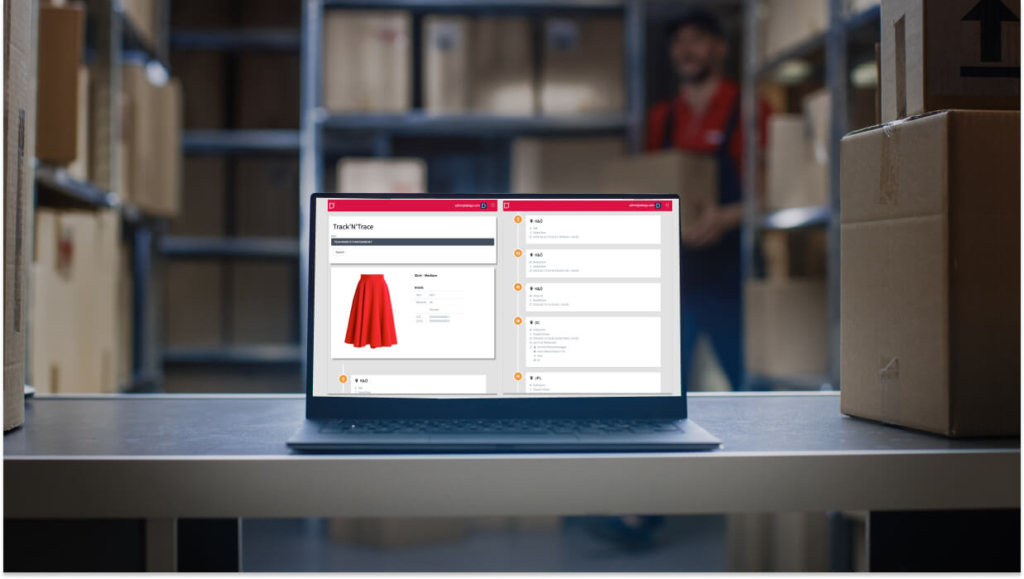

With item-level verification inbound and outbound at DCs, the individual contents can be counted and checked (via radiofrequency). These unique product IDs mean another whole layer of data, individual items can be tracked and traced from source to store.

- Can’t count items more than once

- Makes rapid inventory counts possible

- Individual product codes mean you can track and trace items across the supply chain

- More accurate data across the supply chain

The benefits of item-level retailing

The Detego Platform – Delivering item-level data to retail

The Detego platform is the definitive solution for delivering and utilising item-level data for retailers. The RFID platform covers every step of the item journey, from factories to distribution centres, to stores. Track and trace individual products across the supply chain, perform store stocktakes in minutes and take the guesswork out of retail. If you’re a retailer with several or even hundreds of stores, the Detego platform is purpose-built to get the most out of your stores and supply chain.

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Detego Store is a cloud-hosted RFID solution which digitises stock management processes, making them more efficient and more accurate. Implemented within hours, our multi-user app can provide intelligent stock takes and a smart in-store replenishment process. Later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

Knowing what’s in your store is essential to running a profitable retail business, whether it’s an independent boutique or a store in a chain of thousands. There are two things that keep stores ‘In the know’ when it comes to their inventory, stocktakes and their inventory management systems. A stocktake allows you to establish your view of inventory (at reasonable expense and effort) whereas the better your inventory management system is, the longer that view of stock stays accurate.

Even if your inventory management is top quality, without regular stocktakes accuracy will begin to slip. Factors like theft, admin errors and stock movement will mean that before too long the stock file and the physical inventory become increasingly out of sync.

This problem is multiplied the bigger a retailer’s footprint is. When looking at hundreds or even thousands of stores, stock inaccuracy can add up to unthinkable amounts of capital. Just look at British retailer Ted Baker who last year discovered a £58M hole in their business, entirely due to inventory mismanagement!

For many retailers then, stocktaking is considered a necessary evil. But doing a wall-to-wall count of every individual product in a store is no mean feat. Physical inventories come at great cost: time, money, and overall efficiency. As a result, many stores only perform an annual or bi-annual stocktake, but these leave a lot to be desired.

Let’s go through how and why annual stocktakes can be so expensive to perform and even ask, can retailers afford to go on like this?

