Retail’s warehouse management systems are currently in a state of flux.

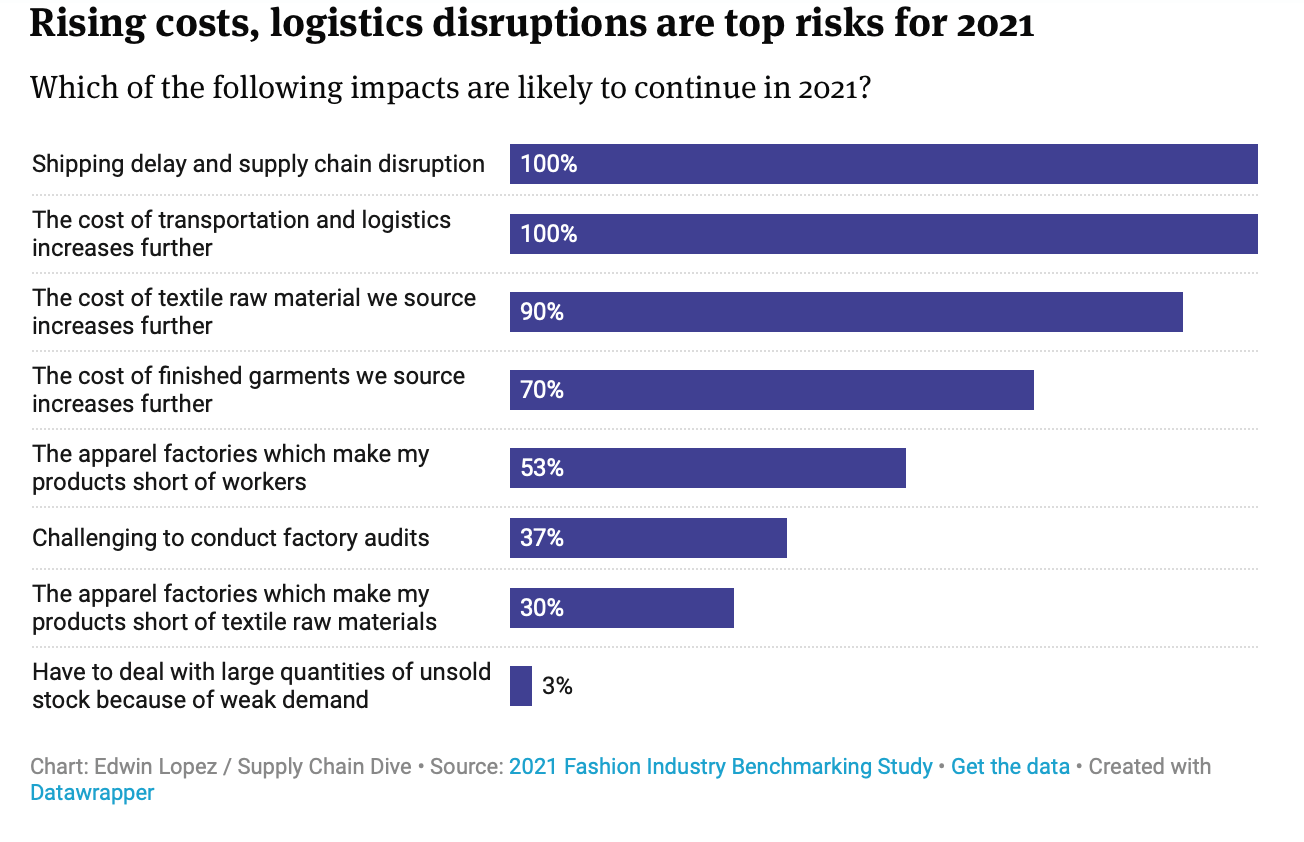

Supply chains are in crisis, consumer demands are unpredictably fluctuating, and labour shortages have reached historic heights – all disrupting the sector’s ability to fulfil even the basics of their supply and demand propositions.

Pair these challenges with the current e-commerce boom, and the result is a pivotal moment in time for the reinvention of retail logistics. In fact, investment in UK warehouses has already exceeded £6 billion this year, while the global warehouse automation market is expected to reach $30.99 billion by 2025.

Warehouses and distribution centres are undeniably the backbones of any retail operation, as departments that control the delivery of goods to consumers who — from their fingertips — expect accurate, timely, and efficient services regardless of what obstacles a retailer faces that week.

But to meet expectations, businesses must focus not just on sharpening their warehouse operations but also welcoming change and catalysing it into an opportunity for strategic innovation.

The Changing Models of Warehouses and Distribution Centers

Innovation within warehouse management is not just limited to improving tried and tested processes with technology. It is currently ripping up legacy systems as we know them and completely rethinking how the departments can be designed, fit for — post-pandemic — purpose.

Here we explore several new big-picture strategies that entirely remodel the way warehouses and distribution centres have traditionally functioned:

Micro-Warehousing

The tandem rise of e-commerce and consumer expectation for fast and efficient home delivery has inspired retailers to decentralise their once mammoth hubs and create physically segregated yet digitally connected operations through micro-warehousing.

Micro-warehouses and fulfilment centres allow retailers to house stock closer to their customer communities, enabling same-day delivery and click-and-collect services. They also help businesses optimise underutilised brick-and-mortar presences by repositioning them as dark stores — that exclusively cater to online purchases.

Distribution and Warehousing as a Service (DaaS, WaaS)

With companies facing new and unexpected obstacles every day, it’s no surprise the that B2B service market is booming. One of the latest propositions the retail sector is testing out is DaaS and WaaS.

Such services enable businesses to outsource these essential departments, radically shifting the strain of dealing with challenges like supply chain disruptions and labour shortages onto external partners who are better equipped to overcome such hurdles. Using WaaS and DaaS is a gamechanger for small and big businesses, assisting SMEs to manage quick growth without risking capital and helping large enterprises focus on other business activities without the distractions of logistical nightmares.

On-Demand Warehousing

With customer demand for goods straying away from typical timelines, businesses are increasingly unsure of how they will adapt to surging trends that follow no predetermined calendar. That is why on-demand warehouse services are becoming more popular.

On-demand warehouse platforms help retailers to find the perfect spaces for their immediate and short-term needs. This setup works with the fluidity of the global retail market, allowing companies to respond to rapid fluctuations, pilot stock with entirely new customer bases, and cater to unexpected peaks in demand – all while removing long-term and rigid contracts.

Digital Warehouse Twinning

If retail has learnt anything over the past 18 months, it’s that preparing for every unexpected eventuality is vital. That is why businesses are beginning to use technology to better their foresight.

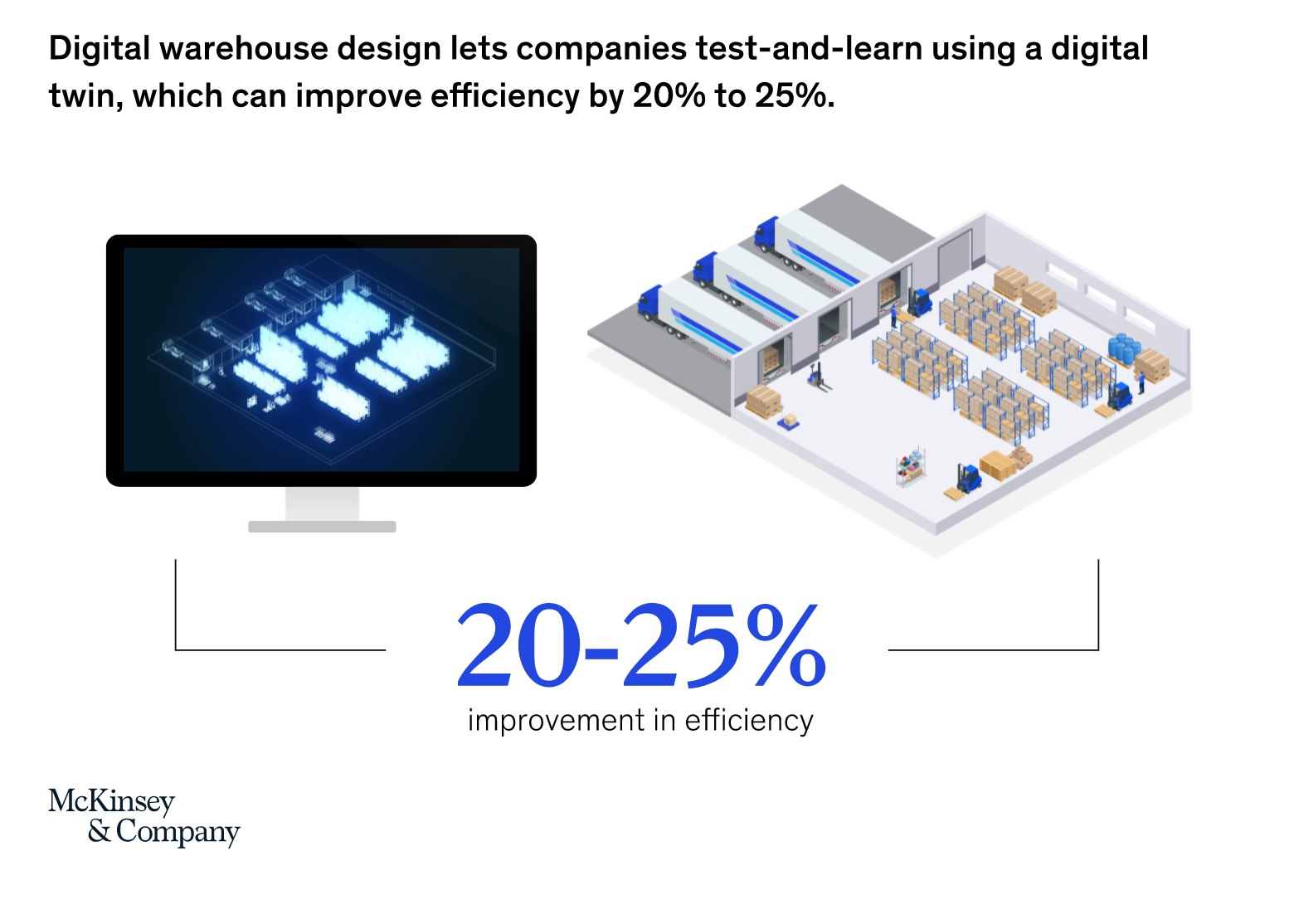

Digital warehouse twinning is currently experiencing an uptick in use with retailers and is predicted to provide a 20%-25% uplift in efficiency. By building a digital twin of their warehouse, businesses can test new strategies and analyse the results of the operational changes they intend to make, all within a simulation. According to McKinsey & Company, this helps businesses make both big and small decisions — like floorplan redesigns and changes in workflow structures — without impacting the everyday functions of their warehouses.

