It is no exaggeration to say that retail has changed like never before.

For some time, operations have been growing increasingly more complex, and shoppers increasingly more discerning. Now that evolution has been accelerated. Retailers must be flexible in meeting consumer demands in the face of a rapidly changing retail landscape if they hope to succeed.

As the industry recovers, retailers pursuing digital transformation in order to optimize operations, expand omnichannel fulfilment, and enable data-driven decisions are poised to lead the way. One of the foundational technologies providing insight to drive digital transformation? RFID.

It’s been around for a long time, but Radio Frequency Identification technology (RFID to you and me) is picking up momentum in the retail space. Both Forbes and McKinsey & Company have published recent articles on how the technology is becoming key for retailers, with the latter even describing ‘RFID’s renaissance’ within the industry.

While this does show a shift in the sector, a renaissance implies that the technology is making ‘ a comeback of some kind. This is not quite accurate, as the business case for RFID has been steadily growing in retail over the years, but we are approaching a new stage of its lifecycle in the industry. This is a natural cycle for most new and transformative technologies, but the effect of the pandemic on retail has accelerated this. Not only are many brands on thin ice in the aftermath, but one of the key reasons for implementing RFID, delivering an Omnichannel strategy, has evolved from ‘beneficial’ to almost ‘non-negotiable’ since last year.

Let’s explore where RFID has come and more importantly, how it has become one of the single most important operational technologies to retailers in recent years.

RFID and the Technology Curve

While RFID was invented in the 1940s, it wasn’t until this century it began being used as a business tool. In retail, it has existed for almost 20 years, but its initial cost, technical limitations and fewer established use cases all meant most companies (wisely) didn’t see the value in it initially.

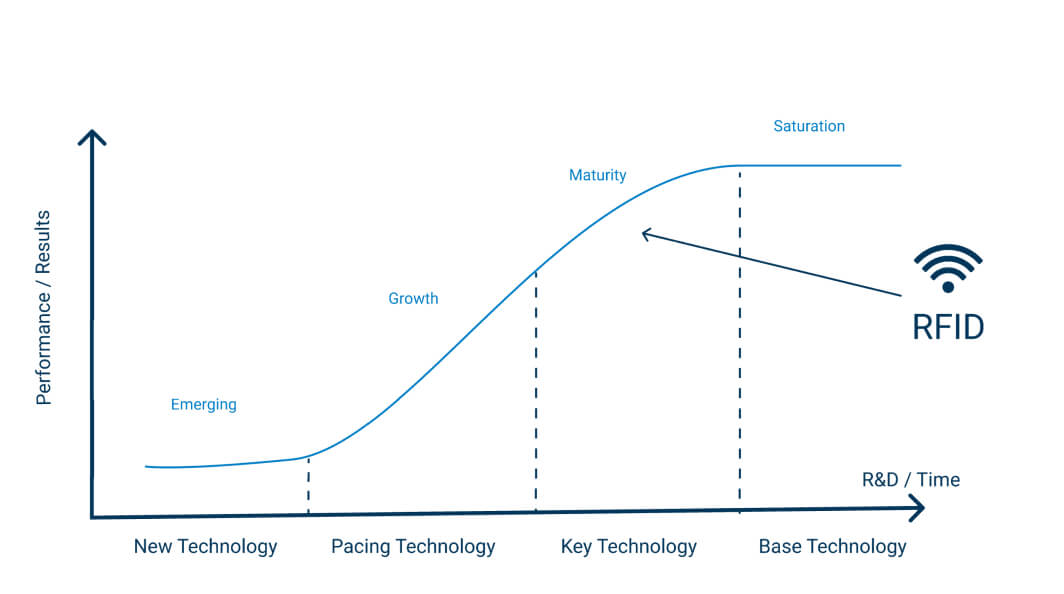

This is common for new technology and over time RFID has matured with more research & development as well as more deployments in live retail environments. This has meant the performance of the technology improved and the return on investment for retailers increased. This is known as a technology S curve (seen below). Over the last ten years, RFID use in retail has experienced this curve with the adoption levels and value for retailers increasing year on year.

Fast-forward to the present day and RFID is at a maturity stage, and we predict that over the next five years will become a ‘base technology’, in apparel and sports retail at the very least. This increase is a result of both the technology maturing over time and the industry evolving as a whole – things like digital disruption, the growth of Omnichannel and the pandemic accelerating certain shifts within the industry have meant the need for RFID has increased greatly.

How has RFID evolved?

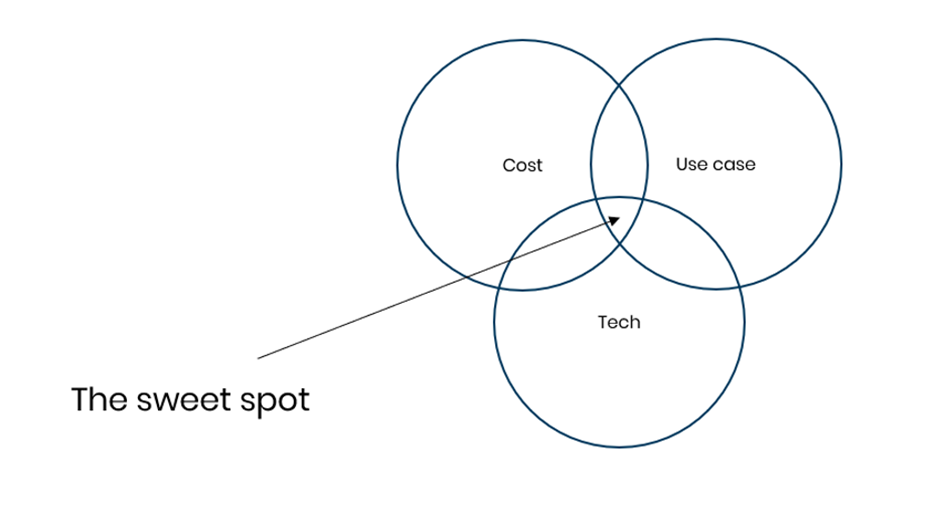

For a technology to take off in business (i.e., for it to have a business case) several factors need to be met. The technology needs to be cost-effective, reliable/easy enough to implement and use and most importantly it needs to have enough valuable applications to make it worth doing in the first place.

Early-stage technologies may have one or two of these down, but to really take off and become saturated within an industry it needs to be in this sweet spot of covering all three. So, how do these requirements stack up for RFID?

Cost

Like any technology, Radio Frequency Identification was expensive when it first came out. Over time as more R&D was done and more providers entered the space, the price has steadily gone down.

