Consumer mindsets are evolving at an accelerating pace.

While it wasn’t long ago that shoppers could be satisfied receiving the tiniest of details from a product’s journey before it came into their possession, years of unsustainable and unethical practices within retail supply chains have begun to tarnish the relationships between businesses and their customers.

Understandably, customers are increasingly demanding that the traditionally opaque supply chains that serve them are made more visible – and they’re using their wallets to back and promote these values. As a result, power has shifted, and unless retailers want to become obsolete, ignorance and dishonesty must be replaced with clarity and accountability.

Especially since — over the past 18 months — the pandemic has intensified this scrutiny, and it seems that now, for retailers to survive, they must relinquish their use of transparency as a novel marketing strategy and view it as a necessary process to be implemented into everything they do.

Transparency as a marketing tool is nothing new, businesses have been branding their performance as a method of storytelling that highlights their morality and pulls audiences in for a while now. Greenwashing, however, has become a concerning result of this trend, with companies picking and choosing what to report and positioning their activities in a positive light.

In fact, in the Business of Fashion’s and McKinsey & Company’s The State of Fashion 2020 report, almost 20% of executives claim that radical transparency is one of the top three themes impacting their business due to changing consumer desire for genuine and clear information.

What Does a Radically Transparent Supply Chain Look Like?

Radical transparency defines the complete disclosure of information at every link of a retailers supply chain. This includes everything from the sourcing of raw materials, water usage in textiles dying, factory working conditions, the environmental impact of goods distribution, and customer care instructions.

In the past few years, many organisations have led the charge regarding supply chain clarity. For example, in just the apparel sector exists Fashion revolution Eco-Age and Good on you – all of which currently hold fashion retailers accountable over the impact of their supply chains by taking different approaches to the promotion of reporting.

And reporting is the cornerstone of supply chain transparency, providing a window into the practice’s businesses abide by. H&M — leaders in supply chain transparency — are among many retailers who have aligned their manufacturing reporting with Transparency Pledge Reformation takes this a step further, making the environmental impact and traceability of their products public.

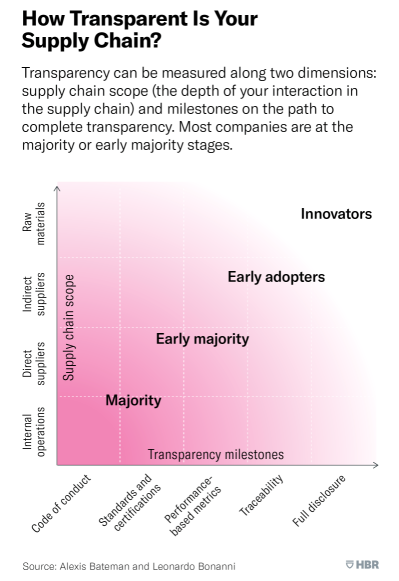

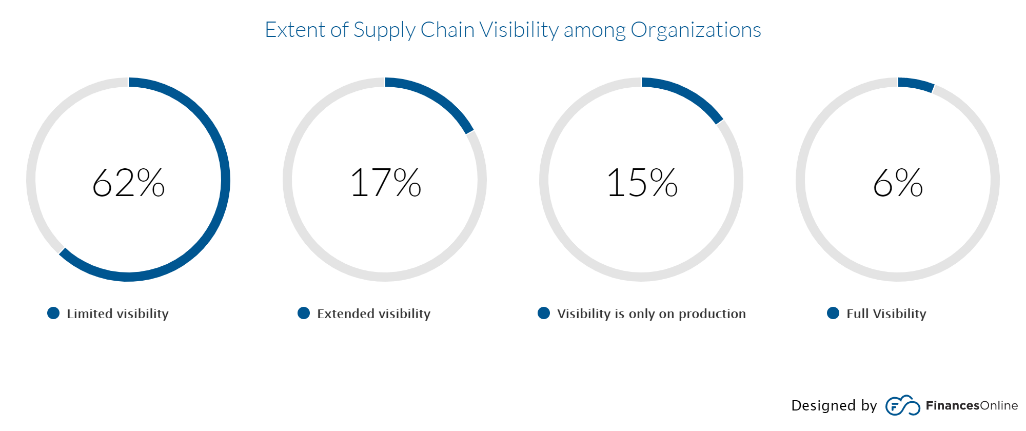

Yet, the widespread adoption of end-to-end supply chain clarity is limited and slow. While most businesses have begun to embed transparency into their internal operations and with direct suppliers, processes beyond their control – for the most part – remain opaque.

As a result, the companies that can trace their products’ raw materials are categorised as pioneers of supply chain transparency, whilst businesses that can track the activities of their indirect suppliers are ahead of the curve. Yet, for the majority of companies, moving towards full disclosure reporting can seem like an impossibly far milestone to reach. Nonetheless, it is one they must begin striving towards now.

Why Prioritise Transparency Now?

While many retailers readily look to improve their supply chain transparency, for many others, full-disclosure reporting is a practice being pressured upon them by both direct and indirect stakeholders. These different parties desire open and honest information for various reasons. Here we discuss the mindsets of these stakeholders and explore the reasons behind their demands for radical supply chain transparency:

1. Customers

The post-pandemic retail sector is filled with innovation that attracts the re-emerged consumer whose activism has been heightened by COVID-19. Multiple lockdowns had given the world time to re-evaluate its values, especially when last year, there was no good excuse to look away from societal issues that took the world stage, such as climate emergencies, poor factory conditions, and racial injustice. As a result, contemporary consumers are more scrutinising now than ever before and want the businesses they shop with to take accountability when problems within their internal operations are uncovered.

Sustainable and Ethical Practice:

It is arguably customers who drive retail’s interest for heightened clarity through their passion for advocating brands with sustainable products and ethical operations. In fact, 64% of shoppers look for ethical or sustainable features when making a purchase, and according to researchers at MIT Sloan School of Management, they may be willing to pay 2% to 10% more for products from companies that provide greater supply chain transparency.

In being able to see the impact of their purchases more clearly, customers are not only able to build trust with a retailer but become more assured that their own behaviours align with the values they hold.

Omnichannel:

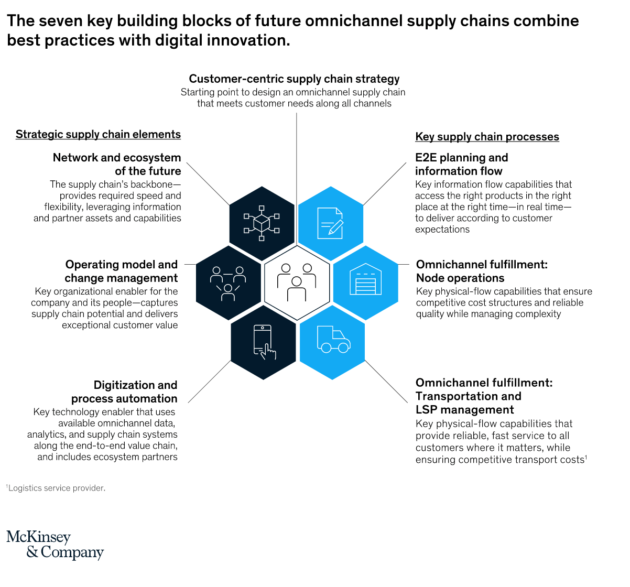

Customer-centricity is key to post-pandemic supply chain success as demand for goods becomes increasingly uncertain and erratically patterned. The growth of omnichannel means that shoppers expect retailers to cater to them at the physical and digital touchpoints they more fluidly move between in the wake of the pandemic.

By improving the transparency of their supply chains, retailers could much more readily provide the services created by the omnichannel shopping experience, such as real-time inventory visibility and same-day delivery fuelled by digitisation.

2. Employees

Employees are core stakeholders that the shift towards transparency would most impact. Making their working environments unambiguous and their everyday tasks clear to external audiences allows employees, customers and investors to hold retailers accountable in a public domain.

Welfare: According to Anti-Slavery International, there are 16 million people trapped in forced labour within the supply chains of businesses that supply our goods and services. Supply chain transparency is a small step to providing workers more protection over workplace conditions, wages, and personal agency, helping mitigate the risk of external suppliers taking advantage of labour in the sector.

As a result, by enhancing supply chain transparency, businesses are able to track the social impact of their operations and shine a light on grey areas within their own chains that they may not have complete control over.

3. Investors

Last year, Boohoo lost more than 1.5 billion euros in market value after it was uncovered that workers manufacturing their products earned less than minimum wage in poor working conditions. So making it clear that now more than ever, customers aligning their purchases with their values will have a tangible impact on revenue.

Return on Investment: For investors, the intrinsic link between supply chain controversy and loss in market value is a concerning risk. For example, violations in ESG practices were estimated to have erased almost half a trillion dollars’ worth of value from public companies from 2015 to 2019. ESG stands for environment, social and governance. All three domains increasingly feed into an investors decision to back a company beyond financial projections.

So, with investors progressively looking to work with businesses that have a positive impact, transparency is a firm method of proving compliance with every step of the EGS chain that can easily be mapped to the supply chain.

Transparency and Visibility: One Cannot Exist Without the Other

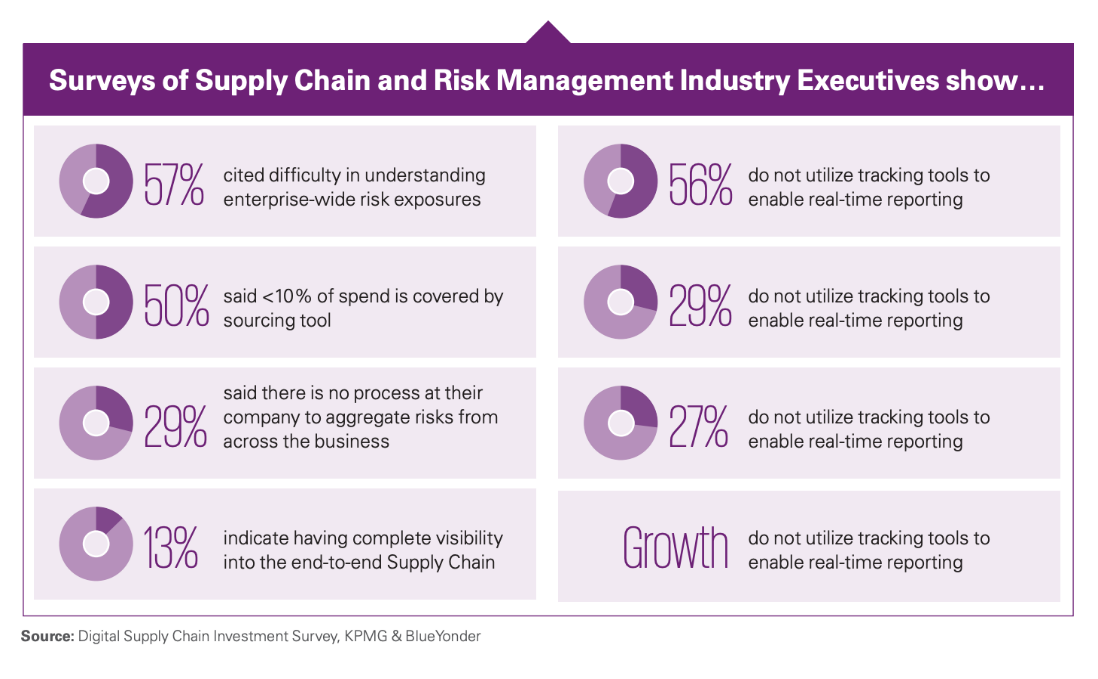

Now that we have made a case for supply chain transparency, there is still the question of how these typically tangled and murky operations can become crystal clear when only 13% of retail executives currently describe having end-to-end visibility.

Although often and mistakenly interchanged for one another, transparency and visibility are two separate concepts when it comes to supply chains, but for retailers, one cannot exist without the other. Therefore, if retailers are to make their supply chains more transparent, they must first be made more visible.

