Summary of RFID in Retail

Radio Frequency Identification (RFID) is a growing force behind the scenes in retail. For the uninitiated, the technology involves using radio frequency (RF) to share information about an object’s unique identity (ID). An RFID reader can identify or ‘read’ hundreds of tags in a matter of seconds, at a distance of several feet. For retail, this reduces the reliance on barcodes for inventory management and opens the door to more advanced applications utilising real-time data.

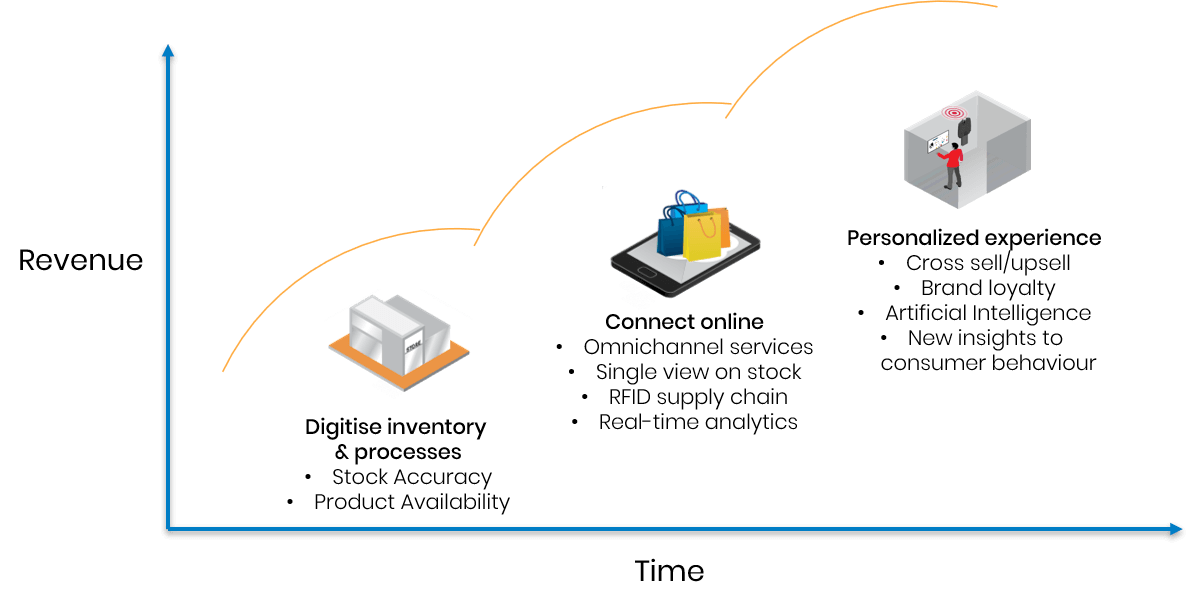

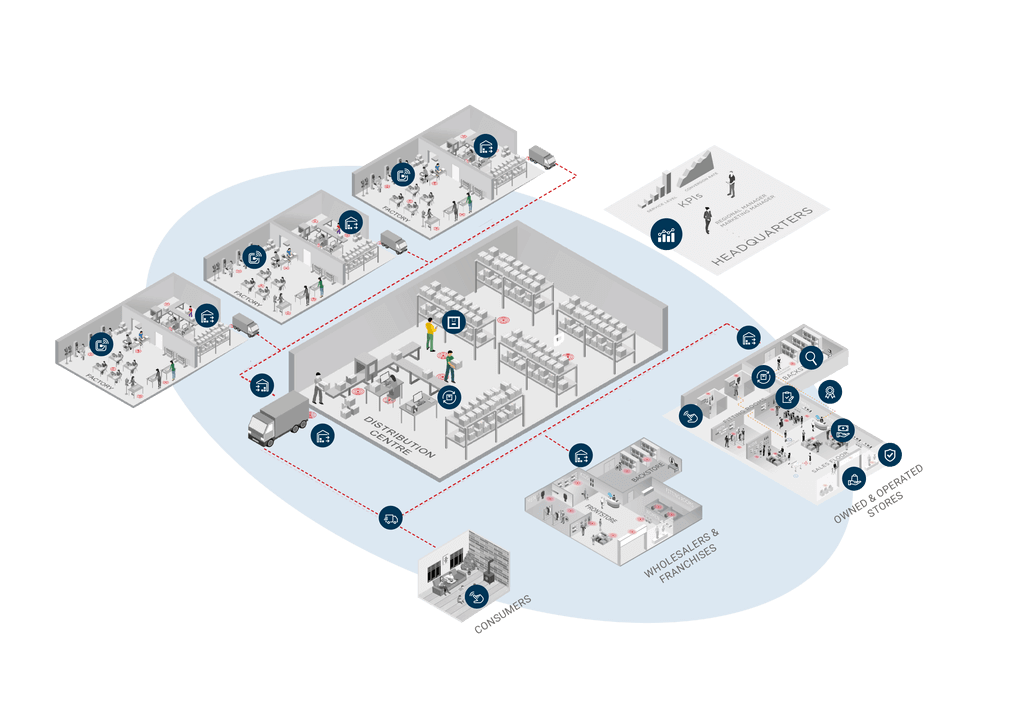

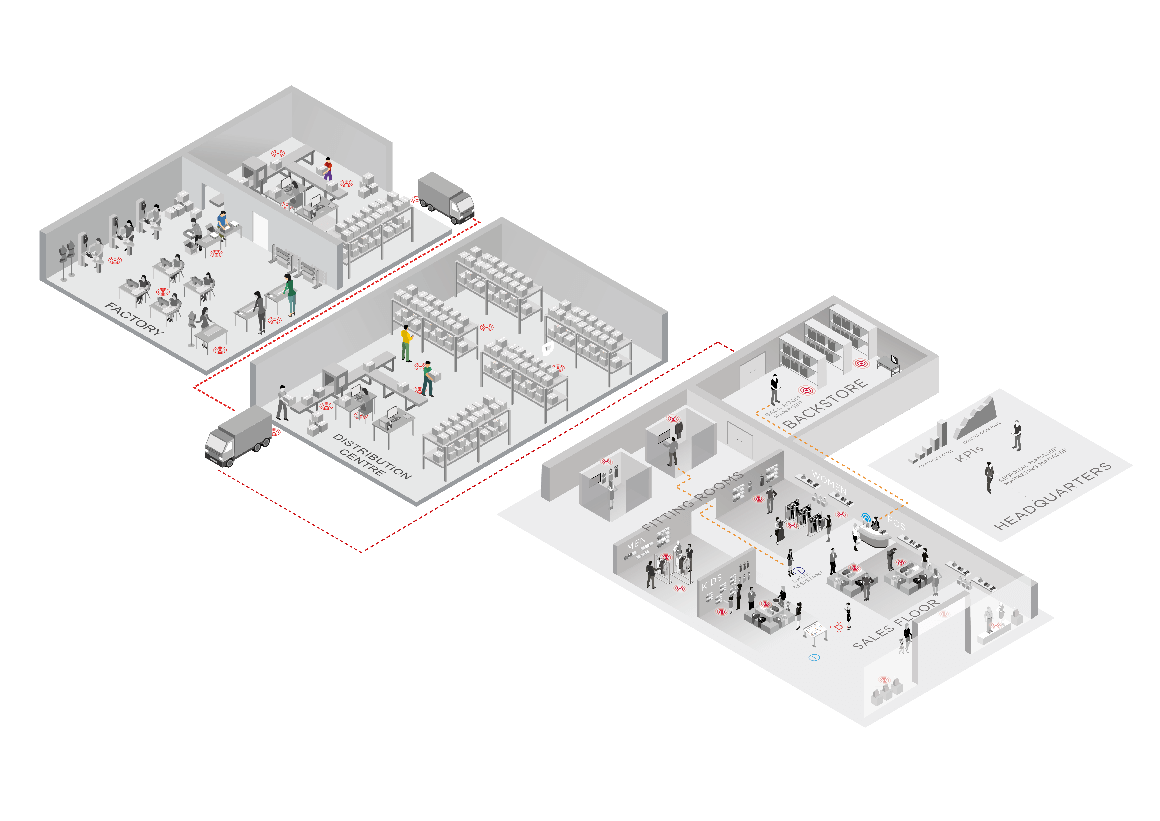

While the story for RFID in retail began in stores, due to the dramatic increase in stock accuracy that it provides driving sales and setting a platform for omnichannel retailing, the potential for RFID in the supply chain has always been there. Now that many global retailers have implemented RFID in stores, they are beginning to leverage and unlock the power of RFID across the supply chain.

For the supply chain, RFID means accuracy, efficiency, and visibility, all of which have a big impact on operations.

The results of RFID in the Supply Chain:

