Detego and Zebra Technologies have a long-standing partnership with successful global RFID rollouts. Joint customers include some of the world’s leading fashion brands.

Learn more in our new whitepaper about how this partnership approach provides the best and most sustainable approach to RFID implementation.

“By using Detego and Zebra RFID solutions to digitize stock counts one major global retailer increased inventory accuracy to 99%”

Complete the form below to download the case study.

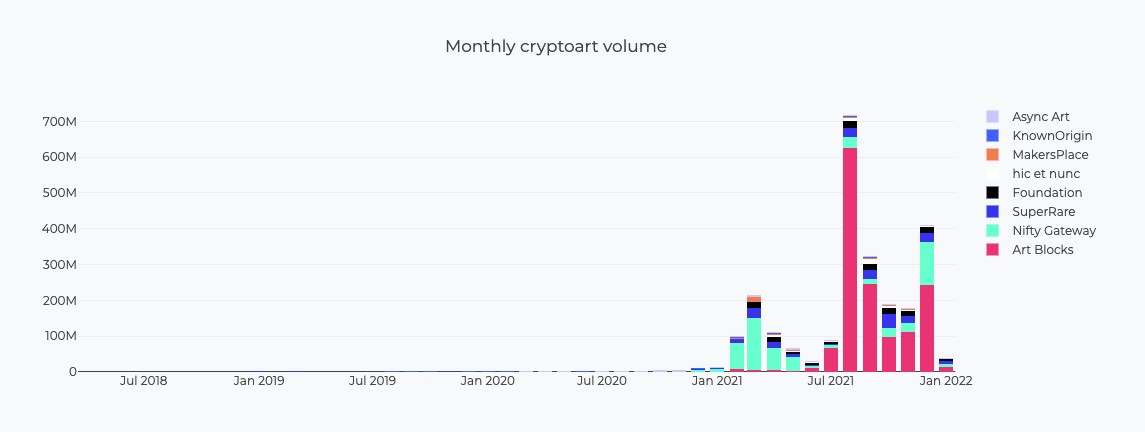

NFTs, or non-fungible tokens, are the current talk of the art world. Though they’ve existed since 2014, the popularity of NFTs rose rapidly in 2021, with trading hitting $10.7 billion in the third quarter of that year.

NFTs can be anything – art, memes, and even newspaper articles or tweets. They are stored on a blockchain, the database that cryptocurrency relies on. However, unlike crypto, NFTs cannot be exchanged with another digital asset – each NFT is entirely unique. Each NFT that is sold has no equivalent, and blockchain technology is used to establish sole ownership and digital provenance. These digital assets can be resold on specialised online marketplaces, making them a lucrative investment opportunity. In the world of NFTs, anything can be monetised and sold, which is also part of their appeal.

Their popularity can be explained by the fact that they are simultaneously exclusive and are becoming more affordable. Individual NFTs are highly unique but theoretically anyone with an internet connection – and enough capital – can access the world of collective NFTs.

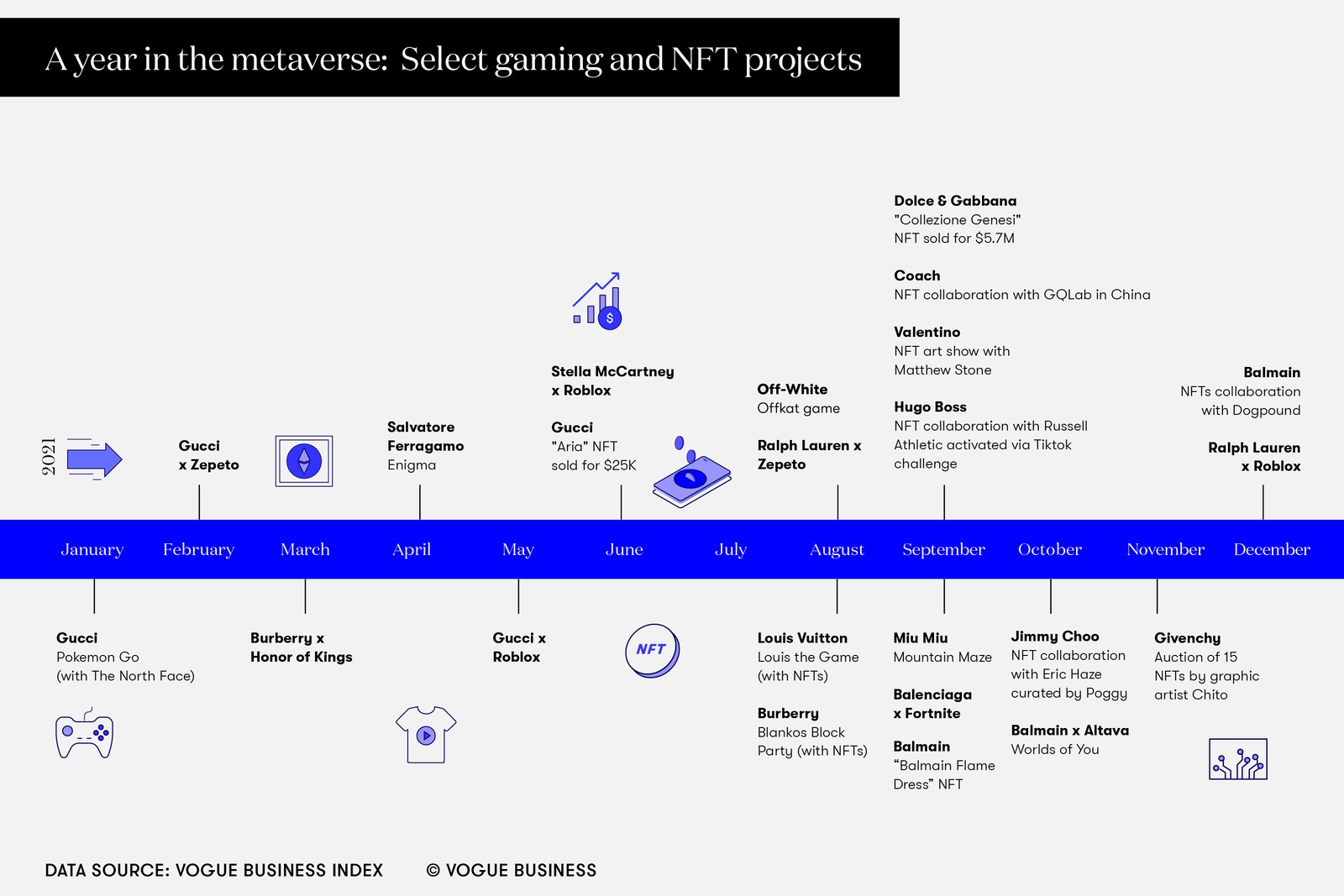

More recently, the world of retail is seeing value in NFTs. While some NFT sales have made headlines for their expense, the majority of NFT purchases in the first 10 months of 2021 were valued at less than $10,000. This means they can be categorised as ‘retail’ in nature. In the second half of 2021, brands including Adidas and BoohooMAN created their own NFT collections, hoping that they could capitalise on the technology’s popularity. High fashion brands are also trying their hand at NFT collections, including Dolce & Gabbana.

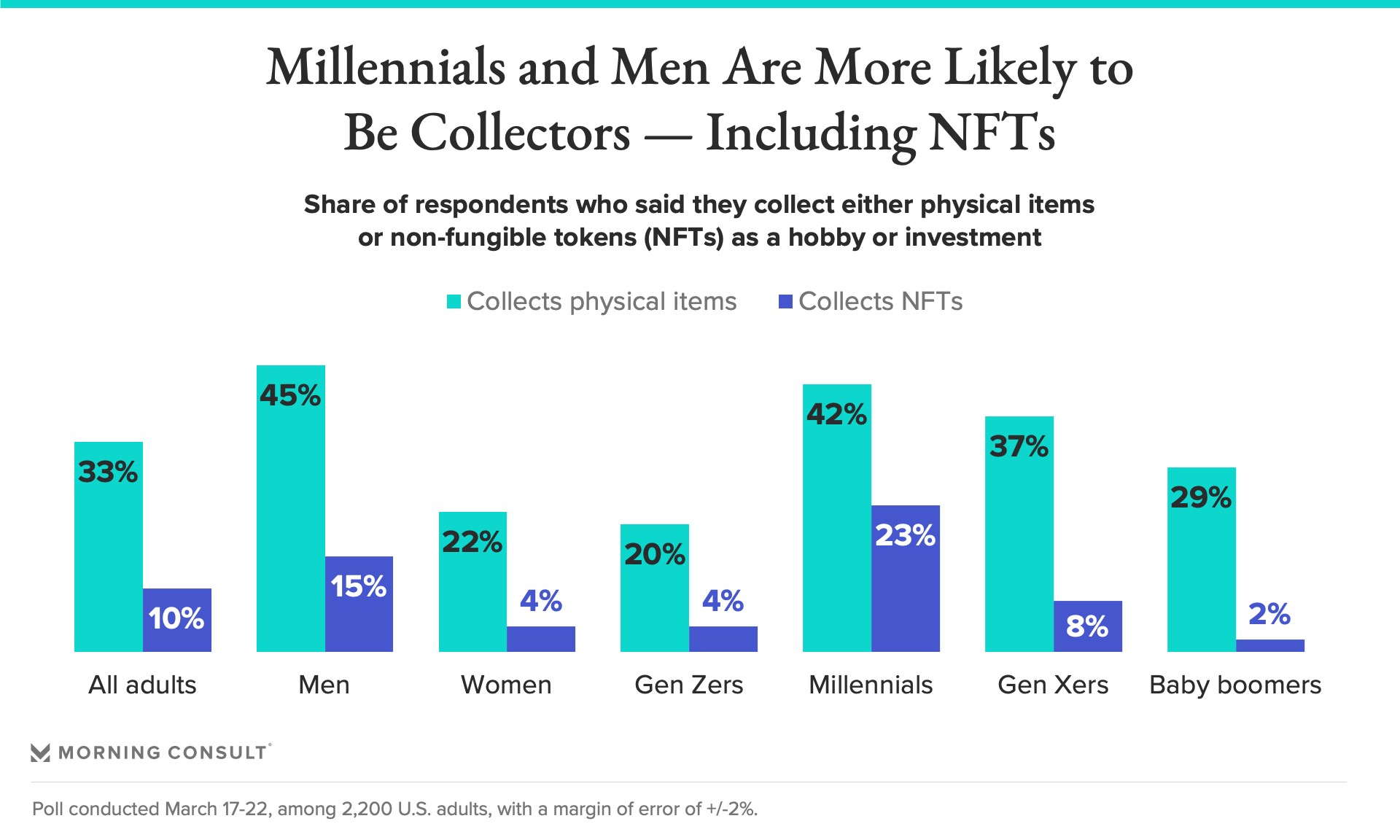

Is there a future in NFTs for retailers? That depends in part on your brand and target market. According to a survey from Morning Report, 15% of male respondents said they collected NFTs, compared to only 4% of female respondents. For high fashion brands, who more often than not have a female consumer base, NFTs can be a way of driving sales from male consumers. Alternatively, if your brand already markets predominantly to men, NFTs are a lucrative way of increasing revenue.

Based on the growth of NFTs in the latter half of 2021, it’s clear that NFTs will continue to increase in popularity. The most expensive NFT in 2021 was sold for $69.3 million in March, and while NFTs for retailers are unlikely to market for the same extraordinary prices, it’s evidence of the profit that can be created with NFTs. The entire NFT market is expected to grow to $240 billion by 2030, and NFTs for retailers could offer brands a lucrative opportunity to enter the burgeoning digital asset market.

A New Market in NFTs for Retailers

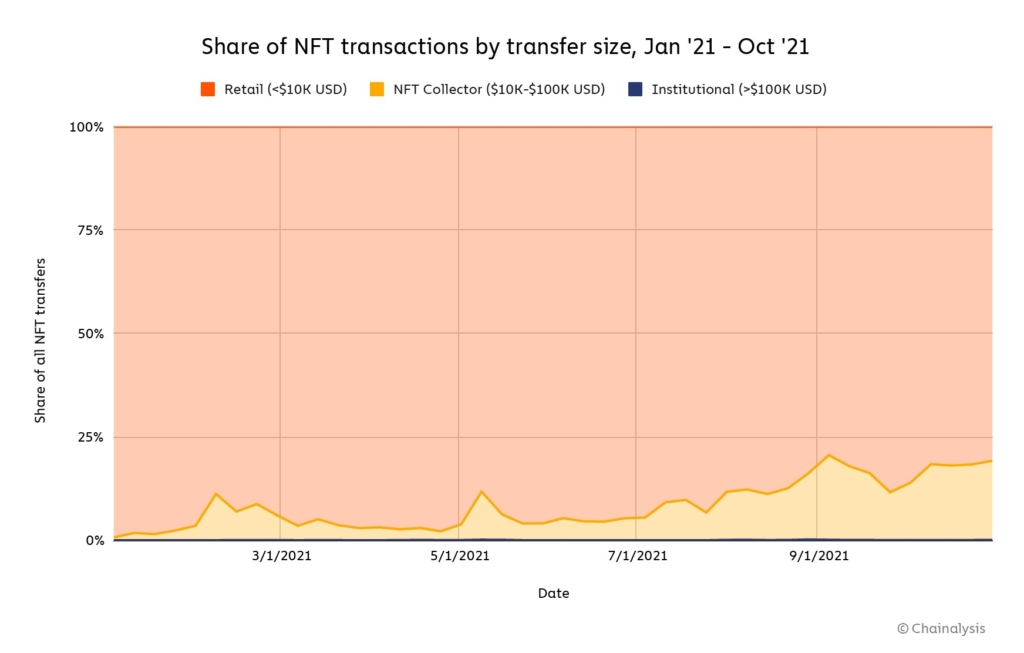

The NFT market has grown from a niche area for technology and crypto enthusiasts to something more accessible to the average consumer. At the same time, over the course of 2021, the average transaction size and the total value of NFTs increased. By October 2021, collector-sized transactions of between $10,000 and $100,000 accounted for 19% of all NFT transactions, compared to 6% in March 2021. This suggests that NFT assets are gaining value rapidly and that collectors and consumers aren’t put off by high price tags.

