Fast fashion retailers who implement RFID can see immediate benefits - but what makes the technology such an exciting retail solution?

How Can Fast Fashion Benefit From RFID?

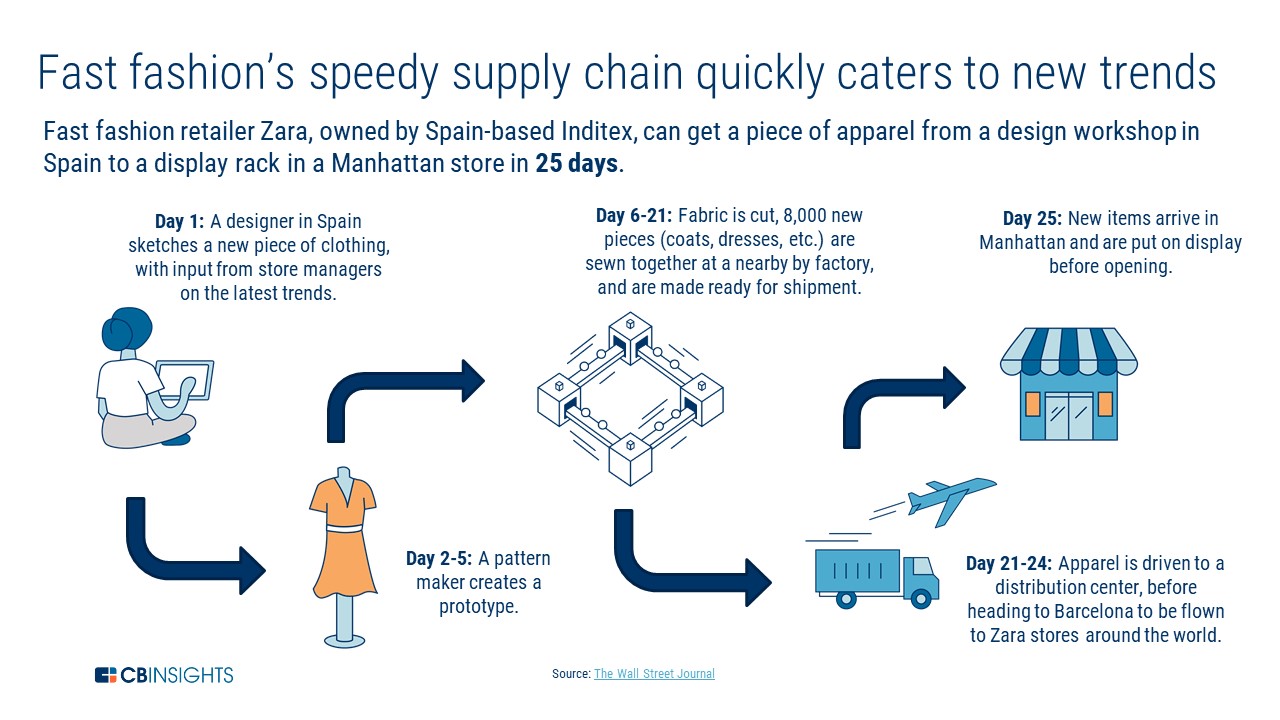

At the foundation of fast fashion is reliance on speedy, effortless supply chains. Thanks to developments in technology, brands can now produce thousands of pieces of new clothing in very little time – Missguided, for example, releases almost 1,000 new products every month. Consumers are attracted to brands who can reinvent their catalogues instantaneously and they expect brands to provide them with the clothing they want as soon as possible.

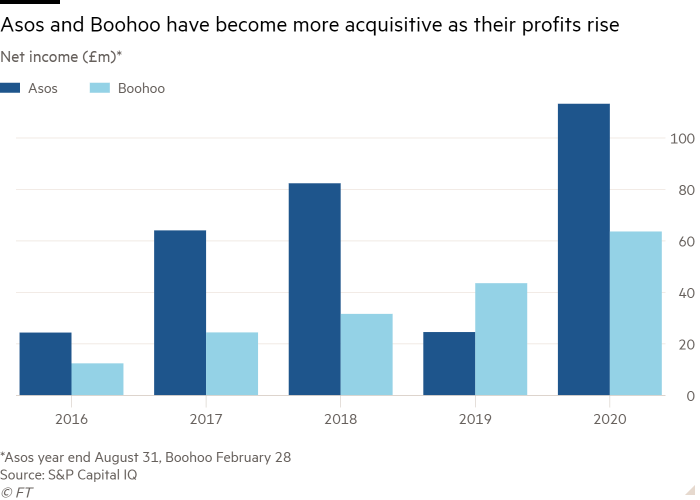

Generation Z, the generation now coming of age and holding increasing disposable income, love fast fashion. Over 50% of Gen Z shoppers purchase from e-tailers like Asos, Pretty Little Thing, and Missguided. Low prices combined with ease of ordering and immediate satisfaction mean these brands are only gaining in popularity. Sales at fast-fashion retailer Boohoo soared over the Covid-19 pandemic, growing 41%. In total, Boohoo generated £124.7m in profits between February 2020 and February 2021.

