It is no exaggeration to say that the past year has been destructive yet transformative for the retail sector. The pandemic caused a considerable dip in the performance of stores worldwide, and now in the wake of – what we hope were – the worst days of Covid-19, recovery is the keyword on everyone’s mind. In the three months since physical stores reopened in the UK, brick and mortar retailers have begun implementing the strategies they meticulously designed when all they could do was watch and wait as e-commerce cannibalised their market share.

Many of these retail strategies were built upon the review of supply chain management, with 70% of Europe’s 30 biggest retailers using Covid-19 as a reason to reevaluate how they’re operated. Yet even now, as sales start to return to pre-pandemic levels — with physical retailers reporting the strongest summer sales in four years — it is clear to see that these strategies are still grappling with how to manage uncertainty.

So, as a result of recent customer demand exceeding expectations, stock is at its lowest level in the entire 38 years of the CBI’s records. Caused by limited inventory visibility — a topic we covered in an article last month — it is a problem that is continuously overlooked in retail, even though its impact reverberates throughout entire business models, and its solution remains relatively simple.

RFID is an easy and practical method of monitoring inventory throughout the entire supply chain, helping retailers respond to market fluctuations navigate the chaos of today’s retail environment. So, could this technology be the answer to brick-and-mortar’s strategic recovery?

Why the Time is Right for Retail’s Digital Maturity

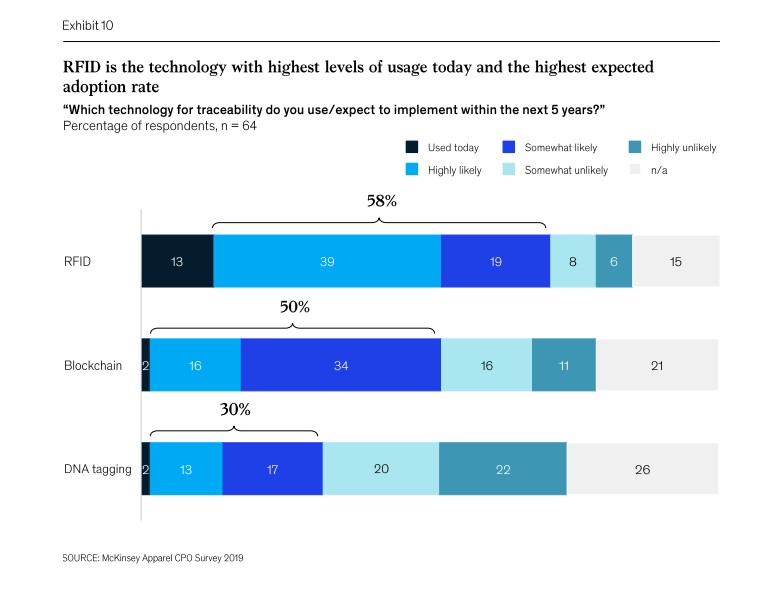

It has been a long time — around 20 years in fact — since RFID was first introduced as a change-making technology to supply chain management. From then on, widespread adoption has been slow yet robust amongst few innovative retailers who understood the need to invest in software providing stock visibility. But now that Covid-19 has accelerated retails digital adoption by at least three years, RFID has experienced a recent uptick in implementation RFID has experienced a recent uptick in implementation, as use cases become as clear as ever before.

