The grey market and parallel imports can have drastic consequences for retailers, especially when it comes to their brand value. Is RFID for retail the answer?

Combatting the Grey Market: How to Protect your Brand Reputation?

Retailers have faced a myriad of crises over the last few years, including but not limited to the Covid-19 pandemic, supply chain disruption, and increasing retail staff resignations. However, another issue that has plagued retailers for far longer, but is becoming more catastrophic to brand reputation, is the grey market. So-called Grey Goods have been ‘legally’ imported into the United States since 1936. But the grey market is also a global problem–wherever a retailer operates, the goal is to have complete control over the supply and distribution of their products. Otherwise, retailers are effectively in competition with themselves. While the grey market is nothing new, the scale of the market has drastically surged in the 21st century. Today, between $7 billion and $10 billion worth of goods are sold outside of authorised channels in the US. Globally, over the last few years, the grey market has grown by 15% and is soon expected to reach a worth of $1,500 billion.

So, how can retailers combat the grey market? Undoubtedly, end-to-end visibility across the supply chain and all sales is a key part of the solution. Without knowing the scale of the market and where grey market resellers are sourcing goods, retailers cannot begin to tackle the problem. One of the most promising solutions to the problem of parallel imports is RFID software. Brands are increasingly turning to RFID for retail to increase supply chain transparency or enable omnichannel retailing; however, RFID software can also help tackle grey market selling by improving product visibility.

What is the Grey Market?

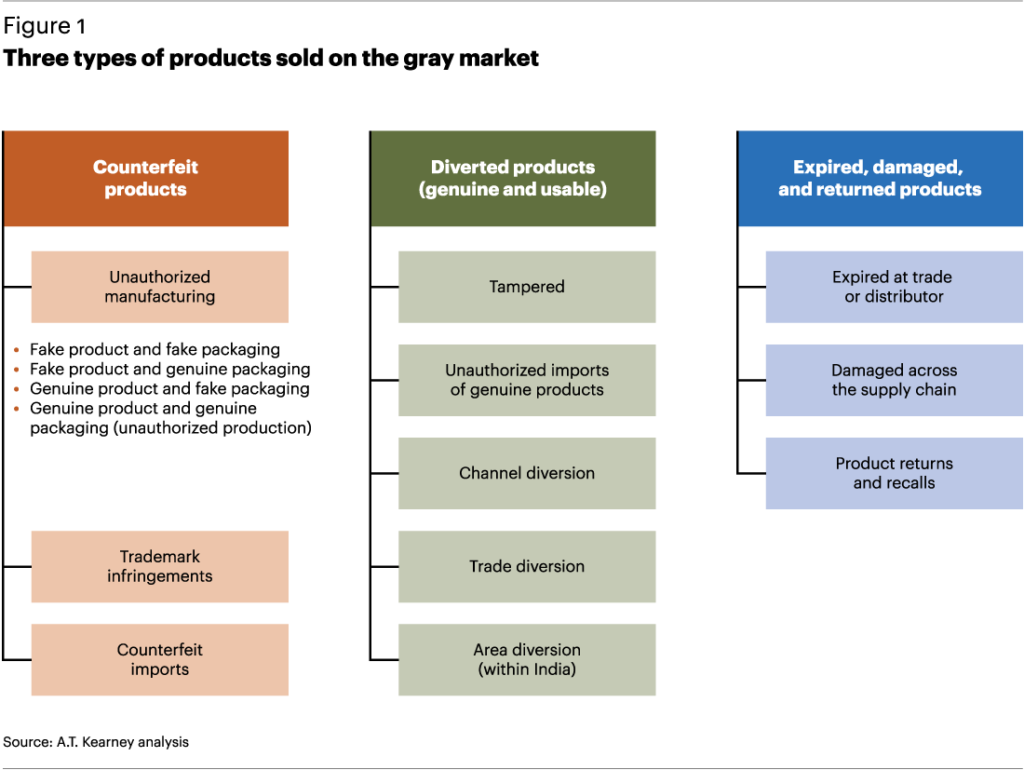

The term ‘grey market’ refers to the legal sale of goods outside a retailer’s authorised supply chain. These goods are legitimate as the primary manufacturer made them, but they are distributed through unauthorised channels. As suggested by its name, the grey market is neither entirely legal nor part of the black (illegal) market–it sits in an unregulated middle ground between the two. As a result, it can be challenging for brands to tackle the problem, as their products are still being sold legally.