RFID in each Stage of the Supply Chain

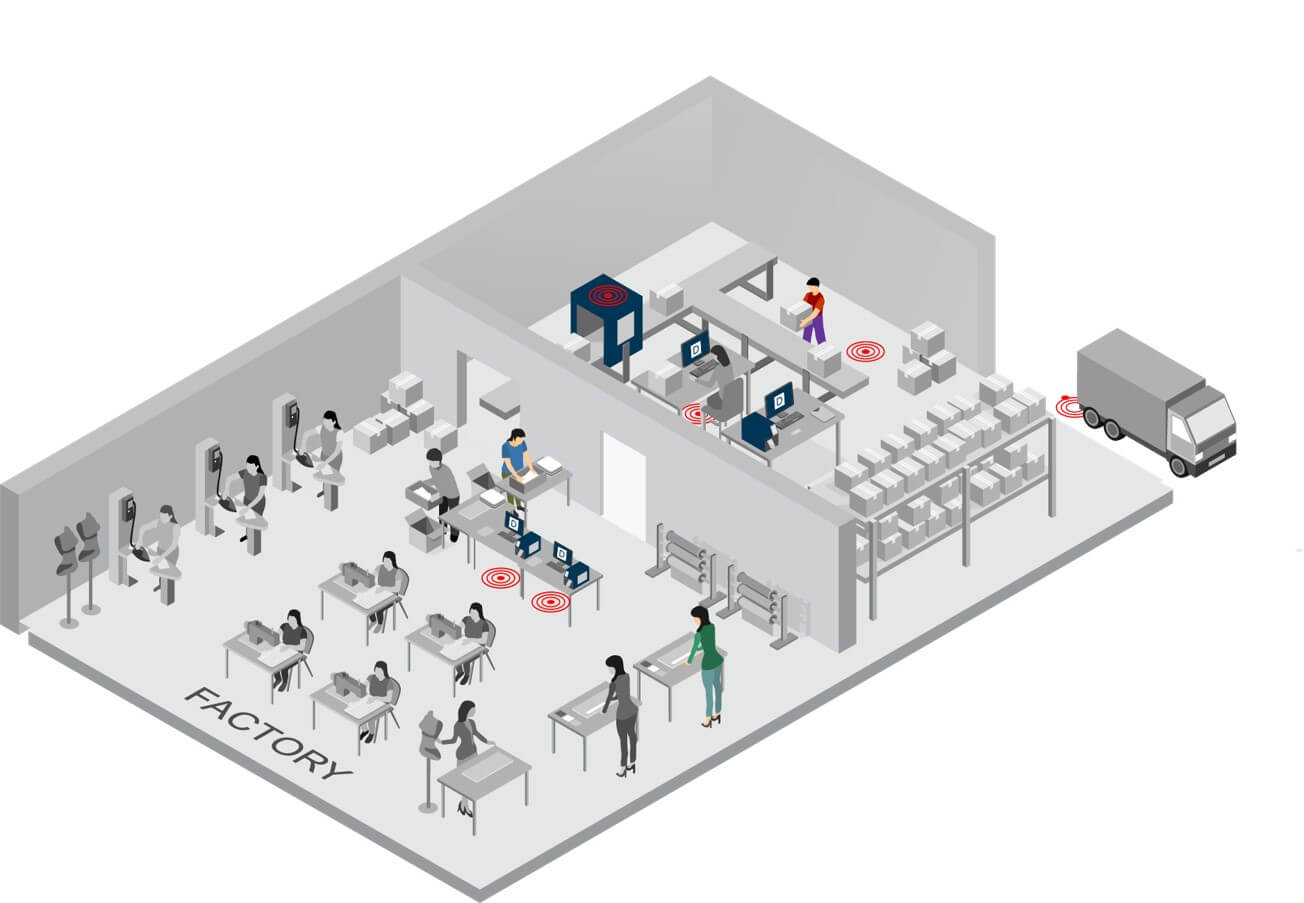

Factory

For a truly end-to-end view of the supply chain, RFID tagging must start at the factory. Items are encoded with an RFID tag at source, where they will be tracked from here to the point of sale. Once items are tagged and ready to ship, the first ‘read-event’ of the process takes place. The shipments are either put through an RFID tunnel (an automated tunnel fitted with an RFID reader) or read with a handheld reader. This outbound count ensures shipping and tagging accuracy, diverting any anomalies to be checked and fixed, and creates item-level ASN’s (advanced shipping notices) to send to the distribution centre, so they know precisely what they will be receiving. Having every item logged at this stage is also vital for creating visibility over the entire supply chain.

As most brands have anywhere from 10-100+ factories supply their DC, it is vital to ensure that the shipments are accurately accounted for to prevent errors further down the supply chain.

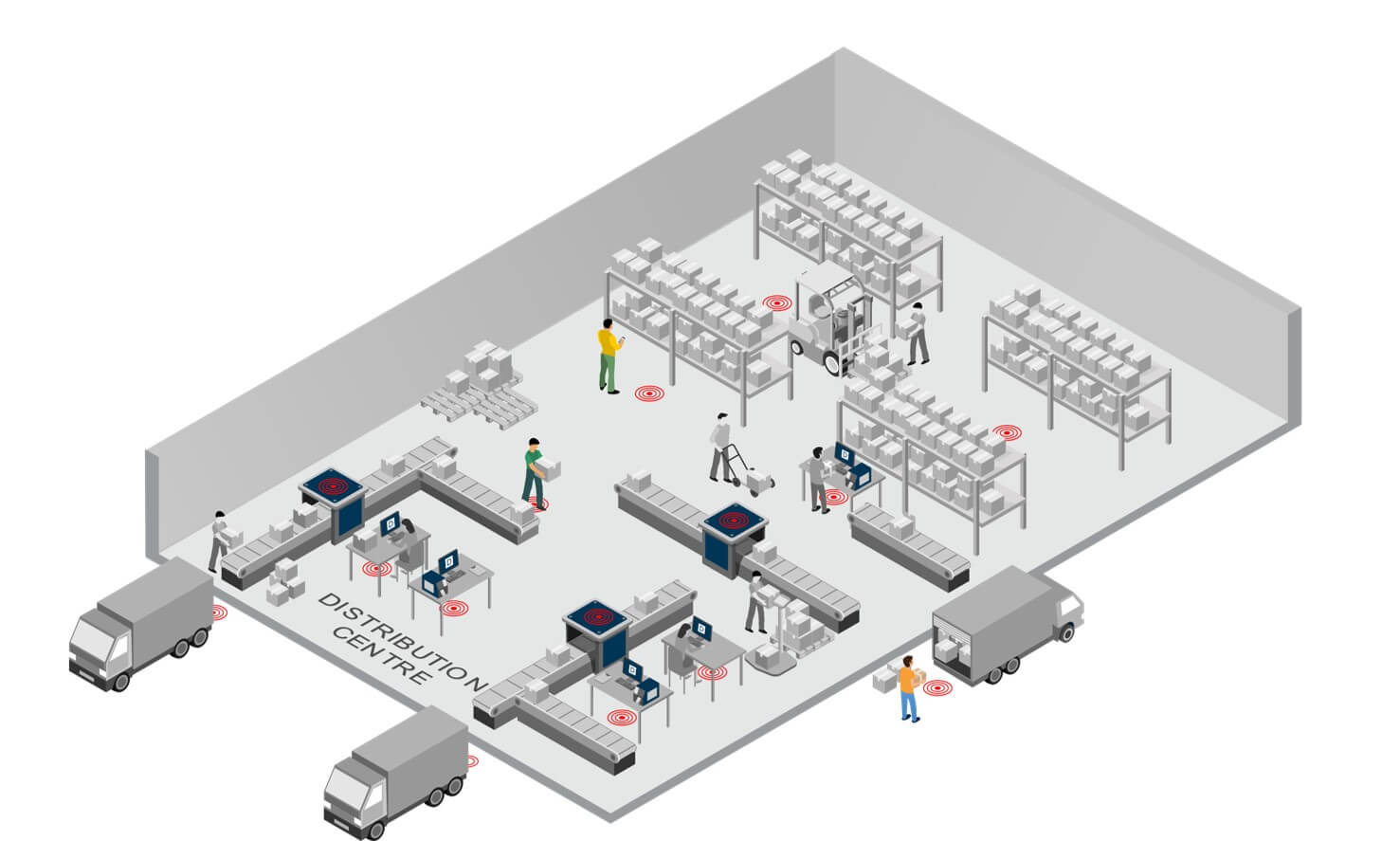

Distribution Centre

The distribution centre is the heart of any retail supply chain. Goods come in from the factory, and orders go out to, and occasionally come back in from stores, franchises, and customers. As it is logistically the most complex stage, it is here where the majority of processes are supported by RFID:

Supply Chain Processes with RFID

When goods arrive at either the distribution centre or the store, RFID readers are used to quickly count the shipments on an individual item-level. Because DC’s have far higher item throughput than stores, they often utilise automated RFID tunnels for this. Shipments entering the DC go directly onto a conveyor and are accounted for as they pass through the tunnel.

The software then compares inbound reads to the advanced shipping notice and updates the warehouse management system or ERP with accurate information. This process helps maintain the integrity of the stock system and also spots discrepancies early so they can be reconciled and fixed quickly (holding suppliers accountable for mistakes).

This is also where incoming returns are processed. Since RFID tags are unique and can’t be forged, DC’s using the technology can easily identify fraudulent returns, as well as processing the legitimate ones faster.

The packing process also utilises RFID when putting together orders and shipments. The process will vary depending on the DC, but RFID can support the process by a picker using RFID tables or audit stations to confirm the carton is correct by checking the actual contents against the picking list.

Finally, RFID is used to count, verify, and log all outbound shipments.

Goods pass along automated conveyor belts through RFID tunnels. Box barcodes (Using a target list supplied by the Warehouse Management Systems) are scanned at the entrance to the tunnel and an RFID reader in the tunnel reads the contents of each box. If the tunnel detects any differences against the target list, the conveyor system automatically diverts the carton for further inspection.

Outbound results are then sent to the WMS, to update the stock information for the DC. When the DC has processed all cartons from the target lists, the system creates an advanced shipping notice (ASN) for the store that will receive the goods.

The benefits of RFID in the supply chain

Now we have run through how retailers use RFID at specific stages in the supply chain let’s look at the results of doing so. We can broadly split these benefits into three areas:

Accuracy

Accuracy is often the first thing people think of when they hear RFID and with good reason. For the supply chain, RFID improves shipping and inventory accuracy by

1 – Performing more reliable (99%) inventory counts than traditional methods

2 – Counting on an item-level as opposed to an SKU level

3 – Being able to identify and fix mistakes at more stages of the process due to the ease and speed of RFID reads

The financial impact of improving inventory and shipping accuracy across a supply chain is huge, and can include:

Efficiency

The other great strength of RFID is the speed at which it can count and verify items or even entire cartons in seconds. With automated RFID tunnels and a conveyor system diverting any cartons with discrepancies, the efficiency of the DC is maximised, and not at the cost of accuracy. DC’s using RFID have a higher throughput, as they are simply able to process items and orders at a faster rate.

Visibility

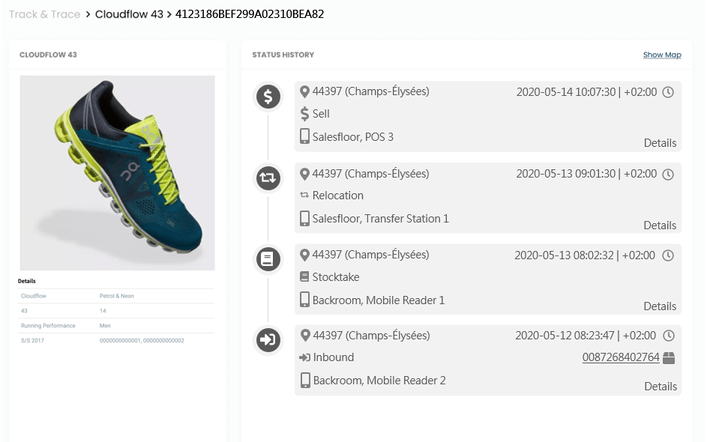

The other major benefit of RFID supply chains is the complete visibility they have other individual items and the movement of merchandise. This not only means shipments and items are trackable in close to real-time, but the number of ‘read-events’ from source to store creates a huge amount of highly valuable data. This data produces useful KPI’s such as throughput, dwell-time, and DC performance. It also allows retailers to trace items back through the supply chain, which is hugely valuable in terms of brand protection and loss prevention.

Summary

RFID is used to accurately count, correct, and track all individual items and cartons across the supply chain. This starts in the factory where items are tagged at source, goes on to the distribution centre where orders are sorted and finally sent out to stores. Every time an item enters or leaves a stage of the process it is counted with RFID and all mistakes are identified and corrected.

The most notable benefits for supply chains using RFID come in the form of greater accuracy, efficiency, and complete visibility over the flow of goods. The increased accuracy of both inventory and individual orders can lead to top-line growth, fewer stock outages and the reduction of customer chargebacks for shipping mistakes. The efficiency increase makes supply chains more durable and increases overall item throughput and finally, the visibility of items allow retailers to optimise their operations and offer better services such as omnichannel purchase options.

RFID can be used for all inbound and outbound shipments, logging the contents of each order, and comparing them to the target list – which identifies shipping mistakes before they happen. RFID can also be used in the picking and packing process, counting the items in a carton as the DC staff picks the order, RFID software then confirms whether the order has been picked correctly before it is sent for outbound processing.

There are several types of RFID readers used throughout the supply chain. RFID tunnels are fixed readers built into a conveyor system, they scan the contents of cartons without needing for the carton to be opened and if they detect any discrepancies the conveyor will send the carton to an exception lane. RFID chambers are often used during exception handling, whereas audit tables can be used for this as well is the picking process. Finally, the handheld RFID reader is often used in stores or storage areas when staff need to move around a space to perform a cycle count.