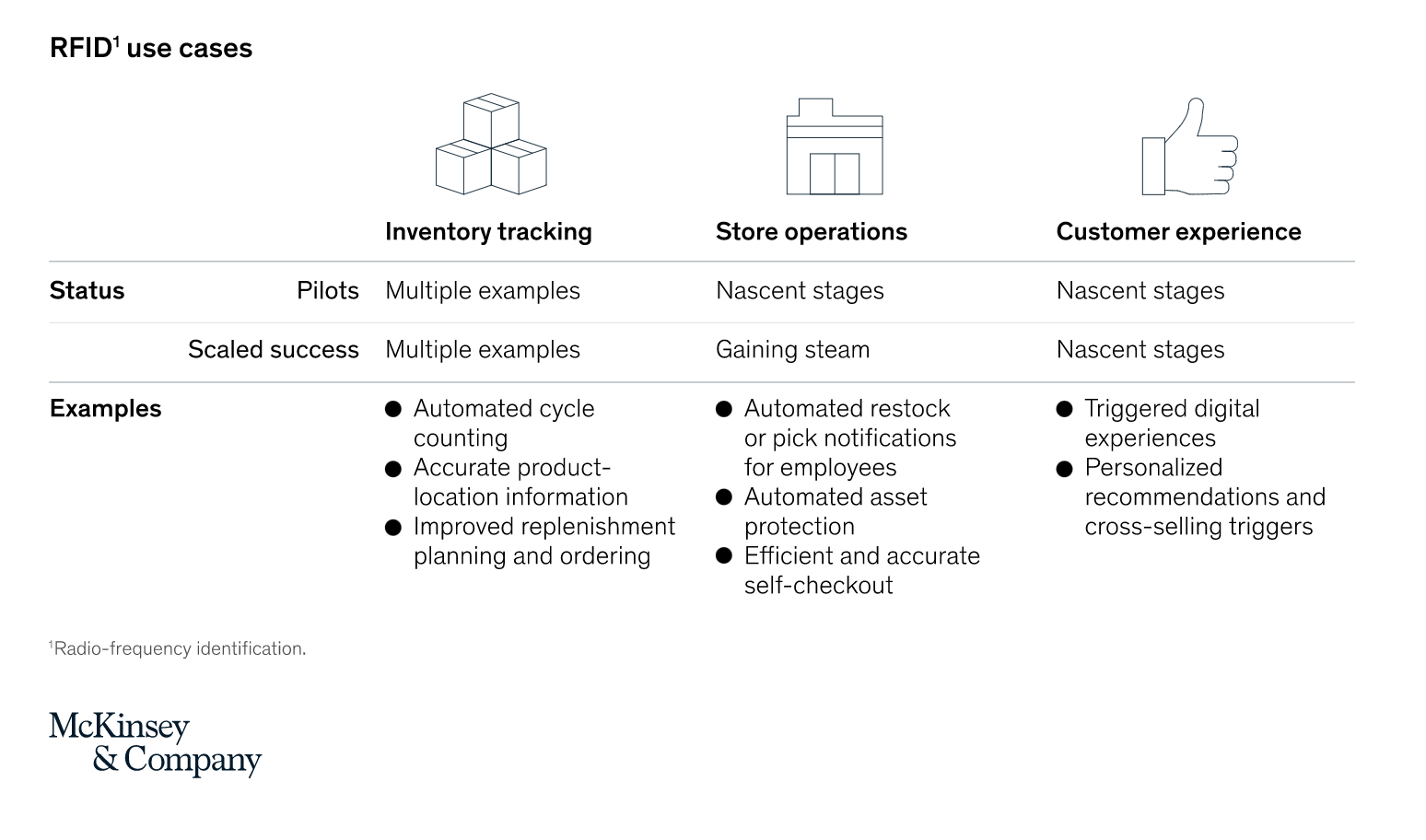

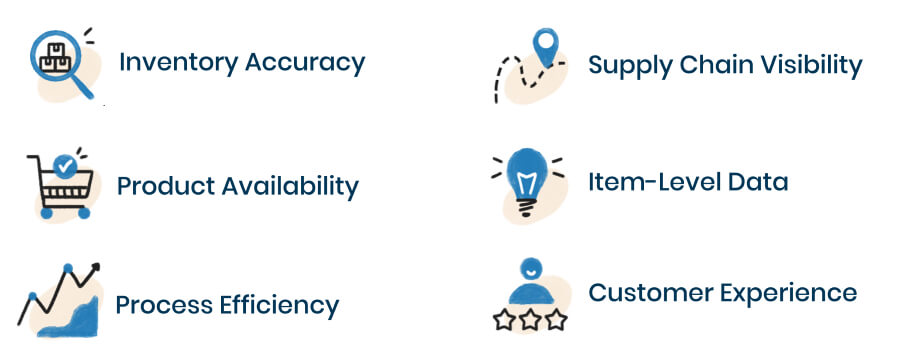

Implementing RFID technology can help provide retailers with unparalleled inventory tracking. By tracing stock at item-level from the factory to warehouse to shop floor, RFID can help retailers improve sustainable and ethical practices within their operations in the following ways:

Post-Purchase Care: By recording raw materials, RFID can assist retailers in tracking the origins of their products and enables them to have a longer life by tracing their composition and helping owners care for their items better.

Carbon Footprint Tracking: RFID technology can follow inventory at item-level at every step of their journey, allowing businesses to calculate the environmental impact of every individual product and correctly offset it.

Workload Easing: RFID also helps retailers ease the strain of workload within factories and distribution centres by taking the place of manual tasks such as stocktake and locating lost items.

Excess Inventory: Limiting the risk of waste products, RFID can help retailers monitor stock and manage future orders with these insights by distributing inventory to locations with high demand or designing a new collection whilst avoiding the features of underperforming products.

Manufacturing Conditions and Compliance: Tracking products back to their production source allows stakeholders to hold retailers accountable if the working conditions and practices of their internal and external factories are below standards.

Implementing Radical Change

Although organisational resistance to change is weakening, according to a recent survey by Accenture, 94% of experts said there is still no obvious effort to align the organisation’s culture with the goals of the change they intended to create. Yet the fact is, supply chains need to become radically more transparent, whether retail wants to embrace it or not.

The pandemic has exemplified change as an uncomfortable yet vital feature of business survival, and technology has been the great enabler for catalysing operational honesty and transparent reporting. But there is still much more to be done. End-to-end transparency is still a rarity, and retailers will need to push forward to experience the benefits of stakeholder satisfaction.

Book a consultation with Detego today to discover how RFID can help your organisation implement lasting and radical change through increased visibility.

Cloud-hosted RFID software

The digital supply chain

Detego’s RFID-based warehouse software enables retailers to automate and dramatically improve their receiving, picking/packing and shipping processes in factories and/or distribution centres. These steps are vital parts of an end-to-end RFID solution, providing full visibility across the entire supply chain.

Retail’s warehouse management systems are currently in a state of flux.

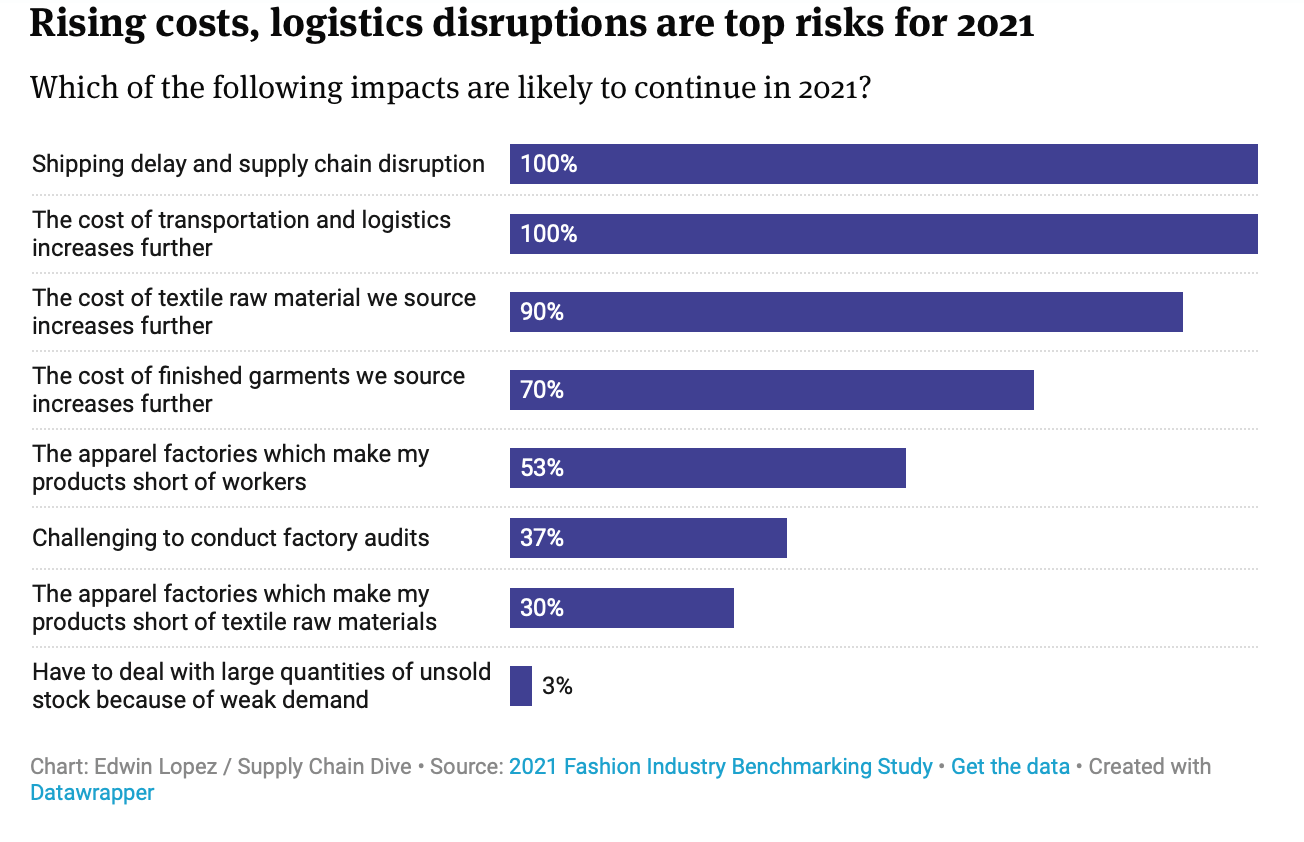

Supply chains are in crisis, consumer demands are unpredictably fluctuating, and labour shortages have reached historic heights – all disrupting the sector’s ability to fulfil even the basics of their supply and demand propositions.

Pair these challenges with the current e-commerce boom, and the result is a pivotal moment in time for the reinvention of retail logistics. In fact, investment in UK warehouses has already exceeded £6 billion this year, while the global warehouse automation market is expected to reach $30.99 billion by 2025.

Warehouses and distribution centres are undeniably the backbones of any retail operation, as departments that control the delivery of goods to consumers who — from their fingertips — expect accurate, timely, and efficient services regardless of what obstacles a retailer faces that week.

But to meet expectations, businesses must focus not just on sharpening their warehouse operations but also welcoming change and catalysing it into an opportunity for strategic innovation.

The Changing Models of Warehouses and Distribution Centers

Innovation within warehouse management is not just limited to improving tried and tested processes with technology. It is currently ripping up legacy systems as we know them and completely rethinking how the departments can be designed, fit for — post-pandemic — purpose.

Here we explore several new big-picture strategies that entirely remodel the way warehouses and distribution centres have traditionally functioned:

Micro-Warehousing

The tandem rise of e-commerce and consumer expectation for fast and efficient home delivery has inspired retailers to decentralise their once mammoth hubs and create physically segregated yet digitally connected operations through micro-warehousing.

Micro-warehouses and fulfilment centres allow retailers to house stock closer to their customer communities, enabling same-day delivery and click-and-collect services. They also help businesses optimise underutilised brick-and-mortar presences by repositioning them as dark stores — that exclusively cater to online purchases.

Distribution and Warehousing as a Service (DaaS, WaaS)

With companies facing new and unexpected obstacles every day, it’s no surprise the that B2B service market is booming. One of the latest propositions the retail sector is testing out is DaaS and WaaS.

Such services enable businesses to outsource these essential departments, radically shifting the strain of dealing with challenges like supply chain disruptions and labour shortages onto external partners who are better equipped to overcome such hurdles. Using WaaS and DaaS is a gamechanger for small and big businesses, assisting SMEs to manage quick growth without risking capital and helping large enterprises focus on other business activities without the distractions of logistical nightmares.

On-Demand Warehousing

With customer demand for goods straying away from typical timelines, businesses are increasingly unsure of how they will adapt to surging trends that follow no predetermined calendar. That is why on-demand warehouse services are becoming more popular.

On-demand warehouse platforms help retailers to find the perfect spaces for their immediate and short-term needs. This setup works with the fluidity of the global retail market, allowing companies to respond to rapid fluctuations, pilot stock with entirely new customer bases, and cater to unexpected peaks in demand – all while removing long-term and rigid contracts.

