The Golden Quarter of Retail, approximately between October and December each year, is typically retail’s most profitable period. Shoppers are planning for the Christmas period earlier than ever–59% of consumers will plan gifts at least a month before the holidays–and Black Friday offers another opportunity for companies to maximise profits.

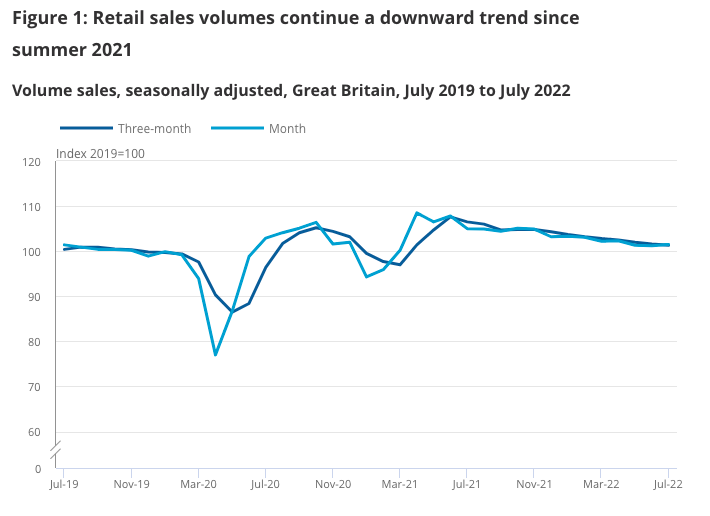

However, the Golden Quarter of Retail has been anything but golden in recent years. In 2020 and 2021, the Covid-19 pandemic affected Christmas footfall, and consumer spending has decreased from pre-Covid years. Between October and December 2021, sales of non-food items fell by 8% compared with 2019 levels, and now we are amidst a cost of living crisis.

When consumers were surveyed in early 2022, there was still some hope for this year’s Golden Quarter. Crucially, almost a fifth of consumers said they would increase spending in the same period in 2022 compared to 2021. The cost of living crisis has put a stop to this. With households increasingly tightening their pursestrings, this year’s Golden Quarter could be very different.

Importantly, though, if consumers are going to spend, they will begin spending early. Last October, retail sales grew for the first time in six months as consumers took to the high street early for Christmas gifts. It could be that, to space out purchasing, consumers once again begin shopping early in 2022. The expansion of the Golden Quarter of Retail to early October–or even September–means that there are additional opportunities for companies to maximise profit.

So, how exactly will the cost of living crisis affect the Golden Quarter of Retail in 2022? And what can retailers do in response?

How Bad is the Cost of Living Crisis?

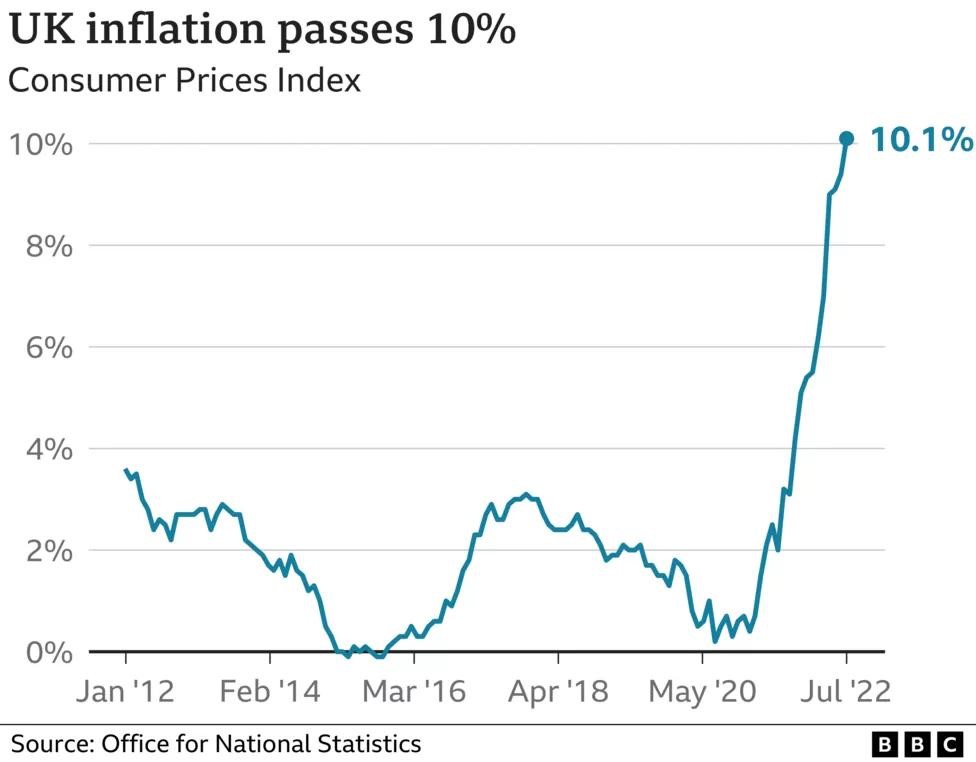

The inflation rate in the UK has been steadily rising for the last year. In August 2022, the rate hit a record-breaking 10.1%, and experts predict it could rise to at least 13% later in the autumn. It’s not just the UK that has been affected, though–across Europe, annual inflation has hit 8.6%.

There are lots of factors that have impacted the incredible rise in inflation in Europe and the UK. The biggest of these factors is undeniably rising energy prices, caused by Russia’s war on Ukraine and the increase in energy demand after the Covid-19 pandemic restrictions were lifted. To put energy price hikes in perspective, natural gas prices rose 96% between January and July 2022 in the UK. In the same period, electricity prices experienced a rise of 54%.

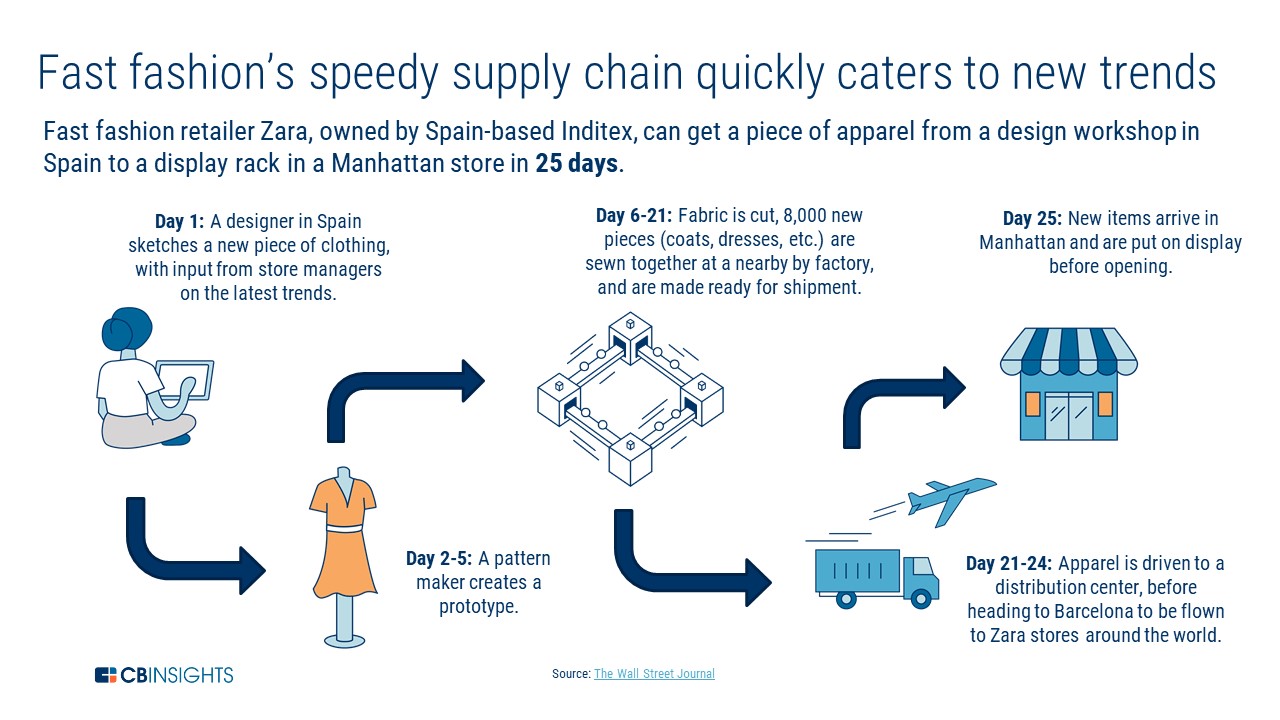

As well as energy bills, the war in Ukraine is also affecting food prices and further disrupting supply chains–another major headache for retailers in the last few years. Supply chain disruption has increased the cost of other goods, including raw materials, which will also affect the price of consumer products this year and into 2023.

Evidently, the cost of living crisis is severe and bodes for a challenging winter for both retailers and consumers. Unfortunately, the rising cost of goods and household utility bills are affecting consumer spending. This won’t surprise analysts, who predicted back in January 2022 that retail sales would be at risk this year. At that time, a survey from Barclays revealed that 43% of consumers expected rising inflation to affect their spending and household budgets.

That prediction seems to have come true. In August 2022, card spending in the UK fell by 1.9%, with consumers cutting back on purchases of clothing, DIY, and beauty products. Analysts at J.P. Morgan have alerted retailers that the cost of living crisis has “only just begun,” and future spending this year could fall by 10% if there is no energy price freeze in the UK.

The retail sector has been particularly affected by the cost of living crisis. In fact, it is the worst-hit sector in Europe in 2022, down 38%; the FTSE 350 Retailers Index has also dropped by 33%. This, along with the potential for more inflation hikes in the coming months, means retail faces a challenging Golden Quarter.

The Golden Quarter of Retail: How It Will Be Affected in 2022

The most significant effect of the cost of living crisis won’t be a surprise: reduced consumer spending. We can already see this happening as households prepare early for a challenging winter. Not only are consumers cutting back on purchasing non-essential items, but they are also reducing their impulse buys, instead waiting for opportune times to purchase.

As a result, Black Friday could prove far more critical in 2022 than in previous years. In fact, 51% of shoppers say that they consider Black Friday a vital time to make money go as far as possible. So, while households may have reduced spending power, they are still planning on spending.

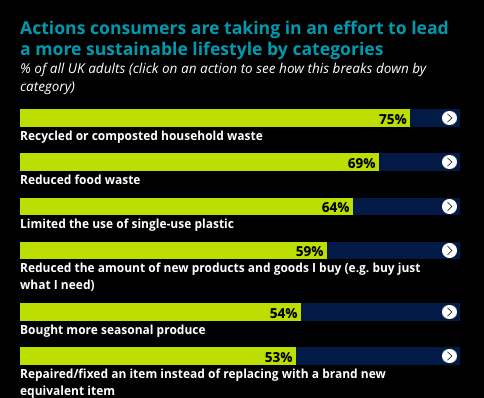

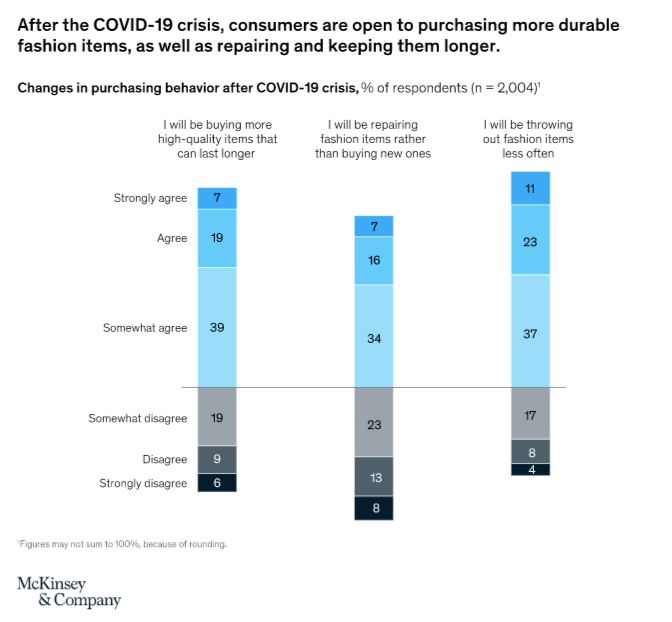

However, it’s also clear that consumers will be more selective about how they spend. As well as waiting for opportune moments like pride reductions, consumers may also be concerned about the quality of their purchases. We’ve already seen how sustainability has become a major factor in purchasing decisions over the last year. However, this could become more important when combined with the effects of the cost of living crisis.

Deloitte’s Sustainability and Consumer Behaviour Survey 2022 details how consumers are adapting their spending in light of environmental goals. The survey results highlight that people are embracing circularity and opting for more durable products. For example, over half of people (53%) have repaired an item in the last 12 months rather than replacing it. Additionally, 40% of people have bought second-hand or refurbished goods rather than new products. These decisions may not just be rooted in sustainability but also in reducing spending.

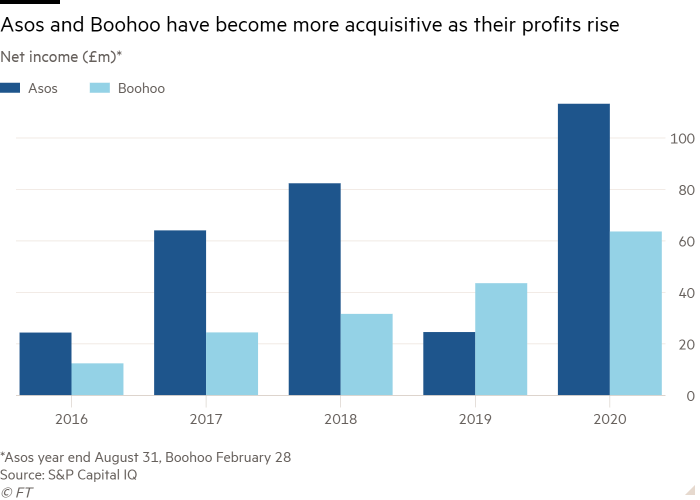

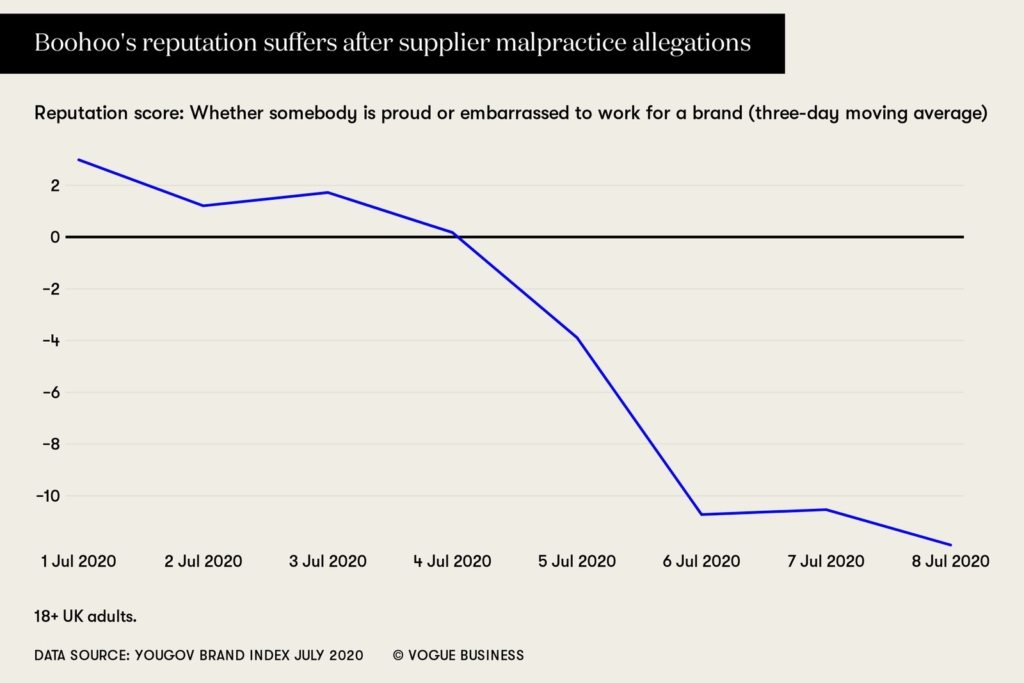

There is some proof already that shoppers are turning to preloved or second-hand goods specifically to combat the cost of living crisis. When asked why consumers buy second-hand items, 36% said they did it for sustainability reasons, while 32% said it was to cut costs. In particular, 35% of people who bought used products say it could make their money go further. Retailers are already taking advantage of this trend in anticipation of the Golden Quarter of Retail; earlier this year, fast fashion brand Boohoo launched their PrettyLittleThing resale site.