The cost of annual stocktakes

The upfront cost

Physical inventory counts are big operations that are expensive to perform. Doing a wall-to-wall stocktake of everything in a store (backroom and salesfloor) takes a lot of time and manhours. To perform a physical inventory count, retailers have two options:

Carry out the stocktake internally

One option is for a store to carry out the inventory itself. This is tricky but not impossible, provided the staff are organised, attentive and know what they’re doing. The major downside is how labour intensive it is, requiring a lot of store staff, making working around opening hours difficult (more on this later).

For independent or particularly well-staffed stores, internal stocktakes can work. The issue is it does not scale. For a retailer with hundreds of stores, asking every one of them to perform such an operation once or twice a year puts a lot of pressure on store management – and the results will be inconsistent at best

Use a third-party service

Using a specialist service to perform the physical inventory does have its advantages. First off, the accuracy of the stocktake is likely to be more reliable, and it is easier to scale up the use of such a service to more and more stores. The major downside is the considerable cost. Whilst it depends on the service used and the size of the store, these stocktakes can cost around $2000 – $3000 per store. Assuming each store only performs such a count once a year, when scaled across tens or hundreds of stores, the cost becomes immense.

The disruption to stores

Regardless of who you have performing the physical stocktake, the other question is when. A full inventory takes time, whilst it naturally depends on the size of the store and the team, it will likely take half a day at a minimum.

If the store is closed once a week, then this is the obvious choice. However, larger brands can often operate seven days a week…

So that leaves retailers with another difficult choice – close the store, or perform the stocktake overnight? Naturally, closing the store means losing sales and disrupting customers. While performing the inventory count overnight can make for a tight schedule.

An overnight inventory count is more doable (and common) when using a third-party, but it is not always feasible if you are using internal staff. Not only are you asking (and paying) for staff to come in out of hours, but you also will not be able to use that set of staff of either day either side of the overnight stocktake – making it incredibly difficult for smaller teams.

The suboptimal results

So those are the implications for actually performing annual/bi-annual stocktakes for retail stores, but there is something else to consider…

The fact is manual inventory counts give you subpar results. Even with supporting technology like barcode scanners, the margin for manual error is still significant meaning right from the outset you will still have errors and discrepancies. A much bigger factor – performing stock counts once or twice a year is simply not enough anymore. Sure, you may have 90% accuracy every 6 months, but what about the time in-between?

Typically store inventories run at 60-80% Item Level accuracy. However, stores will rarely report such low numbers because:

A) They only calculate accuracy after a stocktake

B) They are working on an SKU (stock-keeping Unit) level, and not an item-level.

C) Errors in stocktaking procedures mean stock file and actual inventory do not match, i.e., the accuracy quoted is not accurate

This level of stock inaccuracy also comes at a cost – and it’s a steep one. Stock inaccuracy causes three problems for stores.

Overstock – Excess stock, a result of the inventory list not showing items that are present in the store. Often compounded by stores carrying ‘safety stock’ for key products.

Understock – A lack of product, a result of the store inventory showing items that aren’t really there. Also called ‘phantom stock’, one of the main causes of this is theft. Understock leads to products becoming out-of-stock altogether, meaning lost sales and revenue.

Dead Stock – For perishable products, dead stock means products that can no longer be sold. While sectors like fashion don’t have this problem having stock sat unsold in backrooms can lead to products falling out of season, resulting in mark-downs and profit loss.

The bottom line of this inaccuracy? 10-15% higher working capital in stores, as a result of bloated inventories, and 5-10% of sales being lost simply due to stock not being available for customers to buy.

The alternatives to annual stocktakes

Cycle counts

A cycle count is where a store performs a partial count of a specific portion of store stock. Instead of performing an annual stock take once or twice a year, you might perform a cycle count several times a quarter. Essentially, you are breaking down the annual count into several mini stocktakes.

This has many benefits over annual stocktake – less disruption to the store, less labour intensive and (since it can be done by store staff) it’s cheaper. It can also help avoid the large variation that you get when there is a larger gap between takes.

While this is certainly better, cycle counts require a lot of coordination and still have the same problem as all manual stock counts: they are time-consuming and inaccurate. So, whilst cycle counts will reduce the costs compared to annual stocktakes, the cost of the inaccuracy will stay the same.

RFID

Having looked at the costs and problems associated with manual yearly stocktakes, you’d be forgiven for thinking successful large-scale brands don’t operate like this – and they don’t.