The Future of Warehousing is Digital

Whether retailers intend to simply refine their existing warehouse processes or overhaul their models completely, it is no secret that digitisation will be embedded into the foundations of change.

Over the past 18 months, the adoption of technology has been essential for any business, helping them build agile, resilient, and responsive operations. And now, as retailers reflect upon their performance since the arrival of Covid-19, they’ve realised that quick decisions to implement innovation — once ideas born out of desperation — have grown in viability, becoming intrinsic to long-term strategies designed to help them succeed rather than just survive.

E-tailers like Amazon perfectly exemplify what it means to invest in cutting-edge innovation within warehouse operations whilst seeing a return on investment. For example, Amazon is known for their use of Autonomous Mobile Robots (AMR) to streamline logistics by picking and transporting stock without human supervision and integrating AI to predict inventory demand and help design floorplan navigations based on access needs. As a result, the industry leader in digital warehouse processes can deliver unapparelled levels of fulfilment across their global audiences.

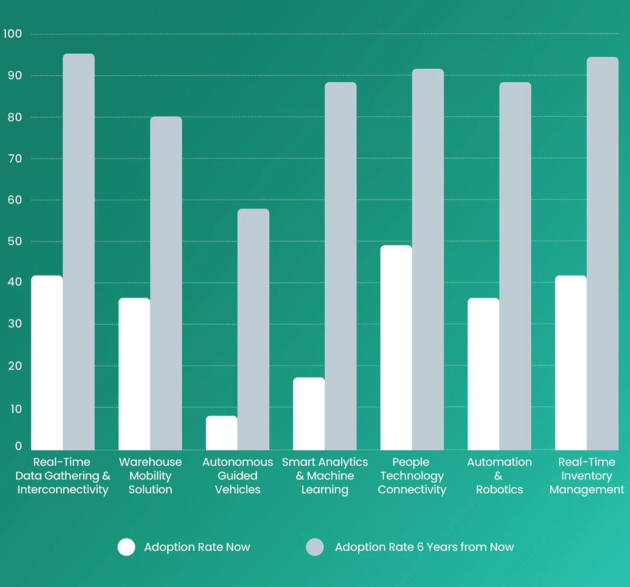

Taking a step back and looking at the retail sector as a whole, technology adoption within warehousing is set to soar over the next 6 years as these innovations evolve from being championed by evangelists into recognised processes with quantifiable results. Because according to the Harvard Business Review, there is plenty of room for improvement; 72% of companies believe their supply chain capabilities like warehousing and logistics to be digitally immature.

Technologies such as real-time data and inventory management are set to gain the most significant adoption rates in the next few years. And for good reason, the retail sector now knows that better stock visibility is necessary to make their activities intuitive to market volatility and shopper’s needs.

Why RFID is a One-Stop Solution for Operating a Warehouse with a Far-Reaching Impact

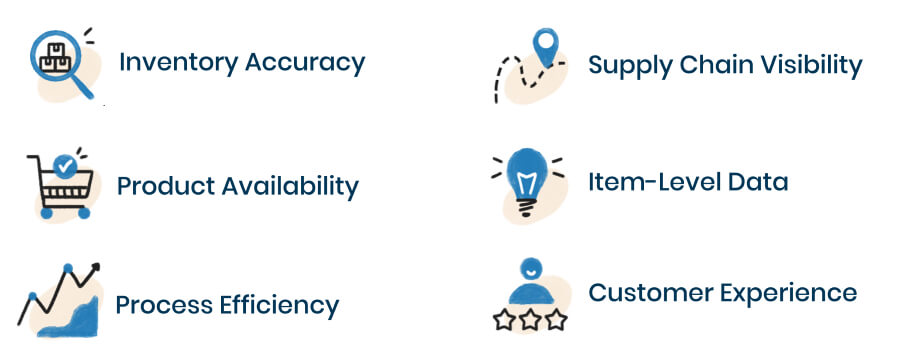

RFID technology provides real-time insights into inventory that currently helps retailers to solve many diverse challenges at once. Here we explore why integrating RFID into warehouses can allow businesses to achieve – what at first seem like wholly unconnected – business goals:

Creating Customer Loyalty

Building customer loyalty begins at the back-end of retail operations and not front-facing customer touchpoints. In fact, retail’s ramp-up of omnichannel – which has been firmly cemented as the go-to strategy for future success – has irreparably impacted how warehouses will need to function moving forward.

Delivering Fast Fulfilment through Product Transparency: When over 98% of shoppers claim delivery impacts their brand loyalty, shipping inaccuracies and delays are becoming a critical issue for retailers as demand for home delivery rises alongside e-commerce’s market takeover.

RFID’s ability to help businesses monitor inventory at item-level and in real-time means that product availability is becoming more accurate and automated as sales and returns are processed. As a result, companies can generate customer trust through the errorless communication of stock levels as they click-and-collect from stores and organise next-day delivery online.

Making Returns Easier with Shipping Accuracy: The rise of free returns policies has led to a mini-epidemic of high logistical costs and growing carbon emissions. In addition – according to the SOTI’S State of Mobility in Retail Report 2021 – over half of customers are unhappy with returns processes and want them made easier.

RFID reduces the risk of shipping mistakes by digitally automating the receipt of inbound goods to verify inventory and track individual stock pieces at every step of complex returns processes.

Reducing Costs and Optimising Efficiency

A rare new era of stagflation has arrived in the US and UK markets. Characterised by the inflation of prices, high unemployment – fuelled by “the great resignation” – and stagnant economic growth, industry experts, are wary of its long-term impact on the retail sector. As a result, retailers are becoming more cautious and considerate with every decision they make, hoping to reduce operational costs to keep prices low and demand high.

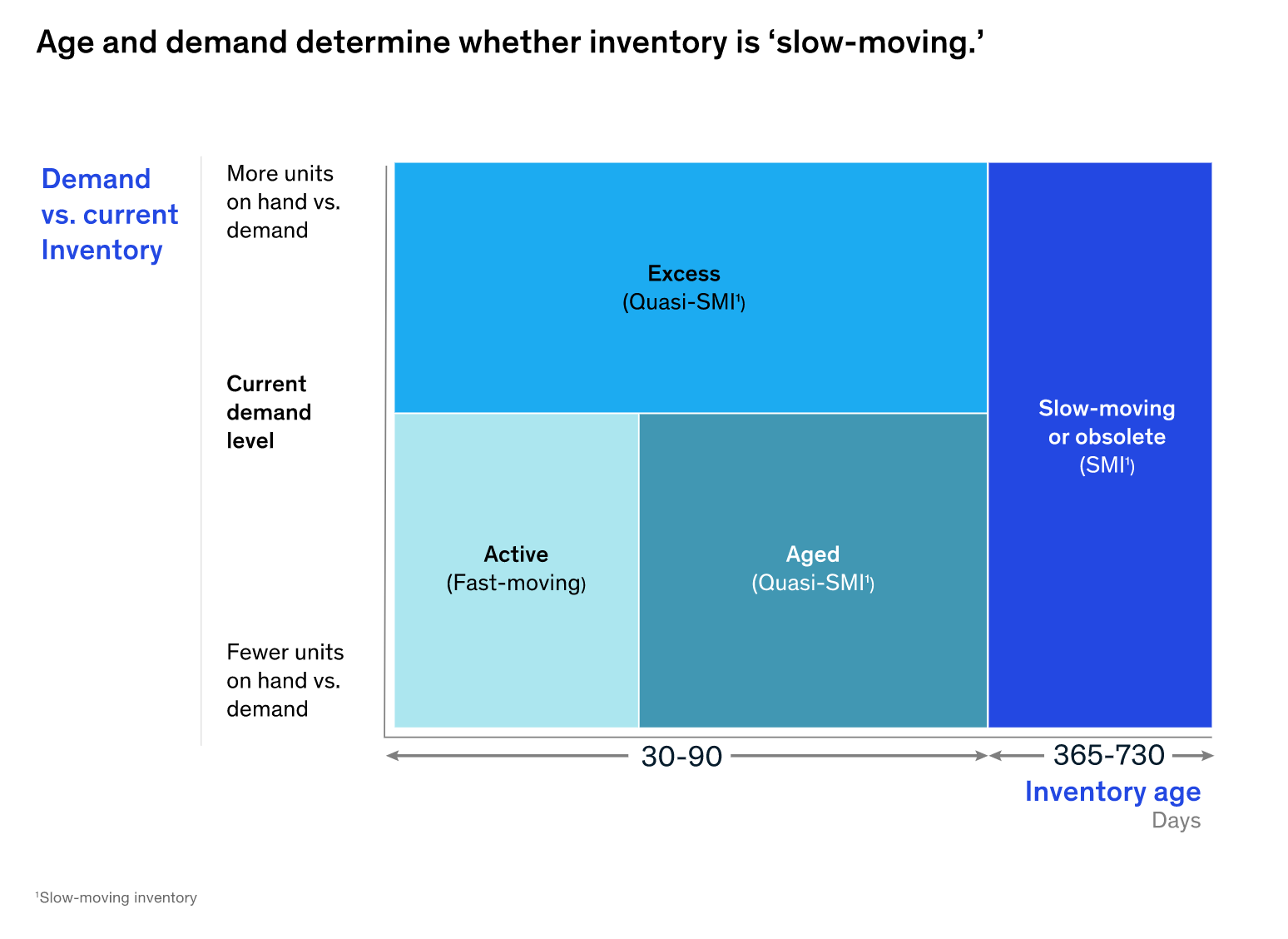

Managing Excess Stock through Inventory Protection: Slow-moving inventory has been a central problem for retail businesses, with the pandemic causing entire product categories such as evening-wear, holidays, and eating-out to become obsolete overnight. As a result, stagnating stock is a loss-leading problem that businesses are now beginning to tackle beyond outdated solutions such as seasonal sales, landfills and destruction.