RFID software for the warehouse

The digital supply chain

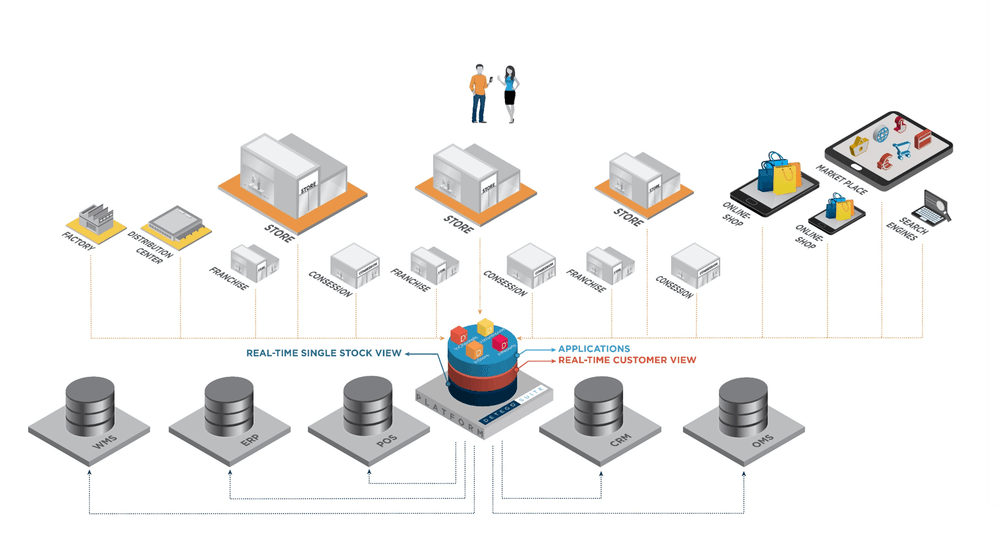

Detego’s RFID-based warehouse software enables retailers to automate and dramatically improve their receiving, picking/packing and shipping processes in factories and/or distribution centers. These steps are vital parts of an end-to-end RFID solution, providing full visibility across the entire supply chain.

Want to see how RFID can transform your business? Book a demo today

What is Smart Shield?

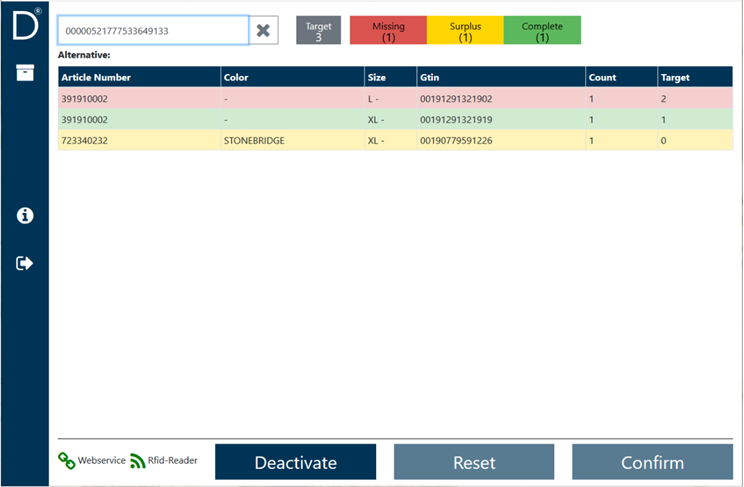

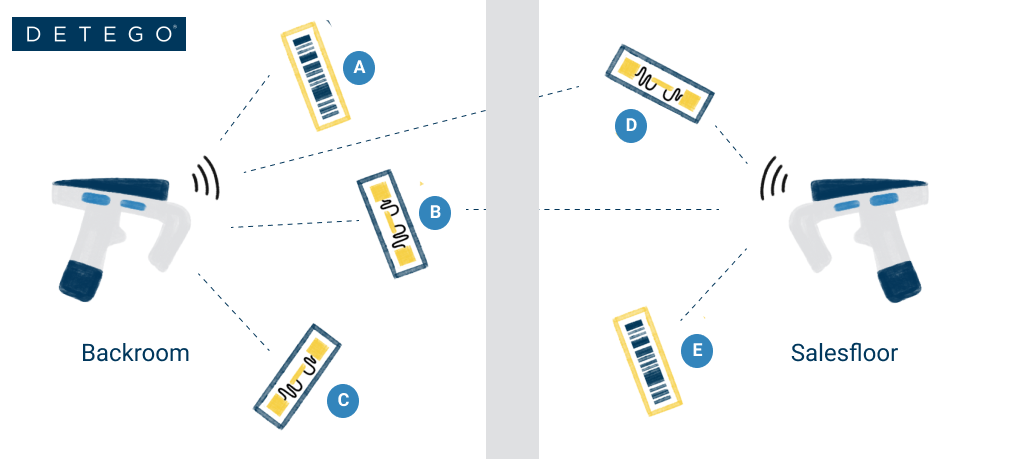

The Detego Smart Shield is a cutting-edge feature that determines the location of individual RFID tags, by using machine learning algorithms. This allows the Detego Platform to differentiate between the backroom and sales floor of a store, without the need for expensive physical shielding installations.

It’s vital that a stocktake tells you not only exactly what is in a store, but where the items are too. The two locations that need differentiating in stores are typically the backroom and the salesfloor. Store staff, and the Detego platform itself, need to be able to see exactly what’s on the sales floor so they can identify when items and specific sizes are running low so they can be replenished from the backroom. If this isn’t done, you can end up with products in stock but not available to purchase on the shop floor – a costly and easily avoidable mistake.

What problem does it solve?

RFID is able to read items from several feet away, and even through objects like boxes and walls – this is what makes it such an excellent technology for managing inventory. What this means, however, is that a staff member doing an RFID-based stocktake in the backroom could accidentally pick up signals from the sales floor, and therefore allocate items to the incorrect location.

The old solution to this problem involved using a physical shield that blocks RFID signals, often in the form of metal sheets or metallic paint. Making physical modifications to a store such as these is both expensive, costing up to $5000 per store, and time-consuming. When it comes to large scale rollouts of hundreds of stores, the added costs and manhours can be a major barrier to entry for RFID.

With the Detego platform, the need for physical shielding is removed entirely, significantly reducing the cost and time to implement RFID in stores. The Smart Shield feature is available out-of-the-box, meaning retailers can implement the cloud-hosted software in stores with very little fuss. This is what makes the Detego platform the most ‘plug and play’ RFID software on the market.

How does it work?

Every RFID tag creates a specific time and signal stamp when being read by an RFID reader – up to several times per second. Detego collects this data (created during stocktakes) and applies machine learning algorithms to determine the most probable location of individual tags.

Explanation of Smart Shield

The Detego Smart Shield in Action

The Smart Shield feature makes a massive difference for retailers undergoing RFID store rollouts at scale. These benefits include:

- Determines the location of individual items, with no need for physical shielding between separate stock locations

- Help optimise other processes and features, such as stock replenishment advice

- Allows for faster roll-out and reduces up-front costs, as no physical shielding is required

A Detego customer utilising Smart Shield recently rolled-out the platform in record speed, achieving 100 stores per month and with a stock accuracy of greater than 98%. This speed of implementation is far beyond anything seen before Smart Shield and allows retailers to get up and running quickly to unlock the benefits of the platform, driving an instant return on investment throughout their store network. By achieving high stock accuracy and on-floor availability in stores, Detego customers typically see between 3-10% revenue increase per store.

Cloud-hosted RFID software

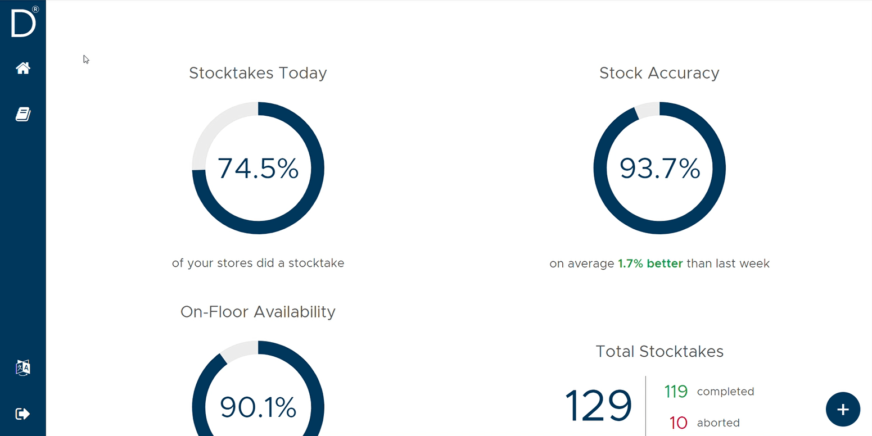

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Detego Store is a cloud-hosted RFID solution which digitises stock management processes, making them more efficient and more accurate. Implemented within hours, our multi-user app can provide intelligent stock takes and a smart in-store replenishment process. Later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

Managing the flow of merchandise in retail supply chains has always been a challenge.

Traditionally, the large quantities being dealt with meant that visibility of merchandise was poor. Items were tracked and accounted for in rough quantities, not consistently or accurately enough to hold suppliers and distribution centres accountable for mistakes and inaccuracies. This meant a fair amount of leakage, either of efficiency or directly in the form of physical shrinkage as items become ‘lost’, damaged or shipped incorrectly.

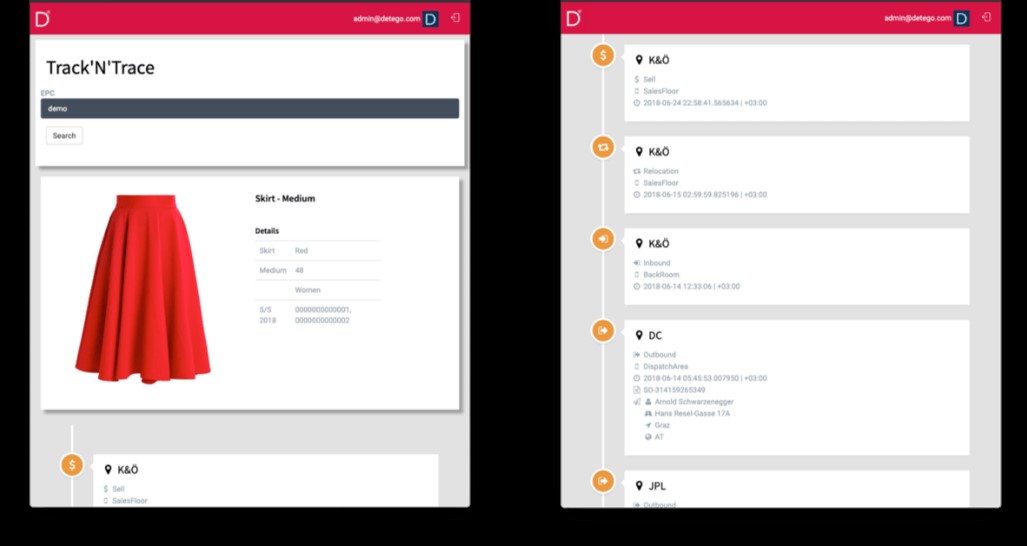

Fast forward to the present day, with advanced technology like RFID and the IoT, and the standard for retail supply chain management has changed. ‘Supply chain 4.0’ can effectively track and trace individual items from source to store, utilising RFID technology to track individual products and the Internet of Things to store and leverage this information on a digital platform or cloud.

