Visual Merchandising’s Data Problem

Visual merchandising is one of the ‘dark arts’ of retail. For the uninitiated, it’s the practice of designing visually appealing sales floors and store fixtures that attract customers and ultimately sell the products on display. It’s a subjective and artistic means of delivering a concrete KPI – sales.

One of the challenges of visual merchandising is data, experimentation & design is all well and good, but not if you have no way of knowing what does and doesn’t work. Sales data is always a good place to start, but there are so many other factors at play that it’s often unwise to attribute visual merchandising to an increase or decrease of sales to a single product. You have to go one step further…

What is Money Mapping?

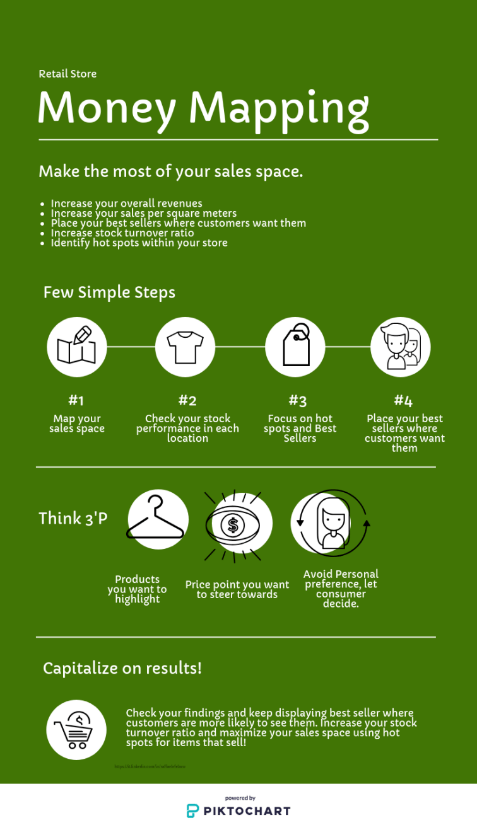

So, how do you measure the sales performance of a store based on its layout and design?

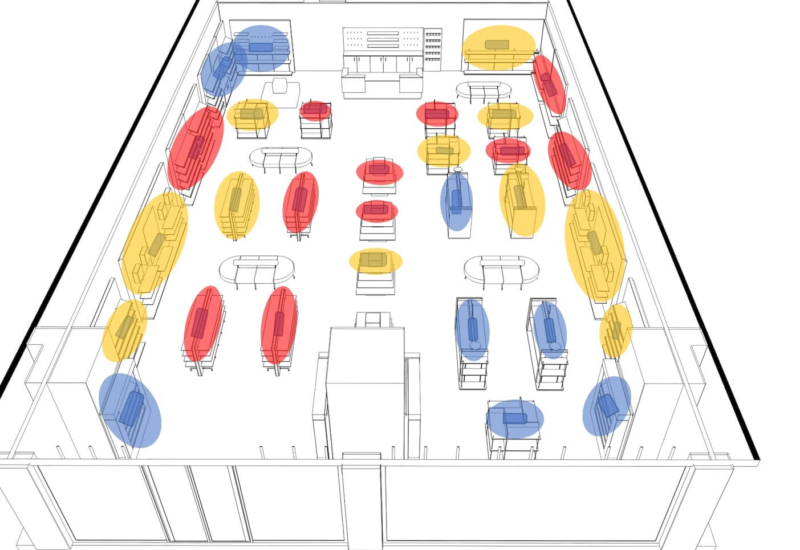

First, you map out the sales floor with the exact location of products. Then you break the map of the store into ‘zones’, typically around certain fixtures, shelves and displays. These zones can consist of several different items, grouped by either category or style depending on the design of the store.

You then collate the sales of every item in this zone and compare it to others in the same store. The result? An impression of shop floor sales broken down by areas of the store.

This is called ‘Money Mapping’ and allows retailers to visualise and analyse which areas of a store are ‘hotspots’ and which are ‘cold’ in terms of sales. This gives an initial view of which areas and fixtures are selling products and which aren’t.

To account for other external influences on sales, best practise is to swap items between fixtures or observe a ‘money map’ over a long time, as collections and merchandise changes between seasons. This way, if the localised sales data remains relatively similar even after products have rotated, then it’s clear the design or locations of the fixture is having an impact.

What are the benefits of Money Mapping?

- Insight on consumer experience

- Provides valuable data for visual merchandisers

- Breaks down areas of sales floor by sales performance

- Can be used to optimise store layout

- Drives Sales

- Can compare Product Placement & Visual Merchandising

- Can be used to conduct A/B tests

This all sounds great, so why doesn’t every retailer and every store do this already? The simple answer – the process of matching the sales data to specific locations on the sales floor, manually for every item and every store, is logistically a big ask. This means, if this can be done at all by visual merchandisers, it can only be done in a small number of stores.

How does AI change money mapping?

So how can we solve this data problem for visual merchandisers and make ‘Money Mapping’ easier and more accessible for retailers?

The first issue is having an accurate map of a store which includes exactly where every single item is sold from. Traditionally this would have to be done manually, and then have the sales data of items cross-referenced with their location in a store.

The solution: Using RFID (Radio Frequency Identification) and AI localisation techniques, we can now create a map of a store as part of the daily or weekly stock count.

This is done by adding ‘reference’ RFID tags into the store. Small tags just like ones that go on products are placed on fixtures and walls in the store. Because these never move, we can use the signal strength (relative to the fixtures) from stock counts to map exactly where items are in the store and what items they are grouped with.

This location info is then integrated with data from point of sale to generate an automated Money Map of a store, as part of the regular reporting and analytics function of the store. This can be done for as many stores as desired. With the data collection automated, visual merchandisers can focus on using the data to optimise product placement and store design across stores.

With larger data sets to work with, this also opens up the potential for more detailed analysis and experimentation such as A/B testing product combinations and store layouts!

What’s the process for AI Money Mapping?

- Attach reference RFID tags to walls and fixtures within the store

- Perform regular RFID stock takes as normal

- Software uses machine learning to ‘map’ out item locations within the store

- Integrate point of sale data with RFID software

- Software produces ‘heat map’ of the store based on sales

- Visual merchandisers can use data to inform strategy and measure results

Conclusion

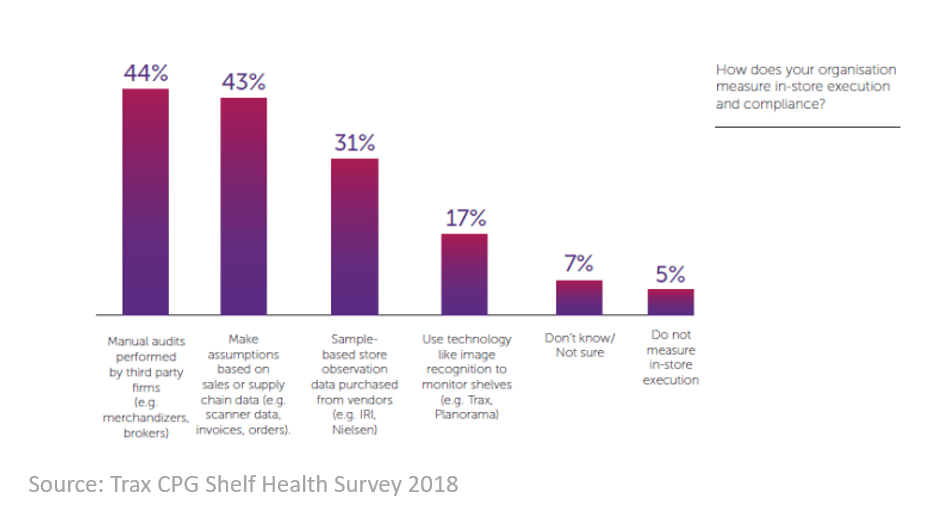

Visual merchandising is a subtle but valuable process for retailers. Done properly it has a huge impact on both sales, customer experience and brand image. The only problem with this is visual merchandisers often don’t have enough data to measure performance and identify where their attention is needed most. The data they can collect is either time consuming, expensive or inaccurate.