RFID can help identify this stagnant inventory and trace its age and demand levels to inform how best to deal with stock in more sustainable ways. For example, the technology’s ability to trace individual goods back to manufacturers can additionally help to prove provenance as they enter resale markets.

Planning for the Future

Data is one of the most valuable assets a company can generate. It allows businesses to understand their customers on a granular level and trace what’s happening in their own ecosystems back to micro and macro market fluctuations. To plan more readily for the still unpredictable future, retailers are increasingly considering how to collect, connect and make sense of data to provide them with the best foresight.

Insights and Reporting through Label Printing: If businesses want to gain reliable and real-time insight into their logistics, they will need to imbed digital touchpoints into many of their existing processes. Warehouses present the perfect opportunity to create these touchpoints and track the inventory’s onward journey.

Quick and easy printing of RFID labels within warehouses can help enterprises with limited budgets to focus their intel-gathering on the journeys of specific stock. This can also enable smart shelving – a method of inventory visibility that allows retailers to trace customer engagement with stock as they pick it up and try it on. Insights generated this way help companies with everything from inventory planning to design development and visual merchandising.

Upskilling Workforces with easy RFID integration: The labour shortages that still plague the retail sector means that companies are becoming increasingly committed to investing in upskilling their workforce and providing them better tools to carry out everyday tasks.

Today, many RFID solutions are designed to work effortlessly with warehousing software, meaning the technology seamlessly fits into existing workflows without disruption. As a result, it helps make picking and packing less time consuming and laborious and increases employee’s ability to adapt to digital advancements with confidence and satisfaction.

Everything and Anything is Possible with Cloud Technology

Warehouses are the heart of any retail operation. As such, refining the processes within the walls of this department presents the opportunity to make widespread improvements across an entire business. Yet, so many of these advancements will be made possible by cloud technology.

Cloud technology allows different departments to automate inventory updates and access information in real-time, connecting workflows and injecting continuity into communication. Implementing cloud-based solutions into warehousing will provide retailers with the freedom of choice to radically change their models or merely update manual processes with digital.

Detego is a cutting-edge platform in the RFID space that delivers impact within their easily implemented cloud solutions. Book a consultation with Detego today to find out how they can help your business improve its warehouse and distribution centre practices and take the first steps towards implementing strategic innovation.

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Detego Store is a cloud-hosted RFID solution which digitises stock management processes, making them more efficient and more accurate. Implemented within hours, our multi-user app can provide intelligent stock takes and a smart in-store replenishment process. Later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

Until recently, it has been relatively easy for consumers to take the smooth supply chains that serve them for granted.

But the pandemic’s continued impact on retail — generating tidal waves of disruptions — has demonstrated just how reliant contemporary customers are on frictionless and immediate delivery of goods.

In just the past three months, the retail sector has suffered the effects of everything from food shortages, factory fires, to torrential weather. All of which have pushed supply chains to breaking point and — for many experts — have been the worst disruptions they have ever witnessed.

Every day, there are news reports of global brands running out of stock, failing to open stores and delaying the delivery of products, subsequently impairing their ability to provide the immediate gratification customers have come to expect from their shopping experiences.

So as the start of the next financial year swiftly approaches, retailers have begun to set their sights on investment in supply chain solutions to navigate future problems — and for a good reason — these challenges have created speed bumps in economic recovery, and according to ING, supply chain issues are here to stay.

However, if retailers have learned anything from the past 18 months, it is that these problems are not in silos of specific geographical locations, sectors, or product categories. Instead, they are an interconnected global web of causes and effects that — at the start of 2020 — retail had primarily been unprepared for. But the industry now knows that to survive, they must embed these lessons into their operations, strategically and efficiently.

Future Supply Chains: From Outdated Systems to Innovative Digital Solutions

Research from 2018 found that visibility, fluctuating consumer demand, and inventory management were already some of the most concerning global supply chain issues.

So it comes as no surprise that the pandemic has not only exasperated these sizable problems, but it has exposed global supply chain operations as outdated processes that often create rather than remove points of immense friction.

But now, moving into a post-pandemic era, revisiting and adapting the legacy processes many supply chains operate upon will not be enough for retail’s survival. Instead, businesses within the sector must begin to consider the solutions confronting supply chain challenges in new and innovative ways designed to work in the world retailers are currently navigating.

Digitisation is central to how these kinds of solutions function, yet before Covid-19, only 15% of US retail businesses had entirely digitised their supply chain management processes, despite 60% of US retailers viewing supply chain digitisation as crucial. However, the acceleration of technology over the past 18 months has presented many opportunities for businesses to integrate these agile and efficient digital systems.

And as a result of the large number of technologies aiming to revolutionise the industry, the supply chain management market is estimated to reach USD 30.91 Billion by 2026.

Current Supply Chain Disruptions and their Emerging Solutions

Today, with supply chain disruptions varying in scope and scale, it is essential that before investments are made, retailers attempt to understand the impact of each problem at every stage of a product’s life cycle to decide upon the best solutions to invest in.

Here we explore the most significant supply chain challenges that retailers are currently and will continue to face alongside the innovative solutions helping to resolve them:

Unpredictable Customer Demands In an article just last month, we looked into the post-pandemic consumer and their unpredictable and ever-changing demands. Whilst uncertainty may be subsiding as the retail sector slowly recovers, consumer experts are still unsure of the long-term impact of the pandemic on customer sentiments. Yet, with retail supply chains hinging upon the fulfilment of customer needs, this uncertainty could cripple a businesses revenue.

AI Forecasting: As AI-driven forecasting begins to mature, many businesses in the retail sector are finding themselves reliant on data-driven foresight to prepare for uncertain customer desires and mitigate the risk of history — as recent as early 2020 — repeating itself.

Shipping Delays

The blockage of a container ship in the Suez Canal in March this year, causing widespread delays worth an estimated $9.6bn of lost trade each day, illustrates how reliant supply chains are on tried and tested operations. Still today, air, sea and land distribution continue to struggle under the weight of these overwhelming market dictations, with retailers running the risk of paying for the storage of products with subsiding customer demand.

Lean Inventory: With no quick fix to shipping backlogs, an increasing number of retailers are broadening where they source their stock from and readdressing how they distribute their goods by exploring lean inventory processes. In this supply chain management method, companies attempt to reduce the waste they generate by lowering the volume of inventory and moving fulfilment closer to demand, ultimately scaling down their shipping needs and shortening lead times from factory to store. Overall, this strategy allows retailers to quickly respond to fluctuations in delivery times, recalibrate their logistics, and reduce the risk of money lost upfront.

Disjointed Workflows

As the nature of employed work becomes increasingly decentralised from offices, retail operations have had to quickly adapt their workflow processes to transfer information and efficiently facilitate teamwork throughout the supply chain. And technology has been a vital foundation for this shift towards the remote yet more connected working styles that have helped entire economies stay afloat over the past year and a half.

Cloud Software: In a recent survey, 83% of business executives say that their businesses now prioritise building and maintaining relationships with existing suppliers, and Cloud software has become integral to the management of these relationships. According to Accenture, “The cloud provides technologies that allow companies to process huge amounts of data—from virtually unlimited sources across the entire supply chain—at speeds and volumes never before possible.”

In practice, more immediate and precise communication between retailers and suppliers can speed up arduous back-and-forth processes such as quality control. Alongside this, the agile nature of the technology allows businesses to create digital continuity throughout entire product life cycles to make agile real-time decisions about goods at every stage.

