Retail has been on a transformation journey ever since the birth of the internet, and the online shopping and digital consumers that came with it.

Many new (often online-first) brands have grown into superpowers, and ‘traditional’ brick-and-mortar retailers have had to adapt their offering in order to stay competitive in what is a dramatically different environment compared to just ten years ago.

Make no mistake, this industry shift as a result of digital channels is still ongoing. While it by no means spells the death of physical retail – the industry must continue to adapt.

Brick-and-mortar retailers selling online, and gradually adopting an omnichannel model, is a big step in this journey.

This gradual shift has been greatly accelerated by the pandemic. While omnichannel was in many retailers five-year plans, the pandemic meant brands had to shift suddenly to survive in a temporary world where online was king.

So, as many retailers are leaning hard into omnichannel – is the industry ready? The operational challenges and costs associated with omnichannel mean some retailers might struggle to really profit. So, what can brands do to change this, and what technology should they invest in to ensure their omnichannel strategy delivers long-term?

The Omnichannel Surge

The pandemic was a big accelerator for the already ongoing digital transformation of retail. The temporary circumstances of the pandemic meant more shoppers were forced online. A report from Nosto claims at the height of lockdowns online channels spiked 66%.

This online spike also affected omnichannel services. Click-and-Collect/BOPIS increased 70 percent by volume and 58 percent by value in 2020, according to ACI Worldwide data. Meanwhile, retailers fulfilling online orders from stores grew by 80% in the US, according to global data.

While spikes like this are temporary, online channels will not return down to pre-pandemic levels. This is not only because of ongoing safety concerns, but because many consumers have been introduced to online channels or omnichannel options like BOPIS & curbside for the first time. Many of these new digital consumers will not give those options up, why would they?

So, while stores are coming back and will remain a key part of retail, the environment that they exist in will have changed, with stores operating as part of online channels rather than in tandem or competition with them.

This isn’t new however – the industry has been talking about the gradual move to omnichannel for a long time. What’s significant is how this sudden spike has forced brands to react and adapt far faster than they would have planned. In fact, the pandemic has accelerated this shift by up to 5 years according to data from IBM.

So, are retailers well-positioned for this sudden spike in omnichannel activity?

Growing Operational Challenges for Omnichannel Stores

For the main two omnichannel activities – BOPIS & Ship-from-store, store staff effectively have to do extra work that the customer or the DC would normally do, respectively. These services have natural advantages for retailers and customers, but without the right support store staff can struggle to fulfil these orders and keep on top of their normal tasks.

When stores are quiet like during the pandemic, this is not an issue and allows you to leverage stores and staff that would otherwise be unproductive. Moving forwards, however, as stores begin to return closer to normal foot-fall levels, staff may be overwhelmed without extra help like more dedicated in-store fulfilment staff or supportive technology.

IT & Inventory Management Improvements Required

Even with the staff and operational manpower to fulfil and deliver these omnichannel services, if a store’s IT system is not up to scratch they will struggle to fulfil orders correctly and deliver on the promises made to customers.

For this to work, brands need a single view of stock across their stores and online shop. For brands to offer reliable and profitable omnichannel services, their inventory management system needs to fulfil three key criteria.

The first is simply accuracy. If stores are running at a standard 70% inventory accuracy, the likelihood of them offering stock to customers that simply isn’t there is too high.

The second – stock needs to be as close to real-time as possible to maintain this accuracy throughout the day. If stock is not updated throughout the day, then it becomes impossible to offer reliable services like BOPIS.

Finally, to do these services effectively it is much more manageable if stock is operating on an item-level rather than an SKU level. This allows stores to easily distinguish between identical items, so ship-from-store or BOPIS can work down to the final remaining SKUs.

Without this infrastructure in place, it’s common for BOPIS or ship-from-store to offer customers stock that isn’t actually there. The result is orders being cancelled shortly after they are made, and customers being disappointed.

Handling Returns

Returns are the Achilles heel of online shopping in general, and omnichannel services are no exception. Not only do returns eat up margins, but they also again require some operational manpower to process and re-distribute, be it at the DC or the store.

This problem is particularly prevalent in apparel and sports retail due to sizes and fit. While apparel stores have a far lower rate of returns than online, when adding BOPIS and ship-from-store and return-to-store into the mix, the rate of returns can increase drastically.