The biggest factor in this was the drop in the cost of RFID tags themselves. At the start of the century, a single RFID tag could cost as much as $0.75/£0.50 but in the current market, they can be sourced for as low as $0.04/£0.06. This not only makes for much better margins for any retailer looking at the technology, but it opened up whole new industries or sectors whose lower product prices points originally made RFID unfeasible.

Tech

The technology behind RFID has also developed beyond just price point. RFID hardware has improved in terms of reliability and read distance. Tags on the other hand have become smaller and more advanced so that metal and liquid products no longer interfere with the signal – both of these improvements means a far broader range of merchandise can be tagged. This is particularly relevant for categories like food or cosmetics. Finally, the software has also evolved, with more advanced functionalities like tag localisation, Smart Shielding, and global track-and-trace.

Use case

One of the greatest strengths of RFID has always been its wide range of uses and applications. This can at times be a double-edged sword, as companies may not know where to start, may deploy use cases in a sub-optimal order or may chase all use cases at once.

Thankfully, most RFID providers and experts know that a phased approach prioritising KPIs like stock accuracy is vital to both achieving ROI and laying the foundation for more advanced use cases like enabling omnichannel. Provided the project is scaled in the right way, the uses of the technology are broad and include supply chain visibility and traceability, real-time data applications like automated planograms as well as consumer-facing use cases like smart-fitting rooms.

How Retail is Evolving: Why is RFID Becoming Key?

Most of these major changes in RFID retail technology itself occurred several years – the business case has been solid for the last five years at least. This is why many major retailers like adidas, Levi’s, Nike and Target to name a few already have high levels of RFID integration. But in the industry as a whole this is ramping up but why?

Naturally change often happens on a curve, with more cautious brands hesitant to change until they see positive results from other companies who take the ‘risk’. On top of this, however, the market and consumer is changing fast and the digitised accuracy and visibility that RFID provides are becoming non-negotiables for most retailers.

The need to optimise profits/costs

Any business wants to optimise their costs and maximise their profits – it’s not rocket science. But the best ways to do that can often be unclear, and sometimes if it requires some upfront investment or new technology brands may decide that now is not the time. For retailers, the store model and brick-and-mortar economics have been gradually changing over time. As the balance between online and offline channels continues to shift, some stores may become unprofitable if nothing is done.

That is where so many retailers get upfront value from RFID. Implementing the technology in stores increases sales (from reducing out-of-stocks) and reduces running costs (from smaller inventories & increased operational efficiency). Lean stores optimised to such levels may be a necessity in the future with stores playing a less crucial role than five years ago.

Increasing Omnichannel and digital integration

Omnichannel has been a growing force in retail for the last five years. Many retailers bet on omnichannel early, investing in the technology to digitally integrate their stores and supply chains with their online channels, and have profited as a result.

To succeed in omnichannel investment is required, as services like click-and-collect or store-fulfilment need a real-time digital view of store stock if they are going to work effectively. RFID is the perfect solution to these omnichannel challenges, and it’s no coincidence that as Omnichannel has become more common amongst retailers, RFID has as well.

This will be the single biggest factor for RFIDs growth in the next few years. While Omnichannel was once more of an optional strategy since the pandemic and ever-increasing digital shopping channels – it is becoming non-negotiable. This isn’t just us saying so, retailers themselves have recognised this, in a recent survey from the Retail Industry Leaders Association (RILA) the number one imperative for the industry was to ‘become omnipotent on omnichannel.’

Pandemic accelerating the need for digital transformation

While the need for digital transformation to optimise costs, integrate channels and improve operational visibility has been increasing in recent years, the COVID-19 pandemic has accelerated this. We’ve covered the effects of the Pandemic in detail over the last year, and many of the mid to long-term effects will push more retailers to RFID adoption.

The changes we have just covered, optimising profits and offering an omnichannel experience, were (or should have been) priorities before, but in the aftermath of the pandemic, they will be the difference makers.

Stores, on the whole, are not going anywhere but they will have to adapt to post-pandemic retail – meaning potentially lower in-store sales and a higher proportion of digital and omnichannel activities. The challenge for retailers is trying to adapt to a changing environment while also financially recovering from the peak of pandemic and lockdowns.

For brands that haven’t started their RFID journey the timing is awkward and yet they may not be able to afford to wait too much longer. While Omnichannel services will be the long-term play, smart retailers will look to use RFID to optimise their profits as soon as possible, securing a return of investment and setting themselves up to profit long-term.

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Detego Store is a cloud-hosted RFID solution which digitises stock management processes, making them more efficient and more accurate. Implemented within hours, our multi-user app can provide intelligent stock takes and a smart in-store replenishment process. Later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

Retail has been on a transformation journey ever since the birth of the internet, and the online shopping and digital consumers that came with it.

Many new (often online-first) brands have grown into superpowers, and ‘traditional’ brick-and-mortar retailers have had to adapt their offering in order to stay competitive in what is a dramatically different environment compared to just ten years ago.

Make no mistake, this industry shift as a result of digital channels is still ongoing. While it by no means spells the death of physical retail – the industry must continue to adapt.

Brick-and-mortar retailers selling online, and gradually adopting an omnichannel model, is a big step in this journey.

This gradual shift has been greatly accelerated by the pandemic. While omnichannel was in many retailers five-year plans, the pandemic meant brands had to shift suddenly to survive in a temporary world where online was king.

So, as many retailers are leaning hard into omnichannel – is the industry ready? The operational challenges and costs associated with omnichannel mean some retailers might struggle to really profit. So, what can brands do to change this, and what technology should they invest in to ensure their omnichannel strategy delivers long-term?

The Omnichannel Surge

The pandemic was a big accelerator for the already ongoing digital transformation of retail. The temporary circumstances of the pandemic meant more shoppers were forced online. A report from Nosto claims at the height of lockdowns online channels spiked 66%.

This online spike also affected omnichannel services. Click-and-Collect/BOPIS increased 70 percent by volume and 58 percent by value in 2020, according to ACI Worldwide data. Meanwhile, retailers fulfilling online orders from stores grew by 80% in the US, according to global data.

While spikes like this are temporary, online channels will not return down to pre-pandemic levels. This is not only because of ongoing safety concerns, but because many consumers have been introduced to online channels or omnichannel options like BOPIS & curbside for the first time. Many of these new digital consumers will not give those options up, why would they?

So, while stores are coming back and will remain a key part of retail, the environment that they exist in will have changed, with stores operating as part of online channels rather than in tandem or competition with them.