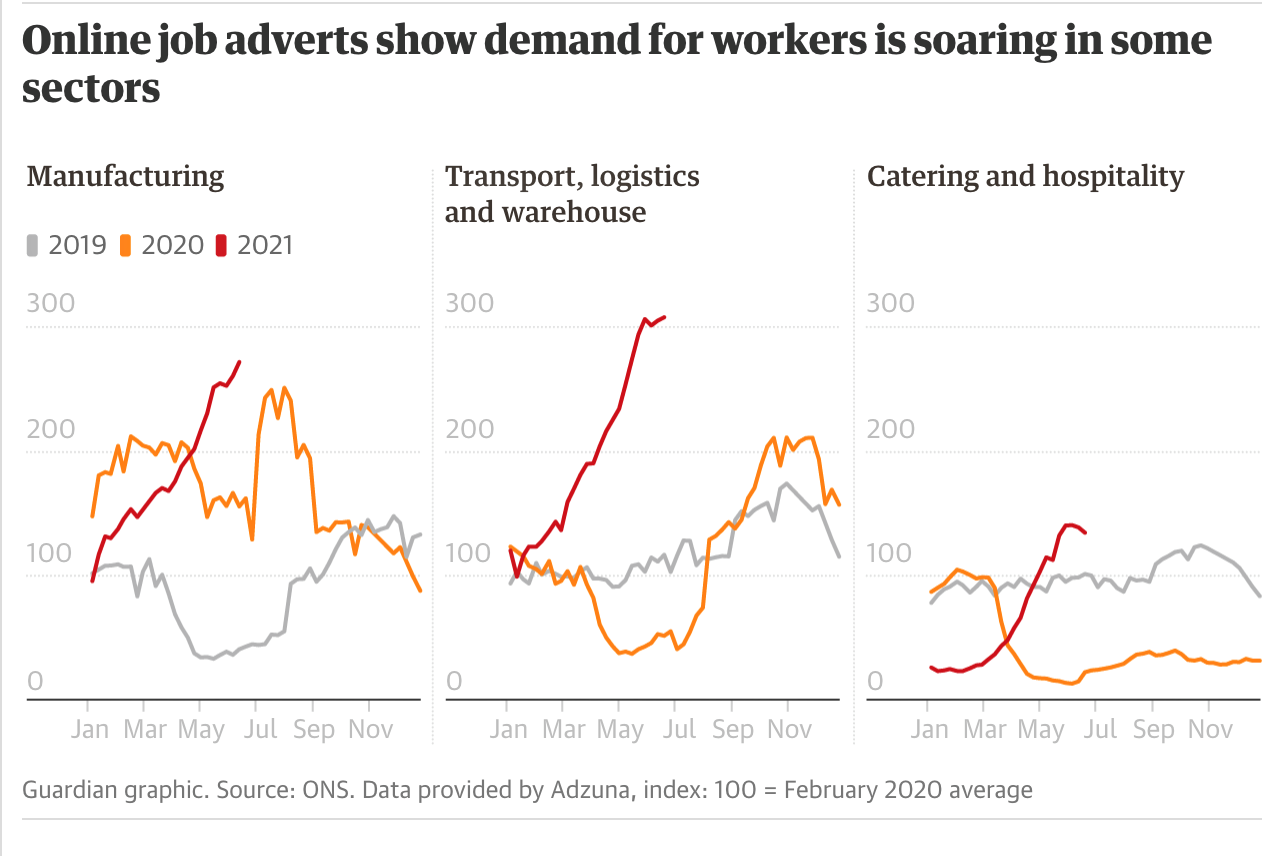

Labour Shortages

The impact of furloughs, redundancies, and under-employment catalysed by the pandemic can still be felt today, as job vacancies continue to rise sharply — particularly in manufacturing and logistics. These workforce gaps have been detrimental to retail recovery, causing insufficiently staffed stores to shutter their doors and order fulfilment schedules to be derailed due to limited warehouse teams. However, these ongoing labour shortages have left retailers scratching their heads — and experts Unhappiness, skills gaps, and at home commitments are all cited as viable explanations.

Employee-First Technology: Providing existing employees — and enticing new staff members — with digital tools that increase job satisfaction and upskill talent is crucial to building back workforce numbers. For example, RFID enabled inventory management software helps employees enhance capabilities to fulfil customer orders whilst reducing the time spent on labour-intensive stock takes and subsequently optimising the daily tasks staff.

Micro-Warehouses: To solve this problem more immediately, micro-warehousing is becoming a popular solution for several reasons. This setup allows retailers to break down their distribution hubs into smaller and easier to operate locations such as brick and mortar stores. Thus, generating opportunities to recruit from more localised communities and creating more manageable workloads whilst providing opportunities to utilise their recently loss-leading physical presence.

Lack of Transparency

Just this month, global fast-fashion retailer and market leader Shein have been accused of ethical violations in the manufacturing and sourcing of their products due to limited transparency within their supply chain. Supply chain transparency has become a growing concern for empowered consumers in recent years as they more readily use their wallets to support businesses whose actions align with their own values. Meanwhile, for retailers, supply chain clarity will help them better to understand every stage and better control their operational costs.

Compliance Technology: Compliance solutions supported by blockchain technology are increasingly helping retailers make opaque internal processes more transparent and prove their commitment to marketed moral values by securely tracking and immediately mapping the regulatory compliance of their manufacturers.

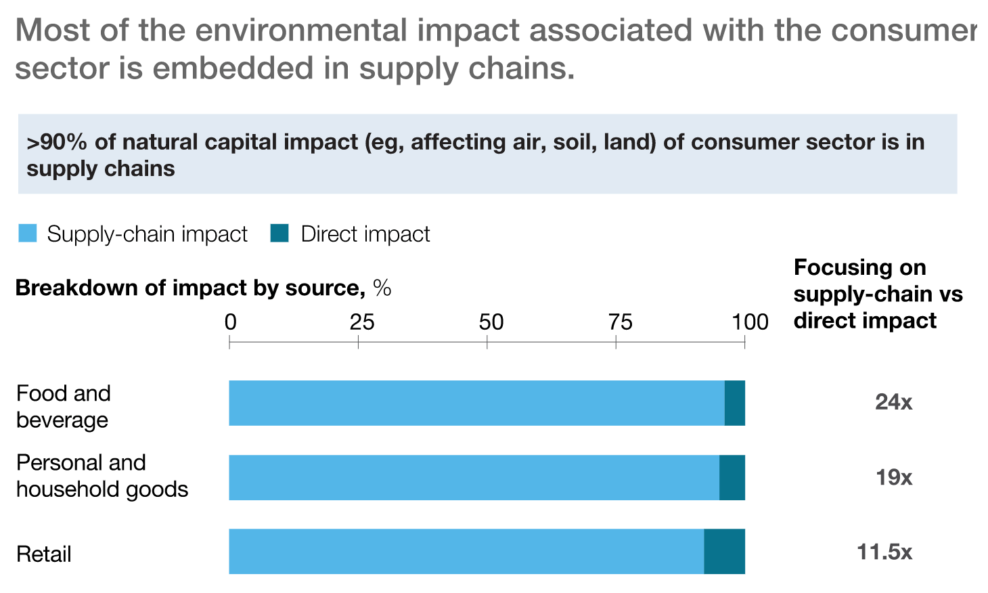

Environmentally Damaging Footprints

According to McKinsey & Company, the typical consumer company’s supply chain creates far greater social and environmental costs than its own operations. This is worrying for both direct and indirect stakeholders such as customers, investors, governments, and activists. And due to the globalisation of retail — as products move back and forth from factories to warehouses to customers across continents — this problem is only growing.

Carbon Footprint Tracking: Recently, carbon footprint tracking has seen a recent uptick in interest due to its ability to quantify the environmental impact of everything from an aeroplane ride to a laundry wash. Therefore, software that calculates CO2 is an interesting solution for helping retailers to understand both the holistic impact of their supply chain whilst at the same time breaking it down to item-level data so they can pinpoint problem areas and make more granular decisions.

Supply Chain Digitisation is Vital, but Where to Start?

At first glance, solutions that reduce risk and enhance responsive decision making are obvious front-runners for retail investment, but considering in context the tangled disruptions retailers are facing, it is the technology that is critical to supply chain innovation.

However, with the vast number of problems retailers face, business leaders must also strategise on how to begin implementing these supply chain solutions and prioritise which problems to approach first. Moreover, due to the complexity of their supply chains, retailers will need to find multifunctional Softwares that are quick to implement and deliver fast results — especially since, in retail, agility was a winning characteristic of market leaders throughout the pandemic.

Here we discuss the three key features retailers should be prioritising when investing in digital supply chain management solutions:

- Multi-Tasking

With supply chain disruptions as deep-rooted and complex as they currently are, management tools that solve multiple problems at once are highly valuable options for retailers of any size. For example, fashion brands New Look, H&M, and Next have just begun piloting an IBM supply chain platform that combines several different technologies such as AI and blockchain to increase transparency and allow the various stages of supply chains to connect and communicate with one another.

- Speed

The continuous volatility and unpredictability of the global landscape makes it vital that supply chain solutions deliver almost immediate results to work alongside the often fleeting context of the market on any given week, day, or even hour. Take inventory software Detego, for example, which uses RFID to provide quick results that are responsive to immediate changes throughout entire operations helping businesses to view inventory levels in real-time and distribute stock globally and locally.

- Ease

In another article earlier this month, we touched upon the importance of employee adoption of technology and discussed the importance of user experiences that help to embed digital solutions into the everyday roles of workforces. It is key that solutions are easy to adopt for a variety of employees at every level. For instance — as previously mentioned — Cloud technology like Oracle helps retailers to generate digital continuity within their workflows by seamlessly transferring data between various stakeholders throughout operations.

The benefit of solutions that tackle multiple challenges with speed and ease is that they are less likely to become obsolete as their capabilities evolve alongside the post-pandemic market and efficiently reduces the number of supply chain evaluations needed every quarter.

Why it’s Important to Investing in Supply Chain Technology Now

As consumer demand for goods continues to move away from predictable seasonal patterns and towards erratic, unpredictable surges, and their loyalty falters, expectations for immediate fulfilment, unparalleled services, and complete transparency are meteorically rising. Meaning a retailers success will depend upon competing to cater to these demands effectively, and honing a frictionless supply chain is vital to achieving this.

So for both retailers on the brink of survival and market leaders, using the upcoming financial year to invest in supply chain management solutions and optimise operational costs is essential.

Yet, luckily for the retail sector, digital supply chain solutions are both growing in diversity and maturing in ability — and it is wise not to take this point in time for granted. Because looking forward, it is clear that rather than waiting for supply chains to snap back to their pre-pandemic states, businesses that accept their volatile new normal and build strategies for the reality of a post-pandemic era will surely be positioning themselves to take disruptions in their stride and stand out in the struggling retail market.

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Book a demo with Detego to find out how RFID inventory management can help your business to tackle multiple supply chain disruptions at once with fast results and easy implementation

It is no exaggeration to say that the past year has been destructive yet transformative for the retail sector. The pandemic caused a considerable dip in the performance of stores worldwide, and now in the wake of – what we hope were – the worst days of Covid-19, recovery is the keyword on everyone’s mind. In the three months since physical stores reopened in the UK, brick and mortar retailers have begun implementing the strategies they meticulously designed when all they could do was watch and wait as e-commerce cannibalised their market share.

Many of these retail strategies were built upon the review of supply chain management, with 70% of Europe’s 30 biggest retailers using Covid-19 as a reason to reevaluate how they’re operated. Yet even now, as sales start to return to pre-pandemic levels — with physical retailers reporting the strongest summer sales in four years — it is clear to see that these strategies are still grappling with how to manage uncertainty.

So, as a result of recent customer demand exceeding expectations, stock is at its lowest level in the entire 38 years of the CBI’s records. Caused by limited inventory visibility — a topic we covered in an article last month — it is a problem that is continuously overlooked in retail, even though its impact reverberates throughout entire business models, and its solution remains relatively simple.

RFID is an easy and practical method of monitoring inventory throughout the entire supply chain, helping retailers respond to market fluctuations navigate the chaos of today’s retail environment. So, could this technology be the answer to brick-and-mortar’s strategic recovery?

Why the Time is Right for Retail’s Digital Maturity

It has been a long time — around 20 years in fact — since RFID was first introduced as a change-making technology to supply chain management. From then on, widespread adoption has been slow yet robust amongst few innovative retailers who understood the need to invest in software providing stock visibility. But now that Covid-19 has accelerated retails digital adoption by at least three years, RFID has experienced a recent uptick in implementation RFID has experienced a recent uptick in implementation, as use cases become as clear as ever before.