Balancing The Cost of Omnichannel

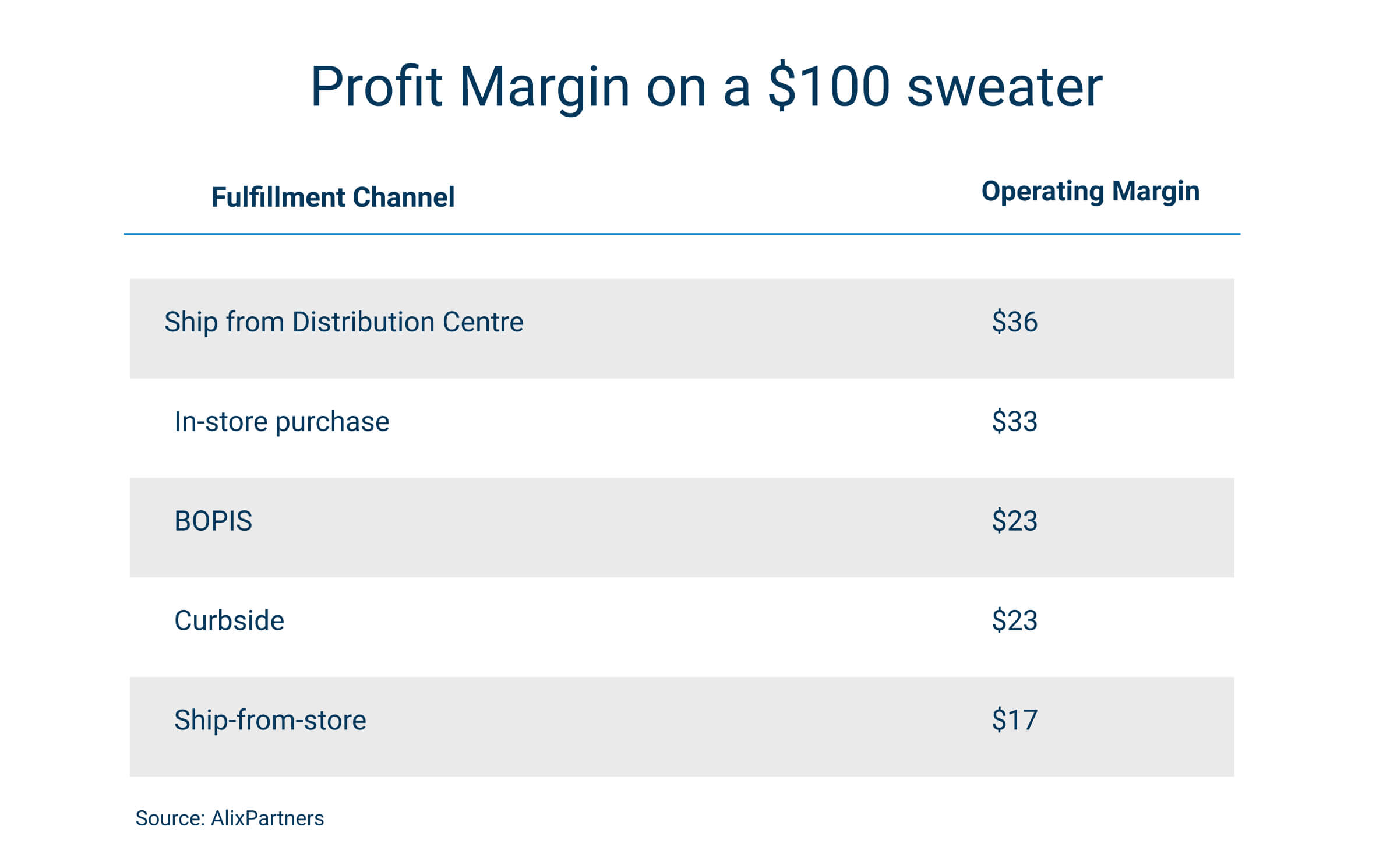

Managing and making the most of fine profit margins has always been key for successful retailers. When selling across channels in different ways – keeping an eye on the variable profit margins is essential.

Shipping from DC, also known as direct-to-consumer, is often the most profitable for retailers. This is why we have seen many brands begin to shift to more DTC models. This model has many advantages like bypassing third parties and servicing a larger area than stores, however, factors like returns can quickly have a negative effect on these margins.

Only somewhat less profitable is in-store sales. While rents and staff costs can be considerable, the operational tasks are effectively shared with the customer. While staff operate checkouts and maintain inventory the customer picks and packs their own orders. It may seem strange to think about in-store shopping in those terms, but some customers are beginning to wise up and appreciate the convenience of retailers doing this for them.

As we get to the omnichannel purchase methods, BOPIS (click-and-collect) and curbside, the operating margin is somewhat worse due to the fact that store staff have to pick and fulfil orders from the shopfloor or backroom. For curbside, there is also the added strain of carrying orders out of the shop to give to customers.

