Knowing what’s in your store is essential to running a profitable retail business, whether it’s an independent boutique or a store in a chain of thousands. There are two things that keep stores ‘In the know’ when it comes to their inventory, stocktakes and their inventory management systems. A stocktake allows you to establish your view of inventory (at reasonable expense and effort) whereas the better your inventory management system is, the longer that view of stock stays accurate.

Even if your inventory management is top quality, without regular stocktakes accuracy will begin to slip. Factors like theft, admin errors and stock movement will mean that before too long the stock file and the physical inventory become increasingly out of sync.

This problem is multiplied the bigger a retailer’s footprint is. When looking at hundreds or even thousands of stores, stock inaccuracy can add up to unthinkable amounts of capital. Just look at British retailer Ted Baker who last year discovered a £58M hole in their business, entirely due to inventory mismanagement!

For many retailers then, stocktaking is considered a necessary evil. But doing a wall-to-wall count of every individual product in a store is no mean feat. Physical inventories come at great cost: time, money, and overall efficiency. As a result, many stores only perform an annual or bi-annual stocktake, but these leave a lot to be desired.

Let’s go through how and why annual stocktakes can be so expensive to perform and even ask, can retailers afford to go on like this?

The cost of annual stocktakes

The upfront cost

Physical inventory counts are big operations that are expensive to perform. Doing a wall-to-wall stocktake of everything in a store (backroom and salesfloor) takes a lot of time and manhours. To perform a physical inventory count, retailers have two options:

Carry out the stocktake internally

One option is for a store to carry out the inventory itself. This is tricky but not impossible, provided the staff are organised, attentive and know what they’re doing. The major downside is how labour intensive it is, requiring a lot of store staff, making working around opening hours difficult (more on this later).

For independent or particularly well-staffed stores, internal stocktakes can work. The issue is it does not scale. For a retailer with hundreds of stores, asking every one of them to perform such an operation once or twice a year puts a lot of pressure on store management – and the results will be inconsistent at best

Use a third-party service

Using a specialist service to perform the physical inventory does have its advantages. First off, the accuracy of the stocktake is likely to be more reliable, and it is easier to scale up the use of such a service to more and more stores. The major downside is the considerable cost. Whilst it depends on the service used and the size of the store, these stocktakes can cost around $2000 – $3000 per store. Assuming each store only performs such a count once a year, when scaled across tens or hundreds of stores, the cost becomes immense.

The disruption to stores

Regardless of who you have performing the physical stocktake, the other question is when. A full inventory takes time, whilst it naturally depends on the size of the store and the team, it will likely take half a day at a minimum.

If the store is closed once a week, then this is the obvious choice. However, larger brands can often operate seven days a week…

So that leaves retailers with another difficult choice – close the store, or perform the stocktake overnight? Naturally, closing the store means losing sales and disrupting customers. While performing the inventory count overnight can make for a tight schedule.

An overnight inventory count is more doable (and common) when using a third-party, but it is not always feasible if you are using internal staff. Not only are you asking (and paying) for staff to come in out of hours, but you also will not be able to use that set of staff of either day either side of the overnight stocktake – making it incredibly difficult for smaller teams.

The suboptimal results

So those are the implications for actually performing annual/bi-annual stocktakes for retail stores, but there is something else to consider…

The fact is manual inventory counts give you subpar results. Even with supporting technology like barcode scanners, the margin for manual error is still significant meaning right from the outset you will still have errors and discrepancies. A much bigger factor – performing stock counts once or twice a year is simply not enough anymore. Sure, you may have 90% accuracy every 6 months, but what about the time in-between?

Typically store inventories run at 60-80% Item Level accuracy. However, stores will rarely report such low numbers because:

A) They only calculate accuracy after a stocktake

B) They are working on an SKU (stock-keeping Unit) level, and not an item-level.

C) Errors in stocktaking procedures mean stock file and actual inventory do not match, i.e., the accuracy quoted is not accurate

This level of stock inaccuracy also comes at a cost – and it’s a steep one. Stock inaccuracy causes three problems for stores.