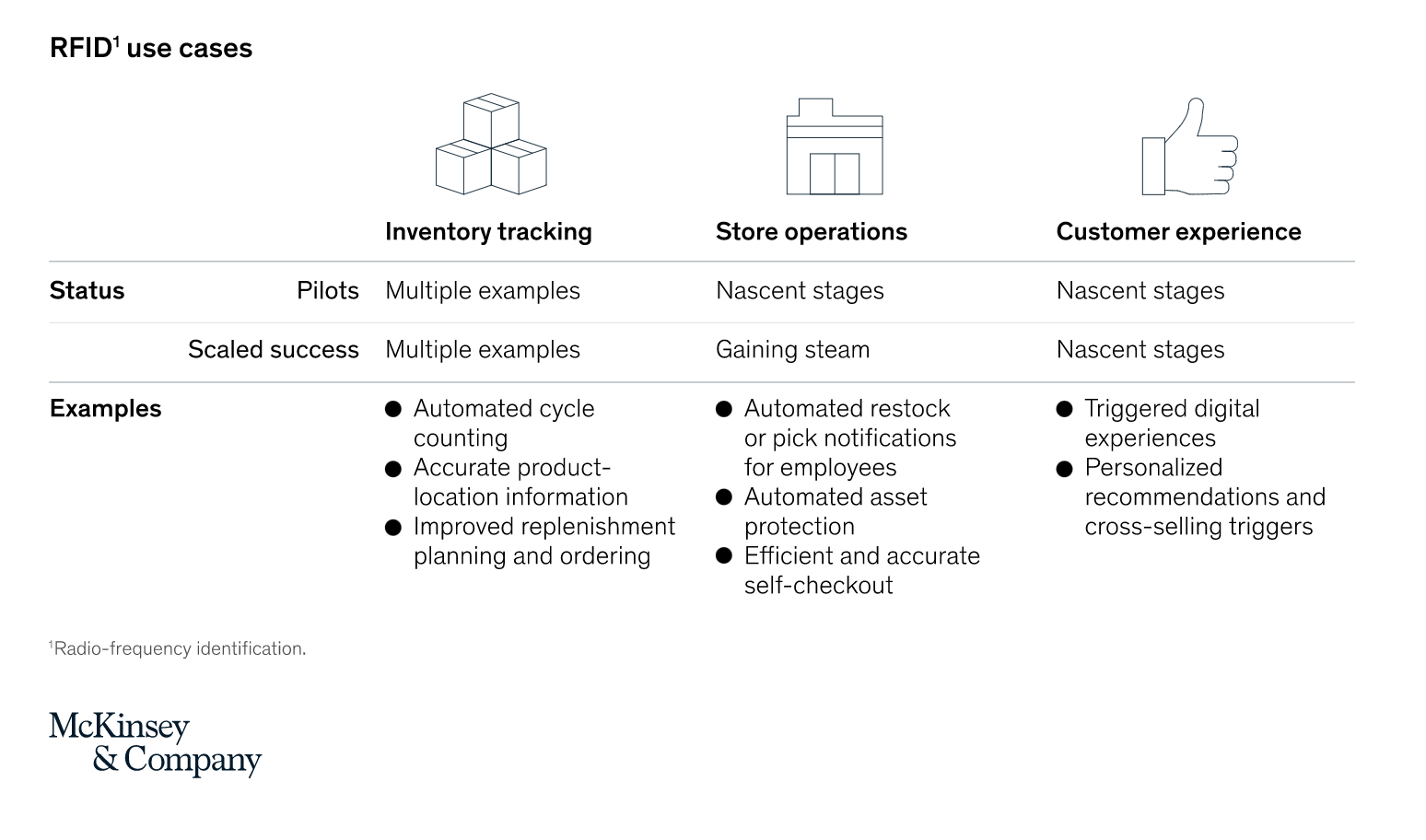

A recent article exploring RFID’s renaissance by McKinsey & Company outlines the current stages these use cases are at with store operations and customer experience only beginning to be explored as solutions. This growing adoption of RFID we see by retailers is comparable to the increased implementation of QR codes, which are currently experiencing a resurgence as COVID-19 heightens demand for digital touchpoints in physical spaces.

The blending of online and offline is one of two fundamental changes to the retail landscape that have ripened RFID for success:

1. Omnichannel Fluidity:

Consumers’ have newfound comfort in moving between digital and physical channels as social restrictions pushed them into online environments over the past year. And as these digitally savvy customers begin to use more omnichannel touchpoints, retailers will need to manage item-level data in real-time to consistently cater to customers as they shift from clicks to bricks.

The second key difference to the retail sector since stores first shut their doors in early 2020 is the ambiguous long, and short-term needs of customers as the context of their everyday lives unpredictably shift on both local and global scales:

2. Uncertain Market Demand

So as the future of the new normal remains blurry, retailers will need to become more responsive to changeable market demands and make sweeping supply chain adjustments to mitigate the risk of wasted inventory in addition to granular decisions to fulfil localised and personalised, item-level needs.

Inventory Visibility Helps Retailers to Anticipate Change and Respond to the Unexpected

The cycle of instantly catering to consumer demands across multiple channels while being powerless to predict them makes RFID all the more compelling as a solution. The technology is being used to increase retailer’s profitability by helping businesses to empower their store processes. RFID efficiently replaces arduous manual stock-takes and regularly updates inventory levels, so stores have a clear real-time view of product location and availability. This not only enhances brick-and-mortar stores as fulfilment centres but allows them to operate accurately across digital and physical channels.

Yet crucially, to mitigate risk, we should not forget that inventory visibility is more than simply viewing stock levels. It also can contextualise inventory information with item-level data – such as size, colour, and price – helping buyers and merchandisers to improve their practices with insights.

The Retailers Already Using Inventory Visibility Software to Strengthen their Post-Pandemic Customer Experiences

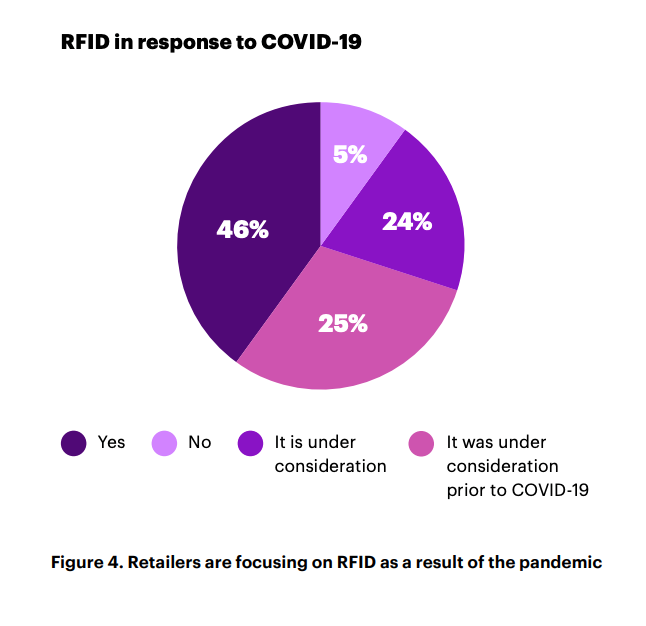

While there are many examples of RFID’s application in industry, recent instances of retailers emboldening their use of the technology to strengthen their post-pandemic strategies are impressive. 46% of respondents to recent Accenture research indicating that they have focused on RFID in response to COVID-19. And although the term inventory software may seem like a dull back-end technology, there are already many new use cases emerging and harnessed by retailers in innovative ways to modernise their offerings.

In-Store Customer Experience

As physical retailers look to win back their market share, the role of stores has needed to evolve with customer demands. For example, research last year by RetailExpo uncovered that 31% of consumers want employees to help with out-of-stocks. And luckily for retailers, store staff are becoming more adept at switching between online and offline more frequently, allowing customer-facing employees to underpin their daily activities with inventory insights such as product availability, reservations and returns.

Mango: Fashion retailer Mango – whose parent company Inditex began to adopt RFID back in 2014 – recently launched a new physical store that combines RFID with deep learning. Generating data, store staff can glean insights using stock performance and availability to enhance their ability to deliver excellent customer service.

Farfetch: Heritage luxury brand Chanel’s collaborative store with Farfetch uses RFID to power consumer-facing services such as changing room mirrors to monitor engagement with inventory and up-sell similar and complementary products. By underpinning the physical shopping experience with data, customers are able to access a level of personalisation often reserved for online commerce.

Omnichannel Continuity

The sudden surge in omnichannel implementation is a topic we discussed in detail in a previous article, and its importance in the current retail environment cannot be underestimated. For the many retailers operating multiple commerce channels throughout the pandemic revisiting their omnichannel capabilities will have been imperative as the purpose of their online and offline environments are no longer siloed.

Reiss: On the unpredictable UK high street, Reiss has managed to stay solid and stable. Achieving a 4% uplift in sales with Detego, the retailer implemented RFID into its stores before the pandemic hit. So now, when purchasing from Reiss’ online store, customers are provided with the option to collect purchases from their brick-and-mortar shops.

Extending Product Life Cycle

We are seeing the emergence of independent resale businesses, and many existing retailers are beginning to consider extending the life of their stock by rolling out buy-back and circularity schemes. Yet, lack of supply chain transparency has for a long time been a growing concern for consumers who demand more ethical and sustainable practices within the sector. So as the industry continues to contemplate the future of products beyond initial consumption, RFID presents itself as a valuable tool for shedding light on an item’s circular journey.

Vestiaire Collective: In collaboration with Alexander McQueen, the luxury resale marketplace Vestiaire Collective uses NFC tags to authenticate its products. This collaboration benefits sellers and buyers by helping owners find value in their wardrobes and reassures consumers of the validity of their products.

eBay: Similarly, the online marketplace eBay uses NFC technology to help users verify the authenticity of purchases of luxury handbags. This is a somewhat important milestone for businesses that want to emphasise their reliability when working with designer goods.