Finally, the most severe operating margin belongs to ship-from-store. This is because you have store running costs on top of in-store fulfilment as well as delivery costs. Despite this, we are seeing many major retailers lean into ship-from-store as a way to boost store sales and leverage store inventories. For example, Target fulfilled 75% of their digital sales using ship-from-store in Q2 last year.

Essentially, these models are all worth doing as they bring in additional customers and sales. Customer expectations are growing, and shoppers want to purchase and revive their products in whatever way suits them best, if you don’t meet those expectations, your competitor will.

However, for more operationally intensive models like ship-from-store and curbside pickup, it’s important to make sure these services are run as efficiently as possible, particularly when done at scale.

So, how can brands meet these challenges and ensure their omnichannel operating margins are as healthy as possible?

How RFID Delivers the Perfect Foundations for Omnichannel Services

Like we said earlier, the concept of Omnichannel retailing has been around for a while. Even before the pandemic, many forward-thinking retailers were beginning to invest in and build out their omnichannel capabilities.

To meet the operational challenge this meant setting up the new processes that go alongside BOPIS or ship-from-store and ideally adding more staff to support these processes. The IT challenges, particularly in terms of inventory and order management, require some more investment and technology integration.

When it comes to delivering the IT requirements for this, Radio Frequency Identification (RFID) is the single solution. While the deliverables of stock accuracy and product availability can provide a ROI for stores by themselves, laying the foundation for strong omnichannel services is often touted as the main reason for retailers choosing to implement the technology.

In a 2018 study, 83% of RFID adopters offered three or more omnichannel fulfilment options compared to only 24% of non-adopters. This is because RFID delivers a highly accurate and even-real time view of inventory at scale and across channels.

This single view of stock means retailers (and their customers) know exactly what is in stock at all times, making it easy to sell store stock online. Because RFID inventories work on an item level, these services can be completely granular, reserving individual items without even disappointing customers by offering them products that aren’t really there.

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Detego Store is a cloud-hosted RFID solution which digitises stock management processes, making them more efficient and more accurate. Implemented within hours, our multi-user app can provide intelligent stock takes and a smart in-store replenishment process. Later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

In the last ten years, many have predicted the ‘death’ of the brick-and-mortar store. While it’s true in recent years competition from e-commerce, amongst other factors, has seen a decline in store numbers, the death of physical retail has been greatly exaggerated.

The global COVID-19 pandemic was another matter entirely. Stores already feeling the pinch were hit with plummeting footfall or forced to close entirely. Customers were driven even further online as the industry shifted to the new digital-first world.

In the UK alone, a net decline of 6,001 shops was recorded in the first half of 2020, compared with 3,509 in the same period of 2019, according to research from PwC.

As stores begin to open back up, particularly across Europe, what does the future hold for the brick-and-mortar store?

Coming Back From the Brink

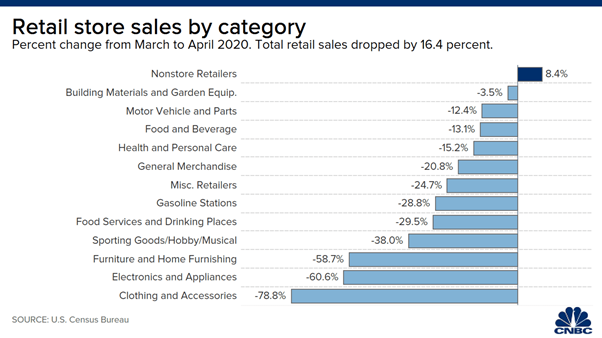

It hardly needs saying, and you can find a more detailed analysis on it here, but the pandemic hit the retail industry hard. The impact was not spread evenly, however, with the effect on sales varying wildly depending on sector and product categories. While sales of certain ‘discretionary’ categories such as fashion took a big hit, essential ones like grocery performed well, while lockdowns meant home-friendly categories like homeware and DIY were more resilient.

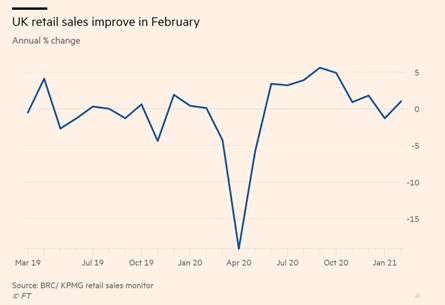

The other major variable was simply the shopping channel. The effect of the pandemic on e-commerce has been well documented, but in 2020 online became the main, often the only channel for many categories. In February 2021, online sales at non-essential retailers surged 82.2% compared with a rise of 3.6% during the same month the previous year, before the onset of Covid-19 in the UK.