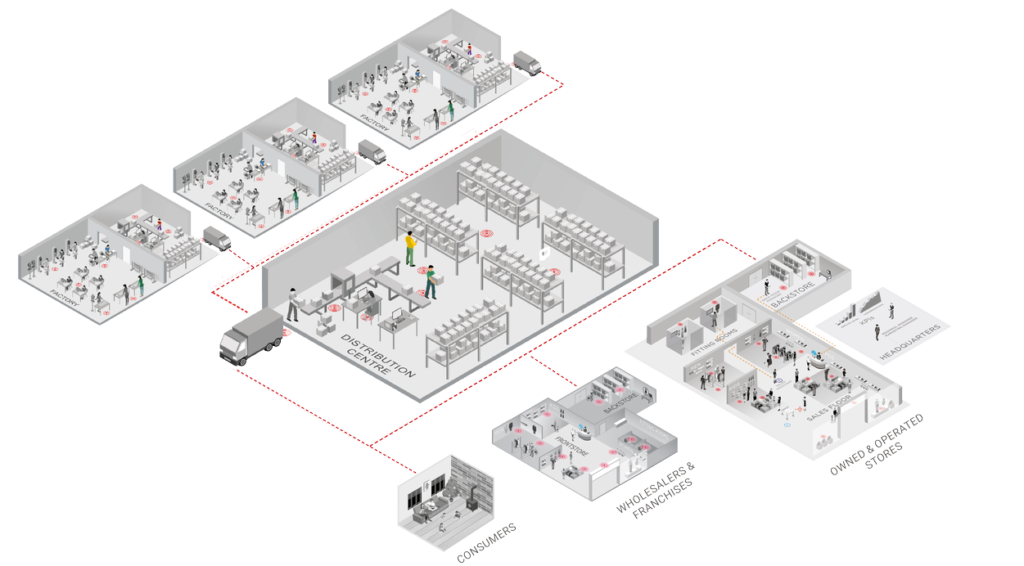

In the most basic description of retail selling, a brand sells to a distributor, who consequently sells those products to authorised retail outlets, who sell to the public. However, in the grey market, unauthorised distributors can also source products–often at discounted prices–and these will sell directly to the consumer at a lower price than authorised dealers.

Many grey market sellers benefit from being smaller than official retailers. This means they can keep costs low by operating without costly advertising or postsale services. Unauthorised dealers can also benefit from supplier pricing strategies that make buying products wholesale very cost-effective. As a result, products are sold to customers at a much lower price, out-competing authorised dealers.

Parallel imports are another related part of the grey market. This is when unauthorised dealers buy products in one country but sell them in another market, and it is a more significant problem in some territories than others. For example, in India, grey market products account for between 2%-10% of the consumer product market. Similarly, Procter & Gamble estimates that they are losing 10% in sales every year due to counterfeit products in China.

While any product can fall prey to the grey market, the market inordinately impacts luxury products simply because of the resale margin. For example, in many cases, products on the grey market are sold 30% to 40% cheaper than in authorised retailers–a vast margin for luxury goods. The scale of the problem is also far more significant in the luxury product market than in other sectors. In 2016, grey market sales accounted for 20% of the global luxury watch market.

The Impact of the Pandemic on the Grey Market

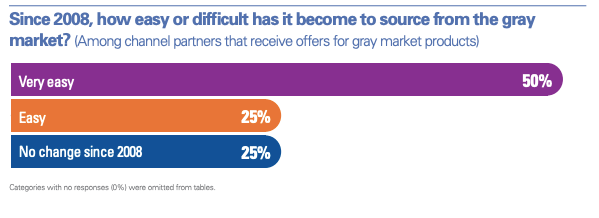

The grey market represents a significant loss of profit for retailers, and the problem is only getting worse. In a KPMG survey of distributors, half of the respondents said that since 2008, it has become easier for them to source products from the grey market rather than authorised channels.

Original equipment manufacturers (OEMs) also believe that the grey market grows every year. 63% of OEMs said they had witnessed an increase in grey market activity since 2008, while a staggering 90% have reported instances of their products being available outside of official channels.

All of this shows that the grey market is only becoming more widespread, even as retailers are increasingly acting to combat unauthorised sales of products. However, the problems with the grey market and parallel imports may have also been exacerbated by the last two years, primarily because of the drastic increase in e-commerce.

