The Golden Quarter of Retail, approximately between October and December each year, is typically retail’s most profitable period. Shoppers are planning for the Christmas period earlier than ever–59% of consumers will plan gifts at least a month before the holidays–and Black Friday offers another opportunity for companies to maximise profits.

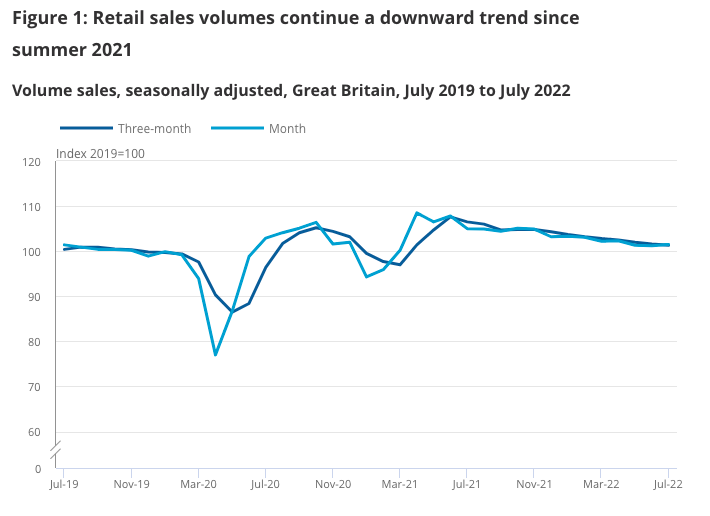

However, the Golden Quarter of Retail has been anything but golden in recent years. In 2020 and 2021, the Covid-19 pandemic affected Christmas footfall, and consumer spending has decreased from pre-Covid years. Between October and December 2021, sales of non-food items fell by 8% compared with 2019 levels, and now we are amidst a cost of living crisis.

When consumers were surveyed in early 2022, there was still some hope for this year’s Golden Quarter. Crucially, almost a fifth of consumers said they would increase spending in the same period in 2022 compared to 2021. The cost of living crisis has put a stop to this. With households increasingly tightening their pursestrings, this year’s Golden Quarter could be very different.

Importantly, though, if consumers are going to spend, they will begin spending early. Last October, retail sales grew for the first time in six months as consumers took to the high street early for Christmas gifts. It could be that, to space out purchasing, consumers once again begin shopping early in 2022. The expansion of the Golden Quarter of Retail to early October–or even September–means that there are additional opportunities for companies to maximise profit.

So, how exactly will the cost of living crisis affect the Golden Quarter of Retail in 2022? And what can retailers do in response?

How Bad is the Cost of Living Crisis?

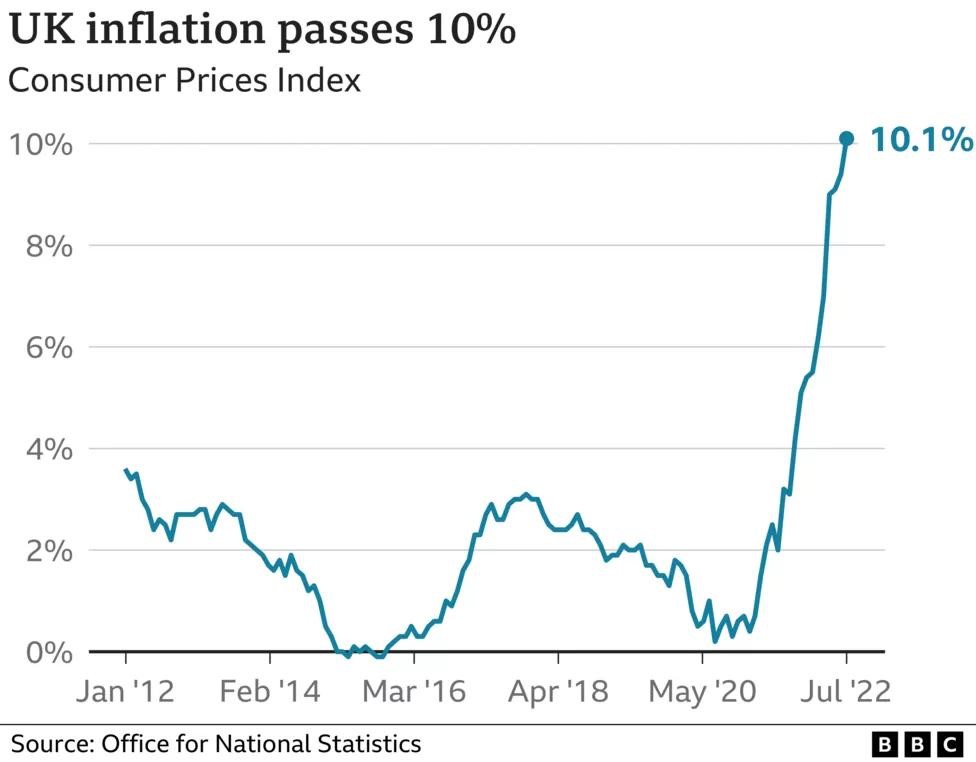

The inflation rate in the UK has been steadily rising for the last year. In August 2022, the rate hit a record-breaking 10.1%, and experts predict it could rise to at least 13% later in the autumn. It’s not just the UK that has been affected, though–across Europe, annual inflation has hit 8.6%.

There are lots of factors that have impacted the incredible rise in inflation in Europe and the UK. The biggest of these factors is undeniably rising energy prices, caused by Russia’s war on Ukraine and the increase in energy demand after the Covid-19 pandemic restrictions were lifted. To put energy price hikes in perspective, natural gas prices rose 96% between January and July 2022 in the UK. In the same period, electricity prices experienced a rise of 54%.

As well as energy bills, the war in Ukraine is also affecting food prices and further disrupting supply chains–another major headache for retailers in the last few years. Supply chain disruption has increased the cost of other goods, including raw materials, which will also affect the price of consumer products this year and into 2023.

Evidently, the cost of living crisis is severe and bodes for a challenging winter for both retailers and consumers. Unfortunately, the rising cost of goods and household utility bills are affecting consumer spending. This won’t surprise analysts, who predicted back in January 2022 that retail sales would be at risk this year. At that time, a survey from Barclays revealed that 43% of consumers expected rising inflation to affect their spending and household budgets.

That prediction seems to have come true. In August 2022, card spending in the UK fell by 1.9%, with consumers cutting back on purchases of clothing, DIY, and beauty products. Analysts at J.P. Morgan have alerted retailers that the cost of living crisis has “only just begun,” and future spending this year could fall by 10% if there is no energy price freeze in the UK.

The retail sector has been particularly affected by the cost of living crisis. In fact, it is the worst-hit sector in Europe in 2022, down 38%; the FTSE 350 Retailers Index has also dropped by 33%. This, along with the potential for more inflation hikes in the coming months, means retail faces a challenging Golden Quarter.

The Golden Quarter of Retail: How It Will Be Affected in 2022

The most significant effect of the cost of living crisis won’t be a surprise: reduced consumer spending. We can already see this happening as households prepare early for a challenging winter. Not only are consumers cutting back on purchasing non-essential items, but they are also reducing their impulse buys, instead waiting for opportune times to purchase.

As a result, Black Friday could prove far more critical in 2022 than in previous years. In fact, 51% of shoppers say that they consider Black Friday a vital time to make money go as far as possible. So, while households may have reduced spending power, they are still planning on spending.

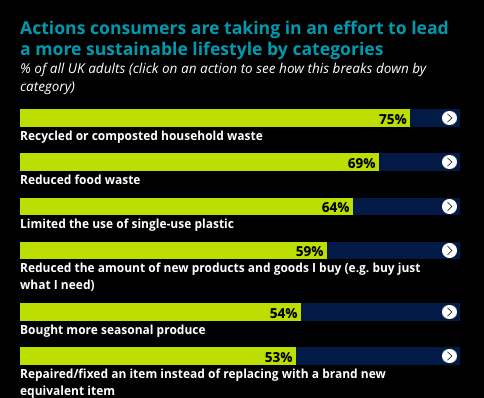

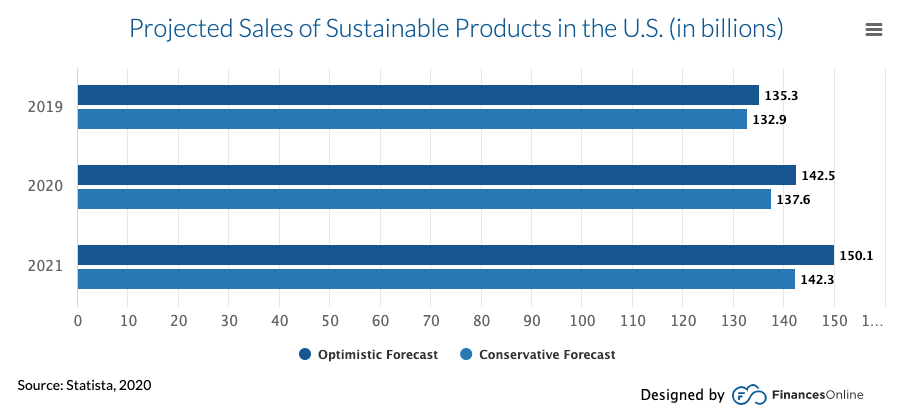

However, it’s also clear that consumers will be more selective about how they spend. As well as waiting for opportune moments like pride reductions, consumers may also be concerned about the quality of their purchases. We’ve already seen how sustainability has become a major factor in purchasing decisions over the last year. However, this could become more important when combined with the effects of the cost of living crisis.

Deloitte’s Sustainability and Consumer Behaviour Survey 2022 details how consumers are adapting their spending in light of environmental goals. The survey results highlight that people are embracing circularity and opting for more durable products. For example, over half of people (53%) have repaired an item in the last 12 months rather than replacing it. Additionally, 40% of people have bought second-hand or refurbished goods rather than new products. These decisions may not just be rooted in sustainability but also in reducing spending.

There is some proof already that shoppers are turning to preloved or second-hand goods specifically to combat the cost of living crisis. When asked why consumers buy second-hand items, 36% said they did it for sustainability reasons, while 32% said it was to cut costs. In particular, 35% of people who bought used products say it could make their money go further. Retailers are already taking advantage of this trend in anticipation of the Golden Quarter of Retail; earlier this year, fast fashion brand Boohoo launched their PrettyLittleThing resale site.

Aside from shifting consumer behaviour, inflation, and the subsequent cost of living crisis, will also impact operating costs for retailers. Rising energy prices will affect international retailers and smaller businesses, and the cost of raw goods may influence which products end up on shelves.

Despite pressures in the Golden Quarter of Retail this year, there is still cause for retailers to be optimistic. While 88% of shoppers say they are concerned or very concerned about the cost of living crisis, 91% of people who usually buy on Black Friday say they will be as engaged this year. Adapting to these shoppers–and their new spending habits–will be paramount if retailers are to see growth during the coming months.

What Can Retailers Do in Response to the Cost of Living Crisis?

It may appear that very little can be done to adapt retail strategy in the face of the cost of living crisis, especially when it’s set to impact every part of retail, from consumer behaviour to operating costs. However, there are still opportunities for companies as they prepare for the Golden Quarter of Retail. The extent to which companies can capitalise on lower consumer demand will depend on how well they can adapt their strategy and ride consumer trends.

In particular, there are three aspects retailers should prioritise as we go into the Golden Quarter of Retail in 2022: actual consumer demand, process efficiency, and supply chain visibility. Focusing on these factors will lead to an optimised retail strategy and greater chances of encouraging purchasing in the Golden Quarter of Retail.

Stock According to Demand

Preventing overstocking will be a crucial priority for retailers this winter. Excess inventory can represent an additional annual cost of between 25% and 32%, so knowing exactly which products and how much to stock will be imperative.

Paying attention to in-store and online consumer behaviour can help retailers determine which products will see more sales in the Golden Quarter of Retail. If retailers can quickly respond to changing behaviour, they will likely encourage consumers to part with their hard-earned cash during a difficult period.