Pure-play e-commerce retailers, therefore, were well-positioned. Multi-channel and omnichannel retailers were able to recoup some of their losses but not nearly enough to compensate for out-of-action stores. For the rarer pure-play brick-and-mortar retailer, however, the loss of revenue was severe – poplar British apparel retailer Primark’s profits plunged by 60%.

Stores Are Opening Their Doors to a More Digital World

But flashforward to now and with stores returning across Europe, what has changed? The majority of retailers are financially weaker due to the pandemic and are desperate to begin recouping and recovering their losses.

But that is not all, as the market has changed significantly in just a years’ time. Even beyond the lingering safety and distancing concerns that stores may have to contend with for some time, the uptake of online shopping and digital channels has accelerated greatly. While the inflated e-commerce levels of 2020 might be over, a proportion of this online penetration will stick. It’s a change that’s been coming for years, but the pandemic has accelerated this shift by up to 5 years according to data from IBM.

The balance of power between online and physical stores has changed, but not to the degree of 2020, where it flipped altogether. The Centre for Retail Research forecasts that online will account for 27.1% of retail sales in 2021, while this is lower than 29.8% in 2020, it is still a huge increase from 19.1% in 2019.

Some retailers and stores who were already struggling pre-pandemic will have cause for concern though as they are facing even more competition from online channels than before.

This competition does not mean the end of stores and in many sectors, the store will remain the primary channel, but this increased competition does mean stores have to do better. This includes both as a value proposition and on an operational level. Stores need to diversify and improve their offerings to attract returning customers, but just as importantly they need to diversify the role of the store and optimise their costs and margins to survive amongst higher levels of competition.

What do stores need to do?

Run Leaner Stores

Before trying to reimagine the store experience or create new store models, there is a big opportunity for many stores to optimise their costs simply by handling their inventory more effectively. You might be rolling your eyes, but we’ve seen time and time again that knowing exactly what is in your store can make be the difference between success and failure.

A fairly extreme example of this is when fashion brand Ted Baker overestimated their inventory value by £58m in a blunder that sent share prices tumbling. While this case is unique due to how extreme the error was, the problem itself is surprisingly common.

A store that has the typical 70% item-level (Not SKU) accuracy will be carrying up to 10-15% more working capital in the form of excess or ‘bloated’ inventory. Reducing this excess inventory at scale can have huge implications on bottom lines and will help brick-and-mortar stores stay profitable post-pandemic, this is without even mentioning the effect understocking can have on customers and sales.

Offer a Broader Range of Products

As stores look to position themselves better for the future – retailers should pay close attention to their product ranges in-store. This relates closely to two things we have just discussed – e-commerce competition and leaner inventories.

According to the Theo Paphitis Retail Group, 65% of online sales at one of their owned brands were for products not stock in their brick-and-mortar stores. While the convenience of e-commerce cannot always be matched (more on this in the next section) this discrepancy in product ranges is a big issue and one that can be solved. The issue is not even new – in a 2018 shopper survey, 67.3% of shoppers said they ‘Couldn’t find what they needed’ as the reason for leaving a store without a purchase.

Solving this issue is not a case of just stocking more products, it needs to go alongside our previous point in running more efficient inventories. This is so that stores can offer more products without increasing overall inventory sizes. On top of this, stores need to make it easier for customers to not only find the products to begin with, (e.g. by increasing product availability) but also by offering products beyond just what the store has in stock (like endless aisle or omnichannel orders) will also make the world of difference.

Utilise Stores as Digital Hubs

Since we’ve mentioned omnichannel – it is already proving to be one of the biggest factors for a store’s success, both during and well-beyond the pandemic. Many people have been banging the omnichannel drum for years and whilst some dismissed it as buzzword or a fad – since the pandemic omnichannel has become a must-have.

In the modern environment, stores cannot be islands. Customers have grown to expect brands to serve them across online and offline stores, in fact, customers don’t even think in terms of ‘channels’, and they shouldn’t have to. Things like click-and-collect and return-to-store have become increasingly popular due to the pandemic and customers aren’t going to just stop using them when it’s over. Click-and-Collect/BOPIS increased 70 percent by volume and 58 percent by value in 2020, according to ACI Worldwide data.

The other side of the omnichannel offering that is less customer-facing, but still of great significance is ship-from-store or in-store fulfilment. Whilst many retailers had already begun experimenting with in-store fulfilment due to its various business benefits, the pandemic forced many more to do so. Originally the reasons for this would be to utilise closed stores and deal with increased demand. Moving forward ship-from-store will remain relevant due to:

- The cost benefits of shipping items locally

- Being able to offer online customers more products

- Leveraging stores/store staff to serve online customers.

How Can RFID Help Stores Stay Competitive?

Most Brick-and-Mortar brands will already be adjusting their strategies to recover from the pandemic and best-position their stores to profitable in the long-term. In order to achieve some goals such as omnichannel integration and efficient inventories, store networks will need the right supporting technology.