Artificial intelligence changes the game for visual merchandising. By utilising RFID tags and Machine Learning, it is possible to ‘map out’ the location of items in a store, and more importantly, the sales distribution of the shop floor. These ‘Money Maps’ tell visual merchandisers what areas of the sales floor are ‘hotspots’ for sales and which are underperforming. Using this data, they can then focus their attention on improving the design or layout of certain areas.

Additionally, with this data stores can look to leverage their sales hotspots either by prioritising the best locations for best-sellers, high-value items or items that are due to go out of season.

Either way, AI-enabled Money Mapping is another important evolution in retail data and analytics. Providing retailers with unprecedented insight into exactly what goes on in Brick and Mortar Stores.

Want the latest retail and retail tech insights directly to your inbox?

What is a Smart Fitting Room?

Smart fitting rooms consist of an interactive touch-screen mirror connected to an RFID reader and a motion sensor. They sense when customers enter the fitting room, and sense what items they have brought in with them by reading their RFID tags. They then assist the customer throughout the fitting room process, giving them information on products and calling for assistance if required. In simple terms, they allow consumers to experience the same benefits they get from online shopping whilst in the fitting room, as well as let them request items be brought directly to them.

What does a Smart fitting room do?

- Detect movement and presence of a customer

- Identifies which item the customer brings to try on

- Displays additional product information

- Provides availability information to the consumer

- Shows product recommendations that would complement the currently selected style

- Provides additional services such as Call for Assistance or Call for different products / colors / sizes

Smart fitting rooms have existed in the fringes of the retail technology space for a number of years. The interactive mirrors certainly capture the imagination, but they’ve only really existed at trade shows and in concept stores rather than out in the wild. It’s fair to say the technology was in the category of interesting and fun but not really taken seriously. Fast forward to 2020, and we have just seen the first major commercial use of smart fitting rooms, in a truly digital, experience-first, award-winning store.

What makes up a Smart Fitting Room?

- Framed Mirror

- RFID Reader & Antennas

- Motion Sensor

- Touchscreen Display

- Internet Connection

- A store that is using RFID item-level tagging

So, now is the time to start paying attention to Smart Fitting Rooms. But for those looking at the technology, either for the first time or with fresh interest now that solutions are live in the market, the business case might be a concern. In this article, we will break down exactly what a smart fitting can do, and what kind of value they offer for retailers, customers and retail profits.

What are the business benefits of Smart Fitting Rooms?

Improving Customer Experience

As a customer-facing technology, we’ll start with the most obvious (yet qualitative) use of the smart fitting room – an improved customer experience.

Rather than taking this for granted, however, let’s dig into how, why and even if smart fitting rooms offer a better experience for customers. Having a mirror automatically detect and display item information is nice and will wow customers (at least to begin with) but doesn’t really add much more value than an interactive screen that can scan products barcodes or even a product QR code.

What sets smart fitting rooms apart from these solutions are the interactive options and how they support customers. This includes offering additional and related or ‘frequently bought together’ items, information on exactly what is available in the store (using the real-time stock view RFID provides) as well as being able to request items be brought directly to the fitting room. These options being built directly into the mirror that customers already use will both delight customers and make the fitting room experience more convenient.

How smart fitting rooms benefit the customer:

- Shows different product combinations

- Makes product recommendations

- Article availability check

- Shows full range of articles to browse through

- Additional information, videos, social media integration

- Customer-friendly fitting (Article-Bring-Service)

- Enables digitally supported purchase decisions

- Direct reservation or ordering of articles

- Different delivery options (delivery to home address, from another store, etc.)

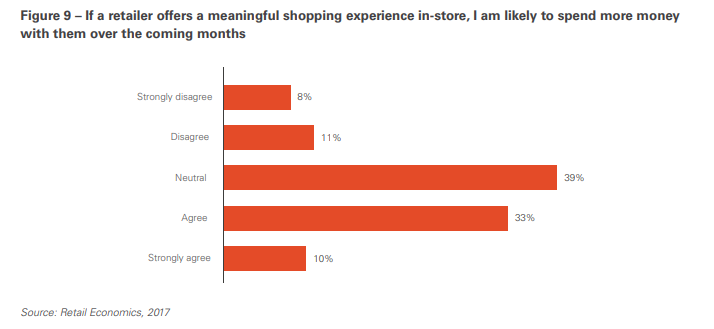

The economic value of customer experience:

Increase Sales

‘Customer experience is king’ has been a favourite tagline of innovative retail for some time. While it’s probably true and certainly sounds good, when it comes to the business case of new technologies you really do need to look at revenue. In terms of the customer, that generally means sales. So, what effect do smart fitting rooms have on sales? Other than more tenuous effects like bringing more customers in to the store, Smart fitting rooms increase retail sales in two ways:

Combating Lost Sales

Fitting room conversions is a self-explanatory if unfamiliar term for brick and mortar stores. That’s because as a KPI retailers have never had any way to measure or track this (more on this later). But fitting rooms are absolutely pivotal to apparel sales.

According to The Retail Doctor, shoppers who use dressing rooms are 70% more likely to buy versus those who don’t. It’s easy to see why, as customers have already decided that they like the item and want to purchase it, so fitting rooms become a question of making sure, and finding the right size.

It’s finding the correct size where most fitting rooms sales are lost. If a customer needs a different size, they will have to leave the fitting room and come back. Studies prove that this can have a major impact on sales, as 50% and 21% of people say they will sometimes and every time respectively leave the fitting room and the store if they were looking for assistance to change colour or size of an item and can’t find anyone.

This is why helpful fitting rooms assistants have such a big impact on sales, customers who receive assistance in fitting rooms make twice as many purchases as those who don’t. Smart fitting rooms address this issue, showing customers what other sizes are available and letting them request different sizes be brought directly to them. This allows stores to have assistance on hand (they are notified via a mobile application) without needing a permanent fitting rooms assistant, which is not feasible for many stores.

Increasing basket size with in-store cross-selling

The other sales driver of smart fitting rooms is having product recommendations made based on the items brought into the fitting room. This brings cross-selling common in e-commerce to the brick and mortar experience. Whilst these can be done as an endless aisle (so the entire product range of a store) the better way is to only offer items that are available in the store (using the stock visibility RFID provides). Much like requesting additional sizes, customers can request to have items that catch their eye brought directly to them. This can drive sales significantly and has been seen to increase fitting rooms basket size by 100% in initial studies.

New Data and Insights For Stores

The lesser-known use case of smart fitting rooms is the data and insight provided about the customer experience. It’s often said that compared to e-commerce, retailers have next to no data about what actually happens inside their stores. Other than what gets sold, they’re blind. In an industry as competitive and fast-moving as retail, this lack of analytics can be fatal.

We’ve already established how important fitting rooms are to apparel sales, so it seems that collecting and analysing data from them is a no-brainer. Traditionally however this hasn’t been the case, but with RFID and smart fitting rooms, retailers can collect that data in a non-invasive way.

What kind of insights are provided by smart fitting rooms?

- Item Conversion rate – How often are items selling (or not selling) immediately after being tried on in a fitting room?

- Fitting baskets vs shopping baskets – Most tried on vs most sold

- Number of items per session

- Session duration

- Recommendation conversion rate – How often are items recommended, requested and then sold?

- Need assistance use – How often are staff called to the fitting room using the mirror?

- Staff response time – How long does it take for store staff to react to customer requests? (gaining actionable insight to customer experience)

Conclusion

Consider the context of interactive displays, AR, VR and even RFID tables. Smart fitting rooms are both a part of this space and completely apart from it. This is because fitting rooms aren’t new, they are and always will be a part of the apparel shopping experience. Rather than adding a new element to the shopping experience like VR for example, smart fitting rooms are improving an integral (and for many, unpleasant) part of the customer experience.

In other words – it’s an evolution, not a revolution.

Whether retailers embrace this evolution will be decided in the coming years, now that smart fitting rooms are finally out in the wild. Perhaps even more crucially, especially when talking about business case, now smart fitting rooms are out in the market we will begin to see data and results that will prove the value once and for all. As early innovators of the technology, we can’t wait.

Want the latest retail and retail tech insights directly to your inbox?