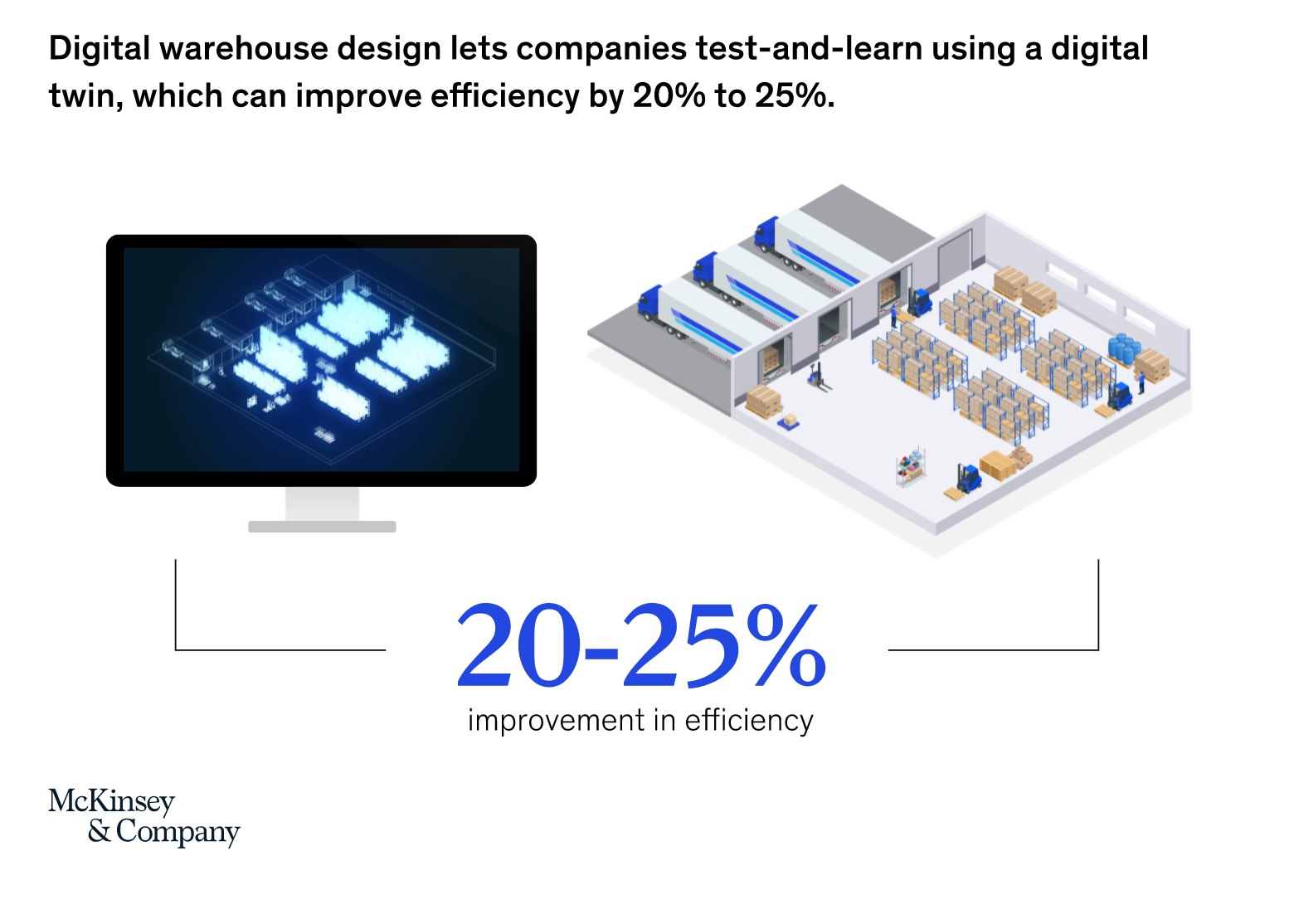

Digital Warehouse Twinning

If retail has learnt anything over the past 18 months, it’s that preparing for every unexpected eventuality is vital. That is why businesses are beginning to use technology to better their foresight.

Digital warehouse twinning is currently experiencing an uptick in use with retailers and is predicted to provide a 20%-25% uplift in efficiency. By building a digital twin of their warehouse, businesses can test new strategies and analyse the results of the operational changes they intend to make, all within a simulation. According to McKinsey & Company, this helps businesses make both big and small decisions — like floorplan redesigns and changes in workflow structures — without impacting the everyday functions of their warehouses.

The Future of Warehousing is Digital

Whether retailers intend to simply refine their existing warehouse processes or overhaul their models completely, it is no secret that digitisation will be embedded into the foundations of change.

Over the past 18 months, the adoption of technology has been essential for any business, helping them build agile, resilient, and responsive operations. And now, as retailers reflect upon their performance since the arrival of Covid-19, they’ve realised that quick decisions to implement innovation — once ideas born out of desperation — have grown in viability, becoming intrinsic to long-term strategies designed to help them succeed rather than just survive.

E-tailers like Amazon perfectly exemplify what it means to invest in cutting-edge innovation within warehouse operations whilst seeing a return on investment. For example, Amazon is known for their use of Autonomous Mobile Robots (AMR) to streamline logistics by picking and transporting stock without human supervision and integrating AI to predict inventory demand and help design floorplan navigations based on access needs. As a result, the industry leader in digital warehouse processes can deliver unapparelled levels of fulfilment across their global audiences.

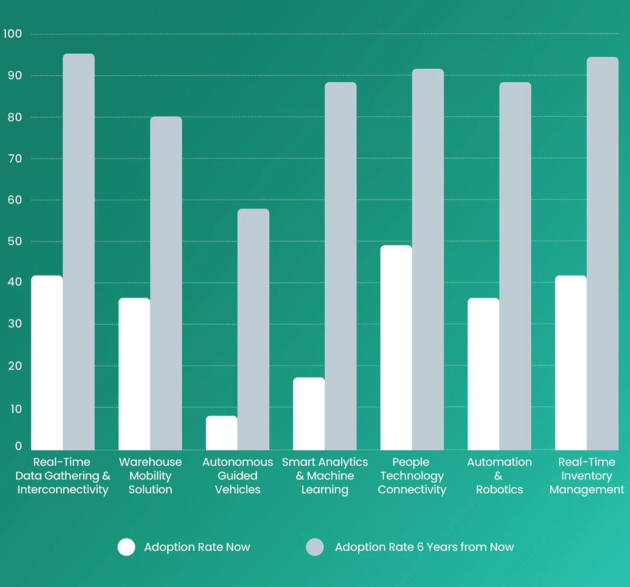

Taking a step back and looking at the retail sector as a whole, technology adoption within warehousing is set to soar over the next 6 years as these innovations evolve from being championed by evangelists into recognised processes with quantifiable results. Because according to the Harvard Business Review, there is plenty of room for improvement; 72% of companies believe their supply chain capabilities like warehousing and logistics to be digitally immature.

Technologies such as real-time data and inventory management are set to gain the most significant adoption rates in the next few years. And for good reason, the retail sector now knows that better stock visibility is necessary to make their activities intuitive to market volatility and shopper’s needs.

Why RFID is a One-Stop Solution for Operating a Warehouse with a Far-Reaching Impact

RFID technology provides real-time insights into inventory that currently helps retailers to solve many diverse challenges at once. Here we explore why integrating RFID into warehouses can allow businesses to achieve – what at first seem like wholly unconnected – business goals:

Creating Customer Loyalty

Building customer loyalty begins at the back-end of retail operations and not front-facing customer touchpoints. In fact, retail’s ramp-up of omnichannel – which has been firmly cemented as the go-to strategy for future success – has irreparably impacted how warehouses will need to function moving forward.

Delivering Fast Fulfilment through Product Transparency: When over 98% of shoppers claim delivery impacts their brand loyalty, shipping inaccuracies and delays are becoming a critical issue for retailers as demand for home delivery rises alongside e-commerce’s market takeover.

RFID’s ability to help businesses monitor inventory at item-level and in real-time means that product availability is becoming more accurate and automated as sales and returns are processed. As a result, companies can generate customer trust through the errorless communication of stock levels as they click-and-collect from stores and organise next-day delivery online.

Making Returns Easier with Shipping Accuracy: The rise of free returns policies has led to a mini-epidemic of high logistical costs and growing carbon emissions. In addition – according to the SOTI’S State of Mobility in Retail Report 2021 – over half of customers are unhappy with returns processes and want them made easier.

RFID reduces the risk of shipping mistakes by digitally automating the receipt of inbound goods to verify inventory and track individual stock pieces at every step of complex returns processes.

Reducing Costs and Optimising Efficiency

A rare new era of stagflation has arrived in the US and UK markets. Characterised by the inflation of prices, high unemployment – fuelled by “the great resignation” – and stagnant economic growth, industry experts, are wary of its long-term impact on the retail sector. As a result, retailers are becoming more cautious and considerate with every decision they make, hoping to reduce operational costs to keep prices low and demand high.

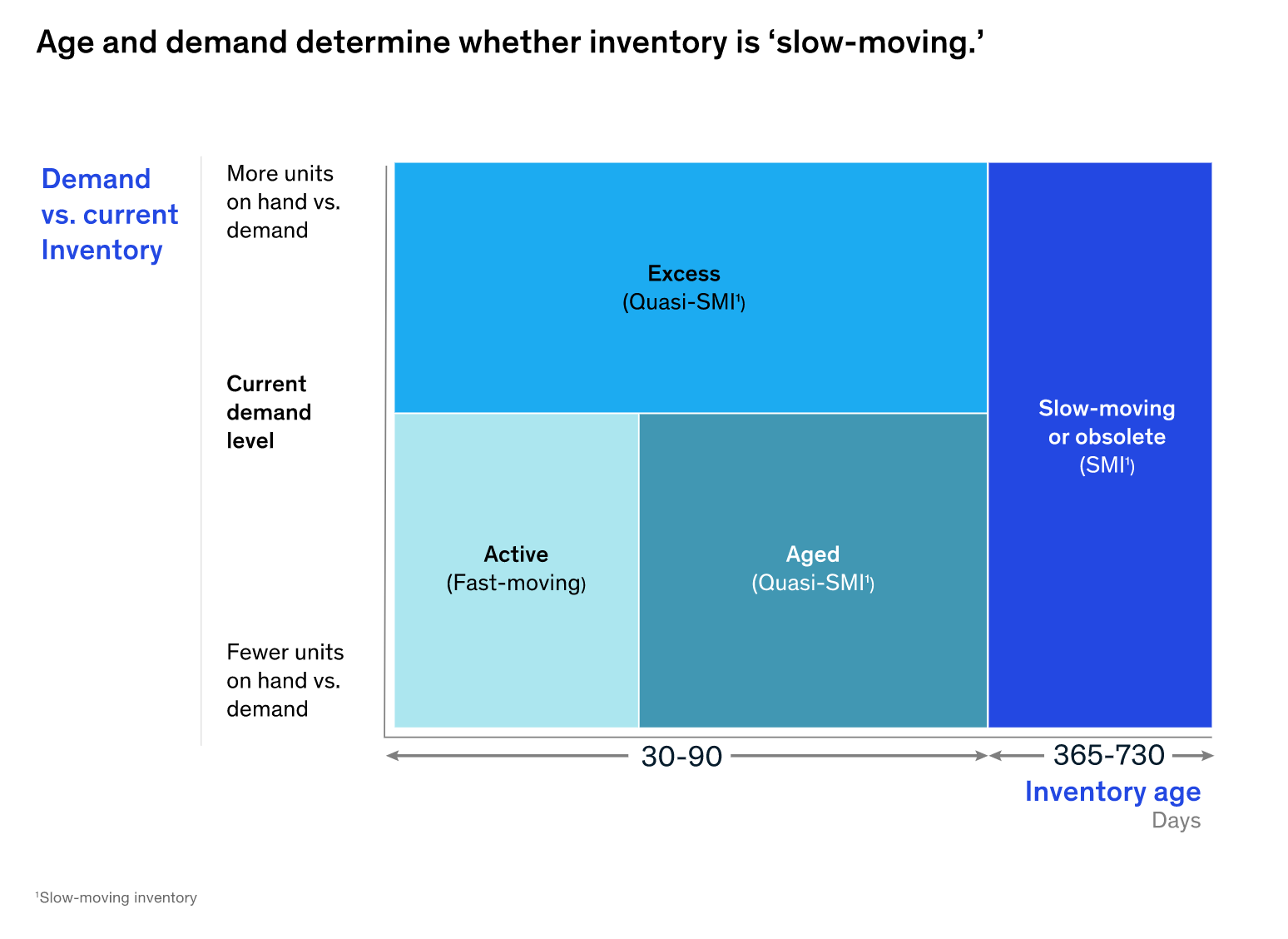

Managing Excess Stock through Inventory Protection: Slow-moving inventory has been a central problem for retail businesses, with the pandemic causing entire product categories such as evening-wear, holidays, and eating-out to become obsolete overnight. As a result, stagnating stock is a loss-leading problem that businesses are now beginning to tackle beyond outdated solutions such as seasonal sales, landfills and destruction.

RFID can help identify this stagnant inventory and trace its age and demand levels to inform how best to deal with stock in more sustainable ways. For example, the technology’s ability to trace individual goods back to manufacturers can additionally help to prove provenance as they enter resale markets.

Planning for the Future

Data is one of the most valuable assets a company can generate. It allows businesses to understand their customers on a granular level and trace what’s happening in their own ecosystems back to micro and macro market fluctuations. To plan more readily for the still unpredictable future, retailers are increasingly considering how to collect, connect and make sense of data to provide them with the best foresight.

Insights and Reporting through Label Printing: If businesses want to gain reliable and real-time insight into their logistics, they will need to imbed digital touchpoints into many of their existing processes. Warehouses present the perfect opportunity to create these touchpoints and track the inventory’s onward journey.

Quick and easy printing of RFID labels within warehouses can help enterprises with limited budgets to focus their intel-gathering on the journeys of specific stock. This can also enable smart shelving – a method of inventory visibility that allows retailers to trace customer engagement with stock as they pick it up and try it on. Insights generated this way help companies with everything from inventory planning to design development and visual merchandising.

Upskilling Workforces with easy RFID integration: The labour shortages that still plague the retail sector means that companies are becoming increasingly committed to investing in upskilling their workforce and providing them better tools to carry out everyday tasks.

Today, many RFID solutions are designed to work effortlessly with warehousing software, meaning the technology seamlessly fits into existing workflows without disruption. As a result, it helps make picking and packing less time consuming and laborious and increases employee’s ability to adapt to digital advancements with confidence and satisfaction.