Improve Process Efficiency

Operational efficiency is always vital, especially during a period of high retail costs. Preparing for the Golden Quarter of Retail will mean extracting as much value from current processes and labour as possible. Improving the efficiency of inventory counts will be paramount, as will reducing the amount of time staff spend searching for required products for customers on the shop floor.

Prioritise Supply Chain Visibility

Finally, retailers should seek to increase the transparency of their supply chains. Not only will this optimise processes by providing data on how retailers can adapt supply chains to reduce costs and increase efficiency, but it can also provide customers will valuable data on retail sustainability: something we know is becoming a significant factor in purchasing decisions.

How RFID Can Help Retailers Adapt to the Cost of Living Crisis

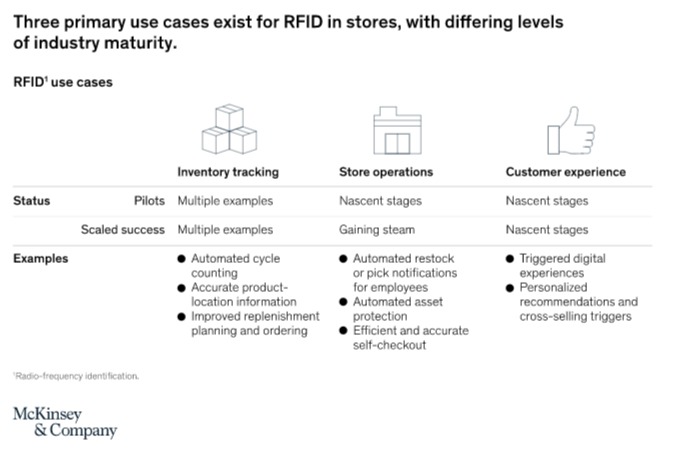

One piece of software connects these three focus areas: RFID technology. When retailers implement RFID tagging, they gain access to a wealth of data that can improve operational efficiency and ensure the shopping experience caters to consumer behaviour. RFID could mean the difference between a challenging Golden Quarter of Retail and a profitable one.

Firstly, RFID can improve processes in stores by reducing cycle count times by 96%. Workers are thus free to spend more time interacting with customers and building brand relationships, which can be a uniquely valuable task during a period of reduced consumer spending, offering returns into the future.

RFID technology can also increase stock accuracy to 99% from a global average of 60%-80%. This is paramount when retailers plan to stock particular products in response to shifting consumer behaviour. Improved stock accuracy can also reduce out-of-stocks, improving the likelihood of sales.

Finally, with RFID tags, products can be accounted for at every stage of the supply chain, offering unique data on operations. As retailers prepare for the cost of living crisis to endure into 2023, they must examine where cost-saving improvements can be made. This could mean changes to lower-cost delivery routes, which could also provide additional benefits to consumers in the form of faster shipping.

Though the Golden Quarter of Retail is set to be challenging this year, there are opportunities for retailers. However, responding to the cost of living crisis will require adaptability. This is a chance for retailers to invest in RFID technology to improve retail efficiency and cut operational costs.

Prepare for the Golden Quarter of Retail

Stock accuracy, on-floor availability, and improved supply chain visibility.

Book a demo with RFID to discover how our cloud-hosted RFID solution could help you maximise your profit during the Golden Quarter of Retail, even while navigating the cost of living crisis. Our multi-user app can provide intelligent stock takes and a smart in-store replenishment process. At the same time, you can effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

We’re over mid-way through 2022, and despite optimism regarding recovery from the recent Covid-19 pandemic, this year has had its own unique challenges for retailers. Across Europe, rising inflation has impacted consumer spending, while supply chain issues have also been exacerbated by Russia’s invasion of Ukraine.

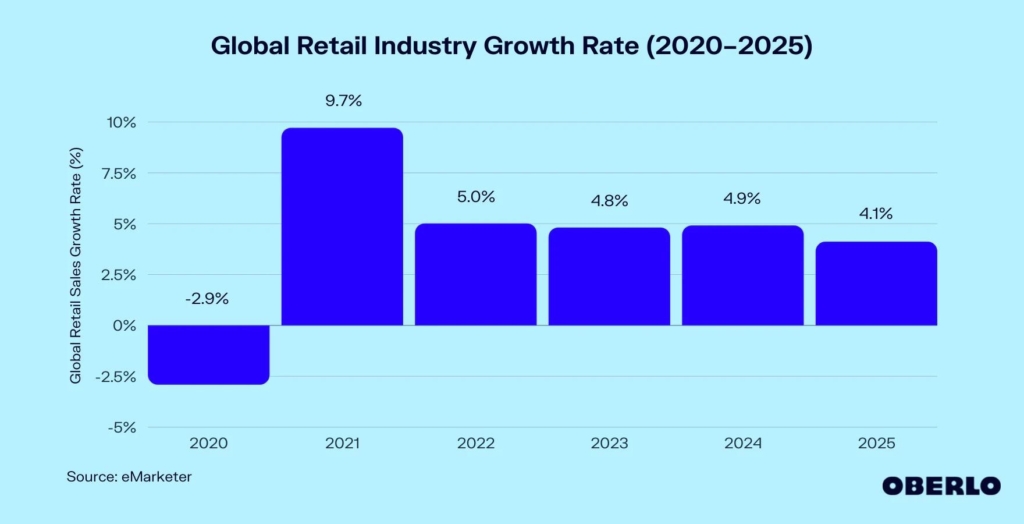

As a result, the retail sector is suffering from slow growth in 2022, which experts predict will worsen before it gets better. In the UK, retail is expected to grow by just 1.9% this year, accounting for inflation, compared with 3.9% growth in 2021. Globally, the retail sector will grow at 5%, half the rate of 2021.

With this in mind, many retailers will be looking optimistically to 2023. However, judging by early forecasts, there is still significant uncertainty in the growth rate for retail next year. In fact, according to some projections, the global retail industry growth rate is expected to slow to 4.8%.

These projections are concerning, but there are ways for retailers to capitalise on the meagre levels of growth in 2023, and that’s by putting in place a revitalised retail operations strategy for the new year. However, developing a successful 2023 retail operations strategy will require advanced knowledge of retail trends and flexibility in adapting brand operations.

Three trends are crucial for retailers when considering their future retail operations management: omnichannel retail, in-store technology, and the future of bricks-and-mortar retail stores. Finally, retailers can also look at how RFID for retail can help improve their operations strategy in 2023.

While the retail industry will undoubtedly see further disruption throughout 2022 and into 2023, taking time now to build a successful retail operations strategy can future-proof your operations and help you weather the storm.

What Does the Retail Market Look Like in 2023?

The retail landscape has changed significantly over the past three years. Covid-19 transformed customer behaviour, forcing retailers to adapt their strategies. So, looking to the year ahead, what are the most significant trends that will affect how retailers plan their 2023 retail operations strategy?

Omnichannel

One of the biggest trends to have affected retail in the last five years is the growth of omnichannel retailing. We’ve examined this trend in previous articles, but it will become more critical in 2023.

Data already shows that retailers must be considering omnichannel in any retail strategy. Research from Nielsen has revealed that 91% of FMCG dollar sales come from omnichannel shoppers, and furthermore, FMCG consumers who shop both in-store and online represent 86% of all consumers.

The trend is the same in other retail sectors. While 55% of all consumers say they choose not to shop online because they lack control over their purchase, 45% of grocery consumers still prefer to shop both online and in-store.

Brands can no longer plan their strategies solely around investing in their online brand–they must consider both in-store and online experiences, and plan additional fulfilment options for shoppers. This is even more vital as different channels come into play in the future, such as live-streaming shopping and social media shopping channels on apps such as Instagram.

In-Store Technology

While many retailers have already embraced the possibilities of in-store technology, in 2023, the trend is expected to become more mainstream as consumers’ expectations change. The traditional brick-and-mortar store of the past no longer exists; today, retailers need to provide interactive and entertaining shopping experiences to retain market share in a competitive retail sector.

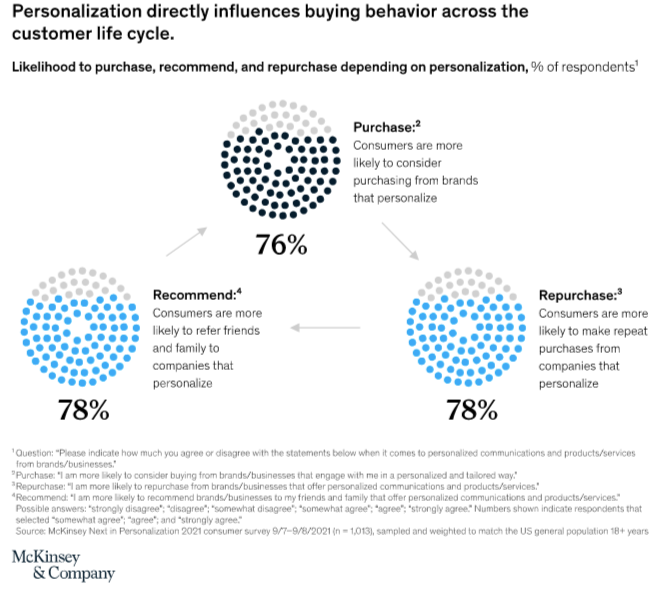

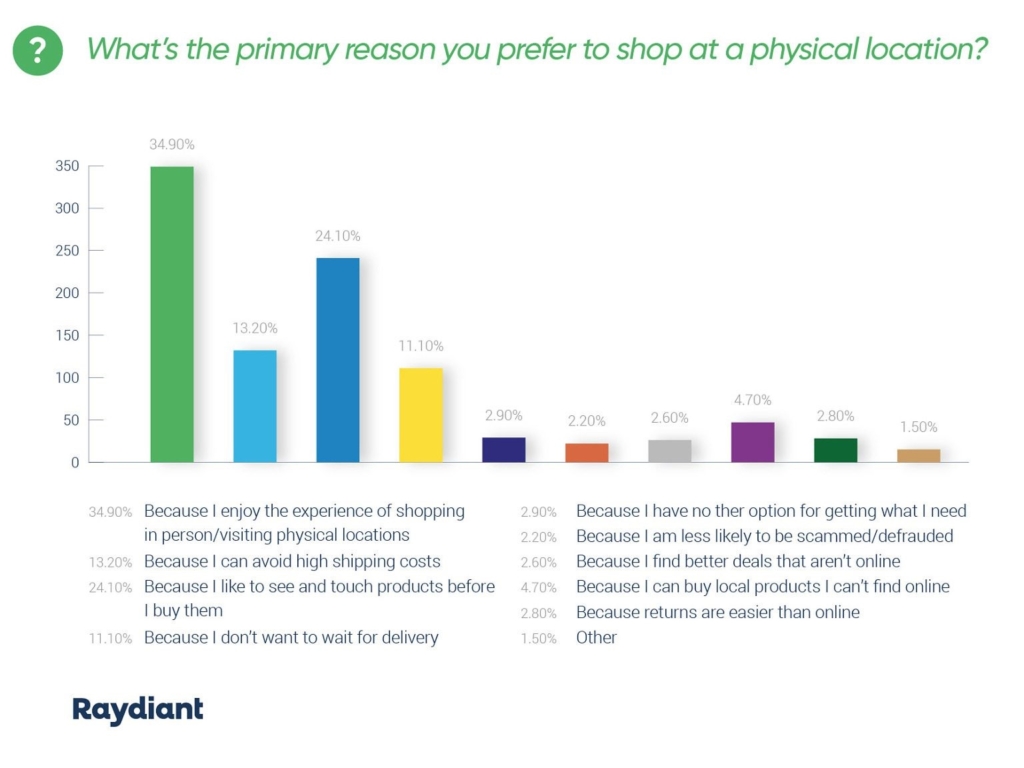

For starters, consumers are increasingly seeking personalised experiences. 71% of consumers already say that they want brands to offer them personalised experiences, whether this is in-store or online. An even more significant percentage (76%) say they get frustrated when this doesn’t happen. However, in-store shopping is still the dominant retail channel; retailers shouldn’t disregard this when creating their 2023 retail operations strategy.

Technology such as Smart Fitting Rooms, powered by RFID, can satisfy the customer’s need for personalisation and ensure stores make the best use of innovative technology. Smart Fitting Rooms can respond to customers in real-time and display additional information about proposed purchases whilst upselling similar products, all from the fitting room.