This isn’t new however – the industry has been talking about the gradual move to omnichannel for a long time. What’s significant is how this sudden spike has forced brands to react and adapt far faster than they would have planned. In fact, the pandemic has accelerated this shift by up to 5 years according to data from IBM.

So, are retailers well-positioned for this sudden spike in omnichannel activity?

Growing Operational Challenges for Omnichannel Stores

For the main two omnichannel activities – BOPIS & Ship-from-store, store staff effectively have to do extra work that the customer or the DC would normally do, respectively. These services have natural advantages for retailers and customers, but without the right support store staff can struggle to fulfil these orders and keep on top of their normal tasks.

When stores are quiet like during the pandemic, this is not an issue and allows you to leverage stores and staff that would otherwise be unproductive. Moving forwards, however, as stores begin to return closer to normal foot-fall levels, staff may be overwhelmed without extra help like more dedicated in-store fulfilment staff or supportive technology.

IT & Inventory Management Improvements Required

Even with the staff and operational manpower to fulfil and deliver these omnichannel services, if a store’s IT system is not up to scratch they will struggle to fulfil orders correctly and deliver on the promises made to customers.

For this to work, brands need a single view of stock across their stores and online shop. For brands to offer reliable and profitable omnichannel services, their inventory management system needs to fulfil three key criteria.

The first is simply accuracy. If stores are running at a standard 70% inventory accuracy, the likelihood of them offering stock to customers that simply isn’t there is too high.

The second – stock needs to be as close to real-time as possible to maintain this accuracy throughout the day. If stock is not updated throughout the day, then it becomes impossible to offer reliable services like BOPIS.

Finally, to do these services effectively it is much more manageable if stock is operating on an item-level rather than an SKU level. This allows stores to easily distinguish between identical items, so ship-from-store or BOPIS can work down to the final remaining SKUs.

Without this infrastructure in place, it’s common for BOPIS or ship-from-store to offer customers stock that isn’t actually there. The result is orders being cancelled shortly after they are made, and customers being disappointed.

Handling Returns

Returns are the Achilles heel of online shopping in general, and omnichannel services are no exception. Not only do returns eat up margins, but they also again require some operational manpower to process and re-distribute, be it at the DC or the store.

This problem is particularly prevalent in apparel and sports retail due to sizes and fit. While apparel stores have a far lower rate of returns than online, when adding BOPIS and ship-from-store and return-to-store into the mix, the rate of returns can increase drastically.

Balancing The Cost of Omnichannel

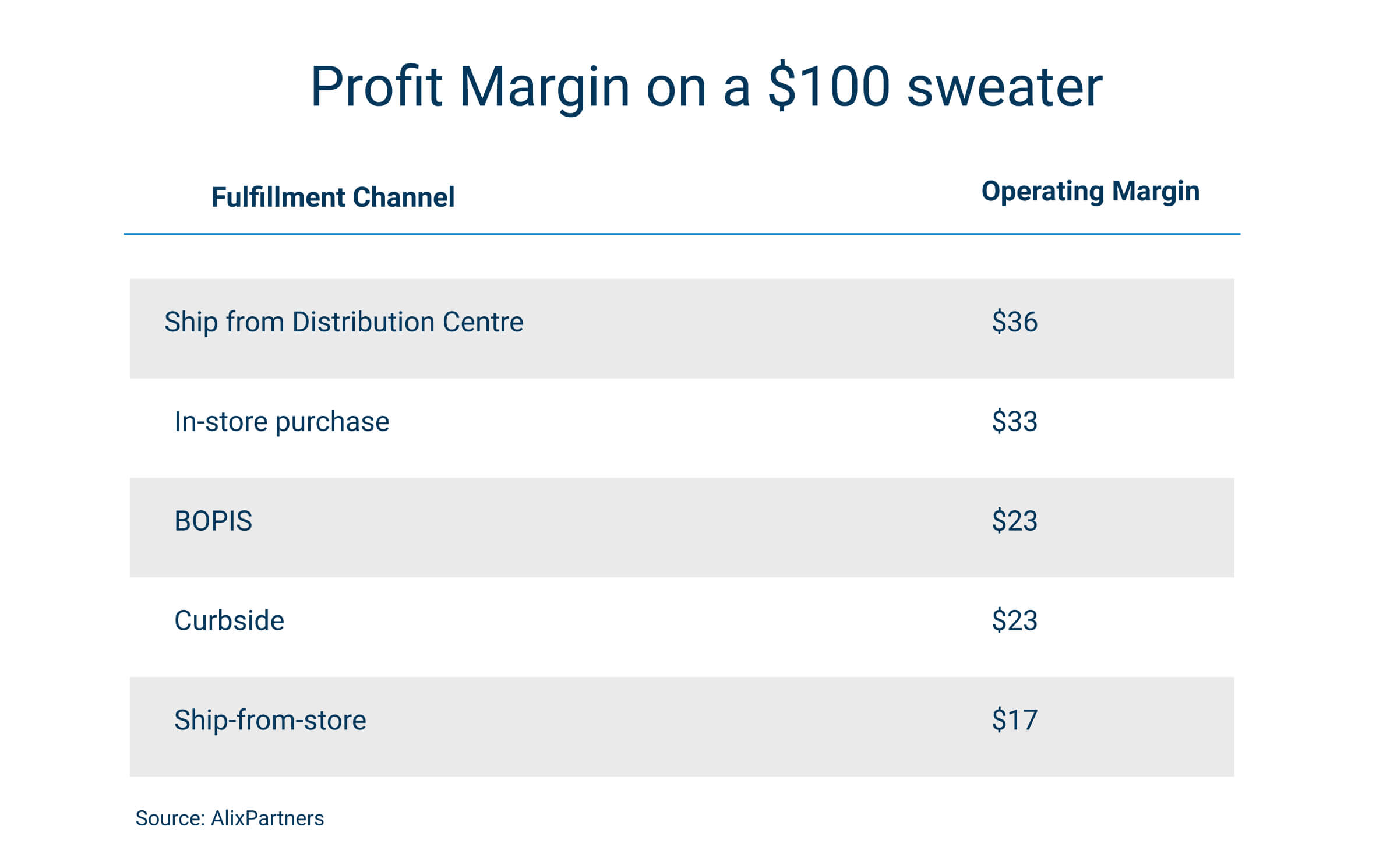

Managing and making the most of fine profit margins has always been key for successful retailers. When selling across channels in different ways – keeping an eye on the variable profit margins is essential.

