2020 has been an incredibly difficult year for people, countries, and businesses. We have covered the effects of COVID-19 on retail in great detail, so let’s begin to look ahead at 2021 and what the key trends are likely to be in the increasingly-familiar ‘new normal’ and beyond. Starting with a key priority for retailers both for now and next year: Reducing labour costs in stores.

Introduction

With the financial impact of this year, as well as the reduced sales in brick-and-mortar stores as more customers opt to shop online, retailers need to cut costs in innovative ways to stay profitable. Cutting costs negatively, by getting rid of staff or stores or putting pressure on employees over scheduling, time theft etc all harm staff, customers, and sales. However, there is a more positive or proactive way to achieve this – improving store processes by implementing technology in stores. In this article, we’ll cover where these improvements can be made and where RFID, in particular, can allow retailers to drastically lower labour costs.

Cutting labour cost at the expense of the customer is not an option

Before we get into what technology can do to cut labour costs across the board, let’s first establish why other forms of cost-cutting should only ever be a last resort for retailers, and even then are unlikely to produce positive results. To do that its helpful to establish the difference between optimising costs and cutting costs.

Optimising – not spending on excess staff or stores that are not needed (very rare)

Cutting – getting rid of staff or entire stores that are required as a cost-saving measure.

When it comes to large or global retailers with hundreds of stores, cutting labour costs at scale by reducing staff falls almost always into the latter category.

But this can have huge repercussions on a stores performance and their ability to serve customers. According to RetailDive a study of one apparel chain found that they were only achieving 85-95% of their potential sales due to its staffing levels. According to a separate report from Massachusetts Institute of Technology, 6% of all possible retail sales are lost because of lack of service, as customers are unable to locate help.

In short, cutting labour costs by reducing staff in stores simply doesn’t pay. So, what are the more positive and proactive ways retailers can cut labour costs in stores without harming staff, customers, or profits?

Faster checkouts and self-checkouts

When looking at the most staff-intensive areas of a store, you have to start with the checkout. While it does vary depending on the category, with grocery being particularly prevalent, cashiers and point-of-sale are a huge drain of staff and therefore a large source of labour cost. But removing staff from this area without offering any alternatives is not effective as long ques scare away customers and hurt sales. So, the options to reduce costs associated with the checkout are:

.

Offer self-service checkouts

It may seem like a no-brainer, and for some retailers it is. Since there is no need for a cashier at every register, one employee can easily monitor 6-10 self-service registers which free up staff to be available elsewhere in the store. However, outside of the food industry, self-service hasn’t really taken off mostly due to the higher price points of items making checkout theft a much bigger concern, in these cases, there is often also a need for staff to remove things like security tags (more on this later).

.

Implement technology at PoS that makes the checkout process faster

The other option that is available instead of or in tandem with self-checkouts is improving PoS technology to make it faster and more efficient, reducing the number of cashiers needed. Popular European food retailers, Aldi, who was described by CNN as a ‘brutally efficient grocery chain’ have barcodes all over their products, making their cashiers infamously fast. But for many retailers and sectors, this isn’t feasible, so what is the other option? An RFID tag can achieve the same purpose as the radio frequency it emits can be read at any angle. Even better, every item can be scanned/read at the same time! Having RFID-enabled checkouts can not only massively cut queue times but also reduce labour costs by having fewer staffed checkouts per store.

Automate stock management

What about the other process store staff spend the majority of their time on? Managing inventory and replenishing sold items can, depending on the retailer and the category, be a big drain on staff time. While automating the process entirely would require robots and eliminate the need for staff altogether (something we do suggest) automating the management of stock with intelligent software is our speciality. With in-store mobile applications that provide accurate and timely replenishment advice, shelf management becomes much easier for staff and cheaper for retailers. The Detego platform takes this even further and can even order replenishment advice so staff take the shortest and most efficient route possible!