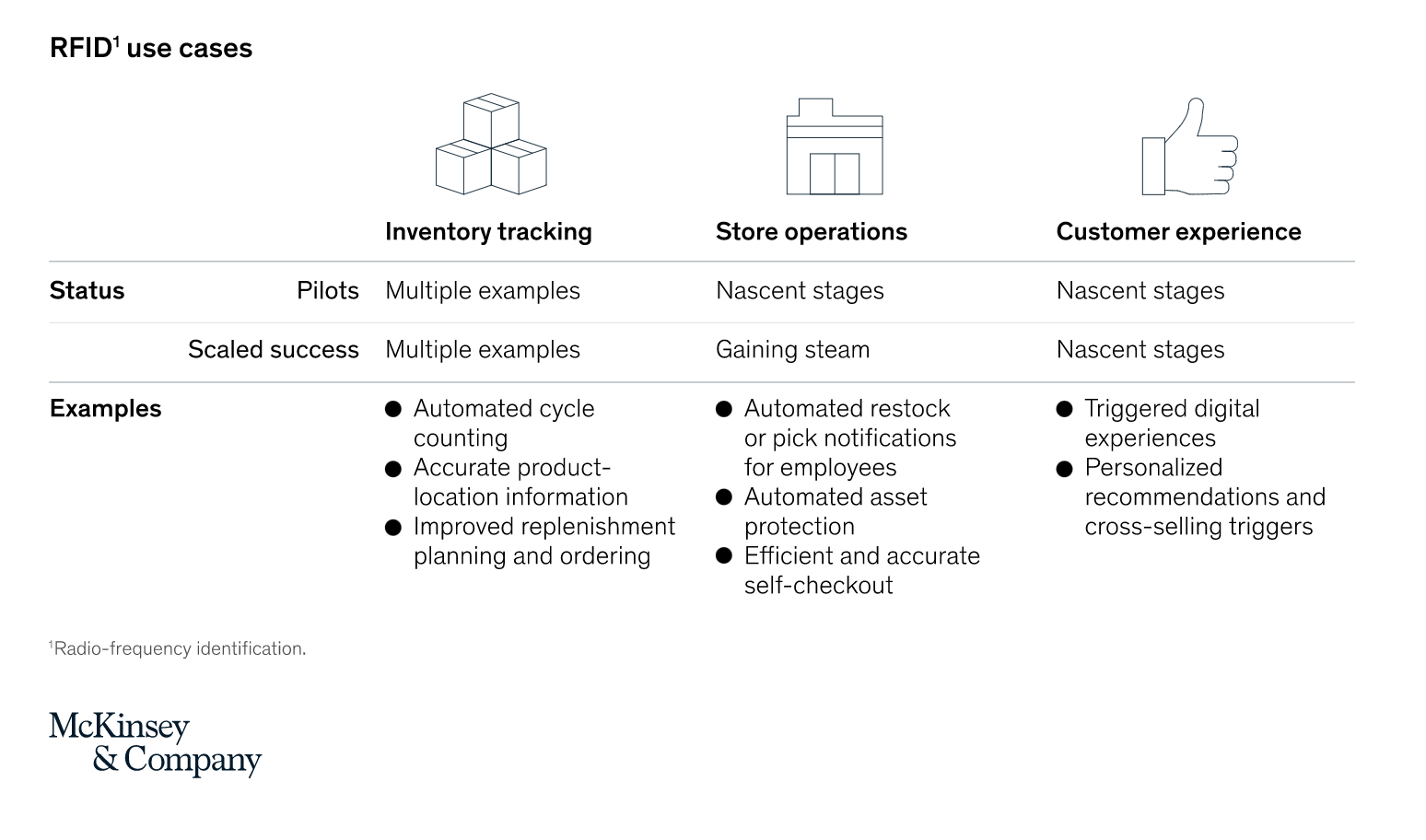

A recent article exploring RFID’s renaissance by McKinsey & Company outlines the current stages these use cases are at with store operations and customer experience only beginning to be explored as solutions. This growing adoption of RFID we see by retailers is comparable to the increased implementation of QR codes, which are currently experiencing a resurgence as COVID-19 heightens demand for digital touchpoints in physical spaces.

The blending of online and offline is one of two fundamental changes to the retail landscape that have ripened RFID for success:

1. Omnichannel Fluidity:

Consumers’ have newfound comfort in moving between digital and physical channels as social restrictions pushed them into online environments over the past year. And as these digitally savvy customers begin to use more omnichannel touchpoints, retailers will need to manage item-level data in real-time to consistently cater to customers as they shift from clicks to bricks.

The second key difference to the retail sector since stores first shut their doors in early 2020 is the ambiguous long, and short-term needs of customers as the context of their everyday lives unpredictably shift on both local and global scales:

2. Uncertain Market Demand

So as the future of the new normal remains blurry, retailers will need to become more responsive to changeable market demands and make sweeping supply chain adjustments to mitigate the risk of wasted inventory in addition to granular decisions to fulfil localised and personalised, item-level needs.

Inventory Visibility Helps Retailers to Anticipate Change and Respond to the Unexpected

The cycle of instantly catering to consumer demands across multiple channels while being powerless to predict them makes RFID all the more compelling as a solution. The technology is being used to increase retailer’s profitability by helping businesses to empower their store processes. RFID efficiently replaces arduous manual stock-takes and regularly updates inventory levels, so stores have a clear real-time view of product location and availability. This not only enhances brick-and-mortar stores as fulfilment centres but allows them to operate accurately across digital and physical channels.

Yet crucially, to mitigate risk, we should not forget that inventory visibility is more than simply viewing stock levels. It also can contextualise inventory information with item-level data – such as size, colour, and price – helping buyers and merchandisers to improve their practices with insights.

The Retailers Already Using Inventory Visibility Software to Strengthen their Post-Pandemic Customer Experiences

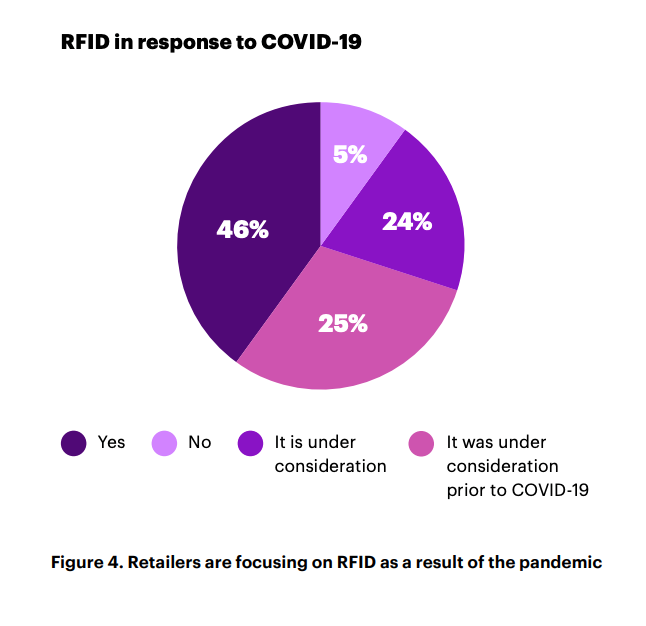

While there are many examples of RFID’s application in industry, recent instances of retailers emboldening their use of the technology to strengthen their post-pandemic strategies are impressive. 46% of respondents to recent Accenture research indicating that they have focused on RFID in response to COVID-19. And although the term inventory software may seem like a dull back-end technology, there are already many new use cases emerging and harnessed by retailers in innovative ways to modernise their offerings.

In-Store Customer Experience

As physical retailers look to win back their market share, the role of stores has needed to evolve with customer demands. For example, research last year by RetailExpo uncovered that 31% of consumers want employees to help with out-of-stocks. And luckily for retailers, store staff are becoming more adept at switching between online and offline more frequently, allowing customer-facing employees to underpin their daily activities with inventory insights such as product availability, reservations and returns.