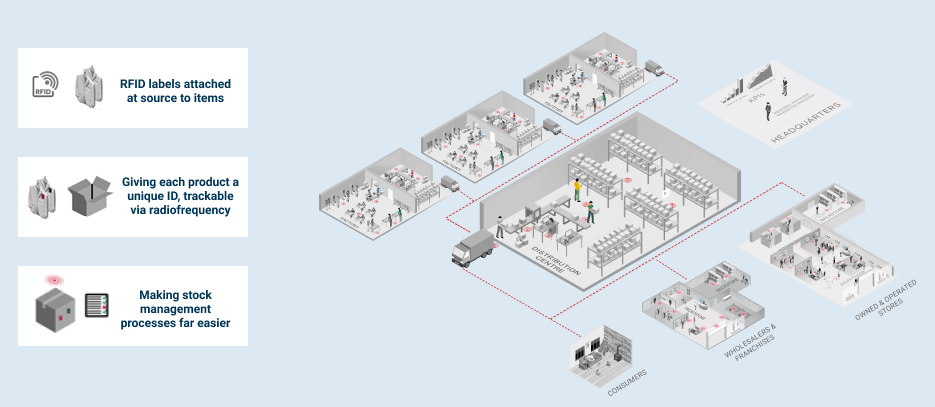

Radio frequency identification (RFID) has become established as a dominant force in the apparel industry, with the technology finally approaching mass adoption after years of threatening to.

The technology involves tags or “labels” that emit a small radio frequency, allowing radio stock counts that are both highly accurate and incredibly fast compared to traditional methods. The result of this is a very up to date, or even real-time, view of stock. The main use cases responsible for the technology’s success include the increased process efficiency, superior inventory management and the enablement of seamless omnichannel services.

That’s the story of RFID in apparel, but what about other retail industries? After years of technical roadblocks that have kept the technology out of other markets, the technology has matured to a point where new industries are RFID-viable for the first time ever. The beauty and cosmetics industry is beginning to take notice of RFID, and perhaps now food retailers should do the same.

Why? Because modern RFID is so well positioned to tackle the food industry’s unique challenges, like optimising inventory, minimising food waste and increasing the traceability of the supply chain.

Whilst this sounds great, the limitations of the technology that we mentioned earlier have historically meant RFID just wasn’t viable for the food market. As well as liquid and metallic products traditionally interfering with the RFID signals, the food industry’s drastically lower average article price compared to the apparel industry were significant roadblocks. But this changing…

Mature RFID technology is ready to take on the food industry

RFID is reaching a level of maturity that means the previous barriers to entry for the food industry are starting to disappear:

- The price of individual RFID tags has fallen significantly, making it viable for more and more food products.

- RFID tags have become smaller – so it’s now possible to label even the smallest items.

- More advanced tags now exist that work on metal and liquid products

- Durable tags that survive high and low temperatures and even microwaves are now available, meaning all kinds of food packaging can be tagged with RFID.

Because of these changes we are already seeing the first steps of RFID breaking into the food industry, with RFID-giant Avery Dennison beginning to operate in the market and last year the first-ever blockchain beef shipment taking place using RFID tagging, providing a potentially industry-changing level of traceability and assurance only possible through RFID.

Superior inventory management for efficient operations.

The first major use case for RFID in the food industry is one already tried and tested in apparel – superior inventory management. Replacing manual stock-keeping methods with fast and highly accurate RFID processes gives retailers a reliable and up-to-date view of their entire stock. Whilst having a clear view of store inventory is highly beneficial for any retail business but for the food industry, where items have to be managed and monitored much more intensely, an RFID system could cut shelf life labour costs by up to 50%. Another major impact of the 99% stock accuracy RFID provides is the reduction in inventory sizes due to not needing extra ‘safety stock’, this could have a major economic effect for food retailers and would also stop inventory shrinkage from expiry dates. Leading us to our next major use for RFID in food retail:

Reducing Food Waste

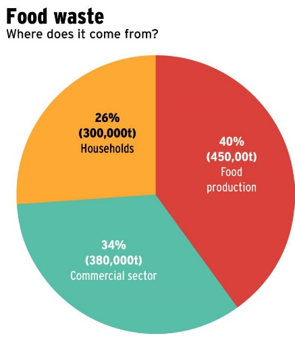

Food waste is a massive problem. Every year in the UK alone 18 million tonnes of food end up in landfill, Around 1/3 from producers/ supply chain, 1/3 from retail and 1/3 from households. Not only is this an environmental and ethical issue, but for the food industry itself, this sees huge amounts of capital literally wasting away.

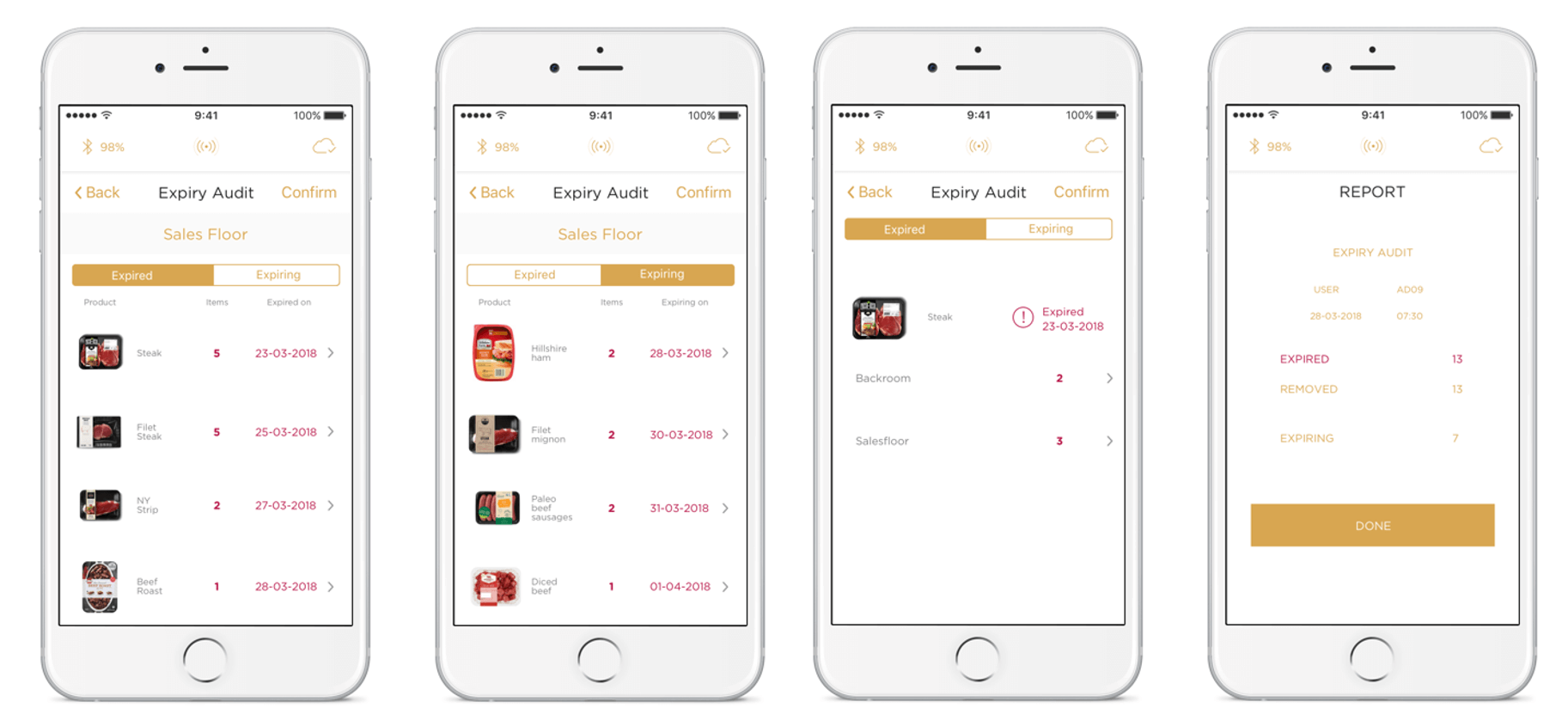

When it comes to retail, fresh produce and waste due to shelf-life is a unique issue to the food industry, but one RFID (and an effective RFID platform) is well suited to manage. Expiry dates result in a huge amount of food waste in the commercial sector and are also very labour intensive to manage on the shop floor.