However, fast fashion is not without its problems. Consumers want their clothing increasingly cheaper and faster, but future global supply chain problems could hinder this. Additionally, fast fashion retailers are now confronting the environmental impact of the market. According to data from McKinsey, fast fashion is now responsible for about 4% of all global carbon dioxide emissions. By 2023, the emissions from textile production alone could increase by 60%.

When faced with the problems within fast fashion – both in terms of sustainability and supply chain optimisation – it’s clear that a solution is needed, and quickly. One viable retail solution is RFID, which could potentially transform the fast-fashion world. But why is RFID for fast fashion such promising technology?

Making Fashion Fast

As opposed to the historic seasons within fashion, fast fashion focuses on rapidly producing new styles at a rate of about 52 ‘micro-seasons’ per year. In 2019, the amount of clothing produced by global fashion brands totalled about 53 million tons, but this was expected to rise to about 160 million tons by 2050. Zara was one of the first brands to trial new bi-weekly deliveries of fashion inventory, and since then consumers have wanted clothes even quicker. Now, fast fashion brands are required to keep hundreds of pieces of stock on hand – either in-store or in distribution centres – to satisfy the constant need for products.

Fast fashion can also attribute its growth to the internet. Retailers with physical stores may see items go unsold – H&M had over $4 billion worth of unsold fashion inventory in 2018 and Primark were sitting on £1.5 billion of clothes in their warehouses. The flexibility of e-tailers, though, means that as long as they can get stock through the supply chain quickly enough, they can adapt to consumer trends. In comparison to brick-and-mortar fast-fashion retailers, brands like Boohoo often order only a select amount of stock, to see if it will sell.

This flexibility within the business model paid dividends when the Covid-19 pandemic hit. While clothing sales overall dropped by about 34% in the early months of the pandemic, internet retailers like Boohoo turned a profit. At the beginning of 2020, Asos predicted that they would make £30 million more than in a regular year due to the pandemic shift to online shopping.

The Problems with Fast Fashion

However, the rapid growth of the fast fashion industry has also exposed the flaws in this market. From supply chain crises to environmental impact, fast fashion has its downsides. Firstly, the industry relies on global supply chains, which is much riskier than keeping production closer to brick-and-mortar stores. Retailers had to confront this problem first-hand in 2021 when a trapped container ship in the Suez Canal caused an estimated loss of $9.6bn goods every day.

While not a direct result of the Suez Canal crisis, shipping costs have also risen dramatically over the last two years. Where a shipping container ship used to cost $1,500, it can now reach $15,000. Similarly, shipping times are also longer because of the pandemic, meaning it can take up to 8 months for stock to reach Europe from Asia. This is compared to about five weeks for production based in Eastern Europe. Consequently, many retailers are choosing to forego global supply chains and low-cost manufacturing processes in Asia and “nearshore” their production closer to home.

Aside from supply chain disruption, fast fashion’s biggest problem relates to its environmental impact. While the fashion industry as a whole has its sustainability issues (it can take 10,000 litres of water to produce 1kg of cotton, for example), fast fashion is particularly problematic. The quick turnaround of fashion inventory in the fast fashion industry means more waste and the increased use of raw materials.

In total, 84% of all discarded clothing ends up in landfill sites; and while 95% of textiles could be recycled, the fast fashion model doesn’t encourage recycling or reworking. What clothing does get donated to second-hand clothing stores or thrift shops has a similarly doomed life – the United States exports over one billion pounds of used clothing every year, most of which gets sent to used clothing markets in Sub-Saharan Africa. Due to the sheer quantity of products, fast fashion also doesn’t have the supply chain transparency to accurately track where products have come from and where they end up.