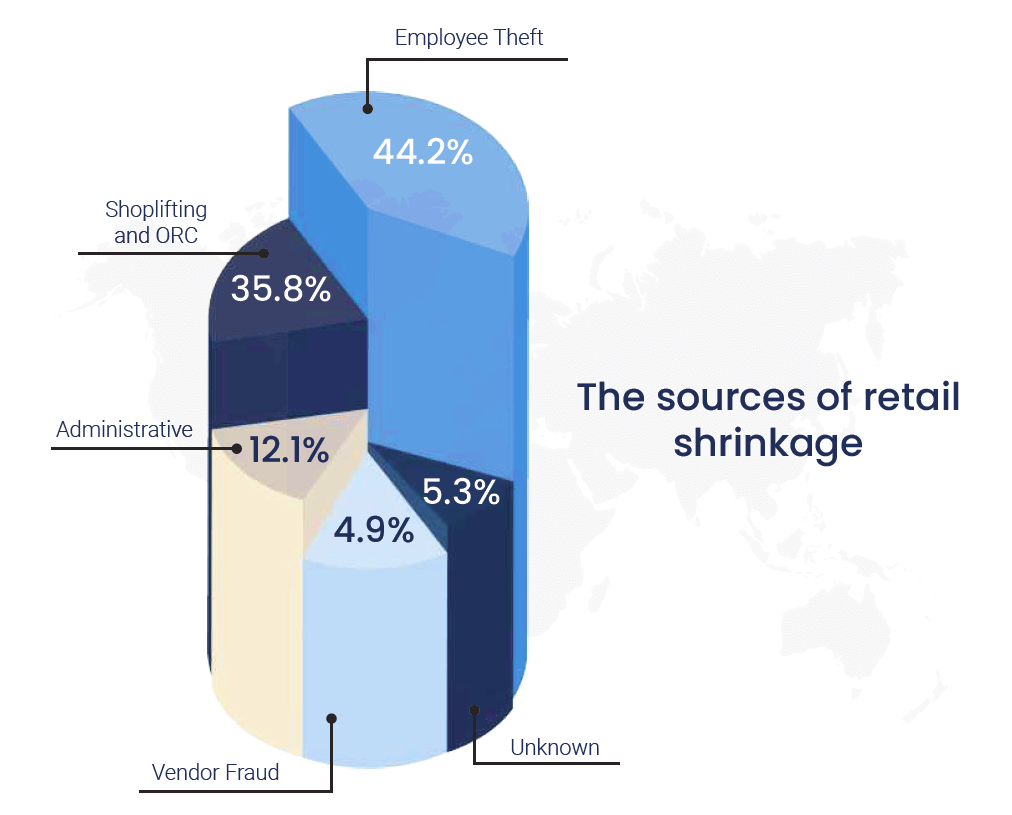

Replace ‘hard’ security tags

Loss prevention is a key principle for most stores. When you are trying to maximise revenue, losing stock and sales eats into profits and makes thin margins even thinner. Naturally, the majority of retailers have systems and technology implemented to combat shoplifting in stores, with the most common being ‘hard’ security tags that need to be removed by staff before passing through the store’s EAS gates. But these tags come with a hidden cost: it’s estimated that a single security tag costs around $0.30 in labour costs to add and remove from each item. Added to the cost of tags themselves this can add up fast, particularly in sectors like apparel where this is done for every item. But since not having loss prevention in place is just as costly, what are the alternatives? RFID tags can be used with EAS gates, and provide a more cost-effective option. They are the ‘soft’ version of such security measures meaning they do not need to be removed before leaving the stores but are slightly less durable. If we are keeping score here, using RFID instead of hard tags have the following advantages:

- The tags themselves are cheaper

- They are tagged at source, meaning store staff don’t need to do it

- They do not need to be removed by staff, as once confirmed as purchased by the PoS, they simply do not set off the EAS gate

- They are multi-functional, meaning that tags can be used for stock management, PoS and loss prevention

Eliminate costly annual stocktakes

Finally, let’s move away from daily processes and labour costs and look at something that (most) retailers only do a handful of times a year but at great cost: The full store stocktake or cycle count. The cycle count is a necessary evil to know exactly what is in retailers stores to maintain stock accuracy and optimise working capital. However, without supporting technology these stocktakes are big undertakings – which is why they are done so rarely. Larger retailers often use third-parties to perform these stocktakes, which cost around $2000 per store (depending on size). When you do this for an entire store network – the costs add up fast.

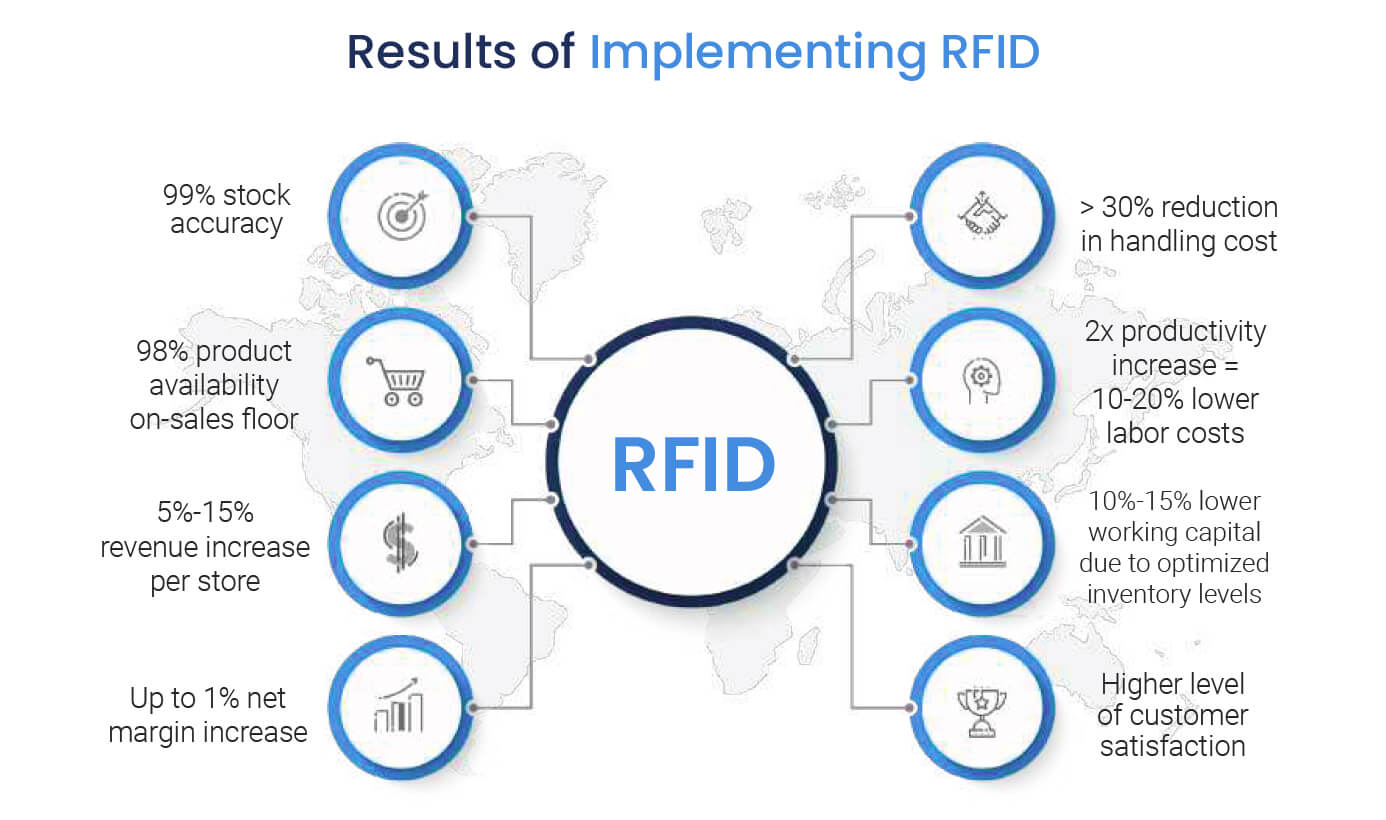

The best alternative to this? Implement RFID in stores, meaning staff can regularly perform RFID stocktakes on a weekly or even daily basis. This removes the cost of the annual stocktakes, but are you just replacing it with the cost of RFID itself? The reason this works financially is the long list of benefits you gain from using RFID, most notably an increase in sales and a reduction in running costs (both from reduced labour and less running capital). This is not just us saying so as the list of retailers who use of RFID has grown hugely and more and more retailers are choosing to adopt the technology.