So how might RFID solve this problem? The benefits that the accurate and item-level view of stock RFID provides has been well documented in the apparel sector, but with the food industry, this real-time view of stock will be even more valuable. An Internet of Things platform (giving individual physical objects a unique digital identity) designed specifically for use with food products would not only be able to monitor and maintain stock levels on shelves but could monitor the expiry date of individual products, alerting staff when items are nearing expiry or need to be marked down.

A fully Visible and Transparent Supply Chain – for consumer satisfaction and better handling of product recalls.

The final major use case of RFID for the food industry is the traceability of products through the supply chain. Whilst other retail industries get value out of this in terms of warehouse efficiency and smooth operations between distribution centres and stores, the food industry is an industry where traceability of products is a major concern, for consumers just as much as retailers. People are increasingly concerned with where their food comes from, and suppliers and retailers could look to take advantage of RFID traceability and even utilise new blockchain methods alongside this to offer their customers assurances and gain the trust of consumers. We are already in the very early stages of this having already seen the first blockchain beef shipment take place, giving consumers 100% traceability and visibility of where their produce comes from.

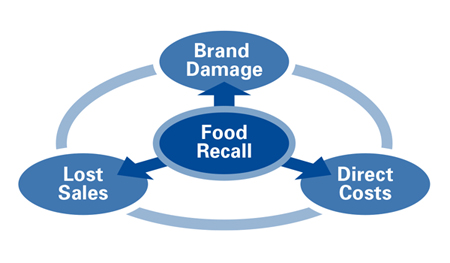

On the other end of the food traceability issue is food recalls. Product recalls are an unfortunately common problem in the food industry, costing the industry an estimated $55.5 billion a year. A recent example of this being the major recall of humous products across the UK due to salmonella. These have a huge impact on the industry, not only economically but also on brand reputation. RFID’s ability to accurately trace individual items across an entire supply chain could prove invaluable in such an event. Having complete accuracy would allow food suppliers to pinpoint exactly where the issue occurred and easily track where all other products from the compromised location were sent, allowing for fast and efficient recalls. This would also potentially reduce food wastage due to over-recall and increase consumer trust in the retailer.

Conclusion

So, the food industry has several challenges that RFID has been proven to solve and the technology has gotten to a point where it is viable among the much more diverse and complicated range of products. The only thing that may hold it back is the cost. Whilst the price of tags has dropped significantly, the price point for food products is far lower than in apparel. This may prove a barrier for tagging some food items, at least initially. Fresh products like meat and fish (and potentially some fruit and veg) however have both a high enough price point and a limited shelf life meaning managing them with RFID could prove hugely beneficial. The food industry is a new frontier for RFID, and time will tell just how well it does in the market. But make no mistake, in the coming years we will see it attempted, and the success of the technology in the industry will be decided, one way or another.

Want the latest retail tech insights directly to your inbox?

Radio frequency identification (RFID) has had a fairly long road to adoption in the retail industry. Leading the way on this journey has often been large tier 1 retailers, either investing and experimenting with the technology in-house or partnering with early RFID specialists like Detego.

However, in the more settled retail RFID industry of today, implementing the technology is a different prospect. Here’s 4 reasons why there’s never been a better time for small and medium retailers to reap the benefits of RFID:

1) RFID has Lowered in Cost

Naturally, price point is a huge factor in choosing to implement a new technology for retailers of any size. Like most technologies, RFID was at its most expensive when it was new, but over time has become more and more affordable. This drop in cost is mostly down to the price of RFID tags themselves decreasing significantly. In the early 2000s, tags cost up to $0.75 (Approx. £0.50) whereas these days the average cost is between 3 to 8 cents (so around £0.05).

Developments in hardware and software also make a difference to the price point of RFID projects. For small and medium sized retailers, in particular, the need for only a single handheld reader per store, new hardware like mobile RFID label printers, and the availability of modular cloud-based SaaS solutions can lower the initial investment required to get started with the technology. This combination of industry progress makes leaner, more affordable RFID solutions a reality.

2) The Established RFID Industry Presents Less Risk and Better Knowledge Application

In the early days, RFID projects presented something of a risk. Bigger brands have the resources and personnel for (often in-house) ‘trial and error’ projects, but smaller organisations do not. Now that Retail RFID is an established sub-industry, retailers no longer have to go it alone and have far more options in terms of vendors, partners and solutions. This often means no steep learning curves and more stable and effective digital transformations. In other words, it’s now known what works and what doesn’t work for RFID in the retail industry.

How has RFID become more feasible for retailers over time?

- Expanded and established use cases

- Project stability

- Securing return of investment

- Easy and less expensive implementation

3) RFID Implementation has Become Easier

Historically, implementation has always been a barrier to entry for RFID. This is because adopting RFID is a fairly transformative project, meaning you have to make significant changes to see the significant benefits. Unfortunately, these changes have looked too daunting for many a retailer, especially for smaller brands who don’t have the resources to spare on long projects or clunky transformations. In recent years however, established RFID solutions offer more of a ‘plug and play’ experience.

How has RFID implementation changed for retailers?

- Out-of-the-box solutions

- Cloud-hosted platforms

- Smart shield

- Able to print and encode labels on-site

4) Scalable Solutions are the Perfect Platform for Smaller Retailers to Unlock the Value of RFID

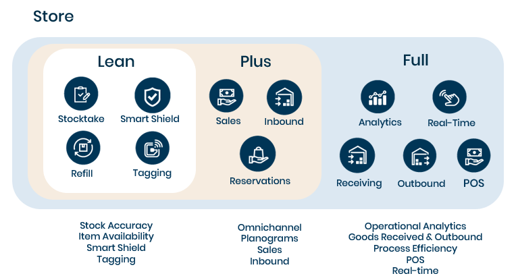

As well as easier implementation, scalable SaaS solutions are now common practise, making RFID projects easier to manage and develop over time. A scalable solution means retailers don’t have to jump straight into the deep end. This makes the technology far more accessible for retailers of all sizes, but perhaps particularly for smaller sized retailer who have a limited technology budget and need to invest over time.

Scalable solutions, like the Detego platform, often focus on core deliverable KPI’s like inventory accuracy and product availability in stores. This is because they provide immediate ROI as well as being the key foundation for many of RFID’s other use cases. One of the main benefits of scalable RFID for smaller retailers is the quickly established ROI can fund the additional investment needed to scale the solution, providing a much easier route to full adoption.

Here’s an example of what a scalable in-store RFID solution (The Detego Store platform) looks like:

Putting It All Together – What an RFID Project Should look Like for a Smaller Retailer.

So, a smaller retailer can take advantage of RFID with only a single handheld reader per store and a lean cloud-hosted RFID solution run through a mobile application. Other than the initial change in production to introduce source-tagging (adding RFID labels at the factory) implementation for such a solution is very minimal. The result of this would be rapid increase in stock accuracy, product availability and a subsequent increase in sales. This type of project provides an almost immediate return of investment, the retailer could then choose to scale and advance their solution at any point or stay with what they have and benefit from a leaner, better managed inventory.

Summary

Not only has the technology matured, including tags, hardware and software, but RFID use cases, best-practise and implantation strategies have now been firmly established. Additionally, the RFID sector is now an established market in its own right, meaning smaller enterprises don’t have to go it alone. By using established and experienced specialist partners, retailers can skip the learning curves and go straight to reaping the benefits of RFID.

Want the latest retail and retail tech insights directly to your inbox?

It’s that time of the year again where Santa Claus is faced with the busiest season of all.

While other retailers are looking forward to a few days of well-earned rest, Santa and his operational team are preparing for a night that would make the most seasoned logistics specialist cringe.

For years and years, children and supply chain operatives alike have wondered just how he does it…

A Tall Order

The original direct-to-consumer model, the North Pole operates the largest factory & distribution centre in the world. As well as the sheer quantity of items, they also deal with a razor-thin delivery-window that makes even Amazon Prime look simple.

Not only is there a head-spinning quantity of orders to contend with, but complete accuracy is a must. Unlike ASOS, a brand that also deals in great quantities; Santa doesn’t have a returns policy.

Instead, mishandled packages and incorrect deliveries break brand-trust and innocent hearts.