However, it’s not all about personalisation. In-store technology could also improve customer experience in other ways, for example, by installing cashier-less checkouts and in-store virtual assistants. This will contribute to a positive shopping experience and keep customers returning.

According to McKinsey, by 2030, technology will affect around one-third of all retail tasks in the UK. Considering how the pandemic has altered consumer behaviour and the shoppers’ expectations, it’s clear that in-store technology will be a crucial driver of brand loyalty and opinion in 2023.

Brick-and-Mortar Stores

As well as embracing omnichannel shopping and fulfilment options, retailers should also be reconsidering the purpose of their physical stores. We know that consumers now want to be entertained while they shop; shopping has become less of an act or chore and more of an experience. In-store technology can make this possible, but it’s also about reconsidering the possibilities of brick-and-mortar stores in your 2023 retail operations strategy.

For example, many brands now utilise their physical locations not just as shops but as event spaces, too, or solely as community spaces. Vans is a primary example of this: their London and Chicago ‘House of Vans’ locations incorporate an art gallery, skate park, cinema, and live music venue, plus cafes and bars.

On the other end of the spectrum, some retailers are turning their physical locations into ‘dark stores’ or ‘ghost stores’ – advanced distribution centres that offer consumers the chance to pick up their orders from the curbside or dispatch products from closer to home. With consumers increasingly asking for different shipping options (59% of consumers are interested in click and collect shipping options), this should be a vital consideration in any 2023 retail operations strategy.

How Supply Chain is Changing

However, future retail trends won’t just affect the consumer experience. Supply chains have had a difficult couple of years; Covid-19 put significant pressure on retail supply chains, and consequently, they are innovating rapidly.

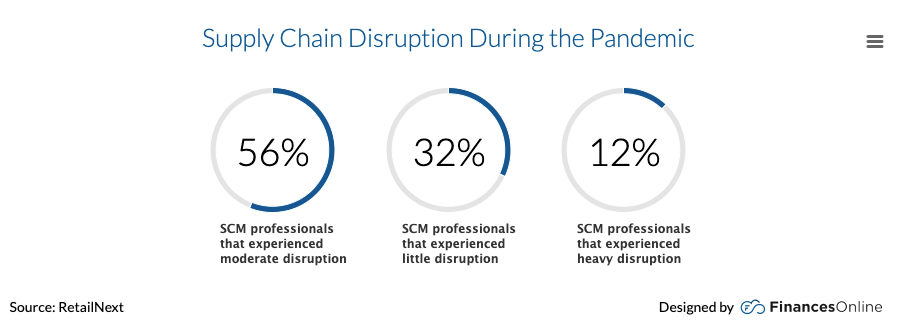

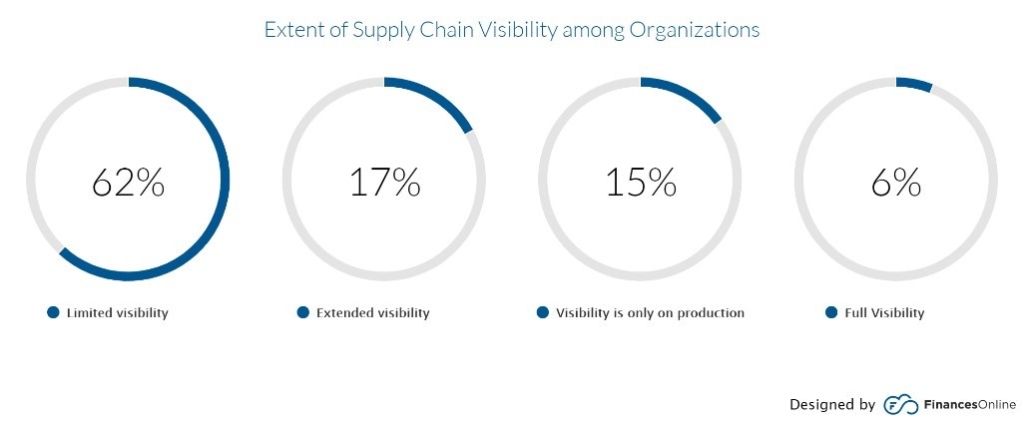

Supply chain disruption throughout the Covid-19 pandemic was extensive. Over half of supply chain management professionals say they experienced ‘moderate disruption’ during the pandemic. However, despite this, many retailers (62%) still have limited supply chain visibility, while 15% say that their visibility is restricted to production.

Supply chain problems during the Covid-19 pandemic have uncovered a pressing need for greater visibility and control over supply chains to prevent the same disruption from occurring in the future. To future-proof retail operations, supply chain visibility is a crucial element for retailers to consider within their 2023 retail operations strategy.

In addition to visibility, transparency is also vital. Since 2017, the number of online searches for sustainable goods has increased by 71%. Consumers now demand that retailers make sustainability a priority, in their products and the production process.

Not only does this mean switching to environmentally-friendly packaging where possible, but also being transparent about retail supply chains. As we mentioned in our recent article about sustainable fashion, supply chains can significantly impact sustainability: retail brand Patagonia state that 95% of their entire carbon missions come from their supply chain.

As a result, any brand’s 2023 retail operations strategy must consider how to make supply chains more transparent, both as a way to signal to customers that sustainability is a priority, and to identify areas of environmental improvement within the supply chain.

RFID for Retail: How Can it Help Streamline Retail Operations Management?

So, when creating a 2023 retail operations strategy, brands should be aware of how they can submit to consumer trends and changes in supply chain strategy. Thankfully, one solution covers both of these things: RFID for retail.

Firstly, when retailers implement RFID in stores, it can offer retailers up to 99% inventory visibility, compared to an average of around 60%-80% visibility. Inventory visibility is key to omnichannel retailing, as brands need a high-level view of all the stock they have and where it is, whether in a warehouse, distribution centre, or on the shop floor.

Similarly, RFID for retail can help retailers expand personalisation in stores and anticipate the trend towards increased automation and technology in retail. In virtual fitting rooms, for example, RFID technology can help display stock levels of items in stores and online and encourage customers to buy.

We’ve also mentioned how retailers should consider offering consumers additional shipping options like pick-up-from-store or ship-from-store. There’s certainly value in adapting physical locations to become ‘dark stores’, but this is only possible if retailers have in-depth data on their stock. RFID for retail can provide this.

Finally, over the last two years, supply chain disruption has exposed the need for greater visibility in supply chains. Only with up-to-date data can retailers strengthen their supply chains for possible future disruption. RFID technology can offer retailers advanced data about supply chains and inventory, giving senior retail operations management teams knowledge of weak points in supply chains.

Retailers can also harness RFID data to explore the environmental impact of supply chains. Retailers who want to prioritise their sustainability practices can also opt to publish this data, increasing their reputation for sustainable retailing.

Why You Should Invest in RFID for Retail in 2023

We’ve outlined how RIFD for retail can help expand and future-proof your 2023 retail operations strategy, but why is now the right time to implement the technology?

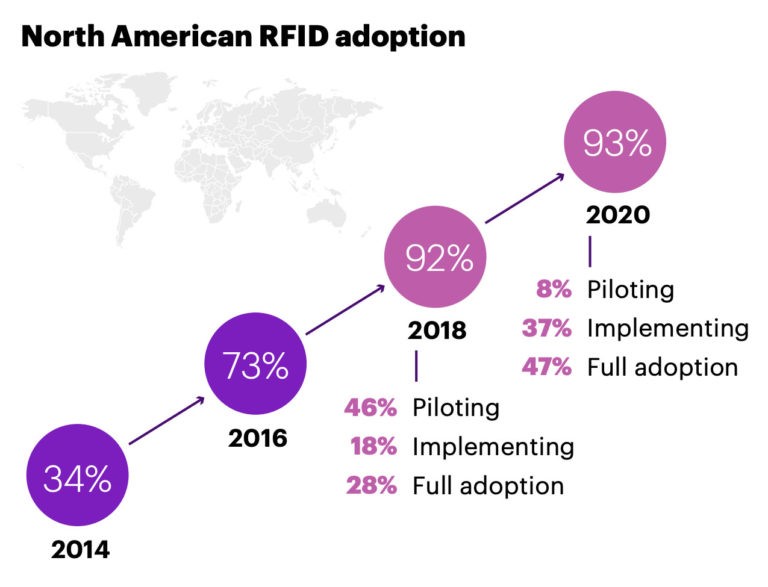

Global RFID adoption has significantly increased in recent years; in North America in 2020, 93% of retail chains were using the technology, up from just 34% in 2014. As a result, the technology is said to have surpassed the ‘tipping point’ where RFID for retail technology is now widespread.

This year alone, major retailers such as Walmart and Nordstrom have announced that they will be incorporating RFID into their future retail strategy, starting at the end of this year. Similarly, next year Michelin will finish incorporating RFID technology onto all of its tyres.

Increased adoption of RFID globally has also significantly impacted the cost of the technology. The average cost of an RFID tag has fallen by 80% in the last 10 years. Similarly, the cost of RFID readers has also dropped by 50%. In that time, the accuracy of RFID technology has doubled, while the number of possible use cases has soared. Now, McKinsey predicts that RFID for retail can unlock 5% top-line growth for retailers.

With retailers increasingly grappling with frequent supply chain disruption and consumers asking for new ways of shopping, there has never been a better time to implement RFID into your 2023 retail operations strategy. This technology will improve your retail operations management and ensure that your future retail strategy maximises profits.

Retail operations RFID management software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Book a demo with RFID to find out how our cloud-hosted RFID for retail solution could help improve your 2023 retail operations strategy. Our multi-user app can provide intelligent stock takes and a smart in-store replenishment process, and later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

While the effects of the Covid-19 pandemic may be lessening, retailers still face plenty of challenges in 2022. Supply chains remain volatile as countries around the world experience new waves of Covid-19 infection, and companies are also struggling with worker shortages.

In addition to this, inflation is affecting retail operations. Businesses are seeing price hikes for raw goods and logistics, and this inevitably means that consumers are going to see the cost of products rise in-store and online.

Despite the evident challenges, though, there are still opportunities for retailers to grow this year. In the United States, retail sales are expected to grow by between 6% and 8% in 2022, though there will be a shift towards services rather than material goods. While inflation is driving up living costs, consumers still want to spend their hard-earned money, but there may be fewer spontaneous purchases.

To capitalise on the forecasted growth this year, retailers must be prepared to make changes to their operations and retail strategy. Firstly, businesses need to focus on finding solutions to supply chain pressures, which may require investment in technology such as RFID for retail. Secondly, retailers need to be aware that customer spending may decrease this year, and as such, building customer loyalty is paramount.

The solution to both of these could be cloud-based inventory software. More than just a way to track stock throughout the supply chain, cloud-based inventory management offers a 360-degree view of your operations, helping you pinpoint the areas that need more help going into 2022.

Retail in 2022: The Challenges

It’s tempting for retailers to think that, because the pandemic is having less of an impact on store footfall and spending now, the retail world is back to normal. Sadly, this is not the case. There are still distinct challenges that retailers must tackle in 2022, the first of these being continued supply chain disruption due to the pandemic.

An industry report released in March 2022 found that 57% of retailers said that supply chain disruptions and shortages were the major supply chain challenge for 2022. This is a significant change – for the last nine years of the same survey, hiring and retaining qualified workers came in as the top challenge facing retailers.