Aside from shifting consumer behaviour, inflation, and the subsequent cost of living crisis, will also impact operating costs for retailers. Rising energy prices will affect international retailers and smaller businesses, and the cost of raw goods may influence which products end up on shelves.

Despite pressures in the Golden Quarter of Retail this year, there is still cause for retailers to be optimistic. While 88% of shoppers say they are concerned or very concerned about the cost of living crisis, 91% of people who usually buy on Black Friday say they will be as engaged this year. Adapting to these shoppers–and their new spending habits–will be paramount if retailers are to see growth during the coming months.

What Can Retailers Do in Response to the Cost of Living Crisis?

It may appear that very little can be done to adapt retail strategy in the face of the cost of living crisis, especially when it’s set to impact every part of retail, from consumer behaviour to operating costs. However, there are still opportunities for companies as they prepare for the Golden Quarter of Retail. The extent to which companies can capitalise on lower consumer demand will depend on how well they can adapt their strategy and ride consumer trends.

In particular, there are three aspects retailers should prioritise as we go into the Golden Quarter of Retail in 2022: actual consumer demand, process efficiency, and supply chain visibility. Focusing on these factors will lead to an optimised retail strategy and greater chances of encouraging purchasing in the Golden Quarter of Retail.

Stock According to Demand

Preventing overstocking will be a crucial priority for retailers this winter. Excess inventory can represent an additional annual cost of between 25% and 32%, so knowing exactly which products and how much to stock will be imperative.

Paying attention to in-store and online consumer behaviour can help retailers determine which products will see more sales in the Golden Quarter of Retail. If retailers can quickly respond to changing behaviour, they will likely encourage consumers to part with their hard-earned cash during a difficult period.

Improve Process Efficiency

Operational efficiency is always vital, especially during a period of high retail costs. Preparing for the Golden Quarter of Retail will mean extracting as much value from current processes and labour as possible. Improving the efficiency of inventory counts will be paramount, as will reducing the amount of time staff spend searching for required products for customers on the shop floor.

Prioritise Supply Chain Visibility

Finally, retailers should seek to increase the transparency of their supply chains. Not only will this optimise processes by providing data on how retailers can adapt supply chains to reduce costs and increase efficiency, but it can also provide customers will valuable data on retail sustainability: something we know is becoming a significant factor in purchasing decisions.

How RFID Can Help Retailers Adapt to the Cost of Living Crisis

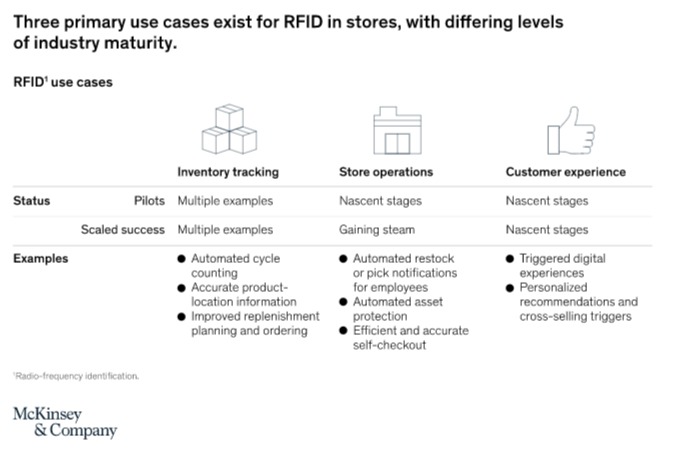

One piece of software connects these three focus areas: RFID technology. When retailers implement RFID tagging, they gain access to a wealth of data that can improve operational efficiency and ensure the shopping experience caters to consumer behaviour. RFID could mean the difference between a challenging Golden Quarter of Retail and a profitable one.

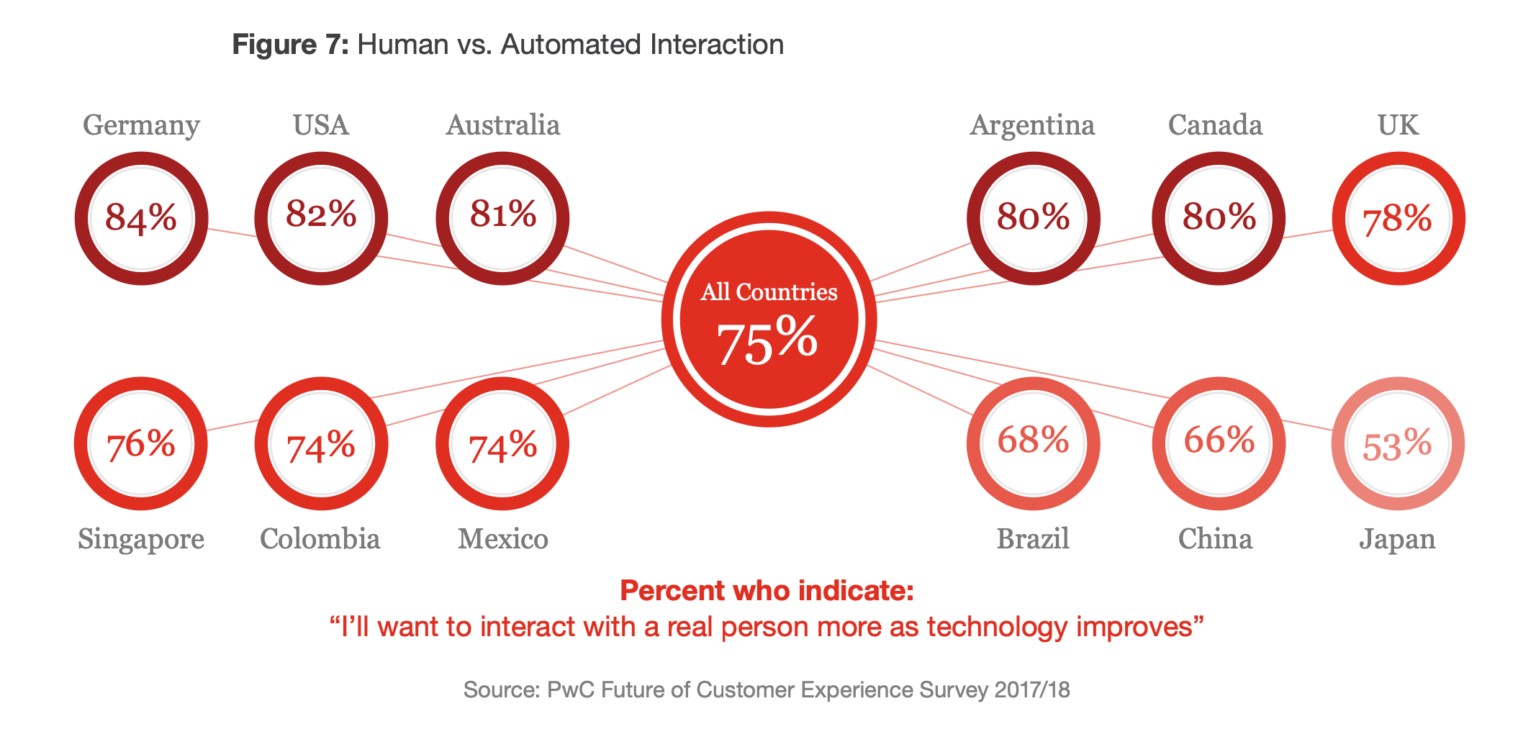

Firstly, RFID can improve processes in stores by reducing cycle count times by 96%. Workers are thus free to spend more time interacting with customers and building brand relationships, which can be a uniquely valuable task during a period of reduced consumer spending, offering returns into the future.

RFID technology can also increase stock accuracy to 99% from a global average of 60%-80%. This is paramount when retailers plan to stock particular products in response to shifting consumer behaviour. Improved stock accuracy can also reduce out-of-stocks, improving the likelihood of sales.

Finally, with RFID tags, products can be accounted for at every stage of the supply chain, offering unique data on operations. As retailers prepare for the cost of living crisis to endure into 2023, they must examine where cost-saving improvements can be made. This could mean changes to lower-cost delivery routes, which could also provide additional benefits to consumers in the form of faster shipping.

Though the Golden Quarter of Retail is set to be challenging this year, there are opportunities for retailers. However, responding to the cost of living crisis will require adaptability. This is a chance for retailers to invest in RFID technology to improve retail efficiency and cut operational costs.

Prepare for the Golden Quarter of Retail

Stock accuracy, on-floor availability, and improved supply chain visibility.

Book a demo with RFID to discover how our cloud-hosted RFID solution could help you maximise your profit during the Golden Quarter of Retail, even while navigating the cost of living crisis. Our multi-user app can provide intelligent stock takes and a smart in-store replenishment process. At the same time, you can effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

We’re over mid-way through 2022, and despite optimism regarding recovery from the recent Covid-19 pandemic, this year has had its own unique challenges for retailers. Across Europe, rising inflation has impacted consumer spending, while supply chain issues have also been exacerbated by Russia’s invasion of Ukraine.

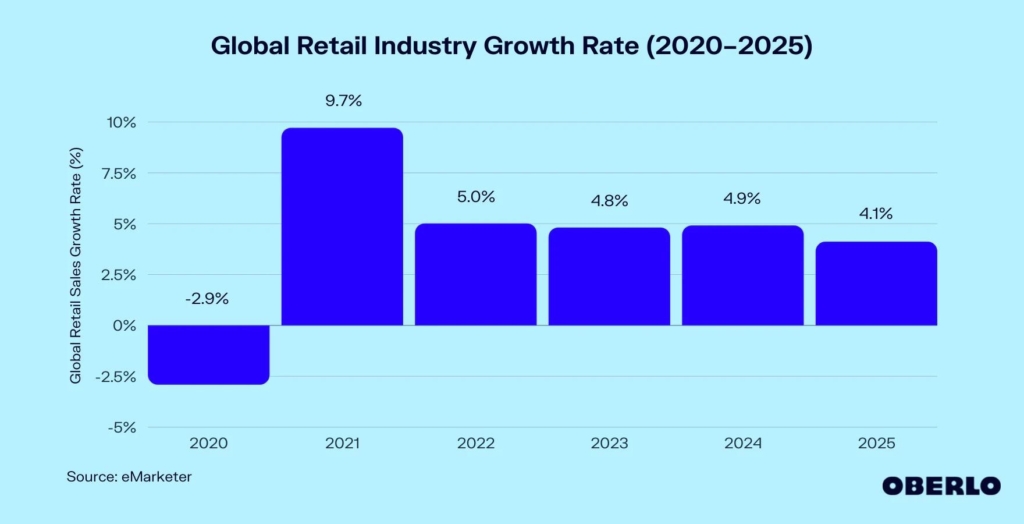

As a result, the retail sector is suffering from slow growth in 2022, which experts predict will worsen before it gets better. In the UK, retail is expected to grow by just 1.9% this year, accounting for inflation, compared with 3.9% growth in 2021. Globally, the retail sector will grow at 5%, half the rate of 2021.

With this in mind, many retailers will be looking optimistically to 2023. However, judging by early forecasts, there is still significant uncertainty in the growth rate for retail next year. In fact, according to some projections, the global retail industry growth rate is expected to slow to 4.8%.

These projections are concerning, but there are ways for retailers to capitalise on the meagre levels of growth in 2023, and that’s by putting in place a revitalised retail operations strategy for the new year. However, developing a successful 2023 retail operations strategy will require advanced knowledge of retail trends and flexibility in adapting brand operations.

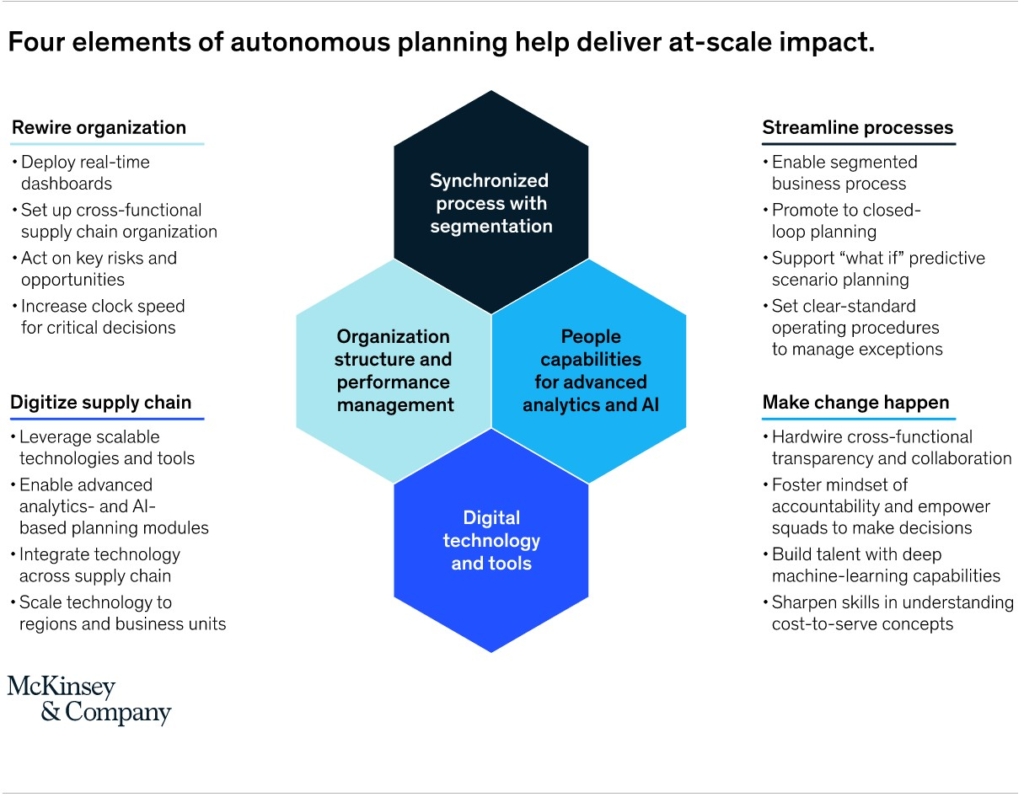

Three trends are crucial for retailers when considering their future retail operations management: omnichannel retail, in-store technology, and the future of bricks-and-mortar retail stores. Finally, retailers can also look at how RFID for retail can help improve their operations strategy in 2023.

While the retail industry will undoubtedly see further disruption throughout 2022 and into 2023, taking time now to build a successful retail operations strategy can future-proof your operations and help you weather the storm.

What Does the Retail Market Look Like in 2023?

The retail landscape has changed significantly over the past three years. Covid-19 transformed customer behaviour, forcing retailers to adapt their strategies. So, looking to the year ahead, what are the most significant trends that will affect how retailers plan their 2023 retail operations strategy?