Despite the growth in large NFT transactions, the majority of purchases are still conducted at retail level – that is, with transactions of less than $10,000. In comparison to the crypto market, NFT purchases are still driven by retail purchases, not collectors or larger institutional transactions of over $100,000. In 2021, 80% of NFT purchases were made by retail buyers, despite the growth in those high-value collectors and institutional transactions. For this reason, the market for NFTs for retailers is promising – it could prove to be a major retail innovation in the next five to ten years.

Additionally, the audience for NFTs for retailers is already there. Millennials are the most likely generation to engage in NFT purchasing, with 42% of millennial respondents to one survey saying they do collect NFTs. They are followed by Generation Xers, of whom 37% say they are collectors.

Despite Generation Z occupying a strong part of the retail market, they are one of the generations least likely to be involved in NFT collecting or retail purchasing, beaten only by baby boomers. Just 4% of Gen Zers said they collect NFTs, because of limited purchasing power or a lack of interest in collecting digital assets as a hobby. Despite Gen Z’s current reluctance to get involved in NFT purchasing, there is interest there. One study found that despite such a small proportion of Gen Zs currently purchasing NFTs, close to 30% say they are interested in purchasing in the future. Of those who said they were uninterested, 57% claimed the reason was because of a lack of understanding. As blockchain and crypto become more mainstream technologies, understanding will inevitably grow, making Gen Z another promising market for retailers involved in the technology.

Retailers are Already Taking Advantage of NFTs

The first instance of a fashion brand embracing NFTs for retailers was when fashion house The Fabricant sold a digital dress for £7,500 in 2019. Since then, more retailers have turned to NFTs to expand their brand awareness or explore a new avenue of profit. According to the Vogue Business Index, 17% of fashion brands have already worked with NFTs.

Last year, Adidas took their first foray into the world of digital art. Their debut collection Into the Metaverse consisted of 30,000 NFTs, each of which gives the buyer exclusive access to physical merchandise that will become available in the future. The NFTs sold out within hours and Adidas earned approximately $22 million in sales. The retailer has since stated their intention to bring out more NFTs in the future, and with the success of their first collection, future profit is almost guaranteed.

They’re not the only brand to consider NFTs for retailers the future of retail. In late 2021, BoohooMAN became one of the first major fast-fashion retailers to branch out into NFTs. However, unlike Adidas, BoohooMAN is planning on giving their NFTs away for free to eight lucky winners. This fundamental change – from NFTs as a revenue stream to a marketing tactic – is evidence that BoohooMAN sees more than just monetary value in digital assets.

Retailers and the Metaverse

Here lies another advantage to engaging in NFTs – increasing brand recognition. At the end of last year, we explored why brand consistency is so important for retailers. With the rapid increase in omnichannel retailing, it’s more important than ever that retailers ensure consistent brand identity across all channels. As another marketing channel, NFTs for retailers can be a powerful way to increase brand awareness and add another facet to your brand identity. This is especially true as we start to see digital spaces like the metaverse becoming more common.

The metaverse is destined to be a 3D version of the internet where users can interact in real-time with others in a realistic virtual space. There are numerous applications for retailers here, including virtual stores where users can shop for virtual goods like NFTs using cryptocurrency. The brand opportunities present in NFTs for retailers are staggering – with so many people potentially entering the metaverse with avatars, there’s a chance for retailers to sell their products and gain much larger visibility across the globe. Despite being a relatively new retail innovation, the metaverse promises to change how customers shop and could be a key part of the future of retail.

Retailer ASICS has already taken one step towards the metaverse, with plans to develop a digital store where consumers can interact with the brand’s products. Luxury retailers are also exploring the possibilities the metaverse can offer. Last year, Burberry launched an online game that users can access by purchasing an NFT. In the game, they can interact with the brand’s identity and products, and purchase virtual accessories like jetpacks, armbands, and pool shoes. With retailers already considering ways to become digital-first, the metaverse offers opportunities for building brand identity, and revenue, outside of physical stores, and NFTs for retailers is a huge part of this.

Are NFTs The Future of Retail?

McKinsey’s State of Fashion 2022 report concluded that NFTs are likely to become part of the mainstream for retailers this year. With the rapid growth of the market and the branding and profit opportunities afforded by the sale of digital assets, it’s clear they will become a staple in the future of retail. In fact, the luxury NFT market is expected to grow to $56 billion by 2030, and while luxury NFTs will still comprise a small proportion of the overall market, this retail innovation will see increased demand because of the metaverse.

When considering if NFTs for retailers represent the future of retail, it’s also worth considering the as-yet undeveloped applications of the technology. Retailers may find that embracing the technology now could offer unforeseen advantages in the future as blockchain and NFTs for retailers become more widespread. As the technology becomes more accessible, it will also be easier for brands to explore opportunities within NFTs.

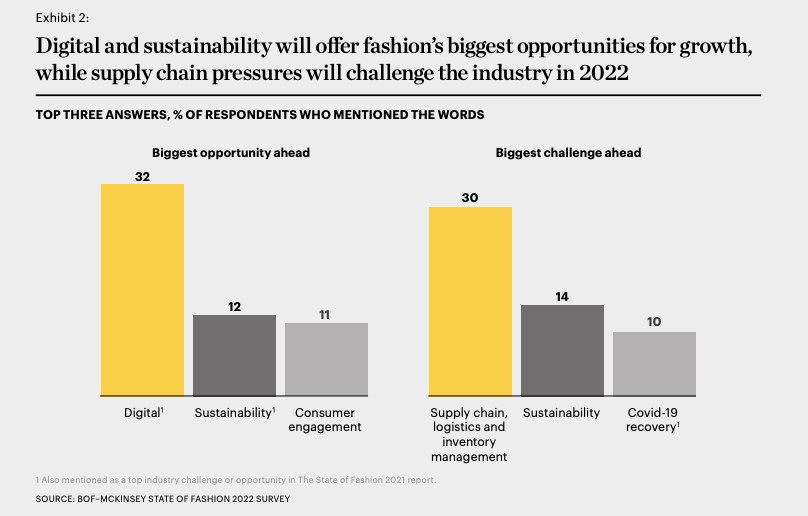

Though the market for NFTs for retailers is likely to grow, retailers should be aware of the potential implications of embracing NFTs. We already know that the retail industry is committed to becoming more sustainable. 14% of respondents to McKinsey’s State of Fashion 2022 said that sustainability would prove the biggest challenge for the fashion industry, while 12% regarded sustainability as an opportunity. NFTs, though, present a major sustainability problem.

NFTs rely on the cryptocurrency Ethereum, which in turn relies on huge amounts of electricity to keep transactions going. To establish digital provenance and security in the blockchain, “miners” solve cryptography problems with high-power computers. In doing so, they draw a huge amount of power from the grid – Ethereum’s total annual carbon footprint is estimated to be the same as that of Hungary. The future of retail may well lie in the metaverse and NFTs. However, brands will have to think carefully about whether embracing NFTs for retailers may contradict their sustainability goals and negatively impact their brand reputation.

NFTs for Retailers and RFID

Beyond investing in collectible NFTs, an additional advantage of blockchain technology that often goes under the radar is that retailers can use it to establish product authenticity. Globally, the counterfeiting industry is valued at $500 billion a year, with luxury retailers particularly vulnerable. In the future, NFTs for retailers might be used to establish product authenticity and supply chain transparency, combating common problems in the retail industry like counterfeiting.

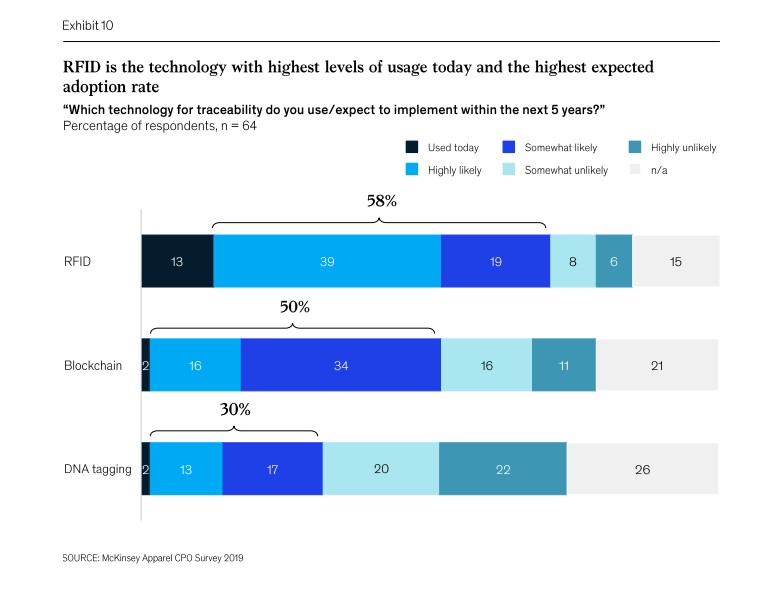

Existing technology like RFID can be harnessed alongside blockchain to provide customers with additional information about their products. “Product passports” will support authentication by offering information about products and their provenance through virtual tags. Chanel are already utilising this technology, replacing physical tags in their luxury handbags with a digital passport through a scannable metal plate.

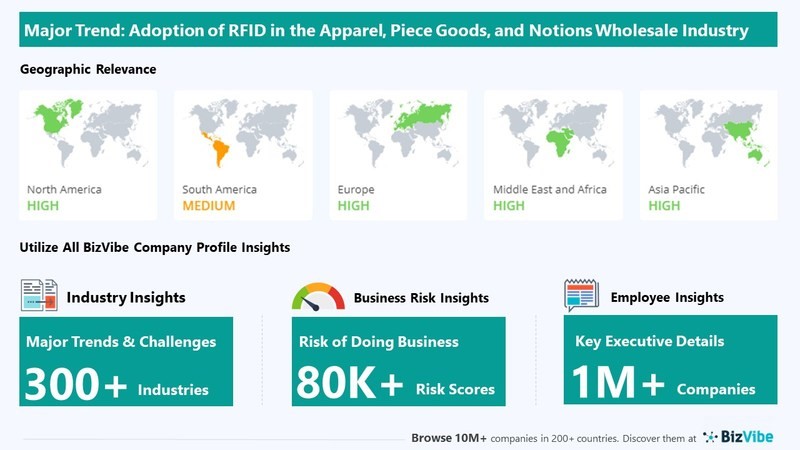

With the global adoption of RFID technology on the rise, it’s likely that we’ll see more collaborations with RFID and NFTs for retailers in the future. Whether NFTs will become a mainstay in the future of retail remains to be seen, as many consumers are still in the dark about the technology. However, there’s no doubt that it’s a retail innovation that offers opportunities for increased revenue, brand visibility, and security.

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Explore how Detego’s all-in-one cloud-hosted RFID retail innovation could help you increase revenue. Our user-friendly software enables you to keep accurate stock counts, improving the efficiency of your omnichannel services and boosting revenue. Click the link below to book a demo.

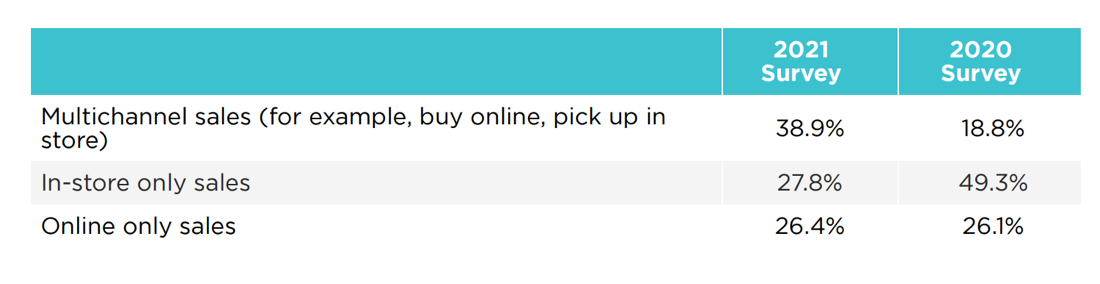

It’s no secret that omnichannel retailing is increasing rapidly. Retailers now understand that to achieve maximum sales and growth, it’s no longer possible just to have a brick-and-mortar store. Instead, retailers must utilise multiple sales methods to reach the maximum number of customers and provide a variety of ways to purchase.

The payoff for retailers who have invested in omnichannel services is massive. US retail giant Target saw its digital sales increase by 195% in 2021. In addition to this, they discovered that omnichannel customers spend four times the amount store-only customers spend and ten times more than digital-only customers. For example, 80% of customers who return products to stores choose to spend their refund in store. The growth possibilities for retailers who embrace omnichannel services are endless.