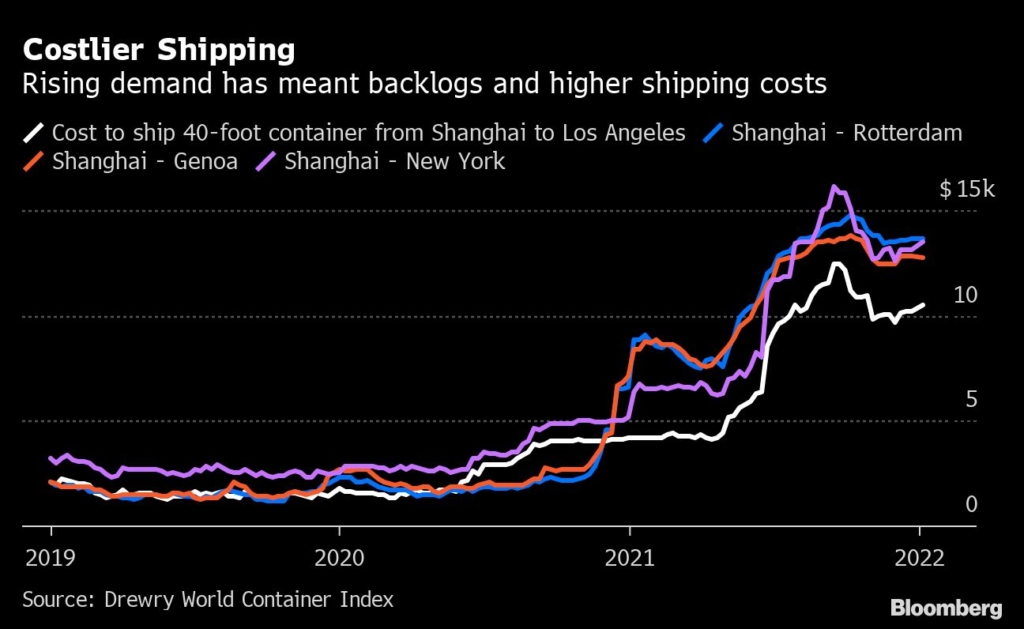

While many retailers expected supply chain disruption to have dissipated in 2022, companies are still dealing with fallout from the Covid-19 pandemic. An additional problem is rising shipping costs, which have steadily increased throughout 2021 and remain high at the beginning of 2022. Strikingly, the container freight index, which reflects the cost of shipping goods via a standard shipping liner, reached a high of $10,839 in September 2021. This is ten times higher than just two years before.

As shipping costs and customer demand increase, retailers are struggling to keep up – and it’s also compounding inflation. 30% of companies expect rising transport costs to limit their exports in 2022, while 29% of companies are worried about rising inflation as a result of supply chain disruption.

Another effect of rising inflation is the cost of goods. As inflation hit a 39-year-high in December 2021, businesses were forced to raise prices in order to cope with increased logistics and production costs. Overall, the cost of goods increased by 7%. More specifically, apparel prices leapt by 5.8% while household furnishing costs increased by 7.4%.

Faced with the rising cost of living, consumers are also changing their spending habits. As the price of items rises, consumers are choosing to hold off on purchases or change their buying habits completely. For example, retail sales in the US grew 0.3% in February, below the 0.4% forecasted. The biggest dent was in online shopping, which dipped by 3.7%. All of this means that retailers will have to find new ways to connect with customers and increase brand loyalty despite rising costs.

Finally, the ‘Great Resignation’ is also set to affect retailers in 2022. We covered this in a recent article, but in short, businesses are being forced to adapt operations as workers are leaving their jobs at a record rate. This is particularly noticeable in the retail industry. 720,000 retail workers quit their jobs in August 2021 alone, and 96% of retailers say they are struggling to find store employees.

The Opportunities for Retailers

There are undoubtedly challenges for retailers in 2022. However, there is also opportunity – especially in the digital space. We’ve already mentioned that retail sales are expected to grow between 6% and 8% this year, but online sales growth will be even higher (11% to 13%). Retailers who prioritise digital growth and embrace technology like RFID for retail will find that there is still space to grow even during a challenging year.

There is also opportunity in recent digital trends like NFTs, which we examined in an article last month. There was rapid growth in NFT production in the latter half of 2021, and the market is expected to continue growing throughout this year. Retailers who have already embraced NFTs, like Adidas, have seen strong sales off the back of the technology. Other retailers like BoohooMAN see the technology as a way to cement their brand identity and reputation.

But let’s not forget about physical stores. Innovative technology can also provide a way for retailers to set their brick-and-mortar stores apart in the post-pandemic world, and offer a new opportunity for growth. Experiences like virtual reality, in-store app functionality and personalised fitting rooms can all elevate physical stores and draw in consumers that are looking for a different in-store experience.

48% of consumers say that they choose to shop in-store because they simply enjoy the overall experience of shopping in person. A further 24% say they like to experience products before purchasing. All of this points to in-store experiences being a growth opportunity for retailers in 2022, as long as they embrace the technology needed to implement unique experiences.

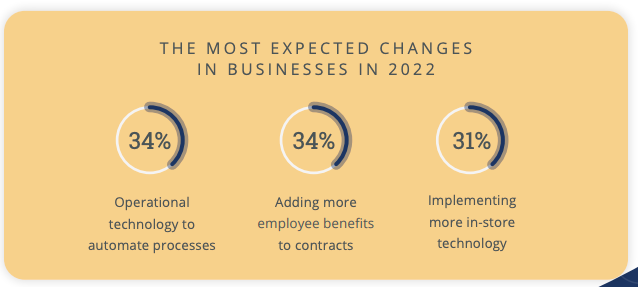

Ultimately, technology is the solution to overcoming the challenges in the retail environment in 2022. Businesses are undoubtedly aware of this; 31% of retail leaders say that they expect to implement more in-store technology in 2022. But what kind of technology should this be?

Well, retailers are also clear on that, too. 34% of retail leaders admit that investment in operational technology to automate processes is a priority for them this year. This includes innovations like cloud-based inventory software. But how can this allow businesses to bounce back in 2022?

Overcoming the Challenges with Cloud-Based Inventory Software

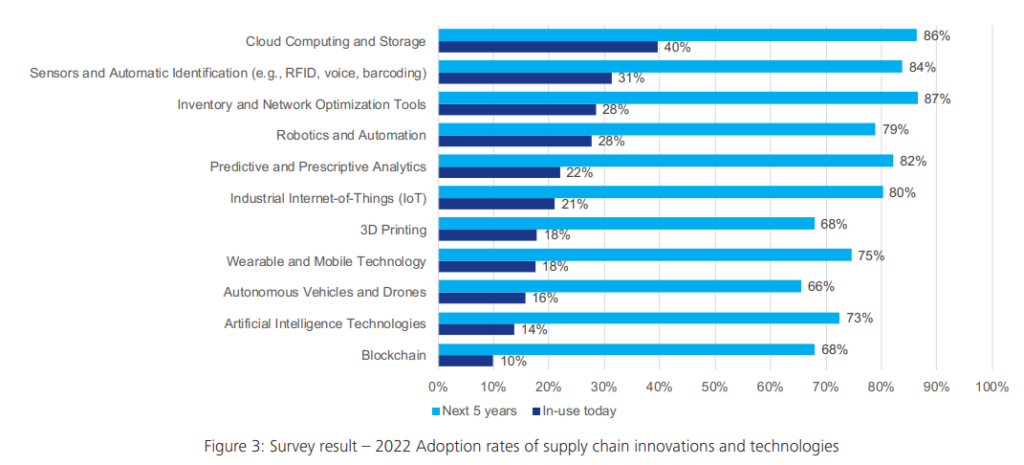

Though retailers are evidently aware of how operations technology like cloud-based inventory software could help them in 2022, many still have not invested in it. The current adoption rate of cloud software is 40%, however, this is expected to rise to 86% over the next five years. This is still the highest adoption rate for all retail technologies, including Internet of Things and robotics, yet there are still too few retailers taking advantage of it.

Cloud-based inventory management is hugely important to recover from the Covid-19 pandemic and tackle sustained problems such as supply chain issues. Despite retailers seeing a return to brick-and-mortar stores – they will continue to remain popular among consumers – a successful e-commerce strategy is key to performing in 2022.

All retail categories are predicted to see e-commerce growth in 2022. This is even more pronounced for apparel and accessories, which was the fastest-growing e-commerce category in 2021 (15.4% YoY growth). Elsewhere, auto and parts will also see significant growth in 2022, capitalising on their 30.1% YoY growth in 2021.

However, for retailers to take advantage of e-commerce gains, they must find a solution to the retail challenges that will inevitably persist throughout 2022: supply chain disruption, rising costs, and finding new ways to connect with customers.

Primarily, cloud-based inventory software offers a way for retailers to better understand their supply chains. As such, retailers who take advantage of this software can gain real-time insights into issues with their stock and react accordingly. By utilising cloud-based inventory management tools like RFID for retail, retailers know exactly where stock is at all times and can improve the flow of goods between distribution centres and stores.

Real-time data can also help retailers boost profits, which is more important than ever during a period of rising costs. As well as showing retailers where products are in their journey through the supply chain, cloud-based inventory software can also help prevent out-of-stock notices in stores.

Stockouts are particularly rife at the moment as supply chain issues hamper on-time deliveries. In fact, stockouts were up 250% in October 2021 compared to pre-pandemic levels. This can prove a major loss to retailers, totalling upwards of $1 billion per year. The in-depth forecasting from cloud-based inventory software can tell retailers the products that are selling particularly well and inform retail executives of exactly when new stock should be ordered to prevent losses on the shop floor or online.

Finally, RFID for retail can allow retailers better insights into their own customers, learning about their buying habits and being able to flexibly change their operations to suit trends. Cloud-based inventory software can also help implement personalised experiences in stores, whether that’s alongside an app or in virtual try-on rooms – and we know that customers are searching for new experiences in stores to keep their visits interesting.

Boosting Retail Performance with Cloud-Based Inventory Software

It’s clear that cloud-based inventory software can offer a solution to many of the issues plaguing retailers in 2022. In fact, many retailers are already aware of the benefits of the technology and have actively adopted it in their operations in recent years. Since then, they’ve reported significant benefits to using cloud-based inventory management technology.

47% of retail executives say that cloud adoption has improved their data access and analysis. The second and third most popular benefits are reducing costs and liabilities (42%) and improving efficiency (38%). Just 8% of executives say they have experienced no benefits of cloud adoption.

We know that cloud-based inventory software offers better supply chain visibility than other, outdated modes of inventory management. But instantaneous data can do more than just resolve supply chain issues – it can also help retailers implement omnichannel services like click-and-collect and ship-from-store. With full stock transparency, retailers can streamline all of their services, ensuring that customers can buy products when and how they wish to.

When combined with cloud-based inventory software, RFID for retail can also help transform the brick-and-mortar store, which we examined in a recent article. For example, 31% of customers want store employees to actively assist them with out-of-stocks. With a cloud-based inventory management portal, employees can assist customers on the ground in stores with just an app. They can check when new shipments of products are likely and also guide the customer to similar products in-store, boosting sales potential and leaving customers more satisfied with their store visit.

There is undoubtedly a wide range of benefits to implementing cloud-based inventory software. Whether you’re looking ahead to future prospects like digital stores or increased personalisation or just looking for a way to get ahead of supply chain disruption, this is the right time to invest in cloud-based inventory management.

Cloud-based RFID Inventory Software

Stock accuracy, on-floor availability, and omnichannel applications.

Book a demo with Detego to find out how our RFID cloud-based inventory management solution could help you outperform competitors and adapt to supply chain disruption. Our multi-user app can provide intelligent stock takes and a smart in-store replenishment process and later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

It’s difficult to escape news about the so-called ‘death of the high street’. For many industry leaders, the rise in e-commerce retailers and the collapse of many large high-street brands have significantly changed how people think about future bricks-and-mortar retail stores.

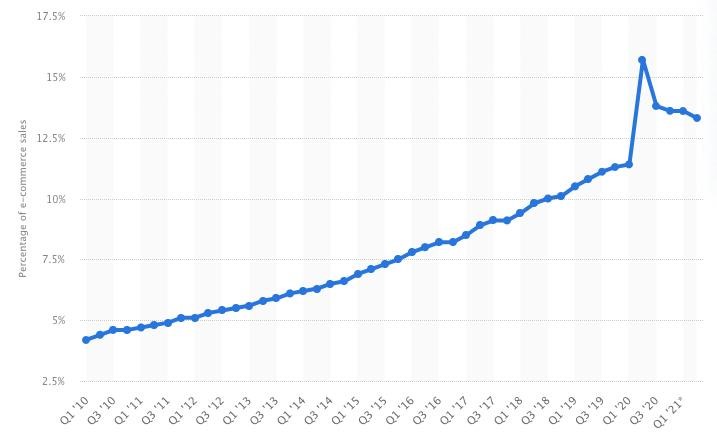

Consumers have been increasingly switching to online shopping for many years. The percentage of global online sales has been rising gradually since 2016, but the global Covid-19 pandemic undoubtedly accelerated this consumer change. In the UK alone, at the height of the pandemic in January 2021, e-commerce sales accounted for almost one-third of all retail sales.