Well, this year the international-gift-deliverer has revealed the secret to their success in delivering world-wide miracles: The Detego Platform.

A Magical Solution

Responding to dramatic industry change including higher demand, fierce competition from e-commerce and children making requests through multiple channels, The North Pole decided to undergo a digital transformation.

The North Pole teamed up with Detego to give every single gift a digital identity. This allowed Santa and his elves to know exactly what they had in stock, ensure 100% accuracy in shipping and to track individual items in transit around the world.

Since every item is produced on-site, The North Pole can easily source-tag every present with RFID.

Santa’s elves then do full cycle counts of their inventory to make sure they’re fully prepared for Christmas. In previous years, this started in September and ended in November! Now, with the multi-user Detego application, lots of elves can take a stock read at the same time without the need for direct line of sight (cutting the ladder budget in half), and leaving no room for error.

No Need to Check the List Twice – Accurate Data You Can Trust

From this accurate view of inventory Santa and his team then sort and distribute presents, using RFID enabled pick-and-pack and exception handling. With modern RFID processes, this ensures no mistakes take place, so no children accidentally receive coal even though they’ve been good that year.

Crucially, by using automated RFID tunnels The North Pole can check every item is correctly packaged and accounted for without ever needing to unwrap presents to double check!

With a system as sophisticated as this, Santa can simply sit back, relax and enjoy Christmas knowing everything’s taken care of.

– From everyone at Detego, we hope you enjoy yours too.

Merry Christmas and Happy Holidays!

‘Christmas presents are magical things, so we needed an equally magic solution to make sure they get to the right place on time, we’ve always worked very hard to do this, but now it’s easier than ever!’

– Santa Claus

(For an introduction to combining AI and RFID see this article)

When it comes to using Artificial intelligence (AI) and Radio Frequency Identification (RFID) in retail for process optimisation, the majority of use cases involve management or ‘HQ’ level decision making. These include automating functions such as store planograms and stock optimisation between stores.

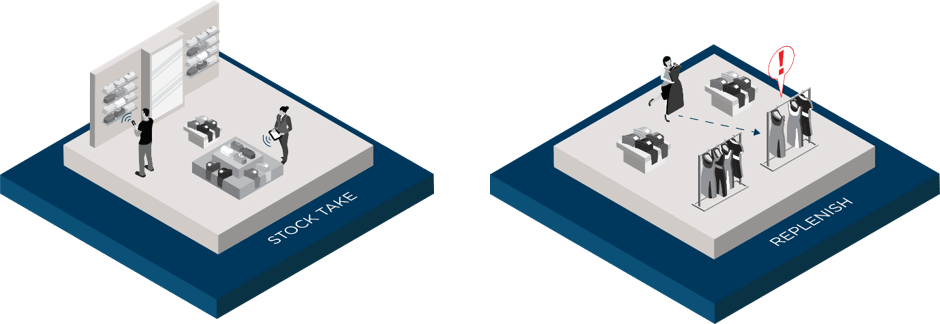

However, AI can also impact retail on a much more micro and everyday level, actively assisting store staff in one of their most common daily routines –stock replenishment.

Using RFID and the information it collects from stock reads, we can produce AI pick lists to optimise and guide staff through the replenishment process. Not only are we combining RFID technology and AI algorithms to produce these pick lists, but existing RFID processes are already assisting staff. When you put all this together, replenishment become a walk in the park.

Let’s start at the beginning…

RFID-based Stocktake and Replenishment – The backbone of modern stock management

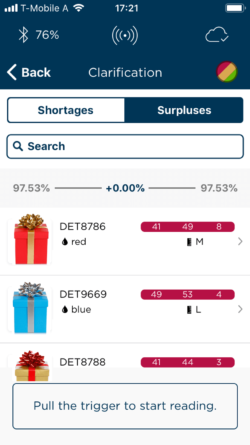

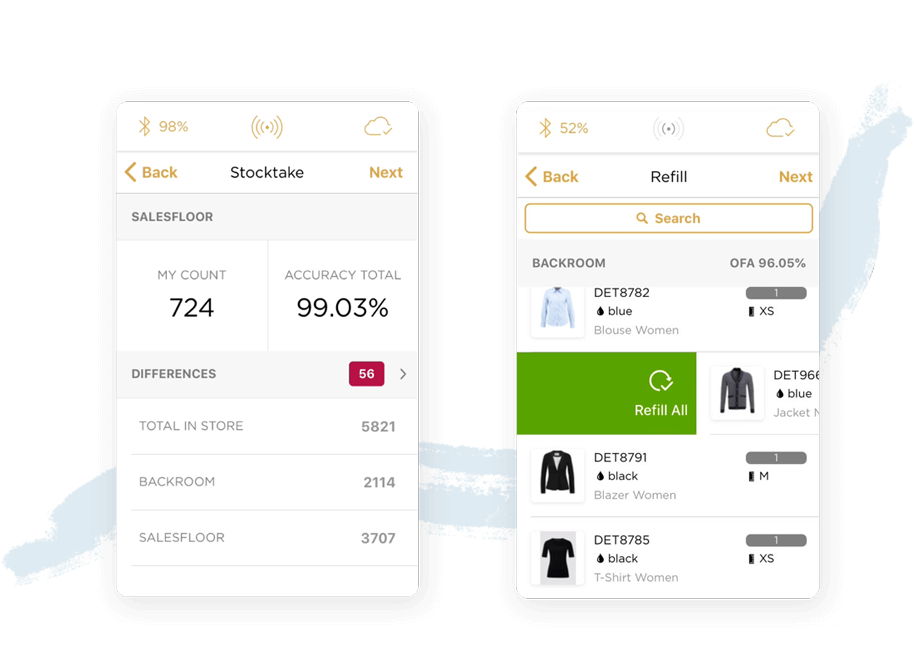

With RFID, store staff can do regular (often daily) cycle counts of the entire store quickly and easily. This is simply done by walking around the backroom and salesfloor with a handheld reader that counts items that are several feet away, using radio frequency. An RFID application or software, like the Detego platform, will then compare the actual stock levels of the shop floor with the desired counts (i.e., planogram), and tell staff exactly what needs to be replenished from the backroom.

So far, what has just been described has been entirely RFID-based and is the standard process for RFID in retail. This is already far easier and more accurate than traditional methods, not to mention the actual effect of the technology like higher stock accuracy and product availability. But why stop there?

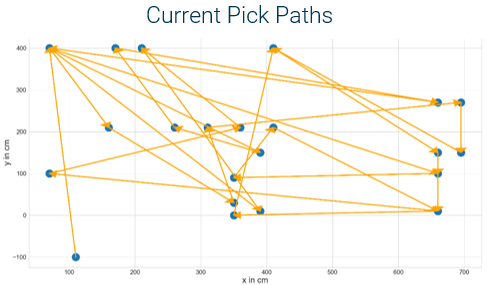

Taking it one step further – AI pick lists for ‘mapping’ the perfect replenishment path

Normally, even with the support of RFID, the store staff are then left to fulfil replenishment by themselves, using the list provided by the application. These pick lists are often only sorted by product features such as name or price. Because back rooms can be quite large in bigger stores, or densely packed in smaller ones, the staff’s ‘pick path’ can be incredibly sporadic. This is made even worse in the case of new staff who don’t know the layout of the backroom by heart, or even experienced staff if stock has simply been moved around and updated with the start of a new season.

By utilising new tag localisation techniques, it is now possible to locate where items are in the backroom in relation to each other. This is done during the regular RFID stocktakes that are already taking place, utilising data mining and machine learning pipelines without any need for additional hardware or specialist tags. Using this information, we can create automated AI pick-paths that, using a mobile application, guide staff through replenishment and present the most efficient order to collect items in.

The above example is designed to present the quickest possible replenishment route for staff, so is solely using items’ distance from one another to calculate a pick list. However, AI pick lists can process the replenishment list in a number of ways, depending on what the store wants to focus on.

Replenishment paths could take additional factors such as product value or expiry date into account, alongside the location of the items. It would then look for items that fit this rule and are nearby one another in the backroom. For example, a pick list targeting on-floor-availability would group nearby items that are running low on the sales floor, so that these items are refilled first to speed up the replenishment process whilst also combatting loss of sales from out of stocks.

