The ‘Golden Quarter of Retail’ is one of the most profitable periods of the year, but the cost of living crisis could mean retailers struggle in 2022. What can be done?

How Will the Cost of Living Crisis Impact the Golden Quarter of Retail This Year?

The Golden Quarter of Retail, approximately between October and December each year, is typically retail’s most profitable period. Shoppers are planning for the Christmas period earlier than ever–59% of consumers will plan gifts at least a month before the holidays–and Black Friday offers another opportunity for companies to maximise profits.

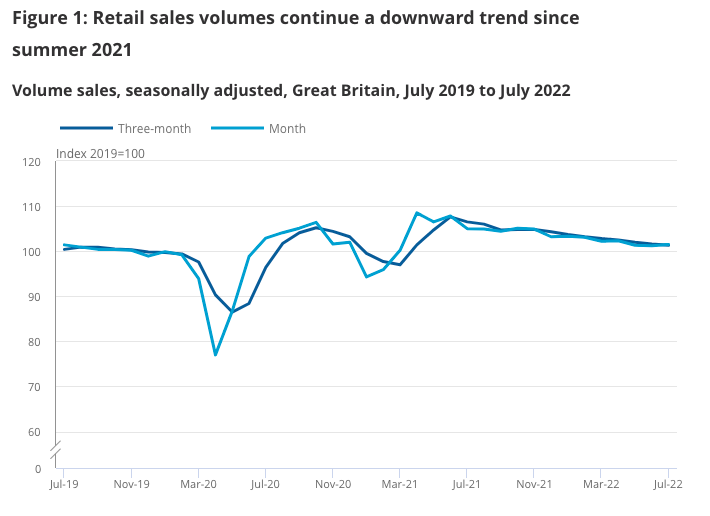

However, the Golden Quarter of Retail has been anything but golden in recent years. In 2020 and 2021, the Covid-19 pandemic affected Christmas footfall, and consumer spending has decreased from pre-Covid years. Between October and December 2021, sales of non-food items fell by 8% compared with 2019 levels, and now we are amidst a cost of living crisis.

When consumers were surveyed in early 2022, there was still some hope for this year’s Golden Quarter. Crucially, almost a fifth of consumers said they would increase spending in the same period in 2022 compared to 2021. The cost of living crisis has put a stop to this. With households increasingly tightening their pursestrings, this year’s Golden Quarter could be very different.

Importantly, though, if consumers are going to spend, they will begin spending early. Last October, retail sales grew for the first time in six months as consumers took to the high street early for Christmas gifts. It could be that, to space out purchasing, consumers once again begin shopping early in 2022. The expansion of the Golden Quarter of Retail to early October–or even September–means that there are additional opportunities for companies to maximise profit.

So, how exactly will the cost of living crisis affect the Golden Quarter of Retail in 2022? And what can retailers do in response?

How Bad is the Cost of Living Crisis?