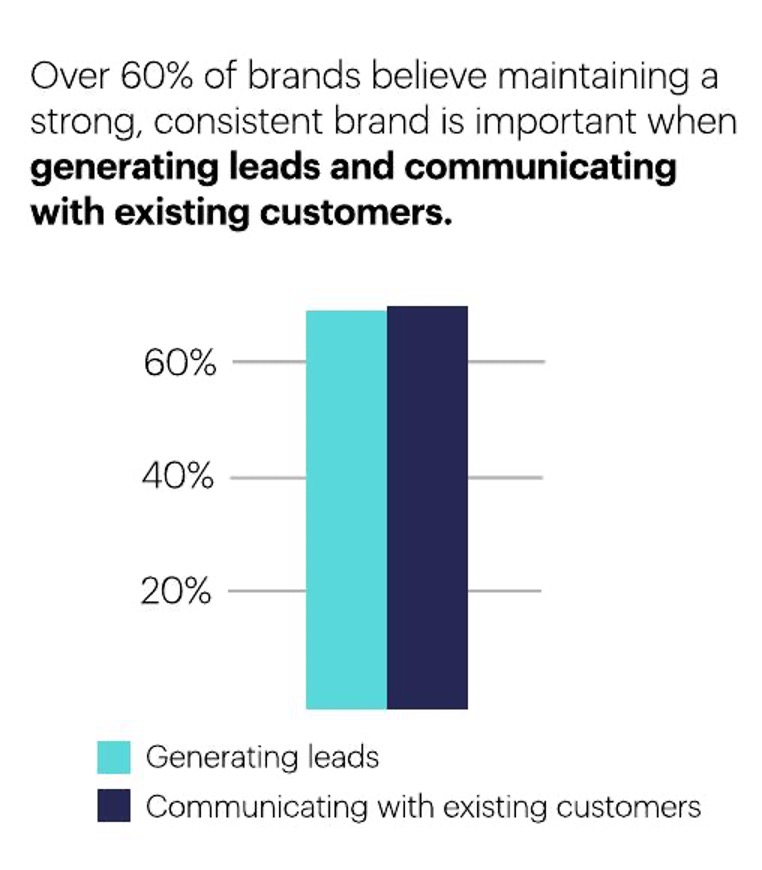

However, a critical feature of successful omnichannel retailing that often goes under the radar is brand consistency for retailers. This means improving your brand assets alongside your physical retail assets – for example, investing in your social media – and keeping a consistent brand identity across all of your digital platforms and in-store.

Retailers that prioritise brand consistency notably fare far better than those with a lukewarm approach to branding and identity. For example, luxury fashion house Louis Vuitton has managed to sustain their brand identity over a 160-year history, repurposing this into an online brand with over 20 million followers on Instagram. Similarly, fashion retailer Boohoo has thrived over the last year as it has built a consistent image across its app, social media accounts, and website.

Brand consistency for retailers has undoubtedly become more important as e-commerce has become a mainstay of the retail environment. Analysis from Millward Brown Optimor found that in 1980, most of the value of an average S&P 500 company came from physical assets such as factories or inventory. However, in 2010, these physical assets comprised a maximum of 40% of the company’s total value. The other 60% of the company’s value came from intangible assets, and around half of it was attributed to the brand.

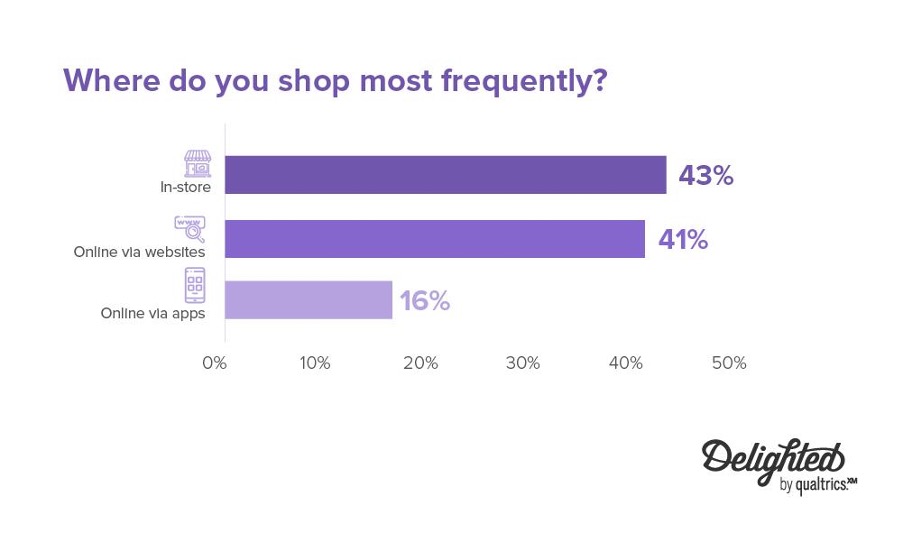

We know that omnichannel retailing will only grow in the future, as will the dependence on e-commerce. In 2021, the percentage of customers who shop online (41%) is catching up with the percentage of customers who still shop in physical stores (43%). As a result, brand consistency for retailers will also become a top priority.

How Retailers Can Successfully Achieve Brand Consistency

There are several factors to achieving brand consistency for retailers. Cultivating a consistent brand identity is also more challenging for retailers than in other industries. Companies need to consider their in-store layout, online persona, product range, customer service channels, promotions, and packaging. To achieve consistency, each area has to work towards the overall brand identity and present a consistent brand image and personality.

A store solution for brand consistency for retailers can often be as simple as choosing a signature colour to implement in your stores and online – this alone can increase brand recognition by 80%. However, before implementing any store solutions, brands must clarify their goals, mission statement, audience, and style guidelines for messaging. If these are strong, it will be easier to design a brand identity that encompasses your company ethos.

For retailers, brand consistency also starts with recognising the customer journey. This means identifying how your customers engage with your brand along multiple touchpoints. For example, if they visit your website, then choose to ship to a store, or visit your physical store to try on products which they will then purchase online. According to McKinsey, performing well on customer journeys is 35% more predictive of customer satisfaction than performance on individual touchpoints. In the end, omnichannel retailing is only as powerful as your brand identity.

If brick-and-mortar stores are still a priority for you, consider store solutions like pop-up displays to educate customers on your products. Other elements like music or lighting will also go some way to communicating your brand’s personality. Whatever you choose, you should implement the same conscious design and stylistic choices across all of your stores, as well as online.

Using Brand Consistency as a Growth Strategy

In 2020, Deloitte concluded that purpose and authenticity were the keys to future retail solutions. Without these two qualities, consumers cannot connect with brands and lose interest in purchasing their products. For retailers, brand consistency provides a way to communicate your brand’s purpose and ensure you appear as authentic as possible.

But brand consistency for retailers isn’t just about implementing a few changes across your online and in-store assets and leaving it at that. Your brand identity needs to be consistently maintained and, in some cases, altered to reflect your customer’s priorities. As such, brand consistency should form part of a retailer’s growth strategy which it returns to frequently.

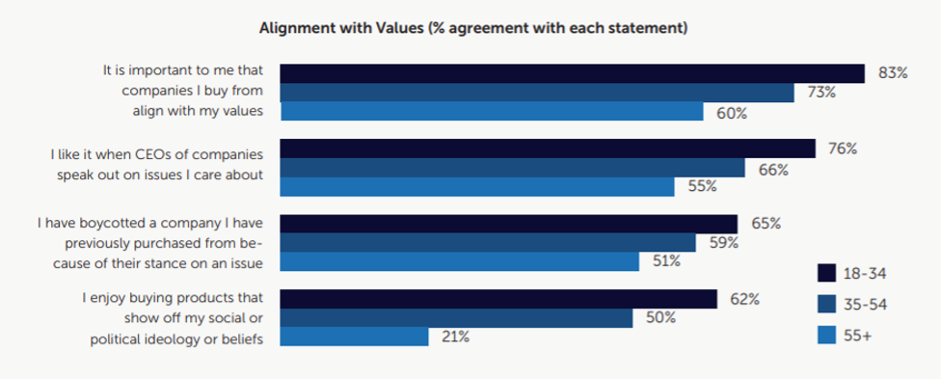

For example, millennial and Generation Z consumers behave very differently from other generations, and companies have to adapt to keep their brands relevant. For example, millennials ascribe more value to brand purpose than older generations – 62% of millennials favour products that promote their social or political beliefs, compared to 21% of people aged 55 or older. The same is true of Gen Z, 60% of whom say it is important that brands value their opinions.

The results are even starker for Generation Z, who by 2026 will make up the largest consumer base in the US. They differ from millennials in their motivations for buying and how they make purchasing decisions. Whereas millennials may be interested in brand status – buying a product for the brand name – Generation Z is more interested in purchasing products that make them stand out, regardless of brand. Brand consistency for retailers will become even more important to appeal to the Generation Z market. There will be an increase in social media marketing spending plus a focus on making physical stores more of an experience than the traditional brick-and-mortar store.

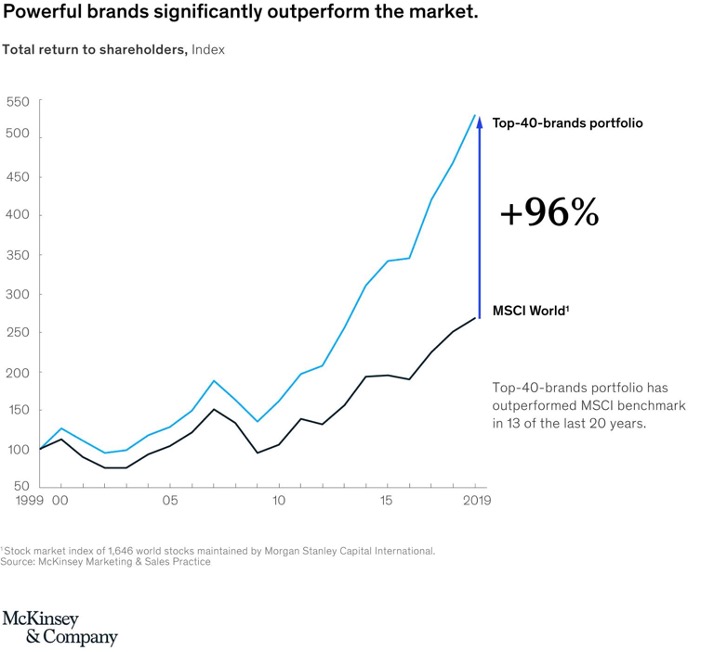

In the end, evidence shows that investing in your brand identity will have long-term benefits. Strong brands consistently outperform averages for the market. McKinsey research shows that the top 40 worldwide brands have outperformed the Morgan Stanley Capital International benchmark every year for the last 13 years. It’s also true that when consistently maintained, a strong brand identity can drive a 10-20% increase in overall growth.

If you can entice the Generation Z market with your brand identity, you’re also going to see lifetime pay-off – 66% of Gen Z shoppers said that once they find a brand they like, they will continue to buy from them for a long time.

Delivering a Seamless Experience for Customers

Cohesive and compelling brand identity will inevitably inform your customer experience – that is, how your customers experience your brand in-store and online. A seamless experience is paramount to the omnichannel retail experience, and retailers cannot get this right before first evaluating how seamless their brand identity is.

We also know that customers want an easy shopping experience as much as a compelling brand identity. The consequences of a bad shopping experience for some consumers can be dire for brands.

Despite their brand loyalty, 64% of Generation Z consumers said they would switch to a competitor after multiple negative experiences with a company.

If you’re taking advantage of omnichannel retailing, not only is brand consistency for retailers across numerous touchpoints important but also executing a seamless shopping experience. Customers want to know they can purchase the products they want, whether they’re shopping online or in-store. A consistent brand experience will also bolster a consistent brand identity: undoubtedly, omnichannel experiences and brand consistency for retailers go hand-in-hand.

But how can retailers build an omnichannel retail experience that also promotes brand consistency? Firstly, retailers should take advantage of customer service technology such as chatbots. Research shows that new generations of consumers are far more comfortable interacting with virtual assistants than older generations. 40% of Gen Z and millennial customers agree that when in a hurry, they would rather interact with a chatbot than a human customer service agent. Chatbots can also be customised to reveal a brand’s personality in their tone of voice and language use, so not only do they promote a seamless experience bus also bolster brand consistency for retailers.

Additionally, retailers should build an omnichannel experience at every stage of the customer’s journey. Customers should have the option to return items either by post or in-store at their chosen location. This opens up further in-store interactions, which we know can often result in additional sales, as well as providing that effortless shopping experience that consumers desire.

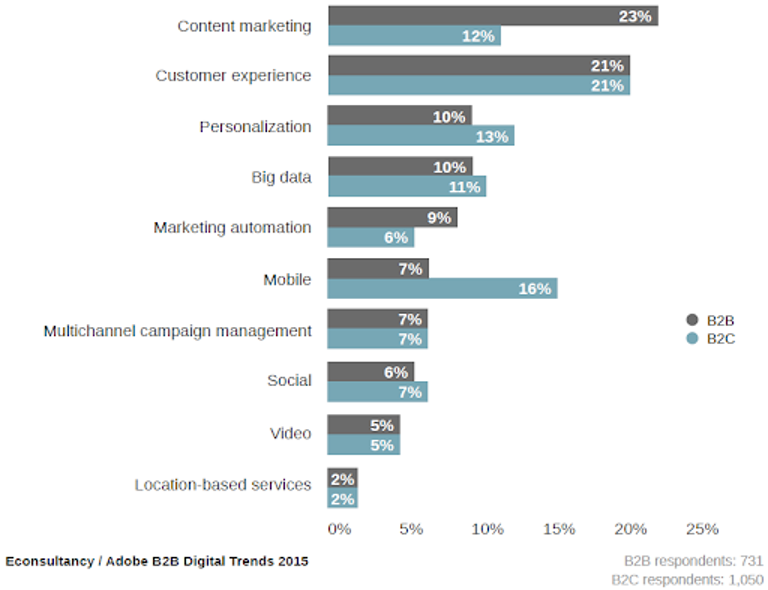

No matter how you go about building an omnichannel experience, companies agree that building a seamless experience is one of the most significant factors in growth; 21% of companies agree that customer experience is the most exciting opportunity for brands. However, customer experience can also be a way to enhance brand consistency for retailers, and technology like inventory software can aid that.