Mango: Fashion retailer Mango – whose parent company Inditex began to adopt RFID back in 2014 – recently launched a new physical store that combines RFID with deep learning. Generating data, store staff can glean insights using stock performance and availability to enhance their ability to deliver excellent customer service.

Farfetch: Heritage luxury brand Chanel’s collaborative store with Farfetch uses RFID to power consumer-facing services such as changing room mirrors to monitor engagement with inventory and up-sell similar and complementary products. By underpinning the physical shopping experience with data, customers are able to access a level of personalisation often reserved for online commerce.

Omnichannel Continuity

The sudden surge in omnichannel implementation is a topic we discussed in detail in a previous article, and its importance in the current retail environment cannot be underestimated. For the many retailers operating multiple commerce channels throughout the pandemic revisiting their omnichannel capabilities will have been imperative as the purpose of their online and offline environments are no longer siloed.

Reiss: On the unpredictable UK high street, Reiss has managed to stay solid and stable. Achieving a 4% uplift in sales with Detego, the retailer implemented RFID into its stores before the pandemic hit. So now, when purchasing from Reiss’ online store, customers are provided with the option to collect purchases from their brick-and-mortar shops.

Extending Product Life Cycle

We are seeing the emergence of independent resale businesses, and many existing retailers are beginning to consider extending the life of their stock by rolling out buy-back and circularity schemes. Yet, lack of supply chain transparency has for a long time been a growing concern for consumers who demand more ethical and sustainable practices within the sector. So as the industry continues to contemplate the future of products beyond initial consumption, RFID presents itself as a valuable tool for shedding light on an item’s circular journey.

Vestiaire Collective: In collaboration with Alexander McQueen, the luxury resale marketplace Vestiaire Collective uses NFC tags to authenticate its products. This collaboration benefits sellers and buyers by helping owners find value in their wardrobes and reassures consumers of the validity of their products.

eBay: Similarly, the online marketplace eBay uses NFC technology to help users verify the authenticity of purchases of luxury handbags. This is a somewhat important milestone for businesses that want to emphasise their reliability when working with designer goods.

For many retailers, Covid-19 has awakened then to the risks of merely dabbling with technological innovation — rather than fully immersing themselves in it — and brought to light the blind spots within their supply chains that previously flew under the radar. But there is no one size fits all when it comes to technology, and these retailers have expertly harnessed inventory software to their individual requirements, carving out spaces for the technology to fulfil specific objectives within their operations.

Building RFID into Retail Supply Chain’s is as Easy as Ever Before

One of the common myths about RFID is the apparent steep costs of its integration. But in reality, using the technology is becoming increasingly cost-effective as retailers see an ROI of more than 10% whilst the price of RFID components such as readers and tags drop. And as technology matures, RFID is more precise than ever. As a result, most businesses see a boost to accuracy rates in stock, helping store staff make better use of their time carrying out customer fulfilment instead of stock-takes.

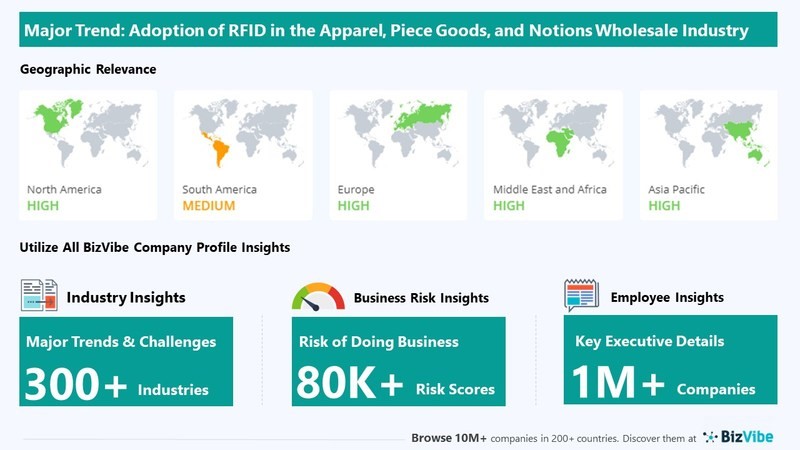

Additionally, where complete RFID integration into supply chains was a complex operation with many moving parts, its currently high global adoption within many continents will make coordinating far-reaching stock journeys easier and agile.

RFID and the Future of Brick-and-Mortar Innovation

There are so few technologies that have the opportunity to impact the everyday experiences of so many store stakeholders — from customers and sales assistants to buyers and merchandisers, all the way through to manufacturers — and RFID is one of them.

As the post-pandemic consumer emerges expecting complete omnichannel continuity to attain their trust and loyalty, inventory visibility could be the key to future-proofing any retail business in both online and offline environments. And retailers now know the importance that understanding their operations in detailed real-time plays in managing the flow of goods with more control and agility.

So although we can all agree that the technology is nothing new, RFID should not be ignored as the answer to unique challenges retailers face today and the essential tool for building dynamic in-store solutions for the future

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Detego Store is a cloud-hosted RFID solution which digitises stock management processes, making them more efficient and more accurate. Implemented within hours, our multi-user app can provide intelligent stock takes and a smart in-store replenishment process. Later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

The retail industry is changing fast. Customer preferences are changing, the balance of power between online and offline shopping is shifting, and as a result, operations and business models are becoming more complex than ever before. While these changes have been ongoing for some years, the pandemic has accelerated the shift and left retailers with no margin for error.

