Omnichannel retail has become increasingly important in 2020. As consumers and retailers adjust to the new normal, how can an effective omnichannel strategy help brands absorb some of the impact of COVID-19 and serve their customers best going forward?

Is 2020 the year that made Omnichannel retail’s new normal?

Omnichannel retailing, offering customers a unified and convenient experience across and between shopping channels, has exploded back into relevance this year. For those in the industry, it might feel like it’s been around for ages – and it has. So long in fact that omnichannel grew into a buzzword that was thrown around relentlessly to the point that the term was declared ‘dead’ by many. The reports of Omnichannel’s death have been greatly exaggerated, however, with the ability to serve customers across multiple channels becoming a life raft for many retailers this year. While the conditions faced this year will be once-in-a-lifetime, many of the effects and trends may be long-term.

What exactly is Omnichannel retailing?

In short, omnichannel is the perfect connection and interplay between a brand’s physical and digital channels. A pie in the sky omnichannel experience is one where the differences or barriers between shopping in-store, online or on a brands app do not exist. You can check a physical stores stock levels on an app, the webshop remembers what you purchased in-store and uses it to recommend you more relevant products and so on. More grounded and familiar examples of this type of retailing are services like click-and-collect (Buy-online-pick-up-in-store) or ship-from-store (buy-online-ship-from-store).

Omnichannel was born from the need for (traditionally) brick-and-mortar brands to compete with online shopping. When retailers tried (and failed) to compete with established eCommerce giants such as Amazon or ASOS by simply launching webshops of their own (Multichannel retailing), they took it one step further. Rather than beat the likes of Amazon at their own game, retailers began doing something Amazon (at the time at least) couldn’t do – leveraging both their physical and digital channels, not in tandem but in unison. For this to work the connection between these channels should be as seamless as possible, so that it stops being the brand’s online experience bleeding into the physical, or vice versa, and it simply becomes the single brand experience.

This move towards omnichannel can come from both directions, as in recent years we have seen pure-play eCommerce brands expand into stores. Amazon for example is building futuristic stores which use customers’ existing amazon accounts instead of checkouts, and are filled with advanced retail technology, blurring the line between physical and digital. Not only is this a unique example of an omnichannel offering but it shows the fact that an omnichannel approach is not just for brick-and-mortar retailers trying to stay competitive, even the ‘disruptor’ e-tailers are repositioning to an omnichannel offering.

2020 and the Omnichannel revival

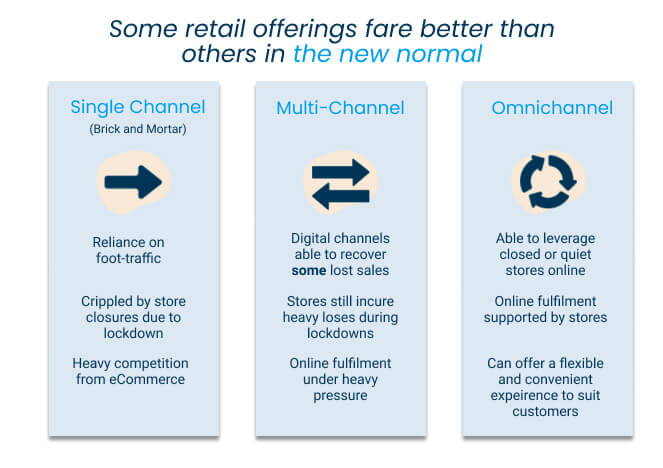

The effect of COVID-19 on retail has been well reported so we won’t delve into that here. The key conditions for the relevance of omnichannel are the huge spike in eCommerce and customers reluctance to return to stores. A report from Nosto claims at the height of lockdowns online channels spiked 66%, and a separate report from Klarna found that 71% of shoppers are putting off doing their Christmas shopping in-store this year due to COVID concerns. Whilst brick-and-mortar sales struggling or stopping entirely was bad news for any retailer, brands that have more advanced digital and omnichannel capabilities have weathered the storm far better. They have done this by being flexible and serving the customer wherever is more convenient and comfortable for them. Whilst for many this is online for others it is a mixture of both. This is where the interplay between channels with services like curbside can make a real impact.