How Inventory Software Can Help Improve Brand Consistency For Retailers

Earlier this year, we examined how brick-and-mortar stores are adapting post-pandemic. Currently, one of the biggest challenges for retailers is keeping consistent levels of stock across physical stores and online, and this has only been exacerbated by the ongoing supply chain crisis. However, providing a consistent experience hinges on providing the products your customers want when they want them. Not providing this can have drastic consequences for sales; 96% of shoppers have left a store without purchasing anything because they couldn’t find the exact product they wanted.

Over the last two years, increased dependence on online retail has also prompted retailers to consider their operations. Retailers are now expected to fulfil orders made online, on mobile, and in-store simultaneously, requiring more accurate fulfilment systems and inventory tracking.

When it comes to retail solutions that improve brand consistency for retailers, there is only one: inventory software. Inventory software can provide retailers with real-time visibility of where their stock is, whether in a distribution centre, in-store, or in transit. This transparency is crucial to keeping up with consumer demands and increasing customer satisfaction and providing seamless brand consistency for retailers across multiple touchpoints.

Nike is one of the brands using inventory software to create a more successful omnichannel retail strategy. Starting in 2019, they implemented RFID technology in almost all of their non-licensed apparel and footwear, a decision that started to pay off during the supply chain issues of 2020 and 2021.

The company saw a 75% increase in digital sales over the pandemic, one-third of their total revenue. The real-time data that RFID provided offered Nike greater insights into customer buying journeys and the popularity of products. As a result, they could easily respond to customer demand and divert products to where they were selling best.

However, deploying RFID with inventory software like Detego’s has also allowed Nike to enhance their brand identity further. By harnessing technology like RFID, Nike has transitioned from selling mainly to wholesale partners to selling directly to consumers: they call this the “consumer direct offensive.” As well as embracing omnichannel retailing, this has also been a way for the company to enhance their brand identity by interacting directly with customers.

Brand consistency for retailers and omnichannel selling work together, and inventory software like RFID is the tool that can enhance both of these crucial parts of your business. Book a consultation with Detego today to find out how RFID software can improve your omnichannel success and enhance your brand identity.

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Book a demo with Detego to find out how our cloud-hosted RFID retail solution could help you improve your stock accuracy. With fast and easy results and application, our all-in-one software provides intelligent stock takes, improving the efficiency of your omnichannel services.

Traditionally, Black Friday has been one of the most successful times of the year for retailers. The total amount of sales during this period – especially online – has only increased year on year, and by employing effective performance solutions for Black Friday, retailers can often outperform their yearly KPIs in this one weekend.

However, this year is set to be different. Companies are already grappling with the ongoing supply chain crisis, but long-term changes to the retail sector make this year more difficult for retail businesses.

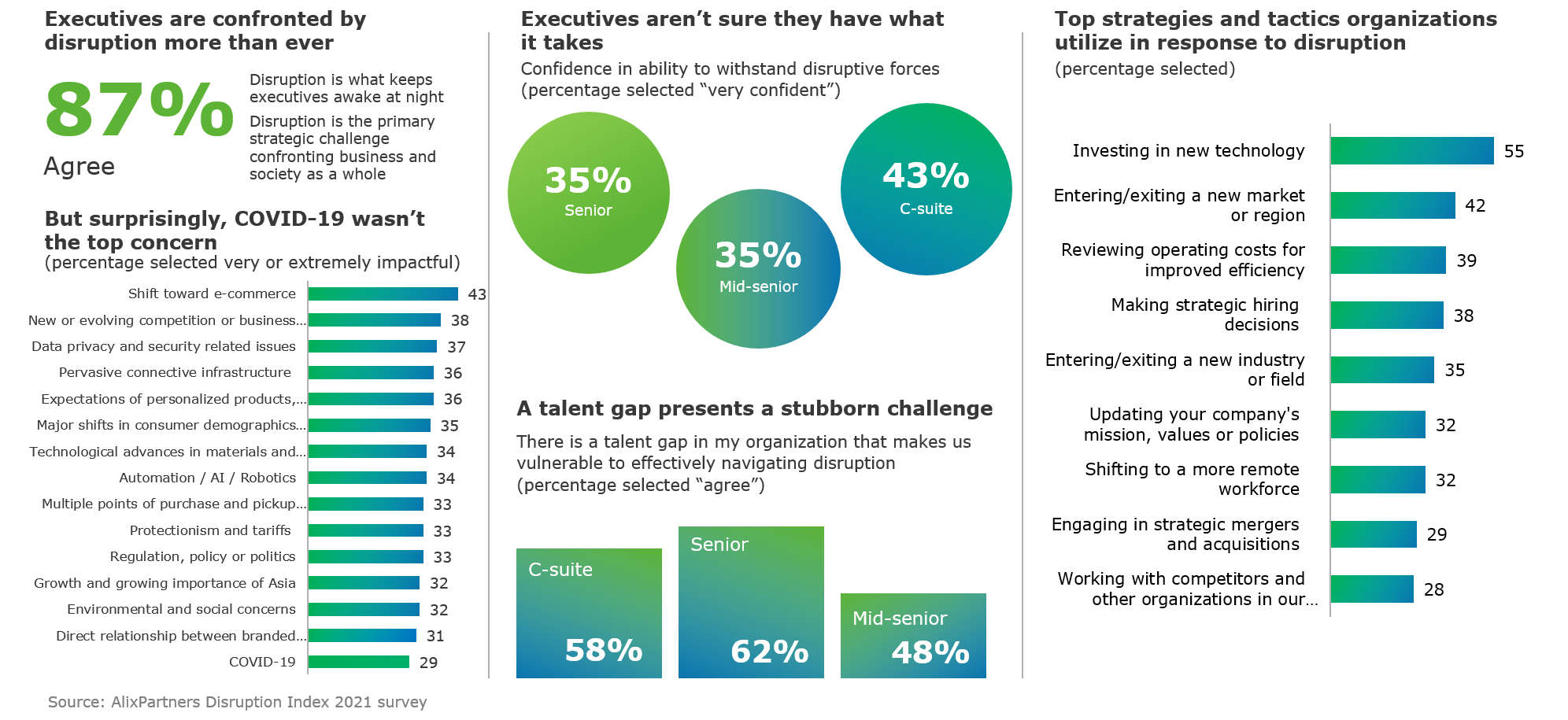

Research has shown that the retail industry is one of the most disrupted of all sectors. This disruption comes from all areas, and isn’t just limited to supply chains or the result of the pandemic. 43% of senior retail executives say the shift towards e-commerce has had a major impact on their organisation, but this is closely matched by other factors. These include evolving competition (38%), data privacy issues (37%), shifts in consumer demographics (35%), and technological advances (34%).

Not only is disruption affecting all areas of retail operations, but senior executives lack the confidence to tackle this disruption. Just 40% of retail leaders feel confident that they can survive the current disruption. To tackle this disruption, more innovative performance solutions for Black Friday are necessary to improve upon last year’s sales.

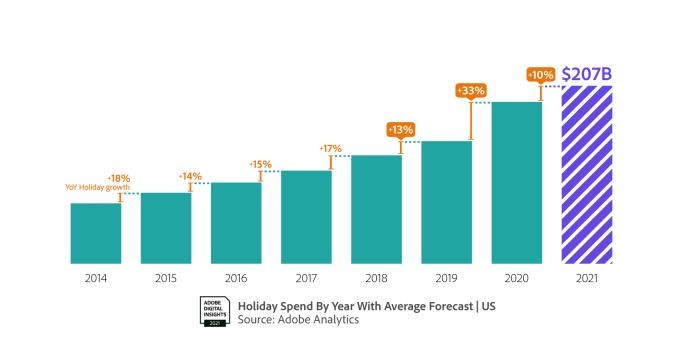

Despite the disruption, this Black Friday 2021 still looks promising for retailers. Online sales continue to increase, following a broader trend in retail but also as a reaction to the pandemic. Holiday spending this year is forecasted to increase by 10% compared to last year, while e-commerce is up 45% compared to 2019. Retailers can easily capitalise on this drive towards spending by pre-empting demand and turning to new performance solutions for Black Friday.

No matter which retail solutions leaders want to prioritise this year, they will undoubtedly be informed by digital transformation – 53% of retail organisations are choosing to invest in new technology to combat ongoing and future disruption. Whether that’s inventory software like RFID or improving their omnichannel customer experience using other forms of retail technology, there are a wide range of digital performance solutions for Black Friday for retailers to take advantage of.

The Current Issues Affecting the Retail Environment

The retail industry is going through a period of sustained volatility, with much of this uncertainty being driven by the on-going supply chain crisis and the recovery from the pandemic. Earlier this year, we looked into the supply chain crisis in detail, examining how the crisis got to this stage.

Unpredictable consumer demands mean that the supply chain crisis has been building for a long time. However, incidents like the pandemic, the blockage of the Suez Canal by the Ever Given container ship, and labour shortages all exacerbated the problem. Just the Suez Canal blockage alone caused an estimated loss of $9.6 billion worth of goods each day.

But how can businesses adapt to the crisis? The biggest change retailers can make is to embrace digital solutions such as AI-driven forecasting and cloud software. But as 87% of retail executives now agree that disruption is a primary challenge confronting both business and society, it’s clear that there is more uncertainty in the future retail landscape. Though we’re seeing the first signs of recovery from the pandemic among retailers, there’s still a lot of change to come.

Whether that’s the increased use of AI in customer service, the rise in e-commerce, new forms of payment including virtual currency, or tackling large competitors like Amazon, the industry is changing rapidly. Now, retail solutions don’t just need to respond to crises as they happen but also anticipate periods of uncertainty and volatility. As a consequence, retail performance solutions for Black Friday should offer short-term growth and long-term investment in technology to future-proof retail operations.

How Consumers Are Changing and What This Means for Retailers

As businesses consider retail solutions to survive this long period of volatility, it’s worth noting that consumers are also changing. With issues like sustainability and omnichannel retailing becoming new priorities for consumers, businesses can no longer rely on outdated performance solutions for Black Friday. Instead, digital retail solutions like RFID allow retailers to anticipate consumer demand and successfully respond to new trends.

The largest chain in consumer habits has come with the rise of Generation Z consumers. These shoppers have increasing disposable income yet are more concerned than older generations with where they spend it – 70% of Gen Z consumers say they monitor their spending more carefully as a result of the pandemic. As such, any proposed performance solutions for Black Friday need to consider their concerns and habits.

In addition to this, Gen Z consumers are more likely to take advantage of omnichannel retailing. More so than the average customer, they want to shop whenever and however they like. They are 56% more likely to shop in-store for goods, but at the same, also 38% more likely to shop online than other generations. Consequently, performance solutions for Black Friday need to consider how to provide an omnichannel experience. In some cases, business leaders should also consider adding additional services like shipping products from a select store or returning to any store the customer chooses.

The importance of omnichannel retailing cannot be underestimated. One survey from Harvard Business Review found that though just 7% of customers shopped exclusively online, 73% actively moved across multiple channels, favouring both in-store and online experiences. The omnichannel customers liked to use multiple touchpoints with brands and were also keen users of in-store digital tools like price checkers and interactive catalogues.

In short, the new generation of consumers can flexibly move from in-store purchases to shopping online. However, despite this move towards online purchases, they still predominantly shop in-store – over half of digital-savvy consumers still choose to shop in-store, with 49% of consumers valuing being able to visit showrooms and then purchase those products online. This means that you need to prioritise store solutions as much as online and omnichannel retailing.

Generation Z consumers are also more likely to be concerned with the environmental impact of their purchases. With COP26 – the UN’s Climate Change Conference – having just ended, fashion retailers are just one of the industries committing to store solutions that prioritise sustainability. Thanks to the pandemic and the global spotlight on climate change, six out of ten Gen Z consumers are more conscious about the items that they buy.

Last year, we examined the recommerce and rental trend among retailers, predicting that it would be one of the biggest retail trends of this year. While consumers are driving demand for a circular economy, bringing a recommerce environment to stores brings its own unique challenges. The most complicated of these challenges is how to track a large amount of unique inventory through the supply chain and into stores. One solution to this is RFID tagging, which when combined with the use of inventory software can give retailers more accurate stock counts.

So, what does all this mean? Primarily, it shows that businesses should prepare performance solutions for Black Friday that prioritise the customers of the future – shoppers who want uncompromised accessibility to products wherever they are and new ways to purchase and return their products.