As brick-and-mortar retail store footfall fell during global lockdowns, some retailers abandoned the high street altogether. Over the course of the pandemic, over 17,500 chain store outlets disappeared from the UK high street entirely. This includes large fashion chains such as Topshop, John Lewis, and Debenhams.

However, at the same time, some brands used the pandemic as an opportunity to explore innovations in brick-and-mortar shopping. In October 2021, e-commerce retailer Amazon opened its first physical store in the UK, while retailer Nike pressed ahead with plans to open an ‘immersive’ store in Seoul, South Korea.

All of this begs the question: what will the future high street look like? In short, significant changes are ahead for how retailers envision their future bricks-and-mortar retail stores, and it all has to do with creating a memorable customer experience and improving omnichannel retail options.

The ‘Death of the High Street’

So, what do news outlets and retail leaders mean when they talk about the ‘death of the high street’?

As technology becomes more accessible and flexible, more and more people are switching to online shopping. By the time the Covid-19 pandemic hit in 2020, online sales were already rising year on year. However, over the course of just a year, the trend became the norm.

In the UK alone, online retail sales grew by 36% in 2020–the highest e-commerce growth in one year since 2007. But the trend is not isolated to the UK. Global e-commerce sales grew by almost 28% in 2020, with the most e-commerce sales occurring in China and the United States.

Though lockdowns were a primary accelerator for online shopping, there are further reasons that people choose to shop from online retailers instead of brick-and-mortar retail stores. The top three reasons for opting to shop online instead of in-store are free shipping, lower prices, and convenience. In the end, 43% of consumers say that they could now go without shopping in a physical store, meaning the future bricks-and-mortar retail store could become redundant.

While almost three-quarters of consumers believe that most shopping will happen online in the future, this is unlikely to be the case. 88% of Generation Z consumers–the youngest demographic of shoppers today–say they still prefer to connect with a brand on both physical and digital channels. Furthermore, just 24% of Gen Z consumers say they strongly prefer to purchase online.

Evidently, then, there are still opportunities for future bricks-and-mortar retail stores. However, this will require a significant change in how retailers envision their physical retail stores. With the rise of omnichannel retailing, customers want multiple ways to purchase from a brand, which could mean blending the online and physical experience.

Furthermore, shoppers don’t just head to stores to purchase products anymore, but rather to have a shopping experience. As such, there are opportunities for retailers to turn their stores into hubs of customer experience rather than just functioning as sales points.

Why Physical Stores Need to Change

At the same time as e-commerce has risen in popularity, so too has omnichannel shopping. Omnichannel refers to the number of ways a customer has to purchase and receive a product. For example, those options could include in-store, online, via an app, and a myriad of shipping opportunities like picking up orders from a physical location and the ability to return items to a store.

Studies show that customers are increasingly turning to omnichannel retailing. This includes the options already suggested, as well as blends of physical and online shopping. For example, customers might view products in-store and then return home to buy online or use their smartphone while in a store to research products–which 56% of shoppers do.

Consequently, retailers must embrace omnichannel retailing if they are to stay competitive in the post-Covid world. Not only because customers are asking for multiple ways to shop, but because, on average, omnichannel shoppers spend more than other customers and are more likely to stay loyal to brands.

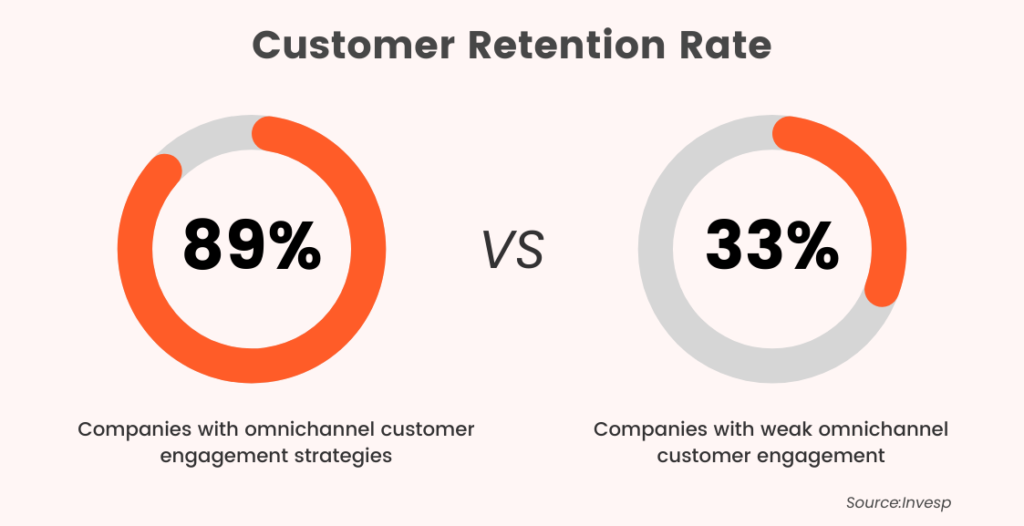

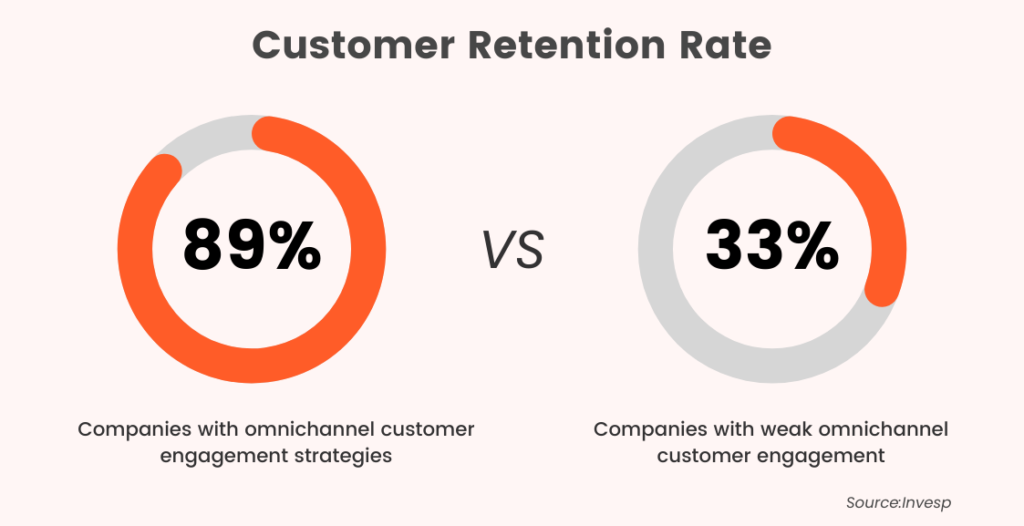

For example, a Google study found that retailers who implement omnichannel strategies drive an 80% higher rate of in-store visits. Furthermore, omnichannel customers also spend 20% more than other consumers. Finally, companies that embrace omnichannel retailing retain 89% of their customers, compared to a 33% retention rate for companies with poor omnichannel strategies.

We know that the average customer already engages with multiple channels. According to McKinsey, more than half of shoppers engage with three to five channels before making a purchase. One of these channels is likely to be a physical retail location. As such, future bricks-and-mortar retail stores will be important for implementing omnichannel opportunities.

Aside from omnichannel options, today’s consumers are also increasingly asking retailers to turn shopping into a complete experience. For example, one study found that although 60% of shoppers prefer to shop online, more respondents (67%) said they miss being able to interact with products. Furthermore, 80% of under-30s say they would shop in-store if the retailer had interactive screens installed in physical locations.

As the so-called attention economy begins to affect retailers, brands will increasingly be forced to embrace new ways of keeping consumers entertained while in stores. The future bricks-and-mortar retail store will thus also be a site of customer experience instead of a sole arena of selling.

What Does the Future Bricks-and-Mortar Retail Store Look Like?

We’ve clarified that there are two key ways that retailers can adapt their future bricks-and-mortar retail stores to suit the consumer: by embracing omnichannel retailing and transforming stores into primarily customer experience hubs. But how will this actually change the future high street?

Customer experience centres

Some companies have already transformed their physical stores into places of experience. We’ve already mentioned Nike’s immersive store in South Korea. Here, customers can enjoy personalised, interactive experiences and compare real-life products, helping them make their purchases.

It’s not just clothing brands that are emphasising the customer experience, though. Since 2014, Starbucks has opened six Starbucks Reserve Roasteries: larger physical locations focused on giving customers an entire coffee experience. These stores feature a more extensive menu than regular stores, coffee tasting bars, and augmented reality tours.

Whether the brand is in the food or fashion industry, every customer experience store has the same focus: to build brand loyalty, offer personalised experiences, and encourage customers to buy again and again.

However, retailers must choose the experiences offered to customers in-store with brand consistency in mind. Brand consistency is crucial for connecting with consumers and building a loyal brand base. Your online and physical presence should create a seamless shopping experience, which will make the customer journey more exciting and improve your omnichannel strategy.

Micro fulfilment

When implementing a successful omnichannel strategy, you must offer as many ways to buy as possible. To do this, retailers can utilise their future bricks-and-mortar retail stores as micro fulfilment centres.

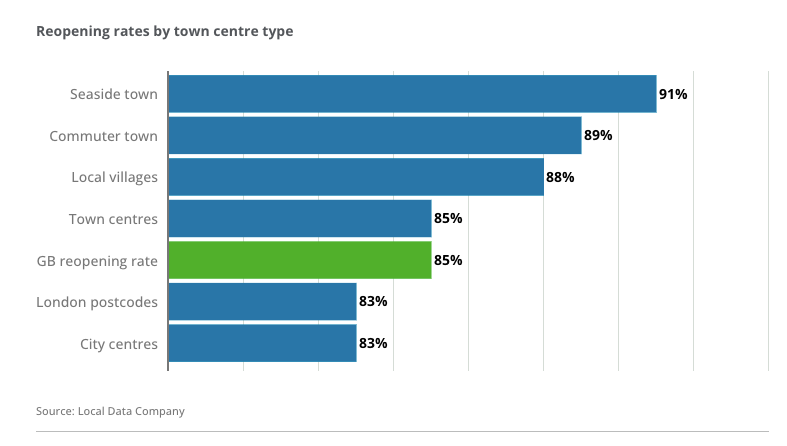

The Covid-19 pandemic has exacerbated the trend toward local shopping. Data from Deloitte shows that smaller town centres in places like seaside towns and commuter hubs recovered much more quickly from business lockdowns than larger city centres. Additionally, 57% of consumers say they would rather spend at local businesses after the pandemic.

Thus, there is an opportunity here for stores to combine selling and shipping from the same store, making it both more environmentally friendly and quicker for local shoppers to get items delivered to them.

42% of customers say they expect a two-day shipping option to be available at checkout. This isn’t always possible with traditional distribution centres, but if each physical location is utilised as a micro fulfilment centre, brands will likely achieve this. With increased customer satisfaction comes increased sales–data from e-commerce business Metapack shows that retailers have seen a 30% increase in online sales after implementing micro fulfilment centres in retail stores.

How RFID Can Help Futureproof Your Retail Store

Technology is essential when it comes to transforming future bricks-and-mortar retail stores. One of the most crucial is RFID, which can assist with elevating the customer experience in physical stores and accomplishing omnichannel strategies.

Firstly, RFID is essential for implementing personalised and interactive customer experiences in stores. For example, RFID tags on products can help create interactive fitting rooms, where sensors know which products a customer has brought into the room. Along with interactive screens, the customer can receive product information and see similar products, contributing to a more successful buying experience.

For brands focused on sustainability, RFID tags can also give customers a behind-the-scenes look at supply chains. Fashion brand Sheep Inc. has embraced this by linking every product produced with a real-life sheep on their wool farm, meaning customers can see what ‘their’ sheep is up to by scanning an RFID tag on their clothing.