The data and visibility provided by such digital supply chains are extremely valuable, allowing retailers to:

●Quantify the performance of the supply chain (visibility),

●Identify “the last known location of items” (accountability),

●Inspect the history of items and even raw materials (traceability).

Here are the 3 fundamentals of retail supply chain optimisation using item-level data:

Visibility

“To be able to see…”

Supply chain visibility is a growing priority for retailers. According to a report by Zebra Technologies, 72% of retailers are working on digitizing their supply chains in order to achieve real-time visibility. Knowing exactly what is in the pipeline allows retailers to control inventory more efficiently, improve operations between stores and DC’s as well as offer effective omnichannel services and delivery options.

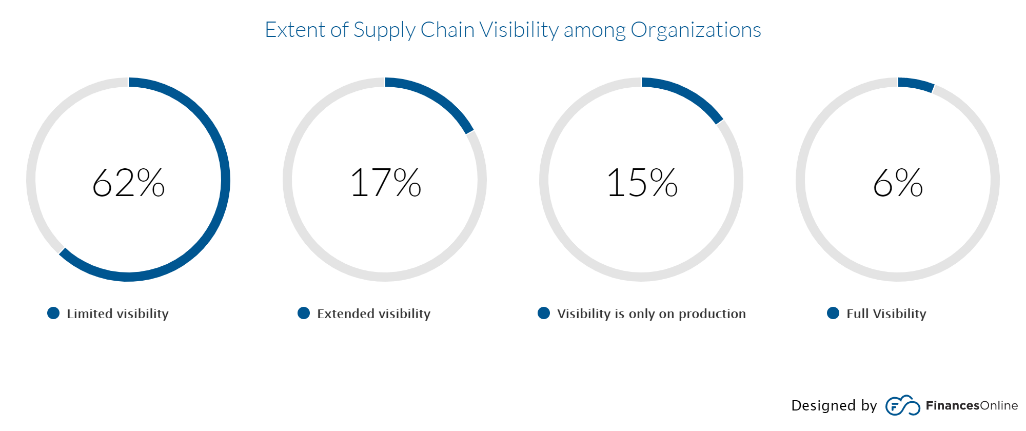

However, the majority of supply chains don’t have anywhere near this level of visibility, as 62% of supply chains operate with a limited view over merchandise flow. This is because goods move along the supply chain in such large quantities, and most supply chains only account for cartons of items, rather than the items themselves.

For example, cartons of T-Shirts with quantities of around 50 are commonly sent out, but without RFID accounting for individual products, you can’t know if the quantities are correct. In other words, you are guessing what should be there as you do not have the visibility to know what is there. This may result in a store believing they have less or more products than they actually do. If however, they do identify the mistake, without visibility over the supply chain there is no way of knowing where the error occurred.

RFID technology can make every step along the supply chain visible while also providing a meaningful context, using digital ‘touchpoints’ to track items throughout their journey. RFID Tunnel installations can even automatically process these cartons, to identify shortages and surpluses all without opening the box. This way large inbound and outbound shipments can be processed quickly, accurately and down to the item-level.

Traceability

“To be able to verify the history…”

If supply chain visibility allows us to know where items are right now, traceability means being able to look back at where they have come from. As items are tracked through the supply chain with RFID, a record of all read events is stored on the cloud. Not only this, but the data from the product journey can be combined with similar data from materials used in each product. This information means retailers can not only see the last locations and events of items but they can also:

- Inspect their history (inception to sale)

- Change layers of abstraction (e.g., from item to carton)

- Go back to the source (materials sourced from cotton farms)

Having the ability to trace individual items back through the supply chain allows retailers to identify where shrinkage occurs and trace products back to the source in the case of a product recall. The traceability is also key as it involves keeping a permanent record of supply chain flow, not only does this mean valuable data, it also gives supply chain leaders the concrete evidence to hold suppliers accountable…

Accountability

“To be responsible…”

With digital track and trace technology in place, retailers will have access to the all-important last known location of items.

This means it is possible to identify where errors occur and hold supply chain and retail partners accountable. On the other hand, it can also serve as proof of service.

This information is also invaluable when it comes to brand protection. Not only can RFID technology easily identify counterfeit products but using the last known location of products allows retailers to identify how legitimate products end up on the grey-market. This is achieved by tracing them back to their last known location in the supply chain.

Knowledge of when and where an item was last seen/did not show up also dramatically speeds up clarification and accountability processes.

These 3 building blocks allow the extraction of KPIs and models to:

- Monitor shrinkage

- Identify grey imports

- Minimize counterfeits

- Automate re-ordering via dwell times and throughput

- Identify bottlenecks.

Looking to optimise your retail supply chain? The Detego platform is the end-to-end track and trace solution

Achieving complete supply chain transparency requires implementing an RFID system across your entire value chain, preserving detailed information about each RFID read event of each individual item (such as inbound verification, stocktake or sale). Thanks to that, knowing an item’s EPC (Electronic Product Code) number is enough to find out what, where and when happened to it. This capability is most useful when stores, distribution centres and factories are all integrated with one system – that system is Detego.

With efficient RFID processes from source-to-store, retailers not only gain new levels of accuracy and efficiency but achieve unprecedented transparency of the supply chain. Detego’s Global Track and Trace feature deliver the visibility, traceability and accountability to optimise retail supply chains for sustainable retail success.

Crisis and change

The relationship between crisis and change is well documented. History is full of innovations coming out of periods of extreme strife. From the collapse of feudalism after the black plague to the invention of the lightbulb during the long depression, even the technology you’re using now, the internet, was a product of the cold war. More recent examples in business (and less historically significant) include both Airbnb and Uber becoming popularised during the 2008 recession. While they both existed before the crisis that popularised them, it was due to a sudden change in customer priorities and needs, where they truly thrived.

Digital technology in a time of physical distancing

Few would argue that COVID-19 is not a global crisis on the same scale as those mentioned above, and great change will be affected by it. COVID is likely to be an engine for major change not only because of its major economic consequences but because of its social implications too.

Video conferencing application, Zoom, has seen an increase in new users of 30x year-over-year, as the platform has become a social tool as well as a business one during lockdown. Speaking of business tools, Microsoft’s team collaboration programme, teams, has had 12 million new users since COVID-19, as businesses get to grips with remote work. Even the physical world of exercise is being supported by digital technology, as applications such as Strava and Peloton have exploded in popularity.

All of these illustrate a major trend of the response to COVID-19 crisis, which has seen digital technology used to bridge the physical distance that is enforced on many worldwide.

Retail’s digital shift – accelerated

To focus on retail, the story is the same, with there being both an economic and a social impact for brands to navigate. The financial impact of COVID-19 has been huge for retailers, with sales dropping by as much as 70%. This has left almost all brick-and-mortar retailers looking at negative cash flow as a result of closed stores. But even when they reopen, consumer confidence and low foot traffic will still be a concern. Brands will need to find ways to engage with their customers and serve their needs in new ways, as well as to adapt operating models to deal with the major financial strain.

The trend of people relying on and embracing digital channels during this crisis could not be truer in the retail industry. Since becoming the only sales channel available in many categories, eCommerce has soared during the pandemic, with increases of 25-80% depending on the country and industry. Whilst eCommerce is by no means ‘new’, the coronavirus has certainly accelerated its use and numbers are expected to remain higher than before even after the pandemic is over.

Leveraging physical stores in a digital world

This change presents some challenges for brick-and-mortar stores. Even though most brands will have seen an increase in their online sales, stores are still the backbone of retail. But with reduced foot traffic and increased competition from online, stores may need to adapt to stay competitive. Like many trends that have seen sudden surges in popularity during the crisis, the means to do this already exist, but they have suddenly become far more significant.

What are some examples of retail innovations likely to be accelerated by COVID-19?

Retail digital transformation

These developments are just one side of an ongoing digital transformation in retail, that is now more important than ever for retailers to get right. Retailers need the visibility, stock accuracy and item-level data to not only reliably serve customers across channels, but to reduce costs and improve business efficiencies in a challenging economic climate. Some retailers are ahead of the game in this regard and will more than likely absorb the impact of the crisis better than others.

Technologies like RFID, the IoT and advanced analytics modules are driving this digital transformation and creating more agile and resilient operating models. Whilst the current situation in retail is bleak, brands coming out of the other side are likely to be more resilient in the long term, as well as more accessible and seamless for customers across channels.

Want to learn more?

Webinar

Apparel Retail’s New Normal: COVID-19 Impact and Future Trends

Now stores are facing new social distancing guidelines, the formula for customer experience has changed. With reduced foot traffic and higher levels of eCommerce, the digital evolution of the retail store is now or never. Join us on the 16th of June as we dive into the physical and digital transformations behind retail’s ‘new normal’.

Data by nature: Why eCommerce analytics are steps ahead

Online retailing not only created a new way of shopping, but it also changed the game when it comes to tracking and analysing the shopping journey. There is almost nothing that is not being evaluated while surfing the webshop. Digital-heat-maps of individual online sessions are analysed, showing every click and scroll through the online store. Every possible KPI is monitored: Conversion rate, click-through rate, average order value, the relation between new and returning visitors, bounce rate and retention to name a few. The really powerful thing about this is that analysis is always followed by action, to improve both the effectiveness of the webshop and the experience of its customers.

Data by design? Time for brick and mortar to take some lessons

Naturally, eCommerce has a significant advantage when it comes to analytics, a digital channel is always going to produce more data. Brick-and-mortar stores need to adapt to compete however, and technology is trying to bridge this gap between the physical and digital. Some of the more hardware-heavy options include AI-powered cameras, smart shelves or even aisle-roaming robots.

While hardware-intensive solutions like customer-tracking smart cameras are available, with the right software supporting it, a technology that simply tracks products (such as RFID) and leverages the IoT (Internet of Things) can revolutionise analytics for stores. These technologies and their supporting platforms are a big driver of ‘Digital transformation’ which delivers the analytics and data that brick-and-mortar stores are desperate for.

Here are 3 lessons from eCommerce for improving analytics in retail stores….

The need for real-time data

For years, brick-and-mortar retailers have been complaining about imprecise stock-figures and unreliable historical data. Unhappy with its purchasing decisions based on last year’s sales figures, retailers would prefer to have real-time data and inventories that allow for reliable and economically viable decisions. After all, it is important to avoid high-security stocks in order to reduce capital tie-up.

But why do we actually have this problem? Are the data points offered by the ERP systems not enough? Unfortunately not – it is not unusual that the ERP system shows higher stock than actually available on the sales floor. This so-called “ghost stock” is the cause for various problems in sales, e.g. the ERP system says a certain article, for example, a red skirt in size S, is in stock, but in reality, it is not. It can neither be sold nor refilled from the central warehouse – a classical out-of-stock situation. Or vice-versa, the ERP displays a lower inventory level than is actually available. The reason for these deviations is insufficient accuracy in individual processes that dangerously sum up over time.

