As more and more retailers invest in omnichannel services, are they ready to invest in order to ensure their omnichannel strategy delivers long-term?

Omnichannel Services Are Taking off, Are Retailers Ready to Profit?

Retail has been on a transformation journey ever since the birth of the internet, and the online shopping and digital consumers that came with it.

Many new (often online-first) brands have grown into superpowers, and ‘traditional’ brick-and-mortar retailers have had to adapt their offering in order to stay competitive in what is a dramatically different environment compared to just ten years ago.

Make no mistake, this industry shift as a result of digital channels is still ongoing. While it by no means spells the death of physical retail – the industry must continue to adapt.

Brick-and-mortar retailers selling online, and gradually adopting an omnichannel model, is a big step in this journey.

This gradual shift has been greatly accelerated by the pandemic. While omnichannel was in many retailers five-year plans, the pandemic meant brands had to shift suddenly to survive in a temporary world where online was king.

So, as many retailers are leaning hard into omnichannel – is the industry ready? The operational challenges and costs associated with omnichannel mean some retailers might struggle to really profit. So, what can brands do to change this, and what technology should they invest in to ensure their omnichannel strategy delivers long-term?

The Omnichannel Surge

The pandemic was a big accelerator for the already ongoing digital transformation of retail. The temporary circumstances of the pandemic meant more shoppers were forced online. A report from Nosto claims at the height of lockdowns online channels spiked 66%.

This online spike also affected omnichannel services. Click-and-Collect/BOPIS increased 70 percent by volume and 58 percent by value in 2020, according to ACI Worldwide data. Meanwhile, retailers fulfilling online orders from stores grew by 80% in the US, according to global data.

While spikes like this are temporary, online channels will not return down to pre-pandemic levels. This is not only because of ongoing safety concerns, but because many consumers have been introduced to online channels or omnichannel options like BOPIS & curbside for the first time. Many of these new digital consumers will not give those options up, why would they?

So, while stores are coming back and will remain a key part of retail, the environment that they exist in will have changed, with stores operating as part of online channels rather than in tandem or competition with them.

This isn’t new however – the industry has been talking about the gradual move to omnichannel for a long time. What’s significant is how this sudden spike has forced brands to react and adapt far faster than they would have planned. In fact, the pandemic has accelerated this shift by up to 5 years according to data from IBM.

So, are retailers well-positioned for this sudden spike in omnichannel activity?

Growing Operational Challenges for Omnichannel Stores

For the main two omnichannel activities – BOPIS & Ship-from-store, store staff effectively have to do extra work that the customer or the DC would normally do, respectively. These services have natural advantages for retailers and customers, but without the right support store staff can struggle to fulfil these orders and keep on top of their normal tasks.

When stores are quiet like during the pandemic, this is not an issue and allows you to leverage stores and staff that would otherwise be unproductive. Moving forwards, however, as stores begin to return closer to normal foot-fall levels, staff may be overwhelmed without extra help like more dedicated in-store fulfilment staff or supportive technology.

IT & Inventory Management Improvements Required

Even with the staff and operational manpower to fulfil and deliver these omnichannel services, if a store’s IT system is not up to scratch they will struggle to fulfil orders correctly and deliver on the promises made to customers.

For this to work, brands need a single view of stock across their stores and online shop. For brands to offer reliable and profitable omnichannel services, their inventory management system needs to fulfil three key criteria.

The first is simply accuracy. If stores are running at a standard 70% inventory accuracy, the likelihood of them offering stock to customers that simply isn’t there is too high.

The second – stock needs to be as close to real-time as possible to maintain this accuracy throughout the day. If stock is not updated throughout the day, then it becomes impossible to offer reliable services like BOPIS.

Finally, to do these services effectively it is much more manageable if stock is operating on an item-level rather than an SKU level. This allows stores to easily distinguish between identical items, so ship-from-store or BOPIS can work down to the final remaining SKUs.

Without this infrastructure in place, it’s common for BOPIS or ship-from-store to offer customers stock that isn’t actually there. The result is orders being cancelled shortly after they are made, and customers being disappointed.

Handling Returns

Returns are the Achilles heel of online shopping in general, and omnichannel services are no exception. Not only do returns eat up margins, but they also again require some operational manpower to process and re-distribute, be it at the DC or the store.

This problem is particularly prevalent in apparel and sports retail due to sizes and fit. While apparel stores have a far lower rate of returns than online, when adding BOPIS and ship-from-store and return-to-store into the mix, the rate of returns can increase drastically.