With the future bricks-and-mortar retail store functioning dually as a sales point and a micro fulfilment centre, brands must have an accurate view of their stock. With RFID, retailers can get a real-time view of where stock is, allowing them to more accurately enable omnichannel options like ship-from-store, return-to-store, and pick-up-from-store.

An estimated 62% of organisations have just limited visibility of their supply chain, while only 6% have achieved full visibility. Without complete visibility, it will be increasingly difficult for retailers to adapt to consumer demands, especially with regard to increasing shipping options and allowing for faster order fulfilment. However, we know that these trends will be vital for the future high street and future bricks-and-mortar retail stores.

RFID offers a variety of use cases when it comes to future bricks-and-mortar retail stores. The technology is crucial for achieving a successful omnichannel strategy and will be increasingly important for establishing in-store interactive customer experiences. As a result, RFID can offer retailers an efficient way of increasing sales and improving brand loyalty. At the same time, it also allows brands to be at the forefront of an innovative future high street.

Futureproof retail stores with RFID

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Book a demo with RFID to find out how our cloud-hosted RFID solution could help you build a future bricks-and-mortar retail store. Our multi-user app can provide intelligent stock takes and improve the customer experience, while RFID can help you effectively turn your store into a micro fulfilment centre and establish e-commerce operations with real-time, item-level inventory visibility and analytics.

For retailers to remain competitive, it’s now imperative that they offer omnichannel services. This was undoubtedly true before the Covid-19 pandemic, but now that more consumers are looking for an alternative, digital ways to shop, it’s even more of a requirement.

According to research from McKinsey, more than one-third of consumers in America have turned to omnichannel services as a result of the pandemic. This includes services such as pick-up-from-store, return-to-store, and shopping on apps. The vast majority of these consumers will continue to take advantage of omnichannel services long after the pandemic has ceased to have an impact on retail.

However, an omnichannel strategy can be a challenge to get right. Though digital experiences are important – especially for younger consumers in the Generation Z and millennial categories – retailers shouldn’t discount the value of physical stores. A successful omnichannel strategy offers a seamless blend of both physical and digital experiences, giving customers the freedom to shop where and how they want to.

Technology is key to implementing an omnichannel strategy. Without analytical insights, it can be difficult to see where you should be diverting your energy. Though omnichannel trends, in general, apply to all retailers, you may have a unique experience with your customers meaning a different strategy is needed. Consequently, data is the only way to make informed decisions for your brand.

Tapping into digital transformation trends also makes it easier to build a unified experience for your customers. 64% of Generation Z consumers say they would switch to a competitor after multiple negative experiences with a brand. With more frequent touchpoints in omnichannel retailing, that means the probability of one of those channels disappointing customers is also higher.

Yet, today, 22% of retailers admit that they don’t have the right technology to implement omnichannel. A similar percentage of retailers say that they would benefit from more omnichannel technology. But what technology can provide this retail solution?

To be part of the digital transformation in retail, companies can turn to RFID. While businesses may already be aware of the power of RFID to support supply chain operations, they may not be as aware of RFID for omnichannel. As well as offering retailers a more accurate look at their stock, when used for omnichannel, RFID technology can also help unlock additional digital experiences for customers, so you can continue to offer consumers more innovative ways to buy.

Omnichannel Retailing Today

While the term ‘omnichannel’ has been around since 2010, it’s only gained traction as a trend over the last few years. This correlates with the growth of the Generation Z market and an increased reliance on digital services throughout the pandemic and beyond – the ‘digital transformation.’ While many retailers are aware that they should be offering omnichannel services, few implement a seamless and successful strategy.

One common misconception about omnichannel retailing is that it means a reliance on digital services. It’s certainly true that many omnichannel services focus on online shopping: apps, virtual try-on rooms, automated returns. However, this doesn’t mean the death of the physical store. Today, 88% of Gen Z consumers say they expect to connect with a brand on both physical and digital channels.

What omnichannel really means is a focus on ‘phygital’: physical and digital at the same time. And while consumers are certainly prioritising online services, many people still enjoy visiting physical retail locations. Over 50% of retail sales still happen in-store. Additionally, one survey revealed that up to 50% of customers would prefer to shop online from a brand that also operates physical stores.

In essence, omnichannel retailing means creating a seamless experience across the online and physical parts of your brand. Omnichannel services will allow your customers to browse for items on an app, check they’re in stock in-store, visit a store to try on or sample, and then return home to purchase. Every channel should be seamlessly connected, so customers never have to restart their purchasing journey when they switch to a different channel.

Another part of omnichannel retaining that is often underappreciated is brand consistency, which we explored in a recent article. Yes, retailers must ensure a seamless experience across touchpoints. But they should also ensure that their brand identity is unified across digital and physical channels. Businesses that prioritise brand consistency actually perform better than brands that have a more lukewarm approach to their branding.

So, a successful omnichannel retail solution should integrate all channels seamlessly while prioritising a consistent experience for customers. But why should omnichannel be a priority for retailers?

Why Should Retailers be Prioritising Omnichannel?

Retailers that implement omnichannel experiences see immediate benefits. Brands with a seamless omnichannel strategy report are three times more likely to increase their revenue, and four times more likely to have loyal customers. But why?

For starters, customers today are no longer shopping on just one channel. Research from McKinsey shows that the average customer engages with three to five channels before making their purchase. Similarly, 67% of customers use multiple channels to complete a transaction. These might include social media, an online store, an app, or a physical location. Omnichannel retailing taps into the digital transformation trend by offering customers exactly what they want: the ability to shop seamlessly online and offline at the same time.

Customers who prioritise a multi-channel buying experience are also far more likely to part with their money than single-channel customers. Omnichannel customers spend about 10% more online than those who only tend to browse through one channel. Additionally, these customers are more likely to stay loyal to brands. Brands that implement a successful omnichannel strategy retain 89% of their customers – compared to 33% for retailers with a weaker omnichannel strategy.

It’s clear, then, that customers want omnichannel services, and are prepared to spend more and stay with their chosen brand if these services are available. Retailers who neglect omnichannel are also much more likely to see a dip in revenue. Strikingly, 40% of consumers will actually choose a competitor if they can’t use their preferred channel for browsing or purchasing.

The Companies Getting Omnichannel Right

We’ve already examined the benefits of omnichannel retailing. But which retailers are getting it right?

Affordable luxury retailer BA&SH proved that the future is ‘phygital’ when they pressed ahead with a range of new store openings in the US and Asia. In 2018, they opened seven new physical locations in Mainland China and three in Hong Kong, all of which achieved profitability after just three months. To support their sales in Asia, they also launched the brand on Tmall at the same time, supporting e-commerce in the region.

It’s a similar story with Adidas, but on a larger scale. They have 2,500 retail stores across the globe, combined with a large e-commerce channel, including an app. The app reaches 30 countries in their market and offers unique omnichannel services including order tracking, personalised content, and in-app chat. Despite e-commerce being the channel they expect to grow most rapidly, Adidas still invests heavily in in-store experiences. For example, they launched flagship digital stores in London and Paris in 2019.

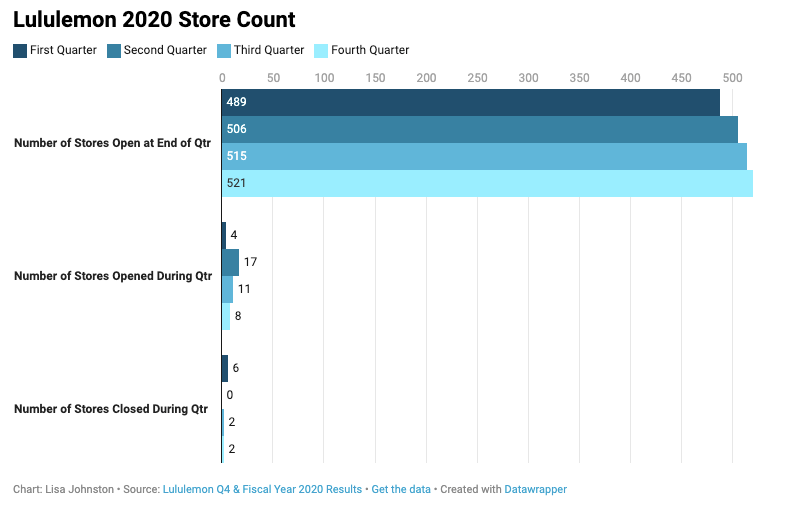

A brand hoping to compete with Adidas is Lululemon. They operated around 489 stores in Q1 of 2020, but grew this to 521 by the end of the year, despite pandemic losses in brick-and-mortar store footfall. This investment allowed Lululemon to capitalise on the pandemic growth in services such as store pickup and appointment shopping. Overall, the company generated a 47% increase in international business in Q4 of 2020, with e-commerce representing 52% of its total revenue.

As demonstrated by these thriving retailers, a successful omnichannel strategy is seamless, unified, and flexible. Each of these retailers was able to adapt to changes in physical footfall and the growth in e-commerce while growing their brands globally. To do this, they have tapped into digital transformation trends, including digital stores, online try-on, and diverse purchase and delivery options. In the case of Lululemon and Adidas, RFID for omnichannel also played a role in their success.

The Benefits of RFID for Omnichannel

As we’ve seen, the retailers who do hit upon omnichannel success embrace digital services without neglecting brick-and-mortar stores. The foundation of a winning omnichannel strategy is seamless integration, harnessing data, and fully optimised operations. By implementing RFID for omnichannel, retailers can hit each one of these factors for success.

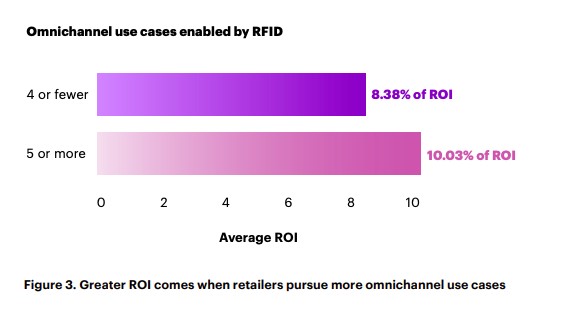

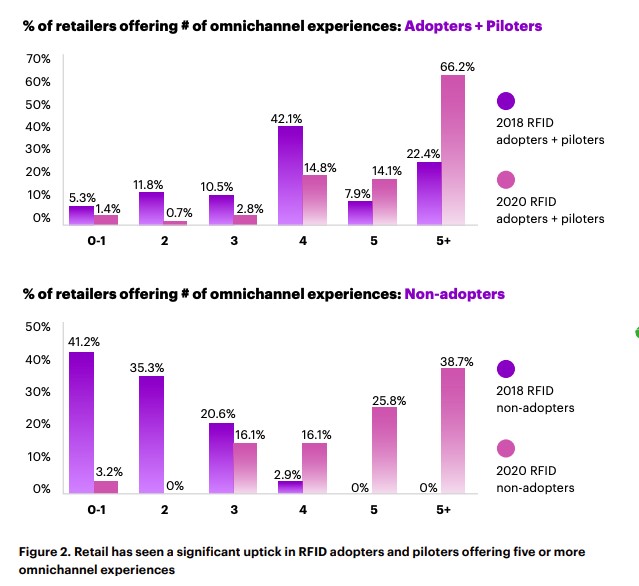

We know that retailers are adopting RFID technology at a faster rate because of Covid-19. In fact, 46% of retailers say that it is a priority for them in responding to the pandemic. But well before the pandemic, retailers were realising that RFID could offer use cases for omnichannel and that it can add a huge amount of value to operations. This is especially true when retailers adopt RFID for multiple omnichannel services.

Retailers who use RFID alongside five or more omnichannel experiences see a 20% higher ROI than retailers who adopt RFID for less than four omnichannel services. When implemented, RFID can offer the real-time insights and accuracy necessary for retailers to scale up their omnichannel services.

Typical store inventory accuracy at item level is around 60%-80%. Unfortunately, much higher accuracy is needed if retailers want to enable multiple omnichannel experiences. Without real-time data, it can be challenging to know where stock is, and you’ll struggle to integrate omnichannel services like pick-up-from-store, app purchases, or shipping from a distribution centre.