In a rapidly changing landscape, many retailers have done well to pivot effectively. However, with the pandemic and digital disruption ramping up most are unprepared in terms of supporting technology to ensure these new strategies are profitable long-term.

Chief among these is the lack of reliable product visibility that many retailers struggle with. For brands introducing new operating models, reopening stores after lockdowns, and selling to customers in more ways than before (like Omnichannel) not having a reliable view of products can severely hamper the profitability and effectiveness of such services.

What is inventory visibility?

Visibility in retail refers to a brand’s ability to see and track its merchandise across stores and supply chains. Simple enough in theory, but actually achieving and maintaining this is far more complicated.

Accurately tracking products is the first hurdle where many retailers stumble. For stores, it comes down to being able to perform regular stocktakes, several times a week rather than several times a year. With ‘standard’ technology like barcode scanners, this is simply impossible, even with a world-class ERP system tracking what’s officially coming in and out. Without physically validating what is in a store, the accuracy levels will quickly drop to around 70% due to factors like operational errors, stock counting inaccuracies and theft.

In the supply chain, on the other hand, it’s not a case of an inaccurate view of stock, but often no real visibility at all. Retail supply chains often only track ‘cartons’ (or boxes) throughout the item journey, since counting the contents of each item again is either impossible or entirely too time-consuming. This means most supply chains run on what should be present in each carton and shipment, but mispacks and theft are all too common.

The other reason many retailers don’t have real visibility over their products is that their IT and inventory management systems only work on an SKU level and not an item-level. For a full breakdown on what this means, read this article.

So, what is this lack of visibility costing retailers?

Everyday, stores lose sales due to poor product visibility

The industry is much more focused on achieving product visibility now due to the Omnichannel surge but there is a more immediate issue that costs the industry £369 billion a year globally: poor product availability. Most people will be very familiar with the experience of products being unavailable in the size/colour they’re looking for, or out-of-stock entirely. In fact, more than most – a survey done in 2019 found that 90% of shoppers had recently at the time (the last 6 months) chosen to leave a store and not make a purchase due to an item being out-of-stock! This problem is caused by low inventory accuracy and subsequently subpar stock replenishment.

If staff don’t have an accurate view of what’s on their shop floors through their IT system, they have no way of consistently ensuring that products are ready to purchase in-store. Many retailers have implemented RFID technology to improve this on floor availability in recent years – driving sales through more accurate inventories and regular replenishment from the backroom.

Product visibility in non-negotiable for retailers embracing omnichannel

We’ve covered it in detail in another article, but after years of flirting with the concept, the pandemic has forced the retail industry to really commit and invest in the omnichannel experience. Services like click-and-collect and ship-from-store have become invaluable in recent times, offering flexibility that works for both customers and retailers alike.

As these services have become more common in the wider industry and more consumers than ever were using services like click-and-collect/curbside last year due to the pandemic, the demand for an omnichannel experience will only increase. Retailers are recognising this and scrambling to adjust, in a recent survey from the Retail Industry Leaders Association (RILA) the number one imperative for the industry was to ‘become omnipotent on omnichannel.’

To make Omnichannel really profitable requires investment. Brands that try and offer services like click-and-collect without the required visibility will find themselves constrained. Either they offer a limited service (relying on safety stock and only selling items they have in surplus) or they offer an unreliable one – routinely cancelling omnichannel orders when they discover items reserved for pickup or delivery are not actually in stock.

Retailers that offer effective and profitable omnichannel services have a real-time digital view of their stock across all channels. To make this work those inventories run on item-level data so that their IT systems can handle items being reserved, shipped-from-store or returned-to-store throughout the day, whilst maintaining a 360’ view of merchandise.

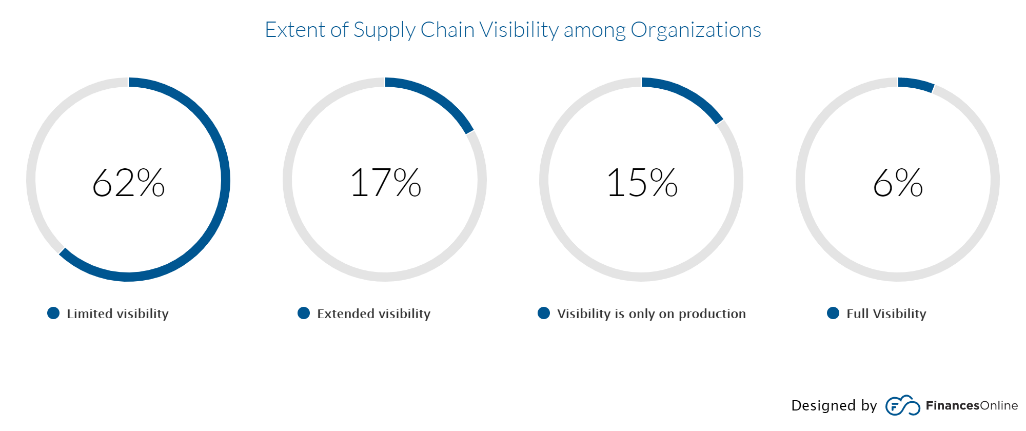

Brands are still working towards gaining visibility over their supply chains

Supply chain visibility is a growing concern for retailers. As supply chains have scaled and become global, issues like inaccuracy, shrinkage and bloated inventories across DCs and stores compound and can become million-dollar issues. For example, UK retailers alone are experiencing annual losses totalling £11 billion due to shrinkage.

Knowing exactly what is passing through each stage of the supply chain is a challenge. With traditional logistic methods working on a carton level and SKU level, retailers struggle to pinpoint where mistakes or shrinkage are occurring. For store networks, this results in stores carrying more products than they need, in the form of both safety stock and ‘phantom stock’ (products that the retailer does not even know about).