Radiofrequency Identification (RFID) is a technology that allows stores to perform rapid inventory counts, via product tags that emit a small radiofrequency. Stores that have implemented RFID can perform weekly or even daily stocktakes, as a single member of staff with an RFID reader can count thousands of items in minutes. The result of this is RFID stores have typical inventory accuracy of 99%, and no more need of annual stock takes.

Installing RFID in stores is a reasonably big project and requires some upfront investment. However, if you look at the cost of performing third-party stocktakes every year alone that money could be used to fund the RFID project and it delivers a stronger return of investment than regular physical inventories. This without mentioning the various other benefits of the technology, which you can read about here.

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Detego Store is a cloud-hosted RFID solution which digitises stock management processes, making them more efficient and more accurate. Implemented within hours, our multi-user app can provide intelligent stock takes and a smart in-store replenishment process. Later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

It’s time to close the curtain on what’s been a challenging year for all. Retail has been under immense pressure this year, but through perseverance, partnership and innovation, we are beginning to come out of the other side.

While it might be tempting to move on from this year and not look back, we feel it’s important to look back and take stock of the biggest developments and stories of the year, good and bad.

Let’s explore the major themes of the year for retail, and revisit some of the content and updates that have told the story of 2020.

COVID-19: Charting a Course Through Unprecedented Times

COVID-19 was the defining event of 2020. The pandemic was devasting to people, communities and businesses. Our day-to-day was transformed overnight, with life and work becoming remote-first and priorities and plans being rethought and reassessed. For retail, with stores being closed, many people under financial pressure and working from home, revenue dropped massively. Not only this but COVID-19 will have a lasting effect on the industry, with experts predicting it accelerated industry change by five years.

Looking Ahead to 2021

But what about looking ahead to next year? Keeping an eye on upcoming trends is always important, this year even more so. While it’s comforting to think that the pandemic will be a thing of the past next year, the reality is it will remain a factor. More significant will be the ‘hangover’ of the post-pandemic, which will have huge implications on the industry and its priorities for the coming year. We explored what these priorities and subsequent trends will be in a recent series:

The Ongoing Digitial Transformation of Retail

We have been calling for, and leading the way in, digital transformation in retail for over ten years, and this year has been no different. Now more than ever, retailers need to innovate and improve their systems and processes to keep up with modern retailing. The benefits that digital transformation can deliver such as reduced costs, increased sales and better online/offline integration will be vital for retailers in the wake of the pandemic and beyond. Retail digital transformation is what Detego does, and this year we’ve been discussing this in more ways than ever before. Whether you’re still discovering why, or need to learn how, we have resources to help you get started.

Building the Supply Chain of the Future

We’ve been innovating and supporting retail stores for over 10 years with RFID. Alongside our customers and partners, we have increasingly been moving upstream and digitising and future-proofing the supply chain. This year, with the focus being on eCommerce and online shopping, supply chain innovation has been front and centre. RFID in the supply chain is an exciting topic and the results and developments from deploying RFID in factories and distribution centres are impressive. Whether its achieving complete supply chain visibility, optimising against shrinkage or building automated DC’s fit for the future, the technology has a lot to offer. Explore it here:

Building Partnerships

This year more than ever, building strong partnerships has been essential. At Detego, we have always prided ourselves on building good relationships and effective collaboration. This year, we have continued working alongside our amazing customers and clients and have even developed new ones to strengthen projects and products in the future.

Want to see how RFID can transform your business? Book a demo today

In the final instalment of our series exploring predicted retail trends for the coming year, we analyse why online order fulfilment will be a key metric for 2021. With COVID-19 causing an unprecedented acceleration in the shift towards eCommerce, retailers must quickly adapt and strengthen their fulfilment capabilities to ensure they can keep up with the higher demand. Read on to learn what the priorities are for retailers to achieve this, and what technologies are delivering the answers.

Why fulfilment will be a priority in 2021

Online shopping or eCommerce has been steadily growing since its invention. This means that the number of online orders that a retailer needs to fulfil gradually goes up year-on-year. The gradual increases required to a retailer’s order capacity are normally easy enough to anticipate and plan for. Like so many other things, however, 2020 kicked this idea to the curb.