Omnichannel

One of the biggest trends to have affected retail in the last five years is the growth of omnichannel retailing. We’ve examined this trend in previous articles, but it will become more critical in 2023.

Data already shows that retailers must be considering omnichannel in any retail strategy. Research from Nielsen has revealed that 91% of FMCG dollar sales come from omnichannel shoppers, and furthermore, FMCG consumers who shop both in-store and online represent 86% of all consumers.

The trend is the same in other retail sectors. While 55% of all consumers say they choose not to shop online because they lack control over their purchase, 45% of grocery consumers still prefer to shop both online and in-store.

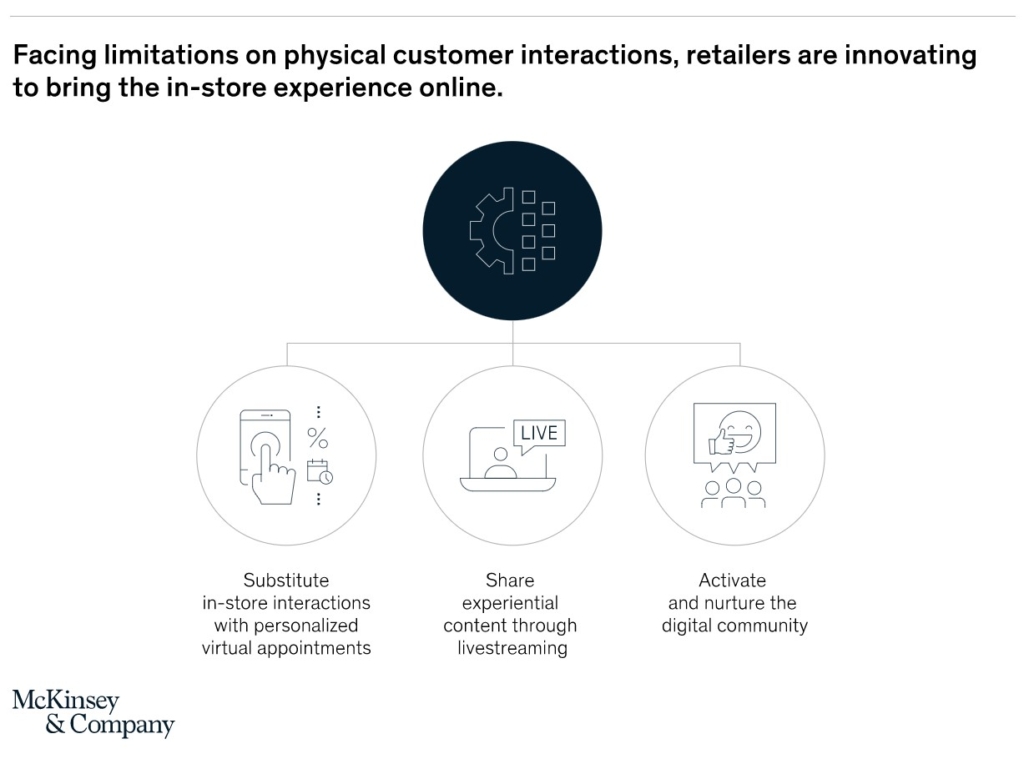

Brands can no longer plan their strategies solely around investing in their online brand–they must consider both in-store and online experiences, and plan additional fulfilment options for shoppers. This is even more vital as different channels come into play in the future, such as live-streaming shopping and social media shopping channels on apps such as Instagram.

In-Store Technology

While many retailers have already embraced the possibilities of in-store technology, in 2023, the trend is expected to become more mainstream as consumers’ expectations change. The traditional brick-and-mortar store of the past no longer exists; today, retailers need to provide interactive and entertaining shopping experiences to retain market share in a competitive retail sector.

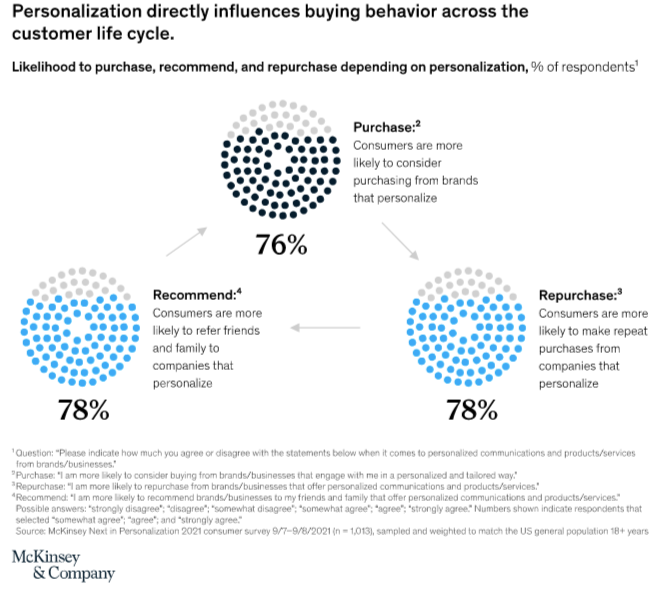

For starters, consumers are increasingly seeking personalised experiences. 71% of consumers already say that they want brands to offer them personalised experiences, whether this is in-store or online. An even more significant percentage (76%) say they get frustrated when this doesn’t happen. However, in-store shopping is still the dominant retail channel; retailers shouldn’t disregard this when creating their 2023 retail operations strategy.

Technology such as Smart Fitting Rooms, powered by RFID, can satisfy the customer’s need for personalisation and ensure stores make the best use of innovative technology. Smart Fitting Rooms can respond to customers in real-time and display additional information about proposed purchases whilst upselling similar products, all from the fitting room.

However, it’s not all about personalisation. In-store technology could also improve customer experience in other ways, for example, by installing cashier-less checkouts and in-store virtual assistants. This will contribute to a positive shopping experience and keep customers returning.

According to McKinsey, by 2030, technology will affect around one-third of all retail tasks in the UK. Considering how the pandemic has altered consumer behaviour and the shoppers’ expectations, it’s clear that in-store technology will be a crucial driver of brand loyalty and opinion in 2023.

Brick-and-Mortar Stores

As well as embracing omnichannel shopping and fulfilment options, retailers should also be reconsidering the purpose of their physical stores. We know that consumers now want to be entertained while they shop; shopping has become less of an act or chore and more of an experience. In-store technology can make this possible, but it’s also about reconsidering the possibilities of brick-and-mortar stores in your 2023 retail operations strategy.

For example, many brands now utilise their physical locations not just as shops but as event spaces, too, or solely as community spaces. Vans is a primary example of this: their London and Chicago ‘House of Vans’ locations incorporate an art gallery, skate park, cinema, and live music venue, plus cafes and bars.

On the other end of the spectrum, some retailers are turning their physical locations into ‘dark stores’ or ‘ghost stores’ – advanced distribution centres that offer consumers the chance to pick up their orders from the curbside or dispatch products from closer to home. With consumers increasingly asking for different shipping options (59% of consumers are interested in click and collect shipping options), this should be a vital consideration in any 2023 retail operations strategy.

How Supply Chain is Changing

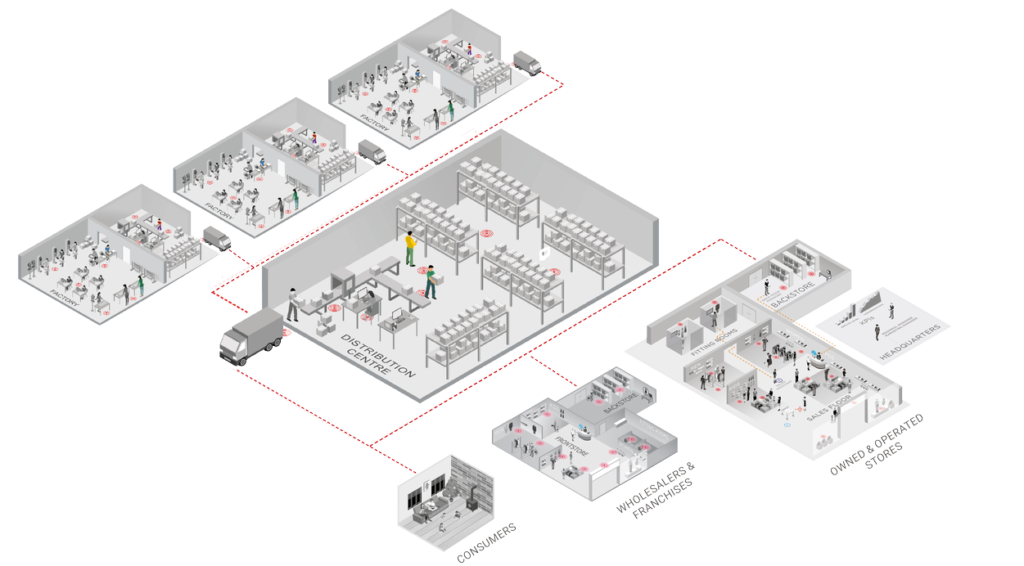

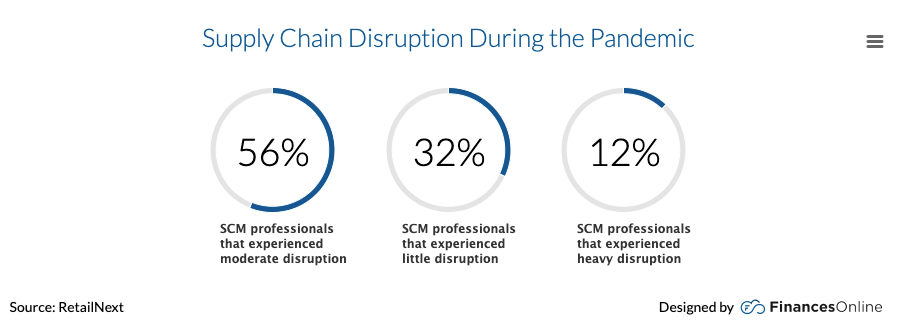

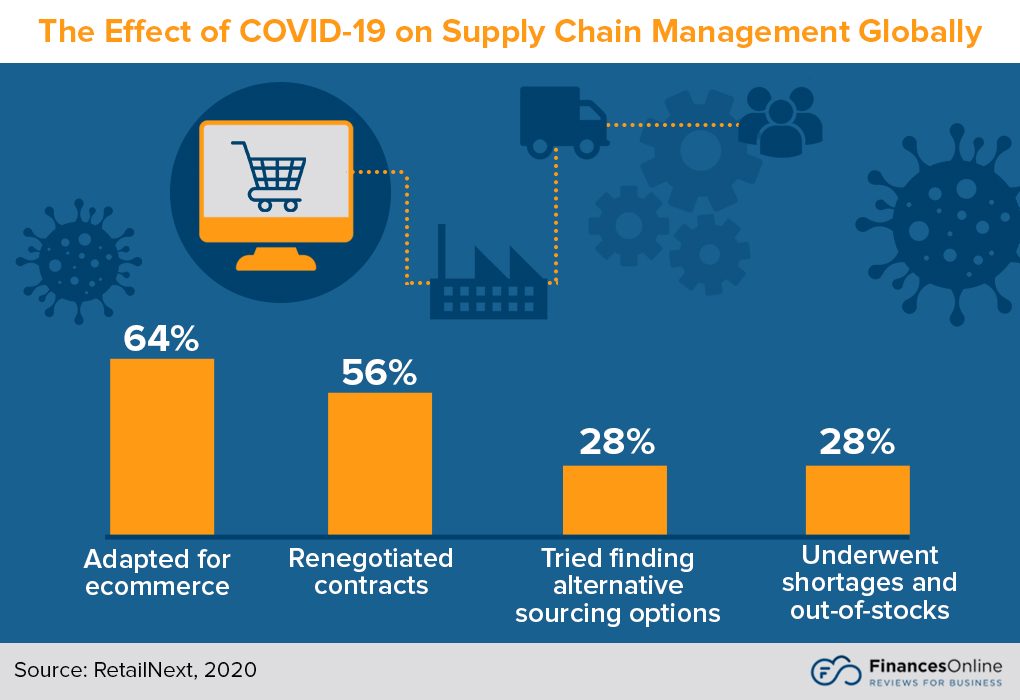

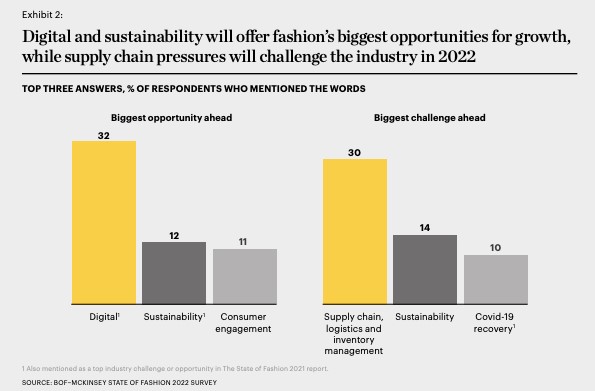

However, future retail trends won’t just affect the consumer experience. Supply chains have had a difficult couple of years; Covid-19 put significant pressure on retail supply chains, and consequently, they are innovating rapidly.

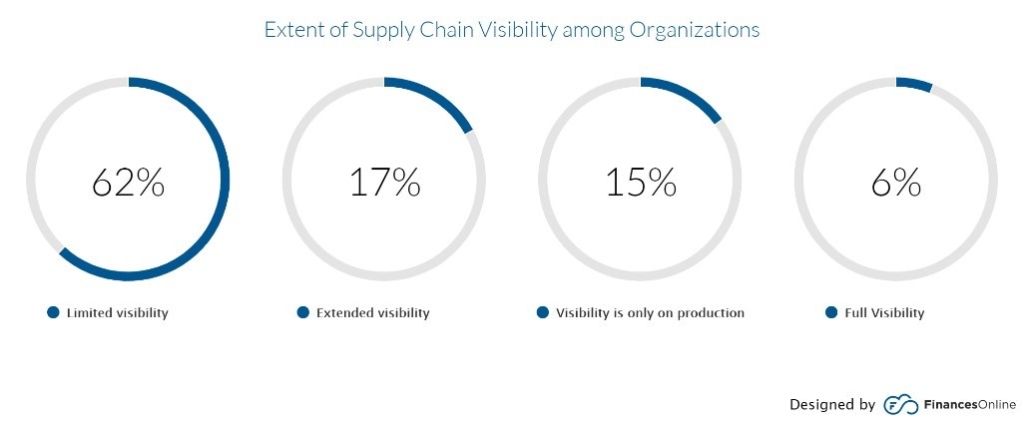

Supply chain disruption throughout the Covid-19 pandemic was extensive. Over half of supply chain management professionals say they experienced ‘moderate disruption’ during the pandemic. However, despite this, many retailers (62%) still have limited supply chain visibility, while 15% say that their visibility is restricted to production.

Supply chain problems during the Covid-19 pandemic have uncovered a pressing need for greater visibility and control over supply chains to prevent the same disruption from occurring in the future. To future-proof retail operations, supply chain visibility is a crucial element for retailers to consider within their 2023 retail operations strategy.