This has been something retailers have been aiming towards for some time, in a report by Zebra Technologies in 2017, 72% of retailers said they were working on digitising their supply chains in order to achieve real-time visibility. Fast-forward to 2021 and while progress has been made, there is still work to be done. Brands need to invest in technologies like RFID to be able to track individual products throughout every step of the supply chain.

Not only do these digitised operations reduce the number of shipping mistakes, but the granular data that they work with allows brands to optimise their supply chains to levels simply not possible before such digital transformation.

As new retail models develop – the need for visibility is only going to increase

Retail is going through a period of unprecedented change. We have referenced supply chains and operations growing increasingly complex for retailers in recent years and that is only going to continue in the future. Not only will omnichannel experiences continue to grow and develop, but new models are beginning to emerge that will test brands’ agility and require an item-level view of products.

The key driver for the majority of these new models is sustainability. The push for greener fashion retail experiences, in particular, is still in the early stages but picking up traction rapidly.

Burgeoning new sustainable models like rental, recommerce and the circular economy promise a far eco-friendlier experience than fast fashion. These models will have their challenges however, rather than the one-way traffic of typical retail models, these methods will require a lot of reverse logistics. It’s vital not only that brands can handle this 360’ flow of merchandise, but with rental and second-hand items, in particular, item-level data is vital as products will all be unique.

As visibility becomes a priority, it’s no coincidence RIFD uptake is booming

So, if product visibility is an issue across the retail industry, what are brands doing about it?

Since visibility has become a key issue in the last few years, more and more retailers have begun implementing RFID technology to track and manage products across their businesses, on an item-level, at 99% accuracy and even in real-time.

RFID ticks several boxes that are key to achieving such visibility. First and foremost, it digitises products and processes in DCs and stores, creating a digital record of all items. It also works on an item-level, so is able to distinguish between two products of the same SKU. Finally, RFID processes are efficient enough to be done throughout the supply chain, on a daily basis including inbound and outbound checks as well as daily stocktakes for stores. This means retailers leveraging RFID have a 360’ view of item movement from source-to-store, with granular item-level data that works on a global scale.

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Detego Store is a cloud-hosted RFID solution which digitises stock management processes, making them more efficient and more accurate. Implemented within hours, our multi-user app can provide intelligent stock takes and a smart in-store replenishment process. Later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

It is no exaggeration to say that retail has changed like never before.

For some time, operations have been growing increasingly more complex, and shoppers increasingly more discerning. Now that evolution has been accelerated. Retailers must be flexible in meeting consumer demands in the face of a rapidly changing retail landscape if they hope to succeed.

As the industry recovers, retailers pursuing digital transformation in order to optimize operations, expand omnichannel fulfilment, and enable data-driven decisions are poised to lead the way. One of the foundational technologies providing insight to drive digital transformation? RFID.

Detego has been working with Geis group, the German logistics specialists, for over 7 years. Gies serves a variety of companies and retailers as a dedicated transport and distribution partner, covering the healthcare, automobile, and retail industries, to name a few. Hans Geis takes great pride in delivering specific software and system solutions tailored to the needs of their customers.

One of Geis group’s customers, the fashion retailer Drykorn, has a particularly high volume of products to process and distribute – with over 700,000 items processed in just 3 months.

Because of this high order volume, and because Drykorn already uses RFID tags on their products – it was the perfect opportunity for Geis to leverage the technology within their logistics centres.

Download the case study to find out how Detego delivered a solution that would deliver long term success:

“Working with Detego has enabled us to achieve significant process optimizations in the areas of incoming and outgoing goods over the past few years.”

Marius Kraft, Project Manager, Geis Group

Beauty retail is an industry at a crossroads. A sector resilient to crisis and change compared to other retail categories, cosmetic brands are beginning to feel the effects of the pandemic and ongoing industry changes.

In recent years, apparel and sports retailers have undergone digital transformations to stay competitive, and now beauty brands have an opportunity to follow suit. Read this eBook to discover how and why beauty retailing is set to transform into the industry of the future.

Beauty retail: An industry at a Crossroads

The apparel and sports retail industry have undergone mass change over recent years. Such retailers have undertaken digital transformation journeys in their store and distribution networks to adapt to digital-first customers and eCommerce competition. The beauty sector, however, is still behind the curve.

In most major beauty-industry markets, in-store shopping accounted for up to 85 per cent of beauty product purchases before the COVID-19 crisis – (McKinsey&Co) making the level of eCommerce penetration lower than in other retail sectors. While retailers in other categories have been forced to innovate and adapt in the face of falling brick-and-mortar sales, competition from eCommerce and direct-to-consumer models, brick-and-mortar beauty sales were more resilient.

But this is changing. Not only are eCommerce levels steadily increasing year-on-year, but the COVID-19 pandemic has accelerated this drastically, driving five years of change in a single year, according to

IBM. This leaves brick-and-mortar beauty retailers on unsteady ground. Beyond this, brands will have to navigate a more digital-centric environment and optimise margins to cope with reduced sales.

The good news is many of the challenges that are now facing beauty have been facing apparel or CPG for years. The digital solutions and strategies that have allowed apparel to adapt are well established and ready to deploy to the sector. The digital transformations that many apparel and sports retailers were forced to undergo will not only fit beauty retailers but will also help them solve older challenges. Beauty retailers may need to go on a similar journey to apparel, but the tracks are there to follow.

What is in the eBook?