Overstock – Excess stock, a result of the inventory list not showing items that are present in the store. Often compounded by stores carrying ‘safety stock’ for key products.

Understock – A lack of product, a result of the store inventory showing items that aren’t really there. Also called ‘phantom stock’, one of the main causes of this is theft. Understock leads to products becoming out-of-stock altogether, meaning lost sales and revenue.

Dead Stock – For perishable products, dead stock means products that can no longer be sold. While sectors like fashion don’t have this problem having stock sat unsold in backrooms can lead to products falling out of season, resulting in mark-downs and profit loss.

The bottom line of this inaccuracy? 10-15% higher working capital in stores, as a result of bloated inventories, and 5-10% of sales being lost simply due to stock not being available for customers to buy.

The alternatives to annual stocktakes

Cycle counts

A cycle count is where a store performs a partial count of a specific portion of store stock. Instead of performing an annual stock take once or twice a year, you might perform a cycle count several times a quarter. Essentially, you are breaking down the annual count into several mini stocktakes.

This has many benefits over annual stocktake – less disruption to the store, less labour intensive and (since it can be done by store staff) it’s cheaper. It can also help avoid the large variation that you get when there is a larger gap between takes.

While this is certainly better, cycle counts require a lot of coordination and still have the same problem as all manual stock counts: they are time-consuming and inaccurate. So, whilst cycle counts will reduce the costs compared to annual stocktakes, the cost of the inaccuracy will stay the same.

RFID

Having looked at the costs and problems associated with manual yearly stocktakes, you’d be forgiven for thinking successful large-scale brands don’t operate like this – and they don’t.

Radiofrequency Identification (RFID) is a technology that allows stores to perform rapid inventory counts, via product tags that emit a small radiofrequency. Stores that have implemented RFID can perform weekly or even daily stocktakes, as a single member of staff with an RFID reader can count thousands of items in minutes. The result of this is RFID stores have typical inventory accuracy of 99%, and no more need of annual stock takes.

Installing RFID in stores is a reasonably big project and requires some upfront investment. However, if you look at the cost of performing third-party stocktakes every year alone that money could be used to fund the RFID project and it delivers a stronger return of investment than regular physical inventories. This without mentioning the various other benefits of the technology, which you can read about here.

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Detego Store is a cloud-hosted RFID solution which digitises stock management processes, making them more efficient and more accurate. Implemented within hours, our multi-user app can provide intelligent stock takes and a smart in-store replenishment process. Later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

The Current Impact of COVID-19 on Retail

Supply Chain Chaos

Retail manufacturing and production have been heavily disrupted by COVID-19, particularly in China. In apparel and textiles, China is still the world’s biggest exporter. Even apparel manufacturers based elsewhere are often reliant on textiles imported from China. China being hit by COVID-19 and having to shut down factories and production has caused huge supply chain and production disruption around the world, with luxury retailers like Burberry and Prada being hit particularly hard.

As more and more countries are affected, supply chains may be disrupted further downstream. Larger distribution centres that service multiple countries could be most problematic, not only for fears of contamination but stores in countries that aren’t as heavily affected could have their product supply disrupted. On the other hand, since China was affected by the pandemic first they may recover first, so by the time other countries are beginning to come out of lockdown and preventative measures, this supply bottleneck may well be clearing further upstream.

Shutting of physical stores & reduced footfall

Across the globe brick and mortar sales are suffering. Stores are either being closed on government orders or simply being closed by the retailer to protect staff and public. The stores that remain open are being hit by the heavily reduced footfall as the majority of the public attempt to avoid unnecessary social contact.

The effects of this on revenue have the potential to be fatal. Lost sales are damaging enough, but when you factor in continued overheads for stores like rent, wages and inventory, it is a dangerous situation. Only time will tell how damaging these effects will be on retailers across the globes, with the main variables being:

- How long areas remain affected & stores are closed for.