Everything and Anything is Possible with Cloud Technology

Warehouses are the heart of any retail operation. As such, refining the processes within the walls of this department presents the opportunity to make widespread improvements across an entire business. Yet, so many of these advancements will be made possible by cloud technology.

Cloud technology allows different departments to automate inventory updates and access information in real-time, connecting workflows and injecting continuity into communication. Implementing cloud-based solutions into warehousing will provide retailers with the freedom of choice to radically change their models or merely update manual processes with digital.

Detego is a cutting-edge platform in the RFID space that delivers impact within their easily implemented cloud solutions. Book a consultation with Detego today to find out how they can help your business improve its warehouse and distribution centre practices and take the first steps towards implementing strategic innovation.

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Detego Store is a cloud-hosted RFID solution which digitises stock management processes, making them more efficient and more accurate. Implemented within hours, our multi-user app can provide intelligent stock takes and a smart in-store replenishment process. Later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

Until recently, it has been relatively easy for consumers to take the smooth supply chains that serve them for granted.

But the pandemic’s continued impact on retail — generating tidal waves of disruptions — has demonstrated just how reliant contemporary customers are on frictionless and immediate delivery of goods.

In just the past three months, the retail sector has suffered the effects of everything from food shortages, factory fires, to torrential weather. All of which have pushed supply chains to breaking point and — for many experts — have been the worst disruptions they have ever witnessed.

Every day, there are news reports of global brands running out of stock, failing to open stores and delaying the delivery of products, subsequently impairing their ability to provide the immediate gratification customers have come to expect from their shopping experiences.

So as the start of the next financial year swiftly approaches, retailers have begun to set their sights on investment in supply chain solutions to navigate future problems — and for a good reason — these challenges have created speed bumps in economic recovery, and according to ING, supply chain issues are here to stay.

However, if retailers have learned anything from the past 18 months, it is that these problems are not in silos of specific geographical locations, sectors, or product categories. Instead, they are an interconnected global web of causes and effects that — at the start of 2020 — retail had primarily been unprepared for. But the industry now knows that to survive, they must embed these lessons into their operations, strategically and efficiently.

Future Supply Chains: From Outdated Systems to Innovative Digital Solutions

Research from 2018 found that visibility, fluctuating consumer demand, and inventory management were already some of the most concerning global supply chain issues.

So it comes as no surprise that the pandemic has not only exasperated these sizable problems, but it has exposed global supply chain operations as outdated processes that often create rather than remove points of immense friction.

But now, moving into a post-pandemic era, revisiting and adapting the legacy processes many supply chains operate upon will not be enough for retail’s survival. Instead, businesses within the sector must begin to consider the solutions confronting supply chain challenges in new and innovative ways designed to work in the world retailers are currently navigating.

Digitisation is central to how these kinds of solutions function, yet before Covid-19, only 15% of US retail businesses had entirely digitised their supply chain management processes, despite 60% of US retailers viewing supply chain digitisation as crucial. However, the acceleration of technology over the past 18 months has presented many opportunities for businesses to integrate these agile and efficient digital systems.

And as a result of the large number of technologies aiming to revolutionise the industry, the supply chain management market is estimated to reach USD 30.91 Billion by 2026.

Current Supply Chain Disruptions and their Emerging Solutions

Today, with supply chain disruptions varying in scope and scale, it is essential that before investments are made, retailers attempt to understand the impact of each problem at every stage of a product’s life cycle to decide upon the best solutions to invest in.

Here we explore the most significant supply chain challenges that retailers are currently and will continue to face alongside the innovative solutions helping to resolve them:

Unpredictable Customer Demands In an article just last month, we looked into the post-pandemic consumer and their unpredictable and ever-changing demands. Whilst uncertainty may be subsiding as the retail sector slowly recovers, consumer experts are still unsure of the long-term impact of the pandemic on customer sentiments. Yet, with retail supply chains hinging upon the fulfilment of customer needs, this uncertainty could cripple a businesses revenue.

AI Forecasting: As AI-driven forecasting begins to mature, many businesses in the retail sector are finding themselves reliant on data-driven foresight to prepare for uncertain customer desires and mitigate the risk of history — as recent as early 2020 — repeating itself.

Shipping Delays

The blockage of a container ship in the Suez Canal in March this year, causing widespread delays worth an estimated $9.6bn of lost trade each day, illustrates how reliant supply chains are on tried and tested operations. Still today, air, sea and land distribution continue to struggle under the weight of these overwhelming market dictations, with retailers running the risk of paying for the storage of products with subsiding customer demand.

Lean Inventory: With no quick fix to shipping backlogs, an increasing number of retailers are broadening where they source their stock from and readdressing how they distribute their goods by exploring lean inventory processes. In this supply chain management method, companies attempt to reduce the waste they generate by lowering the volume of inventory and moving fulfilment closer to demand, ultimately scaling down their shipping needs and shortening lead times from factory to store. Overall, this strategy allows retailers to quickly respond to fluctuations in delivery times, recalibrate their logistics, and reduce the risk of money lost upfront.

Disjointed Workflows

As the nature of employed work becomes increasingly decentralised from offices, retail operations have had to quickly adapt their workflow processes to transfer information and efficiently facilitate teamwork throughout the supply chain. And technology has been a vital foundation for this shift towards the remote yet more connected working styles that have helped entire economies stay afloat over the past year and a half.

Cloud Software: In a recent survey, 83% of business executives say that their businesses now prioritise building and maintaining relationships with existing suppliers, and Cloud software has become integral to the management of these relationships. According to Accenture, “The cloud provides technologies that allow companies to process huge amounts of data—from virtually unlimited sources across the entire supply chain—at speeds and volumes never before possible.”

In practice, more immediate and precise communication between retailers and suppliers can speed up arduous back-and-forth processes such as quality control. Alongside this, the agile nature of the technology allows businesses to create digital continuity throughout entire product life cycles to make agile real-time decisions about goods at every stage.

Labour Shortages

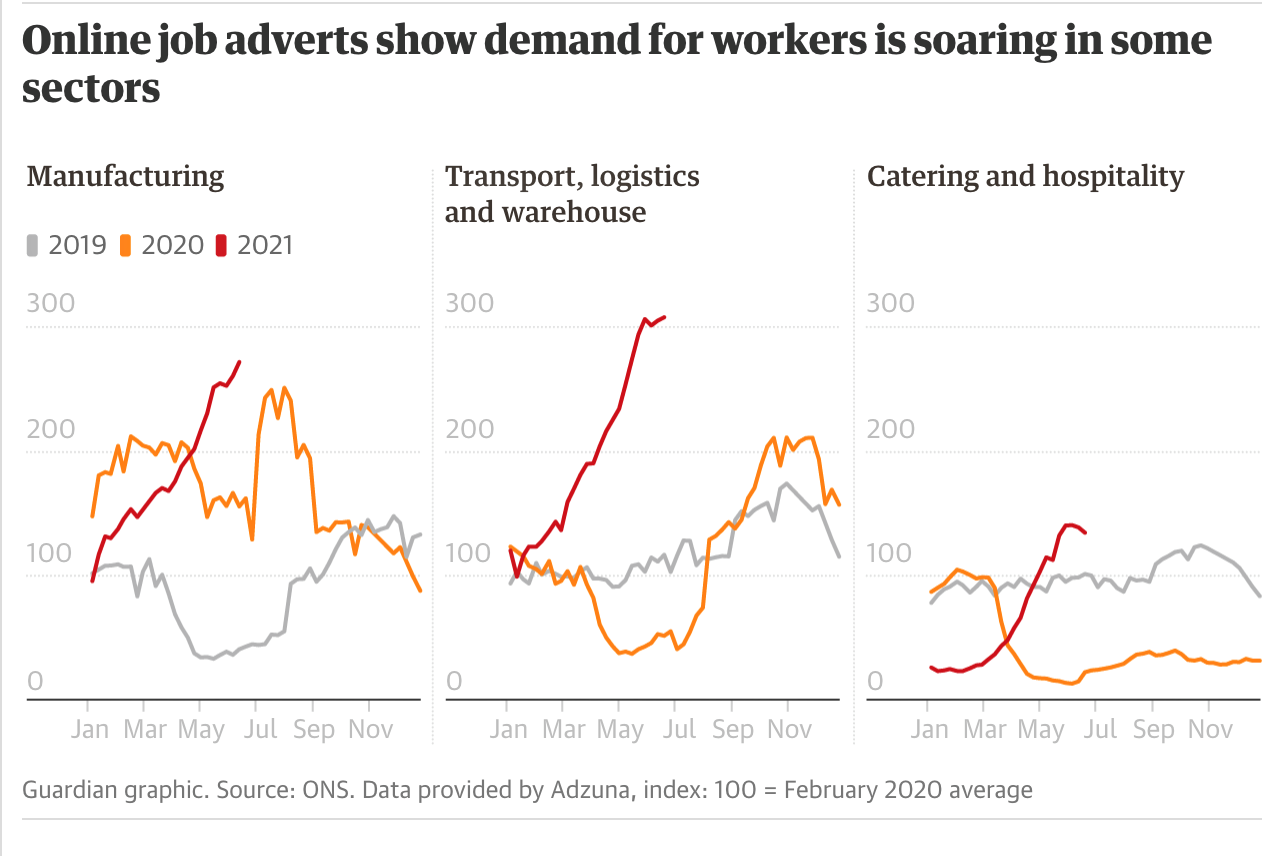

The impact of furloughs, redundancies, and under-employment catalysed by the pandemic can still be felt today, as job vacancies continue to rise sharply — particularly in manufacturing and logistics. These workforce gaps have been detrimental to retail recovery, causing insufficiently staffed stores to shutter their doors and order fulfilment schedules to be derailed due to limited warehouse teams. However, these ongoing labour shortages have left retailers scratching their heads — and experts Unhappiness, skills gaps, and at home commitments are all cited as viable explanations.

Employee-First Technology: Providing existing employees — and enticing new staff members — with digital tools that increase job satisfaction and upskill talent is crucial to building back workforce numbers. For example, RFID enabled inventory management software helps employees enhance capabilities to fulfil customer orders whilst reducing the time spent on labour-intensive stock takes and subsequently optimising the daily tasks staff.

Micro-Warehouses: To solve this problem more immediately, micro-warehousing is becoming a popular solution for several reasons. This setup allows retailers to break down their distribution hubs into smaller and easier to operate locations such as brick and mortar stores. Thus, generating opportunities to recruit from more localised communities and creating more manageable workloads whilst providing opportunities to utilise their recently loss-leading physical presence.

Lack of Transparency

Just this month, global fast-fashion retailer and market leader Shein have been accused of ethical violations in the manufacturing and sourcing of their products due to limited transparency within their supply chain. Supply chain transparency has become a growing concern for empowered consumers in recent years as they more readily use their wallets to support businesses whose actions align with their own values. Meanwhile, for retailers, supply chain clarity will help them better to understand every stage and better control their operational costs.

Compliance Technology: Compliance solutions supported by blockchain technology are increasingly helping retailers make opaque internal processes more transparent and prove their commitment to marketed moral values by securely tracking and immediately mapping the regulatory compliance of their manufacturers.

Environmentally Damaging Footprints

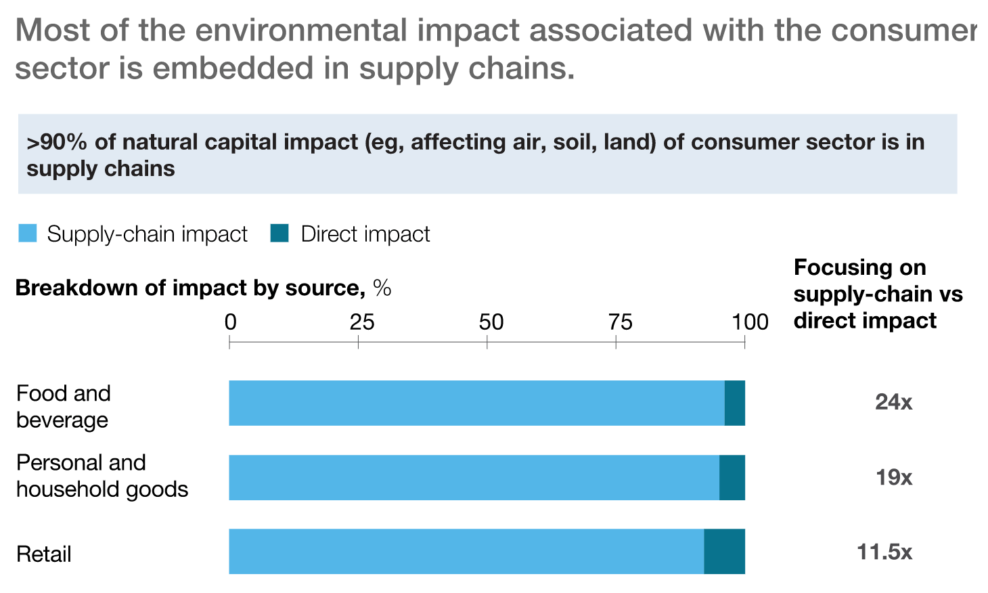

According to McKinsey & Company, the typical consumer company’s supply chain creates far greater social and environmental costs than its own operations. This is worrying for both direct and indirect stakeholders such as customers, investors, governments, and activists. And due to the globalisation of retail — as products move back and forth from factories to warehouses to customers across continents — this problem is only growing.