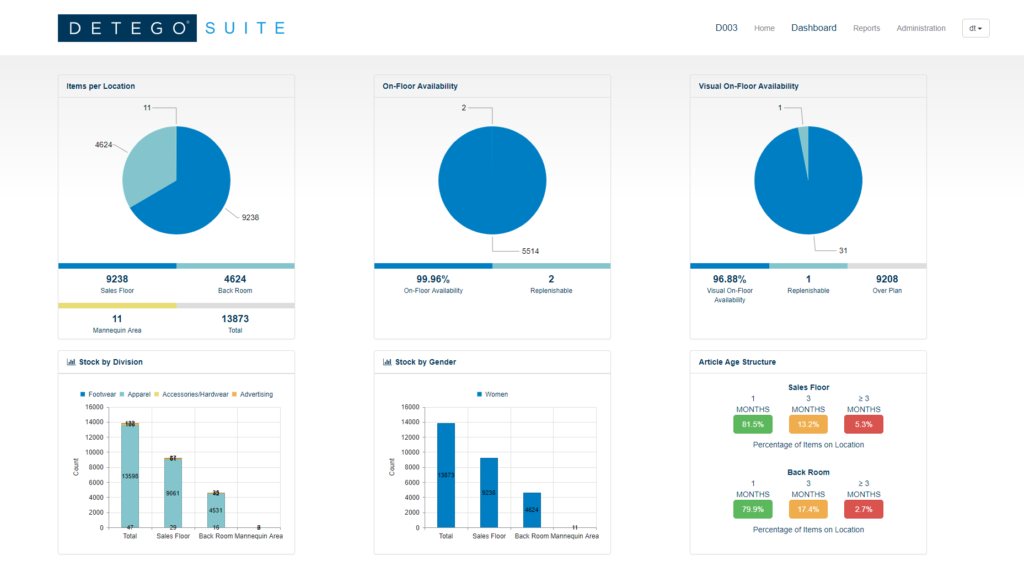

Today’s intelligent article management is based on three pillars: fast, RFID-based article identification on item-level, tracking of every movement in real-time and proactive analysis with concrete recommendations for actions to take for the sales personnel. This is the foundation for optimum customer service and efficient processes.

What does real-time data mean for Brick and Mortar Stores?

- High Stock accuracy

- Increases product availability of the shop floor from accurate replenishment

- Allows for convenient omnichannel services like click-and-collect

- Equips store staff with up-to-the-minute stock information – allowing them to assist customers better

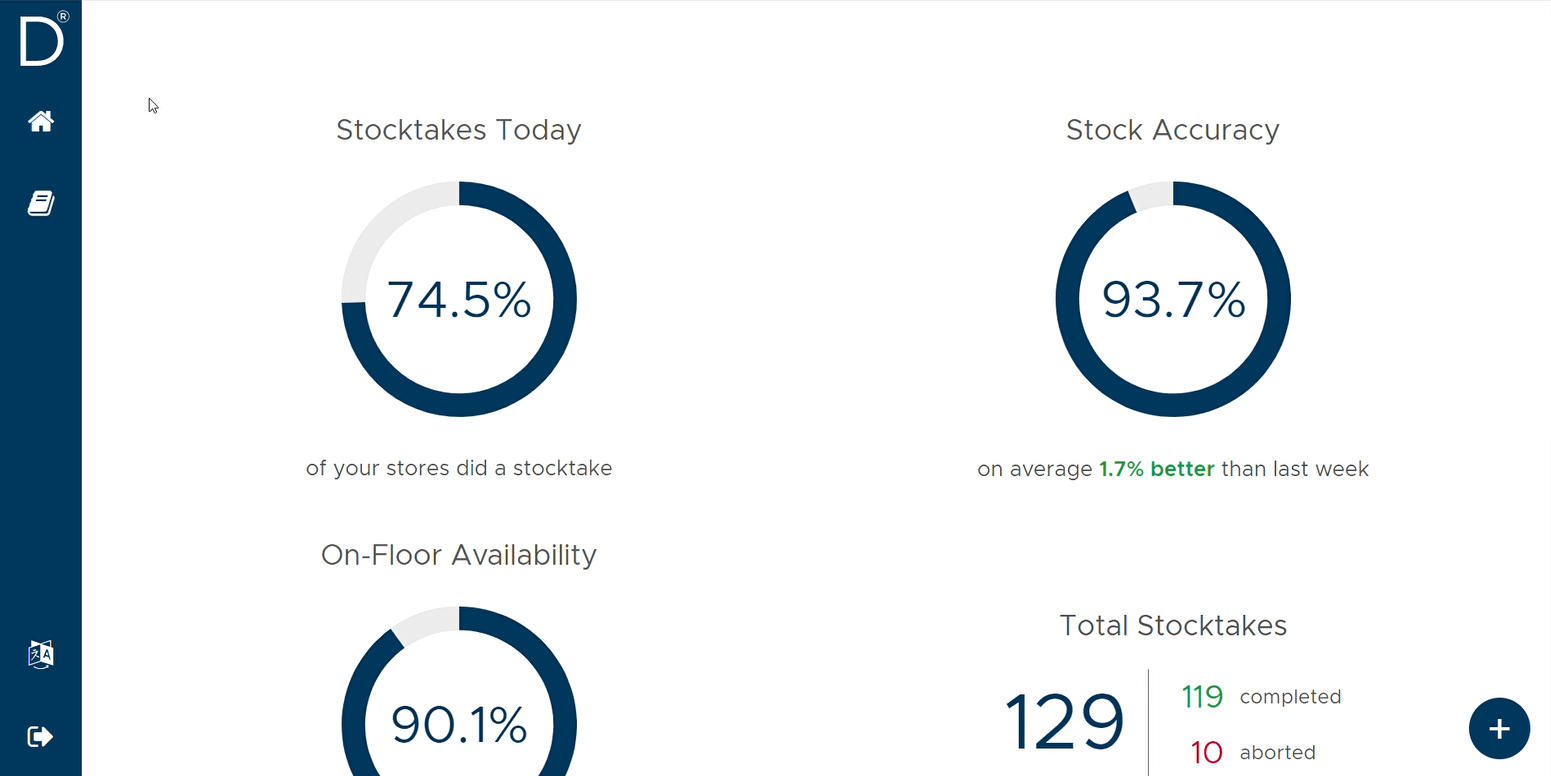

Meaningful KPIs in the store

When measuring KPIs, the practical benefits for retailers are paramount. Three areas of data in the store can be distinguished:

KPIs for Store performance

Inventory Accuracy

Whether five or 800 stores, KPIs for measuring inventory accuracy are significant for every retailer and still represent one of the main challenges in today’s business. Retailers, on average, can actually make accurate statements on just about 75% of their inventory (based on SKU level). However, this is not enough to meet customers’ expectations for omnichannel services. Therefore, inventory transparency and corresponding KPIs are essential for retailers´ success.

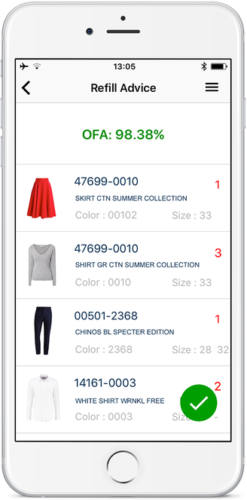

Product availability

Product availability on the sales floor, also known as on-floor availability, is the second central parameter. Initially, it is less about the exact position and more about the fact that the articles are on the sales floor – after all, only items that are actually available can be sold. This key figure can be combined with an alert system that makes sure not to fall short of the defined minimum availability. Complementary to classical ERP-systems, RFID-based merchandise management takes the data granularity to the next level, by knowing exactly at each moment in time if products are really on the salesfloor or still lingering in the backroom of a store.

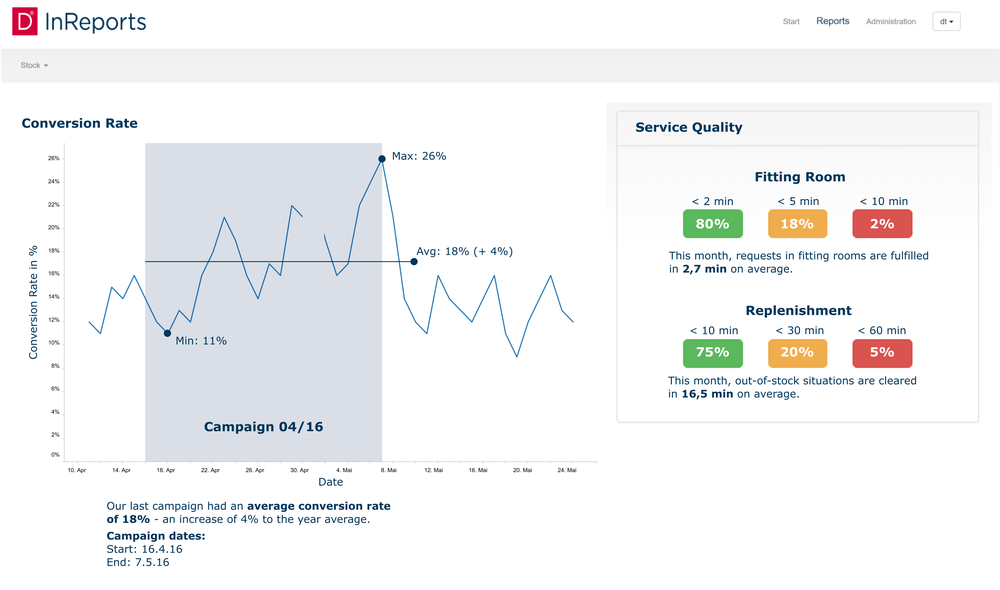

KPIs for individual product & campaign performance

Product dwell-time on salesfloor

Having data on item level, store managers are also given important information on the dwell times of articles on the sales floor. This information is more valuable than simple sales data, as it tells us the average time individual products spend on the sales floor before being sold. This can be used to gauge whether products are performing & corresponding with the sales plan. Common recommendations made from this data include moving items do a different location on the salesfloor (i.e. adjusting the planogram) or relocating excess inventory to another store – both of these measures reduce profit-sapping inventory bloat and end-of-season markdowns.

Fitting room conversion rate

One of the most famous KPIs in e-commerce is the conversion rate that describes the ratio between purchases and website visitors and also provides information on certain items that were already in the shopping cart, but for some reason have not been purchased in the end. Specifically, this aspect was incredibly difficult to measure in the store for a long time but can now be measured in fitting rooms using IoT and RFID technologies. This provides meaningful insights into how many, and above all, which articles does a customer take into the fitting room and which one does she/he actually buy?

KPIs on customer engagement and service quality

On an operational side, KPIs can also be used to manage service quality. We’ve already covered product-availability and stock accuracy, which affect the customer just as much as the store with out-of-stocks or unavailable sizes being all-too-common pain points. The replenishment rate provides another angle to combat this, as it shows how quickly articles are replenished on the sales floor. On the other hand, the fitting room response time describes how quickly sales personnel handle customer requests coming from the fitting room. The KPI “Conversion rate per campaign” shows the success of a campaign and if campaign-specific countermeasures are necessary.

Turning data into actions

The final lesson brick-and-mortar retail should learn from the webshop? Turning data into actions. Since nobody needs a data graveyard, any analysis needs the goal of creating immediate actions to improve. Today’s systems help the management team as well as the store personnel with concrete and automated recommendations for actions to take. This saves time in the decision-making process, unburdens the sales personnel, and enables them to do the right things at the right time.