- To what extent a retailer’s eCommerce operation can pick up the slack (more on this below)

- How big or financially stable the retailer is prior to the epidemic – large tier 1 & 2 retailers may be able to shoulder the burden for longer than their smaller or independent counterparts.

Spike in Online Sales

With many stores closing and consumers avoiding most of the ones that remain, it’s no surprise there has been a spike in online shopping due to COVID-19. This is exemplified by the eCommerce kings Amazon who are taking on 100,000 extra staff across the US as it tries to keep up with a surge in orders sparked by the pandemic.

Whilst its good for both the retailer and the consumer that most brands now operate both on and offline, the sudden shift in proportion between online and offline sales may cause retailers problems if they struggle to keep up with demand. These issues include fulfilment centres not coping with increased demand and the amount of returns that come alongside online orders.

The other major consideration for many retailers is the typically smaller margins on eCommerce orders compared to brick and mortar sales, meaning that they may not be able to rely on their eCommerce branch to survive for too long.

Future Considerations

So, what might a post-COVID-19 retail landscape look like? Will retailers take lessons from the crisis and bolster their infrastructure so they are more prepared for similar events in the future? Or once the dust settles will this be counted as a freak event and forgotten about? Here are possible considerations for retail life after COVID-19.

Continued advancement of e-commerce

This was bound to happen even without the pandemic, but COVID-19 may just have accelerated, or at the very least highlighted, the growth of online shopping and its advantages over physical retail. It is likely that retailers with a strong eCommerce offering will come out of the slump in a much better position.

For multi-channel retailers who had to rely on their online sales more than ever during COVID-19, evaluation into their eCommerce operations, particularly at their efficiency and smaller margins, are very likely. This may take the form of bolstering their supply chain technology and distribution centres, to increase efficiency and reduce running costs to see better margins in the future.

Diversifying manufacturing facilities

Steps have been gradually made in this area even before COVID-19, but in the aftermath of the pandemic, this may be a real concern for retailers and manufacturers. The problem isn’t China, or anywhere in particular. The problem is having such a heavy reliance on a single market, which then becomes a single point of failure for the business. Profit margins will always be a priority, but more cautious retailers and manufactures may look to diversify their production operations to be less reliant on a single region in the future.

Source-to-consumer traceability in supply chains

This is another area that was already a growing priority for many retailers. In the aftermath of COVID-19, it is likely to be even more of a concern, for both retailers and consumers. Not only does traceability help create smoother operations in the supply process, but it can offer assurances to consumers who may have growing concerns about where their products are sourced. With item-level traceability being where the industry is headed, consumers will be able to judge for themselves that their food, clothing and other things they bring into their homes is safely made and transported.

Automated warehouses and supply chains

The other element of the retail supply chain and distribution process that may change in the future is a heavier reliance on automation. This will make supply chains and distribution centres more robust, so able to withstand increased pressure. Automating processes like exception handling also means DC’s can run faster and with a leaner workforce.

Why may retailers look at automating supply chain operations in the future?

- More efficient – can deal with larger quantities of goods

- More accurate can deal with larger demand without creating bottlenecks

- Takes the reliance away from human resource constraints

Self-service stores and cashierless checkout

Finally, could the coronavirus be a catalyst for increased investment in self-service technology like cashier-less stores? We’ve seen retail giants like Amazon and Sainsbury’s explore these initiatives, but they have yet to be adopted on a large scale. Could that change? It may feel like a knee-jerk reaction to invest in technology that supports reduced human interaction but, particularly for supermarkets, solutions like Marks and Spencers’ mobile scan & pay could alleviate pressurised checkout lines.

Conclusion

We’ve gone over the major concerns for retail, the possible impact they could have, and the potential knock-on effects of the COVID-19 pandemic on the retail industry. But the fact is no one really knows. We are in uncharted waters, and for now, retailers are just struggling to ride the wave to the other side.

What we do know is this will pass. The main question for retailers that will determine the severity of the pandemic’s impact is when. Whilst this isn’t the second ‘retail apocalypse’, it is more than likely that the retail landscape that comes out of the coronavirus crisis may be very different from the one that went into it.