Carbon Footprint Tracking: Recently, carbon footprint tracking has seen a recent uptick in interest due to its ability to quantify the environmental impact of everything from an aeroplane ride to a laundry wash. Therefore, software that calculates CO2 is an interesting solution for helping retailers to understand both the holistic impact of their supply chain whilst at the same time breaking it down to item-level data so they can pinpoint problem areas and make more granular decisions.

Supply Chain Digitisation is Vital, but Where to Start?

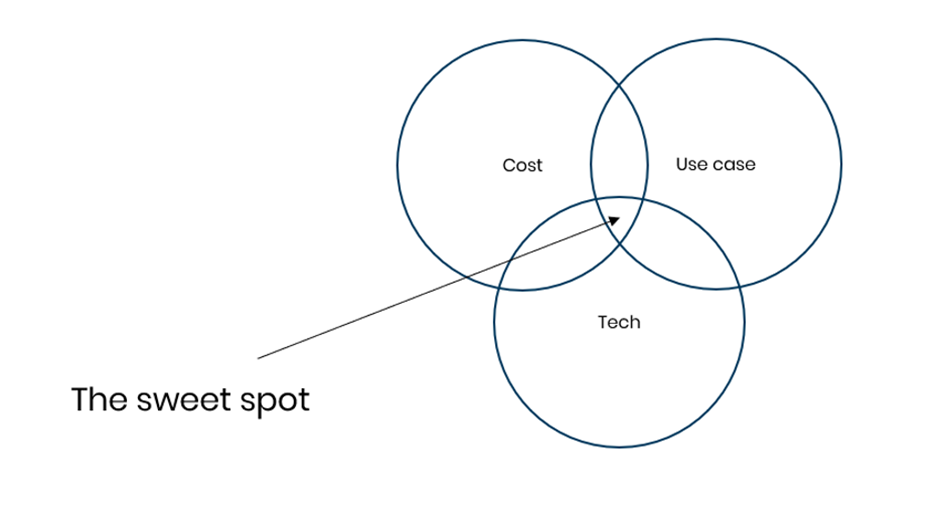

At first glance, solutions that reduce risk and enhance responsive decision making are obvious front-runners for retail investment, but considering in context the tangled disruptions retailers are facing, it is the technology that is critical to supply chain innovation.

However, with the vast number of problems retailers face, business leaders must also strategise on how to begin implementing these supply chain solutions and prioritise which problems to approach first. Moreover, due to the complexity of their supply chains, retailers will need to find multifunctional Softwares that are quick to implement and deliver fast results — especially since, in retail, agility was a winning characteristic of market leaders throughout the pandemic.

Here we discuss the three key features retailers should be prioritising when investing in digital supply chain management solutions:

- Multi-Tasking

With supply chain disruptions as deep-rooted and complex as they currently are, management tools that solve multiple problems at once are highly valuable options for retailers of any size. For example, fashion brands New Look, H&M, and Next have just begun piloting an IBM supply chain platform that combines several different technologies such as AI and blockchain to increase transparency and allow the various stages of supply chains to connect and communicate with one another.

- Speed

The continuous volatility and unpredictability of the global landscape makes it vital that supply chain solutions deliver almost immediate results to work alongside the often fleeting context of the market on any given week, day, or even hour. Take inventory software Detego, for example, which uses RFID to provide quick results that are responsive to immediate changes throughout entire operations helping businesses to view inventory levels in real-time and distribute stock globally and locally.

- Ease

In another article earlier this month, we touched upon the importance of employee adoption of technology and discussed the importance of user experiences that help to embed digital solutions into the everyday roles of workforces. It is key that solutions are easy to adopt for a variety of employees at every level. For instance — as previously mentioned — Cloud technology like Oracle helps retailers to generate digital continuity within their workflows by seamlessly transferring data between various stakeholders throughout operations.

The benefit of solutions that tackle multiple challenges with speed and ease is that they are less likely to become obsolete as their capabilities evolve alongside the post-pandemic market and efficiently reduces the number of supply chain evaluations needed every quarter.

Why it’s Important to Investing in Supply Chain Technology Now

As consumer demand for goods continues to move away from predictable seasonal patterns and towards erratic, unpredictable surges, and their loyalty falters, expectations for immediate fulfilment, unparalleled services, and complete transparency are meteorically rising. Meaning a retailers success will depend upon competing to cater to these demands effectively, and honing a frictionless supply chain is vital to achieving this.

So for both retailers on the brink of survival and market leaders, using the upcoming financial year to invest in supply chain management solutions and optimise operational costs is essential.

Yet, luckily for the retail sector, digital supply chain solutions are both growing in diversity and maturing in ability — and it is wise not to take this point in time for granted. Because looking forward, it is clear that rather than waiting for supply chains to snap back to their pre-pandemic states, businesses that accept their volatile new normal and build strategies for the reality of a post-pandemic era will surely be positioning themselves to take disruptions in their stride and stand out in the struggling retail market.

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Book a demo with Detego to find out how RFID inventory management can help your business to tackle multiple supply chain disruptions at once with fast results and easy implementation

The post-pandemic era — that we continue to move closer to — is defined by uncertainty. And every day, experts, futurists, and commentators from the corners of every industry desperately question how the pandemic will have shaped their sectors’ short and long-term futures.

Retail, however, has arguably just begun to settle into its place within the unpredictable global landscape. Upping their investments into heightened digitisation and improved customer experiences, they are starting to prioritise strategies that can offer them adaptability, agility and resilience to the unforeseen situations that will surely continue to come their way.

These strategic rising investments come at a time when elusive loyalty is becoming harder to capture, with 73% of consumers who have shopped with different retailers during the pandemic intending to incorporate new brands into their routine. Whilst — needless to say — technology continues to revolutionise how entire supply chains operate.

However, the consumer-facing employees tasked with harnessing retail technologies to strengthen their own workflows are inconspicuously deliberating the success of these investment categories. And as a result, they are able to provide customers with the immediate, personalised, and memorable omnichannel experiences they progressively desire when they shop.

Because the experiences of customers and employees are undeniably interconnected, in fact, businesses with happy employees attain 81% higher external customer satisfaction. And many more studies elaborate that when workers are engaged, committed, and fulfilled in their everyday roles, it improves their ability to deliver valuable services to customers.

So to retailers currently refining their post-pandemic survival strategies, we suggest exploring the impact that employee experiences can have on growing customer gratification.

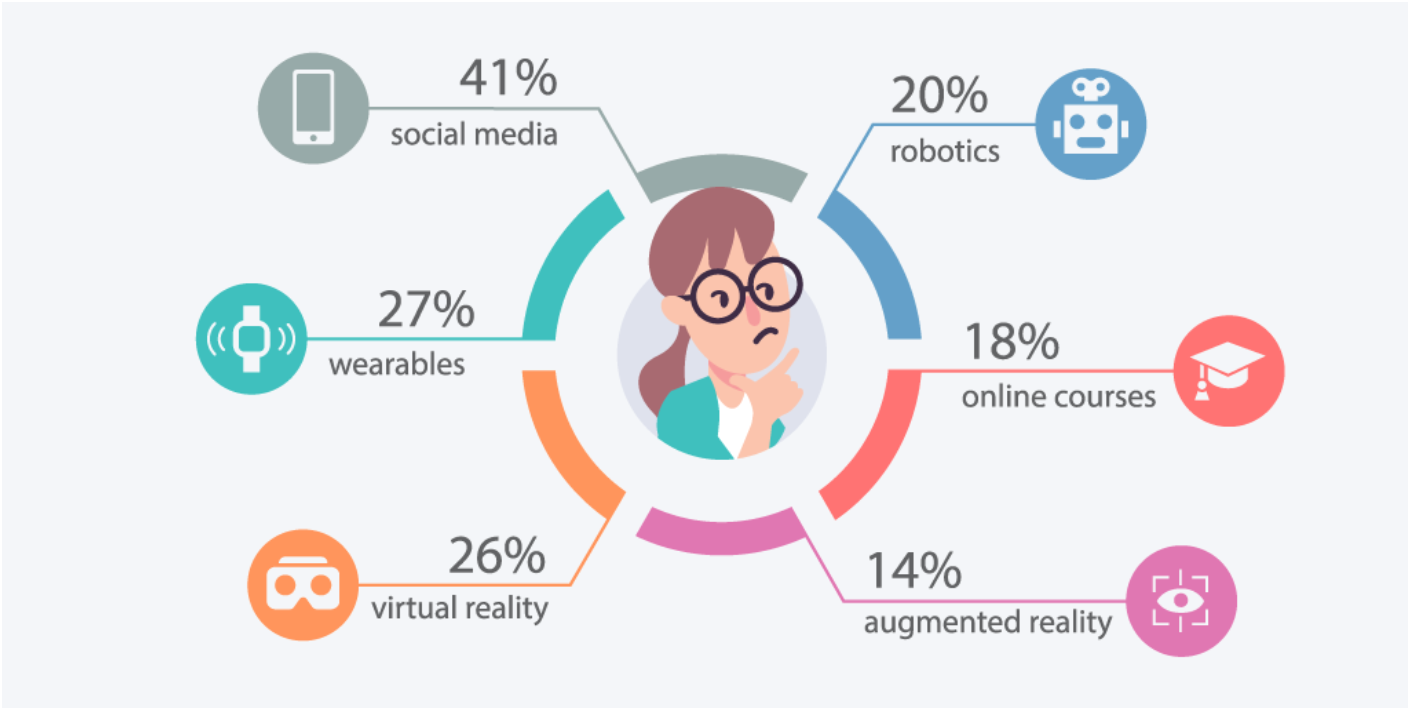

Employee Experiences are Vital as Retailers Up Investment in Technology and Customer Services

Since the pandemic began, these impactful employee experiences have increasingly relied on technologies. Particularly ones that enable individual workers to connect to their everyday professional lives remotely. From social media, robotics, learning and development, wearables through to virtual and augmented reality, these applications are targeted digital solutions that can optimise the everyday activities of diverse workforces.

And as the retail sector’s recovery from the damages of Covid-19 slows, it is unsurprising to see that in order to stimulate its revival, investment into retail technology that simultaneously enhances customer and employee experience has reached an all-time high, and 79% of high street retailers plan to implement more technology solutions this year.

Retailers are rationalising their investment into digital transformation as a surefire method of capturing emerging post-pandemic consumers by extracting value from current employee willingness to harness innovative technologies and imbed them into their own everyday roles.

Now, four months on from the reopening of physical stores, this is particularly relevant for retail’s frontline workforces — such as shop-floor assistants, stock allocators, and delivery drivers — whose adoption of employee-first technology solutions will subsequently drive effective customer-centric services as brick and mortar stores attempt to reclaim their market share.

Designing Positive Post-Pandemic Customer Services

Moving forward, customer adoption and retention are becoming critical to the continued survival of any consumer goods organisation. Yet, retail’s intensifying focus on customer-centricity is due to increasingly demanding shoppers whose mindsets and behaviours have been moulded by the pandemic.

Considering the characteristics of post-pandemic customers — in an article last month — Detego defined these emerging consumer’s as elusive with their allegiances and fluid with their engagement. For example, digitally-savvy shoppers are becoming more adept at bringing competition with them into stores, using their smartphones to concurrently browse rival offerings online and offline.

Post-pandemic behaviour such as this makes it increasingly complex for retailers to control customer journeys and ensure they are providing competitive services at every possible online and offline touchpoint.

So, with physical retailers facing such an immense task in reacquainting themselves with customers returning to their stores, it may seem counter-intuitive to suggest that retail technology investments should focus on improving the activities of employees first and customers second.

But in reality, workforces are the greatest asset a retailer has in generating customer loyalty from positive engagement. And they mustn’t risk underestimating the importance of their employees who — to customers — bring brands to life by personifying their voice and embodying their personality.