How the Detego platform can reduce labour costs by 20%

While covering the ways retailers can cut labour costs without affecting their staff or customers, we’ve touched on many brands can do so with RFID. Cutting labour costs in a proactive way requires investing in technology and upgrading store processes and RFID ticks a lot of boxes here. The Detego platform allows retailers to easily implement RFID in stores and start seeing a fast ROI. Implementing the platform also reduces general costs further by decreasing inventory sizes, reducing working capital by around 15%.

Book your demo today to find out more about our solutions to reduce your labour costs at scale:

As we look to round off what has been an incredibly disrupting year with the all-important holiday season, how is the retail industry likely to fair? Will the usually busy holiday season provide some much-needed relief to retailers feeling the pinch of a tough year, or will sales and profits continue to struggle? We analyse the figures and identify the key trends that will rule this year’s holiday season.

Overview

In terms of general outlook, the majority of experts are predicting the coming season to be positive in general, but with less growth compared to previous years. ICSC and CBRE both predict less than 2% growth in sales for the period, compared to the average of 4.1% we typically see in the holiday season. Considering the economic and social disruption of the past year this lower than normal increase is to be expected, but ultimately will cap off what has been several months of steady growth in both the UK and the US. If we look at consumer polls, the outlook is similar, with a survey from Maybe* finding that its ‘Christmas as usual’ for 71% meaning they plan on spending the same as in ‘normal’ years. But the way customers, and indeed retailers, go about this holiday season looks to be very different from previous years.

Let’s take a look at some of the key trends for the upcoming holiday season:

An extended season

Black Friday is the event that kicks off the holiday season, typically meaning high discounts, crammed shop floors and long ques outside of stores. Due to the realities of the pandemic many retailers have extended their Black Friday offerings to cover several days or even weeks, in an attempt to prevent overcrowding in stores. COVID may have moved the starting line of the season altogether however with prime day, typically taking place in July, pushed back to earlier in October. If ever there was a retailer big enough to move the needle by themselves, it was Amazon – and several retailers in the US including Target and Walmart launched their own deals at the same time to compete with the online giant. Customers will be keen to take advantage of these deals this year more than ever, and according to AlixPartners, 49% of consumers plan to start their holiday shopping by Halloween or earlier in the US, and in the UK Maybe*’s survey found that 65% of respondents have already started their Christmas shopping this year.

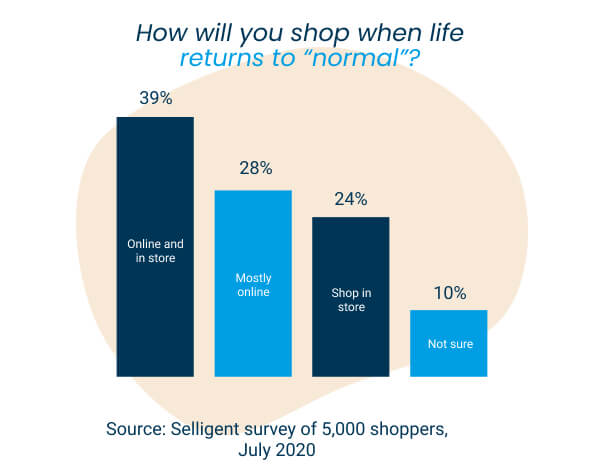

ECommerce will continue to run the show

It’s a statement everyone in the industry is very familiar with this year, but the defining feature of this holiday season will be a major preference for online shopping and eCommerce. While this trend has been steadily increasing over the years, the coronavirus pandemic has caused a huge spike in eCommerce as many consumers avoid stores and practise social distancing. As a result, Deloitte’s Annual Holiday Retail Forecast predicts eCommerce sales will grow between 25-35% year-on-year, compared to 14.7% in 2019. Similarly, the Maybe* consumer survey found a whopping 58% of customers plan to do their Christmas shopping online this year. This will be a test for many retailers, both pure-play and multichannel models, as the increased demand will test the capacity and strength of both their online channels and their fulfilment capabilities.

How will Brick and Mortar stores fare?

But what of the brick-and-mortar store? It’s no secret that physical retail has taken the brunt of the impact on sales and revenue this year, but will the holiday season offer some respite? Retailers hoping to make the most of the period will need to focus on ensuring safety and customer confidence in their stores, with 55% of consumers saying that COVID-19 safety tops their list of holiday shopping concerns according to a survey by PwC. Even with these measures in place, in-store holiday traffic is expected to drop by up to 25% this year in the US. For the UK, it may be even worse, with only 30% of shoppers heading to their local high street for Christmas, according to Maybe*. Black Friday specifically is where store traffic is likely to fall more than ever, with more than a third of US shoppers planning to avoid stores for Black Friday in the US, and a massive 91% said the same for the UK.

Bigger discounts for Black Friday?

So how are retailers planning to approach this year’s Black Friday to account for this? Alongside the extension of the event and the repositioning online, it seems many retailers are planning on discounting deeper and earlier this year. According to data analytics experts Edited, the most common advertised discount this year is 40-50% for apparel products compared to an average of 20-30% the previous year. For fashion retailers, in particular, this makes sense as the goal is to not only try and drive sales but is, perhaps, more importantly, an opportunity to sell older and slow-moving seasonal stock collected throughout this challenging year.

Store fulfilment will be vital for many

With the continued dominance of eCommerce, non-pure-play retailers are being challenged to keep up with the pace as their online channels have been, at least temporarily, promoted from supporting operations to the heart of the business. Two of the biggest retailers in the US have invested heavily in their ship-from-store capabilities this year, with Walmart expanded theirs to 2,500 locations, whilst target reported fulfilling 90% of their online orders from store cutting the cost of fulfilment by 30%. Adopting such a strategy not only allows for such operational benefits but it makes the existing eCommerce arm much more durable – which is exactly what they’ll need to be this season.

Click-and-collect / Curbside continue to be popular purchase options

Similarly, click-and-collect and Curbside services will be more important than ever for many retailers this season. Macy’s CEO called the use of Curbside a ‘big secret weapon’ for the upcoming holiday season. Just how secret it is may be up for some debate, according to customer surveys, 80% of shoppers expect to increase their use of these services over the next six months, and 85% have already significantly increased their use of curbside since the year began. The reason for this is clear as such services tick all the boxes of being convenient, safe and online-first.

