As stores begin to open back up, what does the future hold for the brick-and-mortar store?

Post-Pandemic Stores: Is the Brick-and-Mortar Model Changing For Good?

In the last ten years, many have predicted the ‘death’ of the brick-and-mortar store. While it’s true in recent years competition from e-commerce, amongst other factors, has seen a decline in store numbers, the death of physical retail has been greatly exaggerated.

The global COVID-19 pandemic was another matter entirely. Stores already feeling the pinch were hit with plummeting footfall or forced to close entirely. Customers were driven even further online as the industry shifted to the new digital-first world.

In the UK alone, a net decline of 6,001 shops was recorded in the first half of 2020, compared with 3,509 in the same period of 2019, according to research from PwC.

As stores begin to open back up, particularly across Europe, what does the future hold for the brick-and-mortar store?

Coming Back From the Brink

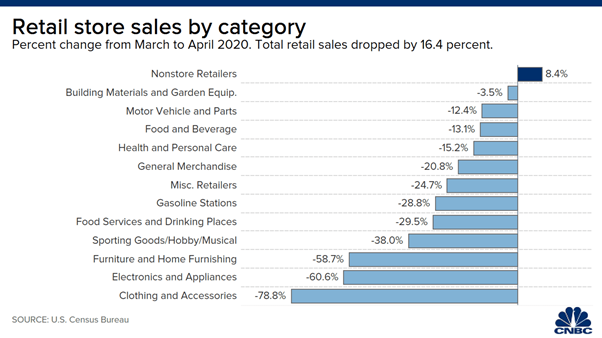

It hardly needs saying, and you can find a more detailed analysis on it here, but the pandemic hit the retail industry hard. The impact was not spread evenly, however, with the effect on sales varying wildly depending on sector and product categories. While sales of certain ‘discretionary’ categories such as fashion took a big hit, essential ones like grocery performed well, while lockdowns meant home-friendly categories like homeware and DIY were more resilient.

The other major variable was simply the shopping channel. The effect of the pandemic on e-commerce has been well documented, but in 2020 online became the main, often the only channel for many categories. In February 2021, online sales at non-essential retailers surged 82.2% compared with a rise of 3.6% during the same month the previous year, before the onset of Covid-19 in the UK.

Pure-play e-commerce retailers, therefore, were well-positioned. Multi-channel and omnichannel retailers were able to recoup some of their losses but not nearly enough to compensate for out-of-action stores. For the rarer pure-play brick-and-mortar retailer, however, the loss of revenue was severe – poplar British apparel retailer Primark’s profits plunged by 60%.

Stores Are Opening Their Doors to a More Digital World

But flashforward to now and with stores returning across Europe, what has changed? The majority of retailers are financially weaker due to the pandemic and are desperate to begin recouping and recovering their losses.

But that is not all, as the market has changed significantly in just a years’ time. Even beyond the lingering safety and distancing concerns that stores may have to contend with for some time, the uptake of online shopping and digital channels has accelerated greatly. While the inflated e-commerce levels of 2020 might be over, a proportion of this online penetration will stick. It’s a change that’s been coming for years, but the pandemic has accelerated this shift by up to 5 years according to data from IBM.

The balance of power between online and physical stores has changed, but not to the degree of 2020, where it flipped altogether. The Centre for Retail Research forecasts that online will account for 27.1% of retail sales in 2021, while this is lower than 29.8% in 2020, it is still a huge increase from 19.1% in 2019.

Some retailers and stores who were already struggling pre-pandemic will have cause for concern though as they are facing even more competition from online channels than before.

This competition does not mean the end of stores and in many sectors, the store will remain the primary channel, but this increased competition does mean stores have to do better. This includes both as a value proposition and on an operational level. Stores need to diversify and improve their offerings to attract returning customers, but just as importantly they need to diversify the role of the store and optimise their costs and margins to survive amongst higher levels of competition.

What do stores need to do?

