The IT system integrator and leading European RFID specialist sys-pro GmbH (Berlin) is acquiring the Graz (Austria) based RFID provider Detego GmbH. Through this acquisition, syspro expands its development capabilities for customised lifecycle RFID solutions.

The new European RFID development centre in Berlin and Graz focuses on highly integrated, future-oriented enterprise applications along the entire supply chain and in particular for customers from the production, logistics and retail sectors. syspro equips companies and brands in the retail sector, among others, with customised RFID solutions for maximum inventory transpacity and thus ensures the best possible availability of goods in all channels.

Through the acquisition of the former Austrian competitor and retail specialist Detego, syspro is enhancing its leading market position and further expanding in the segment of innovative RFID solutions for retail. “We develop effective solutions that help our customers in today’s extremely dynamic competitive environment,” says Harald Dittmar, managing partner of syspro. “The continuous expansion of our RFID offering will provide improved process transparency and significantly support companies in establishing successful process chains in production, logistics and distribution.”

With Detego, syspro is integrating a provider of advanced RFID software that has been successfully established for almost two decades and whose fashion solutions are used by retailers around the world as a central source of information for in-store inventory. The combination of the two brands’ expertise will provide retailers with even more innovative operational insights and robust strategic consulting services.

“Detego has advanced retail analytics through the advancement of RFID technology and applications,” says Dittmar. The two companies share a forward-looking vision for retail excellence. Both companies are committed to shaping the future of the industry by closely analysing the needs of their global customers and leveraging partnerships to provide the tools necessary to address the challenges of omnichannel retail.

“Detego is committed to customer-centric product development with a focus on collaborative problem solving,” said Brian Robertson, Managing Director of Detego. “That’s why syspro and Detego complement each other naturally. With our expertise in RFID technology and culture of innovation, large retail footprint and years of experience in delivering data-driven, results-oriented solutions, retailers will be better equipped to meet the challenges of the future.”

Detego and Zebra Technologies have a long-standing partnership with successful global RFID rollouts. Joint customers include some of the world’s leading fashion brands.

Learn more in our new whitepaper about how this partnership approach provides the best and most sustainable approach to RFID implementation.

“By using Detego and Zebra RFID solutions to digitize stock counts one major global retailer increased inventory accuracy to 99%”

Complete the form below to download the case study.

For retailers to remain competitive, it’s now imperative that they offer omnichannel services. This was undoubtedly true before the Covid-19 pandemic, but now that more consumers are looking for an alternative, digital ways to shop, it’s even more of a requirement.

According to research from McKinsey, more than one-third of consumers in America have turned to omnichannel services as a result of the pandemic. This includes services such as pick-up-from-store, return-to-store, and shopping on apps. The vast majority of these consumers will continue to take advantage of omnichannel services long after the pandemic has ceased to have an impact on retail.

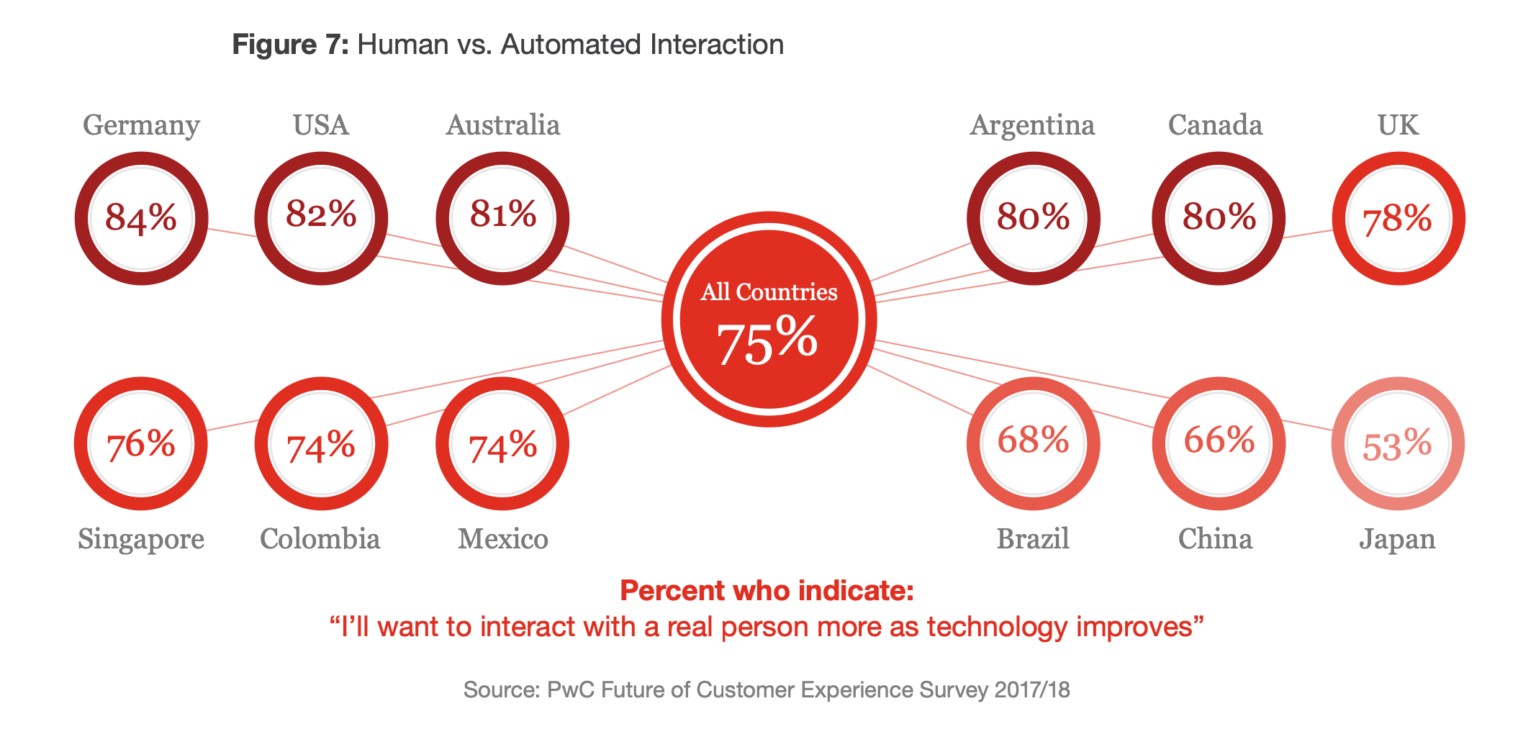

However, an omnichannel strategy can be a challenge to get right. Though digital experiences are important – especially for younger consumers in the Generation Z and millennial categories – retailers shouldn’t discount the value of physical stores. A successful omnichannel strategy offers a seamless blend of both physical and digital experiences, giving customers the freedom to shop where and how they want to.

Technology is key to implementing an omnichannel strategy. Without analytical insights, it can be difficult to see where you should be diverting your energy. Though omnichannel trends, in general, apply to all retailers, you may have a unique experience with your customers meaning a different strategy is needed. Consequently, data is the only way to make informed decisions for your brand.

Tapping into digital transformation trends also makes it easier to build a unified experience for your customers. 64% of Generation Z consumers say they would switch to a competitor after multiple negative experiences with a brand. With more frequent touchpoints in omnichannel retailing, that means the probability of one of those channels disappointing customers is also higher.

Yet, today, 22% of retailers admit that they don’t have the right technology to implement omnichannel. A similar percentage of retailers say that they would benefit from more omnichannel technology. But what technology can provide this retail solution?

To be part of the digital transformation in retail, companies can turn to RFID. While businesses may already be aware of the power of RFID to support supply chain operations, they may not be as aware of RFID for omnichannel. As well as offering retailers a more accurate look at their stock, when used for omnichannel, RFID technology can also help unlock additional digital experiences for customers, so you can continue to offer consumers more innovative ways to buy.

Omnichannel Retailing Today

While the term ‘omnichannel’ has been around since 2010, it’s only gained traction as a trend over the last few years. This correlates with the growth of the Generation Z market and an increased reliance on digital services throughout the pandemic and beyond – the ‘digital transformation.’ While many retailers are aware that they should be offering omnichannel services, few implement a seamless and successful strategy.

One common misconception about omnichannel retailing is that it means a reliance on digital services. It’s certainly true that many omnichannel services focus on online shopping: apps, virtual try-on rooms, automated returns. However, this doesn’t mean the death of the physical store. Today, 88% of Gen Z consumers say they expect to connect with a brand on both physical and digital channels.

What omnichannel really means is a focus on ‘phygital’: physical and digital at the same time. And while consumers are certainly prioritising online services, many people still enjoy visiting physical retail locations. Over 50% of retail sales still happen in-store. Additionally, one survey revealed that up to 50% of customers would prefer to shop online from a brand that also operates physical stores.

In essence, omnichannel retailing means creating a seamless experience across the online and physical parts of your brand. Omnichannel services will allow your customers to browse for items on an app, check they’re in stock in-store, visit a store to try on or sample, and then return home to purchase. Every channel should be seamlessly connected, so customers never have to restart their purchasing journey when they switch to a different channel.

Another part of omnichannel retaining that is often underappreciated is brand consistency, which we explored in a recent article. Yes, retailers must ensure a seamless experience across touchpoints. But they should also ensure that their brand identity is unified across digital and physical channels. Businesses that prioritise brand consistency actually perform better than brands that have a more lukewarm approach to their branding.

So, a successful omnichannel retail solution should integrate all channels seamlessly while prioritising a consistent experience for customers. But why should omnichannel be a priority for retailers?

Why Should Retailers be Prioritising Omnichannel?

Retailers that implement omnichannel experiences see immediate benefits. Brands with a seamless omnichannel strategy report are three times more likely to increase their revenue, and four times more likely to have loyal customers. But why?

For starters, customers today are no longer shopping on just one channel. Research from McKinsey shows that the average customer engages with three to five channels before making their purchase. Similarly, 67% of customers use multiple channels to complete a transaction. These might include social media, an online store, an app, or a physical location. Omnichannel retailing taps into the digital transformation trend by offering customers exactly what they want: the ability to shop seamlessly online and offline at the same time.

Customers who prioritise a multi-channel buying experience are also far more likely to part with their money than single-channel customers. Omnichannel customers spend about 10% more online than those who only tend to browse through one channel. Additionally, these customers are more likely to stay loyal to brands. Brands that implement a successful omnichannel strategy retain 89% of their customers – compared to 33% for retailers with a weaker omnichannel strategy.

It’s clear, then, that customers want omnichannel services, and are prepared to spend more and stay with their chosen brand if these services are available. Retailers who neglect omnichannel are also much more likely to see a dip in revenue. Strikingly, 40% of consumers will actually choose a competitor if they can’t use their preferred channel for browsing or purchasing.

The Companies Getting Omnichannel Right

We’ve already examined the benefits of omnichannel retailing. But which retailers are getting it right?

Affordable luxury retailer BA&SH proved that the future is ‘phygital’ when they pressed ahead with a range of new store openings in the US and Asia. In 2018, they opened seven new physical locations in Mainland China and three in Hong Kong, all of which achieved profitability after just three months. To support their sales in Asia, they also launched the brand on Tmall at the same time, supporting e-commerce in the region.

It’s a similar story with Adidas, but on a larger scale. They have 2,500 retail stores across the globe, combined with a large e-commerce channel, including an app. The app reaches 30 countries in their market and offers unique omnichannel services including order tracking, personalised content, and in-app chat. Despite e-commerce being the channel they expect to grow most rapidly, Adidas still invests heavily in in-store experiences. For example, they launched flagship digital stores in London and Paris in 2019.

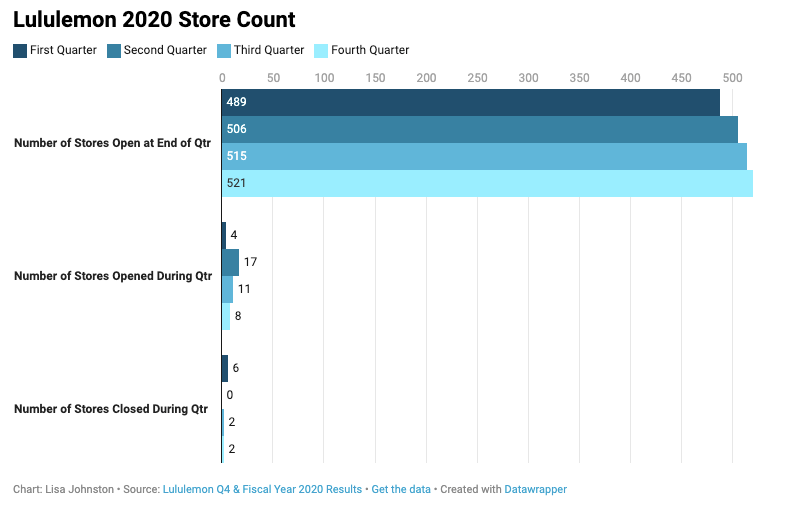

A brand hoping to compete with Adidas is Lululemon. They operated around 489 stores in Q1 of 2020, but grew this to 521 by the end of the year, despite pandemic losses in brick-and-mortar store footfall. This investment allowed Lululemon to capitalise on the pandemic growth in services such as store pickup and appointment shopping. Overall, the company generated a 47% increase in international business in Q4 of 2020, with e-commerce representing 52% of its total revenue.