- Beauty retailing at a crossroads

- Bringing beauty operations up-to-speed

- Accuracy redefining margins

- Fixing beauty’s shrinkage problem

- Catching up with the omnichannel trend

- Countering the Gray Market

- Becoming digital and analytics leaders

Radiofrequency identification (RFID) is one of the leading technologies in retail, helping brands transform their business while maximizing revenue. With COVID-19 accelerating the digitization of retail and meaning stores need to be as profitable as possible to survive, RFID is a must.

Register now and learn from some of the best in the industry: Detego, and the experts in retail IT integrations, Spencer technologies.

Main Takeaways:

- Why are Retailers implementing RFID?

- Common challenges for Retailers and how to tackle them

- How to select partners (Hardware, Software, Services)

- What do you need to run a pilot?

Meet the Speakers:

Lauren Hines – Lauren is a Senior Business Operations Manager. She’s a former Head of Global Networks at BT.

Umesh Cooduvalli – Umesh is a tech-driven VP of Sales for America. He’s using his extensive network within the Supply chain industry with a hunger for new challenges

Nate Strickler – Formely project and Marketing Manager, Nate is currently working closely with partners and network to develop opportunities with Spencer Technologies.

It’s time to close the curtain on what’s been a challenging year for all. Retail has been under immense pressure this year, but through perseverance, partnership and innovation, we are beginning to come out of the other side.

While it might be tempting to move on from this year and not look back, we feel it’s important to look back and take stock of the biggest developments and stories of the year, good and bad.

Let’s explore the major themes of the year for retail, and revisit some of the content and updates that have told the story of 2020.

COVID-19: Charting a Course Through Unprecedented Times

COVID-19 was the defining event of 2020. The pandemic was devasting to people, communities and businesses. Our day-to-day was transformed overnight, with life and work becoming remote-first and priorities and plans being rethought and reassessed. For retail, with stores being closed, many people under financial pressure and working from home, revenue dropped massively. Not only this but COVID-19 will have a lasting effect on the industry, with experts predicting it accelerated industry change by five years.

Looking Ahead to 2021

But what about looking ahead to next year? Keeping an eye on upcoming trends is always important, this year even more so. While it’s comforting to think that the pandemic will be a thing of the past next year, the reality is it will remain a factor. More significant will be the ‘hangover’ of the post-pandemic, which will have huge implications on the industry and its priorities for the coming year. We explored what these priorities and subsequent trends will be in a recent series:

The Ongoing Digitial Transformation of Retail

We have been calling for, and leading the way in, digital transformation in retail for over ten years, and this year has been no different. Now more than ever, retailers need to innovate and improve their systems and processes to keep up with modern retailing. The benefits that digital transformation can deliver such as reduced costs, increased sales and better online/offline integration will be vital for retailers in the wake of the pandemic and beyond. Retail digital transformation is what Detego does, and this year we’ve been discussing this in more ways than ever before. Whether you’re still discovering why, or need to learn how, we have resources to help you get started.

Building the Supply Chain of the Future

We’ve been innovating and supporting retail stores for over 10 years with RFID. Alongside our customers and partners, we have increasingly been moving upstream and digitising and future-proofing the supply chain. This year, with the focus being on eCommerce and online shopping, supply chain innovation has been front and centre. RFID in the supply chain is an exciting topic and the results and developments from deploying RFID in factories and distribution centres are impressive. Whether its achieving complete supply chain visibility, optimising against shrinkage or building automated DC’s fit for the future, the technology has a lot to offer. Explore it here:

Building Partnerships

This year more than ever, building strong partnerships has been essential. At Detego, we have always prided ourselves on building good relationships and effective collaboration. This year, we have continued working alongside our amazing customers and clients and have even developed new ones to strengthen projects and products in the future.

Want to see how RFID can transform your business? Book a demo today

In the final instalment of our series exploring predicted retail trends for the coming year, we analyse why online order fulfilment will be a key metric for 2021. With COVID-19 causing an unprecedented acceleration in the shift towards eCommerce, retailers must quickly adapt and strengthen their fulfilment capabilities to ensure they can keep up with the higher demand. Read on to learn what the priorities are for retailers to achieve this, and what technologies are delivering the answers.

Why fulfilment will be a priority in 2021

Online shopping or eCommerce has been steadily growing since its invention. This means that the number of online orders that a retailer needs to fulfil gradually goes up year-on-year. The gradual increases required to a retailer’s order capacity are normally easy enough to anticipate and plan for. Like so many other things, however, 2020 kicked this idea to the curb.

This year has seen a massive shift towards eCommerce as a result of COVID-19. Even after things go back to normal, experts predict that a large portion of this growth will remain. In fact, according to data from IBM’s U.S. Retail Index, the pandemic has accelerated the shift away from physical stores to digital shopping by roughly five years. Online or multichannel retailers are therefore faced with dealing with a seismic shift in the industry. Many brands will have to deal with the fact that the sudden shift may put the demand for online orders beyond their current capacity for fulfilment. Retailers then need to strengthen and invest in their fulfilment capabilities to avoid being caught out. But where to look first?

What are the priorities for retailers looking at fulfilment in 2021?

So, when we say fulfilment will be a key priority for retailers, what exactly does that mean? What are the limiting factors for online fulfilment, or, in other words, what areas will struggle without additional investment or technology?

Online capacity

The first step in any online purchase – a customer going online in the first place. For a webshop, or indeed any website, capacity simply means the number of visitors it can support. How much capacity is needed will vary, for example – this website does not need to have the same capacity as Amazon (at least for now). With regular demand, capacity is easy enough to get right. It’s sudden shifts or surges that can cause problems. We have all likely experienced this ourselves at one time, with a recent example being the PlayStation 5 UK launch crashing several major retailer’s sites! With eCommerce numbers predicted to stay high – web store capacity may need some attention.