Balancing The Cost of Omnichannel

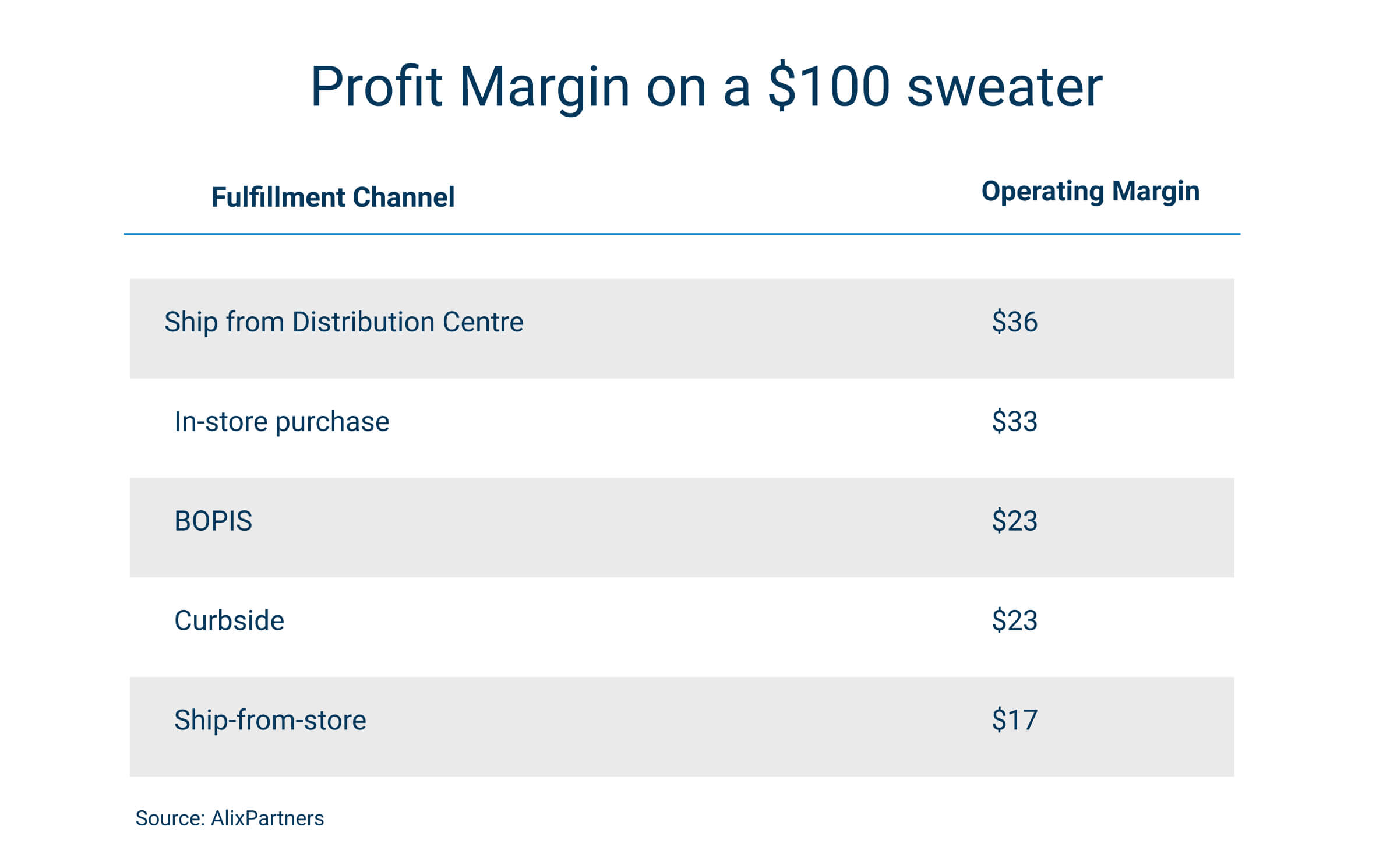

Managing and making the most of fine profit margins has always been key for successful retailers. When selling across channels in different ways – keeping an eye on the variable profit margins is essential.

Shipping from DC, also known as direct-to-consumer, is often the most profitable for retailers. This is why we have seen many brands begin to shift to more DTC models. This model has many advantages like bypassing third parties and servicing a larger area than stores, however, factors like returns can quickly have a negative effect on these margins.

Only somewhat less profitable is in-store sales. While rents and staff costs can be considerable, the operational tasks are effectively shared with the customer. While staff operate checkouts and maintain inventory the customer picks and packs their own orders. It may seem strange to think about in-store shopping in those terms, but some customers are beginning to wise up and appreciate the convenience of retailers doing this for them.

As we get to the omnichannel purchase methods, BOPIS (click-and-collect) and curbside, the operating margin is somewhat worse due to the fact that store staff have to pick and fulfil orders from the shopfloor or backroom. For curbside, there is also the added strain of carrying orders out of the shop to give to customers.

Finally, the most severe operating margin belongs to ship-from-store. This is because you have store running costs on top of in-store fulfilment as well as delivery costs. Despite this, we are seeing many major retailers lean into ship-from-store as a way to boost store sales and leverage store inventories. For example, Target fulfilled 75% of their digital sales using ship-from-store in Q2 last year.

Essentially, these models are all worth doing as they bring in additional customers and sales. Customer expectations are growing, and shoppers want to purchase and revive their products in whatever way suits them best, if you don’t meet those expectations, your competitor will.

However, for more operationally intensive models like ship-from-store and curbside pickup, it’s important to make sure these services are run as efficiently as possible, particularly when done at scale.

So, how can brands meet these challenges and ensure their omnichannel operating margins are as healthy as possible?

How RFID Delivers the Perfect Foundations for Omnichannel Services

Like we said earlier, the concept of Omnichannel retailing has been around for a while. Even before the pandemic, many forward-thinking retailers were beginning to invest in and build out their omnichannel capabilities.

To meet the operational challenge this meant setting up the new processes that go alongside BOPIS or ship-from-store and ideally adding more staff to support these processes. The IT challenges, particularly in terms of inventory and order management, require some more investment and technology integration.

When it comes to delivering the IT requirements for this, Radio Frequency Identification (RFID) is the single solution. While the deliverables of stock accuracy and product availability can provide a ROI for stores by themselves, laying the foundation for strong omnichannel services is often touted as the main reason for retailers choosing to implement the technology.

In a 2018 study, 83% of RFID adopters offered three or more omnichannel fulfilment options compared to only 24% of non-adopters. This is because RFID delivers a highly accurate and even-real time view of inventory at scale and across channels.

This single view of stock means retailers (and their customers) know exactly what is in stock at all times, making it easy to sell store stock online. Because RFID inventories work on an item level, these services can be completely granular, reserving individual items without even disappointing customers by offering them products that aren’t really there.

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Detego Store is a cloud-hosted RFID solution which digitises stock management processes, making them more efficient and more accurate. Implemented within hours, our multi-user app can provide intelligent stock takes and a smart in-store replenishment process. Later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.