Benefits of AI-pick lists

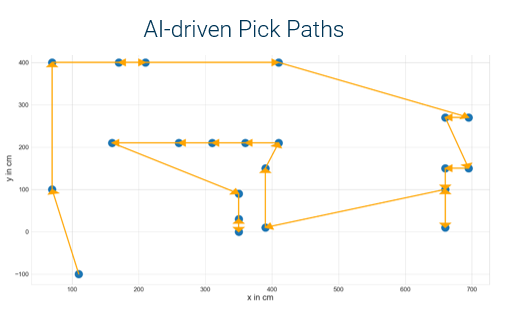

Artificial intelligence, the future of smart retail or another empty buzzword?

Artificial intelligence is the poster child for emerging or ‘new age’ smart technologies. Whilst it’s easy to get carried away with ideas of intelligent robots, AI mostly involves intelligent automation systems. This means computer systems that can process and respond to information by themselves, and even learn and self-correct better ways of doing so over time. AI is a broad spectrum, however, and the complexity and ‘intelligence’ of such systems can vary.

AI’s main use for retailers is to automate analysis and decision making

Because AI is still in relative infancy for retail, a large proportion of its use cases for the industry are still being developed and established. We have already seen a strong uptake in AI for customer intelligence in the form of online chatbots and product recommendation engines.

The other areas of potential, namely optimisation of business processes like supply chain planning, demand prediction and store operations, are beginning to take shape but all share a common problem – they need large amounts of data. This has been the main thing holding AI back in certain areas of the retail value chain, but by utilising another technology becoming increasingly common in the industry, this could all change…

RFID in retail, the story so far:

If the ‘AI revolution’ hasn’t really taken off yet, the RFID one is well underway. RFID is used in retail to track and manage merchandise, on a single item-level, with far greater detail and accuracy than traditional systems can manage. The key benefit of RFID for retailers is an accurate and single view of stock across the entire business and its supply chain.

Naturally, RFID systems produce a huge amount of data for products, both in the supply chain and in the individual store. If only there was something that could process all that data…

AI meets RFID: The perfect match

Combining the large amount of item-level data RFID produces with the automated processing power of AI is the natural next step for retail technology.

The key to doing this is each use case adding value or actively solving a problem. At Detego we often talk about ‘avoiding data for the sake of data’ so when using AI to process such data, producing actionable insights and recommendations is vital.

So, what can we do by utilising AI with RFID, and why should retailers care?

So far, the key areas RFID-driven AI automation offers value to retail operations are assisting store staff, assisting customers and optimising inventory management on both a single store scale and across entire store networks.

Our Data Science team are developing solutions for the following use cases, which we will explore in detail in future articles:

Sustainability in fashion retail is gradually becoming one of the industry’s top priorities. With apparel contributing to around 10% of all greenhouse gas emissions, consumer attitudes towards brands are increasingly being influenced by their efforts towards sustainability. This is in turn causing many retailers to look to improve their environmental records and explore new strategies to do so. In this article we’ll explore exactly what that looks like for the industry, and how RFID (Radio Frequency Identification) can be leveraged to help with this, particularly to improve traceability of items.

Sustainable retail is a priority for more and more consumers

Sustainability in Fashion has been a concern for some time but in recent years consumers, particularly younger generations, who are increasingly concerned with the sustainability of their clothes are forcing major change in the industry. According to the McKinsey apparel CPO survey, there has been a 500% increase in the number of sustainable fashion products launched over the past two years.

This proves that the industry is beginning to move in the right direction, but there is still a long way to go. A report by environmental agency Stand.earth claims that only two major brands are delivering on their commitments to reduce emissions, American Eagle and Levi Strauss, who came out on top of the recent report card.

What does sustainable retail mean for the fashion industry?

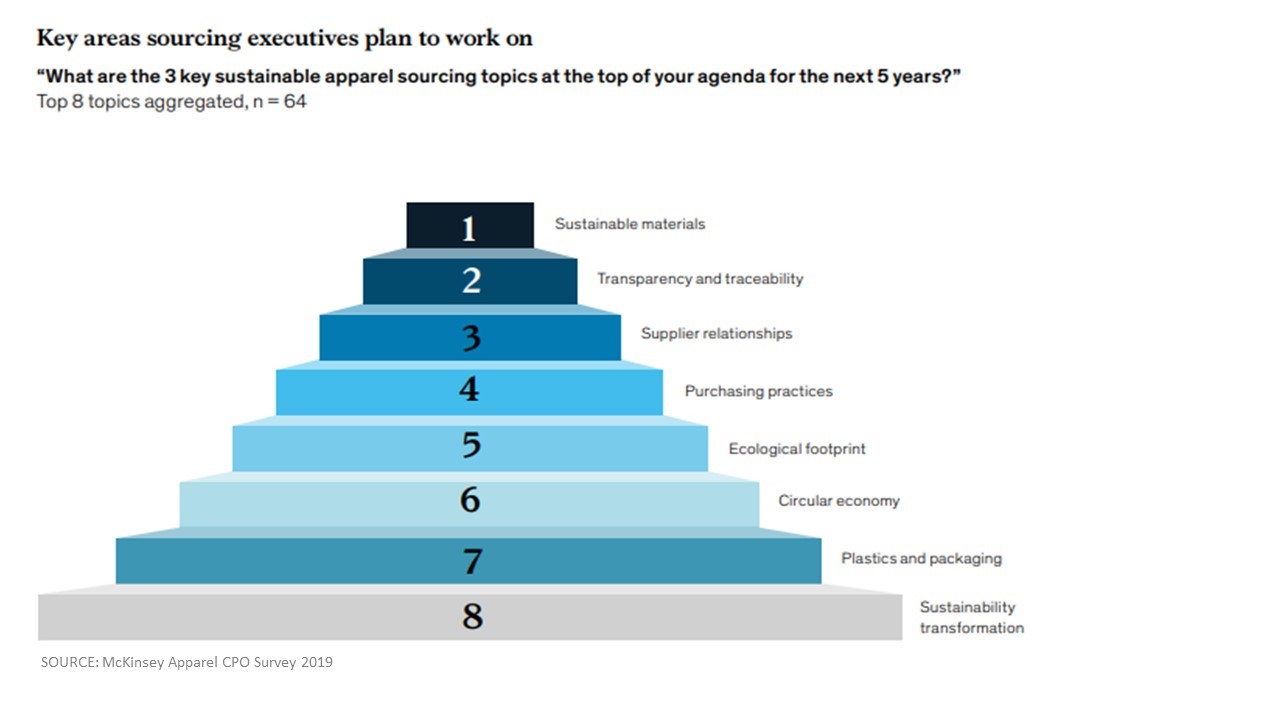

So, if most of the work is yet to be done to improve sustainability in fashion retail then which areas should retailers focus on? Whilst key areas like sustainable materials and practises will be crucial, retailers will need to make improvements in several different areas in order to improve the footprint of their businesses. Edwin Keh, CEO of the Hong Kong Research Institute of Textiles and Apparel argues that “There is no silver bullet; rather, there will be a combination of a lot of small innovations and a few radical changes.” In the figure below, from the McKinsey survey, we can see the truth in this, as brands are focusing on a variety of methods to reduce their environmental footprint.

RFID and Sustainable Fashion Retail

(For an introduction on the basics of RFID for retail, see this article)

So, what part can RFID play in all this? There are three key ways retailers can improve sustainability with the help of RFID:

- Produce less through leaner inventories

- Consumer transparency with item-level traceability through supply chain

- Digitise the emerging ‘fashion rental’ market

The most obvious solution for fashion is to produce less merchandise and prevent wastage of resources. By implementing an RFID inventory system, retailers can have on average 10-15% less inventory in stores, due to the increased stock accuracy and the ability to leverage their stock more efficiently.

Another way brands can use RFID to improve sustainability is to utilise the item-level traceability that RFID tags can provide. As far as sustainability initiatives go, this is a fairly customer-facing use, as brands can leverage the additional data stored within RFID tags to provide transparency about where their products are sourced. Often this will be displayed through customer facing applications such as the brand app and/or NFC (Near Field Communication) initiatives.