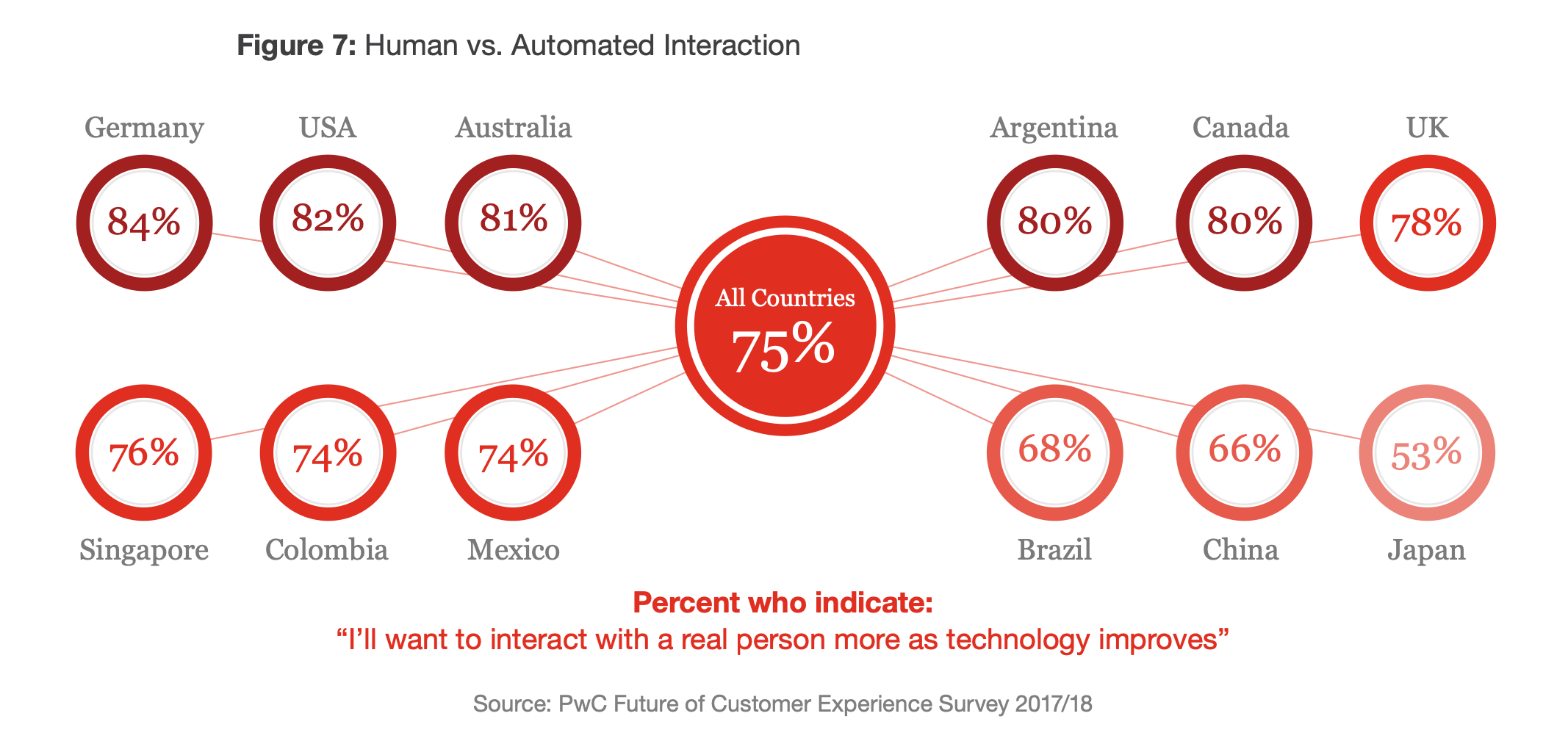

Recent research by PWC found that 46% of all consumers will abandon a brand if employees are not knowledgeable. And at the same time, 71% of consumers claim that employees significantly impact their overall customer experience. With employees having an impact this sizeable on consumers, these statistics reinforce the outpouring of retail experts and researchers who assert that “happy employees create happy customers” and emphasises the need for retailers to refocus their technology investments into solutions that advance employee contentment.

The Current Retail Employee Experience is Far from Perfect

However, improving the employee experience is not an easy task.

Last month’s ‘Pingdemic’, which forced thousands of high street workers to isolate and understaffed retailers to subsequently shut their doors, stressed how crucial retail workers are to organisations. So much in fact that retailers are already strategising on how to mitigate the risk of employee shortages both in the short and longer future.

Without intervention, the global retail sector will continue to struggle with these workforce issues. And recent research across the UK and US exposes that millions of workers intend to leave their jobs post-pandemic — with retail employees quitting their jobs at record rates — as the reality of professional dissatisfaction continues to confront employees as they emerge from their homes and back into their places of work.

As a result, these emerging workforce trends pose a critical threat to the retail sector. The increasing pressure to deliver exceptional customer services with understaffed stores and low employee morale could create a vicious cycle of discontent between employees and customers.

The Features of Effective Employee Experience Technology

Both existing and emerging retail technology’s must, for these reasons, help employees to attain three objectives in their everyday tasks to boost emotional satisfaction, job retention, and digital engagement:

1 Productivity

Solutions that generate productivity help workers reduce time spent on individual activities — allowing employees to achieve more objectives throughout their days and enabling retailers to optimise their operational costs. For example, RFID software Detego helps store, head-office and distribution staff remove the manual processes of stock checks and collate data insights to inform merchandising decisions swiftly.

2 Efficiency

Providing employees access to various solutions allows them to exert agency in their own working styles, honing techniques that suit them and reflexively selecting applications within changing circumstances and outputs. Take match-making platform Uber as an example, in offering several options to consumers such as courier, taxi, and food delivery services, its roster of drivers are enabled to be their own boss and use the app to control their schedules and self-determine their objectives.

3 Creativity

Allowing users to harness technologies to innovate within their daily roles, solve problems and uncover different applications for their work, technologies that enable creativity help workers to express themselves to both internal team members and external consumers. For example, as a wardrobe digitisation application, Own-Kind allows retail employed personal stylists to virtually style outfits for their customers, paring the products in their directory with existing pieces in a customer’s wardrobe.

Yet overall, what defines all three use cases’ ability to enable agility, creativity, and productivity are the user-friendly interfaces designed to satisfy customers on the front-end and enhance employee capabilities at the back-end.

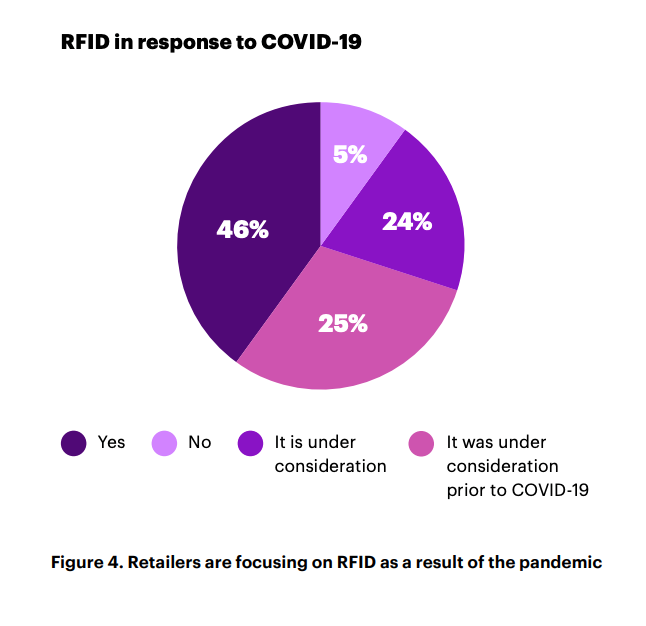

While there are many examples of RFID’s application in industry, recent instances of retailers emboldening their use of the technology to strengthen their post-pandemic strategies are impressive. 46% of respondents to recent Accenture research indicating that they have focused on RFID in response to COVID-19. And although the term inventory software may seem like a dull back-end technology, there are already many new use cases emerging and harnessed by retailers in innovative ways to modernise their offerings.

Investment in Consumer-Focused Retail Technology is Already Impacting Employee Experiences

It is essential not to forget the existing digital solutions within retail that — although consumer-focused — are already empowering the roles of retail employees through unintentional yet valuable emerging use cases in some of the most critical technology categories experiencing an uptick in investments.

E-commerce

Social shopping is one of the fastest-growing commerce trends, with live-stream shopping expected to reach $60 billion this year in China alone because, throughout lockdown, customers continued to crave human engagement within their shopping experiences.

By expanding e-commerce channels with social shopping, retail store staff have a chance to engage with their customers in virtual environments and the physical ones they typically inhabit. In addition, for retail employees who have been furloughed over the past year, this is an opportunity to future-proof their work and expand their roles through omnichannel strategies.

On-Demand

Consumer demand for instant messaging with in-store sales assistants, stylists, and personal shoppers has steadily risen for several years. But messaging software like WhatsApp revealed themselves to be tools for survival when the pandemic began and physical retailers — particularly those with a limited online presence — were at risk of losing carefully built relationships with customers.

Bicester Village is an insightful use case for the quick integration of virtual shopping. In uploading their catalogues to WhatsApp, store staff can now engage with remote consumers they otherwise wouldn’t have met and subsequently increase their sales and commissions.

Supply Chain Logistics

Same-day delivery and collection have revolutionised consumer expectations for fast and immediate fulfilment when shopping both online and in-store. The increase of retailers offering such fulfilment services means that businesses providing consumers inventory visibility allows them to decide where and how they receive their purchases.

By providing shoppers with inventory transparency, allocators and store staff are also able to view stock insights in real-time and transform their abilities to pinpoint, distribute and sell stock on micro and macro scales.

The Retailers Already Directly Investing in their Workforce’s Technology Adoption

At the same time, innovative retailers are investing in directly improving employee experiences using these digital advancements. And as employee-first solutions, they exemplify the reverberating impact that their adoption of technology can have on pivotal moments of the customer journey.

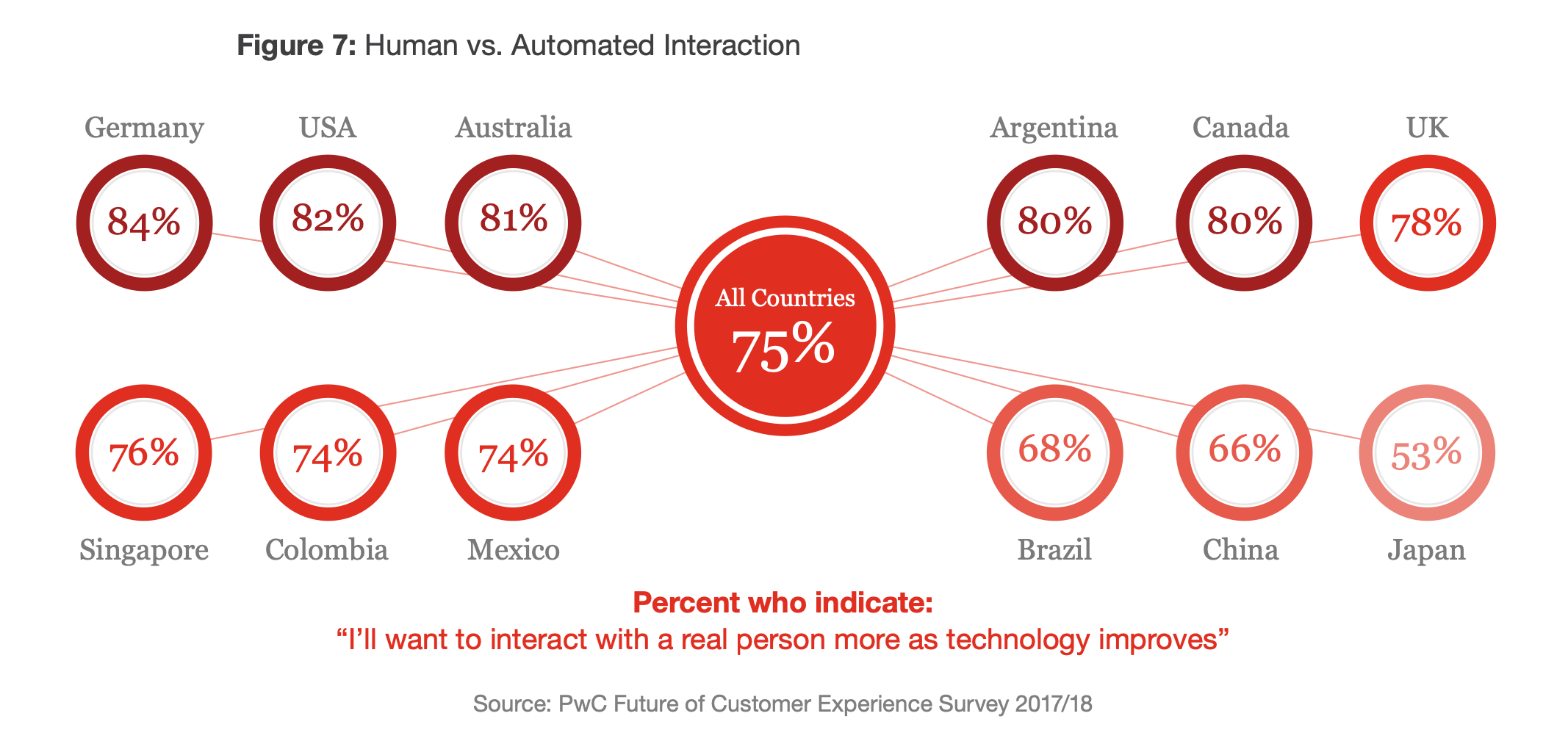

Apple and Efficient POS systems:- When 25% of consumers admit to missing human interactions when shopping online during the height of COVID-19, it is clear that rather than replacing staff, technology should be used to enhance their reach. In fact, research from 2018 already demonstrated that consumers were looking to engage with real people alongside technological advancements. Apple’s commitment to blending digitisation into its brick and mortar stores is exemplary, as employees wander the stores equip with the ability to access customer profiles and finalise sales.

Adidas and On-Demand Delivery:- With retailers continuing to take advantage of the omnichannel surge, many businesses realise they must upskill employees with the capabilities to execute these strategies online and offline. Sportswear brand Adidas for example, have recently trained their employees to use RFID software to optimise their understanding of stock levels and inform their instant knowledge of inventory availability, popularity, and locations through data display and insightful reports.

MATCHESFASHION and Personalisation:– To compete with the personalisation provided by their online counterparts, retailers have begun to explore how they can create attractive propositions and help store staff to blend consumer data into the intuition of their everyday roles. Luxury department store MATCHESFASHION, for example, has recently granted in-store employees access to online customer wishlists, helping them to empower their product recommendations with contextual customer information.