RFID tags on stock can bring item-level stock accuracy levels to 99%. This means retailers have an exact view of where all their stock is, whether that’s in a warehouse or store. As a result, customers are able to know their chosen products are in stock at their chosen location and can opt for the method of delivery that suits them – whether that’s shipping to a store, collecting from a pick-up point, or delivery to home.

But there are more benefits for customers when retailers implement RFID for omnichannel. Tagging products allows customers to track purchases through their shipping journeys, meaning they can get more accurate delivery dates. This is often crucial if they have chosen to pick them up from a store, as they will know exactly when their items have arrived.

Overall, when implemented for omnichannel, RFID grants retailers valuable visibility into their supply chains and stock. With RFID, retailers can focus on creating new and innovative omnichannel services, with the knowledge that they will be able to create a seamless experience across channels.

Implementing RFID for Omnichannel Retailing

According to research from Coresight, 74% of retailers have already started implementing an omnichannel retail strategy. However, this doesn’t mean that these strategies are always successful. Just 34% of companies have a mature omnichannel strategy. Though many retailers will try omnichannel, there’s a big difference between creating a strategy and seeing it through to success.

As we’ve discovered, implementing RFID for omnichannel retail operations can make a huge difference to the success of omnichannel services. The real-time data created by RFID technology can help retailers to plan their omnichannel strategy, focusing on the channels that will bring the most value to their operations. Having a focused omnichannel strategy is vital for retailers that are just starting to experiment with alternative services, and using RFID for omnichannel implementation can help businesses create and implement a successful strategy.

Today, 28% of hardline retailers intend to use RFID to support their omnichannel fulfilment options. As RFID technology becomes more accessible – the cost of an RFID tag has already dropped considerably over the last 20 years – this number is set to increase. Omnichannel is an essential part of retail; to implement it successfully, RFID is the obvious retail solution.

An RFID retail solution

Stock accuracy, on-floor availability, and RFID omnichannel applications in stores.

Book a demo with RFID to find out how our cloud-hosted RFID solution could help you improve your omnichannel strategy. Our multi-user app can provide intelligent stock takes and a smart in-store replenishment process, while utilising RFID for omnichannel services can help you effectively manage your entire store and eCommerce operations with real-time, item-level inventory visibility and analytics.

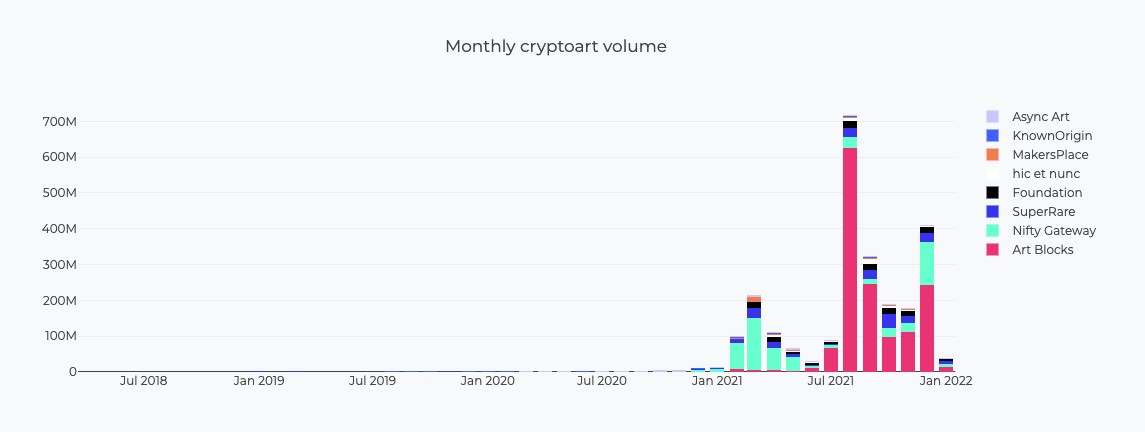

NFTs, or non-fungible tokens, are the current talk of the art world. Though they’ve existed since 2014, the popularity of NFTs rose rapidly in 2021, with trading hitting $10.7 billion in the third quarter of that year.

NFTs can be anything – art, memes, and even newspaper articles or tweets. They are stored on a blockchain, the database that cryptocurrency relies on. However, unlike crypto, NFTs cannot be exchanged with another digital asset – each NFT is entirely unique. Each NFT that is sold has no equivalent, and blockchain technology is used to establish sole ownership and digital provenance. These digital assets can be resold on specialised online marketplaces, making them a lucrative investment opportunity. In the world of NFTs, anything can be monetised and sold, which is also part of their appeal.

Their popularity can be explained by the fact that they are simultaneously exclusive and are becoming more affordable. Individual NFTs are highly unique but theoretically anyone with an internet connection – and enough capital – can access the world of collective NFTs.

More recently, the world of retail is seeing value in NFTs. While some NFT sales have made headlines for their expense, the majority of NFT purchases in the first 10 months of 2021 were valued at less than $10,000. This means they can be categorised as ‘retail’ in nature. In the second half of 2021, brands including Adidas and BoohooMAN created their own NFT collections, hoping that they could capitalise on the technology’s popularity. High fashion brands are also trying their hand at NFT collections, including Dolce & Gabbana.

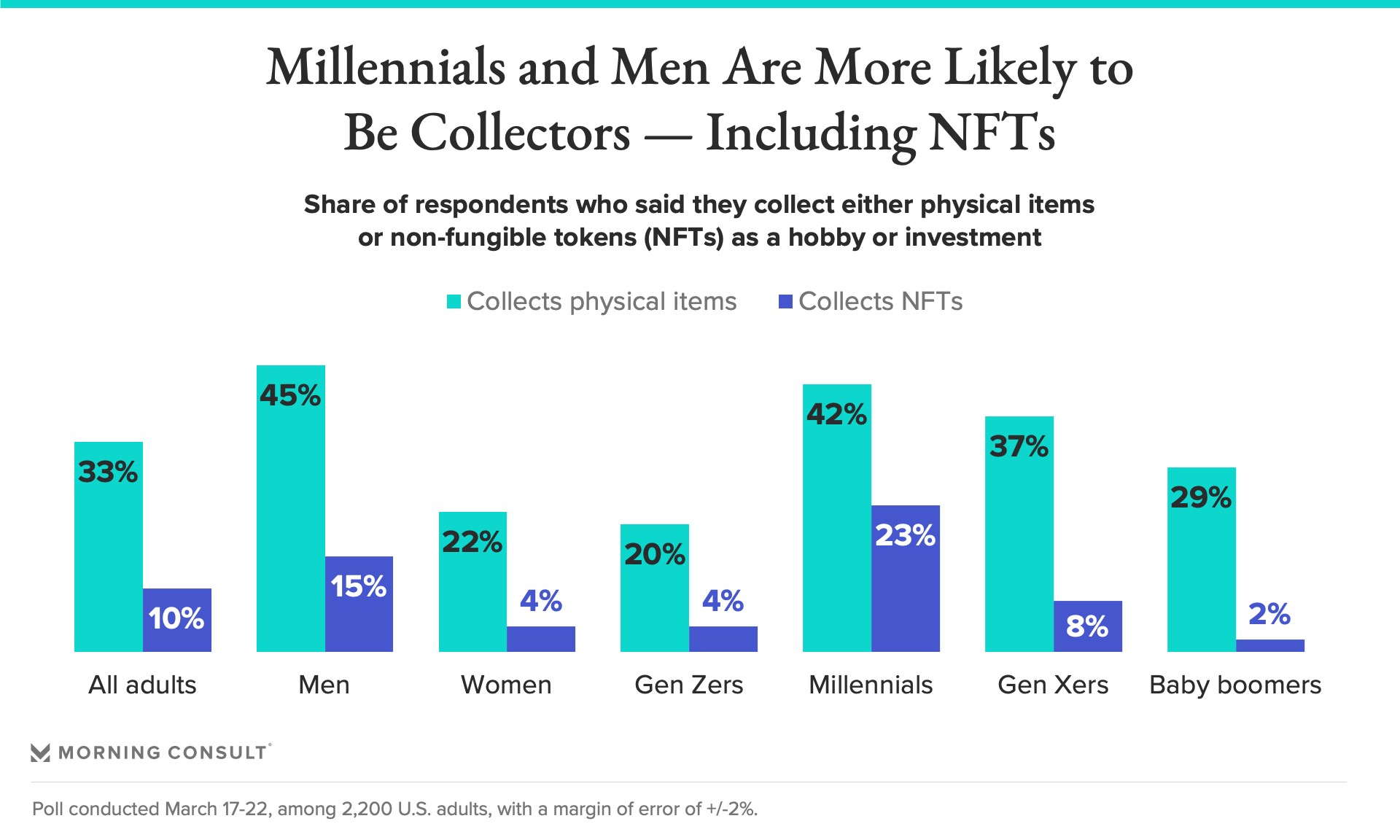

Is there a future in NFTs for retailers? That depends in part on your brand and target market. According to a survey from Morning Report, 15% of male respondents said they collected NFTs, compared to only 4% of female respondents. For high fashion brands, who more often than not have a female consumer base, NFTs can be a way of driving sales from male consumers. Alternatively, if your brand already markets predominantly to men, NFTs are a lucrative way of increasing revenue.

Based on the growth of NFTs in the latter half of 2021, it’s clear that NFTs will continue to increase in popularity. The most expensive NFT in 2021 was sold for $69.3 million in March, and while NFTs for retailers are unlikely to market for the same extraordinary prices, it’s evidence of the profit that can be created with NFTs. The entire NFT market is expected to grow to $240 billion by 2030, and NFTs for retailers could offer brands a lucrative opportunity to enter the burgeoning digital asset market.

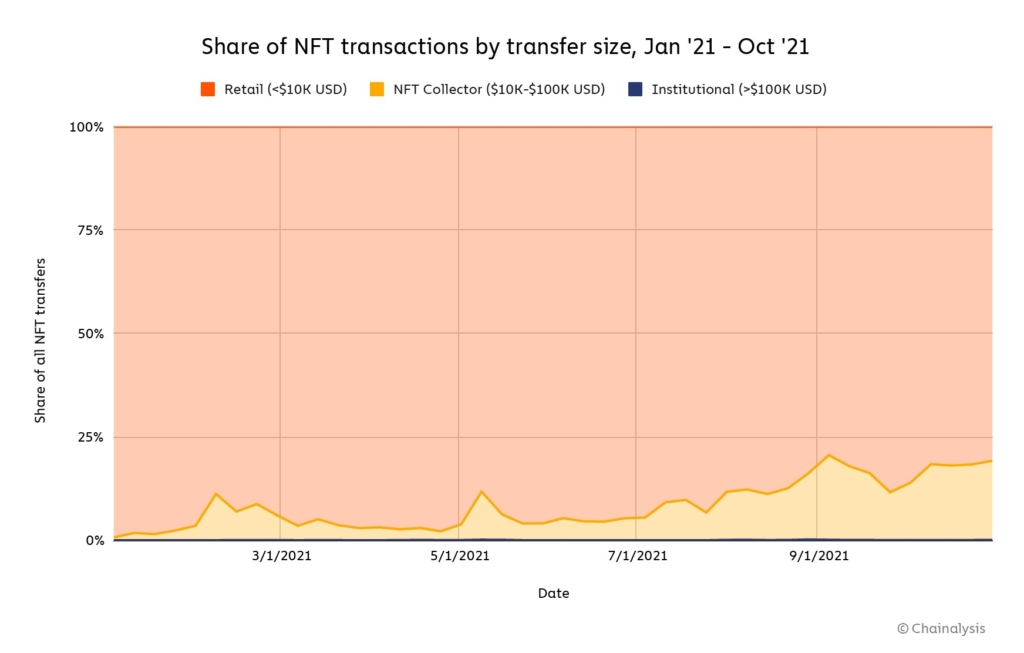

A New Market in NFTs for Retailers

The NFT market has grown from a niche area for technology and crypto enthusiasts to something more accessible to the average consumer. At the same time, over the course of 2021, the average transaction size and the total value of NFTs increased. By October 2021, collector-sized transactions of between $10,000 and $100,000 accounted for 19% of all NFT transactions, compared to 6% in March 2021. This suggests that NFT assets are gaining value rapidly and that collectors and consumers aren’t put off by high price tags.