Delivery speed

Delivery is one of the biggest challenges (and costs) of online retailing. Shipping products across an entire country at scale is already a challenge. What makes it worse is customers are starting to expect more and more from online retailers. Amazon has set the bar high for this, with next-day and free delivery now more and more sought after by customers. As eCommerce channels grow in popularity, retailers may find their delivery models only scale to a point.

DC efficiency

Supply chain bottlenecks can be a killer for fast online fulfilment. The most likely place for this to occur is where the majority* of online orders are shipped from – the distribution centre. If the way orders are being processed is time-consuming or inaccurate, the whole process can slow down. This supply chain efficiency is particularly important for new products (go-to-market) or restocking OOS (out-of-stock) products. If the process for a DC receiving and processing goods is not efficient enough, drastically increasing the number of products required for the DC to process could cause problems.

.

Operational costs

The final big consideration for retailers attempting to scale up their fulfilment capabilities: the cost! All of the previous points are also examples of running costs associated with fulfilling online orders. Many retailers, particularly multichannel, often struggle ensuring their eCommerce arm stays profitable as the margins are much finer. If the balance between online and offline shifts too much, those fine margins could cause problems. Next year will see many of these retailers invest in their fulfilment processes to reduce long term costs and keep their increasingly crucial online channels sustainable.

Is ship-from-store the answer?

One of the leading trends with retailers investing and expanding their online fulfilment capacity is ship-from-store, also known as in-store fulfilment. SFS is an omnichannel retail strategy where retail stores are used to fulfil online orders, essentially leveraging stores as miniature distribution centres! The strategy has many advantages including taking pressure off of DC’s, reducing shipping costs and increasing delivery time. Ship-from-store also benefits the stores themselves as Idle inventory that is sitting in stores can instead be sold – preventing stock building up and keeping stores busy even if footfall is low.

Many major retailers have already started leaning into in-store fulfilment. Walmart expanded their ship-from-store capabilities to 2,500 locations earlier in the year, while target fulfilled 90% of their online orders from stores, cutting the cost of fulfilment by 30% and coinciding with a 100% increase in digital sales year-on-year. These two examples are interesting in that both brands are attempting to ‘take on’ Amazon by leveraging what amazon doesn’t have, a sign that ship-from-store is only going to grow in stature in the years to come.

What fulfilment technologies will become more relevant in 2021?

Automation

As demand for online orders goes up, distribution centres have to evolve. More modern DC’s with high order capacities are highly automated. This includes conveyor systems, automated processing and exception handling (with RFID). High-tech DC’s such as these are more efficient in terms of throughput of items and are far less susceptible to bottlenecks. An example of such a DC is Detego customer Marc Cain, who’s highly automated DC can process 35,000 articles a single day, with 100% accuracy.

Big data and Artificial Intelligence

For larger retailers, online channels produce a lot of data. For retailers who have the technologies to keep track of them, their supply chains also produce huge amounts of data related to the movement and flow of merchandise. As we often say though, data is useless if it’s not being used to produce actionable or useful insights. With AI, retailers can utilise all of this data from their web stores, supply chains and stores to great effect. Operational KPIs like DC throughput and dwell times (how long an item sits at a certain stage of the supply chain) are incredibly valuable for optimising fulfilment. This data can also be used for more advanced algorithms like demand prediction, so retailers can adjust their inventory levels for different regions before there is a shortage of products.

RFID

Tagging products with Radio frequency identification makes a huge difference to supply chains and online fulfilment capacity. Not only does RFID produce real-time item visibility from the factory to the customer, meaning more efficient handovers, but for DC’s it is a game-changer. RFID tunnels within an automated conveyor system can automatically count and check the content of cartons without needing to open the box, in a matter of seconds. This means all products coming in and out of the DC are processed in seconds and with complete accuracy. After the initial investment, the solution also drastically lowers operational costs, not to mention the reduction in chargebacks of incorrect shipping penalties.

Want to see how RFID can transform your business? Book a demo today

Hear from Detego’s implementation experts and BESTSELLERS’s RFID project leader on how retailers should approach digital transformation with RFID.

Radiofrequency identification (RFID) has become a vital technology in retail, particularly for larger brands. Leading retailers use the technology to achieve high stock accuracy, supply chain visibility and to gain the real-time data required for strong digital offerings such as omnichannel.

These are no longer optional for retailers and undergoing digital transformation with RFID is on the agenda for more and more brands.

Join Detego’s delivery specialists with years of experience implementing RFID in retail stores, and supply chains as they go take you through a best-practise approach to implementation.

Hear about the journey from a retailer’s perspective as BESTSELLER talk through their RFID journey which included an initial rollout to just under 200 stores in 3 months!

- Determine the key things to consider when implementing RFID

- Gain insight on the priorities to focus on, things to look out for, and lessons learnt

- Learn about each stage of the journey with specific insight and advice for both stores and distribution centres

- Hear a retailer’s experience of a large rollout covering hundreds of stores.

1- Adapting to the digital-first world

COVID-19 caused a huge increase in the role digital technology plays in our lives. Even for the already tech-savvy, work habits, social lives, exercise, and entertainment were all transformed into digital-first activities. Many of these trends existed before, but the pandemic accelerated this change by forcing many people to rely on digital channels and services more than ever.

The same is true for retail – online shopping and social media marketing are not new but have grown exponentially in the new normal, as customers stay at home and spend more time online. This means that, for all retail industries bar perhaps food, online channels have taken centre stage.