The Environmental Impact of Fast Fashion: Consumer Reactions

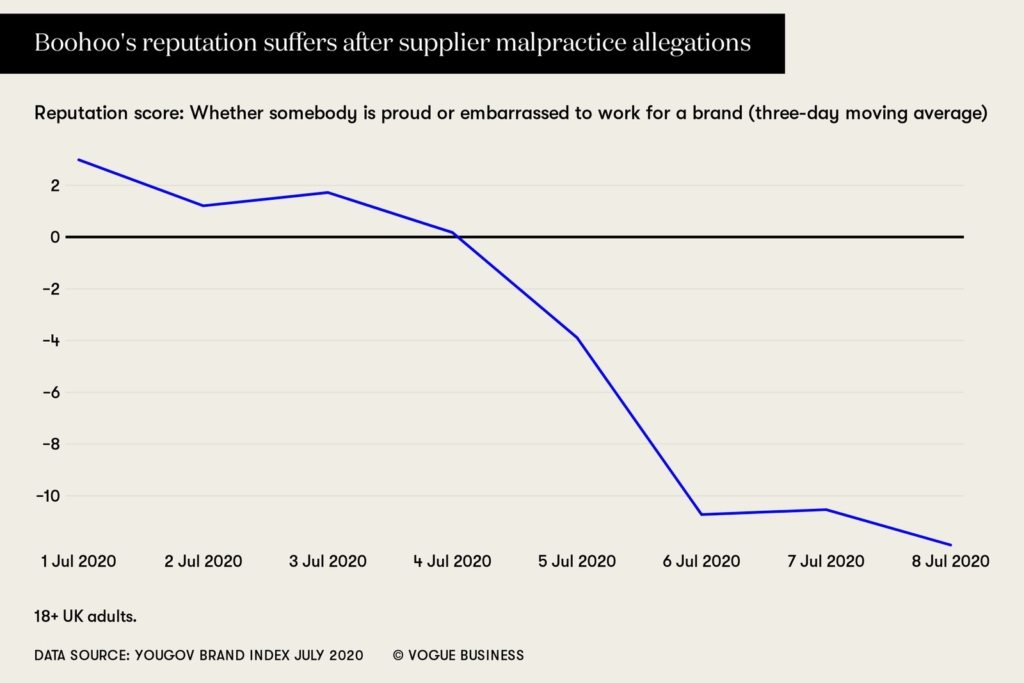

But do shoppers really care if the fast fashion industry is unsustainable? Well, the answer is both yes and no. In 2020, retailer Boohoo was investigated after it was hit with allegations of exploitation related to its factory in Leicester. According to reports, workers in the factory were being paid just £3.50 an hour to make clothing. However, consumer reactions to the news were lukewarm. Despite the company’s reputation taking a sharp hit in the months after the report was released, over half of Gen Zs said they would still buy clothing from Boohoo-owned fast-fashion retailers.

On the whole, though, consumers are reacting to news of unethical and unsustainable practices. A McKinsey report reveals that 1 in 3 consumers have stopped buying from particular brands because of sustainability concerns. 40% of respondents also said that they have actively started buying from clothing companies with a good sustainability record. However, there were still limits to how sustainably consumers can or want to be. 46% of people said that additional information about the origin or sourcing of products would help them to be more sustainable, and 50% wanted more recycling options for used products.

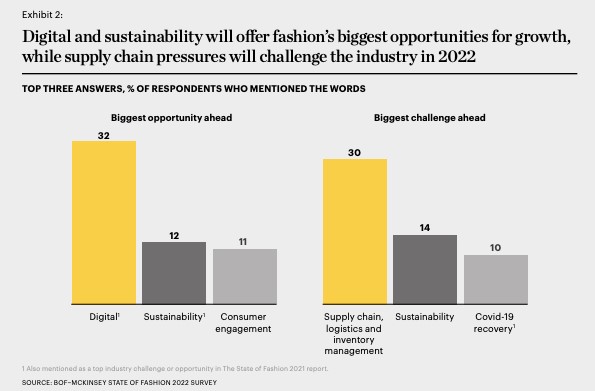

15% of fashion industry executives say that sustainability is one of the top challenges for them in 2022. However, supply chain logistics are perceived as an even bigger threat to the industry, with 30% of respondents citing fashion inventory management or logistics as one of their top three concerns. Any future fast fashion retail solution will have to address the combined issues of supply chain disruption and sustainability – and implementing RFID in fast fashion could achieve this.

The Benefits of RFID for Fast Fashion

So, what’s the retail solution for fast fashion’s problems? Well, fast fashion retailers could turn to RFID to tackle both sustainability issues and problems in their supply chain. RFID in fast fashion is nothing new – Zara has already invested in digital tags in their supply chain network and full integration of RFID across their network was completed in 2020. However, the technology is rapidly decreasing in cost, meaning there’s a huge potential payoff for retailers who invest in fast fashion RFID technology today.