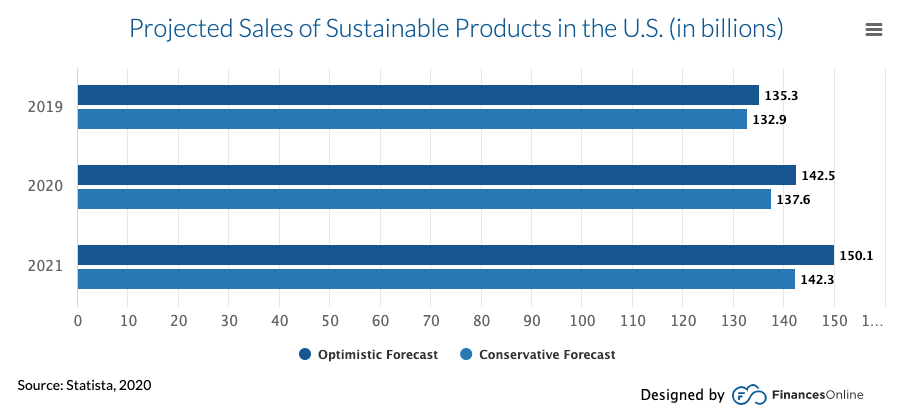

In addition to visibility, transparency is also vital. Since 2017, the number of online searches for sustainable goods has increased by 71%. Consumers now demand that retailers make sustainability a priority, in their products and the production process.

Not only does this mean switching to environmentally-friendly packaging where possible, but also being transparent about retail supply chains. As we mentioned in our recent article about sustainable fashion, supply chains can significantly impact sustainability: retail brand Patagonia state that 95% of their entire carbon missions come from their supply chain.

As a result, any brand’s 2023 retail operations strategy must consider how to make supply chains more transparent, both as a way to signal to customers that sustainability is a priority, and to identify areas of environmental improvement within the supply chain.

RFID for Retail: How Can it Help Streamline Retail Operations Management?

So, when creating a 2023 retail operations strategy, brands should be aware of how they can submit to consumer trends and changes in supply chain strategy. Thankfully, one solution covers both of these things: RFID for retail.

Firstly, when retailers implement RFID in stores, it can offer retailers up to 99% inventory visibility, compared to an average of around 60%-80% visibility. Inventory visibility is key to omnichannel retailing, as brands need a high-level view of all the stock they have and where it is, whether in a warehouse, distribution centre, or on the shop floor.

Similarly, RFID for retail can help retailers expand personalisation in stores and anticipate the trend towards increased automation and technology in retail. In virtual fitting rooms, for example, RFID technology can help display stock levels of items in stores and online and encourage customers to buy.

We’ve also mentioned how retailers should consider offering consumers additional shipping options like pick-up-from-store or ship-from-store. There’s certainly value in adapting physical locations to become ‘dark stores’, but this is only possible if retailers have in-depth data on their stock. RFID for retail can provide this.

Finally, over the last two years, supply chain disruption has exposed the need for greater visibility in supply chains. Only with up-to-date data can retailers strengthen their supply chains for possible future disruption. RFID technology can offer retailers advanced data about supply chains and inventory, giving senior retail operations management teams knowledge of weak points in supply chains.

Retailers can also harness RFID data to explore the environmental impact of supply chains. Retailers who want to prioritise their sustainability practices can also opt to publish this data, increasing their reputation for sustainable retailing.

Why You Should Invest in RFID for Retail in 2023

We’ve outlined how RIFD for retail can help expand and future-proof your 2023 retail operations strategy, but why is now the right time to implement the technology?

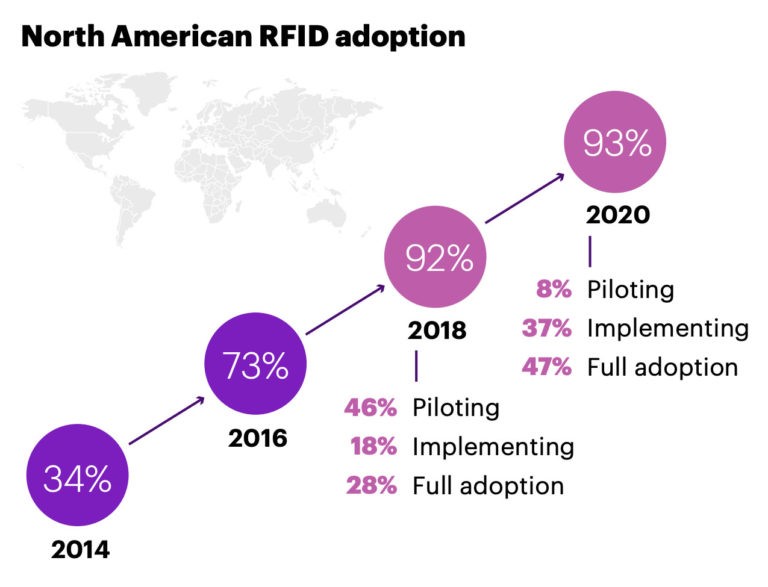

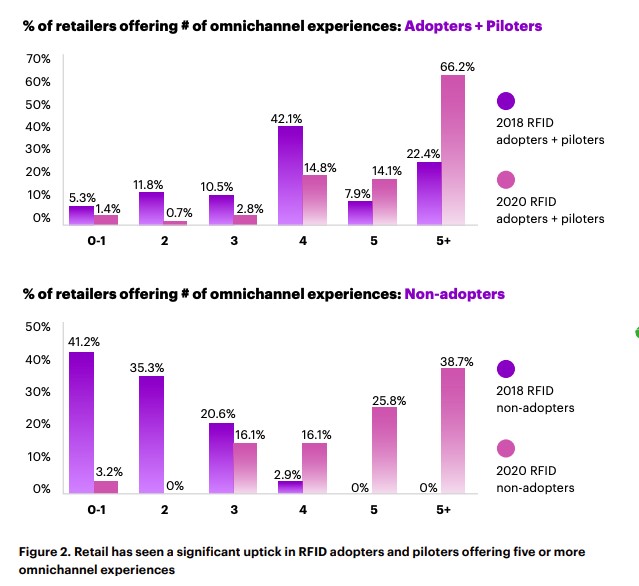

Global RFID adoption has significantly increased in recent years; in North America in 2020, 93% of retail chains were using the technology, up from just 34% in 2014. As a result, the technology is said to have surpassed the ‘tipping point’ where RFID for retail technology is now widespread.

This year alone, major retailers such as Walmart and Nordstrom have announced that they will be incorporating RFID into their future retail strategy, starting at the end of this year. Similarly, next year Michelin will finish incorporating RFID technology onto all of its tyres.

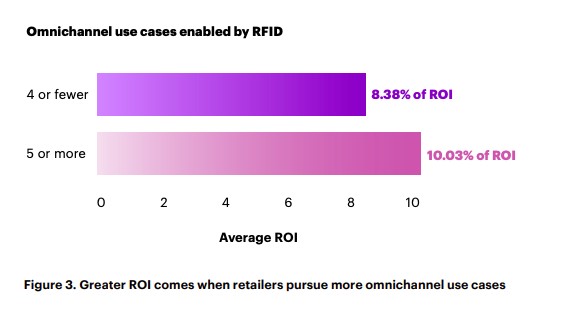

Increased adoption of RFID globally has also significantly impacted the cost of the technology. The average cost of an RFID tag has fallen by 80% in the last 10 years. Similarly, the cost of RFID readers has also dropped by 50%. In that time, the accuracy of RFID technology has doubled, while the number of possible use cases has soared. Now, McKinsey predicts that RFID for retail can unlock 5% top-line growth for retailers.

With retailers increasingly grappling with frequent supply chain disruption and consumers asking for new ways of shopping, there has never been a better time to implement RFID into your 2023 retail operations strategy. This technology will improve your retail operations management and ensure that your future retail strategy maximises profits.

Retail operations RFID management software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Book a demo with RFID to find out how our cloud-hosted RFID for retail solution could help improve your 2023 retail operations strategy. Our multi-user app can provide intelligent stock takes and a smart in-store replenishment process, and later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

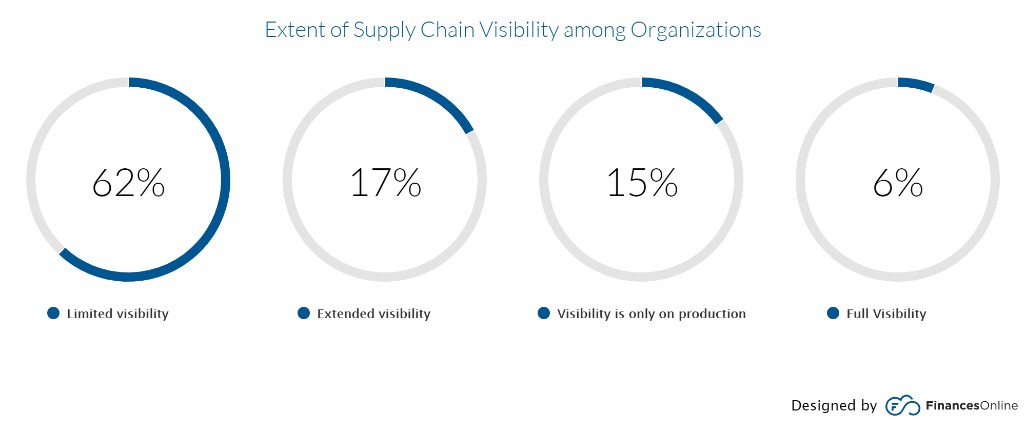

While the effects of the Covid-19 pandemic may be lessening, retailers still face plenty of challenges in 2022. Supply chains remain volatile as countries around the world experience new waves of Covid-19 infection, and companies are also struggling with worker shortages.

In addition to this, inflation is affecting retail operations. Businesses are seeing price hikes for raw goods and logistics, and this inevitably means that consumers are going to see the cost of products rise in-store and online.

Despite the evident challenges, though, there are still opportunities for retailers to grow this year. In the United States, retail sales are expected to grow by between 6% and 8% in 2022, though there will be a shift towards services rather than material goods. While inflation is driving up living costs, consumers still want to spend their hard-earned money, but there may be fewer spontaneous purchases.

To capitalise on the forecasted growth this year, retailers must be prepared to make changes to their operations and retail strategy. Firstly, businesses need to focus on finding solutions to supply chain pressures, which may require investment in technology such as RFID for retail. Secondly, retailers need to be aware that customer spending may decrease this year, and as such, building customer loyalty is paramount.

The solution to both of these could be cloud-based inventory software. More than just a way to track stock throughout the supply chain, cloud-based inventory management offers a 360-degree view of your operations, helping you pinpoint the areas that need more help going into 2022.

Retail in 2022: The Challenges

It’s tempting for retailers to think that, because the pandemic is having less of an impact on store footfall and spending now, the retail world is back to normal. Sadly, this is not the case. There are still distinct challenges that retailers must tackle in 2022, the first of these being continued supply chain disruption due to the pandemic.

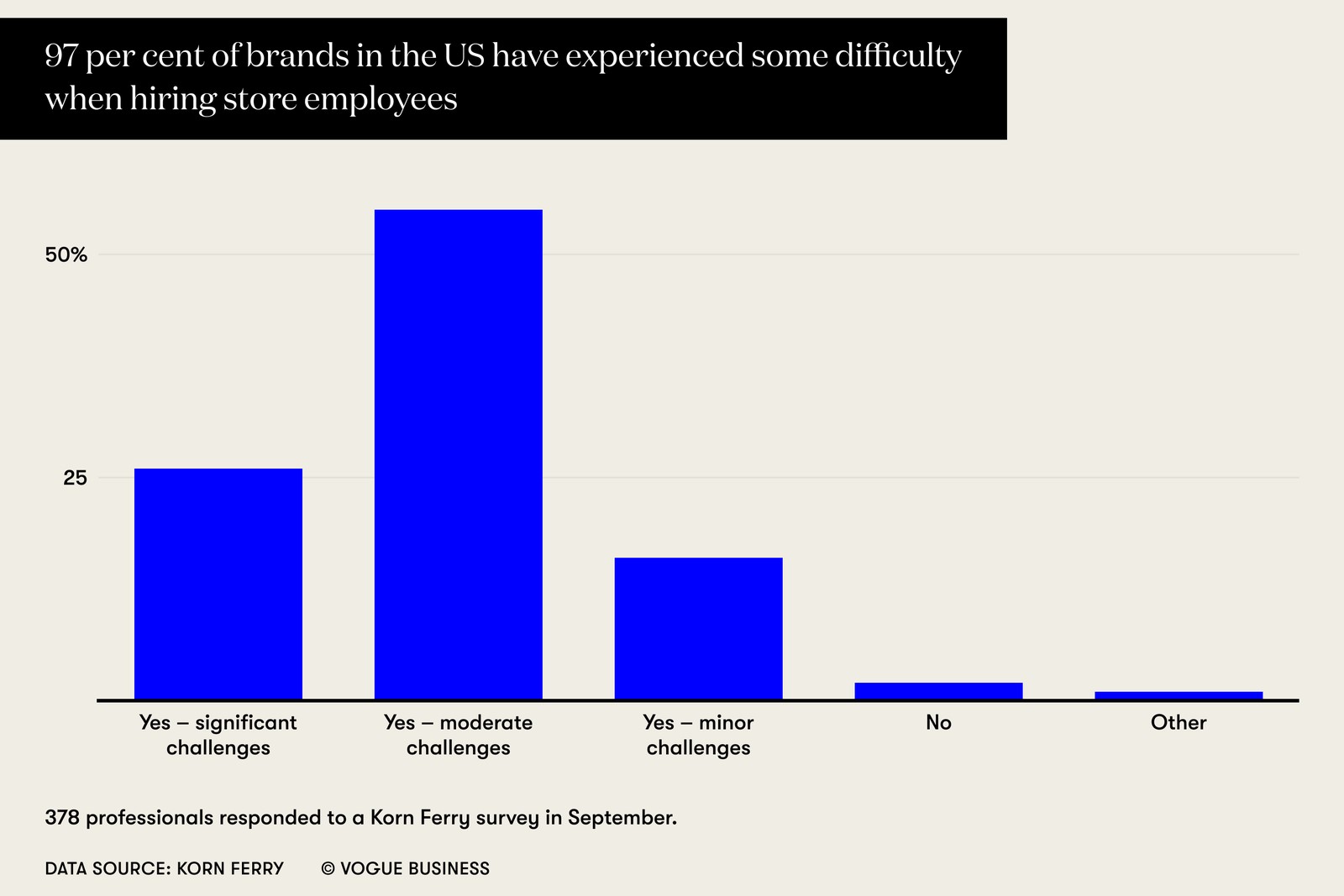

An industry report released in March 2022 found that 57% of retailers said that supply chain disruptions and shortages were the major supply chain challenge for 2022. This is a significant change – for the last nine years of the same survey, hiring and retaining qualified workers came in as the top challenge facing retailers.

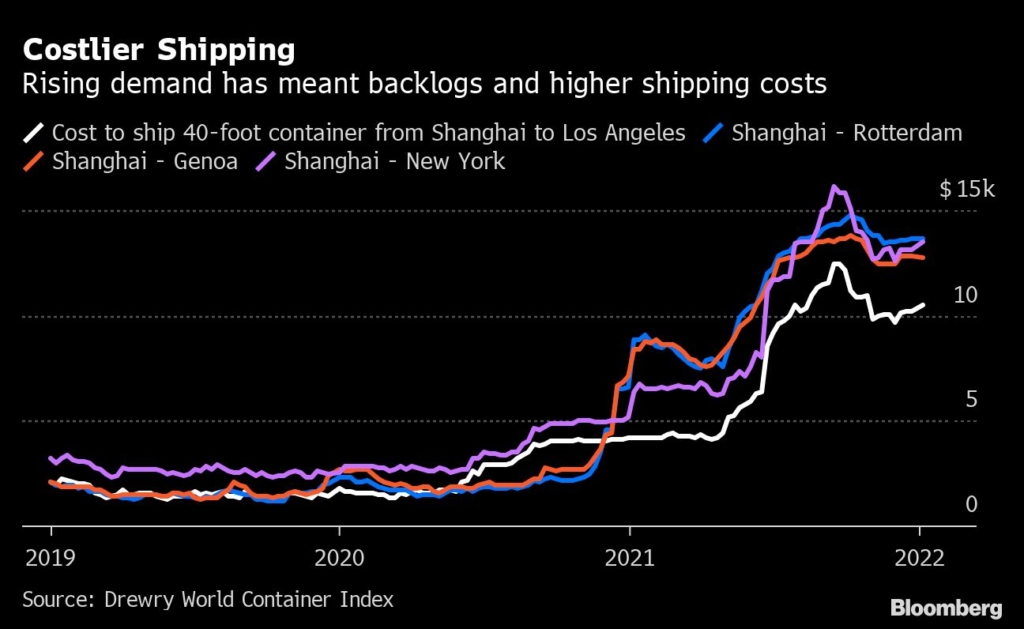

While many retailers expected supply chain disruption to have dissipated in 2022, companies are still dealing with fallout from the Covid-19 pandemic. An additional problem is rising shipping costs, which have steadily increased throughout 2021 and remain high at the beginning of 2022. Strikingly, the container freight index, which reflects the cost of shipping goods via a standard shipping liner, reached a high of $10,839 in September 2021. This is ten times higher than just two years before.