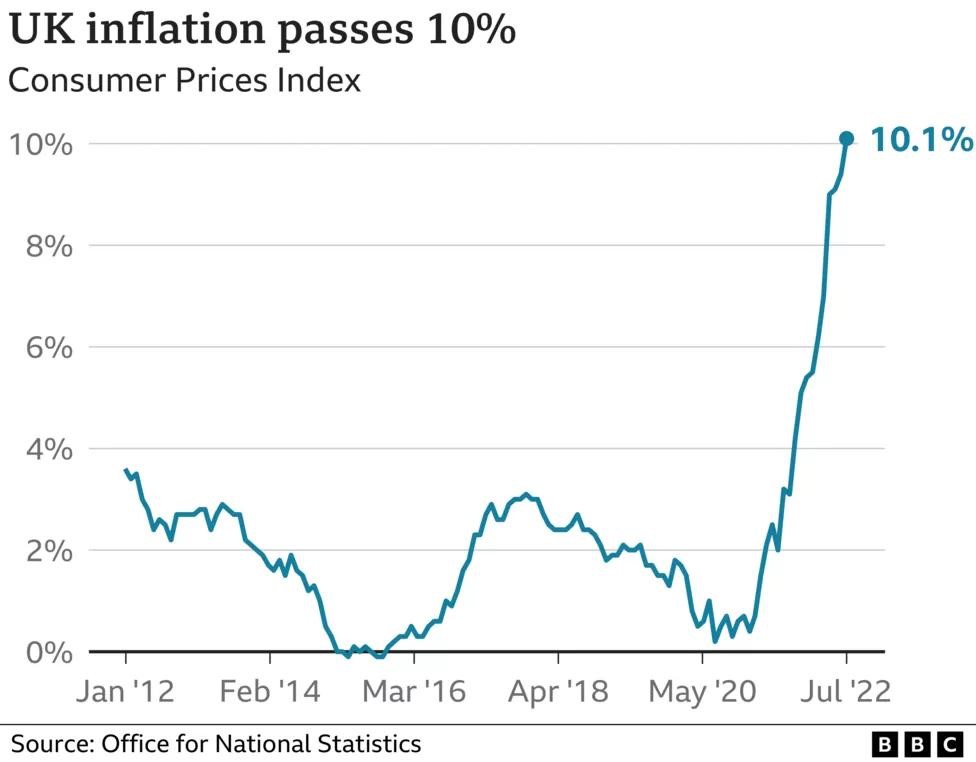

The inflation rate in the UK has been steadily rising for the last year. In August 2022, the rate hit a record-breaking 10.1%, and experts predict it could rise to at least 13% later in the autumn. It’s not just the UK that has been affected, though–across Europe, annual inflation has hit 8.6%.

There are lots of factors that have impacted the incredible rise in inflation in Europe and the UK. The biggest of these factors is undeniably rising energy prices, caused by Russia’s war on Ukraine and the increase in energy demand after the Covid-19 pandemic restrictions were lifted. To put energy price hikes in perspective, natural gas prices rose 96% between January and July 2022 in the UK. In the same period, electricity prices experienced a rise of 54%.

As well as energy bills, the war in Ukraine is also affecting food prices and further disrupting supply chains–another major headache for retailers in the last few years. Supply chain disruption has increased the cost of other goods, including raw materials, which will also affect the price of consumer products this year and into 2023.

Evidently, the cost of living crisis is severe and bodes for a challenging winter for both retailers and consumers. Unfortunately, the rising cost of goods and household utility bills are affecting consumer spending. This won’t surprise analysts, who predicted back in January 2022 that retail sales would be at risk this year. At that time, a survey from Barclays revealed that 43% of consumers expected rising inflation to affect their spending and household budgets.

That prediction seems to have come true. In August 2022, card spending in the UK fell by 1.9%, with consumers cutting back on purchases of clothing, DIY, and beauty products. Analysts at J.P. Morgan have alerted retailers that the cost of living crisis has “only just begun,” and future spending this year could fall by 10% if there is no energy price freeze in the UK.

The retail sector has been particularly affected by the cost of living crisis. In fact, it is the worst-hit sector in Europe in 2022, down 38%; the FTSE 350 Retailers Index has also dropped by 33%. This, along with the potential for more inflation hikes in the coming months, means retail faces a challenging Golden Quarter.

The Golden Quarter of Retail: How It Will Be Affected in 2022

The most significant effect of the cost of living crisis won’t be a surprise: reduced consumer spending. We can already see this happening as households prepare early for a challenging winter. Not only are consumers cutting back on purchasing non-essential items, but they are also reducing their impulse buys, instead waiting for opportune times to purchase.

As a result, Black Friday could prove far more critical in 2022 than in previous years. In fact, 51% of shoppers say that they consider Black Friday a vital time to make money go as far as possible. So, while households may have reduced spending power, they are still planning on spending.

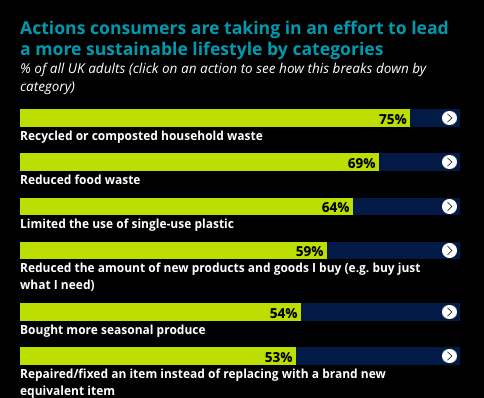

However, it’s also clear that consumers will be more selective about how they spend. As well as waiting for opportune moments like pride reductions, consumers may also be concerned about the quality of their purchases. We’ve already seen how sustainability has become a major factor in purchasing decisions over the last year. However, this could become more important when combined with the effects of the cost of living crisis.

Deloitte’s Sustainability and Consumer Behaviour Survey 2022 details how consumers are adapting their spending in light of environmental goals. The survey results highlight that people are embracing circularity and opting for more durable products. For example, over half of people (53%) have repaired an item in the last 12 months rather than replacing it. Additionally, 40% of people have bought second-hand or refurbished goods rather than new products. These decisions may not just be rooted in sustainability but also in reducing spending.