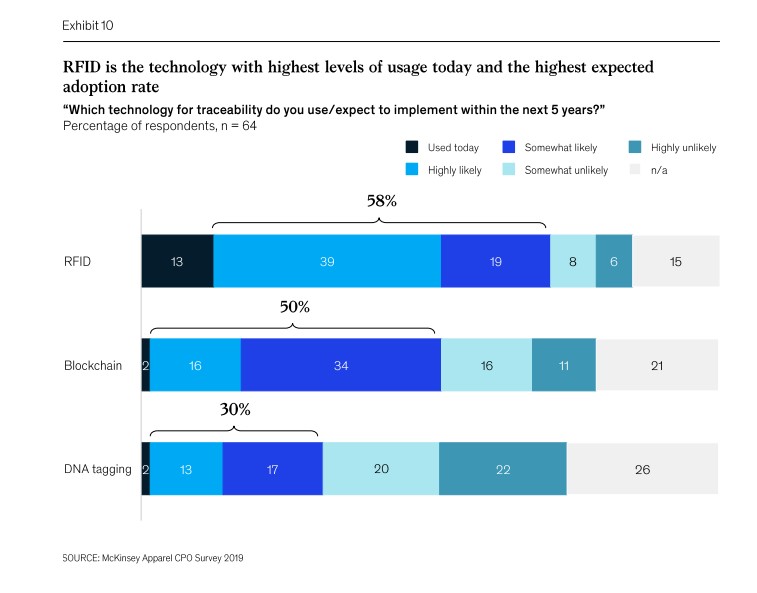

This use case is already being implemented by some retailers, and the majority of RFID-enabled brands seem likely to employ it in the years to come. In the McKinsey survey, 65% of surveyed sourcing executives expect to achieve full traceability from fibre to store by 2025, and the majority of brands plan to use RFID to do so:

The other big impact RFID looks set to make on the fashion sector is in new markets that are only beginning to emerge on to the world stage:

The second-hand clothing market may not be second best for much longer

Due to the large increase in consumer interest in sustainability in fashion retail, something of a sub-industry has developed in the second-hand clothing market in recent years. This is no longer just traditional second-hand clothing outlets such as eBay and charity stores, but also brands that actively trade in used clothing. Chris Homer, CTO of online clothing marketplace ThredUp, says its research found the size of the second-hand clothing market has doubled to $24 billion in the US over the past 10 years, and he predicts the market will overtake fast fashion sales within the next 5-10 years. It isn’t just disruptor brands who are looking towards second-hand clothing, as British retail giant John Lewis recently launched a ‘buyback’ scheme with 20,000 customer to help combat clothing waste.

Could the growing rental-clothing industry be the green alternative to fast fashion?

The other subset of fashion retail that is growing out of sustainability concerns is the rental clothing market. This allows consumers to have access to the same variety and turn-over of clothing that they could have with fast-fashion, but without the waste of resources and impact on the environment. Much like the second-hand market bigger brands are also looking to get involved here, with the international apparel brand H&M having very recently announced a trial of a rental service in their flagship store in Stockholm.

New markets = New challenges

Both of these emerging sustainable apparel markets are yet to truly find their feet, and time will tell how sustainable they are as business models. One of the main challenges we see for such markets is the traceability of items and combating counterfeit returns and losses. In both second hand and rental fashion models, you will be dealing with far more individual and one-off items than in typical fashion retail. As such, keeping track of individual items will be vital, but more challenging than normal. In such models, items will be moving in and out of the store in both directions rather than predominately in one. Strong inventory management will therefore by imperative for these businesses to succeed.

Could RFID be the backbone of the emerging used clothing & rental fashion industries?

It seems RFID could be the perfect technology to build these new sub-industries around, as an RFID system would be able to deliver the perfect conditions for second hand and rental businesses to thrive. With each item having a completely unique ID, retailers would know exactly what they have available, and exactly what they have out with which customer (in the case of rental). As RFID tags are unique and can’t be forged or copied, retailers could offer these services with full confidence that the right product is being returned, eliminating the possibility of any new illicit markets forming.

Finally, using the real-time digital view of inventory created by an RFID system, second-hand and rental retailers would be able to show exactly what products they have available online making items available to click-and-collect or order online. Without such systems these new models might struggle to have a digital presence, which would limit their reach and ultimately their success.

We say it all the time, but effectively running a large retail business is challenging, and it is getting more complex by the year.

Even ignoring COVID-19, the highly competitive nature of the industry means retailers must always be pushing forwards, constantly improving their offering, and ensuring margins are optimised to the nth degree.

Managing a full store network is hard enough, but now retailers must operate online channels and even blend operations to offer services like click-and-collect.

The need to manage increasingly complex operations in better and more innovative ways has led retail down the path of digital transformation.

The digitisation of stores and supply chains delivers one of the most crucial requirements of effective modern retailing – product visibility. For retailers who can achieve a single unified view of stock, meeting the high standards of customers and shareholders get a whole lot easier.

Let’s explore the new holy grail of retail – A Single Stock View

What is a single stock view?

A single point of truth in retail means having a single view of stock across the business. It means stores and distribution centres aren’t islands of merchandise that are clunkily attempting to share their version of stock information with one another as best as possible.

Instead, at the foundation of the business is a unified view of every single product. Because this view of stock covers the entire network, items can move between stores and DC’s and remain in line-of-sight the entire time. This has huge benefits for individual operations and the business as a whole.

Doing this requires the right digital technologies. RFID enables retailers to track their products with pinpoint accuracy, and cloud-based infrastructure and The Internet of Things allows you to build a digital view of products, and easily share this data across the organisation.

A single view of stock must be:

A single point of truth for retail inventory must be:

What are the benefits of a single stock view?

How do you achieve a single view of stock?

So, what does it take to gain this reliable and complete view of stock?

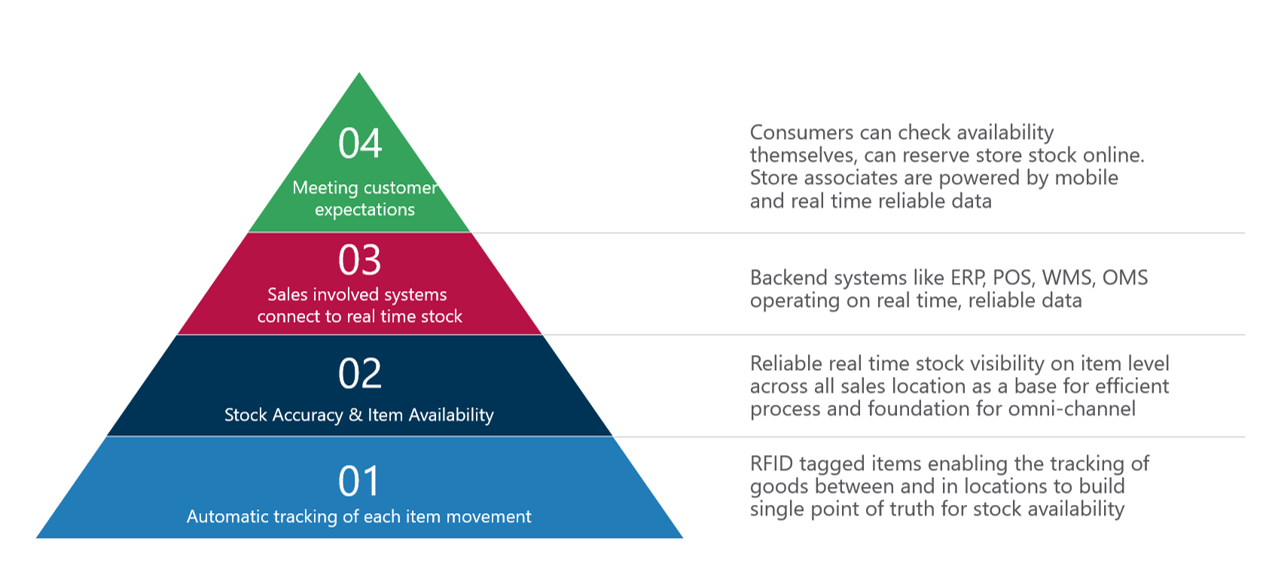

A single view of inventory starts with a single item. By giving each item an RFID tag, you are essentially giving it a unique digital identity. This means, using regular RFID reads and sensors, you can easily track the item as it moves along the supply chain.