As demonstrated by these thriving retailers, a successful omnichannel strategy is seamless, unified, and flexible. Each of these retailers was able to adapt to changes in physical footfall and the growth in e-commerce while growing their brands globally. To do this, they have tapped into digital transformation trends, including digital stores, online try-on, and diverse purchase and delivery options. In the case of Lululemon and Adidas, RFID for omnichannel also played a role in their success.

The Benefits of RFID for Omnichannel

As we’ve seen, the retailers who do hit upon omnichannel success embrace digital services without neglecting brick-and-mortar stores. The foundation of a winning omnichannel strategy is seamless integration, harnessing data, and fully optimised operations. By implementing RFID for omnichannel, retailers can hit each one of these factors for success.

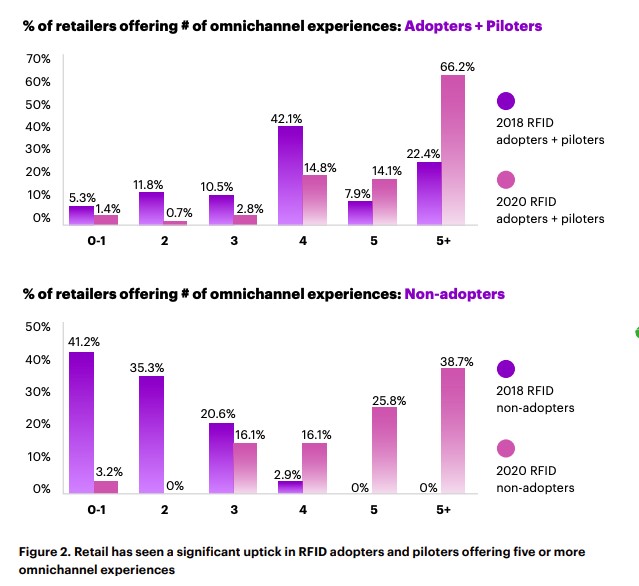

We know that retailers are adopting RFID technology at a faster rate because of Covid-19. In fact, 46% of retailers say that it is a priority for them in responding to the pandemic. But well before the pandemic, retailers were realising that RFID could offer use cases for omnichannel and that it can add a huge amount of value to operations. This is especially true when retailers adopt RFID for multiple omnichannel services.

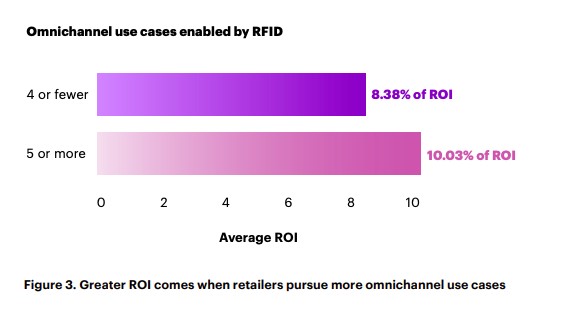

Retailers who use RFID alongside five or more omnichannel experiences see a 20% higher ROI than retailers who adopt RFID for less than four omnichannel services. When implemented, RFID can offer the real-time insights and accuracy necessary for retailers to scale up their omnichannel services.

Typical store inventory accuracy at item level is around 60%-80%. Unfortunately, much higher accuracy is needed if retailers want to enable multiple omnichannel experiences. Without real-time data, it can be challenging to know where stock is, and you’ll struggle to integrate omnichannel services like pick-up-from-store, app purchases, or shipping from a distribution centre.

RFID tags on stock can bring item-level stock accuracy levels to 99%. This means retailers have an exact view of where all their stock is, whether that’s in a warehouse or store. As a result, customers are able to know their chosen products are in stock at their chosen location and can opt for the method of delivery that suits them – whether that’s shipping to a store, collecting from a pick-up point, or delivery to home.

But there are more benefits for customers when retailers implement RFID for omnichannel. Tagging products allows customers to track purchases through their shipping journeys, meaning they can get more accurate delivery dates. This is often crucial if they have chosen to pick them up from a store, as they will know exactly when their items have arrived.

Overall, when implemented for omnichannel, RFID grants retailers valuable visibility into their supply chains and stock. With RFID, retailers can focus on creating new and innovative omnichannel services, with the knowledge that they will be able to create a seamless experience across channels.

Implementing RFID for Omnichannel Retailing

According to research from Coresight, 74% of retailers have already started implementing an omnichannel retail strategy. However, this doesn’t mean that these strategies are always successful. Just 34% of companies have a mature omnichannel strategy. Though many retailers will try omnichannel, there’s a big difference between creating a strategy and seeing it through to success.

As we’ve discovered, implementing RFID for omnichannel retail operations can make a huge difference to the success of omnichannel services. The real-time data created by RFID technology can help retailers to plan their omnichannel strategy, focusing on the channels that will bring the most value to their operations. Having a focused omnichannel strategy is vital for retailers that are just starting to experiment with alternative services, and using RFID for omnichannel implementation can help businesses create and implement a successful strategy.

Today, 28% of hardline retailers intend to use RFID to support their omnichannel fulfilment options. As RFID technology becomes more accessible – the cost of an RFID tag has already dropped considerably over the last 20 years – this number is set to increase. Omnichannel is an essential part of retail; to implement it successfully, RFID is the obvious retail solution.

An RFID retail solution

Stock accuracy, on-floor availability, and RFID omnichannel applications in stores.

Book a demo with RFID to find out how our cloud-hosted RFID solution could help you improve your omnichannel strategy. Our multi-user app can provide intelligent stock takes and a smart in-store replenishment process, while utilising RFID for omnichannel services can help you effectively manage your entire store and eCommerce operations with real-time, item-level inventory visibility and analytics.

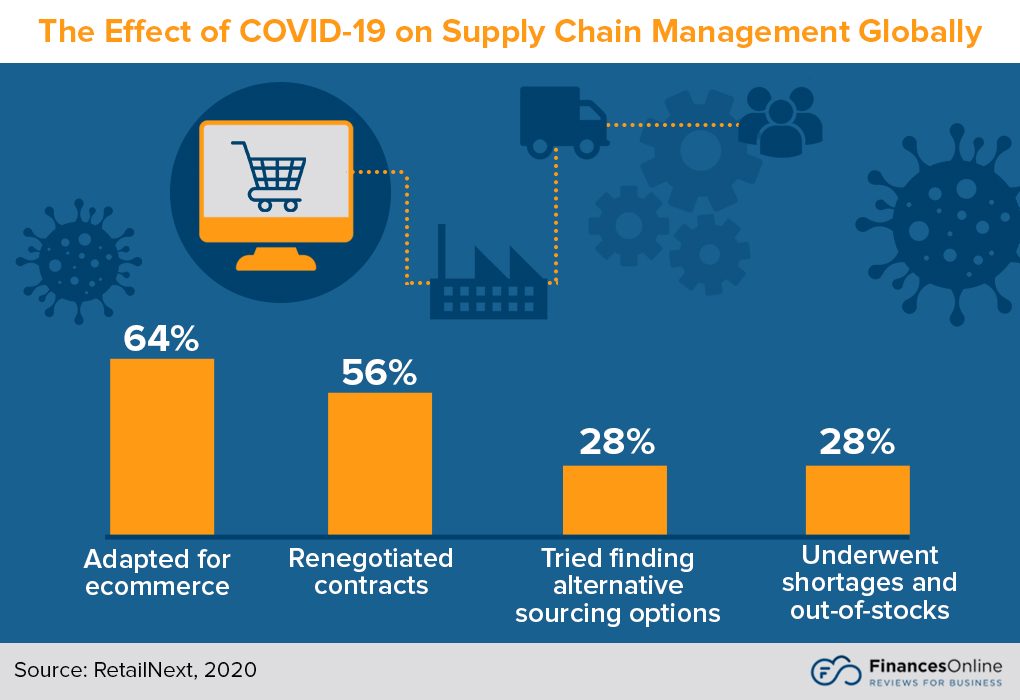

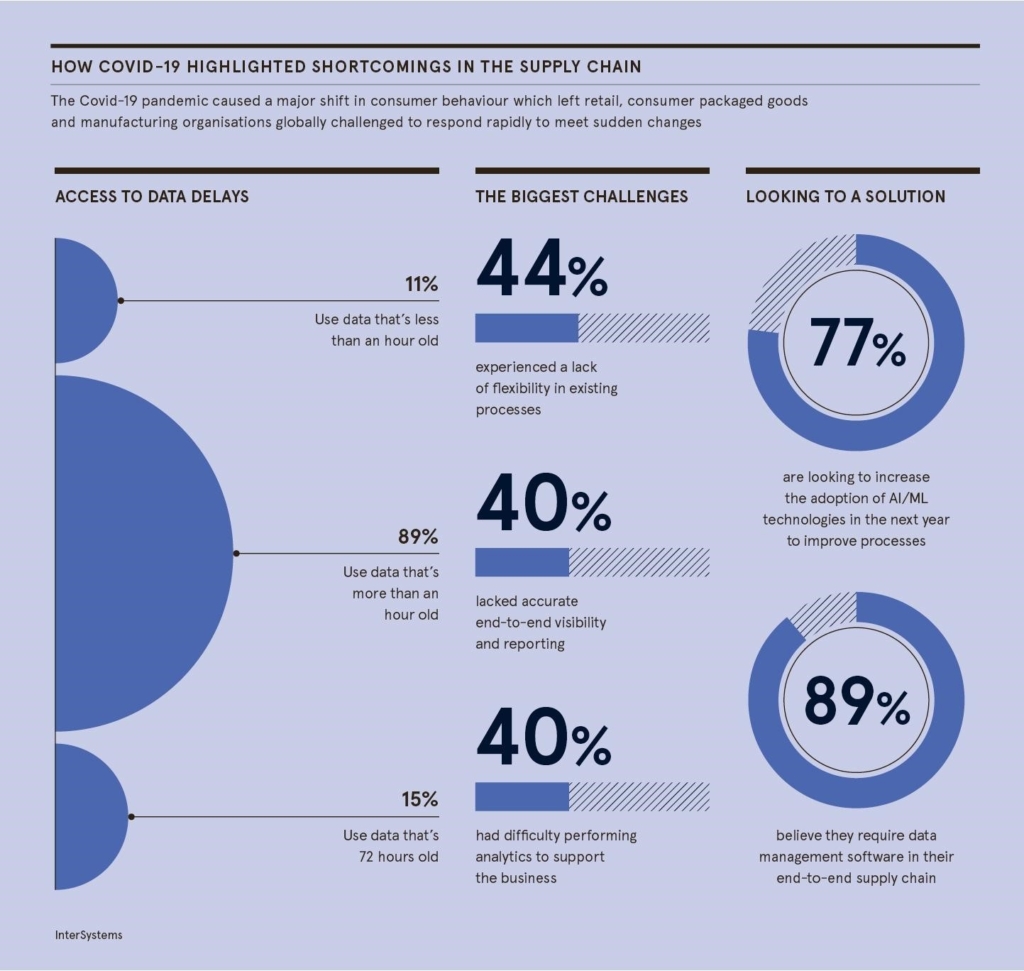

The size and complexity of global supply chains, with their significant resources and risk-mitigation strategies among multiple partners, were previously thought to create significant security. The ongoing COVID-19 pandemic continues to show how wrong that assumption was. Global supply chains are vulnerable and will remain that way without significant planning. Retailers are still vulnerable to large-scale threats as well as regional issues like labour shortages and lockdowns.

For retailers looking to plan and protect their supply chains, it’s time to prioritize risk mitigation and thorough reviews. This article will look at five areas where planning and understanding must be improved for them to adapt to the realization that significant risk is lurking in its supply chain.

Enhance workforce planning

Supply chains are heavily dominated by human labor. People are present at multiple points for every single supply chain action. What COVID should remind supply chains is that every worker needs protection and training. But labor also involves many potential risks. You’ll need to work to keep people safe and understand and plan for times when people are out sick, whether individually or as a group.

Companies should have a plan for increased absenteeism and labor shortages. The post-COVID supply chain will still deal with COVID, the flu, and other seasonal health threats. No one is quite sure what that’ll look like, but experts across a wide range of industries say we should continue to expect increased health screenings and safety protocols.

This means you’re at greater risk of being impacted by regional outbreaks or clusters of illness. Look for robust tools that can help you tackle these concerns on multiple levels. RFID, for example, has applications that can improve your inventory accuracy and on-floor availability while reducing touchpoints and allowing staff and customers maintain proper distancing. Reducing manual tasks, such as inventory cycle counts, also helps protect you against risks related to labor shortages. RFID can even create upsell opportunities as it reinforces health best practices.