RFID is the perfect solution to many of these challenges. Retailers who had already implemented the inventory tracking & managing technology pre-pandemic were well-positioned to adapt and sell inventory cross-channel. In the long term, RFID will allow retailers to optimise costs across stores and supply chains and be agile in the way they can handle and sell products to customers.

To find out more, read our new solution brief created alongside our partners, Zebra Technologies:

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Detego Store is a cloud-hosted RFID solution which digitises stock management processes, making them more efficient and more accurate. Implemented within hours, our multi-user app can provide intelligent stock takes and a smart in-store replenishment process. Later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

We are a year on from the start of the global Coronavirus (COVID-19) pandemic, and the world is still firmly in the grips of the crisis. But with vaccinations being rolled out globally things are certainly improving, and the end may well be in sight.

For retail, the outlook is similar. While more than 30 major retailers filed for bankruptcy last year (almost double that of 2019), the first green shoots are starting to appear. Most major brands have successfully pivoted to stay afloat during the crisis, and across both the US and Europe the rebound of the brick-and-mortar store seems imminent.

But what will post-pandemic retailing look like? How has the industry shifted in both the long and short term, and what can brands do to prepare for and capitalise on the beginning of retail’s recovery?

Early Signs of Retail’s Recovery from the USA and Europe

While nothing is for certain, most signs point towards this current period being the latter/final stage of the pandemic, particularly for Europe and the USA. With vaccinations beginning to roll-out at scale and many European countries beginning to ease restrictions and lockdowns, many experts are hopeful regarding the outlook for retail over the next few months.

Europe’s recovery: a mixed bag

Across Europe, the outlook is mixed. According to analysis from Business of Fashion and McKinsey & Co, whilst demand for struggling categories like fashion is predicted to increase, the ongoing effect of lockdowns is cause for concern. So, whilst recovery is expected, it will likely be to a lesser extent than other markets.

However, we have seen some encouraging signs despite lockdowns, as the BRC-KPMG retail sales monitor found that in February UK sales increased by 1% year-on-year. As stores are allowed to open back up the numbers will continue to improve, H&M said sales in the March 1st to March 13th period were up 10 per cent in local currencies as many countries, including single-biggest market Germany, began allowing some stores to reopen.

US recovery: encouraging signs for fashion and brick-and-mortar stores

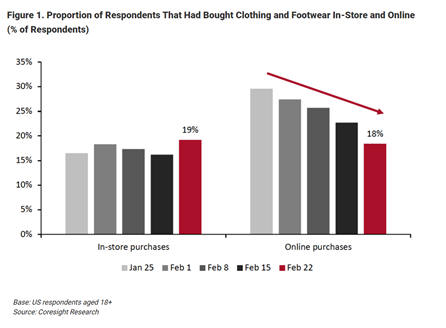

For the United States, the signs are fairly positive, with retail sales in 2021 expected to perform significantly better than in 2020, according to McKinsey and BoF. Additionally, recent findings from Coresight Research’s US Consumer Tracker found that, for fashion retail, the proportion of consumers that are purchasing clothing and footwear in-store was higher than those buying online for the first time since the pandemic – a major milestone for the sector’s recovery.

The report found several reasons for the US apparel industry to be optimistic, as 13% of respondents reported buying more clothing and footwear than pre-crisis, the highest level surveyed so far this year. Meanwhile, the apparel category witnessed the largest decline, of almost 6%, in consumers that are buying less than pre-crisis. Sales in apparel and other ‘discretionary’ categories were the worst affected by the pandemic, so these early signs of recovery are encouraging.

How have brands have shifted in the last year?

It’s been well reported how the global pandemic has affected shopping habits and caused a major increase in eCommerce penetration. According to data from IBM’s U.S. Retail Index (2020), the pandemic accelerated the growth of digital shopping by roughly five years.

This paradigm shift is reflected in the strategies of major retailers since the pandemic. With online becoming, at least temporarily, the primary shopping channel many retailers leant into and reinforced their eCommerce operations. But for the majority of retailers with significant physical store footprints, this was not enough, and the most successful brands developed their omnichannel offerings to better leverage their stores in the new digital-first world:

Buy Online, Pick Up in Store (BOPIS) is here to stay

Many retailers were investing in omnichannel services like BOPIS/Click and Collect well before the pandemic, but since then it has become something of a must-have and may remain so well beyond the pandemic. Retailers that had invested in Omnichannel before last year have reaped the benefits, as BOPIS saw YoY growth of 130% in June 2020. These retailers include US powerhouse Target who saw their curbside delivery service grow 500% year-on-year.