‘The season will ultimately cap off what has been several months of steady growth in both the UK and the US.’

‘COVID may have moved the starting line of the season altogether however…’

‘eCommerce sales (are predicted to) grow between 25-35% year-on-year, compared to 14.7% in 2019.’

‘Retailers hoping to make the most of the period will need to focus on ensuring safety and customer confidence in their stores’

‘it seems many retailers are planning on discounting deeper and earlier this year’

‘online channels have been, at least temporarily, promoted from supporting operations to the heart of the business.’

‘80% of shoppers expect to increase their use of these services over the next six months’

Want the latest retail and retail tech insights directly to your inbox?

Omnichannel retailing, offering customers a unified and convenient experience across and between shopping channels, has exploded back into relevance this year. For those in the industry, it might feel like it’s been around for ages – and it has. So long in fact that omnichannel grew into a buzzword that was thrown around relentlessly to the point that the term was declared ‘dead’ by many. The reports of Omnichannel’s death have been greatly exaggerated, however, with the ability to serve customers across multiple channels becoming a life raft for many retailers this year. While the conditions faced this year will be once-in-a-lifetime, many of the effects and trends may be long-term.

What exactly is Omnichannel retailing?

In short, omnichannel is the perfect connection and interplay between a brand’s physical and digital channels. A pie in the sky omnichannel experience is one where the differences or barriers between shopping in-store, online or on a brands app do not exist. You can check a physical stores stock levels on an app, the webshop remembers what you purchased in-store and uses it to recommend you more relevant products and so on. More grounded and familiar examples of this type of retailing are services like click-and-collect (Buy-online-pick-up-in-store) or ship-from-store (buy-online-ship-from-store).

Omnichannel was born from the need for (traditionally) brick-and-mortar brands to compete with online shopping. When retailers tried (and failed) to compete with established eCommerce giants such as Amazon or ASOS by simply launching webshops of their own (Multichannel retailing), they took it one step further. Rather than beat the likes of Amazon at their own game, retailers began doing something Amazon (at the time at least) couldn’t do – leveraging both their physical and digital channels, not in tandem but in unison. For this to work the connection between these channels should be as seamless as possible, so that it stops being the brand’s online experience bleeding into the physical, or vice versa, and it simply becomes the single brand experience.

This move towards omnichannel can come from both directions, as in recent years we have seen pure-play eCommerce brands expand into stores. Amazon for example is building futuristic stores which use customers’ existing amazon accounts instead of checkouts, and are filled with advanced retail technology, blurring the line between physical and digital. Not only is this a unique example of an omnichannel offering but it shows the fact that an omnichannel approach is not just for brick-and-mortar retailers trying to stay competitive, even the ‘disruptor’ e-tailers are repositioning to an omnichannel offering.

2020 and the Omnichannel revival

The effect of COVID-19 on retail has been well reported so we won’t delve into that here. The key conditions for the relevance of omnichannel are the huge spike in eCommerce and customers reluctance to return to stores. A report from Nosto claims at the height of lockdowns online channels spiked 66%, and a separate report from Klarna found that 71% of shoppers are putting off doing their Christmas shopping in-store this year due to COVID concerns. Whilst brick-and-mortar sales struggling or stopping entirely was bad news for any retailer, brands that have more advanced digital and omnichannel capabilities have weathered the storm far better. They have done this by being flexible and serving the customer wherever is more convenient and comfortable for them. Whilst for many this is online for others it is a mixture of both. This is where the interplay between channels with services like curbside can make a real impact.

The demand for click-and-collect & curbside is higher than ever

As stores have re-opened, many customers want to purchase products from their local stores but are still cautious about fully returning to in-store shopping. Buy-online-pick-up-from-store (BOPIS) offers a convenient and safe solution to these concerns. Customers can check online what stock their local store has available; purchase items online and then collect from the store the same day. This offers a convenient and contact-free alternative to shopping in-store, with Curbside pickup the same concept except customer don’t even have to enter the store. According to customer surveys, 80% of shoppers expect to increase their use of these services over the next six months, and 85% have already significantly increased their use of curbside since the year began. Whilst the initial spike in demand for these services was due to COVID-19, as customers grow accustomed to the convenience, the demand for BOPIS will continue well beyond the pandemic.

Ship-from-store is proving decisive in the online-centric New Normal

On the other side of the omnichannel coin, we’ve seen many retailers absorb the eCommerce bump through the use of ship-from-store. Simply put, ship-from-store involves fulfilling online orders using store stock, effectively leveraging stores as miniature distribution centres. The benefits of this under normal circumstances are already significant, such as cutting down on last-mile fulfilment and offering customers more stock. During the pandemic, however, ship-from-store was a lifesaver for many, allowing brands to not only capitalise on increased online orders but to leverage quiet or even closed stores to prevent unsold inventory piling up. Two of the largest retailers in the USA have been betting heavily on ship-from-store this year, not only as a way to ride the wave of the pandemic but to even compete with the power of Amazon. Walmart expanded their ship-from-store capabilities to 2,500 locations earlier in the year, whilst target reported fulfilling 90% of their online orders from store cutting the cost of fulfilment by 30% and overseeing 100% increase in digital sales YoY.

A temporary blip, or a permanent shift?

The key question is of course, how temporary is this change? As things start to get better around the world, will brands who have bent over backwards to reposition to the ‘new normal’ only find themselves at a loss if things completely revert back to normal? While the drastic increases to eCommerce will fall off a certain extent, in the long-term it will remain higher than pre-pandemic levels. The report from Nosto suggests that this is now levelling off to an average increase of 7%. Not only does this mean the business case for omnichannel services is still stronger than it was at the start of the year, but as customers have relied on services like online and curbside out of necessity, in the future they will continue to demand it of a preference for convenience.

What do retailers need in order to offer a strong omnichannel experience?

So, what are the requirements for retailers attempting to offer their customers these services and experience? Whilst it does depend on how advanced the offering is, the fundamentals are digitisation and integration across all channels.