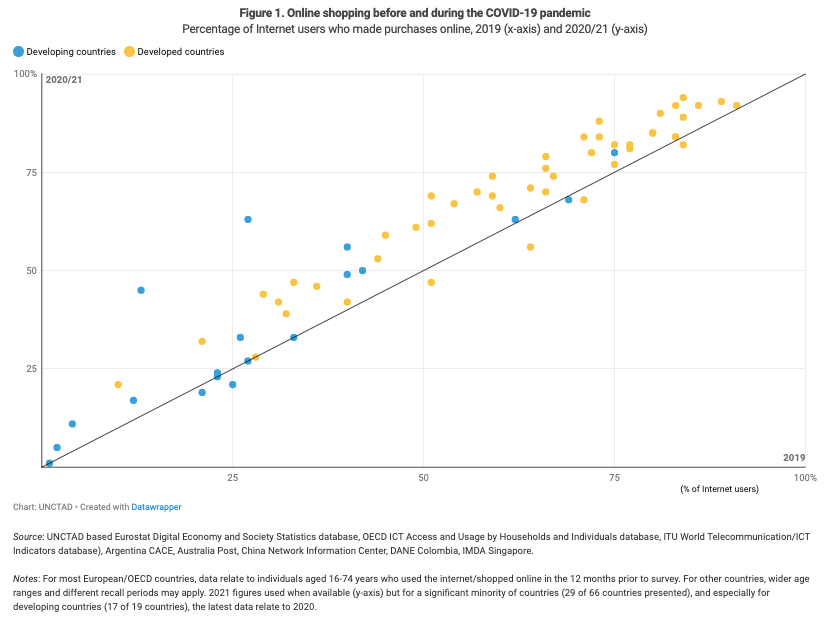

Online marketplaces were experiencing rapid growth even before the Covid-19 pandemic. In 2019, companies like Amazon and Alibaba accounted for 46% of online sales in the US and 61% of global sales. However, the pandemic has undoubtedly accelerated their growth. Figures from the United Nations Conference on Trade and Development show that e-commerce experienced significant rises over 2020 and 2021, particularly in developing countries.

For example, in the United Arab Emirates, internet users who shopped online grew from 27% in 2019 to 63% in 2020. In the EU, Greece, Ireland, Hungary, and Romania saw the most significant rises in e-commerce. Overall, e-commerce’s share of total retail sales globally has grown two to five times faster than before the pandemic. Around 75% of people who used online retailers for the first time during the pandemic have said they will continue to use these channels even after the pandemic. However, the global growth of online shoppers means there are now more opportunities for grey market dealers.

The problem with popular online marketplaces like Amazon is that they often allow unauthorised sellers to operate on their sites. Without strict rules authenticating sellers, grey market products become widespread on e-commerce platforms, with consumers unaware that they are purchasing from unauthorised channels. When left unchecked, both legitimate and grey market goods are free to circulate through the same distribution channel. But what effect does this have on retailers?

How the Grey Market Affects Retailers

While there are some benefits to the grey market–for example, in keeping products widely available and prices competitive for customers–on the whole, it harms retailers. Authorised channels are there for a reason: to control the flow of products through the market, offer additional after-purchase services, protect the consumer from counterfeits, and retain brand value.

For many retailers, additional services offered outside of the direct sale can be a significant source of revenue. This is particularly important for industrial products that may require repairs in the product’s lifetime. Purchasing from a grey market seller means the customer doesn’t get this option, reducing profits for the original brand. As well as that, customers may be disappointed when they realise that they cannot utilise a brand’s additional services after purchasing from a grey market dealer.

This leads us to one of the most significant effects of the grey market: the erosion of brand value. One in three IP experts, for instance, believe that the grey market is one of the most significant factors affecting brand value. In addition to customers being unable to access after-purchase services after buying from the grey market, they may have a bad experience with an unauthorised seller, leading to a bad opinion of the product or brand overall. In another scenario, a consumer may accidentally purchase a counterfeit product from the grey market as it can often be difficult to tell the difference between an authorised and unauthorised seller.

As retailers have very little power to prevent grey market dealers from operating, they cannot control how consumers react to disappointing purchasing experiences with unauthorised dealers. In the worst cases of consumer dissatisfaction, they may voice their complaints on a public platform like social media, contributing to a negative brand image.