The Challenges of Implementing Employee-First Technology

Yet — as always with technology — challenges surrounding its adoption continue to cast doubt on future implementation. And, in the case of retail, many of the obstacles are from internal players. According to research by Fourth, for large retailers, cultural resistance, lack of technology management, upskilling staff and removing legacy systems are the most prominent points of friction when introducing new digital solutions.

Understandably, in practice, if these reasons were to act as barriers to retails digital transformation, the cost of rejection could be steep. For many retailers whose employee turnover remains high, investment into technology management, upskilling staff and replacing old processes could seem like a risky move with limited prospects for an ROI. But it is crucial to keep in mind that when focusing on improving employee experiences through technology, retailers are simultaneously investing in job satisfaction and overall workforce retention.

Additionally, to tackle cultural resistance to these changes, retailers should open up communication with employees to understand how they themselves want to enhance their own experiences using technology.

After all, aren’t employees experts of their own experiences?

Investing Now Means Optimising Future Success

It is compelling to consider that if the pandemic were to occur only 20 years prior, entire industries would have crumbled in a time where technology was not as mature, diverse, and inclusive.

Last year, when Covid-19 began, technology was ripe for adoption and ready for acceleration — ultimately covering a decade worth of growth in mere months. So, moving forward, retailers will need to take advantage of this rare occurrence where an entire demographic of employees and consumers have simultaneously evolved their use of technology — feeding into its rapid evolution and revolutionising the future of retail operations overnight.

In fact, it is clearer now more than ever that employee and customer experiences are not siloed, instead, they entwine with each other and to bolster one stakeholder’s journey you cannot ignore the other’s.

Ultimately, investing in technology to generate win-win experiences for employees and customers is an innovative move for retailers. Especially now that effective customer services begin and end with employees’ adoption of technology.

And implementation should be strategic because if in practice, these solutions fail to provide employees with efficiency, productivity, and creativity, their resulting frustration will undoubtedly translate into customer dissatisfaction.

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Explore Detego’s resources to uncover how the organisation expertly uses RFID technology to improve employee experiences, whilst providing user-friendly interfaces, comprehensive employee upskilling and continued staff support.

It is no exaggeration to say that the past year has been destructive yet transformative for the retail sector. The pandemic caused a considerable dip in the performance of stores worldwide, and now in the wake of – what we hope were – the worst days of Covid-19, recovery is the keyword on everyone’s mind. In the three months since physical stores reopened in the UK, brick and mortar retailers have begun implementing the strategies they meticulously designed when all they could do was watch and wait as e-commerce cannibalised their market share.

Many of these retail strategies were built upon the review of supply chain management, with 70% of Europe’s 30 biggest retailers using Covid-19 as a reason to reevaluate how they’re operated. Yet even now, as sales start to return to pre-pandemic levels — with physical retailers reporting the strongest summer sales in four years — it is clear to see that these strategies are still grappling with how to manage uncertainty.

So, as a result of recent customer demand exceeding expectations, stock is at its lowest level in the entire 38 years of the CBI’s records. Caused by limited inventory visibility — a topic we covered in an article last month — it is a problem that is continuously overlooked in retail, even though its impact reverberates throughout entire business models, and its solution remains relatively simple.

RFID is an easy and practical method of monitoring inventory throughout the entire supply chain, helping retailers respond to market fluctuations navigate the chaos of today’s retail environment. So, could this technology be the answer to brick-and-mortar’s strategic recovery?

Why the Time is Right for Retail’s Digital Maturity

It has been a long time — around 20 years in fact — since RFID was first introduced as a change-making technology to supply chain management. From then on, widespread adoption has been slow yet robust amongst few innovative retailers who understood the need to invest in software providing stock visibility. But now that Covid-19 has accelerated retails digital adoption by at least three years, RFID has experienced a recent uptick in implementation RFID has experienced a recent uptick in implementation, as use cases become as clear as ever before.

A recent article exploring RFID’s renaissance by McKinsey & Company outlines the current stages these use cases are at with store operations and customer experience only beginning to be explored as solutions. This growing adoption of RFID we see by retailers is comparable to the increased implementation of QR codes, which are currently experiencing a resurgence as COVID-19 heightens demand for digital touchpoints in physical spaces.

The blending of online and offline is one of two fundamental changes to the retail landscape that have ripened RFID for success:

1. Omnichannel Fluidity:

Consumers’ have newfound comfort in moving between digital and physical channels as social restrictions pushed them into online environments over the past year. And as these digitally savvy customers begin to use more omnichannel touchpoints, retailers will need to manage item-level data in real-time to consistently cater to customers as they shift from clicks to bricks.

The second key difference to the retail sector since stores first shut their doors in early 2020 is the ambiguous long, and short-term needs of customers as the context of their everyday lives unpredictably shift on both local and global scales:

2. Uncertain Market Demand

So as the future of the new normal remains blurry, retailers will need to become more responsive to changeable market demands and make sweeping supply chain adjustments to mitigate the risk of wasted inventory in addition to granular decisions to fulfil localised and personalised, item-level needs.

Inventory Visibility Helps Retailers to Anticipate Change and Respond to the Unexpected

The cycle of instantly catering to consumer demands across multiple channels while being powerless to predict them makes RFID all the more compelling as a solution. The technology is being used to increase retailer’s profitability by helping businesses to empower their store processes. RFID efficiently replaces arduous manual stock-takes and regularly updates inventory levels, so stores have a clear real-time view of product location and availability. This not only enhances brick-and-mortar stores as fulfilment centres but allows them to operate accurately across digital and physical channels.

Yet crucially, to mitigate risk, we should not forget that inventory visibility is more than simply viewing stock levels. It also can contextualise inventory information with item-level data – such as size, colour, and price – helping buyers and merchandisers to improve their practices with insights.

The Retailers Already Using Inventory Visibility Software to Strengthen their Post-Pandemic Customer Experiences

While there are many examples of RFID’s application in industry, recent instances of retailers emboldening their use of the technology to strengthen their post-pandemic strategies are impressive. 46% of respondents to recent Accenture research indicating that they have focused on RFID in response to COVID-19. And although the term inventory software may seem like a dull back-end technology, there are already many new use cases emerging and harnessed by retailers in innovative ways to modernise their offerings.

In-Store Customer Experience

As physical retailers look to win back their market share, the role of stores has needed to evolve with customer demands. For example, research last year by RetailExpo uncovered that 31% of consumers want employees to help with out-of-stocks. And luckily for retailers, store staff are becoming more adept at switching between online and offline more frequently, allowing customer-facing employees to underpin their daily activities with inventory insights such as product availability, reservations and returns.

Mango: Fashion retailer Mango – whose parent company Inditex began to adopt RFID back in 2014 – recently launched a new physical store that combines RFID with deep learning. Generating data, store staff can glean insights using stock performance and availability to enhance their ability to deliver excellent customer service.

Farfetch: Heritage luxury brand Chanel’s collaborative store with Farfetch uses RFID to power consumer-facing services such as changing room mirrors to monitor engagement with inventory and up-sell similar and complementary products. By underpinning the physical shopping experience with data, customers are able to access a level of personalisation often reserved for online commerce.

Omnichannel Continuity

The sudden surge in omnichannel implementation is a topic we discussed in detail in a previous article, and its importance in the current retail environment cannot be underestimated. For the many retailers operating multiple commerce channels throughout the pandemic revisiting their omnichannel capabilities will have been imperative as the purpose of their online and offline environments are no longer siloed.

Reiss: On the unpredictable UK high street, Reiss has managed to stay solid and stable. Achieving a 4% uplift in sales with Detego, the retailer implemented RFID into its stores before the pandemic hit. So now, when purchasing from Reiss’ online store, customers are provided with the option to collect purchases from their brick-and-mortar shops.

Extending Product Life Cycle

We are seeing the emergence of independent resale businesses, and many existing retailers are beginning to consider extending the life of their stock by rolling out buy-back and circularity schemes. Yet, lack of supply chain transparency has for a long time been a growing concern for consumers who demand more ethical and sustainable practices within the sector. So as the industry continues to contemplate the future of products beyond initial consumption, RFID presents itself as a valuable tool for shedding light on an item’s circular journey.

Vestiaire Collective: In collaboration with Alexander McQueen, the luxury resale marketplace Vestiaire Collective uses NFC tags to authenticate its products. This collaboration benefits sellers and buyers by helping owners find value in their wardrobes and reassures consumers of the validity of their products.

eBay: Similarly, the online marketplace eBay uses NFC technology to help users verify the authenticity of purchases of luxury handbags. This is a somewhat important milestone for businesses that want to emphasise their reliability when working with designer goods.

For many retailers, Covid-19 has awakened then to the risks of merely dabbling with technological innovation — rather than fully immersing themselves in it — and brought to light the blind spots within their supply chains that previously flew under the radar. But there is no one size fits all when it comes to technology, and these retailers have expertly harnessed inventory software to their individual requirements, carving out spaces for the technology to fulfil specific objectives within their operations.

Building RFID into Retail Supply Chain’s is as Easy as Ever Before

One of the common myths about RFID is the apparent steep costs of its integration. But in reality, using the technology is becoming increasingly cost-effective as retailers see an ROI of more than 10% whilst the price of RFID components such as readers and tags drop. And as technology matures, RFID is more precise than ever. As a result, most businesses see a boost to accuracy rates in stock, helping store staff make better use of their time carrying out customer fulfilment instead of stock-takes.

Additionally, where complete RFID integration into supply chains was a complex operation with many moving parts, its currently high global adoption within many continents will make coordinating far-reaching stock journeys easier and agile.

RFID and the Future of Brick-and-Mortar Innovation

There are so few technologies that have the opportunity to impact the everyday experiences of so many store stakeholders — from customers and sales assistants to buyers and merchandisers, all the way through to manufacturers — and RFID is one of them.

As the post-pandemic consumer emerges expecting complete omnichannel continuity to attain their trust and loyalty, inventory visibility could be the key to future-proofing any retail business in both online and offline environments. And retailers now know the importance that understanding their operations in detailed real-time plays in managing the flow of goods with more control and agility.

So although we can all agree that the technology is nothing new, RFID should not be ignored as the answer to unique challenges retailers face today and the essential tool for building dynamic in-store solutions for the future

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Detego Store is a cloud-hosted RFID solution which digitises stock management processes, making them more efficient and more accurate. Implemented within hours, our multi-user app can provide intelligent stock takes and a smart in-store replenishment process. Later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

The retail industry is changing fast. Customer preferences are changing, the balance of power between online and offline shopping is shifting, and as a result, operations and business models are becoming more complex than ever before. While these changes have been ongoing for some years, the pandemic has accelerated the shift and left retailers with no margin for error.

In a rapidly changing landscape, many retailers have done well to pivot effectively. However, with the pandemic and digital disruption ramping up most are unprepared in terms of supporting technology to ensure these new strategies are profitable long-term.

Chief among these is the lack of reliable product visibility that many retailers struggle with. For brands introducing new operating models, reopening stores after lockdowns, and selling to customers in more ways than before (like Omnichannel) not having a reliable view of products can severely hamper the profitability and effectiveness of such services.

What is inventory visibility?

Visibility in retail refers to a brand’s ability to see and track its merchandise across stores and supply chains. Simple enough in theory, but actually achieving and maintaining this is far more complicated.

Accurately tracking products is the first hurdle where many retailers stumble. For stores, it comes down to being able to perform regular stocktakes, several times a week rather than several times a year. With ‘standard’ technology like barcode scanners, this is simply impossible, even with a world-class ERP system tracking what’s officially coming in and out. Without physically validating what is in a store, the accuracy levels will quickly drop to around 70% due to factors like operational errors, stock counting inaccuracies and theft.

In the supply chain, on the other hand, it’s not a case of an inaccurate view of stock, but often no real visibility at all. Retail supply chains often only track ‘cartons’ (or boxes) throughout the item journey, since counting the contents of each item again is either impossible or entirely too time-consuming. This means most supply chains run on what should be present in each carton and shipment, but mispacks and theft are all too common.

The other reason many retailers don’t have real visibility over their products is that their IT and inventory management systems only work on an SKU level and not an item-level. For a full breakdown on what this means, read this article.

So, what is this lack of visibility costing retailers?

Everyday, stores lose sales due to poor product visibility

The industry is much more focused on achieving product visibility now due to the Omnichannel surge but there is a more immediate issue that costs the industry £369 billion a year globally: poor product availability. Most people will be very familiar with the experience of products being unavailable in the size/colour they’re looking for, or out-of-stock entirely. In fact, more than most – a survey done in 2019 found that 90% of shoppers had recently at the time (the last 6 months) chosen to leave a store and not make a purchase due to an item being out-of-stock! This problem is caused by low inventory accuracy and subsequently subpar stock replenishment.

If staff don’t have an accurate view of what’s on their shop floors through their IT system, they have no way of consistently ensuring that products are ready to purchase in-store. Many retailers have implemented RFID technology to improve this on floor availability in recent years – driving sales through more accurate inventories and regular replenishment from the backroom.