Build a plan to address productivity and support losses related to illness-absenteeism. At the same time, continually train teams on safety and health protocols, enhance your cleaning regimens, and turn COVID spacing requirements (and others relevant to your facilities) into more permanent policies.

Start with alternatives at the last mile

One of the biggest pushes companies see in this shifting landscape is the desire to diversify their supply chain. That’s simple to say, but one of the most complex undertakings you can do during a time of uncertainty. Sourcing new manufacturers and establishing relationships in other countries for changing ocean lines or shipping routes are complex. The existing backlog means any shift will take time to test, verify, and approve.

Companies can make a more immediate shift in their last-mile delivery, the final leg of a shipment from your warehouse or facility to the customer’s door. Increasing carrier access by moving to larger facilities and establishing relationships with regional carriers alongside national partners can help any brand build up resilience.

In many cases, this need is a strong enough reason to look at outsourcing fulfillment at any stage in a business’s development. Third-party logistics providers (3PLs) have many of these relationships already. Their higher volume also enables the 3PL to negotiate strong rates and deeper discounts, which they should pass onto customers. 3PLs like Red Stag Fulfillment, which specializes in specific product categories or attributes, can help niche and dedicated businesses make the most gains by pursuing the most relevant carrier discounts or those targeting product types.

Trace from end to end

The COVID-era supply chain struggled, often because of shifting supply and production capabilities, while demand largely grew. Manufacturing shutdowns, port delays, and other breaks in the chain had compounding effects. It was hard to understand how to adapt to any single element, let alone these larger issues.

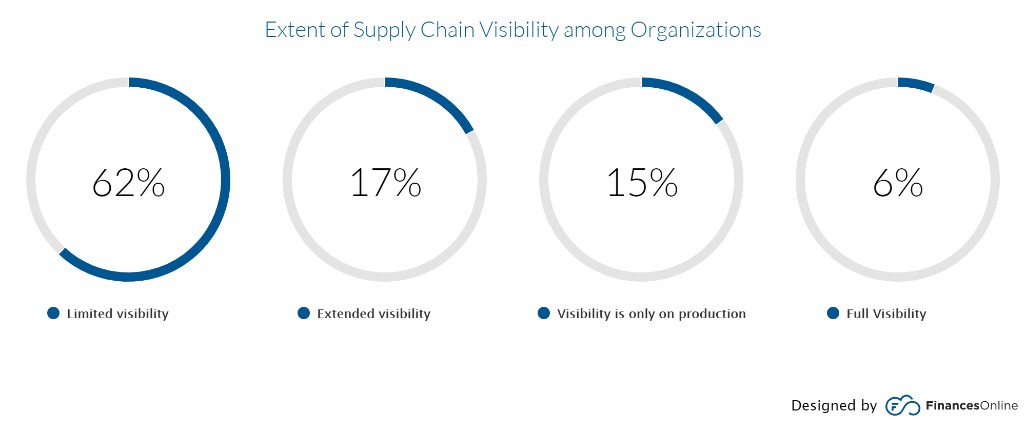

Subsequent reviews of supply chains and risk mitigation studies have shown that, while many companies have expressed interest in chain visibility, most struggle to implement this. That cannot be the case for a viable post-COVID supply chain. It’s time for eCommerce sellers, manufacturers, wholesalers, carriers, and intermediaries to share data proactively. You can start this conversation by reaching out to learn what technologies your partners use and find areas of common ground or shareable data and file types. Tackle it from multiple perspectives including your customers, 80% of whom want to know real-time availability.

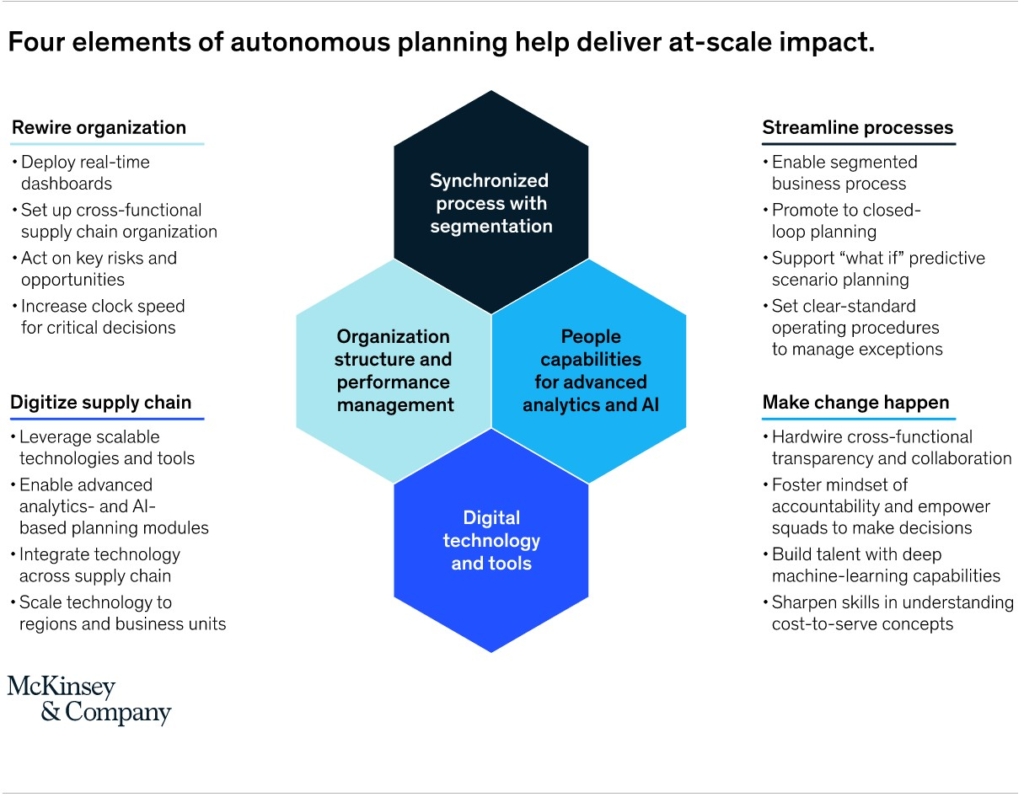

Thanks to current digital technology, end-to-end visibility is achievable, and we now clearly see its value. Align your investments toward information gathering and sharing to optimize other capital expenditures. Pursuing AI and analytics, 3D printing or additive manufacturing, improved conveyors, and other infrastructure technology first could create budget gaps that prevent the adoption of systems and communication strategies where you learn what’s happening at the manufacturing level and can understand its impact through the last mile.

Create an information-sharing plan if you want to be a preferred partner. Start the process by automating the delivery and sharing forecasts. When you detect a change or trend, share this up the chain to help partners better predict demand and strain, enabling them to allocate appropriate space when available.

Review inventory and available space

Supply chains are moving away from just-in-time inventory practices but there are struggles with what comes next. Instead of trying to define a completely new approach, look for adjustments you can make to take realistic steps for safety. For an inventory, that means balancing what you have in stock and preventing stockouts while not hoarding in a way that harms profitability or tying up too much capital. This requires you to get demand forecasts right.

Protect yourself by looking for periods of stockouts and pulling them from your demand forecasts. Run your analytics to plan based on demand when you were able to complete orders so that you’re not using low numbers. You might be able to double-check this work by looking at site traffic to sales pages — if it stayed consistent even when items were on backorder, then potential demand was steady.

After you’ve got forecasts that are correct for stockouts, look at the physical space you have available. How much can you fill? If you order more inventory than normal, do you have room for it? Balance that by determining how many additional costs you’ll incur for this holding. Higher inventory levels have higher labour costs, heating or cooling your facilities can change, you might use more equipment, and so on.

If you’re working with a 3PL, discuss their ability to scale and hold inventory. You want to be a reliable partner that they keep on. That requires you to strike a balance in terms of inventory, ensuring you can meet orders but understanding that long-term storage is causing issues for 3PLs and warehouse companies right now.

Create time to address systemic issues

Evidently, retailers are having difficulty attracting the best talent to retail positions. So, what can they do about this? In an article last year, we explored how technology can help improve the employee experience and thus retain employees. Employee experience technology can accomplish three major goals in retail talent management: increase productivity and goal accomplishment, improve employee agency at work, and help employees be more creative at work.

Perhaps the biggest supply chain takeaway from the COVID-19 pandemic is that many were built to withstand risks and threats in specific areas. When issues pushed beyond small-scale mitigation, supply chains started to buckle. Some faltered when overwhelmed across the entire chain while others had unrealized points of failure that only took light pressure to break.

Supply chain professionals and retailers need to start reviewing their operations systematically. Verify strength in each part and think about how that imparts reliability to the whole. Or see if areas with limited options are generating more significant risk. What many professionals once assumed were geographically limited threats have turned into global concerns.

Pandemic risks highlight systemic issues. Take the time to review what you’ve faced and where you’ve failed. Celebrate the parts of your supply chain that worked. Use those as guidelines for reviewing and improving gaps and potential. No one knows what the next black swan event will be, but we all now know that it has a chance to impact every aspect of our businesses and supply chains.

This guest article was written by Jake Rheud. He is the Vice President of Marketing for Red Stag Fulfillment, an eCommerce fulfilment warehouse that was born out of eCommerce. He has years of experience in eCommerce and business development.

Would you like to feature in our Retail insights section? Contact us today

It’s now been two years since the Covid-19 pandemic began to seriously disrupt business operations around the world. As a consequence, retail management has dealt with a range of problems including supply chain issues and store closures.

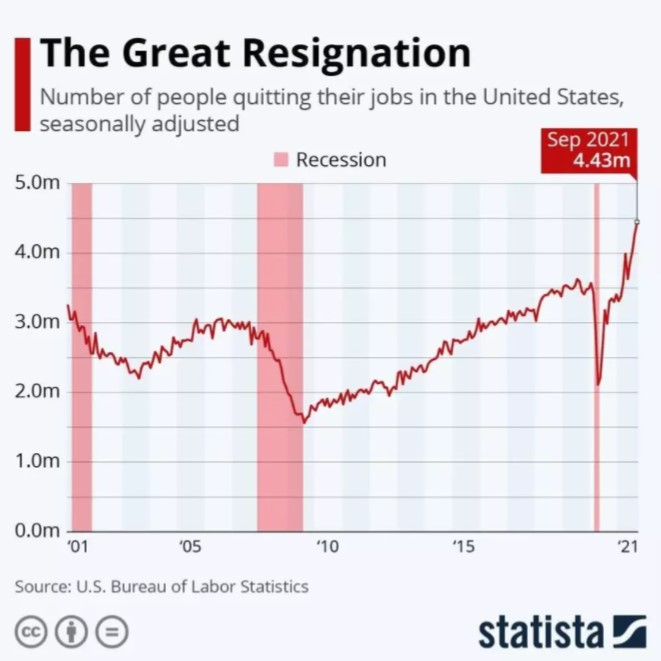

However, one additional problem that has been exacerbated by the pandemic is the ‘Great Resignation’. For the past two years, employees have left their jobs at an alarming rate – in the US alone, 4 million workers quit their jobs in July 2021. A survey of over 30,000 workers around the world found that 41% were considering quitting their jobs in the second half of 2021.

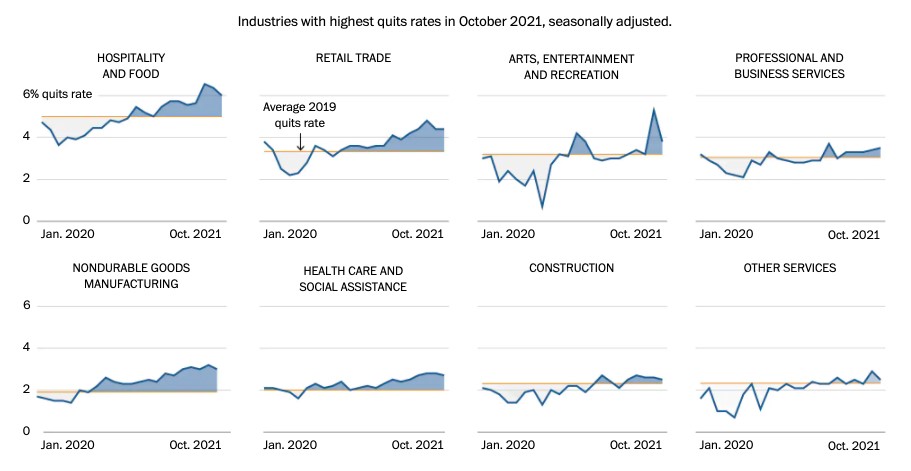

While the ‘Great Resignation’ has severely affected industries like healthcare and technology, the retail industry has not been immune. In August 2021, over 720,000 retail workers quit their jobs, second only to the foodservice and accommodation industry. As it stands, 96% of retailers say they are struggling to find store employees, and 88% said the same about hiring in distribution centres. In an industry that is still reacting to issues like supply chain disruption and wavering sales, this is a huge blow.