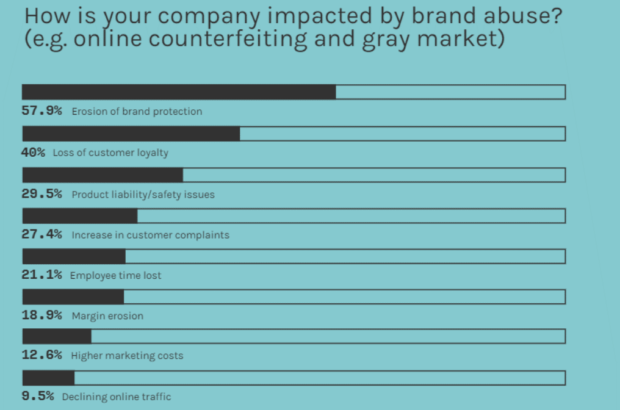

In one study, experts were asked how brand abuse affects their companies, such as that received from disappointed grey market customers. Over 50% of industry experts said that brand abuse contributes to an erosion of brand protection, while 40% said that the brand abuse they receive results in customer disloyalty.

Significantly, less than 20% of experts reported margin erosion as a significant effect of brand abuse. It seems therefore, that manufacturers and retailers consider the loss of customer loyalty a far more substantial effect of the grey market than the potential loss of revenue. Regardless, experts are aware of the adverse effects of the grey market and parallel imports and will need the help of technology to combat this.

What is the Solution?

Brands need complete control over their image and products to succeed in retail, but the grey market hinders this. As a result, brands need grey market inventory management to combat the effects of the grey market and parallel imports. They need to be aware of how and where their products are entering the grey market and be able to accurately track unauthorised sellers–whether they’re based in a physical retail store or on the web.

Aside from reinforcing authorised selling channels, one way of remaining in control of where products are going is by introducing unique serial numbers. With accurate product tracking, retailers can see where products are entering the grey market and obtain a more comprehensive knowledge of the scale of the grey market, including details of unauthorised dealers.

Serial numbers are one of the most common ways of identifying grey market activity; 90% of OEMs say that they already use the technology. However, serial number tracking alone can’t always provide a complete picture of a product’s journey. For that, retailers should turn to grey market RFID software.

The Advantages of RFID Software

RFID for retail has numerous advantages, not least the opportunity for retailers to gain total supply chain transparency. However, retailers are also increasingly becoming aware of its ability to assist in reducing grey market sales.

This year, the international business organisation GS1 released new guidelines for retailers about how to increase inventory accuracy and supply chain visibility. The guidelines also state that RFID for retail can be a powerful tool for grey market tracking.

When manufacturers tag products at their point of production, confusion later on as to which products are genuine and which are counterfeit is minimised. Consequently, customers can have confidence that the product they are buying is legitimate, even when they are inadvertently purchasing from the grey market.

Furthermore, retailers can track their legitimate products throughout the supply chain when they use the Detego end-to-end RFID software platform. With RFID software, it’s easy for retailers to see which unauthorised dealers and e-commerce sites are selling their products within the Grey Market.

When one Canadian skincare company started placing discreet RFID tags on shipments, they could monitor where these were being sold online and buy back the product from unauthorised sellers, reducing the chances of consumers purchasing from the grey market themselves. In some eventualities, this can lead to retailers taking action against distributors who sell to unauthorised dealers, such as revoking a distribution licence.

Utilising RFID software makes it easier to see where products are being sold, but it can also tackle the problem of parallel imports. For example, RFID software can alert retailers when a product is being sold in an unexpected market, allowing retailers to take immediate action to prevent this from happening in the future.

Though RFID technology has been around for over a decade, grey market applications are still being realised. 80% of retailers say that other products cannot replicate the benefits of RFID, and this includes its applications in tackling the grey market and parallel imports. As RFID technology evolves and e-commerce grows, the opportunities for retailers to reduce the effects of the grey market are immense.

An RFID retail solution

Stock accuracy, end-to-end visibility, and supply chain traceability.

Book a demo with RFID to discover how our cloud-hosted RFID for retail solution could help you tackle parallel imports. Our intelligent software can provide grey market inventory management, preventing counterfeits and combating parallel imports. With grey market RFID software, you get end-to-end visibility of your supply chain, making it easier to identify counterfeit products and take steps to protect your brand identity.