KPIs should be suitable for everyday business use. Presented visually and self-explanatory, they need to be linked to clear recommendations for actions to take. This frees up store personnel time and provides a data-driven way of optimization. Examples range from simple in-store replenishment advice, i.e. “The minimum stock for article #47699-0010 has been reached – please refill three pieces” to more advanced topics, e.g. to choose a different placement in the store for a specific article when the dwell time on the sales floor is too high compared to other stores. Advanced systems can even utilise AI and Machine learning to automate and refine certain processes, like adjusting store planograms and creating optimal pick paths when replenishing stock.

Conclusion

Brick-and-mortar retail needs support and an update to the toolbox when it comes to analysis and measures. Not only does the sales personnel benefit from intelligent recommendations for action, but the management team also gains efficient control mechanisms across the entire store network. Decisions are made based on real-time data and therefore allow timely action. Ultimately, the end customer is pleased about a first-class service, which – thanks to the individual and informed advice through the sales personnel – even exceeds the standards of the online retail.

Webinar

Item-level Reporting from

Source-to-Store

Register for this webinar where we outline the impact of digitisation on supply chain analytics and operational efficiency. Covering the wealth of item-level data unlocked by RFID, the presentation will explain the new KPI’s available for modern supply chains and their impact on retail operations.

🏪 What is in-store fulfilment?

In-store fulfilment, also known as ship-from-store, is an Omnichannel retail strategy that essentially involves utilising retail stores as miniature distribution centres. This allows eCommerce orders to be fulfilled and shipped to customers from either the primary DC or a nearby store. Having multiple options for fulfilment available means retailers can take some pressure off DC’s and offer customers more stock and faster delivery by utilising nearby stores.

📦 Could ship-from-store be a viable strategy during the COVID-19 pandemic?

The use of in-store fulfilment and ‘mini DC’s’ has been steadily growing for years, due to both the continued growth of eCommerce as well as the inherent business benefits listed below. In the current climate of COVID-19, with stores closed and the immediate-future uncertain, leveraging closed stores as DC’s could potentially help alleviate the increased pressure on eCommerce operations and help brands achieve business continuity during this time. The practicality of this will vary between brands and even countries, but its possible a reduced small team of staff could run as an effective warehouse during the coming months.

🚚 What are the advantages of using stores as miniature Distribution Centres?

- Takes some pressure off DC’s, meaning a brand can handle increasing eCommerce orders without needing to invest in additional DC’s

- Reduces shipping costs by moving distribution points closer to destination

- Increases delivery speed as orders are shipped from nearby stores

- Idle inventory that is sitting in stores can instead be sold through eCommerce – increases margins by preventing seasonal mark-downs.

- Ship-from-store is an effective and profitable way to prevent inventory stockpiling up at the wrong locations

- Retailers can offer customers more products i.e. not just inventory available at the DC

- Alternative ‘mini-DC’s’ offer fulfilment options if the primary DC is temporarily shut down or disrupted.

- Leverages staff during slow periods for stores or if stores are temporarily closed

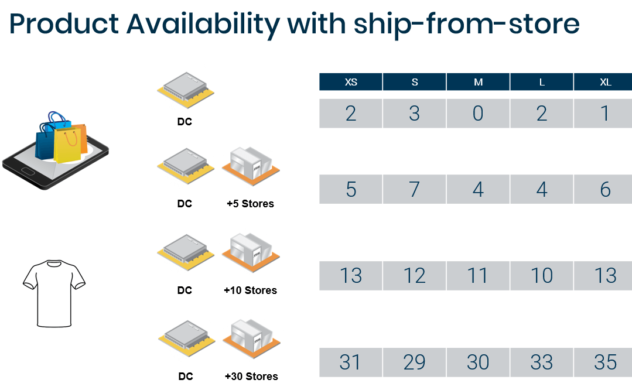

- Offers more products/sizes to customers (see figure below)

☑️ What is required to leverage stores as DC’s?

Whilst the benefits are huge, getting in-store fulfilment right is a fine balance and requires a certain amount of technology and digital integration across the supply chain. Retailers who attempt to offer ship-from-store (or any omnichannel capability) without these prerequisites will struggle. According to the Accenture study ‘Transforming Modern Retail’, Survey respondents that offer ship-from-store claimed that 31 percent of such orders triggered a split shipment, a result of not having the right foundations in place.

So, what do retailers need in order to utilise in-store fulfilment?

- Inventory Visibility – First and foremost, for cooperation across and between shopping channels, (i.e. for eCommerce to leverage inventory outside of their primary DC) brands need to have inventory visibility across their supply chain and stores. This view of stock needs to be unified between all channels and be as up to date as possible in order to achieve a ‘single point of truth’ for a brands merchandise.

- High Stock Accuracy – Having visibility over all of a brands merchandise is a start, but if this information is not highly accurate, cross-channel initiatives like this one will be fairly ineffective. Retail store inventories can be as low as 70% accurate when it comes to item-level product information. If this is the baseline for ship-from-store, it will result in either split shipments or cancelled orders – resulting in high costs and disappointed customers. For Omnichannel options like this, accuracy needs to be near 99% to confidently offer advanced purchasing options to customers.

- Investment in Stores – To facilitate in-store fulfilment a certain amount of investment needs to be made for stores. This may involve slightly altering the layout of a store, or hiring extra staff, depending on the business. More crucially, investment may need to be made in technology to achieve the accurate inventory visibility required to offer ship-from-store. This may include advanced inventory management technology like RFID.

- Maintained Store Inventory levels – Once this is in place and retailers are utilising in-store fulfilment, care needs to be taken to maintain the balance of store inventory between stock available to be used for eCommerce fulfilment and stock that is available for sale in the store. This is a fine balance to maximise sales between both channels. Retailers must ensure ship-from-store orders do not cause out-of-stocks for the brick-and-mortar store that is fulfilling them.

eBook

Solving Retail's Top 10 Needs with RFID

Discover how retail RFID is changing the industry for good. This eBook will guide you through the top 10 needs identified by retailers to ensure sustainable success in the modern environment. Explore the common challenges preventing retailers from achieving their goals and learn how applying smart RFID-based solutions delivers consistently good results.

Want the latest retail and retail tech insights directly to your inbox?

Complete Supply chain visibility was once an optional bonus for retailers, but in the modern industry it is becoming more and more of a necessity.

Whilst in the past, limited tracking of shipments in the supply chain was commonplace, in the modern environment with its more complex supply chains, delivery options and increasing customer expectations, retailers need to do more.

This isn’t just us saying so, retailers recognise this too. According to a report by Zebra Technologies, 72% of retailers are working on digitizing their supply chains in order to achieve real-time visibility.

What Is Supply Chain Visibility?

Having visibility means being able to accurately track products and shipments throughout the supply chain, from the manufacturer, to the distribution centre and finally to the store. Having this visibility prevents shipping errors, improves operational efficiency and allows retailers to leverage products to service their customers better.

Why Do Retailers Need Visibility?

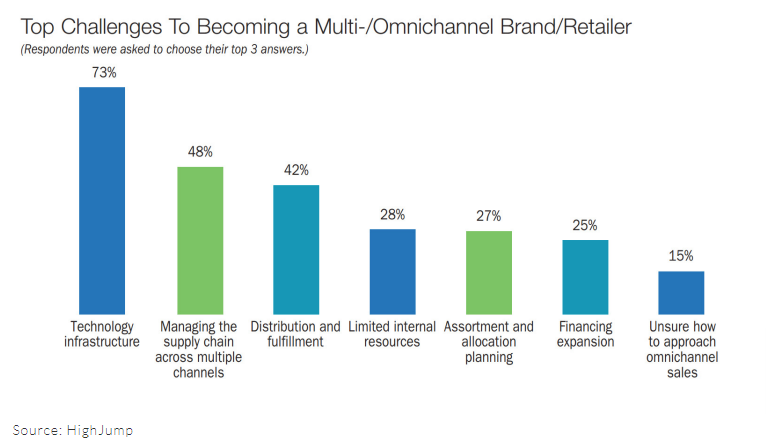

Managing supply chains effectively is always a priority for retailers. But as these supply chains get bigger the challenge becomes more daunting. Visibility is needed to align such large operations, and this is before you add new pressures like omnichannel, traceability and online orders.

Additionally, supply chain visibility is arguably even more important in ecommerce than for pure-play brick and mortar retailers. Not only do you need to know exactly what stock the fulfilment centre has, but what stock it is due to receive and when. And since pure-play brick and mortar retailers are now few and far between , this now means that most retailers’ supply chains need to be more advanced and transparent than previously required.

This is before mentioning the divisive omnichannel word, which often requires even greater transparency and synergy between stores and distribution centres and includes multiple delivery options.

There are also more classic supply chain challenges that can be helped by achieving visibility. General inefficiencies and inaccuracies can be reduced by adding more checkpoints throughout the supply chain – particularly when these are done at an item level, and not shipment or carton level.

Adding this visibility also makes better communication between different stages of the chain possible, which leads to smoother operations. Having visibility at an item-level also makes traceability of items through the supply chain possible. This can make a massive difference in combatting supply chain shrinkage, and in some cases the grey market.

The ‘New’ Challenges:

Multi/omni-channel businesses – It seems like an age ago, but traditional retail supply chains went in one direction and to one place – stores. Now almost all retailers also run their businesses online meaning their they operate on multiple sales channels, therefore, their supply chains service far more destinations than before.

Multiple delivery options – A relatively recent challenge created by the growth of online and the already mentioned omnichannel purchasing options. Retailers want to offer their customers as much stock and as many purchasing options as possible, but without the technology to support it, this can cause problems. In an Accenture survey, respondents claimed that 31 percent of their Ship from Store orders triggered a split shipment.

Customer expectations – Customer expectations has shifted. In a 2019 report, it was found that Half of shoppers reported abandoning a purchase due to a lack of cross-channel buying options. This is a major impact on sales, and many retailers are starting to adapt to the change in expectations.

The Old Challenges:

Supply chain inefficiency – Supply chain inefficiencies and miscommunication through “Chinese Whispers” are costing UK businesses over £1.5bn in lost productivity according to analysis of industry data from Zencargo.

Supply chain shrinkage – According to the National Security Survey, businesses in the United States lose $45.2 billion through inventory shrinkage a year. Whilst retail stores make up the majority of this, supply chains still experience large amounts of inventory shrink, particularly when they have no visibility of products.

What are the benefits of having supply chain visibility?

-

Better customer service

-

Improved inventory control

-

Shorter cycle times

-

Smoother operational processes between stores and DC’s

-

Better data for more intelligent business decisions

-

Reduce out of stocks

-

Track and trace products

-

Offer effective omnichannel services and delivery options

How Do You Achieve Supply Chain Visibility?

-

Implement a system that works at an item-level (not whole cartons)

-

Accurately track products at as many points as possible during shipping

-

Inbound and outbound counts at every stage of shipping

-

Implement effective exception handling

-

Use a cloud-based system to integrate all stages of the supply chain and achieve as close to a real-time view of merchandise movement as possible

-

Send advanced shipping notices (ASN’s) so warehouses and stores now exactly what they’ll receive

-

Use this visibility to enable traceability of each item throughout its journey

The Detego Platform allows retailers to gain complete visibility over their operations

If you’re looking for a solution or partner to help achieve better supply chain visibility, consider our platform!