Ultimately, high employee turnaround is bad for business. There’s a clear correlation between happy employees, more satisfied customers, and higher sales; unhappy staff can result in the opposite. If retailers want to overcome the various issues that have plagued retail over the last two years, they need loyal, talented employees. But what is the solution to the retail talent management crisis?

Well, it could come in the form of retail inventory visibility software. Technology like RFID can have a huge impact on both the customer experience and an employee’s work, and retailers who implement this technology could find that it improves both their operations and their retail talent management.

The Great Resignation: How is it Affecting Retail?

Over the course of 2021, workers across a variety of industries have been driven to quit their jobs. Record quit rates have been recorded in sectors like healthcare, social assistance, and nondurable goods manufacturing. However, while these industries have seen resignations come in waves, in retail, a talent management problem has persisted throughout 2021. For most of the year, the quit rate has been higher than the 2019 average, and while it reached a peak in the summer, the resignation rate continues to be higher than normal.

Undoubtedly, retail workers have had to adapt to difficult working conditions over the past two years. They may have had to work longer hours as companies try to recuperate lost profits during periods of closure. At the same time, their work environment has changed drastically as retailers take into account local public health advice including the use of masks and implementing social distancing in stores.

As we look towards a more normal year for retail in 2022, companies need to understand the Great Resignation and what is driving retail employees to quit. Ultimately, the biggest cause of retail resignations is stress. According to one survey, 26% of retail workers considered leaving their job in 2021 because of mental health concerns, and 5% had already left the sector because of stress-related issues.

Considering the multitude of problems that retailers have had to adapt to over the past two years, this is no surprise. But it also shows that retailers need to do more to prioritise employee wellbeing if they are to overcome the Great Resignation and outperform in 2022.

What are Candidates Looking For?

In order to succeed at talent management in retail, companies also need to know what employees prioritise when looking for a new role. Without this information, it can be difficult to attract talent to your retail business; something that is already an issue.

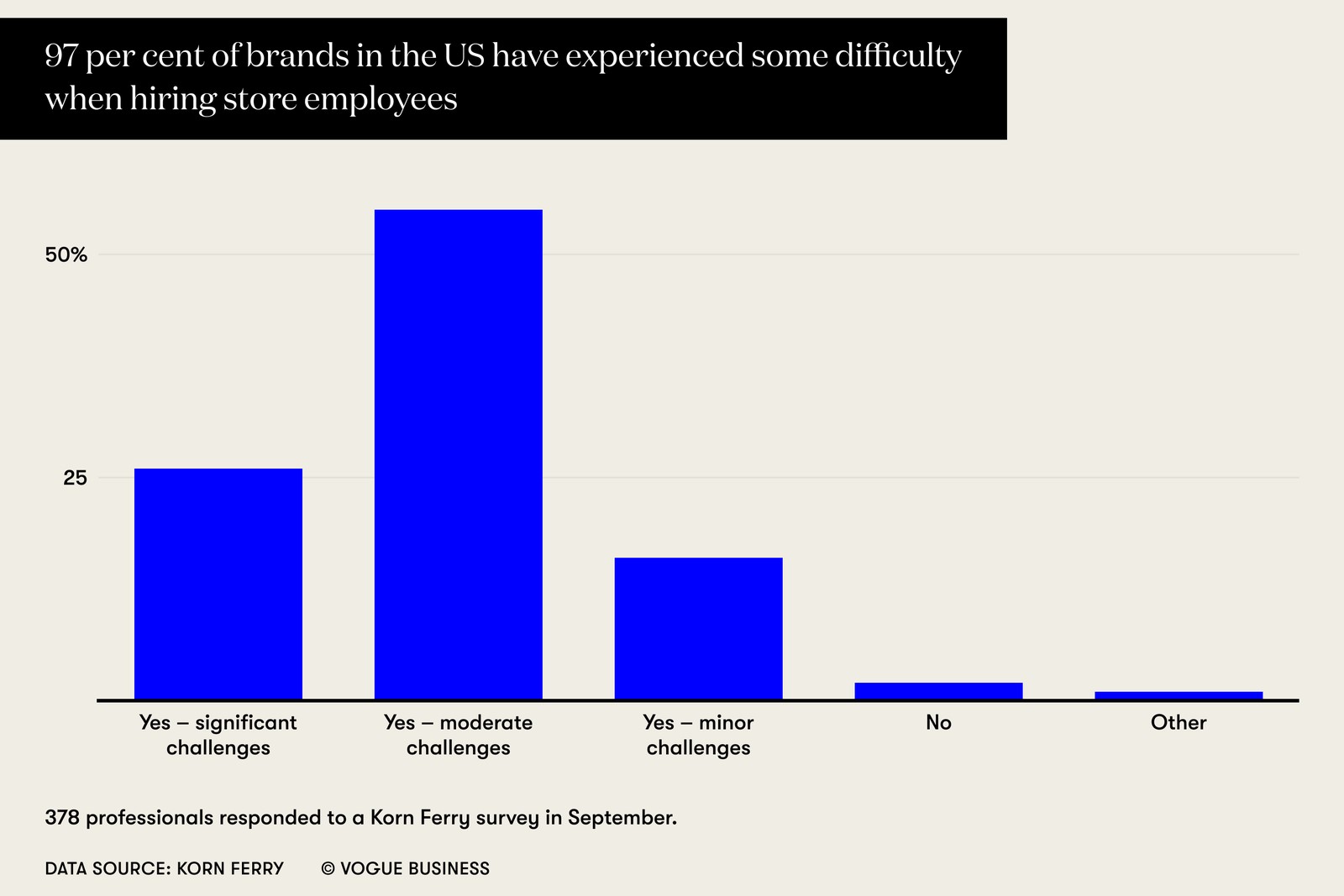

In the US, 97% of retail brands say that they have experienced difficulty when hiring new store employees. In an industry where there is already a shortage of applications and a growing number of employees are leaving their retail roles, it’s crucial that retailers can target applicants with benefits and considerations that they actually want.

Firstly, we know that retail workers are now prioritising their mental health at work. 84% of retail employees have said that their mental health has deteriorated over the past year, and this is evidently contributing to high quit rates in the industry as well as a reluctance towards taking jobs in retail. If companies want to attract the best candidates for in-store roles, as well as in distribution centres, they need to show that they care about employee wellbeing.

Part of this means establishing trust between retail management and workers and showing employees like shop floor staff that they can approach their work independently. Some brands have gone further, though. Retailer Gymshark recruited an entire mental health support team to provide support to workers. Potential retail employees are also asking companies to invest in their wellbeing long-term. This includes offering additional training to improve skills and offer opportunities for growth within roles.

Elsewhere, future workers are also reimagining how productivity is actually calculated. For many workers, it’s no longer about traditional metrics like sales and performance. Instead, retail talent management teams need to foster work environments that prioritise employee value over performance – that is, how much value employees provide to businesses outside of their output.

How can Retailers Attract and Retain Talent?

Evidently, retailers are having difficulty attracting the best talent to retail positions. So, what can they do about this? In an article last year, we explored how technology can help improve the employee experience and thus retain employees. Employee experience technology can accomplish three major goals in retail talent management: increase productivity and goal accomplishment, improve employee agency at work, and help employees be more creative at work.

As a result of the difficulty in retail talent management, some brands are already making changes to their HR operations. For example, over 30% of retail companies have already implemented higher salaries in order to attract retail talent to their businesses. Amazon introduced immediate sign-on bonuses of £1,000 in order to attract talent, targeting warehouse workers specifically. Walmart, on the other hand, has started offering weekly bonuses to its employees, which could pay out upwards of $200 per week.

Retailers with brick-and-mortar stores are also introducing additional employee benefits in order to drive store hiring. This includes wellbeing benefits that seek to improve the mental health of employees. In recent years, John Lewis has adopted new HR policies such as six months of equal parenthood paid leave for all staff and two weeks of paid leave if staff members experience the loss of a pregnancy. Other benefits that retailers are increasingly offering include flexible work hours.

However, technology can also be utilised to help retain employees in retail. Studies show that staff increasingly want their employers to be invested in their work progress – 85% of people say that they want technology to help define their future. For example, 32% say that they want their employers to leverage technology in order to help them progress towards career goals.

One example of utilising technology to help support employees is with retail inventory visibility technology like RFID. Inventory visibility is crucial in retail – without a transparent view of stock, it’s difficult to implement omnichannel services or flexibly adapt to consumer behaviour. However, technology like RFID can also prove a valuable solution to retail talent management.

Empowering Employees Using RFID Technology

Not only is RFID technology a valuable inventory visibility solution in retail, but it can also help improve the employee experience and retain top talent. It’s important to note that the generation that are the latest big spenders, Generation Z, are also the generation that retailers will likely see applying to retail roles. Thus, they are not just retail consumers, they are also employees. With this in mind, technology like retail inventory visibility software can be a valuable way to hold onto these young employees and make them feel valued at work.

Digitising Operations

Firstly, owing to high digital literacy, this generation now expects processes to be digitised and automated, and may be less willing to persevere with outdated operations at work. One of these traditional operations in brick-and-mortar retail stores is physical inventory counts. This process, when performed manually, can require a huge amount of time and manpower. Repetitive procedures like manual stocktakes can also contribute to employee stress, especially if employees make errors, which is more likely with manual operations.RFID technology, on the other hand, can make manual stocktake a thing of the past and increase inventory accuracy to 99%. With RFID tags in each piece of stock, employees need only scan each product with a reader and can produce a full stocktake in around 30 minutes. This leaves employees feeling confident about their work and able to spend more time actually interacting with customers.

Improving Customer Experience

Similarly, customer experiences can also improve when retailers use inventory visibility software. As retailers recover from the effects of the pandemic, giving customers an optimal experience is more important than ever. Happy customers become loyal customers, and loyal customers lead to increased sales. 25% of customers switch brands more today than ever before, so attracting those who will keep returning is crucial.

Retail inventory visibility software, when used alongside an all-in-one mobile application, means employees can assist customers instantaneously with stock requests. In one survey, 42% of people said that ‘unhelpful staff’ was one of the main causes of a bad shopping experience, but businesses who take advantage of inventory visibility software in their retail operations can improve the chance of a better experience, as well as make employees feel confident at work.

Reducing Stress at Work

An all-in-one digital inventory visibility solution for retail can also reduce stresses on workers, leading to better productivity and reducing employee turnover. RFID technology can improve productivity and reduce the chance of stock delays and out-of-stock notices, leading to better interactions between employees and customers.

Retail inventory visibility software can also help managers make better staff decisions. With complete inventory transparency, it’s easier to see if there are going to be any supply chain issues. Instead of staff reacting to problems as they happen, which can cause undue stress if issues are completely unexpected, managers can plan for disruption. This can reduce the chance of staff working overtime or unexpectedly long hours and allow workers to focus on their day-to-day roles and the customer experience.

The Importance of Inventory Visibility for Retail

Aside from improving your retail talent management, there are many other reasons to consider investing in inventory visibility software for retail. Digitising processes like stock takes and making your inventory more transparent can have huge benefits to your business. These advantages can speed up operations, increase productivity, and improve the customer experience.

Additional benefits to implementing RFID technology include:

- Implementing efficient omnichannel services

- Increasing product availability

- Optimised supply chains

- Monitoring stock shrinkage

A fast fashion RFID solution

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Book a demo with RFID to find out how our cloud-hosted RFID solution could help you improve your retail inventory visibility. Our multi-user app can provide intelligent stock takes and a smart in-store replenishment process and later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics

The past two years have been undeniably difficult for retailers. From reduced footfall in physical stores to grappling with staff shortages, there have been few advantages, and many long-term effects, to the recent disruption. The same is true for supply chain issues that have beleaguered retailers over recent years. Businesses have had to adapt to problems including shipping delays, higher delivery costs, and fluctuating consumer demands, and though we’re seeing the first signs of economic recovery, these issues won’t disappear overnight. Some analysts have predicted that it could take until mid-2024 for supply chains to return to relative normal.

So far, retailers have been forced to react to supply chain disruption as it happens, flexibly accommodating their business operations to the issues. However, there are ways for retailers to turn supply chain issues to their advantage, and the solution involves retail inventory management software.

Most businesses will already have some form of retail inventory management process; it’s a crucial part of omnichannel retailing, for example. But technology like RFID combined with powerful inventory software can offer a way for retailers to not only adapt to supply chain disruption but conquer it.

The Current Supply Chain Issues

The fallout from the Covid-19 pandemic is still being felt in global supply chains. While retailers have weathered the worst of the storm with regard to inventory delays, there are still challenges in the global supply chain that will inevitably take time to remedy. In fact, 94% of Fortune 1000 companies are still experiencing supply chain disruptions as a result of the pandemic.