Shipping from DC, also known as direct-to-consumer, is often the most profitable for retailers. This is why we have seen many brands begin to shift to more DTC models. This model has many advantages like bypassing third parties and servicing a larger area than stores, however, factors like returns can quickly have a negative effect on these margins.

Only somewhat less profitable is in-store sales. While rents and staff costs can be considerable, the operational tasks are effectively shared with the customer. While staff operate checkouts and maintain inventory the customer picks and packs their own orders. It may seem strange to think about in-store shopping in those terms, but some customers are beginning to wise up and appreciate the convenience of retailers doing this for them.

As we get to the omnichannel purchase methods, BOPIS (click-and-collect) and curbside, the operating margin is somewhat worse due to the fact that store staff have to pick and fulfil orders from the shopfloor or backroom. For curbside, there is also the added strain of carrying orders out of the shop to give to customers.

Finally, the most severe operating margin belongs to ship-from-store. This is because you have store running costs on top of in-store fulfilment as well as delivery costs. Despite this, we are seeing many major retailers lean into ship-from-store as a way to boost store sales and leverage store inventories. For example, Target fulfilled 75% of their digital sales using ship-from-store in Q2 last year.

Essentially, these models are all worth doing as they bring in additional customers and sales. Customer expectations are growing, and shoppers want to purchase and revive their products in whatever way suits them best, if you don’t meet those expectations, your competitor will.

However, for more operationally intensive models like ship-from-store and curbside pickup, it’s important to make sure these services are run as efficiently as possible, particularly when done at scale.

So, how can brands meet these challenges and ensure their omnichannel operating margins are as healthy as possible?

How RFID Delivers the Perfect Foundations for Omnichannel Services

Like we said earlier, the concept of Omnichannel retailing has been around for a while. Even before the pandemic, many forward-thinking retailers were beginning to invest in and build out their omnichannel capabilities.

To meet the operational challenge this meant setting up the new processes that go alongside BOPIS or ship-from-store and ideally adding more staff to support these processes. The IT challenges, particularly in terms of inventory and order management, require some more investment and technology integration.

When it comes to delivering the IT requirements for this, Radio Frequency Identification (RFID) is the single solution. While the deliverables of stock accuracy and product availability can provide a ROI for stores by themselves, laying the foundation for strong omnichannel services is often touted as the main reason for retailers choosing to implement the technology.

In a 2018 study, 83% of RFID adopters offered three or more omnichannel fulfilment options compared to only 24% of non-adopters. This is because RFID delivers a highly accurate and even-real time view of inventory at scale and across channels.

This single view of stock means retailers (and their customers) know exactly what is in stock at all times, making it easy to sell store stock online. Because RFID inventories work on an item level, these services can be completely granular, reserving individual items without even disappointing customers by offering them products that aren’t really there.

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Detego Store is a cloud-hosted RFID solution which digitises stock management processes, making them more efficient and more accurate. Implemented within hours, our multi-user app can provide intelligent stock takes and a smart in-store replenishment process. Later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

In the last ten years, many have predicted the ‘death’ of the brick-and-mortar store. While it’s true in recent years competition from e-commerce, amongst other factors, has seen a decline in store numbers, the death of physical retail has been greatly exaggerated.

The global COVID-19 pandemic was another matter entirely. Stores already feeling the pinch were hit with plummeting footfall or forced to close entirely. Customers were driven even further online as the industry shifted to the new digital-first world.

In the UK alone, a net decline of 6,001 shops was recorded in the first half of 2020, compared with 3,509 in the same period of 2019, according to research from PwC.

As stores begin to open back up, particularly across Europe, what does the future hold for the brick-and-mortar store?

Coming Back From the Brink

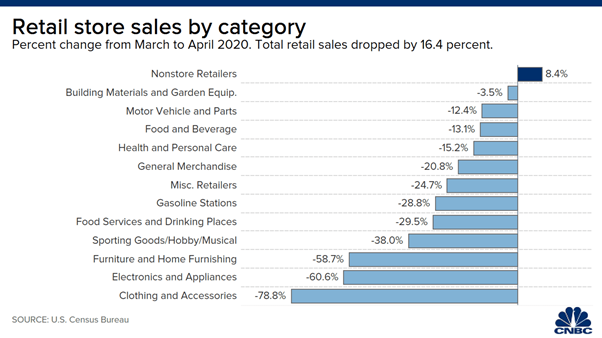

It hardly needs saying, and you can find a more detailed analysis on it here, but the pandemic hit the retail industry hard. The impact was not spread evenly, however, with the effect on sales varying wildly depending on sector and product categories. While sales of certain ‘discretionary’ categories such as fashion took a big hit, essential ones like grocery performed well, while lockdowns meant home-friendly categories like homeware and DIY were more resilient.

The other major variable was simply the shopping channel. The effect of the pandemic on e-commerce has been well documented, but in 2020 online became the main, often the only channel for many categories. In February 2021, online sales at non-essential retailers surged 82.2% compared with a rise of 3.6% during the same month the previous year, before the onset of Covid-19 in the UK.

Pure-play e-commerce retailers, therefore, were well-positioned. Multi-channel and omnichannel retailers were able to recoup some of their losses but not nearly enough to compensate for out-of-action stores. For the rarer pure-play brick-and-mortar retailer, however, the loss of revenue was severe – poplar British apparel retailer Primark’s profits plunged by 60%.

Stores Are Opening Their Doors to a More Digital World

But flashforward to now and with stores returning across Europe, what has changed? The majority of retailers are financially weaker due to the pandemic and are desperate to begin recouping and recovering their losses.

But that is not all, as the market has changed significantly in just a years’ time. Even beyond the lingering safety and distancing concerns that stores may have to contend with for some time, the uptake of online shopping and digital channels has accelerated greatly. While the inflated e-commerce levels of 2020 might be over, a proportion of this online penetration will stick. It’s a change that’s been coming for years, but the pandemic has accelerated this shift by up to 5 years according to data from IBM.

The balance of power between online and physical stores has changed, but not to the degree of 2020, where it flipped altogether. The Centre for Retail Research forecasts that online will account for 27.1% of retail sales in 2021, while this is lower than 29.8% in 2020, it is still a huge increase from 19.1% in 2019.

Some retailers and stores who were already struggling pre-pandemic will have cause for concern though as they are facing even more competition from online channels than before.

This competition does not mean the end of stores and in many sectors, the store will remain the primary channel, but this increased competition does mean stores have to do better. This includes both as a value proposition and on an operational level. Stores need to diversify and improve their offerings to attract returning customers, but just as importantly they need to diversify the role of the store and optimise their costs and margins to survive amongst higher levels of competition.