This year has seen a massive shift towards eCommerce as a result of COVID-19. Even after things go back to normal, experts predict that a large portion of this growth will remain. In fact, according to data from IBM’s U.S. Retail Index, the pandemic has accelerated the shift away from physical stores to digital shopping by roughly five years. Online or multichannel retailers are therefore faced with dealing with a seismic shift in the industry. Many brands will have to deal with the fact that the sudden shift may put the demand for online orders beyond their current capacity for fulfilment. Retailers then need to strengthen and invest in their fulfilment capabilities to avoid being caught out. But where to look first?

What are the priorities for retailers looking at fulfilment in 2021?

So, when we say fulfilment will be a key priority for retailers, what exactly does that mean? What are the limiting factors for online fulfilment, or, in other words, what areas will struggle without additional investment or technology?

Online capacity

The first step in any online purchase – a customer going online in the first place. For a webshop, or indeed any website, capacity simply means the number of visitors it can support. How much capacity is needed will vary, for example – this website does not need to have the same capacity as Amazon (at least for now). With regular demand, capacity is easy enough to get right. It’s sudden shifts or surges that can cause problems. We have all likely experienced this ourselves at one time, with a recent example being the PlayStation 5 UK launch crashing several major retailer’s sites! With eCommerce numbers predicted to stay high – web store capacity may need some attention.

Delivery speed

Delivery is one of the biggest challenges (and costs) of online retailing. Shipping products across an entire country at scale is already a challenge. What makes it worse is customers are starting to expect more and more from online retailers. Amazon has set the bar high for this, with next-day and free delivery now more and more sought after by customers. As eCommerce channels grow in popularity, retailers may find their delivery models only scale to a point.

DC efficiency

Supply chain bottlenecks can be a killer for fast online fulfilment. The most likely place for this to occur is where the majority* of online orders are shipped from – the distribution centre. If the way orders are being processed is time-consuming or inaccurate, the whole process can slow down. This supply chain efficiency is particularly important for new products (go-to-market) or restocking OOS (out-of-stock) products. If the process for a DC receiving and processing goods is not efficient enough, drastically increasing the number of products required for the DC to process could cause problems.

.

Operational costs

The final big consideration for retailers attempting to scale up their fulfilment capabilities: the cost! All of the previous points are also examples of running costs associated with fulfilling online orders. Many retailers, particularly multichannel, often struggle ensuring their eCommerce arm stays profitable as the margins are much finer. If the balance between online and offline shifts too much, those fine margins could cause problems. Next year will see many of these retailers invest in their fulfilment processes to reduce long term costs and keep their increasingly crucial online channels sustainable.

Is ship-from-store the answer?

One of the leading trends with retailers investing and expanding their online fulfilment capacity is ship-from-store, also known as in-store fulfilment. SFS is an omnichannel retail strategy where retail stores are used to fulfil online orders, essentially leveraging stores as miniature distribution centres! The strategy has many advantages including taking pressure off of DC’s, reducing shipping costs and increasing delivery time. Ship-from-store also benefits the stores themselves as Idle inventory that is sitting in stores can instead be sold – preventing stock building up and keeping stores busy even if footfall is low.

Many major retailers have already started leaning into in-store fulfilment. Walmart expanded their ship-from-store capabilities to 2,500 locations earlier in the year, while target fulfilled 90% of their online orders from stores, cutting the cost of fulfilment by 30% and coinciding with a 100% increase in digital sales year-on-year. These two examples are interesting in that both brands are attempting to ‘take on’ Amazon by leveraging what amazon doesn’t have, a sign that ship-from-store is only going to grow in stature in the years to come.

What fulfilment technologies will become more relevant in 2021?

Automation

As demand for online orders goes up, distribution centres have to evolve. More modern DC’s with high order capacities are highly automated. This includes conveyor systems, automated processing and exception handling (with RFID). High-tech DC’s such as these are more efficient in terms of throughput of items and are far less susceptible to bottlenecks. An example of such a DC is Detego customer Marc Cain, who’s highly automated DC can process 35,000 articles a single day, with 100% accuracy.

Big data and Artificial Intelligence

For larger retailers, online channels produce a lot of data. For retailers who have the technologies to keep track of them, their supply chains also produce huge amounts of data related to the movement and flow of merchandise. As we often say though, data is useless if it’s not being used to produce actionable or useful insights. With AI, retailers can utilise all of this data from their web stores, supply chains and stores to great effect. Operational KPIs like DC throughput and dwell times (how long an item sits at a certain stage of the supply chain) are incredibly valuable for optimising fulfilment. This data can also be used for more advanced algorithms like demand prediction, so retailers can adjust their inventory levels for different regions before there is a shortage of products.