Despite the growth in large NFT transactions, the majority of purchases are still conducted at retail level – that is, with transactions of less than $10,000. In comparison to the crypto market, NFT purchases are still driven by retail purchases, not collectors or larger institutional transactions of over $100,000. In 2021, 80% of NFT purchases were made by retail buyers, despite the growth in those high-value collectors and institutional transactions. For this reason, the market for NFTs for retailers is promising – it could prove to be a major retail innovation in the next five to ten years.

Additionally, the audience for NFTs for retailers is already there. Millennials are the most likely generation to engage in NFT purchasing, with 42% of millennial respondents to one survey saying they do collect NFTs. They are followed by Generation Xers, of whom 37% say they are collectors.

Despite Generation Z occupying a strong part of the retail market, they are one of the generations least likely to be involved in NFT collecting or retail purchasing, beaten only by baby boomers. Just 4% of Gen Zers said they collect NFTs, because of limited purchasing power or a lack of interest in collecting digital assets as a hobby. Despite Gen Z’s current reluctance to get involved in NFT purchasing, there is interest there. One study found that despite such a small proportion of Gen Zs currently purchasing NFTs, close to 30% say they are interested in purchasing in the future. Of those who said they were uninterested, 57% claimed the reason was because of a lack of understanding. As blockchain and crypto become more mainstream technologies, understanding will inevitably grow, making Gen Z another promising market for retailers involved in the technology.

Retailers are Already Taking Advantage of NFTs

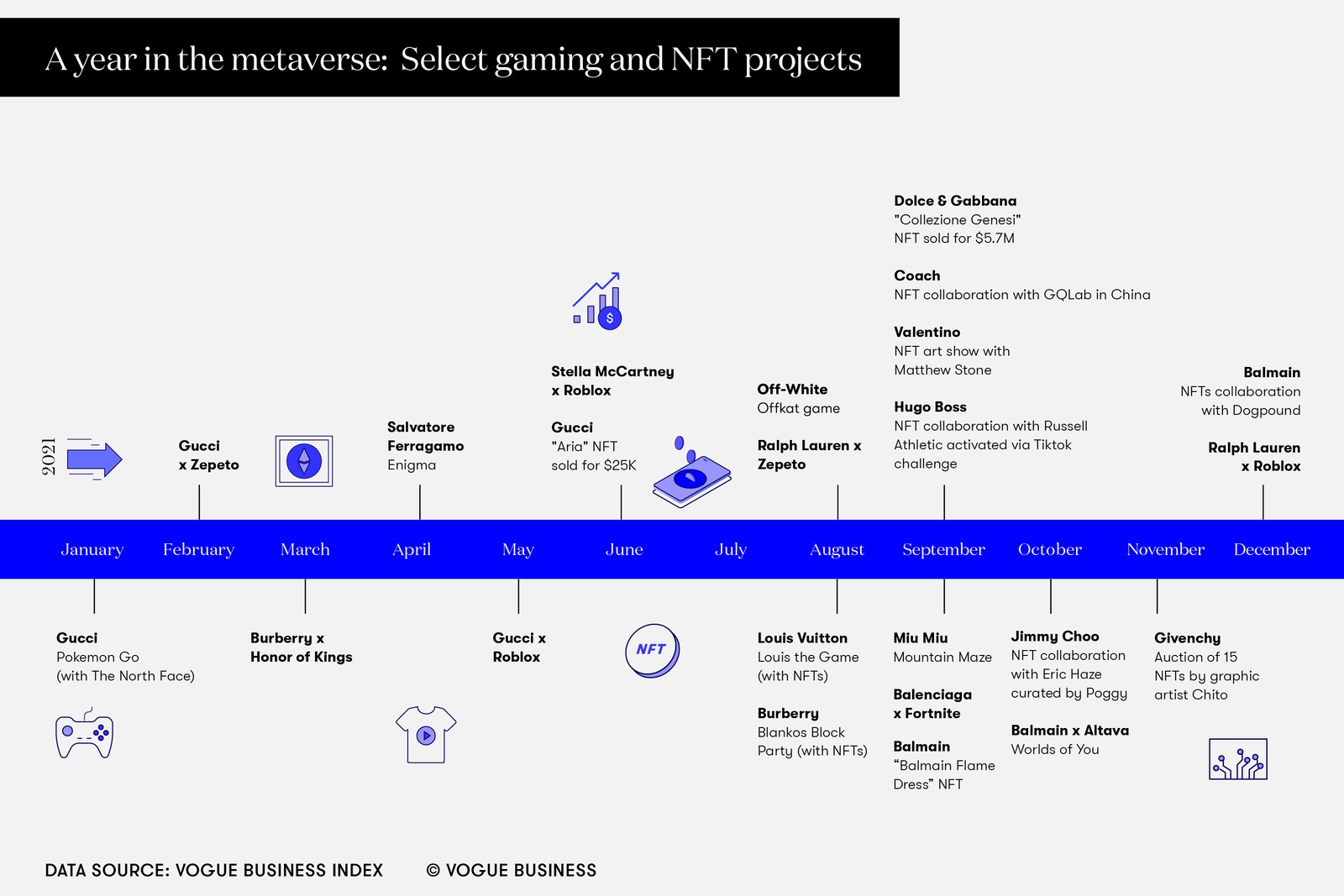

The first instance of a fashion brand embracing NFTs for retailers was when fashion house The Fabricant sold a digital dress for £7,500 in 2019. Since then, more retailers have turned to NFTs to expand their brand awareness or explore a new avenue of profit. According to the Vogue Business Index, 17% of fashion brands have already worked with NFTs.

Last year, Adidas took their first foray into the world of digital art. Their debut collection Into the Metaverse consisted of 30,000 NFTs, each of which gives the buyer exclusive access to physical merchandise that will become available in the future. The NFTs sold out within hours and Adidas earned approximately $22 million in sales. The retailer has since stated their intention to bring out more NFTs in the future, and with the success of their first collection, future profit is almost guaranteed.

They’re not the only brand to consider NFTs for retailers the future of retail. In late 2021, BoohooMAN became one of the first major fast-fashion retailers to branch out into NFTs. However, unlike Adidas, BoohooMAN is planning on giving their NFTs away for free to eight lucky winners. This fundamental change – from NFTs as a revenue stream to a marketing tactic – is evidence that BoohooMAN sees more than just monetary value in digital assets.

Retailers and the Metaverse

Here lies another advantage to engaging in NFTs – increasing brand recognition. At the end of last year, we explored why brand consistency is so important for retailers. With the rapid increase in omnichannel retailing, it’s more important than ever that retailers ensure consistent brand identity across all channels. As another marketing channel, NFTs for retailers can be a powerful way to increase brand awareness and add another facet to your brand identity. This is especially true as we start to see digital spaces like the metaverse becoming more common.

The metaverse is destined to be a 3D version of the internet where users can interact in real-time with others in a realistic virtual space. There are numerous applications for retailers here, including virtual stores where users can shop for virtual goods like NFTs using cryptocurrency. The brand opportunities present in NFTs for retailers are staggering – with so many people potentially entering the metaverse with avatars, there’s a chance for retailers to sell their products and gain much larger visibility across the globe. Despite being a relatively new retail innovation, the metaverse promises to change how customers shop and could be a key part of the future of retail.

Retailer ASICS has already taken one step towards the metaverse, with plans to develop a digital store where consumers can interact with the brand’s products. Luxury retailers are also exploring the possibilities the metaverse can offer. Last year, Burberry launched an online game that users can access by purchasing an NFT. In the game, they can interact with the brand’s identity and products, and purchase virtual accessories like jetpacks, armbands, and pool shoes. With retailers already considering ways to become digital-first, the metaverse offers opportunities for building brand identity, and revenue, outside of physical stores, and NFTs for retailers is a huge part of this.

Are NFTs The Future of Retail?

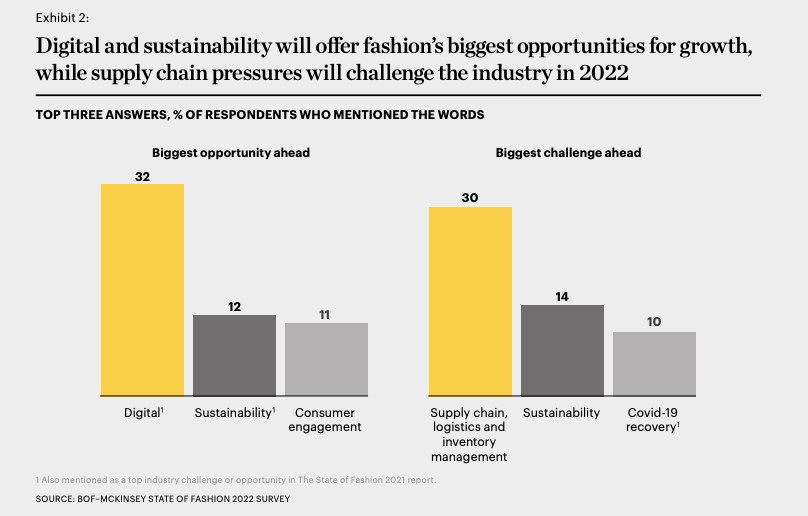

McKinsey’s State of Fashion 2022 report concluded that NFTs are likely to become part of the mainstream for retailers this year. With the rapid growth of the market and the branding and profit opportunities afforded by the sale of digital assets, it’s clear they will become a staple in the future of retail. In fact, the luxury NFT market is expected to grow to $56 billion by 2030, and while luxury NFTs will still comprise a small proportion of the overall market, this retail innovation will see increased demand because of the metaverse.

When considering if NFTs for retailers represent the future of retail, it’s also worth considering the as-yet undeveloped applications of the technology. Retailers may find that embracing the technology now could offer unforeseen advantages in the future as blockchain and NFTs for retailers become more widespread. As the technology becomes more accessible, it will also be easier for brands to explore opportunities within NFTs.

Though the market for NFTs for retailers is likely to grow, retailers should be aware of the potential implications of embracing NFTs. We already know that the retail industry is committed to becoming more sustainable. 14% of respondents to McKinsey’s State of Fashion 2022 said that sustainability would prove the biggest challenge for the fashion industry, while 12% regarded sustainability as an opportunity. NFTs, though, present a major sustainability problem.

NFTs rely on the cryptocurrency Ethereum, which in turn relies on huge amounts of electricity to keep transactions going. To establish digital provenance and security in the blockchain, “miners” solve cryptography problems with high-power computers. In doing so, they draw a huge amount of power from the grid – Ethereum’s total annual carbon footprint is estimated to be the same as that of Hungary. The future of retail may well lie in the metaverse and NFTs. However, brands will have to think carefully about whether embracing NFTs for retailers may contradict their sustainability goals and negatively impact their brand reputation.

NFTs for Retailers and RFID

Beyond investing in collectible NFTs, an additional advantage of blockchain technology that often goes under the radar is that retailers can use it to establish product authenticity. Globally, the counterfeiting industry is valued at $500 billion a year, with luxury retailers particularly vulnerable. In the future, NFTs for retailers might be used to establish product authenticity and supply chain transparency, combating common problems in the retail industry like counterfeiting.

Existing technology like RFID can be harnessed alongside blockchain to provide customers with additional information about their products. “Product passports” will support authentication by offering information about products and their provenance through virtual tags. Chanel are already utilising this technology, replacing physical tags in their luxury handbags with a digital passport through a scannable metal plate.

With the global adoption of RFID technology on the rise, it’s likely that we’ll see more collaborations with RFID and NFTs for retailers in the future. Whether NFTs will become a mainstay in the future of retail remains to be seen, as many consumers are still in the dark about the technology. However, there’s no doubt that it’s a retail innovation that offers opportunities for increased revenue, brand visibility, and security.

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Explore how Detego’s all-in-one cloud-hosted RFID retail innovation could help you increase revenue. Our user-friendly software enables you to keep accurate stock counts, improving the efficiency of your omnichannel services and boosting revenue. Click the link below to book a demo.