Stores as fulfilment centres

Similarly, brands with the infrastructure and agility to do so have been investing and leaning into in-store fulfilment throughout the pandemic. The advantages of this are considerable as it allows retailers to leverage their stores to service online customers. Target again made massive gains from this last year, reporting fulfilling 90% of their online orders directly from their stores, cutting fulfilment costs by 90% and contributing to a 100% increase in online sales compared to 2019.

Major fashion retailers are betting on Direct to Consumer (DTC)

Another major strategic shift that we have seen accelerated by the pandemic is the direct-to-consumer model. Although this model is nothing new, the fact that major global fashion retailers like Nike, adidas and Levi’s are evolving their strategy to become DTC-first is hugely significant. At the height of the pandemic, adidas saw their eCommerce sales increase by 93% but don’t think of this as a temporary shift – adidas recently announced that they’re aiming for DTC to account for 50% of their sales by 2025.

Long-term strategies taking shape?

So, what can we learn from these changes? Are these simply temporary shifts to navigate unprecedented times, or are they indicative of long-term industry change? The answer seems somewhere in the middle. Although the huge increase in digital sales that were seen at the height of the pandemic is already starting to fall away, the consensus is that a proportion of this change will be ‘sticky’ and digital sales will permanently remain higher than pre-pandemic levels.

As for brands exploring new models like DTC and Omnichannel, there is no doubt that these strategies will continue and remain relevant well beyond the pandemic. The demand and benefits of such models were there pre-COVID, and these changes have simply been accelerated.

The fact that many of these examples of omnichannel success come from the US is no accident. With the states having had fewer full lockdowns than their European counterparts, the success of these strategies could make a valuable lesson for European retailers looking to navigate the coming year – as consumer sentiment remains unstable and may well be signs of a more long-term shift in retail globally.

Preparing for Retail’s recovery: Short-term priorities

Taking Stock: Inventory Control will be Vital for Reopening Stores

As stores come out of lockdown across Europe, taking control of inventory will be a top priority. The first step will be taking stock and ensuring brands know exactly what they have in their inventories. For some stores, inventory management may have broken down due to lockdowns, particularly if stores have been used to fulfil online orders but do not have the IT infrastructure to keep effectively manage this.

Beyond this, the question of older or out-of-season products will present a challenge. Stores will already be dealing with bloated inventories due to lower sales and shutdowns, so maintaining optimal inventory levels and potentially selling marked-down products to make room for new stock will be a priority.

Continue to leverage online

Retailers should have invested in their digital channels at the start of the pandemic (and ideally before this). Even with stores opening back up, the increase in digital sales will remain high initially, and some will be sticky post-pandemic – just how much remains to be seen.

Retailers who continue to invest and develop in their digital and omnichannel offerings will profit post-pandemic. We have seen plenty of evidence supporting this from both the US and Chinese markets, so European retailers should follow suit and continue to offer flexible options to customers, many of whom may remain sceptical about returning to stores for some months to come.

Mastering fulfilment

With this consumer uncertainty and ongoing eCommerce penetration – making sure retailers deliver on fulfilment remains a priority. We can again look to target as an example, their same-day delivery sales went up 218% this quarter, showing the opportunity is there for retailers who can go the extra mile with their fulfilment, and even dare to compete with the eCommerce powerhouse of Amazon.

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Detego Store is a cloud-hosted RFID solution which digitises stock management processes, making them more efficient and more accurate. Implemented within hours, our multi-user app can provide intelligent stock takes and a smart in-store replenishment process. Later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

1- Adapting to the digital-first world

COVID-19 caused a huge increase in the role digital technology plays in our lives. Even for the already tech-savvy, work habits, social lives, exercise, and entertainment were all transformed into digital-first activities. Many of these trends existed before, but the pandemic accelerated this change by forcing many people to rely on digital channels and services more than ever.

The same is true for retail – online shopping and social media marketing are not new but have grown exponentially in the new normal, as customers stay at home and spend more time online. This means that, for all retail industries bar perhaps food, online channels have taken centre stage.

More than ever, customers are not only buying online, but they are also shopping online. What’s the difference? If we think of buying as the purchasing of a product, where the price is the primary factor, shopping is everything else – the experience, and the browsing and sampling of products, and ultimately the purchase decision itself. Traditionally e-commerce has always great for the former, but for actually browsing and discovering products its never been as good as in real-life. This is changing though, with digital technology like augmented reality (AR) allowing the customer to virtually try on products or see what they look like in true-to-life scale.

So, to adapt to this increasingly digital way of shopping Multichannel retailers or even pure-play brick and mortar retailers need to make more of an effort to reach their customers online. In the new normal, online is the focal point of the journey.