Using RFID item level-tagging, the cloud-based Detego platform gives each individual item a unique digital identity. Items are then tracked from factory to shop floor using radio frequency identification (RFID) methods. RFID makes this possible as inbound, outbound and even exception handling can then be done through RFID reads – which are fast, accurate and can be done without opening cartons.

Since RFID works on the individual item-level, the result of this is complete visibility of the supply chain. The platform utilises the IoT to create a complete overview of every single product in the supply chain, as its cloud hosted this can be close to real-time and is the ‘single point of truth’ for the entire business.

Want the latest retail and retail tech insights directly to your inbox?

Online returns have been a challenge for retailers since the beginning of eCommerce. This is because of both their volume compared to normal stores, and the costs associated with processing them. In the wake of COVID-19, this problem could prove more critical then ever, as online becomes retailers’ singular sales channel. There is already early evidence of this, with preliminary data from Quantum Metric showing that eCommerce associated with Brick and Mortar retailers saw an average revenue weekly growth rate increase of 52%, and Nike Inc.’s digital sales went up by 36%.

The eCommerce returns dilemma

Online shopping is popular for a reason, but the convenience and choice of eCommerce comes at the price of not being able to ‘try before you buy’ for customers.

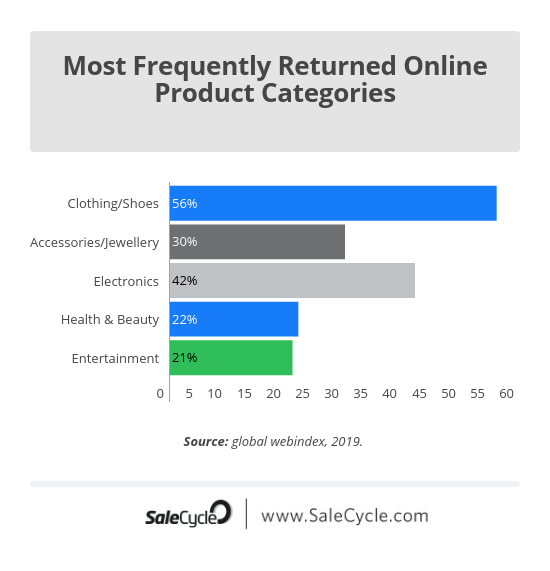

This simple difference is the reason online returns are so much more prevalent than for Brick and Mortar stores. In eCommerce the customers’ homes becomes the fitting room. And, just like any fitting room, products end up back on the shelves. According to Happy Returns, while shoppers return only 10% of what they buy in stores, they send back up to 50% of what they buy online.

This is compounded by customers accounting for this when ordering online. A survey from Barclays found that 30% of shoppers deliberately over-purchase and subsequently return unwanted items. Additionally, 20% regularly order multiple versions (often sizes) of the same item so they could make their mind up when they are delivered, all of which is facilitated by the retailer at great cost.

While it might seem logical to have stricter returns policies, or make customers cover the cost of returns, consumer expectations make this a risky strategy. According to the 2017 UPS Pulse of the Online Shopper survey, 68% of shoppers view returns policies before making a purchase. This leaves retailers with a catch-22 situation when it comes to losing out on online sales or losing profits from processing the inevitable returns that comes with those sales.

What are the challenges of retail returns?

So why are returns such a strain on retailers?

Cost of returns – First and foremost is the simple cost of returns. Since returns are in themselves essentially lost sales, the added cost of returning them, which according to CNBC is on average 30% of the purchase price, can heavily impact retailer’s margins.

Processing returns and reverse logistics – On top of this is the resources and effort of processing returns and getting the stock back available to be sold as quickly as possible. This reverse logistics can be particularly challenging and can result in returned stock not being available for purchase again for some time, often leading to out-of-stocks on the webshop. According to the Barclays report, 57% of retailers say that dealing with returns has a negative impact on the day-to-day running of their business.

Contamination concerns with COVID-19? – A unique and recent challenge, particularly for apparel retailers, is dealing with the potential contamination and contact of returned good with the COVID-19 virus. Initial research suggests that the virus can only survive on fabric surfaces for 24 hours, but for up to 72 on plastics like packaging. This will need to be addressed by eCommerce retailers who continue trading throughout the epidemic.

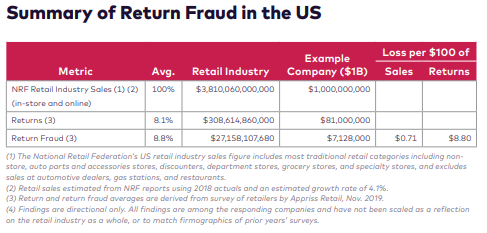

Return fraud – This is a challenge shared by brick-and-mortar stores. Fraudulent returns cost the US alone 27 billion dollars a year. This can involve the ‘returning’ of stolen merchandise for cash, stealing receipts to enable a false return or using someone else’s receipt to return unpurchased store stock. Naturally, using receipts for returns presents a risk, APPRISS found that receipted returns are more than twice as likely to be fraudulent as other methods.

How to reduce the impact of returns on eCommerce

So what options are there for retailers looking to tackle their returns problems?

- Reduce the likelihood of returns, without harming customer experience or sales: Include accurate and detailed product descriptions. Use uniformed/standard sizes where possible and provide a more specific sizing filter. Offer virtual ‘try-ons’ with augmented reality/3D imaging.

- Set clear and accessible rules regarding returns: Make sure customers know what and how they are allowed to return items, this reduces spending resources processing illegitimate returns.

- Improve visibility: Maintain a single view of stock with item-level inbound and outbound processes, this will also allow for online returns back to stores, and ship-from-store. Make this visibility accessible to your entire team and your customers.

- Improve efficiency of inbound and outbound processes: Utilise reliable & efficient technologies and automated processes like exception handling. One of the leading technologies for this is RFID, which prevents the need to open any boxes or packages as it can count and verify items without direct line of sight.

- Improve internal processes: Ensure returns processes (and supporting software) enables additional layers of merchandise management such as grading items based on quality and tracking when the item was returned.

- Counter Return Fraud: Verify legitimacy of returns as much as possible, best practise involves unique item-level validation like RFID or unique serial numbers.

- Ensure returned stock is safe to sell: Implement processes to ensure returns are not damaged in any way, implement a policy to account for safe handling of merchandise during theCovid-19 pandemic, either sanitising products or leaving them a set amount of time before adding back into webshop stock.

Using RFID tagging and looking to improve return processes?

NEW: eCommerce returns module

eCommerce/ DTC is increasing due to COVID-19. This causes an over proportional increase in returns which normally would require a ramp up of staff and equipment to handle the process – Detego’s new RFID enabled return process provides an approx 90% productivity increase.

Want the latest retail and retail tech insights directly to your inbox?

The Current Impact of COVID-19 on Retail

Supply Chain Chaos

Retail manufacturing and production have been heavily disrupted by COVID-19, particularly in China. In apparel and textiles, China is still the world’s biggest exporter. Even apparel manufacturers based elsewhere are often reliant on textiles imported from China. China being hit by COVID-19 and having to shut down factories and production has caused huge supply chain and production disruption around the world, with luxury retailers like Burberry and Prada being hit particularly hard.

As more and more countries are affected, supply chains may be disrupted further downstream. Larger distribution centres that service multiple countries could be most problematic, not only for fears of contamination but stores in countries that aren’t as heavily affected could have their product supply disrupted. On the other hand, since China was affected by the pandemic first they may recover first, so by the time other countries are beginning to come out of lockdown and preventative measures, this supply bottleneck may well be clearing further upstream.

Shutting of physical stores & reduced footfall

Across the globe brick and mortar sales are suffering. Stores are either being closed on government orders or simply being closed by the retailer to protect staff and public. The stores that remain open are being hit by the heavily reduced footfall as the majority of the public attempt to avoid unnecessary social contact.

The effects of this on revenue have the potential to be fatal. Lost sales are damaging enough, but when you factor in continued overheads for stores like rent, wages and inventory, it is a dangerous situation. Only time will tell how damaging these effects will be on retailers across the globes, with the main variables being:

- How long areas remain affected & stores are closed for.

- To what extent a retailer’s eCommerce operation can pick up the slack (more on this below)

- How big or financially stable the retailer is prior to the epidemic – large tier 1 & 2 retailers may be able to shoulder the burden for longer than their smaller or independent counterparts.

Spike in Online Sales

With many stores closing and consumers avoiding most of the ones that remain, it’s no surprise there has been a spike in online shopping due to COVID-19. This is exemplified by the eCommerce kings Amazon who are taking on 100,000 extra staff across the US as it tries to keep up with a surge in orders sparked by the pandemic.

Whilst its good for both the retailer and the consumer that most brands now operate both on and offline, the sudden shift in proportion between online and offline sales may cause retailers problems if they struggle to keep up with demand. These issues include fulfilment centres not coping with increased demand and the amount of returns that come alongside online orders.

The other major consideration for many retailers is the typically smaller margins on eCommerce orders compared to brick and mortar sales, meaning that they may not be able to rely on their eCommerce branch to survive for too long.

Future Considerations

So, what might a post-COVID-19 retail landscape look like? Will retailers take lessons from the crisis and bolster their infrastructure so they are more prepared for similar events in the future? Or once the dust settles will this be counted as a freak event and forgotten about? Here are possible considerations for retail life after COVID-19.

Continued advancement of e-commerce

This was bound to happen even without the pandemic, but COVID-19 may just have accelerated, or at the very least highlighted, the growth of online shopping and its advantages over physical retail. It is likely that retailers with a strong eCommerce offering will come out of the slump in a much better position.

For multi-channel retailers who had to rely on their online sales more than ever during COVID-19, evaluation into their eCommerce operations, particularly at their efficiency and smaller margins, are very likely. This may take the form of bolstering their supply chain technology and distribution centres, to increase efficiency and reduce running costs to see better margins in the future.

Diversifying manufacturing facilities

Steps have been gradually made in this area even before COVID-19, but in the aftermath of the pandemic, this may be a real concern for retailers and manufacturers. The problem isn’t China, or anywhere in particular. The problem is having such a heavy reliance on a single market, which then becomes a single point of failure for the business. Profit margins will always be a priority, but more cautious retailers and manufactures may look to diversify their production operations to be less reliant on a single region in the future.

Source-to-consumer traceability in supply chains

This is another area that was already a growing priority for many retailers. In the aftermath of COVID-19, it is likely to be even more of a concern, for both retailers and consumers. Not only does traceability help create smoother operations in the supply process, but it can offer assurances to consumers who may have growing concerns about where their products are sourced. With item-level traceability being where the industry is headed, consumers will be able to judge for themselves that their food, clothing and other things they bring into their homes is safely made and transported.

Automated warehouses and supply chains

The other element of the retail supply chain and distribution process that may change in the future is a heavier reliance on automation. This will make supply chains and distribution centres more robust, so able to withstand increased pressure. Automating processes like exception handling also means DC’s can run faster and with a leaner workforce.

Why may retailers look at automating supply chain operations in the future?

- More efficient – can deal with larger quantities of goods

- More accurate can deal with larger demand without creating bottlenecks

- Takes the reliance away from human resource constraints

Self-service stores and cashierless checkout

Finally, could the coronavirus be a catalyst for increased investment in self-service technology like cashier-less stores? We’ve seen retail giants like Amazon and Sainsbury’s explore these initiatives, but they have yet to be adopted on a large scale. Could that change? It may feel like a knee-jerk reaction to invest in technology that supports reduced human interaction but, particularly for supermarkets, solutions like Marks and Spencers’ mobile scan & pay could alleviate pressurised checkout lines.