Once it has arrived in a store, the stock becomes far easier to count, monitor and control. Because all this information is stored centrally in a single place, the individual item can be seen by the online store (and its customers) and even neighbouring stores and DC’s.

This transparency boosts efficiency and makes cooperation between different arms of the retail operation far easier to manage.

With RFID in place, you can verify and track your products on an item-level, giving you a complete digital view of every individual item and every single item-movement, in real-time.

But to get every step of the operation singing off the same sheet requires supporting software that is:

- Cloud-Based

- Utilises the Internet of Things

- Is End-to-End, covering from the factory to the shop floor

The Detego platform is the single point of truth for retail inventory

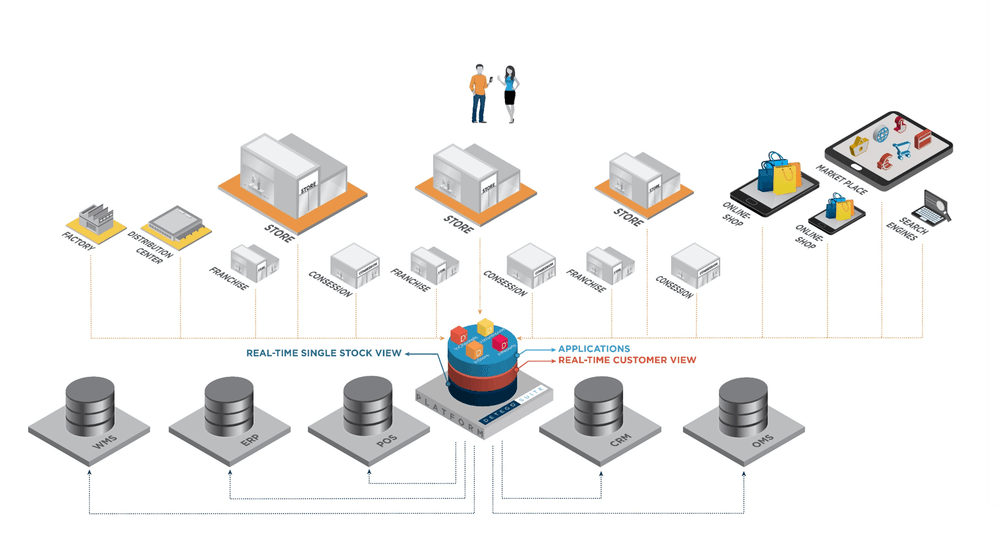

The Detego platform puts all this together and delivers a single stock view that can be counted on. Using RFID, we effectively digitise every single product in the supply chain and the store network. The information can then be fed into existing systems, such as ERP and OMS. The Detego platform covers every step of the item journey, from the factory to the distribution centre to the store. This delivers all the benefits mentioned above, and our in-store application guides store staff to effectively capitalise on this complete view of store inventory.

‘Detego is our “Single point of truth” in terms of in-store inventory. As a result, we are able to improve our omnichannel services such as click & collect, returns from e-commerce in the store or directly deliver to consumers from the store in a very efficient way. These are exactly the services our consumers expect today.’

Tobias Steinhoff, Senior Director Business Solutions Sales Strategy and Excellence, adidas

In the modern retail industry, you’ll no doubt read a lot about how ‘customer experience is king’, but with such a subjective notion that can’t be measured in any reliable fashion, it often feels like a vague concept. An actively bad experience is more tangible (and something we described how to avoid in our previous article) but what makes an exceptional one is more of a grey area. In fact, the elusive notion of customer experience is at risk of becoming yet another retail buzzword.

So, what does good customer experience look like? We’ll start with making an important distinction between shopping and buying. Shopping is the all-round experience of browsing in a store, looking at items, trying them on (in the case of apparel) and finding items and making decisions as you go. Buying on the over hand is a more straight forward (in theory) process were a customer knows what they want to buy, or at least has a rough idea, and finds and purchases their item quickly and easily.

It’s often said that E-commerce is ahead of physical retail when it comes to simply buying but struggles to match the shopping experience of brick-and-mortar. Some retailers have leaned into what sets them apart from online, focusing their investment and new technologies on improving the shopping experience, to surprise and delight their customers. Others have looked to implement technology to compete with e-commerce’s convenience and provide a more streamlined and ‘seamless experience’.

The reality is both of these elements are pivotal to a strong customer experience, and retailers should look to improve both, sticking to the principal that:

Retail should be fun when you want it to be, but fast when you don’t.

Fun retail

The fun side of retail is mostly concerned with the shopping side of the retail experience. This is obviously very subjective, and many retail customers will simply find the traditional shopping experience fun, provided they are not hampered any problematic friction points. For other customers though, more needs to be done to amplify the ‘wow factor’, as Steve Dennis says, to tempt them away from either a competitor or the convenience of online.

Retailers are increasingly looking to technology to boost consumer engagement in the store and provide a more entertaining shopping experience. Examples of this include:

Augmented reality

Augmented reality (or AR) is an interactive experience where virtual images are placed over images of the real world. Applications of AR in retail include mobile applications and fitting rooms where consumers can virtually try on products like clothes or even cosmetic products.

Smart Fitting Rooms

Smart fitting rooms offer a considerable improvement on the traditional fitting room experience and bring a little bit of the online experience into the brick-and-mortar store. The mirror automatically detects items (when tagged with RFID) that have been brought into the room, displays them on the mirror with product information and suggests other items that are available, effectively bringing cross-selling into the store.

Virtual & Robotic store assistants

Robotic store assistants are certainly on the more futuristic end of the spectrum, with the ability to talk to customers and guide them around the store. Whilst this technology is in the earlier stages, with fairly low adoption rates, they are an undeniably fun concept that will make customers think ‘wow’. On the other end of the spectrum we have virtual assistants or chatbots, which can communicate with customers through their smartphones and answer queries and provide them with information about items and stock-levels.

Fast retail

But what happens when a customer doesn’t want to spend their time on the full shopping experience? In such a case, a customer is only focused on buying and not shopping. Certain retailers leave something to be desired here, with disorganised stores and long lines for customer service and checkouts. The buying side of retail also happens to be what e-commerce excels at, so retailers need to invest in technology to be able to compete and keep customers choosing their stores when it comes to fast and convenient purchases. These technologies and strategies include:

Advanced Points of Sale

Long lines for checkouts are a common problem in retail, and for customers looking for a fast experience this is a major friction point. Thankfully there are a range of PoS technologies that make checkout fast and frictionless. Self-checkout is very common in the food industry and reduces queues if not the time taken at the checkout itself. Alternatives like RFID PoS on the other hand significantly reduces checkout times, were as checkout-less solutions like Amazon go and Mishipay remove the checkout altogether.

RFID’s smart inventory

The other main thing slowing down the buying process in the brick-and-mortar experience is finding the correct item in the first place. Locating a specific item in the store can sometimes take far more time that it should, especially if staff don’t have the time or the information to help. What’s even worse than this is if after searching for the item the customer finds out that its out-of-stock altogether. We explored this in detail in our previous article but RFID not only significantly reduces out-of-stocks and increases on-floor product availability, but the real-time view of inventory it provides means customers can check available stock online before setting foot in the store.

Omnichannel services

We’ve spoken about e-commerce being good at the buying half of retail, and with the vast majority of retailers now being online and 73% of customers using multiple channels in their shopping journeys, it’s no surprise the demand for omnichannel is as strong as it is today. For a fast retail experience, customers can take advantage of click-and-collect and click-and-reserve when they just want to buy products rather than shop for them.

Good customer experience does both

So, to wrap things up, if retailers want to establish a reputation for a great customer experience, they need to have an equal focus on the shopping experience and the buying experience. Shopping should be fun; the in-store offering should be superior to online and at its best it should surprise and delight customers with a certain ‘wow factor’. At the same time, sometimes people just want to buy, and if brick-and-mortar stores make that significantly less convenient than online then they’ll suffer to the competition. By effectively leveraging the right technologies retailers can provide a top-level customer experience that delivers on all fronts and keeps customers coming back time and time again.