RFID

Tagging products with Radio frequency identification makes a huge difference to supply chains and online fulfilment capacity. Not only does RFID produce real-time item visibility from the factory to the customer, meaning more efficient handovers, but for DC’s it is a game-changer. RFID tunnels within an automated conveyor system can automatically count and check the content of cartons without needing to open the box, in a matter of seconds. This means all products coming in and out of the DC are processed in seconds and with complete accuracy. After the initial investment, the solution also drastically lowers operational costs, not to mention the reduction in chargebacks of incorrect shipping penalties.

Want to see how RFID can transform your business? Book a demo today

In the penultimate instalment of our series running through predicted key trends for the upcoming year, we explore the direct to consumer (DTC) model. Over the last few years, DTC channels have gone from strength-to-strength because of the better margins and closer ties to customers from selling directly to consumers. In the aftermath of 2020 DTC, a mostly online channel is well-positioned in the new normal and beyond, which begs the question – is direct to consumer the future?

What is DTC retailing?

A direct-to-consumer model is where a manufacturer promotes and sells its products directly to consumers without ‘middlemen’ like third-party retailers or stores. DTC largely refers to eCommerce channels but can include brick-and-mortar stores in the case of larger brands who own and operate the entire product line and supply chain from source to store.

The most common sectors for DTC are fashion, consumer goods and housewares. The model was pioneered by independent retailers and start-ups, who took advantage of the minimal upfront costs and a gap in the market. The first DTC brands were often hyper-specialised, web-only, marketed heavily on social media with a well-defined brand identity, think dollar shave club and Warby Parker. In recent years bigger brands are utilising DTC as a channel, with fashion brands like adidas Nike, and Levi’s are investing heavily in the model. But why?

What are the Advantages of DTC?

You can benefit from better margins

When selling items through either their webshop or brand-owned stores, DTC retailers see more profit. The reasons for this are simple enough, as instead of third-party retailers selling their products for a profit, a brand can sell their products at a similar price at an improved profit margin by keeping the mark up for themselves.

You can increase customer loyalty

DTC offers more opportunity to connect with your customer, as all of the touchpoints are direct between them and the brand – with no one in-between. This means between your website; social media marketing and in-store experience customers get to know the brand behind the products. If this sounds trivial, it’s not – customers care more and more about a brand’s social values. With a DTC arm, it is easier to express a brands personality and foster a more connected loyal customer base.

You can make more data-driven decisions

By selling directly to their end customers, a brand gains far better insight and data on exactly who their customers are. In modern retailing, this kind of data is key, and when selling through a third party this information is lost. By removing the barrier between them and their customers, brands gain the data to market to their customers more effectively and are more mobile when it comes to product and brand positioning.

Where is DTC heading in 2021?

So, if DTC isn’t new, why are we talking about it as a key trend for the coming year? While the model has been growing stronger year-on-year, larger brands are starting to focus and lean on the direct channel, and for many, it is replacing the alternatives to become the primary channel. COVID-19 has undoubtedly accelerated this change. Since a large share of DTC is online, the explosion of eCommerce during this year has consolidated DTC’s position in the industry and for many retailers is providing an ideal opportunity to shift their focus to selling direct to consumers.

Who are the fashion retailers winning with DTC?

adidas

The global sports brand announced this year that it now makes a third of its sales direct-to-consumer. A large part of this is online, with their eCommerce channel seeing increases of 93% during the peak of the pandemic. Beyond COVID this looks set to continue, as adidas’ massive store network will continue to serve customers and deliver a uniquely adidas experience beyond the pandemic.

Levi’s

Similarly, Levi’s is a big proponent of DTC, even before the pandemic. At the start of the year, Levi’s publicly said they were confident that they would weather the impact of COVID better than many other brands because of their strong DTC business. And they were right – in April DTC sales were up 10% and their Net revenue for the quarter was even up 5%. Levi’s is also focused heavily on the experiential elements of DTC, with unique in-store experiences building closer ties with their customers “We’ve been on an intentional path to strengthen that direct relationship,” said Marc Rosen, Levi’s executive vice president.

Will the future be DTC only?