How to Navigate the Challenges of a Volatile Retail Environment

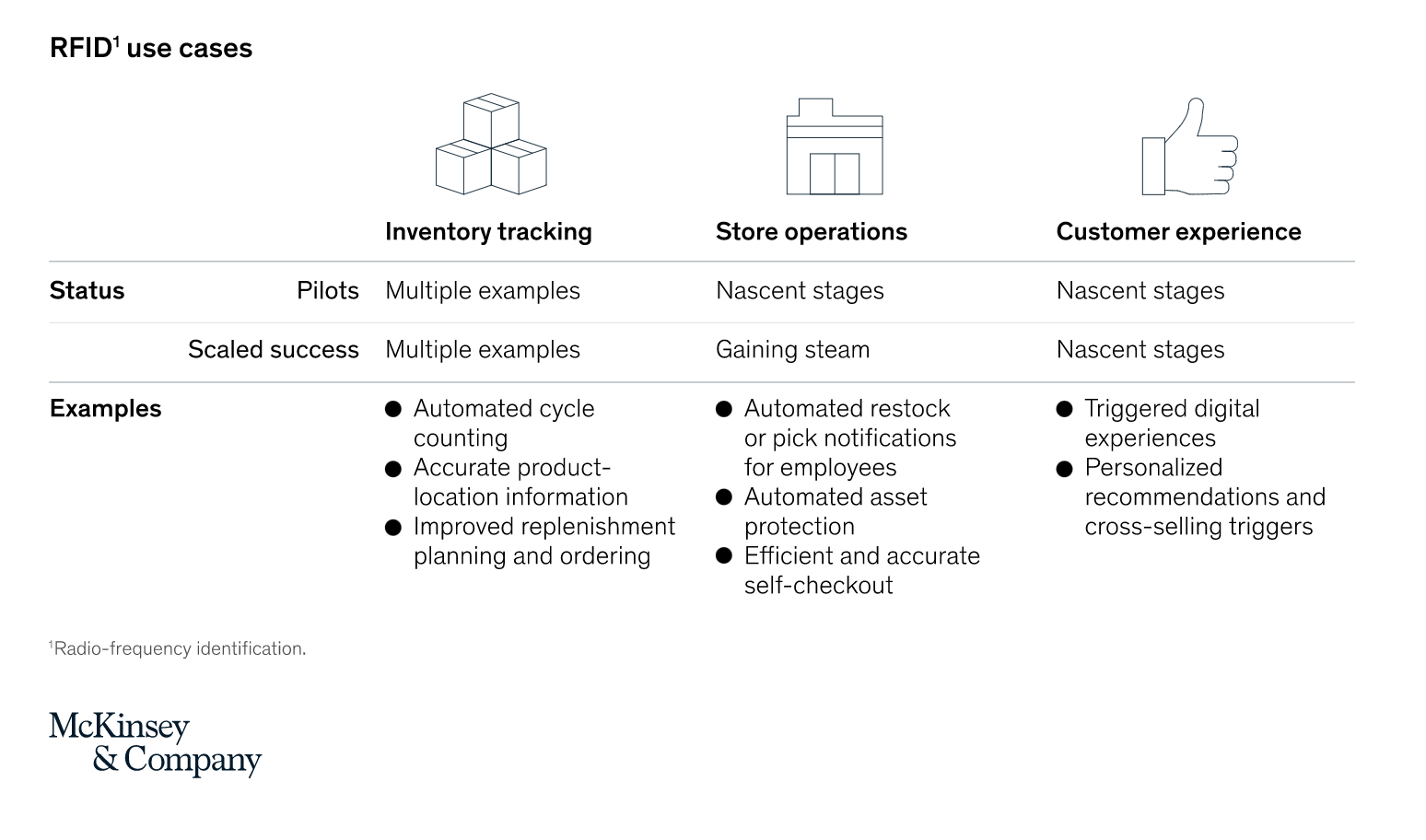

Most importantly, newly implemented performance solutions for Black Friday should tackle how to outperform this year, but also in years to come. Reliance on digital products like inventory software and AI will only increase in the retail space, and businesses that anticipate this will get ahead of the competition. For example, RFID is experiencing what McKinsey is calling a ‘renaissance’ in retail, with technology costs having fallen while new innovations mean even more cost-saving benefits for retailers.

With just a couple of weeks to go, some businesses may not be ready to implement new performance solutions for Black Friday. However, Christmas is also just around the corner, providing another chance to outperform before the end of the year. While January sales don’t reach the same peak as Black Friday – when businesses often make up to 20% of their sales revenue for the entire year – they are still valuable.

Technology and Analytics

Digital transformation is a crucial phrase for retailers when it comes to tackling periods of uncertainty. Still, performance solutions for Black Friday that focus on innovative technology can offer retailers the chance to outperform competitors.

Retailers that harness solutions like predictive customer analytics will know exactly what consumers are looking for and which products might be most in demand during Black Friday and Christmas shopping. Retailers who employ AI have seen a collective $40 billion worth of additional revenue over a three-year period.

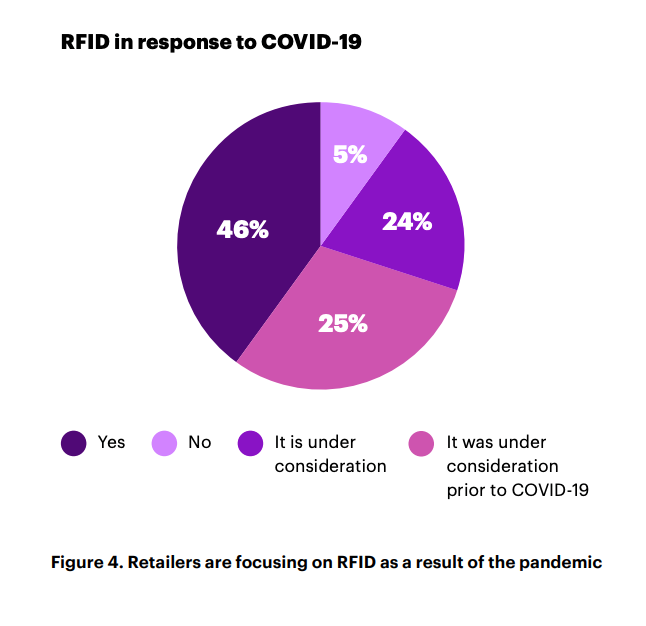

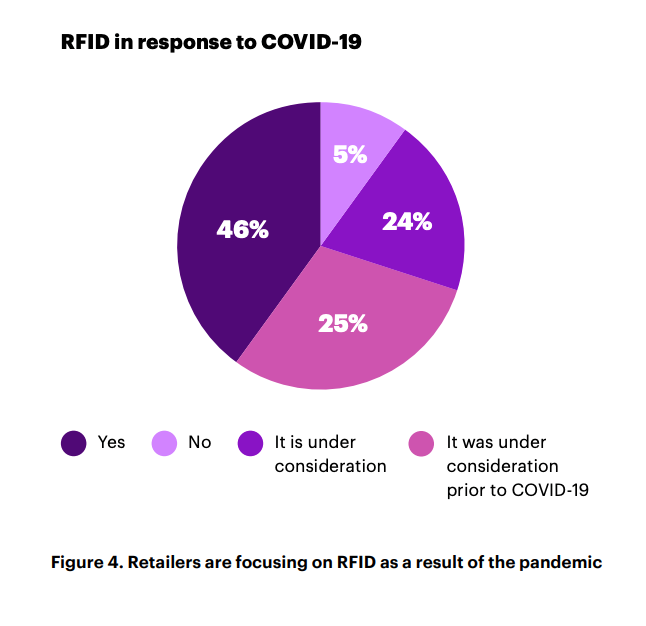

Inventory software is another innovation that will make busy shopping periods more seamless for retailers, with 46% of companies having already implemented RFID as a reaction to the pandemic. We know that use of RFID will only increase, making it a promising performance solution for Black Friday for retailers to consider.

Re-imagining the Brick-and-mortar Shop

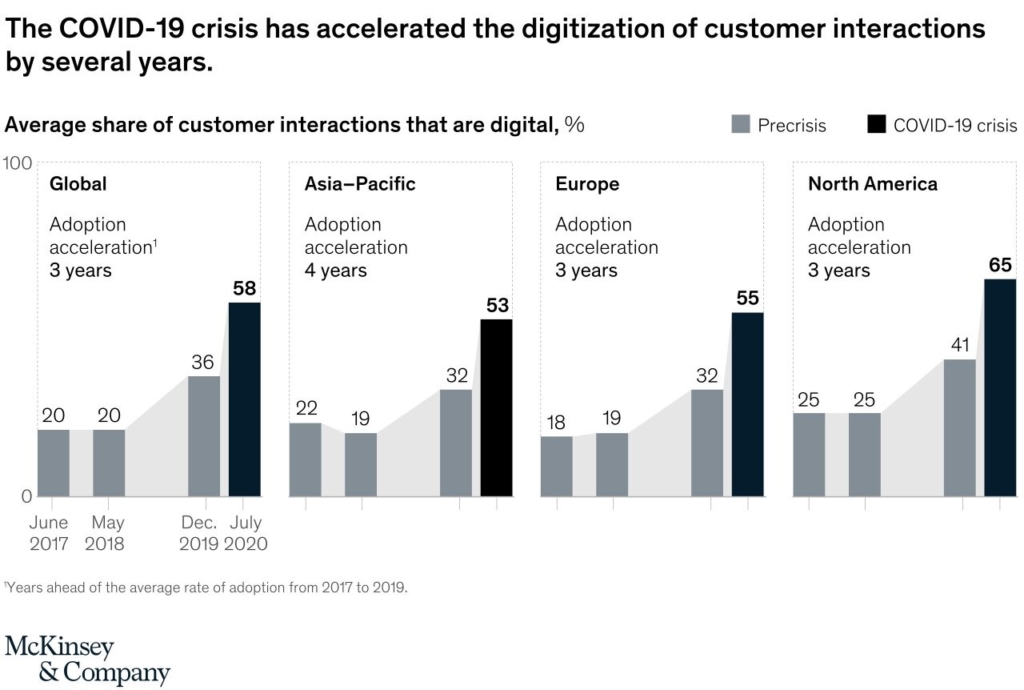

The pandemic has dramatically accelerated the pace of digital transformation in retail supply chains and stores. Over just a few months during the pandemic, executives have implemented close to three or four years of digital innovation in their companies.

Globally, 58% of business interactions with customers are now digital, an acceleration of three years compared with the average year-on-year increase. Consequently, businesses who want to implement successful performance solutions for Black Friday will inevitably turn to technology.

However, it’s also true that consumers may harbour anxiety around shopping in-store for some time. Though it’s unlikely that measures like one-way floor plans and plexiglass screens will stay in place for much longer, retailers will need to reimagine the in-store experience with the consequences of the pandemic in mind.

This might include incorporating aspects of digital experience in physical stores, such as intelligent AI personal shoppers on the customer’s phone or digital mirrors in changing rooms that can provide product recommendations in real-time. These store solutions will reimagine the pre-pandemic store, and take advantage of digital innovations that customers will be seeking in the future.

Omnichannel Retail

Perhaps the biggest retail solution has to be the shift towards omnichannel retailing. Stores can no longer solely exist in a physical or online space but a combination of the two. It turns out that omnichannel customers are also more valuable for businesses, spending on average 4% more on every shopping occasion in store and 10% more online than the average single-channel customer.

We know that consumers want omnichannel experiences, but implementing a performance solution for Black Friday that incorporates this may be more difficult. Inventory software like RFID tags is one solution, offering retailers a way to track stock across the supply chain, both in warehouses and online.

RFID as a Performance Solution for Black Friday

Especially at times of increased volatility and demand, more accurate stock inventory is one of the easiest ways to improve your company’s performance. This is even more important right now when supply chain issues make it more difficult to get an accurate picture of your inventory. Inventory software is the ideal performance solution for Black Friday, offering retailers an accurate picture of stock and the ability to navigate periods of increased demand successfully.

Preventing Out-of-stock Notices

Research from RetailEXPO has revealed that 31% of customers want retail employees to help them with out-of-stocks. This is crucial during Black Friday when demand will be higher, and customers may be looking for specific items in sales. Retailers who have adopted inventory software like RFID will be more likely to uncover new stock, having insights into where the same shipments and products are in their supply chain journey.

Omnichannel Retailing

While there will be an increased number of shoppers heading to physical stores this year, many Black Friday shoppers will still resort to online purchases. RFID easily allows retailers to keep track of stock across online and in-store sales and offer customers the chance to pick up their purchases in-store. As reliance on a mix of channels grows, inventory software is crucial to accurately track stock, increasing performance during times of increased demand like Black Friday.

Detego’s all-in-one retail solution gives you the tools to command complete transparency over your supply chain and inventory. We harness the power of RFID alongside an end-to-end SaaS inventory software platform that improves inventory accuracy.

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Book a demo with RFID to find out how our cloud-hosted RFID solution could help you outperform during busy sales periods. Our multi-user app can provide intelligent stock takes and a smart in-store replenishment process and later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

Detego and Microsoft partnered on this retail success story.

How an iconic British fashion brand and retail store chain successfully increased the availability of items in-store while improving the customer experience.

“It was also around gaining visibility for our omnichannel journey. If you look at those as different challenges, RFID provided a solution that enabled us to use technology to enhance all that.”

Complete the form below to download the case study.

This year’s Christmas period will be unlike the ones before. With retailers just recovering from or still grappling with supply chain issues and facing potential staff shortages caused by Coronavirus and other extenuating circumstances, it’s going to be more difficult to hit yearly KPIs.