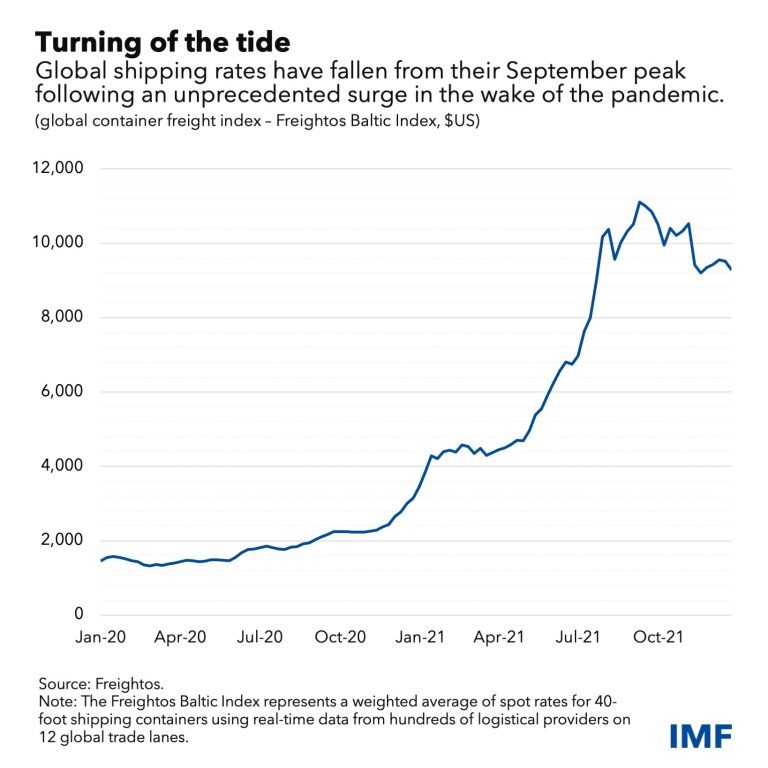

One of these major challenges is the cost of shipping. Global shipping costs spiralled in 2021, reaching a peak in the latter half of the year. In October, the average cost of shipping a standard 40ft container reached $10,000. Costs have since declined by 16%, but are still higher than in normal years – in some cases by more than four times the average. In 2019, the cost of shipping a container from Shanghai to New York was $2,500, but this has since risen to $15,000.

As well as increased costs to ship inventory from manufacturer to store, retailers also have to adapt to delays in shipping. The global supply chain is still adapting to Covid-19 setbacks, resulting in persistent delivery delays. At present, there are 20 million containers waiting at ports all over the world, and this backlog will take more than a few months to resolve. While the scale of the issue doesn’t compare to early 2021 – when supply chain delays and shortages were up 638% – many businesses will still be experiencing shortages or delays well into 2022.

Finally, there has been a shift towards more environmentally-friendly practices in a wide variety of industries. Companies are also looking at ways to make their supply chains and logistics more sustainable. This includes switching to more sustainable shipping options like biofuel instead of diesel, eco-driving, or moving operations closer to customers. However, a move towards sustainable operations is challenging and requires coordinating entire supply chain operations and more complex retail inventory management.

Outperforming During Disruptions

Despite ongoing supply chain troubles, some retailers have done more than just endure the issues – they have thrived on the disruption. Brands like Walmart, M&S, and Pets at Home have all posted strong growth over 2021, despite grappling with intense supply chain disruption. The one thing these brands have in common? Omnichannel retail.

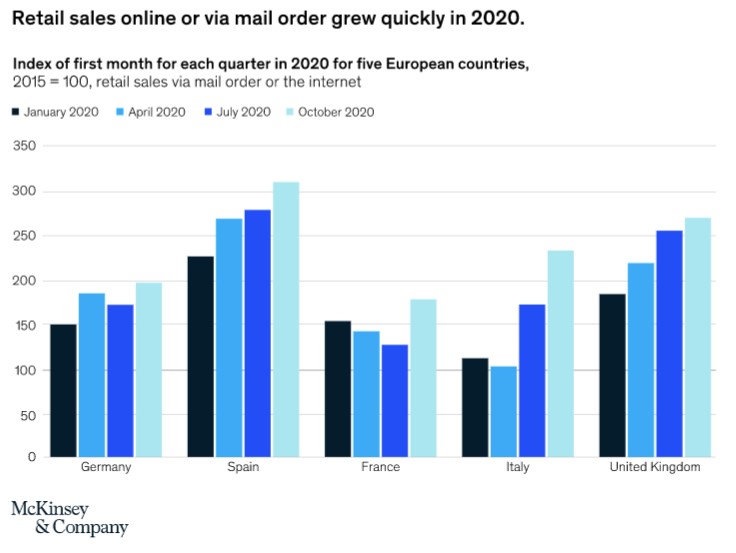

Over the last two years, consumers have switched from in-store shopping to online shopping. There was a pronounced switch to online retailing in 2020, which then persisted throughout 2021. In the UK, online sales made up 30% of overall retail spending in 2021. While still less than a third of overall spending, this is a jump from the 11% of sales that were conducted online in 2019.

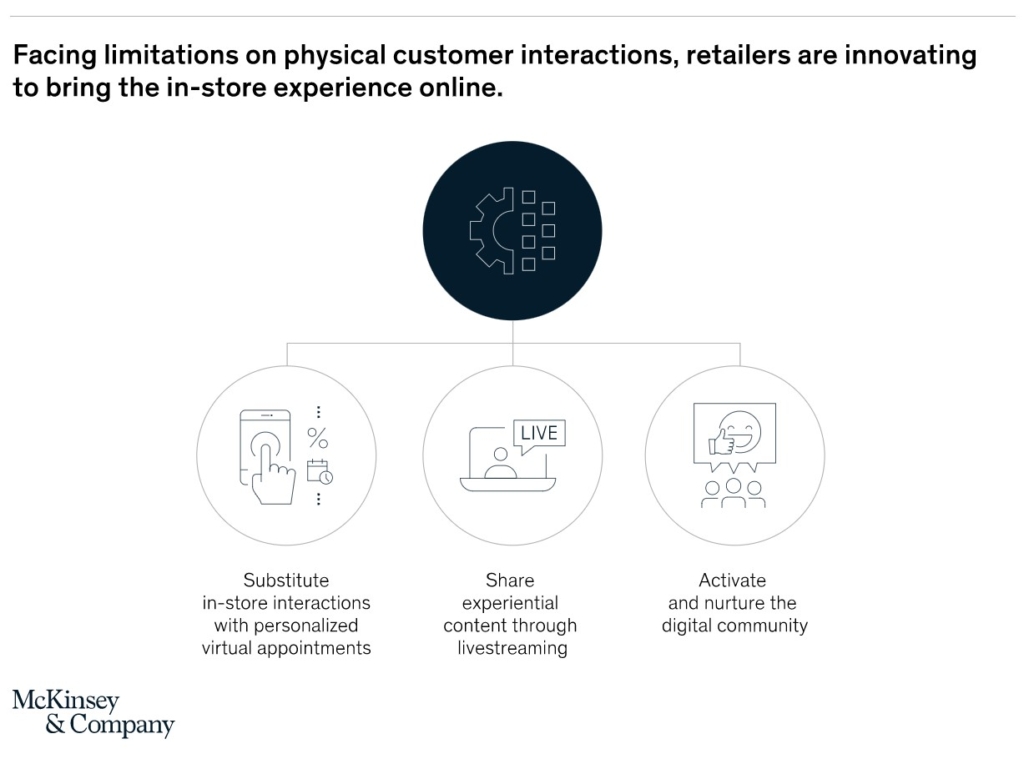

However, for many retailers, it wasn’t simply a question of turning attention to online sales. Instead, an omnichannel solution that combined in-store shopping and online options proved the most effective option. Nike, for example, continued with plans to open a flagship store in Paris during the pandemic. Instead of floundering as footfall in brick-and-mortar stores fell, they found that the physical store also helped drive online sales. Retailers who open a new physical location can see a 37% increase in traffic to their website in the following quarter.

For some companies, it was a question of evaluating their supply chains and seeing where they could improve. Sports brand SylvanSport ran into issues when their overseas tire manufacturer couldn’t deliver on time, so they had to look at alternatives. This included seeking domestic manufacturers to create the product for them while still retaining their overseas manufacturer for future orders. This flexibility within their supply chain allowed them to easily adapt to any issues as well as future-proof their operations in case of further disruption.

How to Adapt to Disruption

It’s clear that supply chain challenges aren’t going away anytime soon. Consequently, retailers must plan for periods of disruption and find a way to come out of them performing stronger. For a start, we know that retailers who have outperformed during the last two years have focused on a few things: omnichannel solutions, consumer trends, and real-time data.

Data is a powerful tool when it comes to adapting to supply chain disruption, but many retailers aren’t taking advantage. In fact, 54% of company executives have said they don’t have clear visibility of their supply chain past Tier 1, and an additional 40% of companies don’t have accurate end-to-end visibility and reporting. This means that any disruption in the early stages of their operations will go unseen, and the consequences felt only when it’s too late.

However, companies are learning that technology like retail inventory management software is a powerful way to improve their operations – 89% of retail organisations said they will need to implement data management software in their supply chain.

Companies that do turn to AI-powered data solutions inevitably become more resilient. Having a clear understanding of supply chains, and their weaknesses in them can make companies more able to adapt to difficulty when it arises. When Japan was hit by a magnitude-9 earthquake in 2011, production at Toyota’s factories ceased for two months. After this, they focused on building an accurate database of their suppliers and parts to track their operations and products through the supply chain. In 2016 and 2019, when more earthquakes hit Japan, Toyota had reduced their production stoppages to just two weeks.

We also know that omnichannel services are the way forward for modern retailers. Consumers are asking for alternative ways of purchasing products, and omnichannel retailing also paves the way for future technology like AI-powered brick-and-mortar stores and virtual shoppers.

Since the beginning of the pandemic, one-third of American shoppers have taken advantage of omnichannel services including deliver-to-store, and two-thirds of those shoppers plan to continue taking advantage of omnichannel retailing in the future. As the previous example from Nike demonstrates, it’s not about turning 100% to online services, but about offering multiple opportunities for consumers to purchase products.

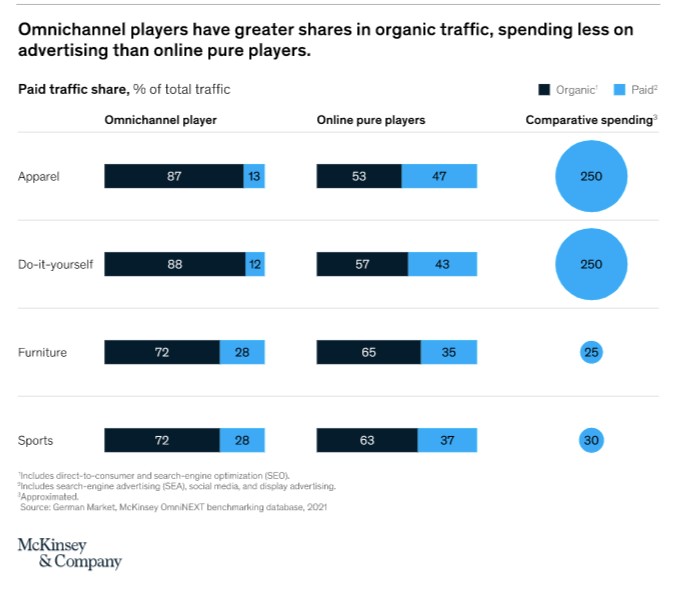

According to a study from McKinsey, brick-and-mortar retailers – though at a disadvantage over the last two years due to a decrease in footfall – still have to spend comparatively less on advertising in order to reach the same amount of customers as online retailers. So, it’s about developing an approach to omnichannel that blends online and physical retailing, allowing customers to purchase exactly when and how they want.

The final way retailers can increase the resilience of their operations and their supply chains is by paying close attention to changes in consumer behaviour. Arguably the biggest consumer trend for 2022 is a shift towards sustainability. In 2021, one in three consumers stopped buying certain brands because of sustainability or ethical concerns, and 46% of consumers wanted additional information over the origin of their products. To retain consumers in the coming years, it’s crucial that brands consider the environmental impact of their supply chains and make the necessary changes before customers choose alternative products.

The Benefits of Retail Inventory Management Software

We’ve identified three ways to turn supply chain disruption to your advantage: developing an omnichannel strategy, harnessing the power of digital insights, and staying aware of consumer trends. For all of these strategies, it’s crucial that companies dedicate some time to reviewing their retail inventory management system. Without a successful system in place to track and count inventory, you won’t be able to implement omnichannel services or make changes to your supply chain in reaction to consumer trends.

In order to accurately track inventory and respond to supply chain disruption, companies should consider investing in retail inventory management software. An all-in-one retail inventory management software, with the help of RFID tags in your supply chain, can provide businesses with real-time insights and inventory flexibility to increase supply chain resilience.