What do stores need to do?

Run Leaner Stores

Before trying to reimagine the store experience or create new store models, there is a big opportunity for many stores to optimise their costs simply by handling their inventory more effectively. You might be rolling your eyes, but we’ve seen time and time again that knowing exactly what is in your store can make be the difference between success and failure.

A fairly extreme example of this is when fashion brand Ted Baker overestimated their inventory value by £58m in a blunder that sent share prices tumbling. While this case is unique due to how extreme the error was, the problem itself is surprisingly common.

A store that has the typical 70% item-level (Not SKU) accuracy will be carrying up to 10-15% more working capital in the form of excess or ‘bloated’ inventory. Reducing this excess inventory at scale can have huge implications on bottom lines and will help brick-and-mortar stores stay profitable post-pandemic, this is without even mentioning the effect understocking can have on customers and sales.

Offer a Broader Range of Products

As stores look to position themselves better for the future – retailers should pay close attention to their product ranges in-store. This relates closely to two things we have just discussed – e-commerce competition and leaner inventories.

According to the Theo Paphitis Retail Group, 65% of online sales at one of their owned brands were for products not stock in their brick-and-mortar stores. While the convenience of e-commerce cannot always be matched (more on this in the next section) this discrepancy in product ranges is a big issue and one that can be solved. The issue is not even new – in a 2018 shopper survey, 67.3% of shoppers said they ‘Couldn’t find what they needed’ as the reason for leaving a store without a purchase.

Solving this issue is not a case of just stocking more products, it needs to go alongside our previous point in running more efficient inventories. This is so that stores can offer more products without increasing overall inventory sizes. On top of this, stores need to make it easier for customers to not only find the products to begin with, (e.g. by increasing product availability) but also by offering products beyond just what the store has in stock (like endless aisle or omnichannel orders) will also make the world of difference.

Utilise Stores as Digital Hubs

Since we’ve mentioned omnichannel – it is already proving to be one of the biggest factors for a store’s success, both during and well-beyond the pandemic. Many people have been banging the omnichannel drum for years and whilst some dismissed it as buzzword or a fad – since the pandemic omnichannel has become a must-have.

In the modern environment, stores cannot be islands. Customers have grown to expect brands to serve them across online and offline stores, in fact, customers don’t even think in terms of ‘channels’, and they shouldn’t have to. Things like click-and-collect and return-to-store have become increasingly popular due to the pandemic and customers aren’t going to just stop using them when it’s over. Click-and-Collect/BOPIS increased 70 percent by volume and 58 percent by value in 2020, according to ACI Worldwide data.

The other side of the omnichannel offering that is less customer-facing, but still of great significance is ship-from-store or in-store fulfilment. Whilst many retailers had already begun experimenting with in-store fulfilment due to its various business benefits, the pandemic forced many more to do so. Originally the reasons for this would be to utilise closed stores and deal with increased demand. Moving forward ship-from-store will remain relevant due to:

- The cost benefits of shipping items locally

- Being able to offer online customers more products

- Leveraging stores/store staff to serve online customers.

How Can RFID Help Stores Stay Competitive?

Most Brick-and-Mortar brands will already be adjusting their strategies to recover from the pandemic and best-position their stores to profitable in the long-term. In order to achieve some goals such as omnichannel integration and efficient inventories, store networks will need the right supporting technology.

RFID is the perfect solution to many of these challenges. Retailers who had already implemented the inventory tracking & managing technology pre-pandemic were well-positioned to adapt and sell inventory cross-channel. In the long term, RFID will allow retailers to optimise costs across stores and supply chains and be agile in the way they can handle and sell products to customers.

To find out more, read our new solution brief created alongside our partners, Zebra Technologies:

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Detego Store is a cloud-hosted RFID solution which digitises stock management processes, making them more efficient and more accurate. Implemented within hours, our multi-user app can provide intelligent stock takes and a smart in-store replenishment process. Later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

Beauty retail is an industry at a crossroads. A sector resilient to crisis and change compared to other retail categories, cosmetic brands are beginning to feel the effects of the pandemic and ongoing industry changes.

In recent years, apparel and sports retailers have undergone digital transformations to stay competitive, and now beauty brands have an opportunity to follow suit. Read this eBook to discover how and why beauty retailing is set to transform into the industry of the future.

Beauty retail: An industry at a Crossroads

The apparel and sports retail industry have undergone mass change over recent years. Such retailers have undertaken digital transformation journeys in their store and distribution networks to adapt to digital-first customers and eCommerce competition. The beauty sector, however, is still behind the curve.

In most major beauty-industry markets, in-store shopping accounted for up to 85 per cent of beauty product purchases before the COVID-19 crisis – (McKinsey&Co) making the level of eCommerce penetration lower than in other retail sectors. While retailers in other categories have been forced to innovate and adapt in the face of falling brick-and-mortar sales, competition from eCommerce and direct-to-consumer models, brick-and-mortar beauty sales were more resilient.

But this is changing. Not only are eCommerce levels steadily increasing year-on-year, but the COVID-19 pandemic has accelerated this drastically, driving five years of change in a single year, according to

IBM. This leaves brick-and-mortar beauty retailers on unsteady ground. Beyond this, brands will have to navigate a more digital-centric environment and optimise margins to cope with reduced sales.

The good news is many of the challenges that are now facing beauty have been facing apparel or CPG for years. The digital solutions and strategies that have allowed apparel to adapt are well established and ready to deploy to the sector. The digital transformations that many apparel and sports retailers were forced to undergo will not only fit beauty retailers but will also help them solve older challenges. Beauty retailers may need to go on a similar journey to apparel, but the tracks are there to follow.

What is in the eBook?

- Beauty retailing at a crossroads

- Bringing beauty operations up-to-speed

- Accuracy redefining margins

- Fixing beauty’s shrinkage problem

- Catching up with the omnichannel trend

- Countering the Gray Market

- Becoming digital and analytics leaders

Radiofrequency identification (RFID) is one of the leading technologies in retail, helping brands transform their business while maximizing revenue. With COVID-19 accelerating the digitization of retail and meaning stores need to be as profitable as possible to survive, RFID is a must.

Register now and learn from some of the best in the industry: Detego, and the experts in retail IT integrations, Spencer technologies.

Main Takeaways:

- Why are Retailers implementing RFID?

- Common challenges for Retailers and how to tackle them

- How to select partners (Hardware, Software, Services)

- What do you need to run a pilot?

Meet the Speakers:

Lauren Hines – Lauren is a Senior Business Operations Manager. She’s a former Head of Global Networks at BT.