The demand for click-and-collect & curbside is higher than ever

As stores have re-opened, many customers want to purchase products from their local stores but are still cautious about fully returning to in-store shopping. Buy-online-pick-up-from-store (BOPIS) offers a convenient and safe solution to these concerns. Customers can check online what stock their local store has available; purchase items online and then collect from the store the same day. This offers a convenient and contact-free alternative to shopping in-store, with Curbside pickup the same concept except customer don’t even have to enter the store. According to customer surveys, 80% of shoppers expect to increase their use of these services over the next six months, and 85% have already significantly increased their use of curbside since the year began. Whilst the initial spike in demand for these services was due to COVID-19, as customers grow accustomed to the convenience, the demand for BOPIS will continue well beyond the pandemic.

Ship-from-store is proving decisive in the online-centric New Normal

On the other side of the omnichannel coin, we’ve seen many retailers absorb the eCommerce bump through the use of ship-from-store. Simply put, ship-from-store involves fulfilling online orders using store stock, effectively leveraging stores as miniature distribution centres. The benefits of this under normal circumstances are already significant, such as cutting down on last-mile fulfilment and offering customers more stock. During the pandemic, however, ship-from-store was a lifesaver for many, allowing brands to not only capitalise on increased online orders but to leverage quiet or even closed stores to prevent unsold inventory piling up. Two of the largest retailers in the USA have been betting heavily on ship-from-store this year, not only as a way to ride the wave of the pandemic but to even compete with the power of Amazon. Walmart expanded their ship-from-store capabilities to 2,500 locations earlier in the year, whilst target reported fulfilling 90% of their online orders from store cutting the cost of fulfilment by 30% and overseeing 100% increase in digital sales YoY.

A temporary blip, or a permanent shift?

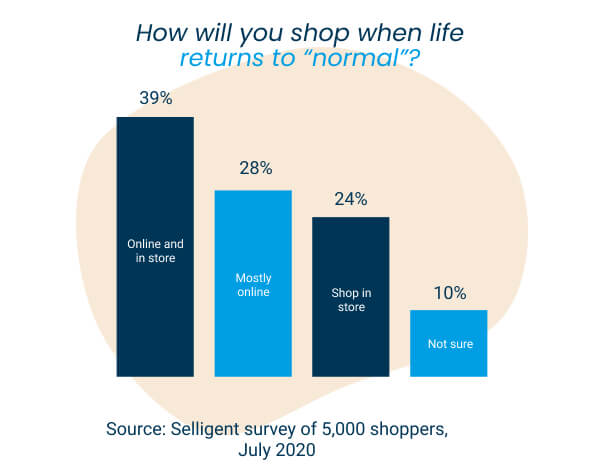

The key question is of course, how temporary is this change? As things start to get better around the world, will brands who have bent over backwards to reposition to the ‘new normal’ only find themselves at a loss if things completely revert back to normal? While the drastic increases to eCommerce will fall off a certain extent, in the long-term it will remain higher than pre-pandemic levels. The report from Nosto suggests that this is now levelling off to an average increase of 7%. Not only does this mean the business case for omnichannel services is still stronger than it was at the start of the year, but as customers have relied on services like online and curbside out of necessity, in the future they will continue to demand it of a preference for convenience.

What do retailers need in order to offer a strong omnichannel experience?

So, what are the requirements for retailers attempting to offer their customers these services and experience? Whilst it does depend on how advanced the offering is, the fundamentals are digitisation and integration across all channels.

Expert Chris Walton says there are three foundations to omnichannel retailing:

- Cloud commerce

- Real-time Data Capture and Applications

- Location and Context Analytics

For services like click-and-collect and ship-from-store, the first two points are key. The cloud is needed for the sharing of information, both between the retailers two channels (the store and webshop) and between the retailer and the customer. The data capture is vital for these services to be accurate as to sell products in-store to online customers, retailers need to know exactly what is in stock in their stores to an individual item level. This is why RFID is a key component of omnichannel retailing as it offers the real-time visibility of the products and the high 99% stock accuracy so retailers can offer omnichannel services with confidence.