More than ever, customers are not only buying online, but they are also shopping online. What’s the difference? If we think of buying as the purchasing of a product, where the price is the primary factor, shopping is everything else – the experience, and the browsing and sampling of products, and ultimately the purchase decision itself. Traditionally e-commerce has always great for the former, but for actually browsing and discovering products its never been as good as in real-life. This is changing though, with digital technology like augmented reality (AR) allowing the customer to virtually try on products or see what they look like in true-to-life scale.

So, to adapt to this increasingly digital way of shopping Multichannel retailers or even pure-play brick and mortar retailers need to make more of an effort to reach their customers online. In the new normal, online is the focal point of the journey.

A webshop is one thing, but retailers need to make more of an effort to reach and meet their customers online. This means not only bringing products to customers with online and social media advertising but taking the entire brand experience online by engaging with customers on social channels and adapting to digital forms of experiences.

2- Understanding the new normal customer

While adapting to meet customers in the new environment is crucial, its just as important to really understand who the new normal customer is.

While they are of course the same people as before, habits and circumstances have completely changed – what customers want, and their priorities have completely shifted. As a result of this shift brand loyalty for many has gone back to square one, with more consumers changing and trying new brands this year than ever before. Whilst this puts retailers under even more pressure, it also presents an opportunity to attract and impress completely new customers.

But what has caused this shift, and who is the new normal customer?

3- Embracing Omnichannel

Omnichannel retail, offering an integrated and consistent experience between online and offline channels, is not a new concept in the industry. But much like online shopping, omnichannel offerings have become exponentially more valuable since COVID-19. With the balance between digital and physical retail shifting, retailers offering a strong omnichannel experience are in a far stronger position than those who do not. Simply having an eCommerce site on top of stores (multi-channel) will put retailers in a better position as pure-play brick-and-mortar retailers, as they can take advantage of the increase in online shoppers and still be able to deliver to loyal customers who can no longer shop in-store. However, with pure plays being rarer than ever this is simply not enough anymore.

Omnichannel goes beyond this, by seamlessly integrating online and offline channels, allowing for offerings like click and collect (Buy-online-pickup-in-store/BOPIS), return-to-store and ship-from-store (BOSFS). The benefits of such a strategy go both ways. Customers get access to more available stock and convenient purchasing options; they can collect from stores (BOPIS and curbside) or can get products shipped straight to their homes. For retailers, omnichannel allows you to leverage stores as miniature distribution centres, cutting down on shipping costs while keeping struggling stores busy. With click-and-collect, the benefits are similar and allow stores to benefit from and serve online customers, Curbside pickup is a new type of click-and-collect that has become hugely popular since the pandemic as it keeps customers feeling safe and allows for social distancing.

4- Optimising costs

As much as positioning for the new normal is vital for success going forward, the unfortunate fact is many brands will be struggling with the financial impact of COVID-19. As a result, optimising costs across the board is vital for retailers trying to weather the storm and stay open long enough to adapt to the new normal. Retailers feeling the worst of the financial strain of COVID will be forced to rethink their footprint in order to survive. Closing down stores and losing staff is always a last resort, but one the vast majority have been faced with this year, as less profitable locations are surrendered to ensure the survival of the brand. But what about retailers in stronger positions, those looking to optimise their costs in the long-term without hampering themselves or their customers?

For stores, improving the efficiency of in-store processes across the board can reduce operating costs in the long-term. Processes like inventory management (Processing inbound shipments, stocktakes, replenishment) point-of-sale and loss-prevention can all be streamlined with cost-effective technology. The focus should not be to manage these things more cheaply but to manage them more effectively. To use the point of inventory management, Detego has repeatedly found that increasing stock accuracy in our customer’s stores from an average of 70% to 98% means stores can run with far leaner inventories. If you do this at scale across your entire store network, it’s possible to reduce working capital by 10-15%.

In the supply chain too, there are huge opportunities to run more efficiently and reduce costs. The cost of handling and processing the flow of goods throughout the supply chain, particularly in Distribution centres, can be reduced by investing in technology like RFID and warehouse automation which reduces labour and handling costs. By improving the accuracy and visibility of their supply chain retailers can also reduce chargebacks and other costs associated with shipping mistakes. Finally, there are huge savings to be made by achieving full supply chain visibility – knowing exactly where individual items are (and where they’ve come from) allows retailers to fully optimise their supply chains reducing losses from shrinkage, counterfeits, and grey market goods.

5- Re-thinking data and digital for a post-COVID world

Retail, particularly sectors like fashion and beauty, has been facing the need for digital transformation for a few years. The rise of online channels, digital-first consumers, and the continuous advance of technology has meant brands can’t afford to stand still when it comes to how they run their businesses. Whilst understandably many brands are focusing on staying afloat in the immediate aftermath, COVID-19 did not stop this need for transformation – it accelerated it. Now there is a greater need than ever to ensure brands have the data and IT infrastructure to react to change and make the right decisions. With the sudden shift in the industry caused by the pandemic, retailers may need to revisit digital and analytics priorities but adapt them to a post-COVID world.

In times of uncertainty, accurate data, improved visibility, and effective analytics can make all the difference. We’ve already discussed how retailers with the right infrastructure (meaning accurate visibility over their products) are profiting from their omnichannel offerings. But having a mature tech stack can unlock tonnes of value that will be vital in the new normal. For example, item-level visibility and granular data in the supply chain not only allows for greater agility when dealing with supply and fulfilment but the data can be used for advanced analytics like demand prediction and inventory optimisation across store networks.