Expert Chris Walton says there are three foundations to omnichannel retailing:

- Cloud commerce

- Real-time Data Capture and Applications

- Location and Context Analytics

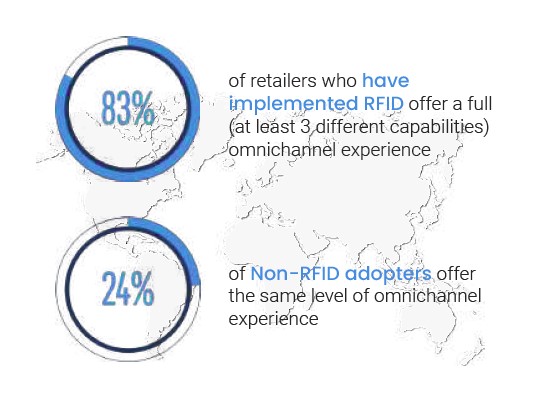

For services like click-and-collect and ship-from-store, the first two points are key. The cloud is needed for the sharing of information, both between the retailers two channels (the store and webshop) and between the retailer and the customer. The data capture is vital for these services to be accurate as to sell products in-store to online customers, retailers need to know exactly what is in stock in their stores to an individual item level. This is why RFID is a key component of omnichannel retailing as it offers the real-time visibility of the products and the high 99% stock accuracy so retailers can offer omnichannel services with confidence.

Want to find out what it takes to implement RFID in retail? Register for our upcoming webinar:

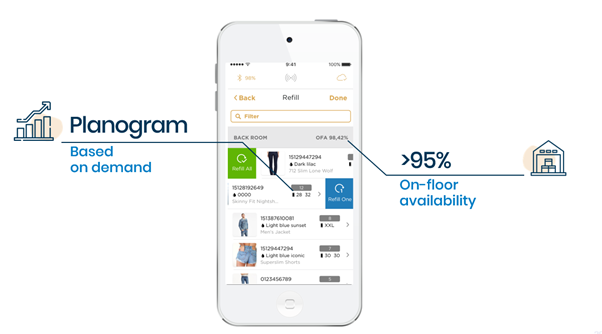

What is the replenishment Feature?

Replenishment is a key feature of the Detego platform for retail stores. Via the mobile application, it guides staff through the process by determining what items need to be replenished on the sales floor, by comparing the salesfloor stock to either a ruleset or a planogram. Staff then go through the replenishment process moving items to the sales floor and confirming the transfer by swiping on the mobile app. This feature increases the OFA (on floor availability) of products in the store, and the application displays the exact OFA as a percentage.

What problem does it solve?

Not finding the right product in the right size is a pain point all too common when shopping in stores. How many times have you not purchased something from a store simply because it wasn’t available, or you couldn’t find it in your size? Use of the Detego replenishment feature improves the availability of products in stores to over 95%. Product availability means having at least one of each product on the sales floor ready to purchase at all times – down to each specific size and colour. So, this means that customers looking for a particular product have at least a 95% chance of finding what they’re looking for, increasing both sales and customer satisfaction.

All stores will have processes for replenishment. It’s a core operational function for retailers that’s vital to maintain sales and keep stores running. Like many operational processes, however, there is great variance in how effective a stores replenishment might be. The two key factors to look at are the accuracy and the timeliness of replenishment. If stock information is incorrect, then any replenishment list created from it will be inaccurate, meaning items that aren’t available on the sales floor are not replenished and therefore can’t be sold. Similarly, if items aren’t replenished in a timely manner, then they will be unavailable to purchase even though they are sat in the backroom of the very same store!

How does replenishment work with the Detego platform?

The Detego platform delivers reliable and accurate replenishment through the use of the Detego mobile application and goes hand-in-hand with the application’s stocktake feature. With the 99% accurate view of both the backroom and the salesfloor achieved by performing daily stocktakes, the Detego replenishment feature compares the inventory on the sales floor to either the store’s planograms or the ruleset of inventory for the store. It then lists all the products that need to be replenished from the backroom on to the salesfloor – providing staff with a pick list. Stores may also have additional capabilities for replenishment depending on which features they have enabled.

Let’s explore the different options for replenishment with the Detego platform:

‘Standard Replenishment’: Replenishing after a full stocktake

After an associate completes a full RFID stocktake, the Detego platform has an accurate view of the items on the sales floor and in the backrooms. It then creates replenishment advice to ensure that products either out-of-stock or running low on the sales floor are moved there from the backroom to maintain a high On-Floor Availability (OFA).

- The Detego platform uses the results of the latest stocktake and creates a list of items that need replenishing from the backroom to the sales floor.

- Staff use a hand-held reader with the mobile app to see the replenishment advice.

- As staff move an item to the sales floor, they confirm the transfer by swiping on the mobile app.

Replenishing sold goods – ‘intraday replenishment’

With an integrated Point of Sales (POS) system, the Detego platform can update the replenishment advice whenever an item is sold. This ensures that the item is replaced on the sales floor if there is stock available in a backroom.

- When an item is sold, the Detego platform checks if that product is now out-of-stock or below the set thresholds.

- If this is true, a notification about the need to replenish the article is sent.

- Staff use a hand-held reader with the mobile app to see the replenishment advice.

- As staff move an item to the sales floor, they confirm the transfer by swiping on the mobile app.

Additional ‘smart’ replenishment features:

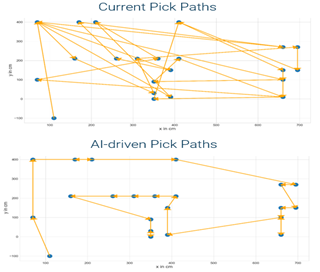

Smart Replenishment: AI Picklists

For larger stores, the Detego platform takes replenishment advice to the next level. The system utilises the RFID tags on every product alongside machine learning algorithms to can determine the relative location of items in the backroom. It then presents the replenishment list to staff in a particular order, grouping items that are near each other in the backroom. The result is that staff picking items to be replenished save time and energy thanks to intelligent assistance from the mobile app.