Umesh Cooduvalli – Umesh is a tech-driven VP of Sales for America. He’s using his extensive network within the Supply chain industry with a hunger for new challenges

Nate Strickler – Formely project and Marketing Manager, Nate is currently working closely with partners and network to develop opportunities with Spencer Technologies.

We are a year on from the start of the global Coronavirus (COVID-19) pandemic, and the world is still firmly in the grips of the crisis. But with vaccinations being rolled out globally things are certainly improving, and the end may well be in sight.

For retail, the outlook is similar. While more than 30 major retailers filed for bankruptcy last year (almost double that of 2019), the first green shoots are starting to appear. Most major brands have successfully pivoted to stay afloat during the crisis, and across both the US and Europe the rebound of the brick-and-mortar store seems imminent.

But what will post-pandemic retailing look like? How has the industry shifted in both the long and short term, and what can brands do to prepare for and capitalise on the beginning of retail’s recovery?

Early Signs of Retail’s Recovery from the USA and Europe

While nothing is for certain, most signs point towards this current period being the latter/final stage of the pandemic, particularly for Europe and the USA. With vaccinations beginning to roll-out at scale and many European countries beginning to ease restrictions and lockdowns, many experts are hopeful regarding the outlook for retail over the next few months.

Europe’s recovery: a mixed bag

Across Europe, the outlook is mixed. According to analysis from Business of Fashion and McKinsey & Co, whilst demand for struggling categories like fashion is predicted to increase, the ongoing effect of lockdowns is cause for concern. So, whilst recovery is expected, it will likely be to a lesser extent than other markets.

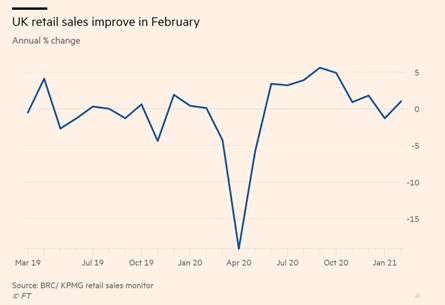

However, we have seen some encouraging signs despite lockdowns, as the BRC-KPMG retail sales monitor found that in February UK sales increased by 1% year-on-year. As stores are allowed to open back up the numbers will continue to improve, H&M said sales in the March 1st to March 13th period were up 10 per cent in local currencies as many countries, including single-biggest market Germany, began allowing some stores to reopen.

US recovery: encouraging signs for fashion and brick-and-mortar stores

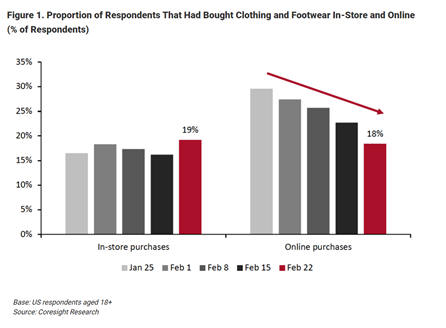

For the United States, the signs are fairly positive, with retail sales in 2021 expected to perform significantly better than in 2020, according to McKinsey and BoF. Additionally, recent findings from Coresight Research’s US Consumer Tracker found that, for fashion retail, the proportion of consumers that are purchasing clothing and footwear in-store was higher than those buying online for the first time since the pandemic – a major milestone for the sector’s recovery.

The report found several reasons for the US apparel industry to be optimistic, as 13% of respondents reported buying more clothing and footwear than pre-crisis, the highest level surveyed so far this year. Meanwhile, the apparel category witnessed the largest decline, of almost 6%, in consumers that are buying less than pre-crisis. Sales in apparel and other ‘discretionary’ categories were the worst affected by the pandemic, so these early signs of recovery are encouraging.

How have brands have shifted in the last year?

It’s been well reported how the global pandemic has affected shopping habits and caused a major increase in eCommerce penetration. According to data from IBM’s U.S. Retail Index (2020), the pandemic accelerated the growth of digital shopping by roughly five years.

This paradigm shift is reflected in the strategies of major retailers since the pandemic. With online becoming, at least temporarily, the primary shopping channel many retailers leant into and reinforced their eCommerce operations. But for the majority of retailers with significant physical store footprints, this was not enough, and the most successful brands developed their omnichannel offerings to better leverage their stores in the new digital-first world:

Buy Online, Pick Up in Store (BOPIS) is here to stay

Many retailers were investing in omnichannel services like BOPIS/Click and Collect well before the pandemic, but since then it has become something of a must-have and may remain so well beyond the pandemic. Retailers that had invested in Omnichannel before last year have reaped the benefits, as BOPIS saw YoY growth of 130% in June 2020. These retailers include US powerhouse Target who saw their curbside delivery service grow 500% year-on-year.

Stores as fulfilment centres

Similarly, brands with the infrastructure and agility to do so have been investing and leaning into in-store fulfilment throughout the pandemic. The advantages of this are considerable as it allows retailers to leverage their stores to service online customers. Target again made massive gains from this last year, reporting fulfilling 90% of their online orders directly from their stores, cutting fulfilment costs by 90% and contributing to a 100% increase in online sales compared to 2019.

Major fashion retailers are betting on Direct to Consumer (DTC)

Another major strategic shift that we have seen accelerated by the pandemic is the direct-to-consumer model. Although this model is nothing new, the fact that major global fashion retailers like Nike, adidas and Levi’s are evolving their strategy to become DTC-first is hugely significant. At the height of the pandemic, adidas saw their eCommerce sales increase by 93% but don’t think of this as a temporary shift – adidas recently announced that they’re aiming for DTC to account for 50% of their sales by 2025.

Long-term strategies taking shape?

So, what can we learn from these changes? Are these simply temporary shifts to navigate unprecedented times, or are they indicative of long-term industry change? The answer seems somewhere in the middle. Although the huge increase in digital sales that were seen at the height of the pandemic is already starting to fall away, the consensus is that a proportion of this change will be ‘sticky’ and digital sales will permanently remain higher than pre-pandemic levels.

As for brands exploring new models like DTC and Omnichannel, there is no doubt that these strategies will continue and remain relevant well beyond the pandemic. The demand and benefits of such models were there pre-COVID, and these changes have simply been accelerated.

The fact that many of these examples of omnichannel success come from the US is no accident. With the states having had fewer full lockdowns than their European counterparts, the success of these strategies could make a valuable lesson for European retailers looking to navigate the coming year – as consumer sentiment remains unstable and may well be signs of a more long-term shift in retail globally.