However, the retail forecast for the final quarter of the year still looks promising. Deloitte predicts that holiday sales will grow by 7% to 9% compared with the same period last year, and retailers should focus on taking advantage of consumer demand this Christmas. While retailers can expect high demand for products this year, there are additional ways you can improve store performance.

Not only do physical retailers have to compete with online purchases in the run-up to Christmas, but there is also increased pressure to make up for any lost performance from earlier this year due to the dual crises of the pandemic and supply chain problems.

There are many retail solutions for improving store performance, ranging from implementing omnichannel marketing to improving customer service. Most store solutions come down to accurate inventory counts. Knowing the stock you have, where shipments are, and what products you can offer the consumer will inevitably improve the customer experience and your overall store performance this Christmas. For this reason, you should consider retail solutions like inventory software as part of a strategy to improve performance.

Our suggestions for store solutions are just a start. To successfully improve store performance this Christmas, retailers should take a 360-degree view of their operations, from their supply chain to stock replenishment and customer expectations of their store. Inventory software like RFID tags will go a long way to tackling some of these issues.

While a switch to digital inventory solutions will take time and training to implement successfully, it’s a long-term solution that will protect retailers against future supply chain issues and ensure optimal customer satisfaction in your stores.

A difficult Time for Retailers

If your store is struggling to reach its KPIs this year, you’re not alone. Supply chain issues – partly caused by the Coronavirus crisis – have made it more difficult for stores to get the stock they need this year, leading to reduced sales and performance.

These issues exist all the way through the supply chain and are not limited to one geographical region or country. Around 38% of ocean freight was delivered on time this year, half of last year’s total. Consequently, prices for raw materials and delivery are rising, on top of increased demand from retailers for their stock.

Stores experiencing a drop in their stock availability are already witnessing the effects on their total profits this year. Maternity wear retailer Seraphine reported lower stock holdings from July onwards, which meant they couldn’t satisfy customer demand in-store. Consequently, the retailer now predicts a 15% reduction in profits compared to last year.

As demand for products increases in the run-up to Christmas, many retailers are consequently over-ordering or placing retail orders too early to get their stock inventory back to normal levels. But this is far from an ideal retail solution and creates issues further up the supply chain for raw materials manufacturers.

Stores that can anticipate stock issues and respond to them quickly will have a better chance of weathering the supply chain crisis and improving their performance – which is more important than ever as the retail sector prepares for increased demand over Christmas. To do this, retailers should take advantage of inventory software.

The importance of inventory accuracy

There are many ways to improve store performance, from focusing on the overall customer experience to automation and omnichannel marketing. Most of these store solutions have in common, though, is the problem of accurate stock inventory. If retailers are going to recover from the ongoing supply chain crisis successfully, then a 360-degree view of operations and stock levels is crucial – and inventory software can help you do this.

Tracking and cataloguing store inventory isn’t limited to the shop floor. Retailers must have a broad view of their inventory from the end of the manufacturing process to when a shipment arrives at the store warehouse. Tracking such a large amount of stock – for some retailers, this can mean processing 70,000 items in just a few months – requires its own digital solutions, which can take time to implement. However, the impact of such inventory software is significant.

Missing stock on the shop floor is a massive problem for physical retailers, especially in the wake of supply chain issues. The digital age has transformed customer expectations, meaning that physical stores must compete with online retailers. Now, if customers are disappointed by product availability in-store, their solution is to order the same product online.

To put this into perspective, 75% of millennial shoppers leave a store without a purchase instead, buying that item online. The main reason for this? It’s encountering out-of-stock items in the store.

Accurate stock inventory is also key to providing a successful omnichannel customer experience. Especially in the busy Christmas period, customers will be looking for flexibility in the shopping process, including options to collect their products in-store, order online for in-store pick-up, and even in-store ordering to their home. This omnichannel approach to the shopping process inevitably increases the chance of a successful sale and makes the entire experience effortless for the customer.

In all of these cases, inventory software is the tool that will enable retailers to have a broad view of their entire stock inventory, from warehouse to shop floor. Technology like RFID can transform your strategy to retailing by making it easier to perform stock counts, track products across the shop floor, and make informed decisions about your retail strategy

Why RFID is thriving

Radio-frequency identification (RFID) has fast-evolved from a technology used at the fringes of retail, to a global technology that is delivering business results to retailers everywhere.

According to a recent study published by Accenture:

- The majority of retailers (80%) said the benefits of RFID cannot be replicated by another technology.

When fitted to a product at the manufacturing stage, an RFID tag will send continuous data to a reader as long as it is in range. This tag removes the need for laborious stock taking with a barcode scanner, as the reader will scan everything in range and catalogue it – even if the product is in a boxed shipment.

Used alongside inventory software, RFID can produce accurate stock counts, track stock from the factory to the warehouse, and work alongside other technology in-store to create a personalised experience for customers.

With accurate stock counts becoming more important as the busy Christmas period arrives, inventory software like RFID is a valuable store solution that can easily improve your store’s performance.

How Inventory Software Can Improve Store Performance

With a digital inventory solution like RFID, retailers can solve the problem of inaccurate stock counts, which become even more important during times of increased consumer demand. It can also improve the omnichannel customer experience by giving consumers more transparency about where products are and how they can purchase them – all of which will improve your store performance in the long run.

Keeping Shelves Fully-stocked

We know that one of the biggest problems for retailers is keeping shelves fully stocked and the consequences of out-of-stock products. While you can expect some stock disruption with supply chain problems, RFID can alleviate some customer pain by ensuring shop floors are as full as they can be under the circumstances.

This digital store solution will allow you to take frequent inventory counts – up to twice a day, compared to the average of once or twice a year. When used with inventory software, you can also get on-time recommendations for which products to refresh on the shop floor, ensuring that no customer ever leaves disappointed.

This digital store solution will allow you to take frequent inventory counts – up to twice a day, compared to the average of once or twice a year. When used with inventory software, you can also get on-time recommendations for which products to refresh on the shop floor, ensuring that no customer ever leaves disappointed.

Improving the In-store Customer Experience

Nowadays, customers want more from their physical stores. Whether that’s more personalised recommendations from staff, virtual shop assistants, or interactivity in-store, RFID can help you do this.

RFID tags can work with other innovative technology like smart fitting room mirrors to offer personalised product recommendations for customers while shopping in your store. When a customer takes a product fitted with an RFID tag to a fitting room, the product’s unique code is read, and the product is displayed on the smart mirror, alongside similar products that the customer may like to try. There may also be the option to request products while in the fitting room, making the shopping experience more seamless for the consumer.

Producing Accurate Data

For retailers to successfully navigate the increased demands of the Christmas period and ultimately improve performance, accurate data is crucial. RFID is a digital tool that provides real-time data about stock levels and makes suggestions about managing inventory better.

Instead of relying on historical data for your in-store stock decisions, RFID gives you the tools to make informed decisions about your store. From stock availability to automated refills and data on dwell times, this inventory software will improve performance in your store through more accurate insights.

Offering Omnichannel Retailing

It’s no longer a battle between brick-and-mortar stores versus online, but most retailers are a hybrid of both. This means that your stock inventory needs to be more precise and accurate, reflecting both your in-store availability as well as online, so customers can get exactly what they want whether they’re in-store or at home. The key to omnichannel retailing is ensuring there are enough options for your customers – whether they want to pick their product up in-store, order it to their home, or return it to a different store, there should be a retail solution for that. For this to work, retailers need an accurate view of their stock counts and where stock is at all times. By utilising RFID with all-in-one inventory software, you can achieve up to 99% stock accuracy, meaning the customer is never disappointed by out-of-stock notices or unavailable shipping.

Why You Should Invest in Inventory Software now

Retailers gear up for increased consumer demand, inventory software and RFID can be a valuable retail solution in the run-up to Christmas by eliminating labour-intensive stock counts and improving stock visibility from warehouse to shop floor.

Retailers are increasingly investing in inventory software like RFID to streamline their supply chains. In the US, investment in retail technology has reached $8.6 billion, reflecting its value as a store performance solution. It’s a similar story in the UK, where technology like inventory software could uplift £21 billion to the retail sector.

Not only will more accurate inventory information make your operations more effortless and reduce labour requirements, but it will inevitably improve store performance. You can use a store solution like RFID to strengthen omnichannel retailing and provide increased personalisation in-store, leading to more opportunities for sales. Ultimately, RFID is an ideal retail solution for periods of increased demand, such as the run-up to Christmas.

Detego is the only all-in-one retail solution on the market, utilising RFID alongside a complete end-to-end SaaS platform to improve your inventory accuracy. From stocktaking and stock replenishment to tagging, our inventory software can handle it all, reducing the chances of human error and increasing opportunities for sales in your stores

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Detego Store is a cloud-hosted RFID solution which digitises stock management processes, making them more efficient and more accurate. Implemented within hours, our multi-user app can provide intelligent stock takes and a smart in-store replenishment process. Later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

Managing inventory levels is more vital now than ever before.

At the same time that out-of-season stagnant stock sits untouched in warehouses, desirable inventory is increasingly becoming short in supply on shopfloors. In fact, when slow-moving stock can still make up to 40% of a retailers inventory, it seems strange that the current shortage of goods is reportedly here to stay. But taking this juxtaposition into account, it’s not hard to predict that many more retailers will be feeling the strain of simultaneously being overstocked and out-of-stocked as the holiday season approaches.

At a time when struggling businesses could stand to increase revenue drastically, they will have to be more strategically minded, optimising the distribution of limited inventory and harnessing emerging opportunities to turn obsolete stock into profit. In order to do this, however, retailers will need to actively seek to improve their loss prevention processes as every item of stock – even obsolete inventory – becomes increasingly more vital to lifting the bottom line.

The Impact of Inventory Loss in the Post-Pandemic Environment

Due to the heightening imbalance of desirable and undesirable stock, it is no exaggeration to say that within the grand scheme of a retailer’s operation, even a single piece of inventory can drastically impact a business’s opportunity to make money or lose it.

For instance, with the circular economy booming, the slow-moving stock is increasingly being repurposed to recuperate costs, while inaccurate real-time product availability of popular goods could negatively hinder a retailer’s ability to build omnichannel relationships with customers.

That is why shrinkage – when a business loses inventory for reasons other than sales – is a driving issue for retailers and one that looks to exasperate the inventory challenges already at play.

Last year, shrinkage cost the US retail market $61.7 billion, and as supply chain disruptions continue, retailers will increasingly need to tighten their control over assets at an item-level scope, especially now that their distribution strategies are influenced by localised demand for particular product categories, styles, and sizes as customers continue to expect personalised and immediate services.

But to facilitate this level of customer service, improvements to inventory management must be made that prioritises precise inventory tracking and agile loss prevention.

Causes of Shrinkage are Becoming Increasingly Complex

To improve their loss prevention strategies, retailers must get to the root of the current shrinkage causes that are growing more wicked in nature due to inventory touch-points multiplying at speed. Here we explore the most coming reasons for stock loss in retail and why they are challenging businesses today:

- Returns Fraud

Social media has contentiously given rise to the trend that it’s “unfashionable” to be photographed in the same outfit twice, leading to a growing community of serial returners who consistently purchase fashion products, wear them once or twice and then return them. And as social commerce grows –generating more and more omnichannel touchpoints – so do the opportunities for fraudulent returns within this growing trend. Last year, scams involving the returns of products already cost retailers $43 billion, and in this year’s National Retail Security Survey 2021, retail companies reported that multichannel sales had created the most significant increase in fraud this year.

As customers continue to purchase online and then pick up orders in-store and vice-versa, the challenge for retailers is that they must cater to the growing demographic of digitally literate consumers who now move between online and physical touchpoints whilst implementing inventory traceability. Because if not adequately managed, omnichannel can open up opportunities for stock loss, with fraudsters taking advantage of any discontinuity between online and offline returns processes.

2. Shoplifting

Even with mandated closures for much of the year, 2020 saw UK retailers lose over £770 million from shoplifting alone. So now, with physical stores firmly back open, shoplifting has re-emerged as a critical challenge of retailers who are hoping to turn these spaces from loss-leaders to optimal environments for customer engagement.

Criminal activity in stores, however, not only poses a threat to the bottom lines of these operations but can also negatively impact the experiences of customers and employees. Especially now that many companies have begun to take a stronger social stance towards the wellness of their workforces. Retailers must from now on empower employees to handle shoplifting efficiently, confidently, and safely.

3. Employee Theft

Global employee theft is predicted to cost retailers 2.9 trillion annually and accounts for 28% of inventory loss, with physical goods most likely to be stolen from the workplace. Viewed as an epidemic within the retail ecosystem, there are many diverse existing approaches to loss prevention, from behavioural focused strategies such as staff recruitment and training processes to physical deterrents such as CCTV and POS data mining.

Product visibility is non-negotiable for retailers embracing omnichannel

The challenge for retailers who are tackling employee theft, however, is in how to build a connected and holistic solution that improves workforce attitudes and culture towards stealing, reduces opportunities for theft and at the same time incentivises them to become active players in inventory protection.

- Damages

It goes without saying that damages to inventory are inevitable. As goods that are often journeying to far-reaching locations, wear and tear in transit is to be expected and – although not ideal – retailers commonly anticipate this reality and reflect it within their financial accounting. At a time, however, where in-demand stock is in short supply, damages to assets is being viewed as a growing nuisance that, whilst wholly unavoidable, should be dramatically reduced.