Want to learn more?

Apparel Retail’s New Normal: COVID-19 Impact and Future Trends

Webinar

Now stores are facing new social distancing guidelines, the formula for customer experience has changed. With reduced foot traffic and higher levels of eCommerce, the digital evolution of the retail store is now or never. Join us on the 16th of June as we dive into the physical and digital transformations behind retail’s ‘new normal’.

Inventory management is a problem as old as retail itself, so when brick and mortar stores look to digitise and modernise themselves for the modern age, shouldn’t their inventory systems do the same? Radio Frequency Identification (RFID) has gradually become embedded in the fashion retail industry due to this need to innovate stock management. What makes the technology unique is that every single RFID tag emits a small radio frequency. An RFID reader picks up hundreds of these signals in a matter of seconds, from several feet away, without requiring a direct line of site. The tag then shares whatever data it is encoded with, typically item info, dates, times and shipping information but theoretically, the only limit to what can be stored and utilised is the imaginations of the designers and engineers.

At its most basic level, RFID allows for incredibly fast and efficient stock management with little room for human error, meaning stock accuracy soars (reaching levels of 99% with RFID) and labour time falls dramatically. The technology also allows for more advanced usage such as faster Point of Sale or the enablement of omnichannel services – something the fashion industry has made good use of in recent years.

So, if the technology is so advantageous, why is it not dominating all retail markets? Initially, RFID labels were not only fairly expensive (averaging out at just under £1 per label) but they were also often too large to tag smaller products. This meant RFID did not make financial or logistical sense for many retailers, particularly in markets with a low individual item value. Another big issue was the interference that metal and liquid products have on RFID signals, meaning certain products could not be tagged with any real confidence.

These roadblocks proved fatal for RFID’s success in many industries, including beauty and cosmetics. But in the Fashion sector, with a high individual article price and the need for high stock accuracy and article availability, it was a huge success. However, these barriers to success in other markets are beginning to disappear, and the business potential of RFID is continuing to grow. The Beauty industry could now look to utilise the tags, achieving similar or perhaps even greater results as those seen in the apparel sector.

What’s changed?

The beauty industry has been keen to implement RFID for some time. Previous efforts to combat its limitations include the use of ‘smart packaging’ that took steps to make tagging cosmetic products possible through packages that are not only big enough to hold the tags in the first place but can also combat the interference caused by metallic or liquid products. This made RFID a possibility in the beauty industry if beauty suppliers were prepared to take the extra steps to make it so. But due to the solution being built into a product’s packaging, it meant it was not appropriate for every product and it was ultimately out of the hands of the retailers themselves, making full shop floor visibility a rarity.

If we were waiting for something of a ‘eureka moment’ for RFID, then the wait may well be over. Just this month, tag producer and RFID-heavyweight Avery Dennison announced the launch of their first on-metal tags. This is a huge breakthrough for the beauty industry and could be the silver bullet for the biggest barrier to entry for RFID. As the solution is very recent, we haven’t seen it applied on a large scale yet. But because the new tags work with liquid products as well as metal ones, beauty products are suddenly RFID-viable.

But this breakthrough is meaningless if labels are still too big to attach to products, or if they are too expensive to really warrant doing so. Thankfully, it’s good news on both fronts. As with any new technology, the price of RFID tags has been gradually dropping since their invention. Whilst previously an individual tag could be priced around £1, these days they are closer to 5p. The size of labels has similarly shrunk, meaning tags can be physically applied to feasibly any product or its outer packaging. This is great news for the beauty industry, as many cosmetic products are smaller and external pull-off labels, like those used in apparel, are not viable. This means the scope retailers have for tagging individual products is far more generous than it was in the past.

Fresh opportunities for beauty retailers

So, we’ve seen evidence that the technology has finally reached a point where it can be used in the beauty industry, but why should we care? What do cosmetic retailers stand to gain from the technology? And, perhaps more importantly, what difference does it make to the customer?