Preparing for Retail’s recovery: Short-term priorities

Taking Stock: Inventory Control will be Vital for Reopening Stores

As stores come out of lockdown across Europe, taking control of inventory will be a top priority. The first step will be taking stock and ensuring brands know exactly what they have in their inventories. For some stores, inventory management may have broken down due to lockdowns, particularly if stores have been used to fulfil online orders but do not have the IT infrastructure to keep effectively manage this.

Beyond this, the question of older or out-of-season products will present a challenge. Stores will already be dealing with bloated inventories due to lower sales and shutdowns, so maintaining optimal inventory levels and potentially selling marked-down products to make room for new stock will be a priority.

Continue to leverage online

Retailers should have invested in their digital channels at the start of the pandemic (and ideally before this). Even with stores opening back up, the increase in digital sales will remain high initially, and some will be sticky post-pandemic – just how much remains to be seen.

Retailers who continue to invest and develop in their digital and omnichannel offerings will profit post-pandemic. We have seen plenty of evidence supporting this from both the US and Chinese markets, so European retailers should follow suit and continue to offer flexible options to customers, many of whom may remain sceptical about returning to stores for some months to come.

Mastering fulfilment

With this consumer uncertainty and ongoing eCommerce penetration – making sure retailers deliver on fulfilment remains a priority. We can again look to target as an example, their same-day delivery sales went up 218% this quarter, showing the opportunity is there for retailers who can go the extra mile with their fulfilment, and even dare to compete with the eCommerce powerhouse of Amazon.

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Detego Store is a cloud-hosted RFID solution which digitises stock management processes, making them more efficient and more accurate. Implemented within hours, our multi-user app can provide intelligent stock takes and a smart in-store replenishment process. Later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

If you’re always reading about item-level data or item-level inventories but aren’t sure what all the fuss is about, we’re here to explain. It’s not just another retail tech buzzword, it tells the story of an industry transforming, the first step in a global shift from analogue to digital retailing (and we aren’t just talking about Ecommerce here).

When a retailer’s IT systems work on an item-level, they can identify, count, track and trace each individual product. While it sounds simple enough, in theory, it’s harder to do in practice and has only recently been made possible by new technology like RFID.

The benefits are huge, and while we will explore them in more detail, they include running leaner and more efficient stores, stronger supply chains and powerful data and insights.

Before we do that, lets briefly cover the current (or old, arguably) alternative to this: a stock keeping unit or (SKU).

What is a stock keeping unit?

A Stock Keeping Unit uses a basic code that specifies the identity of a product – for example, a plain white t-shirt, size L.

One of the main differences here is that an SKU can (and should be) logged and counted multiple times, for example, if you are counting those 10 white t-shirts, you are counting the same SKU 10 times.

Barcodes tend to operate on SKU’s, and you can scan the same barcode over and over.

- Specifies the product type and size

- Is counted multiple times

What does item-level data mean?

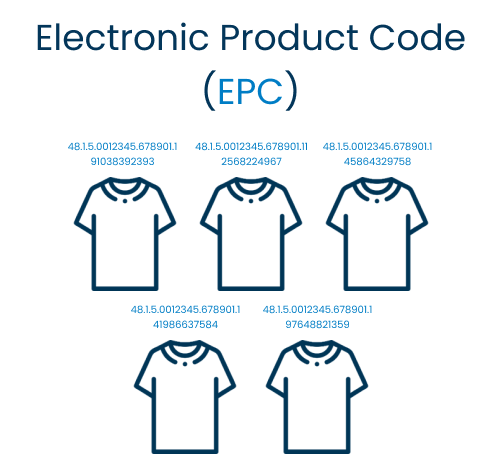

For retailers, working on an item-level simply means treating each item as a unique, identifiable piece of merchandise.

On the technical side, that means each item must have a unique code – called an Electronic Product Code (EPC).

Effectively, item-level data means being able to tell the difference between 10 medium white t-shirts. With EPCs, you could replace one of those 10 with another of the same item and be able to identify the new one from its unique code.

This might seem arbitrary, but it is one of the key drivers of transformation and change in the way retailers manage their stores and supply chains in recent years. Removing the human error element is one thing, but the unique ID’s open the door to much more.

These unique product codes are what makes RFID possible, as hundreds of radio signals can be emitted and read at once. Since each item has a unique ID there is never any risk of counting something twice. This means its possible to do store stocktakes in a matter of minutes, and verify items going through the supply chain without even opening up the box!

Additionally, the item-level data makes the world of difference when it comes to the supply chain.

If you were to track items on an SKU level within the supply chain, it would only tell you how much of each product passes through. Even this is too time-consuming, however, as it would require opening boxes and scanning individual bar codes, so instead DC’s and factories scan boxes, and operate on a carton level.

With item-level verification inbound and outbound at DCs, the individual contents can be counted and checked (via radiofrequency). These unique product IDs mean another whole layer of data, individual items can be tracked and traced from source to store.

- Can’t count items more than once

- Makes rapid inventory counts possible

- Individual product codes mean you can track and trace items across the supply chain

- More accurate data across the supply chain

The benefits of item-level retailing

The Detego Platform – Delivering item-level data to retail

The Detego platform is the definitive solution for delivering and utilising item-level data for retailers. The RFID platform covers every step of the item journey, from factories to distribution centres, to stores. Track and trace individual products across the supply chain, perform store stocktakes in minutes and take the guesswork out of retail. If you’re a retailer with several or even hundreds of stores, the Detego platform is purpose-built to get the most out of your stores and supply chain.

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Detego Store is a cloud-hosted RFID solution which digitises stock management processes, making them more efficient and more accurate. Implemented within hours, our multi-user app can provide intelligent stock takes and a smart in-store replenishment process. Later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

Knowing what’s in your store is essential to running a profitable retail business, whether it’s an independent boutique or a store in a chain of thousands. There are two things that keep stores ‘In the know’ when it comes to their inventory, stocktakes and their inventory management systems. A stocktake allows you to establish your view of inventory (at reasonable expense and effort) whereas the better your inventory management system is, the longer that view of stock stays accurate.

Even if your inventory management is top quality, without regular stocktakes accuracy will begin to slip. Factors like theft, admin errors and stock movement will mean that before too long the stock file and the physical inventory become increasingly out of sync.

This problem is multiplied the bigger a retailer’s footprint is. When looking at hundreds or even thousands of stores, stock inaccuracy can add up to unthinkable amounts of capital. Just look at British retailer Ted Baker who last year discovered a £58M hole in their business, entirely due to inventory mismanagement!