Real-Time Insights

An all-in-one retail inventory management software offers retailers real-time insights that can transform operations. While digitising your entire supply chain might seem like a mammoth task, RFID supply chain technology is becoming more accessible and easy to implement.

In particular, the ability to monitor supply chains at all times, and receive real-time data from supply chains, makes it easier to make operations decisions fast. When the container ship, the Ever Given blocked the Suez Canal last year, 15% of the world’s freight was impacted. Implementing solutions quickly became of the utmost importance – only companies who had immediate insights into the effect of the crisis on their operations could make decisions to avert supply chain disasters.

Retailers that had already implemented a retail inventory management solution could immediately make decisions to shock-proof their operations from the disaster and recover more quickly.

Supply Chain Visibility

In order to adapt to disruption, it’s important that businesses have a clear, end-to-end view of their operations. However, many businesses currently don’t have the level of supply chain visibility necessary to quickly adapt to disruption. Retail inventory management software, when paired with RFID tags in the supply chain, can give businesses the visibility they require to outperform.

Only with a clear view of the supply chain from manufacturer to store can businesses accurately see where their stock is and react to shipping errors or delays. This is even more crucial as businesses turn to omnichannel experiences to boost sales, where it’s crucial to see where stock is and ensure that other services like ship-to-store or store pick-up can happen successfully.

Not only does retail inventory management software offer businesses end-to-end insights into their operations, but it can also help with sustainability efforts by enabling operations to be fully transparent to consumers.

More Accurate Inventory Counts

Implementing RFID in your supply chain can also make it easier to get accurate inventory counts. When there’s a disruption to inventory deliveries, knowing exactly what stock you have can make a big difference to your sales and allow store changes to be made swiftly. When used alongside a retail inventory management platform, RFID tags can help achieve 99% stock accuracy.

RFID technology enables retailers to quickly see which stock may incur delays and prepare for potential out of stock notices. For example, Reiss increased their sales by 4% by increasing their stock accuracy as they had an accurate view of exactly what stock was available and where. This makes it easier to implement omnichannel strategies like buy-online-pick-up-in-store (BOPIS). With accurate stock counts, it’s also easier for retailers to quickly adapt to consumer trends, focusing their attention on only the stock that is selling well.

Retail inventory management solution

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Book a demo with Detego to find out how our cloud-hosted retail inventory management solution could help you outperform competitors and adapt to supply chain disruption. Our multi-user app can provide intelligent stock takes and a smart in-store replenishment process and later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

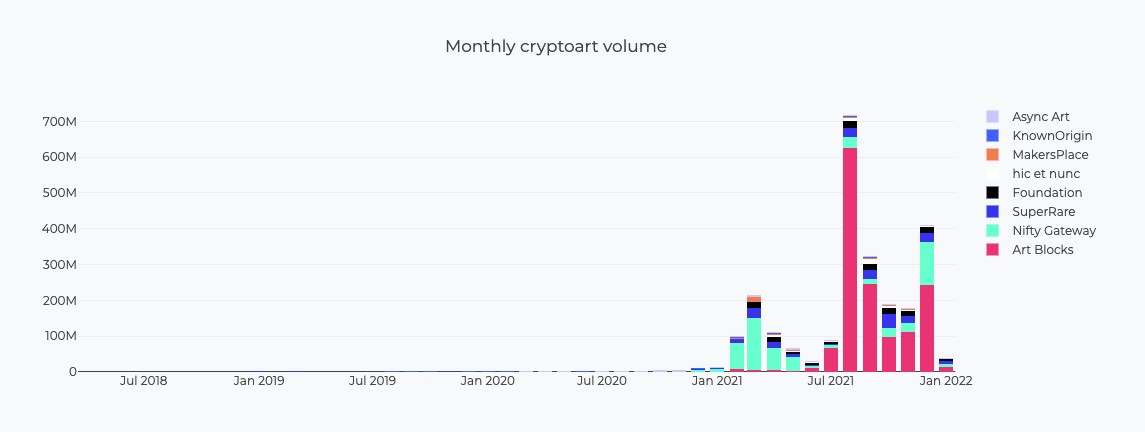

NFTs, or non-fungible tokens, are the current talk of the art world. Though they’ve existed since 2014, the popularity of NFTs rose rapidly in 2021, with trading hitting $10.7 billion in the third quarter of that year.

NFTs can be anything – art, memes, and even newspaper articles or tweets. They are stored on a blockchain, the database that cryptocurrency relies on. However, unlike crypto, NFTs cannot be exchanged with another digital asset – each NFT is entirely unique. Each NFT that is sold has no equivalent, and blockchain technology is used to establish sole ownership and digital provenance. These digital assets can be resold on specialised online marketplaces, making them a lucrative investment opportunity. In the world of NFTs, anything can be monetised and sold, which is also part of their appeal.

Their popularity can be explained by the fact that they are simultaneously exclusive and are becoming more affordable. Individual NFTs are highly unique but theoretically anyone with an internet connection – and enough capital – can access the world of collective NFTs.

More recently, the world of retail is seeing value in NFTs. While some NFT sales have made headlines for their expense, the majority of NFT purchases in the first 10 months of 2021 were valued at less than $10,000. This means they can be categorised as ‘retail’ in nature. In the second half of 2021, brands including Adidas and BoohooMAN created their own NFT collections, hoping that they could capitalise on the technology’s popularity. High fashion brands are also trying their hand at NFT collections, including Dolce & Gabbana.

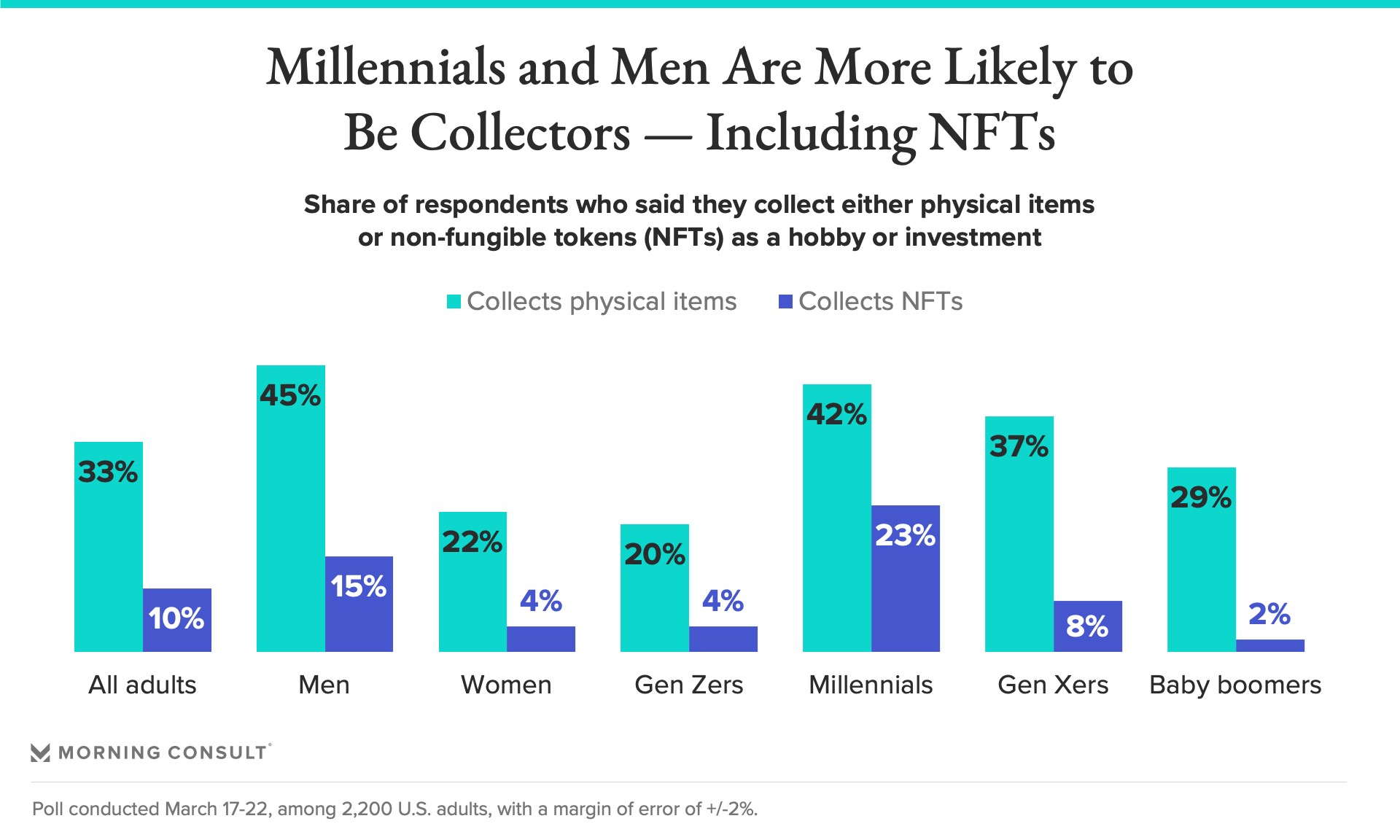

Is there a future in NFTs for retailers? That depends in part on your brand and target market. According to a survey from Morning Report, 15% of male respondents said they collected NFTs, compared to only 4% of female respondents. For high fashion brands, who more often than not have a female consumer base, NFTs can be a way of driving sales from male consumers. Alternatively, if your brand already markets predominantly to men, NFTs are a lucrative way of increasing revenue.

Based on the growth of NFTs in the latter half of 2021, it’s clear that NFTs will continue to increase in popularity. The most expensive NFT in 2021 was sold for $69.3 million in March, and while NFTs for retailers are unlikely to market for the same extraordinary prices, it’s evidence of the profit that can be created with NFTs. The entire NFT market is expected to grow to $240 billion by 2030, and NFTs for retailers could offer brands a lucrative opportunity to enter the burgeoning digital asset market.

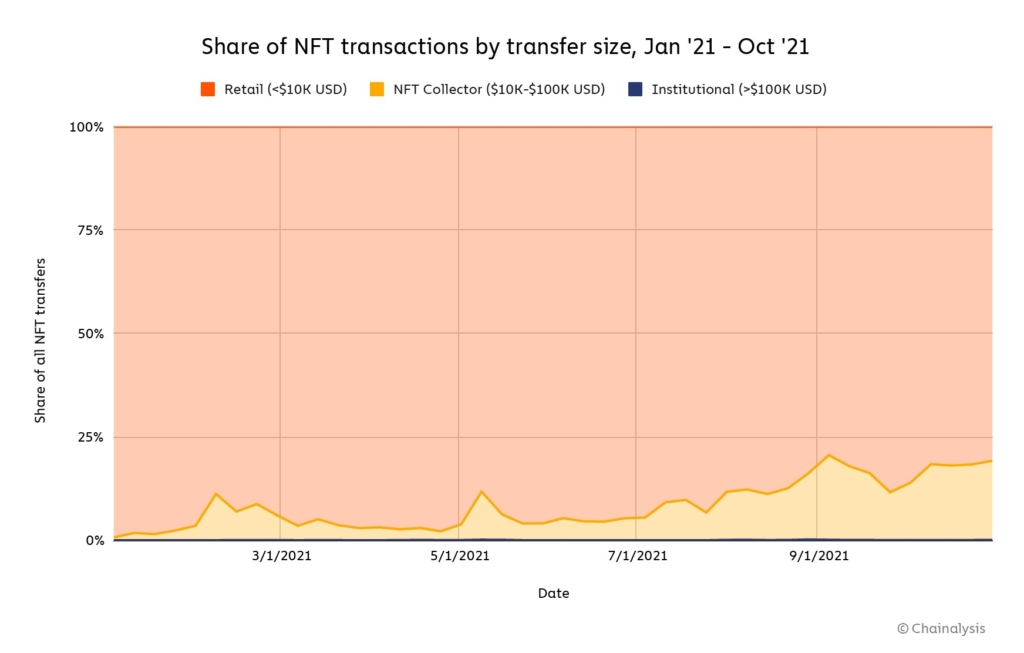

A New Market in NFTs for Retailers

The NFT market has grown from a niche area for technology and crypto enthusiasts to something more accessible to the average consumer. At the same time, over the course of 2021, the average transaction size and the total value of NFTs increased. By October 2021, collector-sized transactions of between $10,000 and $100,000 accounted for 19% of all NFT transactions, compared to 6% in March 2021. This suggests that NFT assets are gaining value rapidly and that collectors and consumers aren’t put off by high price tags.

Despite the growth in large NFT transactions, the majority of purchases are still conducted at retail level – that is, with transactions of less than $10,000. In comparison to the crypto market, NFT purchases are still driven by retail purchases, not collectors or larger institutional transactions of over $100,000. In 2021, 80% of NFT purchases were made by retail buyers, despite the growth in those high-value collectors and institutional transactions. For this reason, the market for NFTs for retailers is promising – it could prove to be a major retail innovation in the next five to ten years.