Efficient & accurate stock counts

We’ll start with the most basic principle: RFID revolutionises stock counts. Whilst this may seem like a lesser detail, the accuracy and speed with which inventories are collected does form the backbone of the business case for RFID. With products arriving at stores and distribution centres already tagged, inventory management becomes effortless. Stock counts become a matter of seconds as opposed to minutes (using barcodes) or even hours (using pencil & clipboard). This increased efficiency will have two big impacts on beauty retailers. The first is the reduction in labour intensity of managing stock. Not only do RFID stock counts not eat up the time of the retail staff but having a complete and transparent view of stock also makes item replenishment from the backroom to the sales floor much simpler to manage. Intelligent inventory systems can display alerts when items need replenishment, so staff can spend less time monitoring shop floor levels themselves.

Sales uplift

The other main impact of RFID stock counts is the increase in stock accuracy for retailers. The industry standard stock accuracy without RFID is somewhere around 70% (although retailers often do not realise it is as low as this) compared to 99% with RFID. This stock accuracy coupled with the ease of shop floor replenishment increases article availability and therefore sales by avoiding out of stock situations. Whereas traditionally beauty retailers were often stuck with the choice between neglecting inventory accuracy or losing out on money from higher labour costs or loss of sales, with RFID retailers can have the best of both worlds. This accuracy and efficiency stretch across the entire supply chain, increasing shipping accuracy and aiding logistics at warehouses and distribution centres and, crucially, providing a complete view of stock. Increased process efficiency is perhaps the biggest way RFID adds value to retail. The knock-on effect of this is retail staff having more time to spend on customer service, which improves the shopping experience and increases sales. Beauty retailers could push these results even further by implementing faster point of sale solutions using RFID.

So with accurate stock counts taking place effortlessly both in the store and in distribution centres, and with tags being as cheap as they are, beauty retailers can realistically look at achieving full inventory visibility across the entire supply chain. But what does this achieve? Item level transparency unlocks the real potential of RFID, as it allows innovative solutions and use cases to be deployed which can drastically reduce the time it takes to see a return on investment.

Reduction in shrinkage

For example, one of the biggest challenges for many beauty retailers is item shrinkage. The average shrink percentage in the retail industry is generally about 2% of sales, amounting to $49 billion in losses globally. Having total item visibility would give beauty retailers the tools to combat this critical issue. The complete transparency of supply chains makes individual items entirely traceable, so retailers could pinpoint exactly where shrinkage is taking place and combat it accordingly.

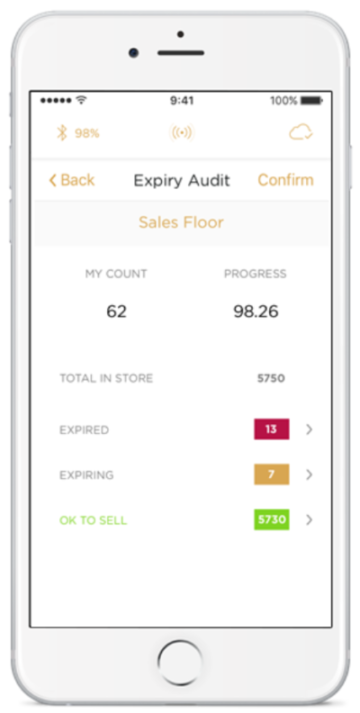

Limited shelf-life is another cause of shrinkage in the industry; one that RFID is well suited to manage as an items sell-by date can be stored on the tag itself. Once scanned, this information then becomes an extension of the 100% article visibility that retailers have access to. This complete view of stock would not only tell staff when items need replenishing from the back room, but it would also tell them which items are passed or approaching their expiry date. Automating the monitoring of this process alongside replenishment would further aid efficiency and assure retailers that products are being marked down and therefore sold instead of expiring, combatting shrinkage and actively increasing sales.