For many retailers then, stocktaking is considered a necessary evil. But doing a wall-to-wall count of every individual product in a store is no mean feat. Physical inventories come at great cost: time, money, and overall efficiency. As a result, many stores only perform an annual or bi-annual stocktake, but these leave a lot to be desired.

Let’s go through how and why annual stocktakes can be so expensive to perform and even ask, can retailers afford to go on like this?

The cost of annual stocktakes

The upfront cost

Physical inventory counts are big operations that are expensive to perform. Doing a wall-to-wall stocktake of everything in a store (backroom and salesfloor) takes a lot of time and manhours. To perform a physical inventory count, retailers have two options:

Carry out the stocktake internally

One option is for a store to carry out the inventory itself. This is tricky but not impossible, provided the staff are organised, attentive and know what they’re doing. The major downside is how labour intensive it is, requiring a lot of store staff, making working around opening hours difficult (more on this later).

For independent or particularly well-staffed stores, internal stocktakes can work. The issue is it does not scale. For a retailer with hundreds of stores, asking every one of them to perform such an operation once or twice a year puts a lot of pressure on store management – and the results will be inconsistent at best

Use a third-party service

Using a specialist service to perform the physical inventory does have its advantages. First off, the accuracy of the stocktake is likely to be more reliable, and it is easier to scale up the use of such a service to more and more stores. The major downside is the considerable cost. Whilst it depends on the service used and the size of the store, these stocktakes can cost around $2000 – $3000 per store. Assuming each store only performs such a count once a year, when scaled across tens or hundreds of stores, the cost becomes immense.

The disruption to stores

Regardless of who you have performing the physical stocktake, the other question is when. A full inventory takes time, whilst it naturally depends on the size of the store and the team, it will likely take half a day at a minimum.

If the store is closed once a week, then this is the obvious choice. However, larger brands can often operate seven days a week…

So that leaves retailers with another difficult choice – close the store, or perform the stocktake overnight? Naturally, closing the store means losing sales and disrupting customers. While performing the inventory count overnight can make for a tight schedule.

An overnight inventory count is more doable (and common) when using a third-party, but it is not always feasible if you are using internal staff. Not only are you asking (and paying) for staff to come in out of hours, but you also will not be able to use that set of staff of either day either side of the overnight stocktake – making it incredibly difficult for smaller teams.

The suboptimal results

So those are the implications for actually performing annual/bi-annual stocktakes for retail stores, but there is something else to consider…

The fact is manual inventory counts give you subpar results. Even with supporting technology like barcode scanners, the margin for manual error is still significant meaning right from the outset you will still have errors and discrepancies. A much bigger factor – performing stock counts once or twice a year is simply not enough anymore. Sure, you may have 90% accuracy every 6 months, but what about the time in-between?

Typically store inventories run at 60-80% Item Level accuracy. However, stores will rarely report such low numbers because:

A) They only calculate accuracy after a stocktake

B) They are working on an SKU (stock-keeping Unit) level, and not an item-level.

C) Errors in stocktaking procedures mean stock file and actual inventory do not match, i.e., the accuracy quoted is not accurate

This level of stock inaccuracy also comes at a cost – and it’s a steep one. Stock inaccuracy causes three problems for stores.

Overstock – Excess stock, a result of the inventory list not showing items that are present in the store. Often compounded by stores carrying ‘safety stock’ for key products.

Understock – A lack of product, a result of the store inventory showing items that aren’t really there. Also called ‘phantom stock’, one of the main causes of this is theft. Understock leads to products becoming out-of-stock altogether, meaning lost sales and revenue.

Dead Stock – For perishable products, dead stock means products that can no longer be sold. While sectors like fashion don’t have this problem having stock sat unsold in backrooms can lead to products falling out of season, resulting in mark-downs and profit loss.

The bottom line of this inaccuracy? 10-15% higher working capital in stores, as a result of bloated inventories, and 5-10% of sales being lost simply due to stock not being available for customers to buy.

The alternatives to annual stocktakes

Cycle counts

A cycle count is where a store performs a partial count of a specific portion of store stock. Instead of performing an annual stock take once or twice a year, you might perform a cycle count several times a quarter. Essentially, you are breaking down the annual count into several mini stocktakes.

This has many benefits over annual stocktake – less disruption to the store, less labour intensive and (since it can be done by store staff) it’s cheaper. It can also help avoid the large variation that you get when there is a larger gap between takes.

While this is certainly better, cycle counts require a lot of coordination and still have the same problem as all manual stock counts: they are time-consuming and inaccurate. So, whilst cycle counts will reduce the costs compared to annual stocktakes, the cost of the inaccuracy will stay the same.

RFID

Having looked at the costs and problems associated with manual yearly stocktakes, you’d be forgiven for thinking successful large-scale brands don’t operate like this – and they don’t.

Radiofrequency Identification (RFID) is a technology that allows stores to perform rapid inventory counts, via product tags that emit a small radiofrequency. Stores that have implemented RFID can perform weekly or even daily stocktakes, as a single member of staff with an RFID reader can count thousands of items in minutes. The result of this is RFID stores have typical inventory accuracy of 99%, and no more need of annual stock takes.

Installing RFID in stores is a reasonably big project and requires some upfront investment. However, if you look at the cost of performing third-party stocktakes every year alone that money could be used to fund the RFID project and it delivers a stronger return of investment than regular physical inventories. This without mentioning the various other benefits of the technology, which you can read about here.

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Detego Store is a cloud-hosted RFID solution which digitises stock management processes, making them more efficient and more accurate. Implemented within hours, our multi-user app can provide intelligent stock takes and a smart in-store replenishment process. Later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

Hear from Detego’s implementation experts and BESTSELLERS’s RFID project leader on how retailers should approach digital transformation with RFID.

Radiofrequency identification (RFID) has become a vital technology in retail, particularly for larger brands. Leading retailers use the technology to achieve high stock accuracy, supply chain visibility and to gain the real-time data required for strong digital offerings such as omnichannel.

These are no longer optional for retailers and undergoing digital transformation with RFID is on the agenda for more and more brands.

Join Detego’s delivery specialists with years of experience implementing RFID in retail stores, and supply chains as they go take you through a best-practise approach to implementation.

Hear about the journey from a retailer’s perspective as BESTSELLER talk through their RFID journey which included an initial rollout to just under 200 stores in 3 months!

- Determine the key things to consider when implementing RFID

- Gain insight on the priorities to focus on, things to look out for, and lessons learnt

- Learn about each stage of the journey with specific insight and advice for both stores and distribution centres

- Hear a retailer’s experience of a large rollout covering hundreds of stores.