As shipping costs and customer demand increase, retailers are struggling to keep up – and it’s also compounding inflation. 30% of companies expect rising transport costs to limit their exports in 2022, while 29% of companies are worried about rising inflation as a result of supply chain disruption.

Another effect of rising inflation is the cost of goods. As inflation hit a 39-year-high in December 2021, businesses were forced to raise prices in order to cope with increased logistics and production costs. Overall, the cost of goods increased by 7%. More specifically, apparel prices leapt by 5.8% while household furnishing costs increased by 7.4%.

Faced with the rising cost of living, consumers are also changing their spending habits. As the price of items rises, consumers are choosing to hold off on purchases or change their buying habits completely. For example, retail sales in the US grew 0.3% in February, below the 0.4% forecasted. The biggest dent was in online shopping, which dipped by 3.7%. All of this means that retailers will have to find new ways to connect with customers and increase brand loyalty despite rising costs.

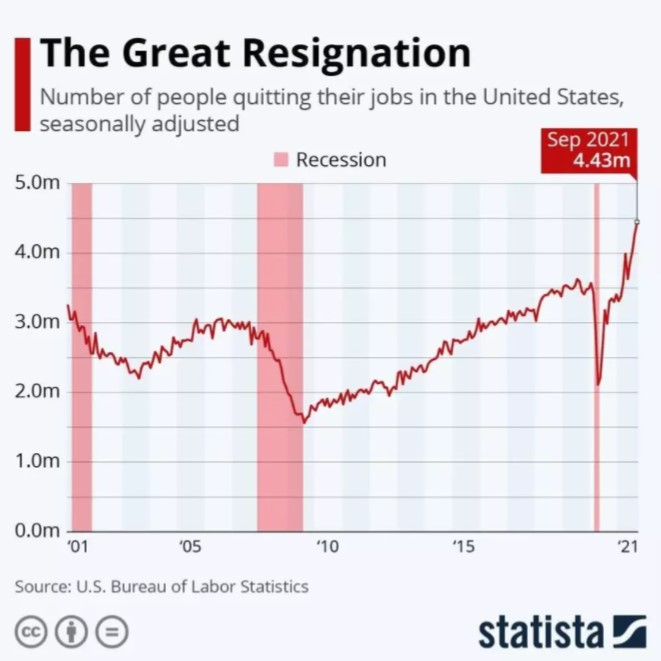

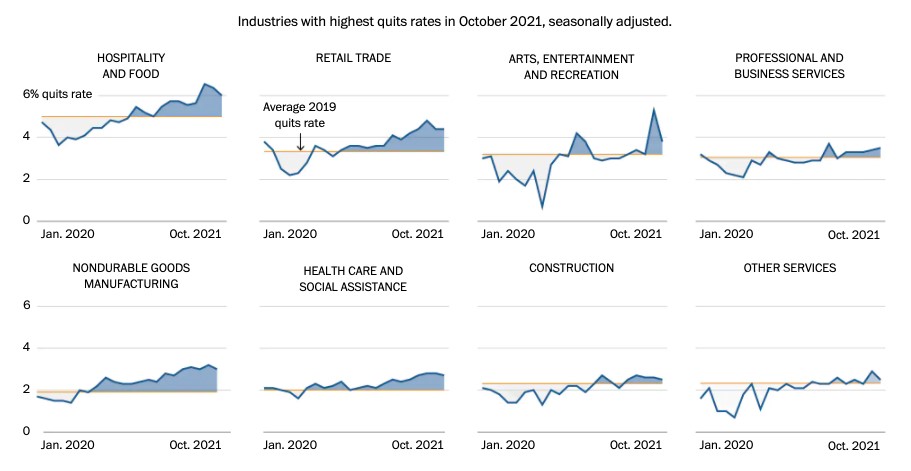

Finally, the ‘Great Resignation’ is also set to affect retailers in 2022. We covered this in a recent article, but in short, businesses are being forced to adapt operations as workers are leaving their jobs at a record rate. This is particularly noticeable in the retail industry. 720,000 retail workers quit their jobs in August 2021 alone, and 96% of retailers say they are struggling to find store employees.

The Opportunities for Retailers

There are undoubtedly challenges for retailers in 2022. However, there is also opportunity – especially in the digital space. We’ve already mentioned that retail sales are expected to grow between 6% and 8% this year, but online sales growth will be even higher (11% to 13%). Retailers who prioritise digital growth and embrace technology like RFID for retail will find that there is still space to grow even during a challenging year.

There is also opportunity in recent digital trends like NFTs, which we examined in an article last month. There was rapid growth in NFT production in the latter half of 2021, and the market is expected to continue growing throughout this year. Retailers who have already embraced NFTs, like Adidas, have seen strong sales off the back of the technology. Other retailers like BoohooMAN see the technology as a way to cement their brand identity and reputation.

But let’s not forget about physical stores. Innovative technology can also provide a way for retailers to set their brick-and-mortar stores apart in the post-pandemic world, and offer a new opportunity for growth. Experiences like virtual reality, in-store app functionality and personalised fitting rooms can all elevate physical stores and draw in consumers that are looking for a different in-store experience.

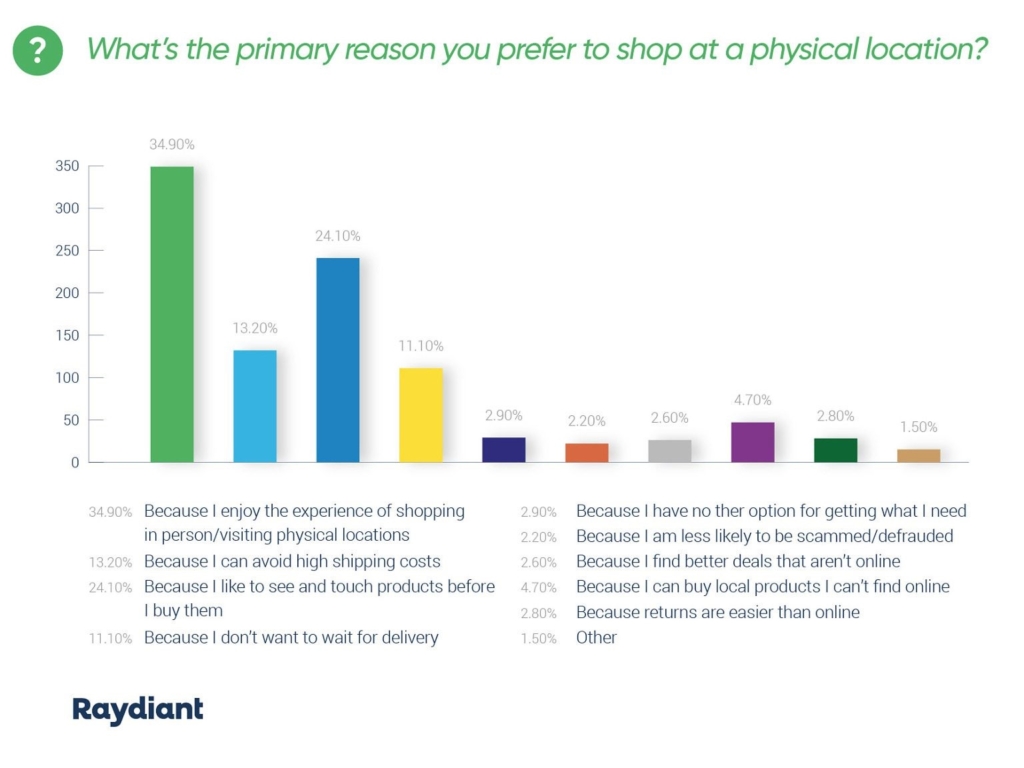

48% of consumers say that they choose to shop in-store because they simply enjoy the overall experience of shopping in person. A further 24% say they like to experience products before purchasing. All of this points to in-store experiences being a growth opportunity for retailers in 2022, as long as they embrace the technology needed to implement unique experiences.

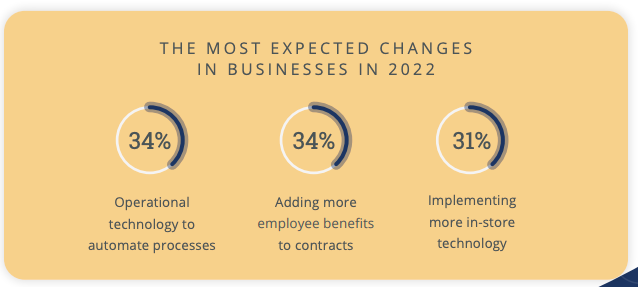

Ultimately, technology is the solution to overcoming the challenges in the retail environment in 2022. Businesses are undoubtedly aware of this; 31% of retail leaders say that they expect to implement more in-store technology in 2022. But what kind of technology should this be?

Well, retailers are also clear on that, too. 34% of retail leaders admit that investment in operational technology to automate processes is a priority for them this year. This includes innovations like cloud-based inventory software. But how can this allow businesses to bounce back in 2022?

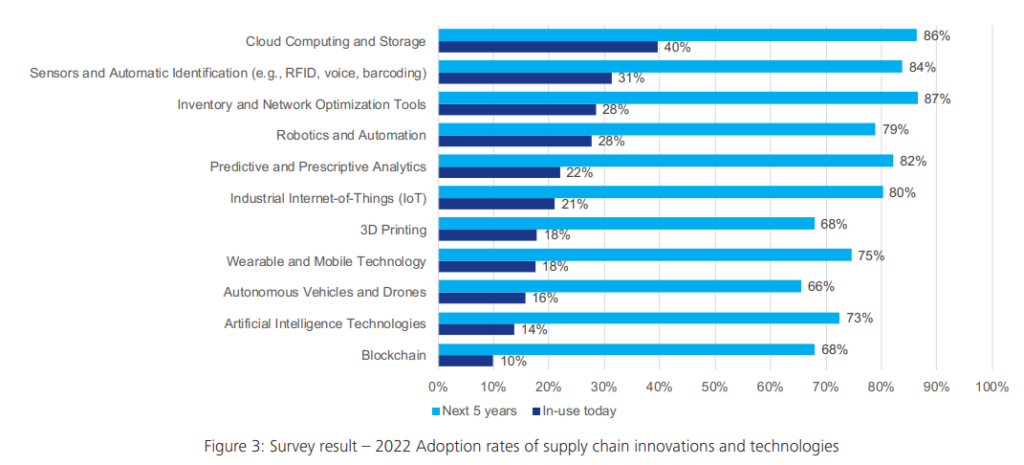

Overcoming the Challenges with Cloud-Based Inventory Software

Though retailers are evidently aware of how operations technology like cloud-based inventory software could help them in 2022, many still have not invested in it. The current adoption rate of cloud software is 40%, however, this is expected to rise to 86% over the next five years. This is still the highest adoption rate for all retail technologies, including Internet of Things and robotics, yet there are still too few retailers taking advantage of it.

Cloud-based inventory management is hugely important to recover from the Covid-19 pandemic and tackle sustained problems such as supply chain issues. Despite retailers seeing a return to brick-and-mortar stores – they will continue to remain popular among consumers – a successful e-commerce strategy is key to performing in 2022.

All retail categories are predicted to see e-commerce growth in 2022. This is even more pronounced for apparel and accessories, which was the fastest-growing e-commerce category in 2021 (15.4% YoY growth). Elsewhere, auto and parts will also see significant growth in 2022, capitalising on their 30.1% YoY growth in 2021.

However, for retailers to take advantage of e-commerce gains, they must find a solution to the retail challenges that will inevitably persist throughout 2022: supply chain disruption, rising costs, and finding new ways to connect with customers.

Primarily, cloud-based inventory software offers a way for retailers to better understand their supply chains. As such, retailers who take advantage of this software can gain real-time insights into issues with their stock and react accordingly. By utilising cloud-based inventory management tools like RFID for retail, retailers know exactly where stock is at all times and can improve the flow of goods between distribution centres and stores.

Real-time data can also help retailers boost profits, which is more important than ever during a period of rising costs. As well as showing retailers where products are in their journey through the supply chain, cloud-based inventory software can also help prevent out-of-stock notices in stores.

Stockouts are particularly rife at the moment as supply chain issues hamper on-time deliveries. In fact, stockouts were up 250% in October 2021 compared to pre-pandemic levels. This can prove a major loss to retailers, totalling upwards of $1 billion per year. The in-depth forecasting from cloud-based inventory software can tell retailers the products that are selling particularly well and inform retail executives of exactly when new stock should be ordered to prevent losses on the shop floor or online.

Finally, RFID for retail can allow retailers better insights into their own customers, learning about their buying habits and being able to flexibly change their operations to suit trends. Cloud-based inventory software can also help implement personalised experiences in stores, whether that’s alongside an app or in virtual try-on rooms – and we know that customers are searching for new experiences in stores to keep their visits interesting.

Boosting Retail Performance with Cloud-Based Inventory Software

It’s clear that cloud-based inventory software can offer a solution to many of the issues plaguing retailers in 2022. In fact, many retailers are already aware of the benefits of the technology and have actively adopted it in their operations in recent years. Since then, they’ve reported significant benefits to using cloud-based inventory management technology.

47% of retail executives say that cloud adoption has improved their data access and analysis. The second and third most popular benefits are reducing costs and liabilities (42%) and improving efficiency (38%). Just 8% of executives say they have experienced no benefits of cloud adoption.

We know that cloud-based inventory software offers better supply chain visibility than other, outdated modes of inventory management. But instantaneous data can do more than just resolve supply chain issues – it can also help retailers implement omnichannel services like click-and-collect and ship-from-store. With full stock transparency, retailers can streamline all of their services, ensuring that customers can buy products when and how they wish to.

When combined with cloud-based inventory software, RFID for retail can also help transform the brick-and-mortar store, which we examined in a recent article. For example, 31% of customers want store employees to actively assist them with out-of-stocks. With a cloud-based inventory management portal, employees can assist customers on the ground in stores with just an app. They can check when new shipments of products are likely and also guide the customer to similar products in-store, boosting sales potential and leaving customers more satisfied with their store visit.

There is undoubtedly a wide range of benefits to implementing cloud-based inventory software. Whether you’re looking ahead to future prospects like digital stores or increased personalisation or just looking for a way to get ahead of supply chain disruption, this is the right time to invest in cloud-based inventory management.

Cloud-based RFID Inventory Software

Stock accuracy, on-floor availability, and omnichannel applications.

Book a demo with Detego to find out how our RFID cloud-based inventory management solution could help you outperform competitors and adapt to supply chain disruption. Our multi-user app can provide intelligent stock takes and a smart in-store replenishment process and later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

It’s difficult to escape news about the so-called ‘death of the high street’. For many industry leaders, the rise in e-commerce retailers and the collapse of many large high-street brands have significantly changed how people think about future bricks-and-mortar retail stores.