Transparency

If fast fashion retailers are to prove that their products are from entirely sustainable sources, they will have to embrace transparency in their operations. Consumers now want to know where their products come from, and whether they can trust sustainable labels on clothing.

For fast fashion, RFID can be the retail solution to transparency. Only with accurate data and information about supply chains can retailers provide honest and open updates about their fashion inventory and ethics.

Fashion inventory visibility

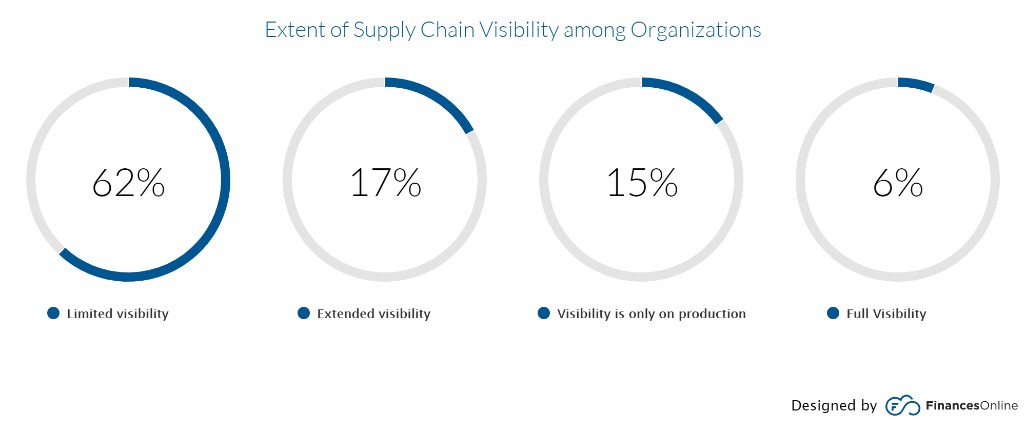

Real-time visibility is important for any retailer, but even more so in the fast fashion industry. Only when you can track stock in real-time can you adapt to shortages and delays. RFID in fast fashion offers a way to accurately track stock through the supply chain, allowing retailers to make more accurate decisions and identify problems.

When fashion inventory is tagged at the point of production, its journey can be traced throughout the supply chain to a high degree of accuracy. It’s also possible to scan large amounts of stock at once, making the process straightforward and offering instantaneous data. RFID can also make supply chains more resilient by revealing weak points in operations. As a result, decisions affecting the supply chain can be made more quickly and with accurate data to back them up.

Returns

We know that consumers are asking for options regarding recycling initiatives and returns policies in order to make their clothing consumption more ethical. With customers increasingly turning to online ordering, the returns process has become more complex for stores, as they need to offer options to post from home or return to store. RFID in fast fashion solves this problem, letting retailers know exactly where a product is at all times.

RFID is also a way for retailers to embrace sustainable options like fashion rental. When RFID tags are implemented on all fashion inventory, it’s easy to implement returns and even categorise clothes for washing after they’ve been returned.

Sustainability

RFID in fast fashion can also boost a retailer’s overall sustainability by improving the accuracy of stock takes. Knowing exactly which items are selling and which aren’t means that retailers can adapt quickly to consumer demand, and only order what will sell. There is a huge problem with inventory loss in the fashion world, but this can be solved with accurate data. With RFID, fast-fashion retailers can only order the inventory they need and be assured that they won’t run into out of stock notices because of the technology’s accuracy.

The Future of RFID in Fast Fashion

There’s no doubt that, despite its drawbacks, fast fashion will continue to be popular, especially among younger generations who often are blind to the environmental impact of the fashion market. Many fast fashion brands are already making changes to their business models in reaction to issues like sustainability. Inditex, which owns Zara, Bershka, and Pull&Bear, has said that 100% of their cotton, linen, and polyester will be from sustainable sources by 2025. H&M is vowing to improve the percentage of sustainable or recycled materials they use from 57% to 100% by 2030.

While these initiatives will undoubtedly make brands more sustainable, they are also complex and high-cost. If brands are looking for a low-cost, high-return way to boost their ethics and improve their reputation, RFID in fast fashion is an ideal retail solution.

A fast fashion RFID solution

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Book a demo with Detego to find out how our cloud-hosted RFID retail solution could help you optimise your approach to fast fashion inventory. Our multi-user app can provide intelligent stock takes and a smart in-store replenishment process and later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.