For many retailers, Covid-19 has awakened then to the risks of merely dabbling with technological innovation — rather than fully immersing themselves in it — and brought to light the blind spots within their supply chains that previously flew under the radar. But there is no one size fits all when it comes to technology, and these retailers have expertly harnessed inventory software to their individual requirements, carving out spaces for the technology to fulfil specific objectives within their operations.

Building RFID into Retail Supply Chain’s is as Easy as Ever Before

One of the common myths about RFID is the apparent steep costs of its integration. But in reality, using the technology is becoming increasingly cost-effective as retailers see an ROI of more than 10% whilst the price of RFID components such as readers and tags drop. And as technology matures, RFID is more precise than ever. As a result, most businesses see a boost to accuracy rates in stock, helping store staff make better use of their time carrying out customer fulfilment instead of stock-takes.

Additionally, where complete RFID integration into supply chains was a complex operation with many moving parts, its currently high global adoption within many continents will make coordinating far-reaching stock journeys easier and agile.

RFID and the Future of Brick-and-Mortar Innovation

There are so few technologies that have the opportunity to impact the everyday experiences of so many store stakeholders — from customers and sales assistants to buyers and merchandisers, all the way through to manufacturers — and RFID is one of them.

As the post-pandemic consumer emerges expecting complete omnichannel continuity to attain their trust and loyalty, inventory visibility could be the key to future-proofing any retail business in both online and offline environments. And retailers now know the importance that understanding their operations in detailed real-time plays in managing the flow of goods with more control and agility.

So although we can all agree that the technology is nothing new, RFID should not be ignored as the answer to unique challenges retailers face today and the essential tool for building dynamic in-store solutions for the future

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Detego Store is a cloud-hosted RFID solution which digitises stock management processes, making them more efficient and more accurate. Implemented within hours, our multi-user app can provide intelligent stock takes and a smart in-store replenishment process. Later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

The retail industry is changing fast. Customer preferences are changing, the balance of power between online and offline shopping is shifting, and as a result, operations and business models are becoming more complex than ever before. While these changes have been ongoing for some years, the pandemic has accelerated the shift and left retailers with no margin for error.

In a rapidly changing landscape, many retailers have done well to pivot effectively. However, with the pandemic and digital disruption ramping up most are unprepared in terms of supporting technology to ensure these new strategies are profitable long-term.

Chief among these is the lack of reliable product visibility that many retailers struggle with. For brands introducing new operating models, reopening stores after lockdowns, and selling to customers in more ways than before (like Omnichannel) not having a reliable view of products can severely hamper the profitability and effectiveness of such services.

What is inventory visibility?

Visibility in retail refers to a brand’s ability to see and track its merchandise across stores and supply chains. Simple enough in theory, but actually achieving and maintaining this is far more complicated.

Accurately tracking products is the first hurdle where many retailers stumble. For stores, it comes down to being able to perform regular stocktakes, several times a week rather than several times a year. With ‘standard’ technology like barcode scanners, this is simply impossible, even with a world-class ERP system tracking what’s officially coming in and out. Without physically validating what is in a store, the accuracy levels will quickly drop to around 70% due to factors like operational errors, stock counting inaccuracies and theft.

In the supply chain, on the other hand, it’s not a case of an inaccurate view of stock, but often no real visibility at all. Retail supply chains often only track ‘cartons’ (or boxes) throughout the item journey, since counting the contents of each item again is either impossible or entirely too time-consuming. This means most supply chains run on what should be present in each carton and shipment, but mispacks and theft are all too common.

The other reason many retailers don’t have real visibility over their products is that their IT and inventory management systems only work on an SKU level and not an item-level. For a full breakdown on what this means, read this article.

So, what is this lack of visibility costing retailers?

Everyday, stores lose sales due to poor product visibility

The industry is much more focused on achieving product visibility now due to the Omnichannel surge but there is a more immediate issue that costs the industry £369 billion a year globally: poor product availability. Most people will be very familiar with the experience of products being unavailable in the size/colour they’re looking for, or out-of-stock entirely. In fact, more than most – a survey done in 2019 found that 90% of shoppers had recently at the time (the last 6 months) chosen to leave a store and not make a purchase due to an item being out-of-stock! This problem is caused by low inventory accuracy and subsequently subpar stock replenishment.

If staff don’t have an accurate view of what’s on their shop floors through their IT system, they have no way of consistently ensuring that products are ready to purchase in-store. Many retailers have implemented RFID technology to improve this on floor availability in recent years – driving sales through more accurate inventories and regular replenishment from the backroom.

Product visibility in non-negotiable for retailers embracing omnichannel

We’ve covered it in detail in another article, but after years of flirting with the concept, the pandemic has forced the retail industry to really commit and invest in the omnichannel experience. Services like click-and-collect and ship-from-store have become invaluable in recent times, offering flexibility that works for both customers and retailers alike.

As these services have become more common in the wider industry and more consumers than ever were using services like click-and-collect/curbside last year due to the pandemic, the demand for an omnichannel experience will only increase. Retailers are recognising this and scrambling to adjust, in a recent survey from the Retail Industry Leaders Association (RILA) the number one imperative for the industry was to ‘become omnipotent on omnichannel.’

To make Omnichannel really profitable requires investment. Brands that try and offer services like click-and-collect without the required visibility will find themselves constrained. Either they offer a limited service (relying on safety stock and only selling items they have in surplus) or they offer an unreliable one – routinely cancelling omnichannel orders when they discover items reserved for pickup or delivery are not actually in stock.

Retailers that offer effective and profitable omnichannel services have a real-time digital view of their stock across all channels. To make this work those inventories run on item-level data so that their IT systems can handle items being reserved, shipped-from-store or returned-to-store throughout the day, whilst maintaining a 360’ view of merchandise.

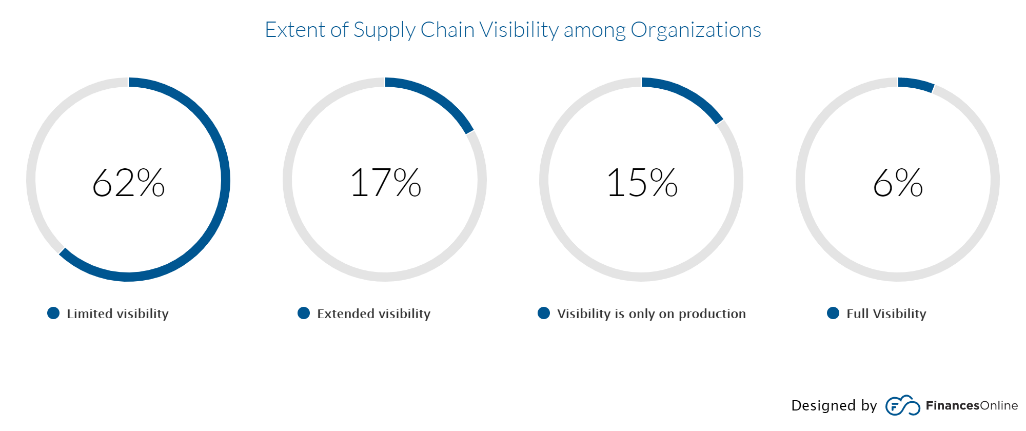

Brands are still working towards gaining visibility over their supply chains

Supply chain visibility is a growing concern for retailers. As supply chains have scaled and become global, issues like inaccuracy, shrinkage and bloated inventories across DCs and stores compound and can become million-dollar issues. For example, UK retailers alone are experiencing annual losses totalling £11 billion due to shrinkage.

Knowing exactly what is passing through each stage of the supply chain is a challenge. With traditional logistic methods working on a carton level and SKU level, retailers struggle to pinpoint where mistakes or shrinkage are occurring. For store networks, this results in stores carrying more products than they need, in the form of both safety stock and ‘phantom stock’ (products that the retailer does not even know about).

This has been something retailers have been aiming towards for some time, in a report by Zebra Technologies in 2017, 72% of retailers said they were working on digitising their supply chains in order to achieve real-time visibility. Fast-forward to 2021 and while progress has been made, there is still work to be done. Brands need to invest in technologies like RFID to be able to track individual products throughout every step of the supply chain.

Not only do these digitised operations reduce the number of shipping mistakes, but the granular data that they work with allows brands to optimise their supply chains to levels simply not possible before such digital transformation.

As new retail models develop – the need for visibility is only going to increase

Retail is going through a period of unprecedented change. We have referenced supply chains and operations growing increasingly complex for retailers in recent years and that is only going to continue in the future. Not only will omnichannel experiences continue to grow and develop, but new models are beginning to emerge that will test brands’ agility and require an item-level view of products.

The key driver for the majority of these new models is sustainability. The push for greener fashion retail experiences, in particular, is still in the early stages but picking up traction rapidly.

Burgeoning new sustainable models like rental, recommerce and the circular economy promise a far eco-friendlier experience than fast fashion. These models will have their challenges however, rather than the one-way traffic of typical retail models, these methods will require a lot of reverse logistics. It’s vital not only that brands can handle this 360’ flow of merchandise, but with rental and second-hand items, in particular, item-level data is vital as products will all be unique.

As visibility becomes a priority, it’s no coincidence RIFD uptake is booming

So, if product visibility is an issue across the retail industry, what are brands doing about it?

Since visibility has become a key issue in the last few years, more and more retailers have begun implementing RFID technology to track and manage products across their businesses, on an item-level, at 99% accuracy and even in real-time.

RFID ticks several boxes that are key to achieving such visibility. First and foremost, it digitises products and processes in DCs and stores, creating a digital record of all items. It also works on an item-level, so is able to distinguish between two products of the same SKU. Finally, RFID processes are efficient enough to be done throughout the supply chain, on a daily basis including inbound and outbound checks as well as daily stocktakes for stores. This means retailers leveraging RFID have a 360’ view of item movement from source-to-store, with granular item-level data that works on a global scale.

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Detego Store is a cloud-hosted RFID solution which digitises stock management processes, making them more efficient and more accurate. Implemented within hours, our multi-user app can provide intelligent stock takes and a smart in-store replenishment process. Later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

It is no exaggeration to say that retail has changed like never before.