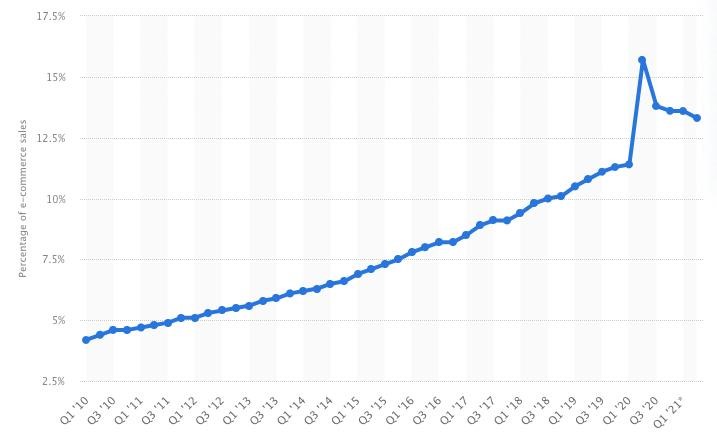

Consumers have been increasingly switching to online shopping for many years. The percentage of global online sales has been rising gradually since 2016, but the global Covid-19 pandemic undoubtedly accelerated this consumer change. In the UK alone, at the height of the pandemic in January 2021, e-commerce sales accounted for almost one-third of all retail sales.

As brick-and-mortar retail store footfall fell during global lockdowns, some retailers abandoned the high street altogether. Over the course of the pandemic, over 17,500 chain store outlets disappeared from the UK high street entirely. This includes large fashion chains such as Topshop, John Lewis, and Debenhams.

However, at the same time, some brands used the pandemic as an opportunity to explore innovations in brick-and-mortar shopping. In October 2021, e-commerce retailer Amazon opened its first physical store in the UK, while retailer Nike pressed ahead with plans to open an ‘immersive’ store in Seoul, South Korea.

All of this begs the question: what will the future high street look like? In short, significant changes are ahead for how retailers envision their future bricks-and-mortar retail stores, and it all has to do with creating a memorable customer experience and improving omnichannel retail options.

The ‘Death of the High Street’

So, what do news outlets and retail leaders mean when they talk about the ‘death of the high street’?

As technology becomes more accessible and flexible, more and more people are switching to online shopping. By the time the Covid-19 pandemic hit in 2020, online sales were already rising year on year. However, over the course of just a year, the trend became the norm.

In the UK alone, online retail sales grew by 36% in 2020–the highest e-commerce growth in one year since 2007. But the trend is not isolated to the UK. Global e-commerce sales grew by almost 28% in 2020, with the most e-commerce sales occurring in China and the United States.

Though lockdowns were a primary accelerator for online shopping, there are further reasons that people choose to shop from online retailers instead of brick-and-mortar retail stores. The top three reasons for opting to shop online instead of in-store are free shipping, lower prices, and convenience. In the end, 43% of consumers say that they could now go without shopping in a physical store, meaning the future bricks-and-mortar retail store could become redundant.

While almost three-quarters of consumers believe that most shopping will happen online in the future, this is unlikely to be the case. 88% of Generation Z consumers–the youngest demographic of shoppers today–say they still prefer to connect with a brand on both physical and digital channels. Furthermore, just 24% of Gen Z consumers say they strongly prefer to purchase online.

Evidently, then, there are still opportunities for future bricks-and-mortar retail stores. However, this will require a significant change in how retailers envision their physical retail stores. With the rise of omnichannel retailing, customers want multiple ways to purchase from a brand, which could mean blending the online and physical experience.

Furthermore, shoppers don’t just head to stores to purchase products anymore, but rather to have a shopping experience. As such, there are opportunities for retailers to turn their stores into hubs of customer experience rather than just functioning as sales points.

Why Physical Stores Need to Change

At the same time as e-commerce has risen in popularity, so too has omnichannel shopping. Omnichannel refers to the number of ways a customer has to purchase and receive a product. For example, those options could include in-store, online, via an app, and a myriad of shipping opportunities like picking up orders from a physical location and the ability to return items to a store.

Studies show that customers are increasingly turning to omnichannel retailing. This includes the options already suggested, as well as blends of physical and online shopping. For example, customers might view products in-store and then return home to buy online or use their smartphone while in a store to research products–which 56% of shoppers do.

Consequently, retailers must embrace omnichannel retailing if they are to stay competitive in the post-Covid world. Not only because customers are asking for multiple ways to shop, but because, on average, omnichannel shoppers spend more than other customers and are more likely to stay loyal to brands.

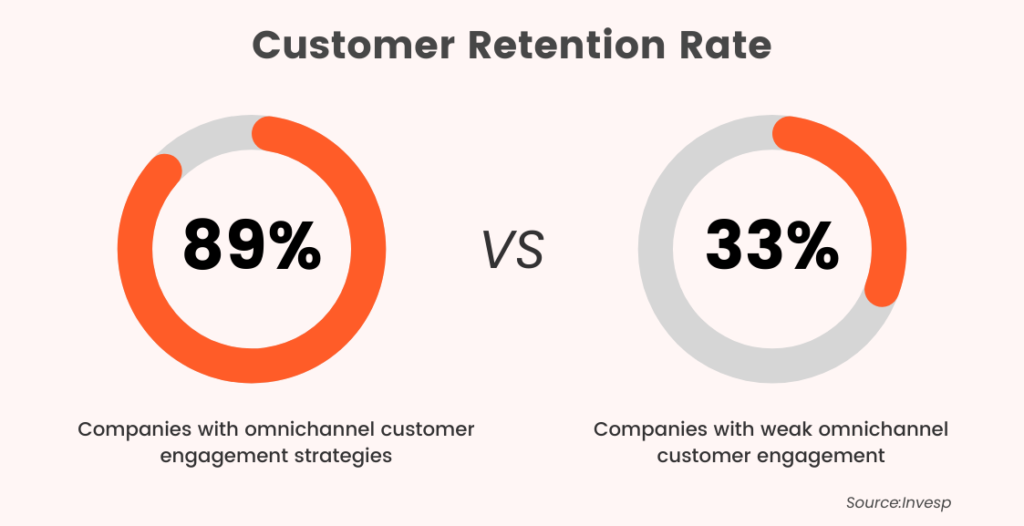

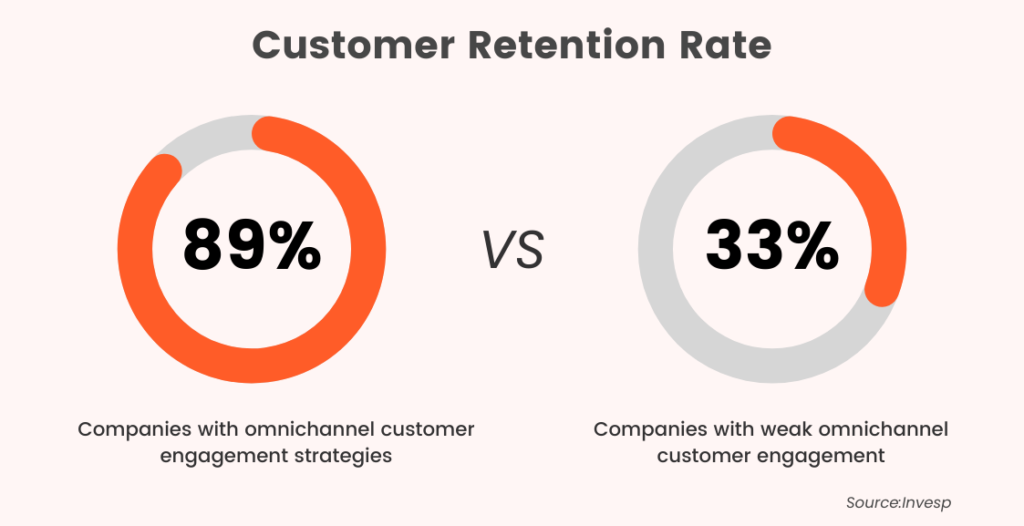

For example, a Google study found that retailers who implement omnichannel strategies drive an 80% higher rate of in-store visits. Furthermore, omnichannel customers also spend 20% more than other consumers. Finally, companies that embrace omnichannel retailing retain 89% of their customers, compared to a 33% retention rate for companies with poor omnichannel strategies.

We know that the average customer already engages with multiple channels. According to McKinsey, more than half of shoppers engage with three to five channels before making a purchase. One of these channels is likely to be a physical retail location. As such, future bricks-and-mortar retail stores will be important for implementing omnichannel opportunities.

Aside from omnichannel options, today’s consumers are also increasingly asking retailers to turn shopping into a complete experience. For example, one study found that although 60% of shoppers prefer to shop online, more respondents (67%) said they miss being able to interact with products. Furthermore, 80% of under-30s say they would shop in-store if the retailer had interactive screens installed in physical locations.

As the so-called attention economy begins to affect retailers, brands will increasingly be forced to embrace new ways of keeping consumers entertained while in stores. The future bricks-and-mortar retail store will thus also be a site of customer experience instead of a sole arena of selling.

What Does the Future Bricks-and-Mortar Retail Store Look Like?

We’ve clarified that there are two key ways that retailers can adapt their future bricks-and-mortar retail stores to suit the consumer: by embracing omnichannel retailing and transforming stores into primarily customer experience hubs. But how will this actually change the future high street?

Customer experience centres

Some companies have already transformed their physical stores into places of experience. We’ve already mentioned Nike’s immersive store in South Korea. Here, customers can enjoy personalised, interactive experiences and compare real-life products, helping them make their purchases.

It’s not just clothing brands that are emphasising the customer experience, though. Since 2014, Starbucks has opened six Starbucks Reserve Roasteries: larger physical locations focused on giving customers an entire coffee experience. These stores feature a more extensive menu than regular stores, coffee tasting bars, and augmented reality tours.

Whether the brand is in the food or fashion industry, every customer experience store has the same focus: to build brand loyalty, offer personalised experiences, and encourage customers to buy again and again.

However, retailers must choose the experiences offered to customers in-store with brand consistency in mind. Brand consistency is crucial for connecting with consumers and building a loyal brand base. Your online and physical presence should create a seamless shopping experience, which will make the customer journey more exciting and improve your omnichannel strategy.

Micro fulfilment

When implementing a successful omnichannel strategy, you must offer as many ways to buy as possible. To do this, retailers can utilise their future bricks-and-mortar retail stores as micro fulfilment centres.

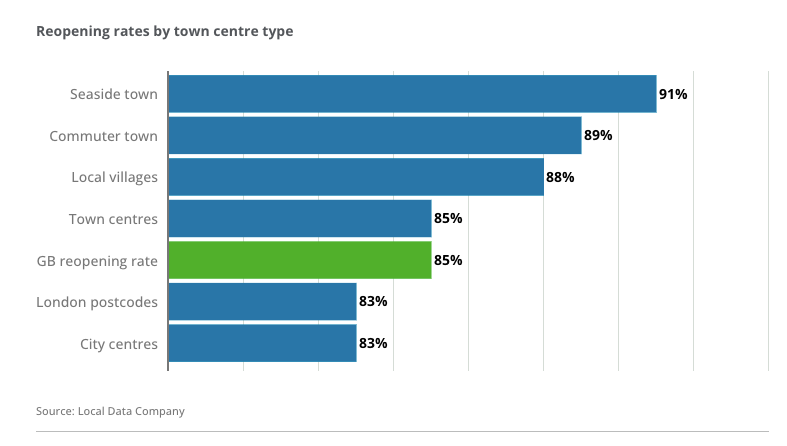

The Covid-19 pandemic has exacerbated the trend toward local shopping. Data from Deloitte shows that smaller town centres in places like seaside towns and commuter hubs recovered much more quickly from business lockdowns than larger city centres. Additionally, 57% of consumers say they would rather spend at local businesses after the pandemic.

Thus, there is an opportunity here for stores to combine selling and shipping from the same store, making it both more environmentally friendly and quicker for local shoppers to get items delivered to them.

42% of customers say they expect a two-day shipping option to be available at checkout. This isn’t always possible with traditional distribution centres, but if each physical location is utilised as a micro fulfilment centre, brands will likely achieve this. With increased customer satisfaction comes increased sales–data from e-commerce business Metapack shows that retailers have seen a 30% increase in online sales after implementing micro fulfilment centres in retail stores.

How RFID Can Help Futureproof Your Retail Store

Technology is essential when it comes to transforming future bricks-and-mortar retail stores. One of the most crucial is RFID, which can assist with elevating the customer experience in physical stores and accomplishing omnichannel strategies.

Firstly, RFID is essential for implementing personalised and interactive customer experiences in stores. For example, RFID tags on products can help create interactive fitting rooms, where sensors know which products a customer has brought into the room. Along with interactive screens, the customer can receive product information and see similar products, contributing to a more successful buying experience.

For brands focused on sustainability, RFID tags can also give customers a behind-the-scenes look at supply chains. Fashion brand Sheep Inc. has embraced this by linking every product produced with a real-life sheep on their wool farm, meaning customers can see what ‘their’ sheep is up to by scanning an RFID tag on their clothing.

With the future bricks-and-mortar retail store functioning dually as a sales point and a micro fulfilment centre, brands must have an accurate view of their stock. With RFID, retailers can get a real-time view of where stock is, allowing them to more accurately enable omnichannel options like ship-from-store, return-to-store, and pick-up-from-store.

An estimated 62% of organisations have just limited visibility of their supply chain, while only 6% have achieved full visibility. Without complete visibility, it will be increasingly difficult for retailers to adapt to consumer demands, especially with regard to increasing shipping options and allowing for faster order fulfilment. However, we know that these trends will be vital for the future high street and future bricks-and-mortar retail stores.

RFID offers a variety of use cases when it comes to future bricks-and-mortar retail stores. The technology is crucial for achieving a successful omnichannel strategy and will be increasingly important for establishing in-store interactive customer experiences. As a result, RFID can offer retailers an efficient way of increasing sales and improving brand loyalty. At the same time, it also allows brands to be at the forefront of an innovative future high street.

Futureproof retail stores with RFID

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Book a demo with RFID to find out how our cloud-hosted RFID solution could help you build a future bricks-and-mortar retail store. Our multi-user app can provide intelligent stock takes and improve the customer experience, while RFID can help you effectively turn your store into a micro fulfilment centre and establish e-commerce operations with real-time, item-level inventory visibility and analytics.

Retailers have faced a myriad of crises over the last few years, including but not limited to the Covid-19 pandemic, supply chain disruption, and increasing retail staff resignations. However, another issue that has plagued retailers for far longer, but is becoming more catastrophic to brand reputation, is the grey market. So-called Grey Goods have been ‘legally’ imported into the United States since 1936. But the grey market is also a global problem–wherever a retailer operates, the goal is to have complete control over the supply and distribution of their products. Otherwise, retailers are effectively in competition with themselves. While the grey market is nothing new, the scale of the market has drastically surged in the 21st century. Today, between $7 billion and $10 billion worth of goods are sold outside of authorised channels in the US. Globally, over the last few years, the grey market has grown by 15% and is soon expected to reach a worth of $1,500 billion.

So, how can retailers combat the grey market? Undoubtedly, end-to-end visibility across the supply chain and all sales is a key part of the solution. Without knowing the scale of the market and where grey market resellers are sourcing goods, retailers cannot begin to tackle the problem. One of the most promising solutions to the problem of parallel imports is RFID software. Brands are increasingly turning to RFID for retail to increase supply chain transparency or enable omnichannel retailing; however, RFID software can also help tackle grey market selling by improving product visibility.

What is the Grey Market?