There is some proof already that shoppers are turning to preloved or second-hand goods specifically to combat the cost of living crisis. When asked why consumers buy second-hand items, 36% said they did it for sustainability reasons, while 32% said it was to cut costs. In particular, 35% of people who bought used products say it could make their money go further. Retailers are already taking advantage of this trend in anticipation of the Golden Quarter of Retail; earlier this year, fast fashion brand Boohoo launched their PrettyLittleThing resale site.

Aside from shifting consumer behaviour, inflation, and the subsequent cost of living crisis, will also impact operating costs for retailers. Rising energy prices will affect international retailers and smaller businesses, and the cost of raw goods may influence which products end up on shelves.

Despite pressures in the Golden Quarter of Retail this year, there is still cause for retailers to be optimistic. While 88% of shoppers say they are concerned or very concerned about the cost of living crisis, 91% of people who usually buy on Black Friday say they will be as engaged this year. Adapting to these shoppers–and their new spending habits–will be paramount if retailers are to see growth during the coming months.

What Can Retailers Do in Response to the Cost of Living Crisis?

It may appear that very little can be done to adapt retail strategy in the face of the cost of living crisis, especially when it’s set to impact every part of retail, from consumer behaviour to operating costs. However, there are still opportunities for companies as they prepare for the Golden Quarter of Retail. The extent to which companies can capitalise on lower consumer demand will depend on how well they can adapt their strategy and ride consumer trends.

In particular, there are three aspects retailers should prioritise as we go into the Golden Quarter of Retail in 2022: actual consumer demand, process efficiency, and supply chain visibility. Focusing on these factors will lead to an optimised retail strategy and greater chances of encouraging purchasing in the Golden Quarter of Retail.

Stock According to Demand

Preventing overstocking will be a crucial priority for retailers this winter. Excess inventory can represent an additional annual cost of between 25% and 32%, so knowing exactly which products and how much to stock will be imperative.

Paying attention to in-store and online consumer behaviour can help retailers determine which products will see more sales in the Golden Quarter of Retail. If retailers can quickly respond to changing behaviour, they will likely encourage consumers to part with their hard-earned cash during a difficult period.

Improve Process Efficiency

Operational efficiency is always vital, especially during a period of high retail costs. Preparing for the Golden Quarter of Retail will mean extracting as much value from current processes and labour as possible. Improving the efficiency of inventory counts will be paramount, as will reducing the amount of time staff spend searching for required products for customers on the shop floor.

Prioritise Supply Chain Visibility

Finally, retailers should seek to increase the transparency of their supply chains. Not only will this optimise processes by providing data on how retailers can adapt supply chains to reduce costs and increase efficiency, but it can also provide customers will valuable data on retail sustainability: something we know is becoming a significant factor in purchasing decisions.

How RFID Can Help Retailers Adapt to the Cost of Living Crisis

One piece of software connects these three focus areas: RFID technology. When retailers implement RFID tagging, they gain access to a wealth of data that can improve operational efficiency and ensure the shopping experience caters to consumer behaviour. RFID could mean the difference between a challenging Golden Quarter of Retail and a profitable one.

Firstly, RFID can improve processes in stores by reducing cycle count times by 96%. Workers are thus free to spend more time interacting with customers and building brand relationships, which can be a uniquely valuable task during a period of reduced consumer spending, offering returns into the future.

RFID technology can also increase stock accuracy to 99% from a global average of 60%-80%. This is paramount when retailers plan to stock particular products in response to shifting consumer behaviour. Improved stock accuracy can also reduce out-of-stocks, improving the likelihood of sales.

Finally, with RFID tags, products can be accounted for at every stage of the supply chain, offering unique data on operations. As retailers prepare for the cost of living crisis to endure into 2023, they must examine where cost-saving improvements can be made. This could mean changes to lower-cost delivery routes, which could also provide additional benefits to consumers in the form of faster shipping.

Though the Golden Quarter of Retail is set to be challenging this year, there are opportunities for retailers. However, responding to the cost of living crisis will require adaptability. This is a chance for retailers to invest in RFID technology to improve retail efficiency and cut operational costs.

Prepare for the Golden Quarter of Retail

Stock accuracy, on-floor availability, and improved supply chain visibility.

Book a demo with RFID to discover how our cloud-hosted RFID solution could help you maximise your profit during the Golden Quarter of Retail, even while navigating the cost of living crisis. Our multi-user app can provide intelligent stock takes and a smart in-store replenishment process. At the same time, you can effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.