AI planograms

So, replenishment work by comparing the stock that is on the sales floor to a list or ruleset that determines what should be there. But where do these lists or rules come from, and is there room for improvement? Typically, stores will either have a basic ruleset for all stock, or more complex planograms for specific items. While rulesets are simple, they are sometimes suboptimal, but planograms for individual products are hard to maintain. With the Detego platform, stores can run Artificial Intelligence planograms which constantly learn and adapt what the optimal quantities and size distribution is for every single product in the store

Want to see this feature in action for yourself?

Book an online demo with us today:

Watch the latest episode of the Retail Corner Podcast, where Detego’s executive chairman, Kim Berknov, joins a panel of industry experts to discuss a growing trend in retail: the pop-up store.

Digital retailers looking to expand into the brick-and-mortar sector are eyeing fairly new concept of Pop-Up Stores to lower implementation cost, test new markets and increase engagement with new customers.

In this panel discussion, experts from the retail industry bring into the spotlight the value-added benefits, logistics, misconceptions and supported technology in creating pop-up stores.

You can listen to Retail Corner here, or watch below:

The Panelists:

Kim Berknov – Executive Chairman, DETEGO

Sampath Kannan – CEO, Tejas Software

Vince Cavasin – Head of Marketing, FenixCommerce

Vivek Raj – CEO, Digital Spaces Inc

Anil Varghese – CEO, Proxima360

Moderator:

Carlos Diaz – Director, Sales, Proxima360

Want the latest retail and retail tech insights directly to your inbox?

Discover how retail RFID is changing the industry for good. This eBook will guide you through the top 10 needs identified by retailers to ensure sustainable success in the modern environment. Explore the common challenges preventing retailers from achieving their goals and learn how applying smart RFID-based solutions delivers consistently good results.

What is in the eBook?

The retail industry is currently ruled by change. The digital age has seen a huge growth in competition from e-commerce and a rapid shift in consumer preferences. This shift has altered the industry greatly with modern ‘omnichannel’ customers demanding to shop where they want, how they want and when they want. Delivering such an experience is a challenge, one that requires brick-and-mortar retailers to change.

In this eBook, we analyse the top 10 needs identified by retailers to ensure sustainable success in the modern environment. Within each of these needs, we identify the challenges often preventing retailers from achieving them, and how applying smart RFID-based solutions can deliver consistently good results.

Improving key metrics in stores

- How retailers use RFID for quick and efficient stocktakes and cycle counts

- Improving stock accuracy in stores

- How smart solutions are being put to use for item-level replenishment, ensuring products and sizes are always available to be sold.

Delivering to customers with retail RFID

- How stores can reduce common customer friction points

- The relationship between RFID and effective omnichannel services

- The advanced retail RFID solutions that improve the in-store customer experience like chatbots and smart fitting rooms.

Optimising supply chains from source to store with automated processes

- How to achieve supply chain visibility with real-time info on the movement of products inside and across individual stores and distribution stages.

- How RFID is used to aid logistics at distribution centres, including automated processes like exception handling and order picking.

- What RFID means for retailers’ data and analytics capabilities, such as advanced supply chain traceability and new KPIs for stores and DC’s.

Protecting brands and products from theft, counterfeits and the grey market.

- How RFID can be used to monitor and reduce shrinkage, including theft, both in stores and across the entire supply chain.

- How brands are combatting counterfeit goods by tagging and tracing their products with RFID.

- What the Grey Market means for retail and how several major brands use RFID traceability to locate and stop the source of grey market products.

Watch the latest episode the Retail Corner Podcast, where Detego’s executive chairman, Kim Berknov, discusses RFID technology’s ongoing impact on the retail industry.

As retail companies try to adapt and think outside the box in the new normal, more than ever, every sale is of extreme importance. This brings crucial importance to the never-ending quest for 100% accuracy of having the right merchandise at the right place, at the right time. Kim Berknov joins Proxima360‘s Carlos Diaz on the Retail Corner podcast to discuss transforming inventory accuracy with RFID.

The podcast covers:

- What improvements have been made to RFID in order to see drastic changes in cycle counts, inventory counts and receiving merchandise

- The timing and productivity difference between conventional inventory counts versus RFID technology

- How RFID improves the replenishment process

- The best approach to get started in implementing RFID

- And more…

You can listen to Retail Corner here, or watch below:

Want the latest retail and retail tech insights directly to your inbox?

How is a Detego stocktake different?

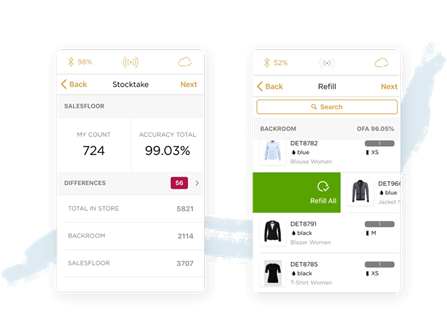

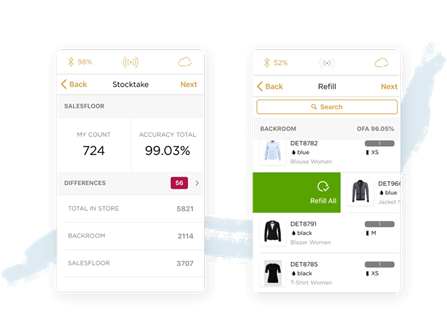

For retail stores using the Detego platform, the stocktake is where it all starts. While typically stores would only perform a full stocktake, also knows as a cycle count or an inventory, a handful of times a year, the RFID-powered Detego application allows stocktakes to be performed bi-weekly or even daily.

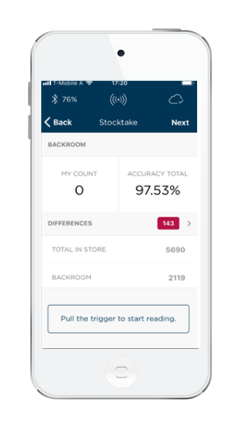

Staff perform a stocktake through the Detego mobile application, connected to a handheld RFID reader. The application guides staff through the process, displaying the current count, the differences from the target list and the stock accuracy percentage. Stocktakes are vital to maintaining an accurate inventory – with the Detego platform stores can reach as high as 99% stock accuracy.

What problem does it solve?

Regular stocktakes are essential to maintaining a high level of stock accuracy and maintaining On-Floor Availability (OFA) of products.