Run Leaner Stores

Before trying to reimagine the store experience or create new store models, there is a big opportunity for many stores to optimise their costs simply by handling their inventory more effectively. You might be rolling your eyes, but we’ve seen time and time again that knowing exactly what is in your store can make be the difference between success and failure.

A fairly extreme example of this is when fashion brand Ted Baker overestimated their inventory value by £58m in a blunder that sent share prices tumbling. While this case is unique due to how extreme the error was, the problem itself is surprisingly common.

A store that has the typical 70% item-level (Not SKU) accuracy will be carrying up to 10-15% more working capital in the form of excess or ‘bloated’ inventory. Reducing this excess inventory at scale can have huge implications on bottom lines and will help brick-and-mortar stores stay profitable post-pandemic, this is without even mentioning the effect understocking can have on customers and sales.

Offer a Broader Range of Products

As stores look to position themselves better for the future – retailers should pay close attention to their product ranges in-store. This relates closely to two things we have just discussed – e-commerce competition and leaner inventories.

According to the Theo Paphitis Retail Group, 65% of online sales at one of their owned brands were for products not stock in their brick-and-mortar stores. While the convenience of e-commerce cannot always be matched (more on this in the next section) this discrepancy in product ranges is a big issue and one that can be solved. The issue is not even new – in a 2018 shopper survey, 67.3% of shoppers said they ‘Couldn’t find what they needed’ as the reason for leaving a store without a purchase.

Solving this issue is not a case of just stocking more products, it needs to go alongside our previous point in running more efficient inventories. This is so that stores can offer more products without increasing overall inventory sizes. On top of this, stores need to make it easier for customers to not only find the products to begin with, (e.g. by increasing product availability) but also by offering products beyond just what the store has in stock (like endless aisle or omnichannel orders) will also make the world of difference.

Utilise Stores as Digital Hubs

Since we’ve mentioned omnichannel – it is already proving to be one of the biggest factors for a store’s success, both during and well-beyond the pandemic. Many people have been banging the omnichannel drum for years and whilst some dismissed it as buzzword or a fad – since the pandemic omnichannel has become a must-have.

In the modern environment, stores cannot be islands. Customers have grown to expect brands to serve them across online and offline stores, in fact, customers don’t even think in terms of ‘channels’, and they shouldn’t have to. Things like click-and-collect and return-to-store have become increasingly popular due to the pandemic and customers aren’t going to just stop using them when it’s over. Click-and-Collect/BOPIS increased 70 percent by volume and 58 percent by value in 2020, according to ACI Worldwide data.

The other side of the omnichannel offering that is less customer-facing, but still of great significance is ship-from-store or in-store fulfilment. Whilst many retailers had already begun experimenting with in-store fulfilment due to its various business benefits, the pandemic forced many more to do so. Originally the reasons for this would be to utilise closed stores and deal with increased demand. Moving forward ship-from-store will remain relevant due to:

- The cost benefits of shipping items locally

- Being able to offer online customers more products

- Leveraging stores/store staff to serve online customers.

How Can RFID Help Stores Stay Competitive?

Most Brick-and-Mortar brands will already be adjusting their strategies to recover from the pandemic and best-position their stores to profitable in the long-term. In order to achieve some goals such as omnichannel integration and efficient inventories, store networks will need the right supporting technology.

RFID is the perfect solution to many of these challenges. Retailers who had already implemented the inventory tracking & managing technology pre-pandemic were well-positioned to adapt and sell inventory cross-channel. In the long term, RFID will allow retailers to optimise costs across stores and supply chains and be agile in the way they can handle and sell products to customers.

To find out more, read our new solution brief created alongside our partners, Zebra Technologies:

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Detego Store is a cloud-hosted RFID solution which digitises stock management processes, making them more efficient and more accurate. Implemented within hours, our multi-user app can provide intelligent stock takes and a smart in-store replenishment process. Later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.