But it is the reporting of damaged goods that should be a significant concern for businesses. Again, as consumer sentiments move towards fast fulfilment, retailers will need to have precise real-time insight into stock availability, and its location, yet unaccounted for damaged items can sabotage a business’s ability to carry out effective customer services.

- Administrative and Supplier Error or Fraud

Error or fraud in the reporting of inventory levels is a severe problem that multiple stakeholders can enact at any given time. It is vital to a retailer’s bottom-line that delivery of goods from vendors is 100% correct at the time of receipt. Whether intentional or not, incorrect data from suppliers could have knock-on effects throughout the supply chain down to stocktake on a shop-floor and incorrect e-commerce order fulfilment.

At the same time, what could seem like minor mistakes such as pricing or labelling errors can snowball into significantly lost profit, lapses in customer satisfaction, and employee frustration. And in fact, administrative and paperwork errors can account for 18.8% of annual shrinkage. In order to mitigate these errors, retailers must begin to explore how inventory data can be communicated correctly and consistently throughout these various internal touchpoints

Why Current Methods of Loss Prevention can Lack Long-Lasting Results

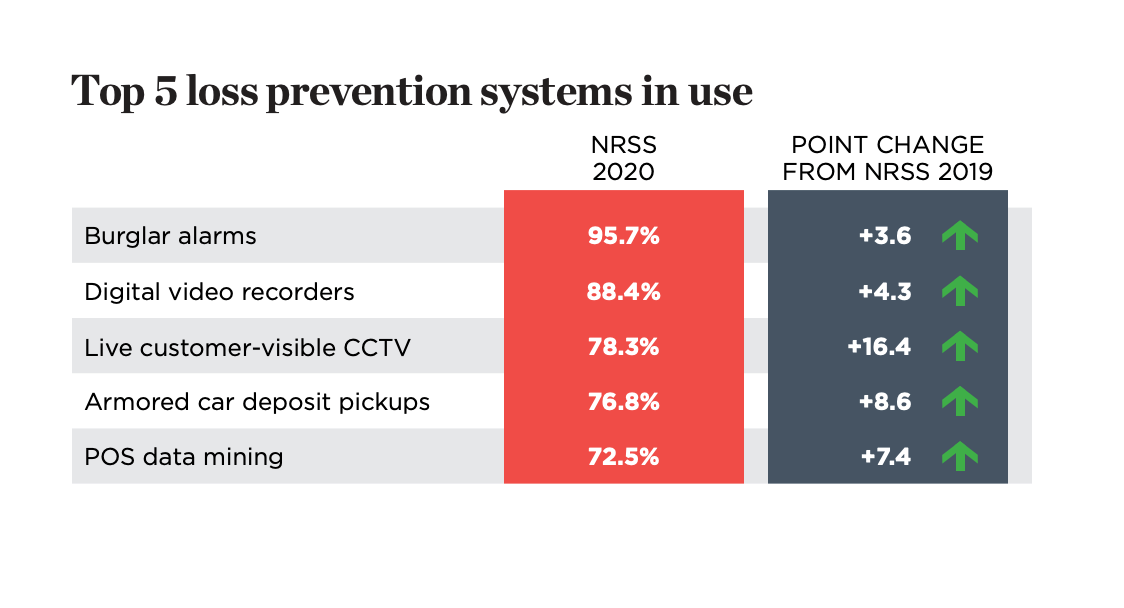

Loss prevention has to date, been an issue of high importance for the retail sector. Still, the recent acceleration of technology adoption has provided a window into the efficiency that digital-driven supply chain management presents. While current loss prevention methods are year-on-year, reducing the cost of lost goods, these solutions can often lack depth and breadth as they operate in silos from one another.

Additionally, many of these existing strategies, such as alarms and armoured cars – while effective – predominantly focus on mitigating the loss of large quantities of stock rather than at the item-level that is becoming increasingly important. At the same time, they often do not account for reducing back-end administrative fraud and errors such as incorrect delivery dockets.

It is, therefore, critical that continuity of information is built into future loss prevention strategies so that goods are traced throughout the entire supply chain, and long-term improvements can be implemented.

How RFID Can Prevent Shrinkage in One Simple Solution

Smart-Shelving

RFID’s ability to help retailers monitor how customers interact with their products to improve personalisation and recommendation in stores can subsequently work in favour of loss prevention. For example, RFID enabled smart shelving sends a trigger to employees whenever stock is low and can help report real-time anomalies of inventory movement and location tracking.

The technology’s ability to send stock quantities and location information to multiple stakeholders in stores, head-office and warehouses could act as a significant dissuade employees hoping to isolate incidents of theft. Additionally, the simple existence of an item-level RFID tag can act as an effective deterrent to shoplifters.

Returns Processing

Due to RFID being able to trace inventory throughout the entire supply chain, this software can act as a journal for any product, providing evidence of where it has been before being returned into a retailer’s ecosystem. In turn, this can allow businesses to identify where returns fraud is happening and assess where the weaknesses are in their returns process.

Data collected can also provide insight into the kinds of products experiencing serial returns and investigate if this is down to poor quality, fit, or even if the item is highly “Instagramable” rather than wearable. These are all essential datasets that can be fed back to designers, marketers and manufacturers who can, in turn, look to reduce the reason for returns within their roles.

Automated Real-Time Updates

The automated updates that RFID provides allow companies to manage inventory with more connectivity within their operations. Unfortunately, inconsistent communication between the complex and isolated processes within retail operations has for a long time provided the opportunity for administrative, human errors and fraud.

RFID simplifies communication and allows warehouses, distribution centres, and stores to correlate physical stock against digital information at the item level. Additionally, RFID removes chances for vendors and employees to tamper with data and falsify information.

RFID Can Makes Data-Driven Loss Prevention a Reality

Not only can RFID act as a deterrent, but it can also help businesses to build resilient future strategies that reduce the causes of inventory loss at the source.

As an offshoot of the all-important supply chain transparency we discussed last month and item-level visibility the retail sector still struggles to enforce, RFID’s ability to deliver data-driven insights and pinpoint precisely where inventory loss occurs is highly valuable for highlighting areas for improvement within the supply chain and possibly uncovering reasons for the unattributed loss.

Book a demo with Detego today to see how our inventory transparency software can help you tackle loss prevention challenges.

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Detego Store is a cloud-hosted RFID solution which digitises stock management processes, making them more efficient and more accurate. Implemented within hours, our multi-user app can provide intelligent stock takes and a smart in-store replenishment process. Later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

The post-pandemic era — that we continue to move closer to — is defined by uncertainty. And every day, experts, futurists, and commentators from the corners of every industry desperately question how the pandemic will have shaped their sectors’ short and long-term futures.

Retail, however, has arguably just begun to settle into its place within the unpredictable global landscape. Upping their investments into heightened digitisation and improved customer experiences, they are starting to prioritise strategies that can offer them adaptability, agility and resilience to the unforeseen situations that will surely continue to come their way.

These strategic rising investments come at a time when elusive loyalty is becoming harder to capture, with 73% of consumers who have shopped with different retailers during the pandemic intending to incorporate new brands into their routine. Whilst — needless to say — technology continues to revolutionise how entire supply chains operate.

However, the consumer-facing employees tasked with harnessing retail technologies to strengthen their own workflows are inconspicuously deliberating the success of these investment categories. And as a result, they are able to provide customers with the immediate, personalised, and memorable omnichannel experiences they progressively desire when they shop.

Because the experiences of customers and employees are undeniably interconnected, in fact, businesses with happy employees attain 81% higher external customer satisfaction. And many more studies elaborate that when workers are engaged, committed, and fulfilled in their everyday roles, it improves their ability to deliver valuable services to customers.

So to retailers currently refining their post-pandemic survival strategies, we suggest exploring the impact that employee experiences can have on growing customer gratification.

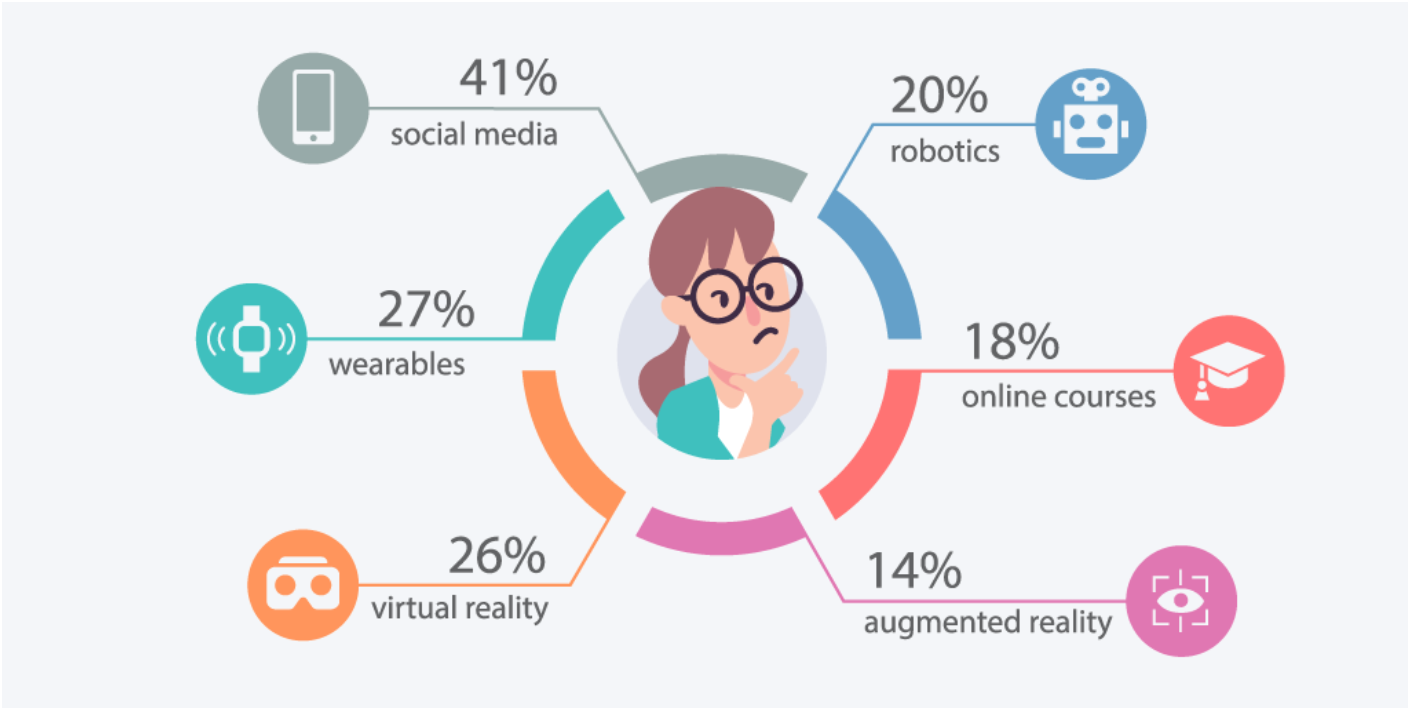

Employee Experiences are Vital as Retailers Up Investment in Technology and Customer Services

Since the pandemic began, these impactful employee experiences have increasingly relied on technologies. Particularly ones that enable individual workers to connect to their everyday professional lives remotely. From social media, robotics, learning and development, wearables through to virtual and augmented reality, these applications are targeted digital solutions that can optimise the everyday activities of diverse workforces.

And as the retail sector’s recovery from the damages of Covid-19 slows, it is unsurprising to see that in order to stimulate its revival, investment into retail technology that simultaneously enhances customer and employee experience has reached an all-time high, and 79% of high street retailers plan to implement more technology solutions this year.

Retailers are rationalising their investment into digital transformation as a surefire method of capturing emerging post-pandemic consumers by extracting value from current employee willingness to harness innovative technologies and imbed them into their own everyday roles.

Now, four months on from the reopening of physical stores, this is particularly relevant for retail’s frontline workforces — such as shop-floor assistants, stock allocators, and delivery drivers — whose adoption of employee-first technology solutions will subsequently drive effective customer-centric services as brick and mortar stores attempt to reclaim their market share.

Designing Positive Post-Pandemic Customer Services

Moving forward, customer adoption and retention are becoming critical to the continued survival of any consumer goods organisation. Yet, retail’s intensifying focus on customer-centricity is due to increasingly demanding shoppers whose mindsets and behaviours have been moulded by the pandemic.

Considering the characteristics of post-pandemic customers — in an article last month — Detego defined these emerging consumer’s as elusive with their allegiances and fluid with their engagement. For example, digitally-savvy shoppers are becoming more adept at bringing competition with them into stores, using their smartphones to concurrently browse rival offerings online and offline.

Post-pandemic behaviour such as this makes it increasingly complex for retailers to control customer journeys and ensure they are providing competitive services at every possible online and offline touchpoint.

So, with physical retailers facing such an immense task in reacquainting themselves with customers returning to their stores, it may seem counter-intuitive to suggest that retail technology investments should focus on improving the activities of employees first and customers second.

But in reality, workforces are the greatest asset a retailer has in generating customer loyalty from positive engagement. And they mustn’t risk underestimating the importance of their employees who — to customers — bring brands to life by personifying their voice and embodying their personality.