A webshop is one thing, but retailers need to make more of an effort to reach and meet their customers online. This means not only bringing products to customers with online and social media advertising but taking the entire brand experience online by engaging with customers on social channels and adapting to digital forms of experiences.

2- Understanding the new normal customer

While adapting to meet customers in the new environment is crucial, its just as important to really understand who the new normal customer is.

While they are of course the same people as before, habits and circumstances have completely changed – what customers want, and their priorities have completely shifted. As a result of this shift brand loyalty for many has gone back to square one, with more consumers changing and trying new brands this year than ever before. Whilst this puts retailers under even more pressure, it also presents an opportunity to attract and impress completely new customers.

But what has caused this shift, and who is the new normal customer?

3- Embracing Omnichannel

Omnichannel retail, offering an integrated and consistent experience between online and offline channels, is not a new concept in the industry. But much like online shopping, omnichannel offerings have become exponentially more valuable since COVID-19. With the balance between digital and physical retail shifting, retailers offering a strong omnichannel experience are in a far stronger position than those who do not. Simply having an eCommerce site on top of stores (multi-channel) will put retailers in a better position as pure-play brick-and-mortar retailers, as they can take advantage of the increase in online shoppers and still be able to deliver to loyal customers who can no longer shop in-store. However, with pure plays being rarer than ever this is simply not enough anymore.

Omnichannel goes beyond this, by seamlessly integrating online and offline channels, allowing for offerings like click and collect (Buy-online-pickup-in-store/BOPIS), return-to-store and ship-from-store (BOSFS). The benefits of such a strategy go both ways. Customers get access to more available stock and convenient purchasing options; they can collect from stores (BOPIS and curbside) or can get products shipped straight to their homes. For retailers, omnichannel allows you to leverage stores as miniature distribution centres, cutting down on shipping costs while keeping struggling stores busy. With click-and-collect, the benefits are similar and allow stores to benefit from and serve online customers, Curbside pickup is a new type of click-and-collect that has become hugely popular since the pandemic as it keeps customers feeling safe and allows for social distancing.

4- Optimising costs

As much as positioning for the new normal is vital for success going forward, the unfortunate fact is many brands will be struggling with the financial impact of COVID-19. As a result, optimising costs across the board is vital for retailers trying to weather the storm and stay open long enough to adapt to the new normal. Retailers feeling the worst of the financial strain of COVID will be forced to rethink their footprint in order to survive. Closing down stores and losing staff is always a last resort, but one the vast majority have been faced with this year, as less profitable locations are surrendered to ensure the survival of the brand. But what about retailers in stronger positions, those looking to optimise their costs in the long-term without hampering themselves or their customers?

For stores, improving the efficiency of in-store processes across the board can reduce operating costs in the long-term. Processes like inventory management (Processing inbound shipments, stocktakes, replenishment) point-of-sale and loss-prevention can all be streamlined with cost-effective technology. The focus should not be to manage these things more cheaply but to manage them more effectively. To use the point of inventory management, Detego has repeatedly found that increasing stock accuracy in our customer’s stores from an average of 70% to 98% means stores can run with far leaner inventories. If you do this at scale across your entire store network, it’s possible to reduce working capital by 10-15%.

In the supply chain too, there are huge opportunities to run more efficiently and reduce costs. The cost of handling and processing the flow of goods throughout the supply chain, particularly in Distribution centres, can be reduced by investing in technology like RFID and warehouse automation which reduces labour and handling costs. By improving the accuracy and visibility of their supply chain retailers can also reduce chargebacks and other costs associated with shipping mistakes. Finally, there are huge savings to be made by achieving full supply chain visibility – knowing exactly where individual items are (and where they’ve come from) allows retailers to fully optimise their supply chains reducing losses from shrinkage, counterfeits, and grey market goods.

5- Re-thinking data and digital for a post-COVID world

Retail, particularly sectors like fashion and beauty, has been facing the need for digital transformation for a few years. The rise of online channels, digital-first consumers, and the continuous advance of technology has meant brands can’t afford to stand still when it comes to how they run their businesses. Whilst understandably many brands are focusing on staying afloat in the immediate aftermath, COVID-19 did not stop this need for transformation – it accelerated it. Now there is a greater need than ever to ensure brands have the data and IT infrastructure to react to change and make the right decisions. With the sudden shift in the industry caused by the pandemic, retailers may need to revisit digital and analytics priorities but adapt them to a post-COVID world.

In times of uncertainty, accurate data, improved visibility, and effective analytics can make all the difference. We’ve already discussed how retailers with the right infrastructure (meaning accurate visibility over their products) are profiting from their omnichannel offerings. But having a mature tech stack can unlock tonnes of value that will be vital in the new normal. For example, item-level visibility and granular data in the supply chain not only allows for greater agility when dealing with supply and fulfilment but the data can be used for advanced analytics like demand prediction and inventory optimisation across store networks.