So, is Direct to consumer retailing the future, and if so, what does this mean for the industry at large? To again use the example of adidas, right at the start of the year the brand said they are aiming to generate 60% of their sales from direct retail by the end of 2020, showing that even before the pandemic brands are repositioning. The reasons why seem clear enough, with the mentioned benefits alongside increasing levels of eCommerce making increased reliance on DTC, especially for bigger brands, a no-brainer. But will retail of the future be entirely DTC? Exactly like when these questions come up for eCommerce, the answer is always more of a balance. Harmony between varied channels and offerings will always be optimal and foster greater resilience, but the balance can always shift – and DTC is looking like the king moving forward.

How can your DTC operations benefit from the Detego platform?

Product manufactures selling directly to customers is an end-to-end operation. So when trying to ensure accuracy and visibility, they need an end-to-end solution. For retailers running a DTC operation, the Detego RFID platform ensures the experience for customers is smooth and reliable, with products always available and seamless integration between online and offline channels. The RFID technology means brands can truly streamline their DTC channel with item-level visibility right from the factory to the customer – no errors, no guesswork. Our two examples of fashion retailers who are leading the way on direct, Levi’s and adidas, both use the Detego platform in their stores around the world. If you want to find out how the Detego platform can help you deliver to your customers, get in touch today!

Want to see how RFID can transform your business? Book a demo today

In the second instalment of our series exploring retail trends for next year, we’re exploring the latest development in fashion retail sustainability. The industry has been aiming to reduce its environmental impact in recent years – read our article on a general overview of sustainability in fashion retail. A growing trend is the concept of a circular economy, particularly recommerce and rental. By 2023 it is estimated the resale market will be worth 51 billion dollars and the newer rental market close to 2 billion. Read on to find out how and why these new services are here to stay.

What is the circular economy?

A circular economy is one that reduces waste and pollution, keeps products and materials in use, and benefits the environment. In other words, a circular economy is a model that is sustainable to the core. For fashion retail, this means sustainable materials and re-using and recycling products and materials. This is a stark contrast to the fast fashion model that is pervasive in the industry, but consumer preferences are changing, and retailers are changing as a result. According to the McKinsey apparel CPO survey, there has been a 500% increase in the number of sustainable fashion products launched over the past two years.

But more sustainable products are just one part of the puzzle, achieving a circular fashion economy requires new models altogether. Since retailers still need to see a profit these initiatives need to be sustainable on three levels, they need to work for the customer, the environment, and the retailer’s bottom line.

So what initiatives are retailers exploring to build towards a more circular fashion economy?

Is recommerce set to take over fast fashion in the future?

Recommerce as a concept is nothing new, also known as resale commerce, it covers reselling pre-owned or second-hand items. Famous examples of this include eBay, and more recently in the fashion space the quickly-growing Depop, where consumers sell to one another directly. A different example of resale in fashion is vintage or thrift stores and e-tailers like ThredUP, which rather than being a platform for resales are an actual retailer dealing exclusively in recommence.

The newest trend in this space is particularly interesting, as traditional retailers are getting involved in reselling their second-hand products directly. These brands incentivise customers to return their pre-loved clothes through store credit, and either sell them again or recycle the material. We have seen several examples of retailers exploring recommerce models in recent months, and this will no doubt continue in 2021.

Detego customer, Levi’s, announced in October the launch of ‘Levi’s SecondHand’. The resale program allows shoppers to buy second-hand Levi’s products for a lower price as well as earn gift cards towards future purchases by selling their pre-loved pieces back to the retailer.

“Repurposing and repairing clothes require minimal additional energy input, no water and no dyes to make more jeans,” Levi’s CMO Jennifer Sey said, in a statement. “Buying a used pair of Levi’s through SecondHand saves approximately 80% of the CO2 emissions and 700 grams of waste compared to buying a new pair of Levi’s.”

This trend is set to continue to grow in the next few years. According to an annual resale report from ThredUp, recomerce is projected to grow 24 billion dollars to 51 billion dollars in the next five years. Additionally, by 2028 resale will be 1.5 times bigger than fast fashion with second-hand items accounting for an average of 13% of people’s wardrobes.

Will fashion rental services become the new normal?

Another approach to a more circular fashion economy includes clothing rental services. These have grown in popularity over recent years, as consumers can enjoy changing their wardrobe without the environmental harm of typical fast fashion. One of the most famous rental companies is Rent the Runway, who recently took an extra step in closing the loop by teaming up with reseller ThredUp to sell pre-rented clothing.