Additionally, the audience for NFTs for retailers is already there. Millennials are the most likely generation to engage in NFT purchasing, with 42% of millennial respondents to one survey saying they do collect NFTs. They are followed by Generation Xers, of whom 37% say they are collectors.

Despite Generation Z occupying a strong part of the retail market, they are one of the generations least likely to be involved in NFT collecting or retail purchasing, beaten only by baby boomers. Just 4% of Gen Zers said they collect NFTs, because of limited purchasing power or a lack of interest in collecting digital assets as a hobby. Despite Gen Z’s current reluctance to get involved in NFT purchasing, there is interest there. One study found that despite such a small proportion of Gen Zs currently purchasing NFTs, close to 30% say they are interested in purchasing in the future. Of those who said they were uninterested, 57% claimed the reason was because of a lack of understanding. As blockchain and crypto become more mainstream technologies, understanding will inevitably grow, making Gen Z another promising market for retailers involved in the technology.

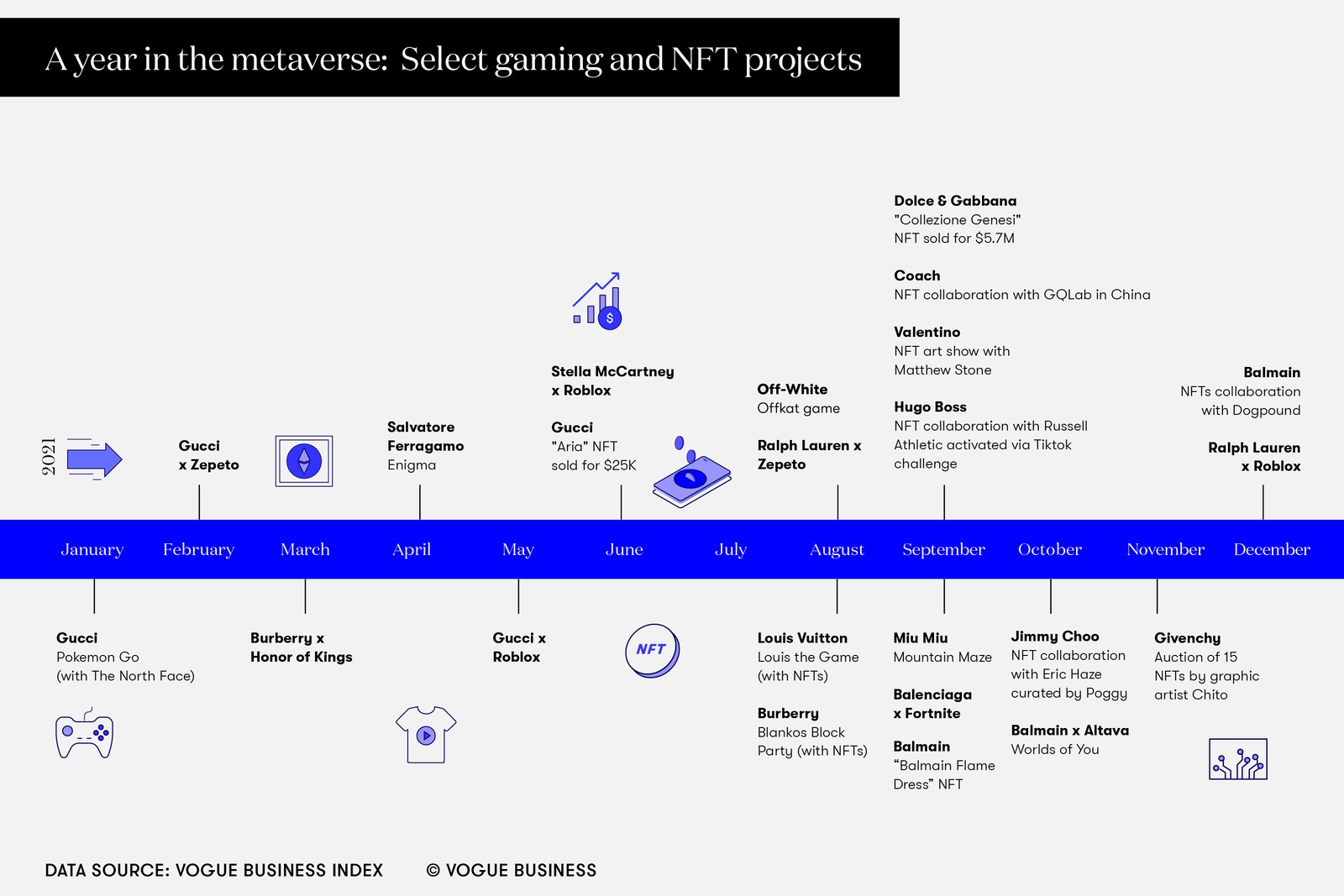

Retailers are Already Taking Advantage of NFTs

The first instance of a fashion brand embracing NFTs for retailers was when fashion house The Fabricant sold a digital dress for £7,500 in 2019. Since then, more retailers have turned to NFTs to expand their brand awareness or explore a new avenue of profit. According to the Vogue Business Index, 17% of fashion brands have already worked with NFTs.

Last year, Adidas took their first foray into the world of digital art. Their debut collection Into the Metaverse consisted of 30,000 NFTs, each of which gives the buyer exclusive access to physical merchandise that will become available in the future. The NFTs sold out within hours and Adidas earned approximately $22 million in sales. The retailer has since stated their intention to bring out more NFTs in the future, and with the success of their first collection, future profit is almost guaranteed.

They’re not the only brand to consider NFTs for retailers the future of retail. In late 2021, BoohooMAN became one of the first major fast-fashion retailers to branch out into NFTs. However, unlike Adidas, BoohooMAN is planning on giving their NFTs away for free to eight lucky winners. This fundamental change – from NFTs as a revenue stream to a marketing tactic – is evidence that BoohooMAN sees more than just monetary value in digital assets.

Retailers and the Metaverse

Here lies another advantage to engaging in NFTs – increasing brand recognition. At the end of last year, we explored why brand consistency is so important for retailers. With the rapid increase in omnichannel retailing, it’s more important than ever that retailers ensure consistent brand identity across all channels. As another marketing channel, NFTs for retailers can be a powerful way to increase brand awareness and add another facet to your brand identity. This is especially true as we start to see digital spaces like the metaverse becoming more common.

The metaverse is destined to be a 3D version of the internet where users can interact in real-time with others in a realistic virtual space. There are numerous applications for retailers here, including virtual stores where users can shop for virtual goods like NFTs using cryptocurrency. The brand opportunities present in NFTs for retailers are staggering – with so many people potentially entering the metaverse with avatars, there’s a chance for retailers to sell their products and gain much larger visibility across the globe. Despite being a relatively new retail innovation, the metaverse promises to change how customers shop and could be a key part of the future of retail.

Retailer ASICS has already taken one step towards the metaverse, with plans to develop a digital store where consumers can interact with the brand’s products. Luxury retailers are also exploring the possibilities the metaverse can offer. Last year, Burberry launched an online game that users can access by purchasing an NFT. In the game, they can interact with the brand’s identity and products, and purchase virtual accessories like jetpacks, armbands, and pool shoes. With retailers already considering ways to become digital-first, the metaverse offers opportunities for building brand identity, and revenue, outside of physical stores, and NFTs for retailers is a huge part of this.

Are NFTs The Future of Retail?

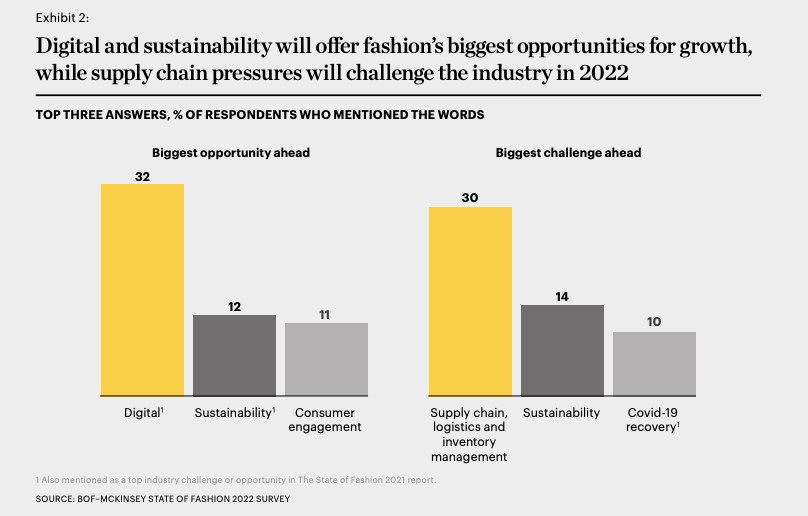

McKinsey’s State of Fashion 2022 report concluded that NFTs are likely to become part of the mainstream for retailers this year. With the rapid growth of the market and the branding and profit opportunities afforded by the sale of digital assets, it’s clear they will become a staple in the future of retail. In fact, the luxury NFT market is expected to grow to $56 billion by 2030, and while luxury NFTs will still comprise a small proportion of the overall market, this retail innovation will see increased demand because of the metaverse.

When considering if NFTs for retailers represent the future of retail, it’s also worth considering the as-yet undeveloped applications of the technology. Retailers may find that embracing the technology now could offer unforeseen advantages in the future as blockchain and NFTs for retailers become more widespread. As the technology becomes more accessible, it will also be easier for brands to explore opportunities within NFTs.

Though the market for NFTs for retailers is likely to grow, retailers should be aware of the potential implications of embracing NFTs. We already know that the retail industry is committed to becoming more sustainable. 14% of respondents to McKinsey’s State of Fashion 2022 said that sustainability would prove the biggest challenge for the fashion industry, while 12% regarded sustainability as an opportunity. NFTs, though, present a major sustainability problem.

NFTs rely on the cryptocurrency Ethereum, which in turn relies on huge amounts of electricity to keep transactions going. To establish digital provenance and security in the blockchain, “miners” solve cryptography problems with high-power computers. In doing so, they draw a huge amount of power from the grid – Ethereum’s total annual carbon footprint is estimated to be the same as that of Hungary. The future of retail may well lie in the metaverse and NFTs. However, brands will have to think carefully about whether embracing NFTs for retailers may contradict their sustainability goals and negatively impact their brand reputation.

NFTs for Retailers and RFID

Beyond investing in collectible NFTs, an additional advantage of blockchain technology that often goes under the radar is that retailers can use it to establish product authenticity. Globally, the counterfeiting industry is valued at $500 billion a year, with luxury retailers particularly vulnerable. In the future, NFTs for retailers might be used to establish product authenticity and supply chain transparency, combating common problems in the retail industry like counterfeiting.

Existing technology like RFID can be harnessed alongside blockchain to provide customers with additional information about their products. “Product passports” will support authentication by offering information about products and their provenance through virtual tags. Chanel are already utilising this technology, replacing physical tags in their luxury handbags with a digital passport through a scannable metal plate.

With the global adoption of RFID technology on the rise, it’s likely that we’ll see more collaborations with RFID and NFTs for retailers in the future. Whether NFTs will become a mainstay in the future of retail remains to be seen, as many consumers are still in the dark about the technology. However, there’s no doubt that it’s a retail innovation that offers opportunities for increased revenue, brand visibility, and security.

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Explore how Detego’s all-in-one cloud-hosted RFID retail innovation could help you increase revenue. Our user-friendly software enables you to keep accurate stock counts, improving the efficiency of your omnichannel services and boosting revenue. Click the link below to book a demo.

This year’s Christmas period will be unlike the ones before. With retailers just recovering from or still grappling with supply chain issues and facing potential staff shortages caused by Coronavirus and other extenuating circumstances, it’s going to be more difficult to hit yearly KPIs.

However, the retail forecast for the final quarter of the year still looks promising. Deloitte predicts that holiday sales will grow by 7% to 9% compared with the same period last year, and retailers should focus on taking advantage of consumer demand this Christmas. While retailers can expect high demand for products this year, there are additional ways you can improve store performance.

Not only do physical retailers have to compete with online purchases in the run-up to Christmas, but there is also increased pressure to make up for any lost performance from earlier this year due to the dual crises of the pandemic and supply chain problems.

There are many retail solutions for improving store performance, ranging from implementing omnichannel marketing to improving customer service. Most store solutions come down to accurate inventory counts. Knowing the stock you have, where shipments are, and what products you can offer the consumer will inevitably improve the customer experience and your overall store performance this Christmas. For this reason, you should consider retail solutions like inventory software as part of a strategy to improve performance.

Our suggestions for store solutions are just a start. To successfully improve store performance this Christmas, retailers should take a 360-degree view of their operations, from their supply chain to stock replenishment and customer expectations of their store. Inventory software like RFID tags will go a long way to tackling some of these issues.

While a switch to digital inventory solutions will take time and training to implement successfully, it’s a long-term solution that will protect retailers against future supply chain issues and ensure optimal customer satisfaction in your stores.