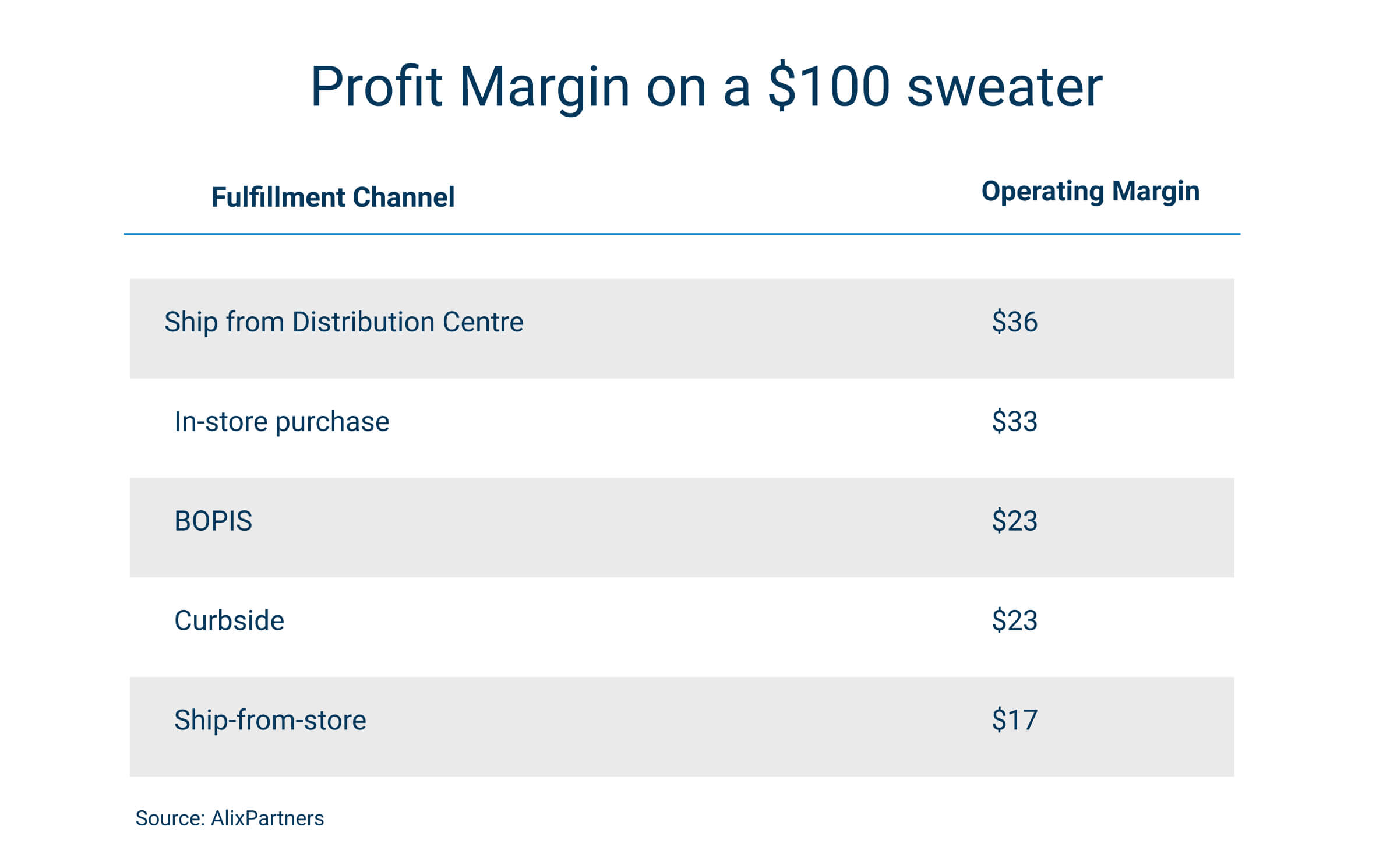

Product visibility in non-negotiable for retailers embracing omnichannel

We’ve covered it in detail in another article, but after years of flirting with the concept, the pandemic has forced the retail industry to really commit and invest in the omnichannel experience. Services like click-and-collect and ship-from-store have become invaluable in recent times, offering flexibility that works for both customers and retailers alike.

As these services have become more common in the wider industry and more consumers than ever were using services like click-and-collect/curbside last year due to the pandemic, the demand for an omnichannel experience will only increase. Retailers are recognising this and scrambling to adjust, in a recent survey from the Retail Industry Leaders Association (RILA) the number one imperative for the industry was to ‘become omnipotent on omnichannel.’

To make Omnichannel really profitable requires investment. Brands that try and offer services like click-and-collect without the required visibility will find themselves constrained. Either they offer a limited service (relying on safety stock and only selling items they have in surplus) or they offer an unreliable one – routinely cancelling omnichannel orders when they discover items reserved for pickup or delivery are not actually in stock.

Retailers that offer effective and profitable omnichannel services have a real-time digital view of their stock across all channels. To make this work those inventories run on item-level data so that their IT systems can handle items being reserved, shipped-from-store or returned-to-store throughout the day, whilst maintaining a 360’ view of merchandise.

Brands are still working towards gaining visibility over their supply chains

Supply chain visibility is a growing concern for retailers. As supply chains have scaled and become global, issues like inaccuracy, shrinkage and bloated inventories across DCs and stores compound and can become million-dollar issues. For example, UK retailers alone are experiencing annual losses totalling £11 billion due to shrinkage.

Knowing exactly what is passing through each stage of the supply chain is a challenge. With traditional logistic methods working on a carton level and SKU level, retailers struggle to pinpoint where mistakes or shrinkage are occurring. For store networks, this results in stores carrying more products than they need, in the form of both safety stock and ‘phantom stock’ (products that the retailer does not even know about).

This has been something retailers have been aiming towards for some time, in a report by Zebra Technologies in 2017, 72% of retailers said they were working on digitising their supply chains in order to achieve real-time visibility. Fast-forward to 2021 and while progress has been made, there is still work to be done. Brands need to invest in technologies like RFID to be able to track individual products throughout every step of the supply chain.

Not only do these digitised operations reduce the number of shipping mistakes, but the granular data that they work with allows brands to optimise their supply chains to levels simply not possible before such digital transformation.

As new retail models develop – the need for visibility is only going to increase

Retail is going through a period of unprecedented change. We have referenced supply chains and operations growing increasingly complex for retailers in recent years and that is only going to continue in the future. Not only will omnichannel experiences continue to grow and develop, but new models are beginning to emerge that will test brands’ agility and require an item-level view of products.

The key driver for the majority of these new models is sustainability. The push for greener fashion retail experiences, in particular, is still in the early stages but picking up traction rapidly.

Burgeoning new sustainable models like rental, recommerce and the circular economy promise a far eco-friendlier experience than fast fashion. These models will have their challenges however, rather than the one-way traffic of typical retail models, these methods will require a lot of reverse logistics. It’s vital not only that brands can handle this 360’ flow of merchandise, but with rental and second-hand items, in particular, item-level data is vital as products will all be unique.

As visibility becomes a priority, it’s no coincidence RIFD uptake is booming

So, if product visibility is an issue across the retail industry, what are brands doing about it?

Since visibility has become a key issue in the last few years, more and more retailers have begun implementing RFID technology to track and manage products across their businesses, on an item-level, at 99% accuracy and even in real-time.

RFID ticks several boxes that are key to achieving such visibility. First and foremost, it digitises products and processes in DCs and stores, creating a digital record of all items. It also works on an item-level, so is able to distinguish between two products of the same SKU. Finally, RFID processes are efficient enough to be done throughout the supply chain, on a daily basis including inbound and outbound checks as well as daily stocktakes for stores. This means retailers leveraging RFID have a 360’ view of item movement from source-to-store, with granular item-level data that works on a global scale.

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Detego Store is a cloud-hosted RFID solution which digitises stock management processes, making them more efficient and more accurate. Implemented within hours, our multi-user app can provide intelligent stock takes and a smart in-store replenishment process. Later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

It is no exaggeration to say that retail has changed like never before.

For some time, operations have been growing increasingly more complex, and shoppers increasingly more discerning. Now that evolution has been accelerated. Retailers must be flexible in meeting consumer demands in the face of a rapidly changing retail landscape if they hope to succeed.

As the industry recovers, retailers pursuing digital transformation in order to optimize operations, expand omnichannel fulfilment, and enable data-driven decisions are poised to lead the way. One of the foundational technologies providing insight to drive digital transformation? RFID.

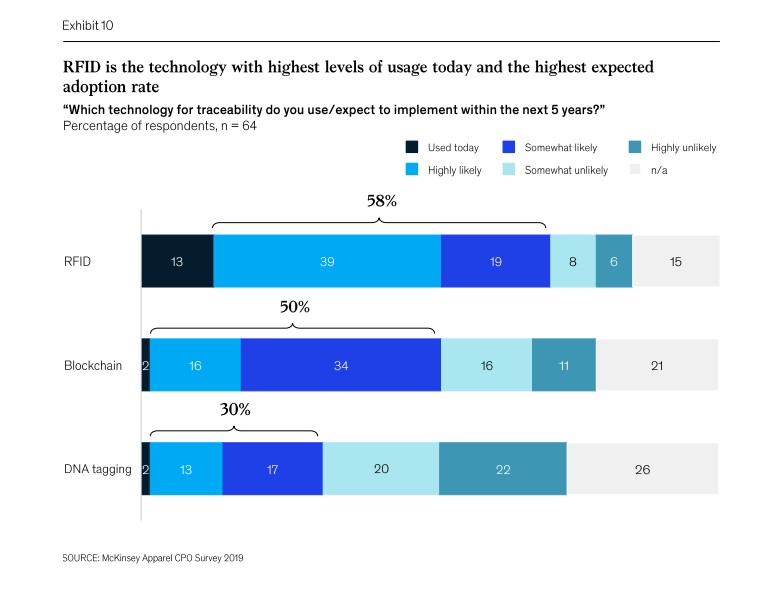

It’s been around for a long time, but Radio Frequency Identification technology (RFID to you and me) is picking up momentum in the retail space. Both Forbes and McKinsey & Company have published recent articles on how the technology is becoming key for retailers, with the latter even describing ‘RFID’s renaissance’ within the industry.

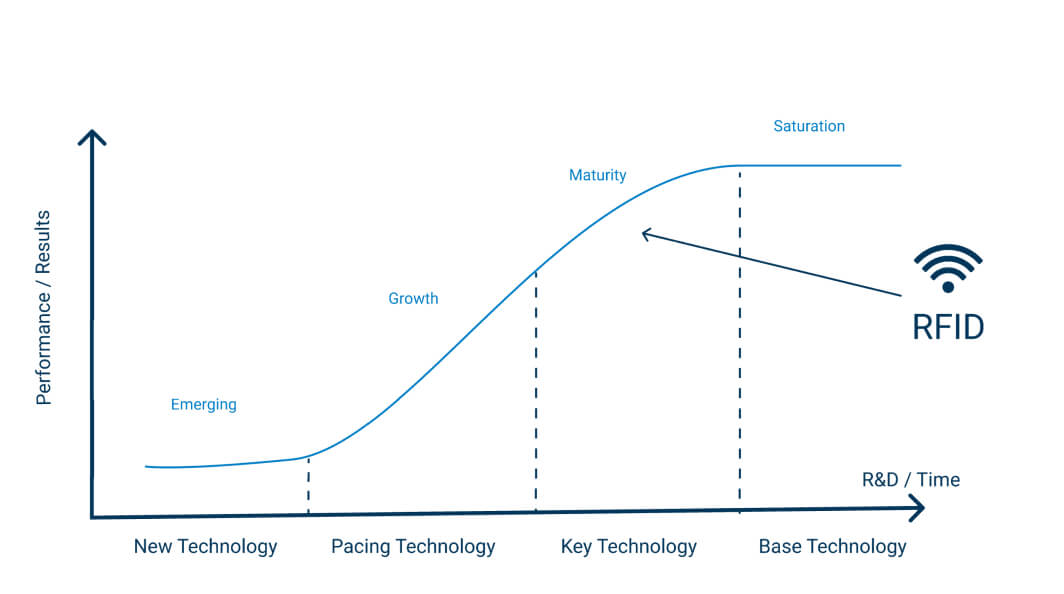

While this does show a shift in the sector, a renaissance implies that the technology is making ‘ a comeback of some kind. This is not quite accurate, as the business case for RFID has been steadily growing in retail over the years, but we are approaching a new stage of its lifecycle in the industry. This is a natural cycle for most new and transformative technologies, but the effect of the pandemic on retail has accelerated this. Not only are many brands on thin ice in the aftermath, but one of the key reasons for implementing RFID, delivering an Omnichannel strategy, has evolved from ‘beneficial’ to almost ‘non-negotiable’ since last year.

Let’s explore where RFID has come and more importantly, how it has become one of the single most important operational technologies to retailers in recent years.

RFID and the Technology Curve

While RFID was invented in the 1940s, it wasn’t until this century it began being used as a business tool. In retail, it has existed for almost 20 years, but its initial cost, technical limitations and fewer established use cases all meant most companies (wisely) didn’t see the value in it initially.

This is common for new technology and over time RFID has matured with more research & development as well as more deployments in live retail environments. This has meant the performance of the technology improved and the return on investment for retailers increased. This is known as a technology S curve (seen below). Over the last ten years, RFID use in retail has experienced this curve with the adoption levels and value for retailers increasing year on year.