For some time, operations have been growing increasingly more complex, and shoppers increasingly more discerning. Now that evolution has been accelerated. Retailers must be flexible in meeting consumer demands in the face of a rapidly changing retail landscape if they hope to succeed.

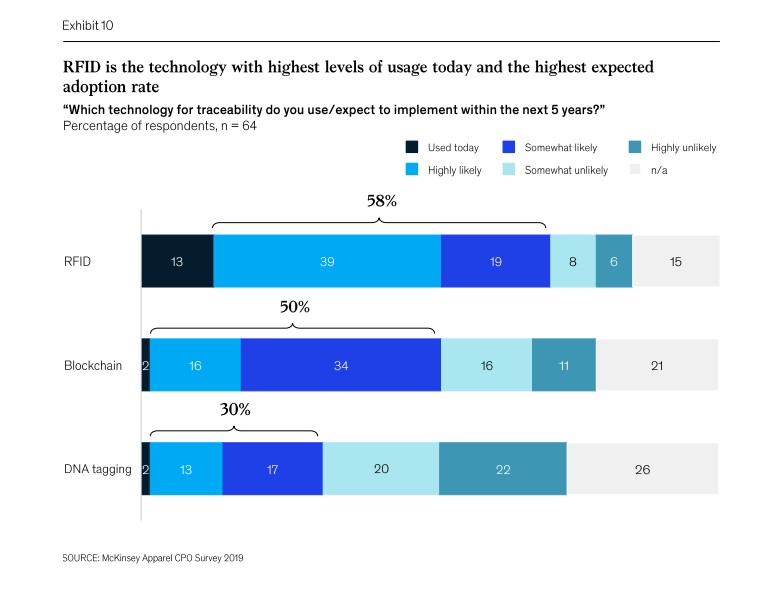

As the industry recovers, retailers pursuing digital transformation in order to optimize operations, expand omnichannel fulfilment, and enable data-driven decisions are poised to lead the way. One of the foundational technologies providing insight to drive digital transformation? RFID.

It’s been around for a long time, but Radio Frequency Identification technology (RFID to you and me) is picking up momentum in the retail space. Both Forbes and McKinsey & Company have published recent articles on how the technology is becoming key for retailers, with the latter even describing ‘RFID’s renaissance’ within the industry.

While this does show a shift in the sector, a renaissance implies that the technology is making ‘ a comeback of some kind. This is not quite accurate, as the business case for RFID has been steadily growing in retail over the years, but we are approaching a new stage of its lifecycle in the industry. This is a natural cycle for most new and transformative technologies, but the effect of the pandemic on retail has accelerated this. Not only are many brands on thin ice in the aftermath, but one of the key reasons for implementing RFID, delivering an Omnichannel strategy, has evolved from ‘beneficial’ to almost ‘non-negotiable’ since last year.

Let’s explore where RFID has come and more importantly, how it has become one of the single most important operational technologies to retailers in recent years.

RFID and the Technology Curve

While RFID was invented in the 1940s, it wasn’t until this century it began being used as a business tool. In retail, it has existed for almost 20 years, but its initial cost, technical limitations and fewer established use cases all meant most companies (wisely) didn’t see the value in it initially.

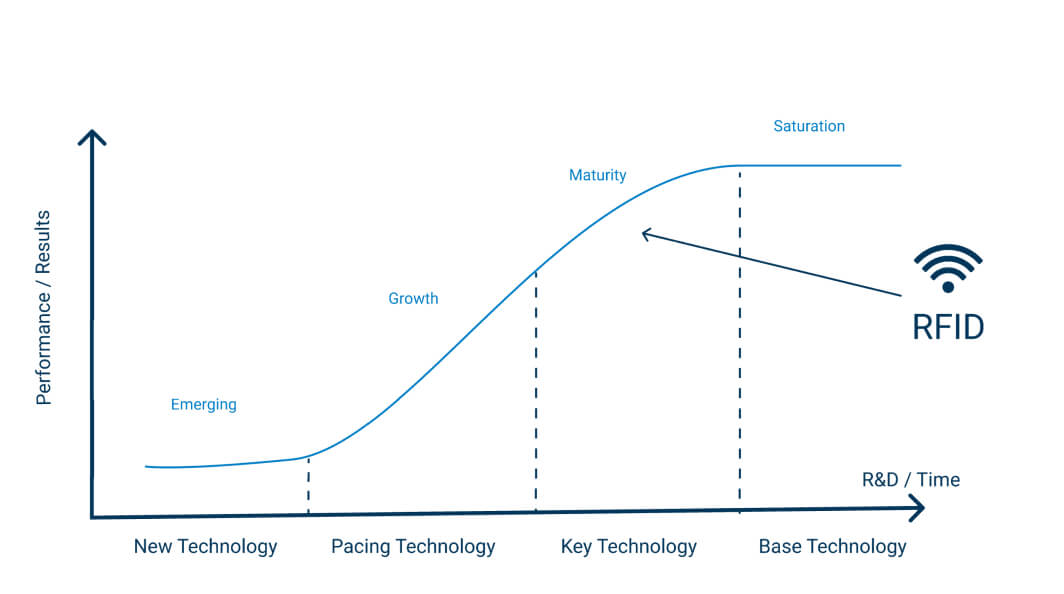

This is common for new technology and over time RFID has matured with more research & development as well as more deployments in live retail environments. This has meant the performance of the technology improved and the return on investment for retailers increased. This is known as a technology S curve (seen below). Over the last ten years, RFID use in retail has experienced this curve with the adoption levels and value for retailers increasing year on year.

Fast-forward to the present day and RFID is at a maturity stage, and we predict that over the next five years will become a ‘base technology’, in apparel and sports retail at the very least. This increase is a result of both the technology maturing over time and the industry evolving as a whole – things like digital disruption, the growth of Omnichannel and the pandemic accelerating certain shifts within the industry have meant the need for RFID has increased greatly.

How has RFID evolved?

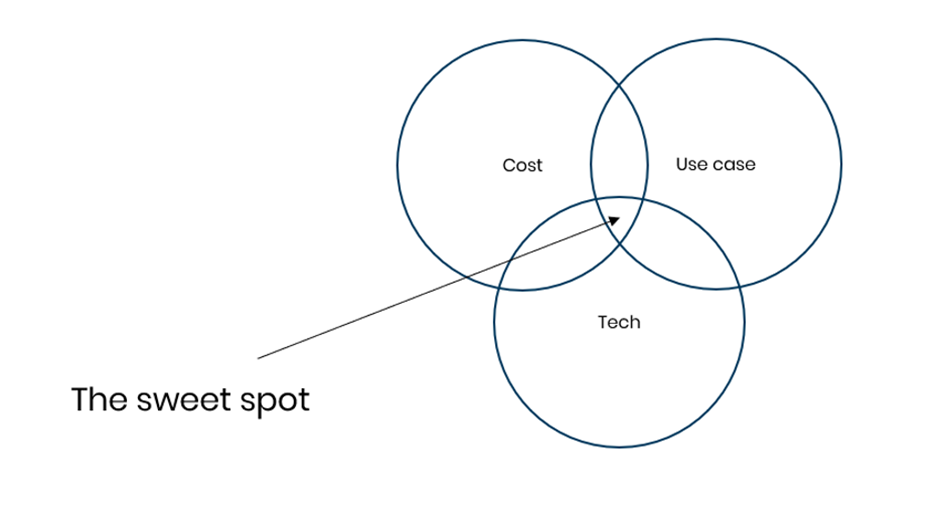

For a technology to take off in business (i.e., for it to have a business case) several factors need to be met. The technology needs to be cost-effective, reliable/easy enough to implement and use and most importantly it needs to have enough valuable applications to make it worth doing in the first place.

Early-stage technologies may have one or two of these down, but to really take off and become saturated within an industry it needs to be in this sweet spot of covering all three. So, how do these requirements stack up for RFID?

Cost

Like any technology, Radio Frequency Identification was expensive when it first came out. Over time as more R&D was done and more providers entered the space, the price has steadily gone down.

The biggest factor in this was the drop in the cost of RFID tags themselves. At the start of the century, a single RFID tag could cost as much as $0.75/£0.50 but in the current market, they can be sourced for as low as $0.04/£0.06. This not only makes for much better margins for any retailer looking at the technology, but it opened up whole new industries or sectors whose lower product prices points originally made RFID unfeasible.

Tech

The technology behind RFID has also developed beyond just price point. RFID hardware has improved in terms of reliability and read distance. Tags on the other hand have become smaller and more advanced so that metal and liquid products no longer interfere with the signal – both of these improvements means a far broader range of merchandise can be tagged. This is particularly relevant for categories like food or cosmetics. Finally, the software has also evolved, with more advanced functionalities like tag localisation, Smart Shielding, and global track-and-trace.

Use case

One of the greatest strengths of RFID has always been its wide range of uses and applications. This can at times be a double-edged sword, as companies may not know where to start, may deploy use cases in a sub-optimal order or may chase all use cases at once.

Thankfully, most RFID providers and experts know that a phased approach prioritising KPIs like stock accuracy is vital to both achieving ROI and laying the foundation for more advanced use cases like enabling omnichannel. Provided the project is scaled in the right way, the uses of the technology are broad and include supply chain visibility and traceability, real-time data applications like automated planograms as well as consumer-facing use cases like smart-fitting rooms.

How Retail is Evolving: Why is RFID Becoming Key?

Most of these major changes in RFID retail technology itself occurred several years – the business case has been solid for the last five years at least. This is why many major retailers like adidas, Levi’s, Nike and Target to name a few already have high levels of RFID integration. But in the industry as a whole this is ramping up but why?

Naturally change often happens on a curve, with more cautious brands hesitant to change until they see positive results from other companies who take the ‘risk’. On top of this, however, the market and consumer is changing fast and the digitised accuracy and visibility that RFID provides are becoming non-negotiables for most retailers.

The need to optimise profits/costs

Any business wants to optimise their costs and maximise their profits – it’s not rocket science. But the best ways to do that can often be unclear, and sometimes if it requires some upfront investment or new technology brands may decide that now is not the time. For retailers, the store model and brick-and-mortar economics have been gradually changing over time. As the balance between online and offline channels continues to shift, some stores may become unprofitable if nothing is done.