A difficult Time for Retailers

If your store is struggling to reach its KPIs this year, you’re not alone. Supply chain issues – partly caused by the Coronavirus crisis – have made it more difficult for stores to get the stock they need this year, leading to reduced sales and performance.

These issues exist all the way through the supply chain and are not limited to one geographical region or country. Around 38% of ocean freight was delivered on time this year, half of last year’s total. Consequently, prices for raw materials and delivery are rising, on top of increased demand from retailers for their stock.

Stores experiencing a drop in their stock availability are already witnessing the effects on their total profits this year. Maternity wear retailer Seraphine reported lower stock holdings from July onwards, which meant they couldn’t satisfy customer demand in-store. Consequently, the retailer now predicts a 15% reduction in profits compared to last year.

As demand for products increases in the run-up to Christmas, many retailers are consequently over-ordering or placing retail orders too early to get their stock inventory back to normal levels. But this is far from an ideal retail solution and creates issues further up the supply chain for raw materials manufacturers.

Stores that can anticipate stock issues and respond to them quickly will have a better chance of weathering the supply chain crisis and improving their performance – which is more important than ever as the retail sector prepares for increased demand over Christmas. To do this, retailers should take advantage of inventory software.

The importance of inventory accuracy

There are many ways to improve store performance, from focusing on the overall customer experience to automation and omnichannel marketing. Most of these store solutions have in common, though, is the problem of accurate stock inventory. If retailers are going to recover from the ongoing supply chain crisis successfully, then a 360-degree view of operations and stock levels is crucial – and inventory software can help you do this.

Tracking and cataloguing store inventory isn’t limited to the shop floor. Retailers must have a broad view of their inventory from the end of the manufacturing process to when a shipment arrives at the store warehouse. Tracking such a large amount of stock – for some retailers, this can mean processing 70,000 items in just a few months – requires its own digital solutions, which can take time to implement. However, the impact of such inventory software is significant.

Missing stock on the shop floor is a massive problem for physical retailers, especially in the wake of supply chain issues. The digital age has transformed customer expectations, meaning that physical stores must compete with online retailers. Now, if customers are disappointed by product availability in-store, their solution is to order the same product online.

To put this into perspective, 75% of millennial shoppers leave a store without a purchase instead, buying that item online. The main reason for this? It’s encountering out-of-stock items in the store.

Accurate stock inventory is also key to providing a successful omnichannel customer experience. Especially in the busy Christmas period, customers will be looking for flexibility in the shopping process, including options to collect their products in-store, order online for in-store pick-up, and even in-store ordering to their home. This omnichannel approach to the shopping process inevitably increases the chance of a successful sale and makes the entire experience effortless for the customer.

In all of these cases, inventory software is the tool that will enable retailers to have a broad view of their entire stock inventory, from warehouse to shop floor. Technology like RFID can transform your strategy to retailing by making it easier to perform stock counts, track products across the shop floor, and make informed decisions about your retail strategy

Why RFID is thriving

Radio-frequency identification (RFID) has fast-evolved from a technology used at the fringes of retail, to a global technology that is delivering business results to retailers everywhere.

According to a recent study published by Accenture:

- The majority of retailers (80%) said the benefits of RFID cannot be replicated by another technology.

When fitted to a product at the manufacturing stage, an RFID tag will send continuous data to a reader as long as it is in range. This tag removes the need for laborious stock taking with a barcode scanner, as the reader will scan everything in range and catalogue it – even if the product is in a boxed shipment.

Used alongside inventory software, RFID can produce accurate stock counts, track stock from the factory to the warehouse, and work alongside other technology in-store to create a personalised experience for customers.

With accurate stock counts becoming more important as the busy Christmas period arrives, inventory software like RFID is a valuable store solution that can easily improve your store’s performance.

How Inventory Software Can Improve Store Performance

With a digital inventory solution like RFID, retailers can solve the problem of inaccurate stock counts, which become even more important during times of increased consumer demand. It can also improve the omnichannel customer experience by giving consumers more transparency about where products are and how they can purchase them – all of which will improve your store performance in the long run.

Keeping Shelves Fully-stocked

We know that one of the biggest problems for retailers is keeping shelves fully stocked and the consequences of out-of-stock products. While you can expect some stock disruption with supply chain problems, RFID can alleviate some customer pain by ensuring shop floors are as full as they can be under the circumstances.

This digital store solution will allow you to take frequent inventory counts – up to twice a day, compared to the average of once or twice a year. When used with inventory software, you can also get on-time recommendations for which products to refresh on the shop floor, ensuring that no customer ever leaves disappointed.

This digital store solution will allow you to take frequent inventory counts – up to twice a day, compared to the average of once or twice a year. When used with inventory software, you can also get on-time recommendations for which products to refresh on the shop floor, ensuring that no customer ever leaves disappointed.

Improving the In-store Customer Experience

Nowadays, customers want more from their physical stores. Whether that’s more personalised recommendations from staff, virtual shop assistants, or interactivity in-store, RFID can help you do this.

RFID tags can work with other innovative technology like smart fitting room mirrors to offer personalised product recommendations for customers while shopping in your store. When a customer takes a product fitted with an RFID tag to a fitting room, the product’s unique code is read, and the product is displayed on the smart mirror, alongside similar products that the customer may like to try. There may also be the option to request products while in the fitting room, making the shopping experience more seamless for the consumer.

Producing Accurate Data

For retailers to successfully navigate the increased demands of the Christmas period and ultimately improve performance, accurate data is crucial. RFID is a digital tool that provides real-time data about stock levels and makes suggestions about managing inventory better.

Instead of relying on historical data for your in-store stock decisions, RFID gives you the tools to make informed decisions about your store. From stock availability to automated refills and data on dwell times, this inventory software will improve performance in your store through more accurate insights.

Offering Omnichannel Retailing

It’s no longer a battle between brick-and-mortar stores versus online, but most retailers are a hybrid of both. This means that your stock inventory needs to be more precise and accurate, reflecting both your in-store availability as well as online, so customers can get exactly what they want whether they’re in-store or at home. The key to omnichannel retailing is ensuring there are enough options for your customers – whether they want to pick their product up in-store, order it to their home, or return it to a different store, there should be a retail solution for that. For this to work, retailers need an accurate view of their stock counts and where stock is at all times. By utilising RFID with all-in-one inventory software, you can achieve up to 99% stock accuracy, meaning the customer is never disappointed by out-of-stock notices or unavailable shipping.

Why You Should Invest in Inventory Software now

Retailers gear up for increased consumer demand, inventory software and RFID can be a valuable retail solution in the run-up to Christmas by eliminating labour-intensive stock counts and improving stock visibility from warehouse to shop floor.

Retailers are increasingly investing in inventory software like RFID to streamline their supply chains. In the US, investment in retail technology has reached $8.6 billion, reflecting its value as a store performance solution. It’s a similar story in the UK, where technology like inventory software could uplift £21 billion to the retail sector.

Not only will more accurate inventory information make your operations more effortless and reduce labour requirements, but it will inevitably improve store performance. You can use a store solution like RFID to strengthen omnichannel retailing and provide increased personalisation in-store, leading to more opportunities for sales. Ultimately, RFID is an ideal retail solution for periods of increased demand, such as the run-up to Christmas.

Detego is the only all-in-one retail solution on the market, utilising RFID alongside a complete end-to-end SaaS platform to improve your inventory accuracy. From stocktaking and stock replenishment to tagging, our inventory software can handle it all, reducing the chances of human error and increasing opportunities for sales in your stores

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Detego Store is a cloud-hosted RFID solution which digitises stock management processes, making them more efficient and more accurate. Implemented within hours, our multi-user app can provide intelligent stock takes and a smart in-store replenishment process. Later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

The post-pandemic era — that we continue to move closer to — is defined by uncertainty. And every day, experts, futurists, and commentators from the corners of every industry desperately question how the pandemic will have shaped their sectors’ short and long-term futures.

Retail, however, has arguably just begun to settle into its place within the unpredictable global landscape. Upping their investments into heightened digitisation and improved customer experiences, they are starting to prioritise strategies that can offer them adaptability, agility and resilience to the unforeseen situations that will surely continue to come their way.

These strategic rising investments come at a time when elusive loyalty is becoming harder to capture, with 73% of consumers who have shopped with different retailers during the pandemic intending to incorporate new brands into their routine. Whilst — needless to say — technology continues to revolutionise how entire supply chains operate.

However, the consumer-facing employees tasked with harnessing retail technologies to strengthen their own workflows are inconspicuously deliberating the success of these investment categories. And as a result, they are able to provide customers with the immediate, personalised, and memorable omnichannel experiences they progressively desire when they shop.

Because the experiences of customers and employees are undeniably interconnected, in fact, businesses with happy employees attain 81% higher external customer satisfaction. And many more studies elaborate that when workers are engaged, committed, and fulfilled in their everyday roles, it improves their ability to deliver valuable services to customers.

So to retailers currently refining their post-pandemic survival strategies, we suggest exploring the impact that employee experiences can have on growing customer gratification.

Employee Experiences are Vital as Retailers Up Investment in Technology and Customer Services

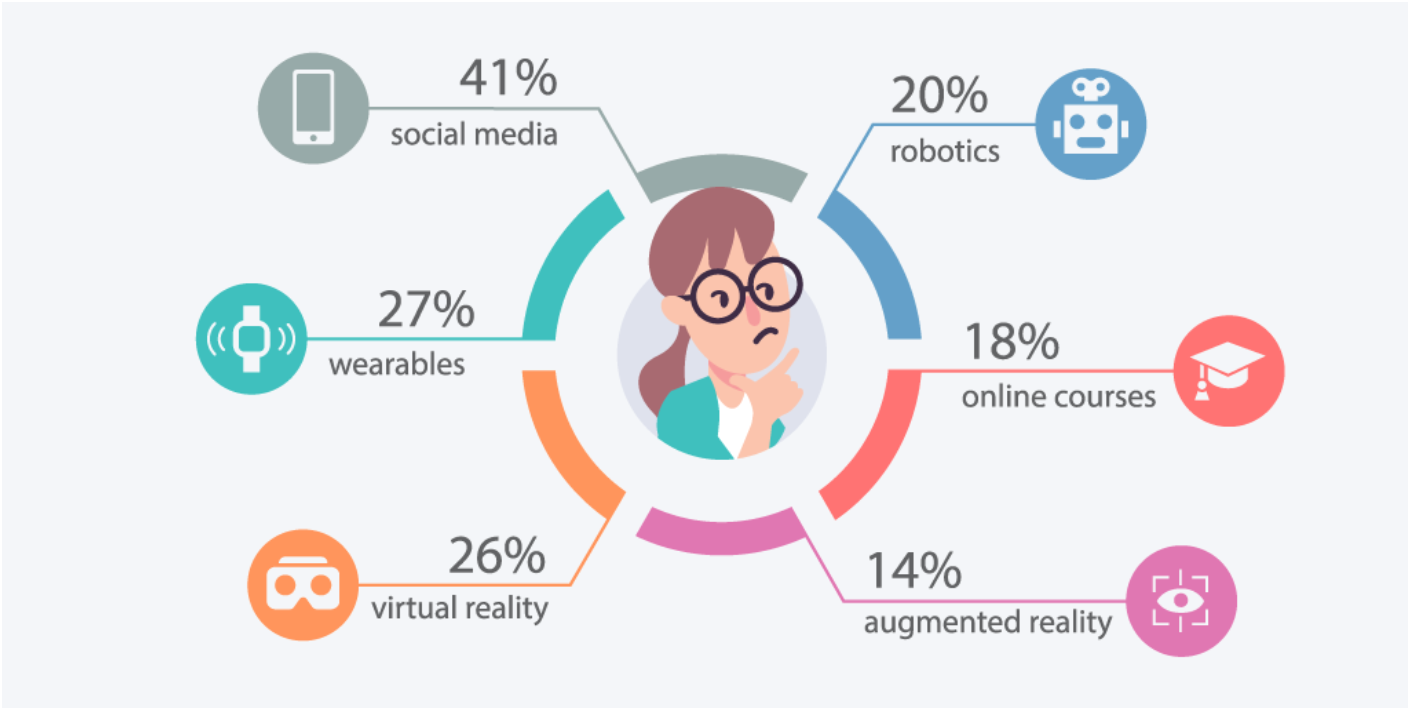

Since the pandemic began, these impactful employee experiences have increasingly relied on technologies. Particularly ones that enable individual workers to connect to their everyday professional lives remotely. From social media, robotics, learning and development, wearables through to virtual and augmented reality, these applications are targeted digital solutions that can optimise the everyday activities of diverse workforces.

And as the retail sector’s recovery from the damages of Covid-19 slows, it is unsurprising to see that in order to stimulate its revival, investment into retail technology that simultaneously enhances customer and employee experience has reached an all-time high, and 79% of high street retailers plan to implement more technology solutions this year.