Performing regular stocktakes:

-

Is the key to achieving high stock accuracy and shop floor availability

-

Enables store managers to uncover stock discrepancies

-

Provides insight into product performance and enables review of pricing strategies

-

Exposes theft

However, a manual count of inventory or a barcode cycle count is incredibly time-consuming. Counting items individually takes at least several hours and often means closing the store or working around opening hours. As a result, cycle counts in retail stores are typically only performed a handful of times a year, meaning lower stock accuracy in stores – the average being between 60-70%.

The Detego platform changes this. Powered by RFID, staff using the stocktake feature can perform a stocktake of both the backroom and salesfloor in around 30 minutes (depending on store size). The RFID reader can read product signals all at once, so it can count hundreds of items in seconds. A Detego stocktake can also never count a product more than once and is far less likely to miss items as direct line of sight is not needed. The result of this an increase of stock accuracy to ~98%.

The Detego system:

-

Makes stocktaking much more efficient, easier, and faster

-

Brings more accurate stocktake results

-

Reduces operational costs of doing a stocktake

‘We scan every day, giving us the accuracy of the exact stock we have in the store, in roughly 35 minutes’

Manisha Hassan, Reiss Store Manager

Why is having a high stock accuracy in stores so important?

Stock accuracy for stores has become a core KPI for retailers. At the most basic level its vital for maintaining the availability of products on the salesfloor and preventing out of stocks which in turn increases sales – our customer, Reiss, increases sales by 4% by increasing their stock accuracy. Stores without such accurate inventory must compensate to maintain sales, so they will often carry excess stock to prevent out of stocks and lost sales. Increasing stock accuracy in such cases results in a significant reduction in inventory size, reducing working capital by as much as 30%.

When you look at more advanced retail trends, like the increasing connection between online and offline – high stock is simply non-negotiable. Offering online customers real-time store stock information naturally requires the retailer to know exactly what is in stock, and advanced services like buy-online-pick-up-in-store (BOPIS) built off of poor stock accuracy are destined to fail.

How does it work?

-

Each staff member selects the stocktaking option on their handheld device.

-

As each staff member reads the items in their designated area, their handheld device reflects the number of items that they have read and the current stock accuracy.

-

If more than one person is performing the stocktake, the devices are synchronised, and the stock accuracy is calculated using all the counts.

-

Once most items have been read, staff can see the number of differences between the actual and target counts and can attempt to resolve the differences (for example, re-reading an area and replacing any missing tags).

-

When a staff member has completed their read and resolved as many differences as possible, they confirm the result on their device.

The Detego stocktake in action

Our customers, fashion retailer Reiss, implemented the Detego platform in their 50 UK stores. They moved from doing 2-3 cycle counts a year to a stocktake every day. The result was an average store stock accuracy of 98%, and a resulting 4% uplift in sales.

Types of stocktake with the Detego platform

Guided Stocktake

A guided stocktake is the most common method for a Detego cycle count. Guided means that the handheld readers used for a stocktake show the number of items that the device has read and the calculated stock accuracy based on the number of products read by all devices and the expected stock of the store.

After reading all of the items in the store, staff can investigate the differences between the actual and expected counts, a process called difference clarification.

For example, staff may realise that they missed an area in the location they were reading, or there may be a surplus of a specific product on the salesfloor. Once staff have resolved as many differences as possible, they confirm their final count.

Blind Stocktake

A Blind stocktake works the same way as a guided one except that the handheld readers only show the number of items that the device has read. They don’t show the expected number of items or the current stock accuracy and staff can’t investigate any differences on their handheld device. Staff simply read the items in their designated location and confirm their count when their read is complete.

-

May be required for regulatory reasons

-

Enables the store manager to control the stocktake as individual store staff cannot investigate differences on their own

-

Reduces the risk of items going missing during a stocktake

Partial Stocktake

A Partial stocktake checks a subset of inventory, for example, a category of items, such as footwear, or a specific product. Partial stocktakes are useful if there is not time to perform a full stocktake, or if there are issues to resolve with certain types of stock. Partial stocktakes are useful in the following situations:

-

A full stocktake would take too long to complete in the time available

-

A full stocktake has highlighted issues with a particular item or location that need further investigation

-

A full stocktake for large stores would be complex and difficult to manage, so it’s more efficient to check individual locations separately

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Detego Store is a cloud-hosted RFID solution which digitises stock management processes, making them more efficient and more accurate. Implemented within hours, our multi-user app can provide intelligent stock takes and a smart in-store replenishment process. Later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

What is Smart Shield?

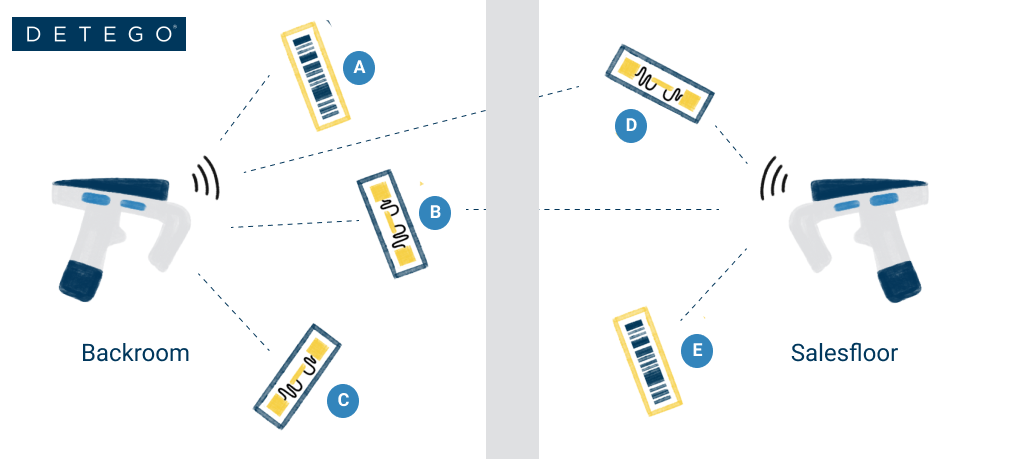

The Detego Smart Shield is a cutting-edge feature that determines the location of individual RFID tags, by using machine learning algorithms. This allows the Detego Platform to differentiate between the backroom and sales floor of a store, without the need for expensive physical shielding installations.