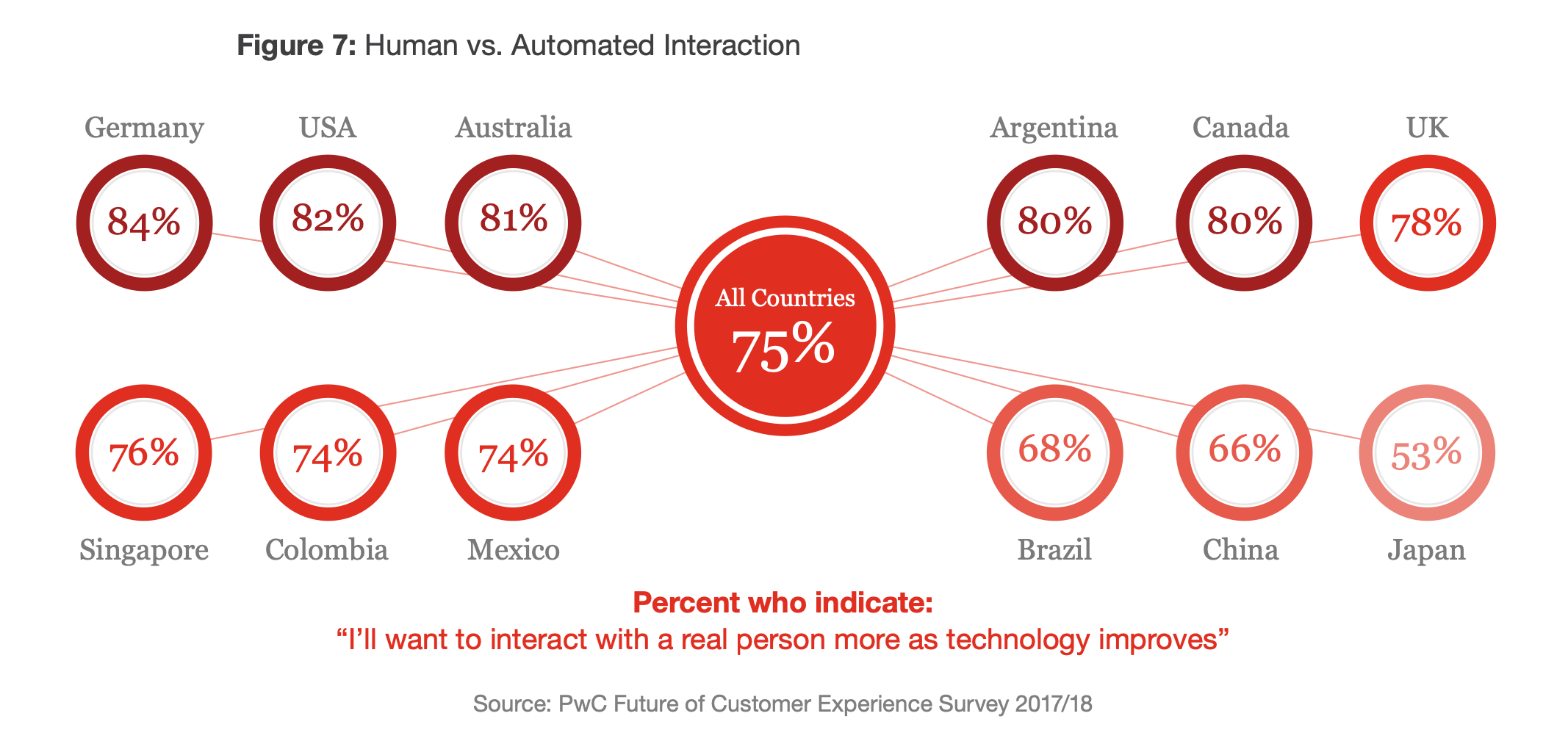

Recent research by PWC found that 46% of all consumers will abandon a brand if employees are not knowledgeable. And at the same time, 71% of consumers claim that employees significantly impact their overall customer experience. With employees having an impact this sizeable on consumers, these statistics reinforce the outpouring of retail experts and researchers who assert that “happy employees create happy customers” and emphasises the need for retailers to refocus their technology investments into solutions that advance employee contentment.

The Current Retail Employee Experience is Far from Perfect

However, improving the employee experience is not an easy task.

Last month’s ‘Pingdemic’, which forced thousands of high street workers to isolate and understaffed retailers to subsequently shut their doors, stressed how crucial retail workers are to organisations. So much in fact that retailers are already strategising on how to mitigate the risk of employee shortages both in the short and longer future.

Without intervention, the global retail sector will continue to struggle with these workforce issues. And recent research across the UK and US exposes that millions of workers intend to leave their jobs post-pandemic — with retail employees quitting their jobs at record rates — as the reality of professional dissatisfaction continues to confront employees as they emerge from their homes and back into their places of work.

As a result, these emerging workforce trends pose a critical threat to the retail sector. The increasing pressure to deliver exceptional customer services with understaffed stores and low employee morale could create a vicious cycle of discontent between employees and customers.

The Features of Effective Employee Experience Technology

Both existing and emerging retail technology’s must, for these reasons, help employees to attain three objectives in their everyday tasks to boost emotional satisfaction, job retention, and digital engagement:

1 Productivity

Solutions that generate productivity help workers reduce time spent on individual activities — allowing employees to achieve more objectives throughout their days and enabling retailers to optimise their operational costs. For example, RFID software Detego helps store, head-office and distribution staff remove the manual processes of stock checks and collate data insights to inform merchandising decisions swiftly.

2 Efficiency

Providing employees access to various solutions allows them to exert agency in their own working styles, honing techniques that suit them and reflexively selecting applications within changing circumstances and outputs. Take match-making platform Uber as an example, in offering several options to consumers such as courier, taxi, and food delivery services, its roster of drivers are enabled to be their own boss and use the app to control their schedules and self-determine their objectives.

3 Creativity

Allowing users to harness technologies to innovate within their daily roles, solve problems and uncover different applications for their work, technologies that enable creativity help workers to express themselves to both internal team members and external consumers. For example, as a wardrobe digitisation application, Own-Kind allows retail employed personal stylists to virtually style outfits for their customers, paring the products in their directory with existing pieces in a customer’s wardrobe.

Yet overall, what defines all three use cases’ ability to enable agility, creativity, and productivity are the user-friendly interfaces designed to satisfy customers on the front-end and enhance employee capabilities at the back-end.

While there are many examples of RFID’s application in industry, recent instances of retailers emboldening their use of the technology to strengthen their post-pandemic strategies are impressive. 46% of respondents to recent Accenture research indicating that they have focused on RFID in response to COVID-19. And although the term inventory software may seem like a dull back-end technology, there are already many new use cases emerging and harnessed by retailers in innovative ways to modernise their offerings.

Investment in Consumer-Focused Retail Technology is Already Impacting Employee Experiences

It is essential not to forget the existing digital solutions within retail that — although consumer-focused — are already empowering the roles of retail employees through unintentional yet valuable emerging use cases in some of the most critical technology categories experiencing an uptick in investments.

E-commerce

Social shopping is one of the fastest-growing commerce trends, with live-stream shopping expected to reach $60 billion this year in China alone because, throughout lockdown, customers continued to crave human engagement within their shopping experiences.

By expanding e-commerce channels with social shopping, retail store staff have a chance to engage with their customers in virtual environments and the physical ones they typically inhabit. In addition, for retail employees who have been furloughed over the past year, this is an opportunity to future-proof their work and expand their roles through omnichannel strategies.

On-Demand

Consumer demand for instant messaging with in-store sales assistants, stylists, and personal shoppers has steadily risen for several years. But messaging software like WhatsApp revealed themselves to be tools for survival when the pandemic began and physical retailers — particularly those with a limited online presence — were at risk of losing carefully built relationships with customers.

Bicester Village is an insightful use case for the quick integration of virtual shopping. In uploading their catalogues to WhatsApp, store staff can now engage with remote consumers they otherwise wouldn’t have met and subsequently increase their sales and commissions.

Supply Chain Logistics

Same-day delivery and collection have revolutionised consumer expectations for fast and immediate fulfilment when shopping both online and in-store. The increase of retailers offering such fulfilment services means that businesses providing consumers inventory visibility allows them to decide where and how they receive their purchases.

By providing shoppers with inventory transparency, allocators and store staff are also able to view stock insights in real-time and transform their abilities to pinpoint, distribute and sell stock on micro and macro scales.

The Retailers Already Directly Investing in their Workforce’s Technology Adoption

At the same time, innovative retailers are investing in directly improving employee experiences using these digital advancements. And as employee-first solutions, they exemplify the reverberating impact that their adoption of technology can have on pivotal moments of the customer journey.

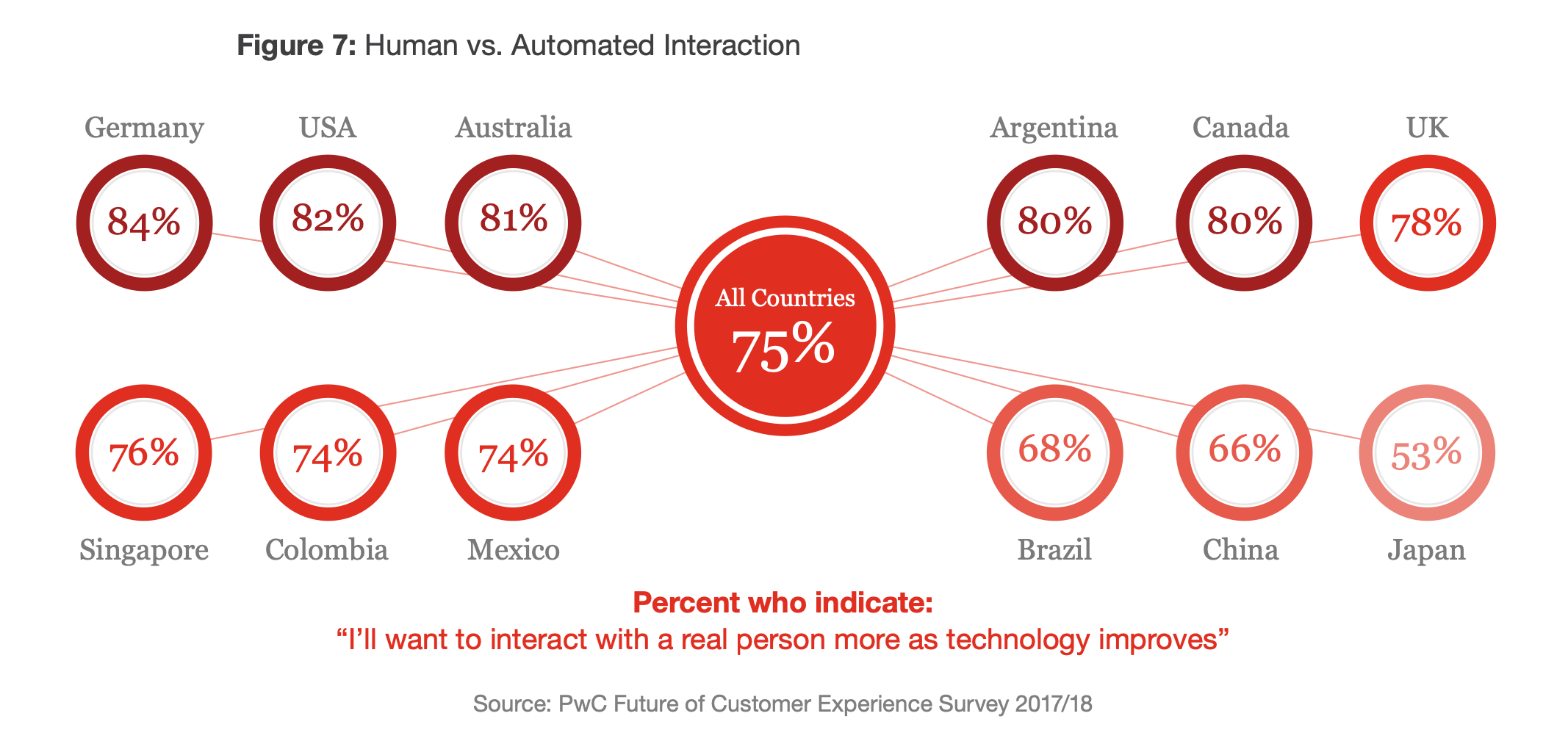

Apple and Efficient POS systems:- When 25% of consumers admit to missing human interactions when shopping online during the height of COVID-19, it is clear that rather than replacing staff, technology should be used to enhance their reach. In fact, research from 2018 already demonstrated that consumers were looking to engage with real people alongside technological advancements. Apple’s commitment to blending digitisation into its brick and mortar stores is exemplary, as employees wander the stores equip with the ability to access customer profiles and finalise sales.

Adidas and On-Demand Delivery:- With retailers continuing to take advantage of the omnichannel surge, many businesses realise they must upskill employees with the capabilities to execute these strategies online and offline. Sportswear brand Adidas for example, have recently trained their employees to use RFID software to optimise their understanding of stock levels and inform their instant knowledge of inventory availability, popularity, and locations through data display and insightful reports.

MATCHESFASHION and Personalisation:– To compete with the personalisation provided by their online counterparts, retailers have begun to explore how they can create attractive propositions and help store staff to blend consumer data into the intuition of their everyday roles. Luxury department store MATCHESFASHION, for example, has recently granted in-store employees access to online customer wishlists, helping them to empower their product recommendations with contextual customer information.

The Challenges of Implementing Employee-First Technology

Yet — as always with technology — challenges surrounding its adoption continue to cast doubt on future implementation. And, in the case of retail, many of the obstacles are from internal players. According to research by Fourth, for large retailers, cultural resistance, lack of technology management, upskilling staff and removing legacy systems are the most prominent points of friction when introducing new digital solutions.