Conclusion

We’ve gone over the major concerns for retail, the possible impact they could have, and the potential knock-on effects of the COVID-19 pandemic on the retail industry. But the fact is no one really knows. We are in uncharted waters, and for now, retailers are just struggling to ride the wave to the other side.

What we do know is this will pass. The main question for retailers that will determine the severity of the pandemic’s impact is when. Whilst this isn’t the second ‘retail apocalypse’, it is more than likely that the retail landscape that comes out of the coronavirus crisis may be very different from the one that went into it.

Want to learn more?

Apparel Retail’s New Normal: COVID-19 Impact and Future Trends

Webinar

Now stores are facing new social distancing guidelines, the formula for customer experience has changed. With reduced foot traffic and higher levels of eCommerce, the digital evolution of the retail store is now or never. Join us on the 16th of June as we dive into the physical and digital transformations behind retail’s ‘new normal’.

When it comes to digital transformation, RFID (Radio Frequency Identification) has been the hype in retail for several years now. It has, however, been a bumpy road to success. In the past, stories of failed implementations and botched rollouts were far too common and kept many retailers from taking the plunge. Thankfully these days the picture is much more encouraging. We are now spoilt for case studies and examples of retailers having enormous success with the technology to digitise their inventory and processes for the modern retail environment.

So, what makes the difference between failure and success?

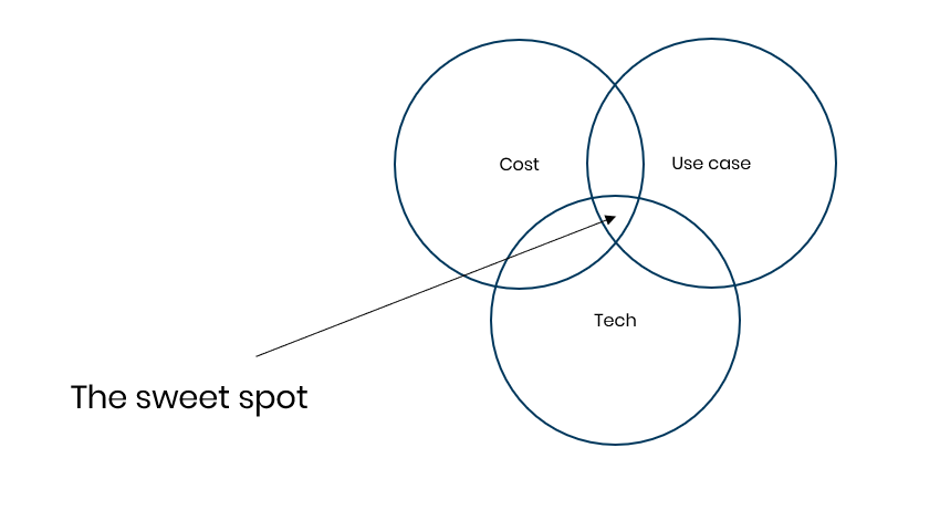

Ultimately it comes down to a combination of knowledge, technology and price. Improvements in all three of these areas have evolved the technology into a vital component of any digital transformation journey in retail. But as with any transformative project, getting the detail right is vital. The approach to implementation and suppliers you choose to engage with will have big implications on ROI.

A best-practise approach is easier said than done, so you need to surround yourself with a team of experts who have skin in the game and ensure the solution you choose to implement has the capabilities to lead your digital transformation for years to come.

Our recommended 6 steps to digital transformation with RFID:

1. Understand the problems you want to solve and clearly define the KPIs

The first step in any new tech investment is to be sure that you have clarity around what problems you are hoping to solve. This will often require some hard-hitting questions and honest auditing of current processes and data to understand where you and your customer’s biggest pain points are. Customer feedback surveys are always a good way to gain insight into this.

What common retail problems can RFID solve?

- Stock inaccuracy leading to out-of-stock situations

- Poor product availability on salesfloors and webshop resulting in lost sales

- Labour costs and operational inefficiencies

- Reduction in excess/safety stock

- Inventory visibility and supply chain traceability

Luckily, these problems all have clear KPIs related to them and can be used as a great measurement tool to understand your current position and build a business case for the investment.

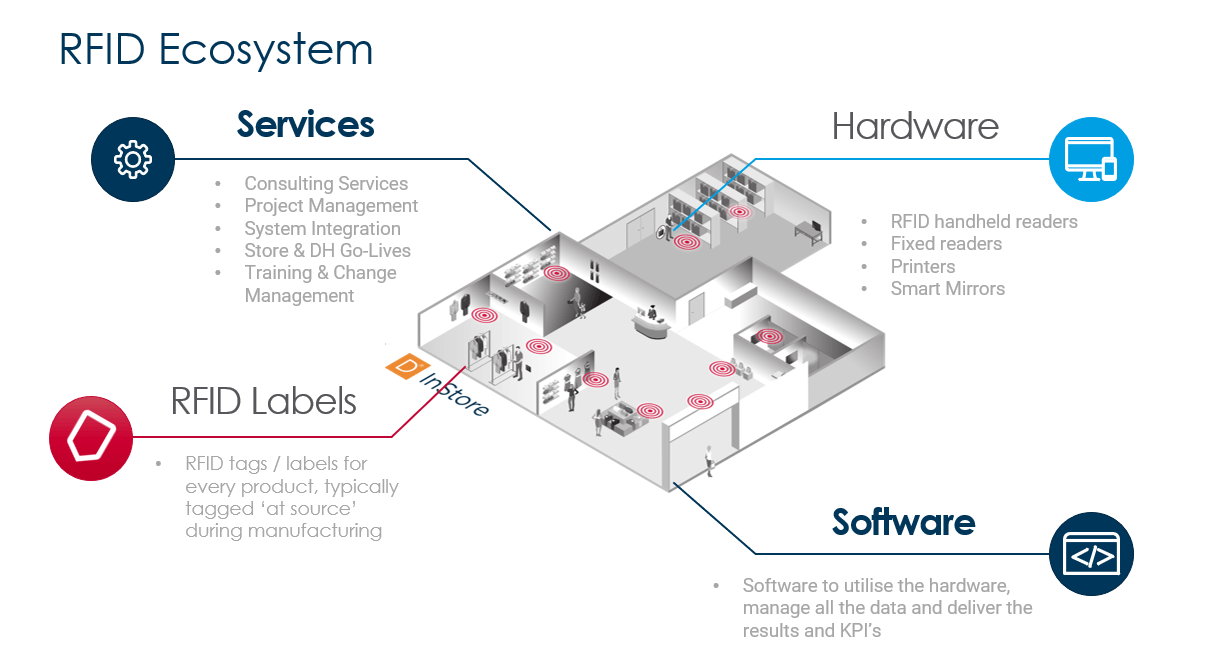

2. Choose a software partner that will help you achieve more

Once you have clearly defined RFID as the technology you want to implement, it is then vital to choose the right partners to go on your digital transformation journey with. Within the RFID market, there are generally three partner types – hardware, labels and software. The software component is the most important aspect as this must be able to process all the data, integrate with existing systems and empower employees with user-friendly applications to improve daily processes. Choosing the best-suited partners will make all the difference to ensuring you have a scalable and future proof solution for the next 5+ years.

What to look for in an RFID software partner?

- Credibility in the market – do they have proven RFID deployments with reputable brands in your sector?

- Future-proofed services – do they have a product roadmap that inspires innovation and constant improvement?

- Scalability and flexibility – does the solution fit your business needs and implementation roadmap?

- Industry expertise – do they have deep industry knowledge to understand your specific business requirements and help you think through these challenges?

3. Trial the solution, prove the business case

Any digital transformation project requires buy-in from multiple departments and key decision-makers. The best way to achieve this is to prove the business case in a live retail environment. This is done through a ‘Pilot’ process whereby the solution is tested in around 3-5 live stores, allowing for the critical KPIs to be assessed and to gain a clearer understanding of the implications for store processes. With SaaS-enabled solutions, this process can be done more efficiently through the use of cloud-hosted mobile solutions, essentially making them ‘plug & play’.

What does the pilot process involve?

-

Tagging party of all items in Pilot stores with RFID labels

-

Product Master Data uploaded to SFTP (or FTP)

-

Training of store associates

-

Use of handheld readers and mobile app to perform daily store operations

-

Daily KPI tracking to analyse results:

- Improvement in stock accuracy

- Improvement in on-floor availability

- Increase in sales

4. Store rollout with speed for immediate ROI

Although it seems attractive to enable all of the features and RFID-enabled services in one go, and undergo a digital transformation overnight, the reality is often different. Instead, retailers should approach implementation in phases to manage the changes in process and IT requirements. A best-practice approach to RFID implementation should focus on improving the fundamental processes that will bring the most immediate ROI to the business. These processes include stocktakes and replenishment to significantly increase stock accuracy and on-floor availability within stores. Improving these two KPI’s generally results in a direct sales uplift of 5-10%. From there, you can re-invest returns back into the continuous enablement of RFID throughout your business.

What elements are most critical to a successful store rollout?

-

Speed and ease of implementation

- New innovations such as Smart Shielding removes the need for physical shielding installations – saving time and money.

- SaaS-enabled platforms allow for scalable pricing models and cloud-hosted solutions.

- Open APIs allow for easy system integration with ERP

-

Support services

- Training to educate staff on the changes in daily processes

- Customer success and support to maximise the use of the software

-

Change management leadership

- Ensuring you have a dedicated team to oversee the rollout

5. Full omnichannel enablement

After securing the foundations of stock accuracy and on-floor availability in stores, the next step is to connect the online and offline business. Omnichannel services such as click & collect (aka BOPIS) and Ship-From-Store are expected in the modern retail environment as consumers demand to shop anywhere, anytime and any way they want. However, it’s important to ensure you can deliver on these retail experiences so that customers don’t end up disappointed. Enabling this requires connecting inventory from your store networks with your distribution centres and webshop to create a single and transparent view of stock.

What’s required for Omnichannel retailing?

- Transparent view of stock across all stores made available to the online store

- Automate warehouse processes with RFID tunnel and outbound processes

- Offer new services such as click & collect, ship-from-store etc.

6. Unlock the true power of RFID with new retail experiences

Stock accuracy, product availability and omnichannel services are synonymous with RFID in retail and should always be the focus of any digital transformation utilising the technology. However, there is also an unlimited amount of untapped data and potential that is a sitting gold mine once you have RFID implemented throughout the supply chain. New solutions for consumer engagement and artificial intelligence engines can now be utilised to provide new services, experiences and insights for retailers and consumers alike.

What new innovations can be enabled?

Interested in discussing your RFID Journey? Talk to the experts.

At Detego we know retail and we know RFID. This combination has enabled us to develop the most innovative RFID software solutions on the market, alongside major global fashion brands. With RFID now on almost every retailer’s roadmap, we have the answers for any step of the journey, anywhere within your operations.

Everyone has to start somewhere, which is why we have out-of-the-box solutions to quick-start your RFID journey. Alternatively, if RFID is well and truly ingrained in your business, then talk to Detego about how we are using AI and innovative new practices to take real-time decision making to the next level.