Unlocking effective omnichannel retailing

Having complete item visibility would also mean beauty retailers could finally capitalise on the emergence of omnichannel. The strategy is becoming such a dominant force across retail that it is becoming less and less of a choice to implement and more of a necessity. The beauty industry has yet to make the most of omnichannel as, whilst many retailers operate across multiple channels, they are not fully integrated or connected as well as they could be. A report by Newstore suggests that whilst 80% of shoppers research online before even stepping into a store, only 36% of brands have enabled in-store inventory visibility for customers either online or a mobile app. This experience of seamless integration of shopping experience across all channels is something consumers are beginning to expect, as neighbour industries like fashion already offer such an experience. Perhaps the main reason for beauty being slower to adopt effective omnichannel is the need for total item visibility to really do so. Weaving multiple channels of shopping together requires a total view of stock, which then transforms brick and mortar stores into digital hubs. Now that the beauty industry can finally set its sights on full RFID implementation, it can look forward to benefiting from the omnichannel capabilities that come with it.

The omnichannel experience is a good example of how the beauty industry can use RFID to actively increase consumer engagement, but it is certainly not the only one. Existing technology that is used in other markets like chatbots could easily make an impact in beauty stores, recommending products for customers and informing them on stock. Once RFID begins to become established, we will also no doubt see the emergence of customer engagement solutions specific to the industry and its demands. The technology and its uses are ultimately very flexible so can be manipulated to provide market-specific solutions. But to reach this point the beauty industry will first need to embrace the technology. Then we can really see its full potential unlocked.

(Originally posted on WhichPLM.com)

Did we spark your interest?

RFID ready to digitise the cosmetics industry

RFID (Radio Frequency Identification) has already proven itself in fashion retail, with many retailers taking advantage of the increased product availability (>98%), inventory accuracy (>99%) and omnichannel capabilities that the technology provides.

The cosmetics industry would stand to profit just as much from this level of insight and visibility into their inventory levels, however utilising the technology has traditionally been far more difficult than in the apparel market. This is because cosmetic products are generally too small to be tagged accordingly and they frequently contain liquids or metal materials in their packaging that negatively affect RFID technology.

However, with recent advancements in the technology, this is beginning to change. RFID tags becoming smaller now makes labelling practically any product possible and, with the price of labels continuing to drop, financially viable. Perhaps most important though is the invention of new ‘on-metal’ RFID labels that can be used to tag both metallic and liquid products without issue, hence removing the biggest barrier to RFID in the cosmetics industry.

New developments can benefit cosmetic brands and optimise customer experience

New packaging materials and smaller, more sensitive RFID tags finally help cosmetic brands to provide ever-greater inventory accuracy both in the store and in the webshop, to fulfil the increasing need for fast global shipping and replenishment.

The particular issue of shelf-life is a challenge of the cosmetics industry that is not shared by the apparel market. RFID, however, seems ideally suited to the task of managing expiry dates, as the tags can hold the information on an item-level, meaning the store staff receives real-time visibility on the shelf-life of every item in the store and would receive alerts warning them when items are close to or past their expiry date. This also enables products to be marked-down to ensure they are sold before expiration.

Benefits for retailers:

- Inventory visibility along the entire supply chain

- No out-of-stock situations due to increased product availability

- Superior quality of customer service

- Reduced inventory shrinkage in stores

- Operational efficiencies for in-store processes

- Increased brand loyalty

- Analytics in real-time and store KPIs

- Easily manage shelf-life of products

Benefits for customers:

- High product availability across all channels

- Unique shopping experience

- Product recommendations with additional information

- Supports in decision-making process

- Click and collect

- Ship-from-store

- Instore ordering

Matching the style

The cosmetics industry is aware that the inclusion of advanced technologies in the corporate and retail environment can enhance their presence in the future. This includes not using just any technology, but one that fits the company philosophy and compliments their appearance and store as well as product design. Technology should guarantee the future of the company, retain employees and fascinate customers. And whilst there are of course a multitude of benefits from RFID already established in the Fashion industry, as more cosmetic companies begin to utilize the technology more use cases specific to the industry will be discovered, and its full potential unlocked.