It’s vital that a stocktake tells you not only exactly what is in a store, but where the items are too. The two locations that need differentiating in stores are typically the backroom and the salesfloor. Store staff, and the Detego platform itself, need to be able to see exactly what’s on the sales floor so they can identify when items and specific sizes are running low so they can be replenished from the backroom. If this isn’t done, you can end up with products in stock but not available to purchase on the shop floor – a costly and easily avoidable mistake.

What problem does it solve?

RFID is able to read items from several feet away, and even through objects like boxes and walls – this is what makes it such an excellent technology for managing inventory. What this means, however, is that a staff member doing an RFID-based stocktake in the backroom could accidentally pick up signals from the sales floor, and therefore allocate items to the incorrect location.

The old solution to this problem involved using a physical shield that blocks RFID signals, often in the form of metal sheets or metallic paint. Making physical modifications to a store such as these is both expensive, costing up to $5000 per store, and time-consuming. When it comes to large scale rollouts of hundreds of stores, the added costs and manhours can be a major barrier to entry for RFID.

With the Detego platform, the need for physical shielding is removed entirely, significantly reducing the cost and time to implement RFID in stores. The Smart Shield feature is available out-of-the-box, meaning retailers can implement the cloud-hosted software in stores with very little fuss. This is what makes the Detego platform the most ‘plug and play’ RFID software on the market.

How does it work?

Every RFID tag creates a specific time and signal stamp when being read by an RFID reader – up to several times per second. Detego collects this data (created during stocktakes) and applies machine learning algorithms to determine the most probable location of individual tags.

Explanation of Smart Shield

The Detego Smart Shield in Action

The Smart Shield feature makes a massive difference for retailers undergoing RFID store rollouts at scale. These benefits include:

- Determines the location of individual items, with no need for physical shielding between separate stock locations

- Help optimise other processes and features, such as stock replenishment advice

- Allows for faster roll-out and reduces up-front costs, as no physical shielding is required

A Detego customer utilising Smart Shield recently rolled-out the platform in record speed, achieving 100 stores per month and with a stock accuracy of greater than 98%. This speed of implementation is far beyond anything seen before Smart Shield and allows retailers to get up and running quickly to unlock the benefits of the platform, driving an instant return on investment throughout their store network. By achieving high stock accuracy and on-floor availability in stores, Detego customers typically see between 3-10% revenue increase per store.

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Detego Store is a cloud-hosted RFID solution which digitises stock management processes, making them more efficient and more accurate. Implemented within hours, our multi-user app can provide intelligent stock takes and a smart in-store replenishment process. Later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

Crisis and change

The relationship between crisis and change is well documented. History is full of innovations coming out of periods of extreme strife. From the collapse of feudalism after the black plague to the invention of the lightbulb during the long depression, even the technology you’re using now, the internet, was a product of the cold war. More recent examples in business (and less historically significant) include both Airbnb and Uber becoming popularised during the 2008 recession. While they both existed before the crisis that popularised them, it was due to a sudden change in customer priorities and needs, where they truly thrived.

Digital technology in a time of physical distancing

Few would argue that COVID-19 is not a global crisis on the same scale as those mentioned above, and great change will be affected by it. COVID is likely to be an engine for major change not only because of its major economic consequences but because of its social implications too.

Video conferencing application, Zoom, has seen an increase in new users of 30x year-over-year, as the platform has become a social tool as well as a business one during lockdown. Speaking of business tools, Microsoft’s team collaboration programme, teams, has had 12 million new users since COVID-19, as businesses get to grips with remote work. Even the physical world of exercise is being supported by digital technology, as applications such as Strava and Peloton have exploded in popularity.

All of these illustrate a major trend of the response to COVID-19 crisis, which has seen digital technology used to bridge the physical distance that is enforced on many worldwide.

Retail’s digital shift – accelerated

To focus on retail, the story is the same, with there being both an economic and a social impact for brands to navigate. The financial impact of COVID-19 has been huge for retailers, with sales dropping by as much as 70%. This has left almost all brick-and-mortar retailers looking at negative cash flow as a result of closed stores. But even when they reopen, consumer confidence and low foot traffic will still be a concern. Brands will need to find ways to engage with their customers and serve their needs in new ways, as well as to adapt operating models to deal with the major financial strain.

The trend of people relying on and embracing digital channels during this crisis could not be truer in the retail industry. Since becoming the only sales channel available in many categories, eCommerce has soared during the pandemic, with increases of 25-80% depending on the country and industry. Whilst eCommerce is by no means ‘new’, the coronavirus has certainly accelerated its use and numbers are expected to remain higher than before even after the pandemic is over.

Leveraging physical stores in a digital world

This change presents some challenges for brick-and-mortar stores. Even though most brands will have seen an increase in their online sales, stores are still the backbone of retail. But with reduced foot traffic and increased competition from online, stores may need to adapt to stay competitive. Like many trends that have seen sudden surges in popularity during the crisis, the means to do this already exist, but they have suddenly become far more significant.

What are some examples of retail innovations likely to be accelerated by COVID-19?

Retail digital transformation

These developments are just one side of an ongoing digital transformation in retail, that is now more important than ever for retailers to get right. Retailers need the visibility, stock accuracy and item-level data to not only reliably serve customers across channels, but to reduce costs and improve business efficiencies in a challenging economic climate. Some retailers are ahead of the game in this regard and will more than likely absorb the impact of the crisis better than others.

Technologies like RFID, the IoT and advanced analytics modules are driving this digital transformation and creating more agile and resilient operating models. Whilst the current situation in retail is bleak, brands coming out of the other side are likely to be more resilient in the long term, as well as more accessible and seamless for customers across channels.

Want to learn more?

Webinar

Apparel Retail’s New Normal: COVID-19 Impact and Future Trends

Now stores are facing new social distancing guidelines, the formula for customer experience has changed. With reduced foot traffic and higher levels of eCommerce, the digital evolution of the retail store is now or never. Join us on the 16th of June as we dive into the physical and digital transformations behind retail’s ‘new normal’.