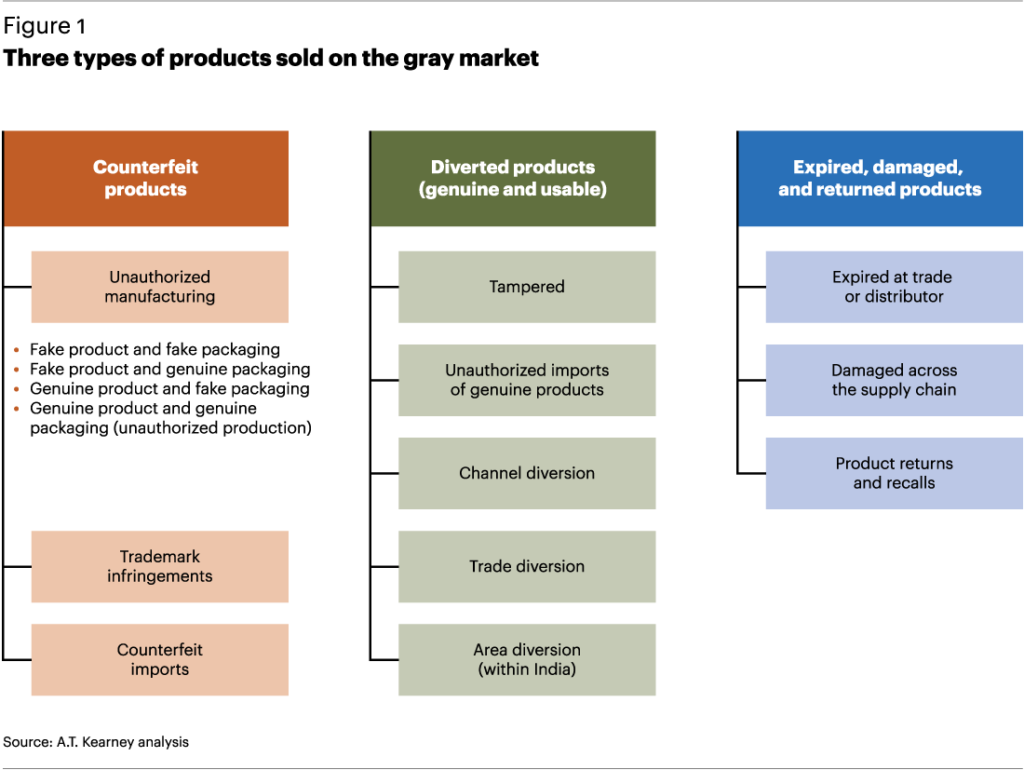

The term ‘grey market’ refers to the legal sale of goods outside a retailer’s authorised supply chain. These goods are legitimate as the primary manufacturer made them, but they are distributed through unauthorised channels. As suggested by its name, the grey market is neither entirely legal nor part of the black (illegal) market–it sits in an unregulated middle ground between the two. As a result, it can be challenging for brands to tackle the problem, as their products are still being sold legally.

In the most basic description of retail selling, a brand sells to a distributor, who consequently sells those products to authorised retail outlets, who sell to the public. However, in the grey market, unauthorised distributors can also source products–often at discounted prices–and these will sell directly to the consumer at a lower price than authorised dealers.

Many grey market sellers benefit from being smaller than official retailers. This means they can keep costs low by operating without costly advertising or postsale services. Unauthorised dealers can also benefit from supplier pricing strategies that make buying products wholesale very cost-effective. As a result, products are sold to customers at a much lower price, out-competing authorised dealers.

Parallel imports are another related part of the grey market. This is when unauthorised dealers buy products in one country but sell them in another market, and it is a more significant problem in some territories than others. For example, in India, grey market products account for between 2%-10% of the consumer product market. Similarly, Procter & Gamble estimates that they are losing 10% in sales every year due to counterfeit products in China.

While any product can fall prey to the grey market, the market inordinately impacts luxury products simply because of the resale margin. For example, in many cases, products on the grey market are sold 30% to 40% cheaper than in authorised retailers–a vast margin for luxury goods. The scale of the problem is also far more significant in the luxury product market than in other sectors. In 2016, grey market sales accounted for 20% of the global luxury watch market.

The Impact of the Pandemic on the Grey Market

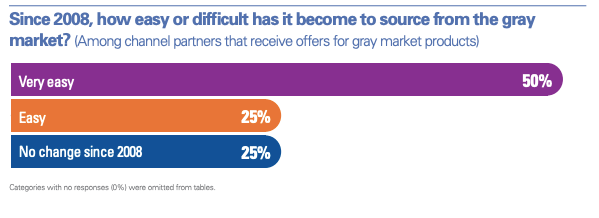

The grey market represents a significant loss of profit for retailers, and the problem is only getting worse. In a KPMG survey of distributors, half of the respondents said that since 2008, it has become easier for them to source products from the grey market rather than authorised channels.

Original equipment manufacturers (OEMs) also believe that the grey market grows every year. 63% of OEMs said they had witnessed an increase in grey market activity since 2008, while a staggering 90% have reported instances of their products being available outside of official channels.

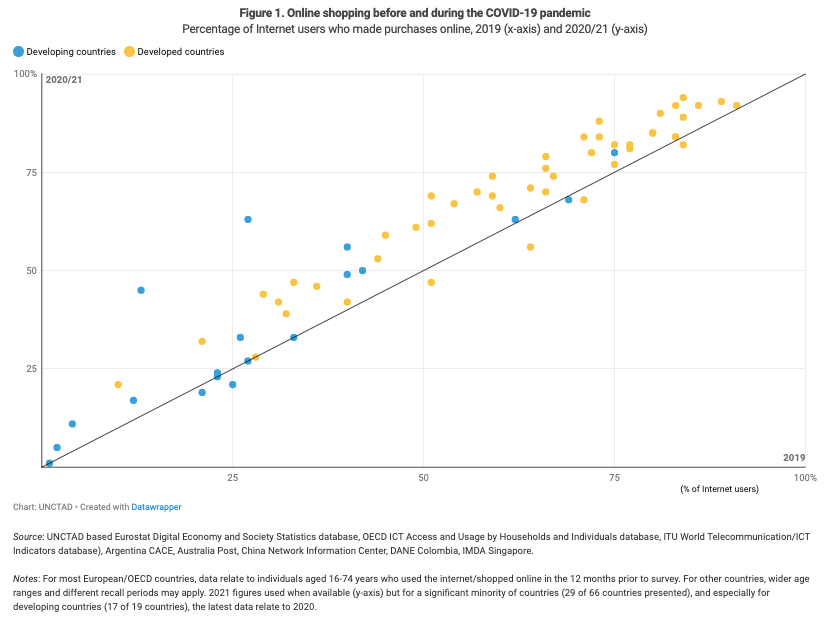

All of this shows that the grey market is only becoming more widespread, even as retailers are increasingly acting to combat unauthorised sales of products. However, the problems with the grey market and parallel imports may have also been exacerbated by the last two years, primarily because of the drastic increase in e-commerce.

Online marketplaces were experiencing rapid growth even before the Covid-19 pandemic. In 2019, companies like Amazon and Alibaba accounted for 46% of online sales in the US and 61% of global sales. However, the pandemic has undoubtedly accelerated their growth. Figures from the United Nations Conference on Trade and Development show that e-commerce experienced significant rises over 2020 and 2021, particularly in developing countries.

For example, in the United Arab Emirates, internet users who shopped online grew from 27% in 2019 to 63% in 2020. In the EU, Greece, Ireland, Hungary, and Romania saw the most significant rises in e-commerce. Overall, e-commerce’s share of total retail sales globally has grown two to five times faster than before the pandemic. Around 75% of people who used online retailers for the first time during the pandemic have said they will continue to use these channels even after the pandemic. However, the global growth of online shoppers means there are now more opportunities for grey market dealers.

The problem with popular online marketplaces like Amazon is that they often allow unauthorised sellers to operate on their sites. Without strict rules authenticating sellers, grey market products become widespread on e-commerce platforms, with consumers unaware that they are purchasing from unauthorised channels. When left unchecked, both legitimate and grey market goods are free to circulate through the same distribution channel. But what effect does this have on retailers?

How the Grey Market Affects Retailers

While there are some benefits to the grey market–for example, in keeping products widely available and prices competitive for customers–on the whole, it harms retailers. Authorised channels are there for a reason: to control the flow of products through the market, offer additional after-purchase services, protect the consumer from counterfeits, and retain brand value.

For many retailers, additional services offered outside of the direct sale can be a significant source of revenue. This is particularly important for industrial products that may require repairs in the product’s lifetime. Purchasing from a grey market seller means the customer doesn’t get this option, reducing profits for the original brand. As well as that, customers may be disappointed when they realise that they cannot utilise a brand’s additional services after purchasing from a grey market dealer.

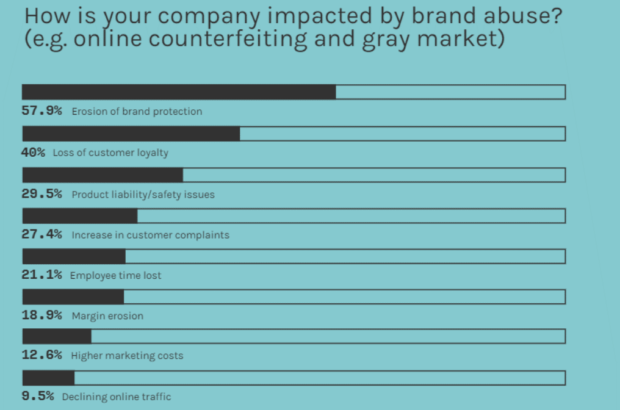

This leads us to one of the most significant effects of the grey market: the erosion of brand value. One in three IP experts, for instance, believe that the grey market is one of the most significant factors affecting brand value. In addition to customers being unable to access after-purchase services after buying from the grey market, they may have a bad experience with an unauthorised seller, leading to a bad opinion of the product or brand overall. In another scenario, a consumer may accidentally purchase a counterfeit product from the grey market as it can often be difficult to tell the difference between an authorised and unauthorised seller.

As retailers have very little power to prevent grey market dealers from operating, they cannot control how consumers react to disappointing purchasing experiences with unauthorised dealers. In the worst cases of consumer dissatisfaction, they may voice their complaints on a public platform like social media, contributing to a negative brand image.

In one study, experts were asked how brand abuse affects their companies, such as that received from disappointed grey market customers. Over 50% of industry experts said that brand abuse contributes to an erosion of brand protection, while 40% said that the brand abuse they receive results in customer disloyalty.

Significantly, less than 20% of experts reported margin erosion as a significant effect of brand abuse. It seems therefore, that manufacturers and retailers consider the loss of customer loyalty a far more substantial effect of the grey market than the potential loss of revenue. Regardless, experts are aware of the adverse effects of the grey market and parallel imports and will need the help of technology to combat this.

What is the Solution?

Brands need complete control over their image and products to succeed in retail, but the grey market hinders this. As a result, brands need grey market inventory management to combat the effects of the grey market and parallel imports. They need to be aware of how and where their products are entering the grey market and be able to accurately track unauthorised sellers–whether they’re based in a physical retail store or on the web.

Aside from reinforcing authorised selling channels, one way of remaining in control of where products are going is by introducing unique serial numbers. With accurate product tracking, retailers can see where products are entering the grey market and obtain a more comprehensive knowledge of the scale of the grey market, including details of unauthorised dealers.

Serial numbers are one of the most common ways of identifying grey market activity; 90% of OEMs say that they already use the technology. However, serial number tracking alone can’t always provide a complete picture of a product’s journey. For that, retailers should turn to grey market RFID software.

The Advantages of RFID Software

RFID for retail has numerous advantages, not least the opportunity for retailers to gain total supply chain transparency. However, retailers are also increasingly becoming aware of its ability to assist in reducing grey market sales.

This year, the international business organisation GS1 released new guidelines for retailers about how to increase inventory accuracy and supply chain visibility. The guidelines also state that RFID for retail can be a powerful tool for grey market tracking.

When manufacturers tag products at their point of production, confusion later on as to which products are genuine and which are counterfeit is minimised. Consequently, customers can have confidence that the product they are buying is legitimate, even when they are inadvertently purchasing from the grey market.

Furthermore, retailers can track their legitimate products throughout the supply chain when they use the Detego end-to-end RFID software platform. With RFID software, it’s easy for retailers to see which unauthorised dealers and e-commerce sites are selling their products within the Grey Market.

When one Canadian skincare company started placing discreet RFID tags on shipments, they could monitor where these were being sold online and buy back the product from unauthorised sellers, reducing the chances of consumers purchasing from the grey market themselves. In some eventualities, this can lead to retailers taking action against distributors who sell to unauthorised dealers, such as revoking a distribution licence.

Utilising RFID software makes it easier to see where products are being sold, but it can also tackle the problem of parallel imports. For example, RFID software can alert retailers when a product is being sold in an unexpected market, allowing retailers to take immediate action to prevent this from happening in the future.

Though RFID technology has been around for over a decade, grey market applications are still being realised. 80% of retailers say that other products cannot replicate the benefits of RFID, and this includes its applications in tackling the grey market and parallel imports. As RFID technology evolves and e-commerce grows, the opportunities for retailers to reduce the effects of the grey market are immense.

An RFID retail solution

Stock accuracy, end-to-end visibility, and supply chain traceability.

Book a demo with RFID to discover how our cloud-hosted RFID for retail solution could help you tackle parallel imports. Our intelligent software can provide grey market inventory management, preventing counterfeits and combating parallel imports. With grey market RFID software, you get end-to-end visibility of your supply chain, making it easier to identify counterfeit products and take steps to protect your brand identity.

Sustainability is a buzzword in the fashion industry and has been for many years. As the world looks for ways to slow the extent of climate change, retail is an important beacon for change.

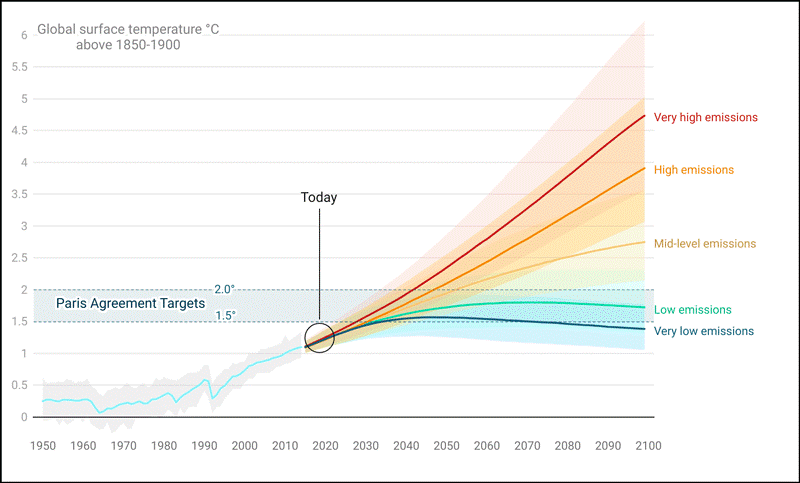

The Intergovernmental Panel on Climate Change’s (IPCC) most recent report makes for uncomfortable reading. The panel predicts that global warming will reach 1.5 degrees Celsius by the early 2030s, resulting in unprecedented ice melt, seawater rising, and extreme heatwaves. However, there is also hope that reducing emissions and global consumption could halt rising temperatures, enabling the world to meet the goals of the Paris Agreement.