Much like recommerce, the rental model was first popularised by independent innovators and is now being explored by larger retail brands. In the US, Urban outfitters have built their own rental service, Nuuly, from scratch. To use another example of suitability leaders Levi’s, the brand has collaborated with popular Danish brand Ganni by creating an exclusive product range for their incoming rental service Ganni Repeat. Through the service, users can rent pieces for up to three weeks. Each piece is professionally cleaned between rentals and stored for 72 hours before being shipped to the next customer.

What are the challenges for rental and recommerce services?

Preventing return fraud

For rental services, and retailers ‘buying’ back pre-owned items, fraud is a big concern. Much like with regular retail returns, scammers can abuse the system by returning the wrong item (a similar or counterfeit item of clothing for example) and keeping the more expensive original. So how can you prevent this type of fraud-theft? When dealing with unique, high-cost products the best option is digitally labelling items with individual non-forgeable ID’s. These allow you to scan the code, like an RFID tag, and the identity of the product. So, through supporting software like the Detego platform, you can confirm each item received is original and ship with confidence to your customers.

Item-level inventories

Retailers offering pre-owned products or rentals will need to re-think the way they look at their inventory. Since second-hand and rental collections consist largely of unique individual products rather than large quantities of the same stock, working with stock-keeping units (SKUs) will not be sufficient in managing inventories and keeping track of stock online and in-store.

Managing these types of inventories will require a different level of accuracy. We regularly advocate the benefits of raising item-level stock accuracy from 70-80% to 99% but for these operations, missing 20% will be crucial. This is because unlike fast fashion, this would mean a fifth of all items are under or overstocked, as you are not carrying multiples of the same SKU so the potential for missed sales or opportunities is massive. Only with complete accuracy can you eliminate disappointing customers and offer them stock information on rentals or second-hand products online, so they can find the perfect product.

Reverse logistics

The final big challenge for both recommerce and rental services is handling the two-way flow of merchandise between the retailer and end-customer. An end customer may order a rental online, have it shipped from store, and then return It at a different location, where it will then need to be sent back to the DC for the next customer. Without even mentioning cleaning or repairs, this is a big logistical challenge. With the unique nature of rentals, in particular, retailers will need to ensure returning items are processed and ready-to-rent again as fast as possible. Achieving this requires a single real-time view of stock across all channels. This means that every item coming in, out or moving between channels need to be tracked, with the real-time view of items shared between all channels and customers.

Why RFID is invaluable for recommerce and rental models

As fashion retailers build towards a more circular economy by exploring and expanding their use of new sustainable business models like recommerce and rentals, they will need to invest in the right technologies to offer these services at scale. Radiofrequency identification is already well-positioned in the apparel industry, with more and more retailers utilising the technology to gain accurate stock visibility and offer omnichannel services. For rental and recommerce models, particularly on a large scale, RFID may prove to be non-negotiable. The unique item-level ID’s will be invaluable for both rental returns and recommerce goods and will allow customers and retailer to ensure the legitimacy of all items. On an operational level, RFID delivers 99% accuracy across channels and is an ideal tool for reverse logistics as it delivers a real-time view of stock movement.

Want to see how RFID can transform your business? Book a demo today

Hear from Detego’s implementation experts and BESTSELLERS’s RFID project leader on how retailers should approach digital transformation with RFID.

Radiofrequency identification (RFID) has become a vital technology in retail, particularly for larger brands. Leading retailers use the technology to achieve high stock accuracy, supply chain visibility and to gain the real-time data required for strong digital offerings such as omnichannel.

These are no longer optional for retailers and undergoing digital transformation with RFID is on the agenda for more and more brands.

Join Detego’s delivery specialists with years of experience implementing RFID in retail stores, and supply chains as they go take you through a best-practise approach to implementation.

Hear about the journey from a retailer’s perspective as BESTSELLER talk through their RFID journey which included an initial rollout to just under 200 stores in 3 months!

- Determine the key things to consider when implementing RFID

- Gain insight on the priorities to focus on, things to look out for, and lessons learnt

- Learn about each stage of the journey with specific insight and advice for both stores and distribution centres

- Hear a retailer’s experience of a large rollout covering hundreds of stores.