Want to explore this topic further?

Learn more about omnichannel with Detego:

Crisis and change

The relationship between crisis and change is well documented. History is full of innovations coming out of periods of extreme strife. From the collapse of feudalism after the black plague to the invention of the lightbulb during the long depression, even the technology you’re using now, the internet, was a product of the cold war. More recent examples in business (and less historically significant) include both Airbnb and Uber becoming popularised during the 2008 recession. While they both existed before the crisis that popularised them, it was due to a sudden change in customer priorities and needs, where they truly thrived.

Digital technology in a time of physical distancing

Few would argue that COVID-19 is not a global crisis on the same scale as those mentioned above, and great change will be affected by it. COVID is likely to be an engine for major change not only because of its major economic consequences but because of its social implications too.

Video conferencing application, Zoom, has seen an increase in new users of 30x year-over-year, as the platform has become a social tool as well as a business one during lockdown. Speaking of business tools, Microsoft’s team collaboration programme, teams, has had 12 million new users since COVID-19, as businesses get to grips with remote work. Even the physical world of exercise is being supported by digital technology, as applications such as Strava and Peloton have exploded in popularity.

All of these illustrate a major trend of the response to COVID-19 crisis, which has seen digital technology used to bridge the physical distance that is enforced on many worldwide.

Retail’s digital shift – accelerated

To focus on retail, the story is the same, with there being both an economic and a social impact for brands to navigate. The financial impact of COVID-19 has been huge for retailers, with sales dropping by as much as 70%. This has left almost all brick-and-mortar retailers looking at negative cash flow as a result of closed stores. But even when they reopen, consumer confidence and low foot traffic will still be a concern. Brands will need to find ways to engage with their customers and serve their needs in new ways, as well as to adapt operating models to deal with the major financial strain.

The trend of people relying on and embracing digital channels during this crisis could not be truer in the retail industry. Since becoming the only sales channel available in many categories, eCommerce has soared during the pandemic, with increases of 25-80% depending on the country and industry. Whilst eCommerce is by no means ‘new’, the coronavirus has certainly accelerated its use and numbers are expected to remain higher than before even after the pandemic is over.

Leveraging physical stores in a digital world

This change presents some challenges for brick-and-mortar stores. Even though most brands will have seen an increase in their online sales, stores are still the backbone of retail. But with reduced foot traffic and increased competition from online, stores may need to adapt to stay competitive. Like many trends that have seen sudden surges in popularity during the crisis, the means to do this already exist, but they have suddenly become far more significant.

What are some examples of retail innovations likely to be accelerated by COVID-19?

Retail digital transformation

These developments are just one side of an ongoing digital transformation in retail, that is now more important than ever for retailers to get right. Retailers need the visibility, stock accuracy and item-level data to not only reliably serve customers across channels, but to reduce costs and improve business efficiencies in a challenging economic climate. Some retailers are ahead of the game in this regard and will more than likely absorb the impact of the crisis better than others.

Technologies like RFID, the IoT and advanced analytics modules are driving this digital transformation and creating more agile and resilient operating models. Whilst the current situation in retail is bleak, brands coming out of the other side are likely to be more resilient in the long term, as well as more accessible and seamless for customers across channels.

Want to learn more?

Webinar

Apparel Retail’s New Normal: COVID-19 Impact and Future Trends

Now stores are facing new social distancing guidelines, the formula for customer experience has changed. With reduced foot traffic and higher levels of eCommerce, the digital evolution of the retail store is now or never. Join us on the 16th of June as we dive into the physical and digital transformations behind retail’s ‘new normal’.

Apparel Retail’s New Normal: COVID-19 Impact and Future Trends

16th June 4 pm BST / 11 am EDT

As apparel retail begins to get back to its feet, how are retailers preparing in the short-term, and what lasting effects will there be? The pandemic will cause the rapid acceleration of ongoing changes in the industry, and entirely new ones that could never have been expected.

Now stores are facing new social distancing guidelines, the formula for customer experience has changed. With reduced foot traffic and higher levels of eCommerce, the digital evolution of the retail store is now or never. Join us on the 16th of June as we dive into the physical and digital transformations behind retail’s ‘new normal’.

This webinar will cover:

- The impact of the COVID-19 crisis on the apparel retail industry

- How retailers are adapting retail stores to social distancing measures

- How a shift in the balance between eCommerce and brick-and-mortar is driving retailers to adopt digital-enabled stores

- How retailers can utilise digital and analytics to optimise operations and solve key challenges