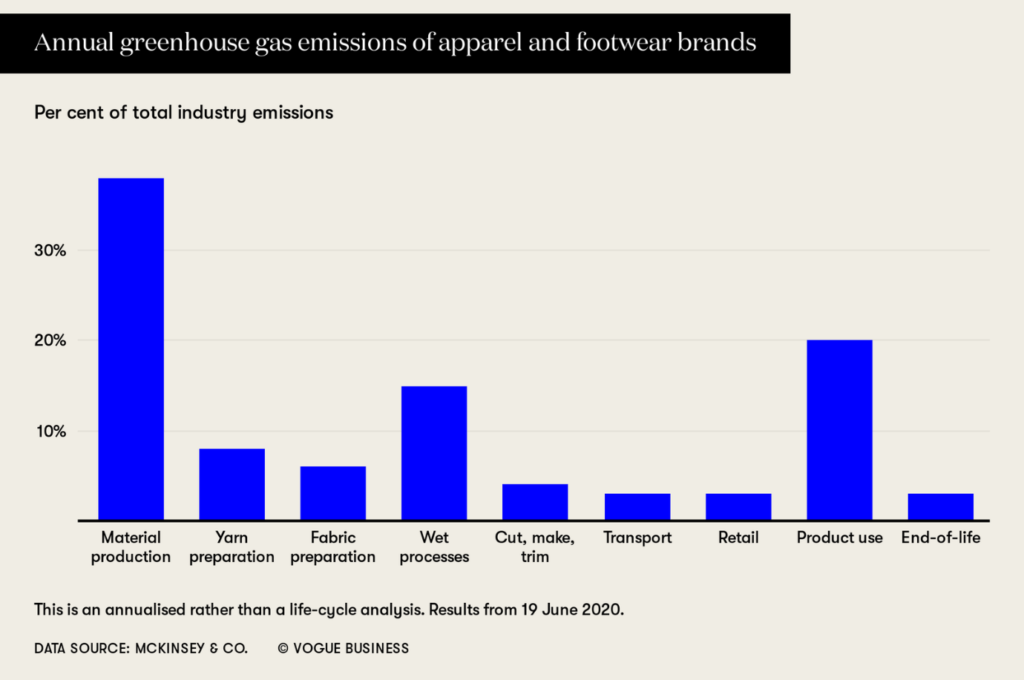

One industry that requires urgent change is fashion retail. The fashion industry alone accounts for as much as 10% of global greenhouse gas emissions as well as 20% of wastewater. Additionally, 85% of the world’s textiles end their life in landfills or incinerators.

Many retailers are already doing what they can to make their operations more sustainable. This includes investing in sustainable materials as well as making physical stores more environmentally friendly. However, consumers are demanding more. This requires new innovations, and RFID for sustainable fashion retail could prove to be the solution.

Many retailers already understand the value offered by RFID in improving the efficiency of operations and omnichannel retailing, but are less aware of the applications of RFID for sustainable fashion retail. However, the technology is crucial if retailers are to make their supply chains more environmentally friendly.

The Emergence of Sustainability in Fashion Retail

Fashion retail sustainability is not a new trend, but it’s certainly true that the move towards more environmentally-friendly fashion has sped up in the last few years. This has been exacerbated both by consumer trends and the damning evidence coming out of research from organisations like the IPCC.

At the G7 summit in August 2020, 32 fashion companies pledged to make their businesses more sustainable. This includes cutting out the use of single-use plastic by 2030 and seeking out environmentally-friendly raw materials. Luxury fashion, meanwhile, is aiming for net-zero emissions by 2050.

In luxury fashion, Chloé is going further. In October 2021, they became the first luxury fashion brand to receive B-Corp certification, a testament to their commitment to the ‘triple bottom line’. With their latest footwear line, they used 58% lower-impact materials, compared to 40% for their autumn/winter 2021 collection.

It’s not just a desire to help the planet that is driving fashion retailers to commit to sustainability initiatives, though. Consumer behaviour is also changing. Today, 66% of people say sustainability is a key factor when they make a purchase. The figure is even higher for the younger, millennial age group, at 75%.

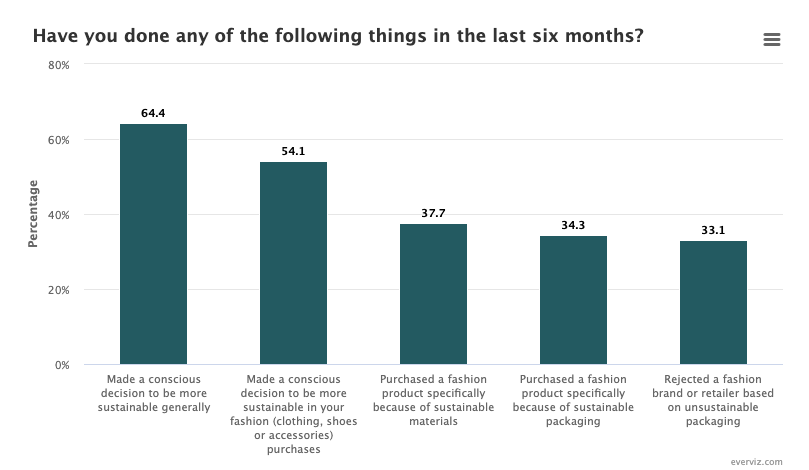

There’s even more evidence of how consumer demand is changing. The Sustainability and the Consumer Report from 2021 by Drapers examined how consumers in the UK are reacting to sustainable fashion retail.

The study found that, between January and July 2021, 64% of consumers had made a conscious decision to be more sustainable, and 54% of consumers chose to be more sustainable with their fashion retail choices specifically. Overall, one-quarter of consumers say they think about sustainability all the time when making purchasing decisions.

Changing consumer behaviour is evidently driving fashion to be more sustainable. In fact, 50% of C-suite executives in fashion and textiles say that consumer demand is affecting their approach to sustainability. For many brands, responding to consumer demands might mean establishing carbon offsetting or making biodegradable packaging. But committing to fashion retail sustainability will require more than this.

The Problem of the Supply Chain

Fashion supply chains are endlessly complex. Globalisation and cost pressures have ensured that few fashion brands actually have an end-to-end view of their entire supply chain. However, the key to fashion retail sustainability actually lies in the supply chain.

Retail brand Patagonia have stated that 95% of their total carbon emissions come from their supply chain. A staggering 86% of this figure is solely from the creation of the materials necessary for production. Overall, retail supply chain emissions are 28 times as high as operational emissions. However, emissions created in other areas of the supply chain–for example, getting products from production to stores–is not to be underestimated.

For retail brands, cutting emissions within their own operations–distinct from the process of creating raw materials–could deliver 20% of total reductions in carbon emissions. A more efficient approach to transport, retail, and packaging could deliver a saving of 308 million tonnes of CO2 by 2030.

Not only is there a consumer demand for change across the supply chain–and for companies to be able to articulate that change and take control of their entire operations–but there could be financial risks to not adapting. Companies will face up to $120 billion in costs from environmental risks in their supply chain by 2026 due to physical impacts like floods and the increased cost of raw materials due to climate change.

Aside from supply, there are other areas within fashion retailing that will require an overhaul to be more sustainable. One of these is reducing waste. While part of the responsibility for reducing waste lies with the consumer (12% of people aged 18-24 buy fashion once a week, and 11% say they bin clothing they don’t want anymore), fashion retailers can also do more on their side. For example, every season, about 30% of clothes that are made are never sold. Improved operations and logistics–and utilising data to understand consumer trends–could help reduce the amount of clothes that go unused.

Similarly, fashion retailers can invest in circular modes of production and selling, whereby clothes can be returned to a company at the end of their life. Drop-off boxes for recycling clothes are already a staple in some stores, and all go towards improving the sustainability of fashion retail.

While there are a number of ways retailers can improve their sustainability, many companies are simply not ready to make the changes. In order to reduce their environmental impact, companies should be embracing technological innovations such as enhanced data gathering, digitised supply chains, and RFID for retail.

Turning to Technology to Solve Sustainability Issues

Today, 95% of retail CEOs say they plan to increase their investment in digital solutions, evidence that the entire industry sees the value in digital innovation. And while technology has evidently contributed to more emissions by making clothes cheaper and faster to produce, technology like RFID for sustainable fashion retail can also be a way to solve many of the industry’s environmental problems.

One of the biggest problems in the retail supply chain is a lack of visibility. As consumers increasingly demand information on the sustainability of retail operations, retailers will need to turn to new ways of obtaining that data.

Not only does digitising of supply chains increase efficiency and transparency (both of which are important when reducing overall environmental impact), but it also offers retailers in-depth data into their supply chain. More data equals more accountability–it’s a way for retailers to show consumers that they are actively working towards sustainability in their operations.

Retailers that are concerned about the cost of introducing digital innovations in their supply chain needn’t worry. Research shows that around 90% of actions necessary to reduce overall environmental impact can be delivered for a cost below $50 per tonne of CO2. In the end, companies that work towards digitising their supply chains save up to 50% on their costs: and that’s not counting the drastic sustainability benefits.

Additionally, the cost of innovations like RFID for retail has been steadily falling over the last ten years to 80% of its original cost. This is crucial, as RFID could be the solution for sustainable fashion retail.

How RFID Can Benefit Sustainable Fashion Retail

RFID has huge benefits for retail. Not only can the technology support omnichannel retailing but also make supply chains more efficient and help improve the customer experience. Overall, retailers–especially in the fashion industry–are increasingly turning to RFID to solve retail problems.

93% of retailers in the US already use RFID, up from just 34% in 2014. Additionally, 22% of softlines retailers have plans to adopt RFID in order to support supply chain and analytics. Despite this, though, many are still unaware of the value of RFID for sustainable fashion retail.

When it comes to making fashion more sustainable, two things are vitally important: data and traceability. As we’ve explored, without end-to-end visibility, it’s impossible for retailers to understand the environmental risks in their supply chain. Furthermore, without data, retailers cannot be transparent and will lack the understanding to make changes to their supply chains to make them more sustainable.

The solution to both of these problems is RFID for retail. When retailers embrace RFID for sustainable fashion retail, they take the first step toward more environmentally-friendly business practices.

Reduce and Reuse Applications

With millions of items sent to landfill every year, retailers need to find a solution to the problem of retail waste. When RFID is used for sustainable fashion retail, it can help retailers find ways to reuse stock and reduce the raw materials required for creating products.

For example, RFID can show retailers which products are and aren’t selling in real-time, allowing retailers to make immediate decisions to improve sustainability. They could make adjustments to stock at the initial manufacturing stage, minimising their use of materials.

Additionally, RFID also has applications for sustainable fashion retail in promoting a circular fashion economy by allowing garments to be returned to retailers at the end of their life. RFID could allow reuse and recycling applications for old stock by tracking exactly where stock is and allowing for more accurate sorting of old stock in preparation for recycling.

Smart Inventory Management

Using RFID tags in retail results in a 25% improvement in inventory accuracy. With Detego’s end-to-end RFID software, retailers can achieve 99% total inventory accuracy. This is crucial for fashion retail sustainability, as more efficient inventory logistics means less waste along the supply chain and in stores.

With RFID for sustainable fashion retail, stores can trust that they are only ordering what they need, and they have the ability to quickly react to consumer trends, producing only what will eventually sell. This prevents overstocking and makes transportation more efficient.

Optimising Retail Space

We know that e-commerce is more sustainable than physical retailing. In fact, on average, shopping online emits three times less CO2 than visiting a real-life store. However, brick-and-mortar stores are clearly here to stay.

Research from Deloitte found that more consumers are embracing omnichannel shopping–a mix of physical and online–rather than solely e-commerce. In fact, 27% of online retail purchases are fulfilled at a physical location.

As the need for a mix of physical stores and online shopping becomes more apparent, retailers will have to think carefully about how to improve the sustainability of their stores. RFID for sustainable fashion retail offers a way to do this–by optimising retail space by only selling the items that are in demand at that particular time.

End-to-End Traceability

We already know that without end-to-end visibility, retailers cannot begin to create a sustainability strategy. The technology grants retailers full visibility of their operations, as stock makes its way from warehouses to distribution centres or stores.

By harnessing the data created by RFID tags, retailers can begin to publish information about their sustainability strategy. Not only will this inform future sustainability actions by letting retailers know which policies are performing, but it also lets consumers know that you’re taking action against climate change. As such, RFID for sustainable fashion retail has multiple benefits: it makes retailers more sustainable and improves customer interactions with your brand.

An RFID retail solution

Stock accuracy, on-floor availability, and RFID omnichannel applications in stores.

Book an RFID demo to find out how our cloud-hosted RFID for retail solution could help you improve your sustainable credentials. Our multi-user app can provide intelligent stock takes and a smart in-store replenishment process, making your retail strategy more sustainable. With RFID for sustainable fashion retail, you get end-to-end visibility of your supply chain, making it easier to make changes to be more environmentally friendly.

For retailers to remain competitive, it’s now imperative that they offer omnichannel services. This was undoubtedly true before the Covid-19 pandemic, but now that more consumers are looking for an alternative, digital ways to shop, it’s even more of a requirement.

According to research from McKinsey, more than one-third of consumers in America have turned to omnichannel services as a result of the pandemic. This includes services such as pick-up-from-store, return-to-store, and shopping on apps. The vast majority of these consumers will continue to take advantage of omnichannel services long after the pandemic has ceased to have an impact on retail.

However, an omnichannel strategy can be a challenge to get right. Though digital experiences are important – especially for younger consumers in the Generation Z and millennial categories – retailers shouldn’t discount the value of physical stores. A successful omnichannel strategy offers a seamless blend of both physical and digital experiences, giving customers the freedom to shop where and how they want to.

Technology is key to implementing an omnichannel strategy. Without analytical insights, it can be difficult to see where you should be diverting your energy. Though omnichannel trends, in general, apply to all retailers, you may have a unique experience with your customers meaning a different strategy is needed. Consequently, data is the only way to make informed decisions for your brand.

Tapping into digital transformation trends also makes it easier to build a unified experience for your customers. 64% of Generation Z consumers say they would switch to a competitor after multiple negative experiences with a brand. With more frequent touchpoints in omnichannel retailing, that means the probability of one of those channels disappointing customers is also higher.

Yet, today, 22% of retailers admit that they don’t have the right technology to implement omnichannel. A similar percentage of retailers say that they would benefit from more omnichannel technology. But what technology can provide this retail solution?

To be part of the digital transformation in retail, companies can turn to RFID. While businesses may already be aware of the power of RFID to support supply chain operations, they may not be as aware of RFID for omnichannel. As well as offering retailers a more accurate look at their stock, when used for omnichannel, RFID technology can also help unlock additional digital experiences for customers, so you can continue to offer consumers more innovative ways to buy.

Omnichannel Retailing Today

While the term ‘omnichannel’ has been around since 2010, it’s only gained traction as a trend over the last few years. This correlates with the growth of the Generation Z market and an increased reliance on digital services throughout the pandemic and beyond – the ‘digital transformation.’ While many retailers are aware that they should be offering omnichannel services, few implement a seamless and successful strategy.

One common misconception about omnichannel retailing is that it means a reliance on digital services. It’s certainly true that many omnichannel services focus on online shopping: apps, virtual try-on rooms, automated returns. However, this doesn’t mean the death of the physical store. Today, 88% of Gen Z consumers say they expect to connect with a brand on both physical and digital channels.

What omnichannel really means is a focus on ‘phygital’: physical and digital at the same time. And while consumers are certainly prioritising online services, many people still enjoy visiting physical retail locations. Over 50% of retail sales still happen in-store. Additionally, one survey revealed that up to 50% of customers would prefer to shop online from a brand that also operates physical stores.

In essence, omnichannel retailing means creating a seamless experience across the online and physical parts of your brand. Omnichannel services will allow your customers to browse for items on an app, check they’re in stock in-store, visit a store to try on or sample, and then return home to purchase. Every channel should be seamlessly connected, so customers never have to restart their purchasing journey when they switch to a different channel.