That is where so many retailers get upfront value from RFID. Implementing the technology in stores increases sales (from reducing out-of-stocks) and reduces running costs (from smaller inventories & increased operational efficiency). Lean stores optimised to such levels may be a necessity in the future with stores playing a less crucial role than five years ago.

Increasing Omnichannel and digital integration

Omnichannel has been a growing force in retail for the last five years. Many retailers bet on omnichannel early, investing in the technology to digitally integrate their stores and supply chains with their online channels, and have profited as a result.

To succeed in omnichannel investment is required, as services like click-and-collect or store-fulfilment need a real-time digital view of store stock if they are going to work effectively. RFID is the perfect solution to these omnichannel challenges, and it’s no coincidence that as Omnichannel has become more common amongst retailers, RFID has as well.

This will be the single biggest factor for RFIDs growth in the next few years. While Omnichannel was once more of an optional strategy since the pandemic and ever-increasing digital shopping channels – it is becoming non-negotiable. This isn’t just us saying so, retailers themselves have recognised this, in a recent survey from the Retail Industry Leaders Association (RILA) the number one imperative for the industry was to ‘become omnipotent on omnichannel.’

Pandemic accelerating the need for digital transformation

While the need for digital transformation to optimise costs, integrate channels and improve operational visibility has been increasing in recent years, the COVID-19 pandemic has accelerated this. We’ve covered the effects of the Pandemic in detail over the last year, and many of the mid to long-term effects will push more retailers to RFID adoption.

The changes we have just covered, optimising profits and offering an omnichannel experience, were (or should have been) priorities before, but in the aftermath of the pandemic, they will be the difference makers.

Stores, on the whole, are not going anywhere but they will have to adapt to post-pandemic retail – meaning potentially lower in-store sales and a higher proportion of digital and omnichannel activities. The challenge for retailers is trying to adapt to a changing environment while also financially recovering from the peak of pandemic and lockdowns.

For brands that haven’t started their RFID journey the timing is awkward and yet they may not be able to afford to wait too much longer. While Omnichannel services will be the long-term play, smart retailers will look to use RFID to optimise their profits as soon as possible, securing a return of investment and setting themselves up to profit long-term.

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Detego Store is a cloud-hosted RFID solution which digitises stock management processes, making them more efficient and more accurate. Implemented within hours, our multi-user app can provide intelligent stock takes and a smart in-store replenishment process. Later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

Beauty retail is an industry at a crossroads. A sector resilient to crisis and change compared to other retail categories, cosmetic brands are beginning to feel the effects of the pandemic and ongoing industry changes.

In recent years, apparel and sports retailers have undergone digital transformations to stay competitive, and now beauty brands have an opportunity to follow suit. Read this eBook to discover how and why beauty retailing is set to transform into the industry of the future.

Beauty retail: An industry at a Crossroads

The apparel and sports retail industry have undergone mass change over recent years. Such retailers have undertaken digital transformation journeys in their store and distribution networks to adapt to digital-first customers and eCommerce competition. The beauty sector, however, is still behind the curve.

In most major beauty-industry markets, in-store shopping accounted for up to 85 per cent of beauty product purchases before the COVID-19 crisis – (McKinsey&Co) making the level of eCommerce penetration lower than in other retail sectors. While retailers in other categories have been forced to innovate and adapt in the face of falling brick-and-mortar sales, competition from eCommerce and direct-to-consumer models, brick-and-mortar beauty sales were more resilient.

But this is changing. Not only are eCommerce levels steadily increasing year-on-year, but the COVID-19 pandemic has accelerated this drastically, driving five years of change in a single year, according to

IBM. This leaves brick-and-mortar beauty retailers on unsteady ground. Beyond this, brands will have to navigate a more digital-centric environment and optimise margins to cope with reduced sales.

The good news is many of the challenges that are now facing beauty have been facing apparel or CPG for years. The digital solutions and strategies that have allowed apparel to adapt are well established and ready to deploy to the sector. The digital transformations that many apparel and sports retailers were forced to undergo will not only fit beauty retailers but will also help them solve older challenges. Beauty retailers may need to go on a similar journey to apparel, but the tracks are there to follow.

What is in the eBook?

- Beauty retailing at a crossroads

- Bringing beauty operations up-to-speed

- Accuracy redefining margins

- Fixing beauty’s shrinkage problem

- Catching up with the omnichannel trend

- Countering the Gray Market

- Becoming digital and analytics leaders

Radiofrequency identification (RFID) is one of the leading technologies in retail, helping brands transform their business while maximizing revenue. With COVID-19 accelerating the digitization of retail and meaning stores need to be as profitable as possible to survive, RFID is a must.

Register now and learn from some of the best in the industry: Detego, and the experts in retail IT integrations, Spencer technologies.

Main Takeaways:

- Why are Retailers implementing RFID?

- Common challenges for Retailers and how to tackle them

- How to select partners (Hardware, Software, Services)

- What do you need to run a pilot?

Meet the Speakers:

Lauren Hines – Lauren is a Senior Business Operations Manager. She’s a former Head of Global Networks at BT.

Umesh Cooduvalli – Umesh is a tech-driven VP of Sales for America. He’s using his extensive network within the Supply chain industry with a hunger for new challenges

Nate Strickler – Formely project and Marketing Manager, Nate is currently working closely with partners and network to develop opportunities with Spencer Technologies.

If you’re always reading about item-level data or item-level inventories but aren’t sure what all the fuss is about, we’re here to explain. It’s not just another retail tech buzzword, it tells the story of an industry transforming, the first step in a global shift from analogue to digital retailing (and we aren’t just talking about Ecommerce here).

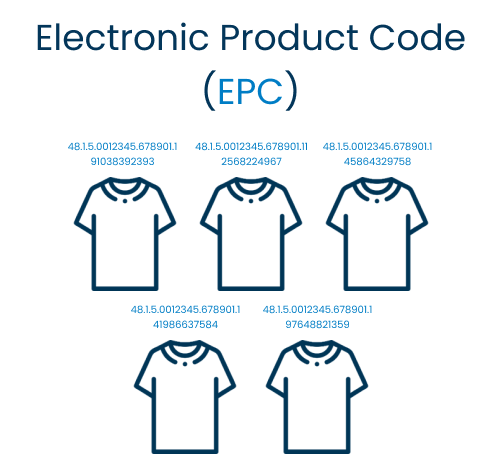

When a retailer’s IT systems work on an item-level, they can identify, count, track and trace each individual product. While it sounds simple enough, in theory, it’s harder to do in practice and has only recently been made possible by new technology like RFID.

The benefits are huge, and while we will explore them in more detail, they include running leaner and more efficient stores, stronger supply chains and powerful data and insights.

Before we do that, lets briefly cover the current (or old, arguably) alternative to this: a stock keeping unit or (SKU).

What is a stock keeping unit?

A Stock Keeping Unit uses a basic code that specifies the identity of a product – for example, a plain white t-shirt, size L.

One of the main differences here is that an SKU can (and should be) logged and counted multiple times, for example, if you are counting those 10 white t-shirts, you are counting the same SKU 10 times.

Barcodes tend to operate on SKU’s, and you can scan the same barcode over and over.

- Specifies the product type and size

- Is counted multiple times

What does item-level data mean?

For retailers, working on an item-level simply means treating each item as a unique, identifiable piece of merchandise.

On the technical side, that means each item must have a unique code – called an Electronic Product Code (EPC).

Effectively, item-level data means being able to tell the difference between 10 medium white t-shirts. With EPCs, you could replace one of those 10 with another of the same item and be able to identify the new one from its unique code.

This might seem arbitrary, but it is one of the key drivers of transformation and change in the way retailers manage their stores and supply chains in recent years. Removing the human error element is one thing, but the unique ID’s open the door to much more.

These unique product codes are what makes RFID possible, as hundreds of radio signals can be emitted and read at once. Since each item has a unique ID there is never any risk of counting something twice. This means its possible to do store stocktakes in a matter of minutes, and verify items going through the supply chain without even opening up the box!

Additionally, the item-level data makes the world of difference when it comes to the supply chain.

If you were to track items on an SKU level within the supply chain, it would only tell you how much of each product passes through. Even this is too time-consuming, however, as it would require opening boxes and scanning individual bar codes, so instead DC’s and factories scan boxes, and operate on a carton level.

With item-level verification inbound and outbound at DCs, the individual contents can be counted and checked (via radiofrequency). These unique product IDs mean another whole layer of data, individual items can be tracked and traced from source to store.

- Can’t count items more than once

- Makes rapid inventory counts possible

- Individual product codes mean you can track and trace items across the supply chain

- More accurate data across the supply chain

The benefits of item-level retailing

The Detego Platform – Delivering item-level data to retail

The Detego platform is the definitive solution for delivering and utilising item-level data for retailers. The RFID platform covers every step of the item journey, from factories to distribution centres, to stores. Track and trace individual products across the supply chain, perform store stocktakes in minutes and take the guesswork out of retail. If you’re a retailer with several or even hundreds of stores, the Detego platform is purpose-built to get the most out of your stores and supply chain.

Cloud-hosted RFID software

Stock accuracy, on-floor availability, and omnichannel applications in stores.

Detego Store is a cloud-hosted RFID solution which digitises stock management processes, making them more efficient and more accurate. Implemented within hours, our multi-user app can provide intelligent stock takes and a smart in-store replenishment process. Later, you can scale the solution to offer omnichannel services and effectively manage your entire store operations with real-time, item-level inventory visibility and analytics.

It’s time to close the curtain on what’s been a challenging year for all. Retail has been under immense pressure this year, but through perseverance, partnership and innovation, we are beginning to come out of the other side.

While it might be tempting to move on from this year and not look back, we feel it’s important to look back and take stock of the biggest developments and stories of the year, good and bad.

Let’s explore the major themes of the year for retail, and revisit some of the content and updates that have told the story of 2020.

COVID-19: Charting a Course Through Unprecedented Times

COVID-19 was the defining event of 2020. The pandemic was devasting to people, communities and businesses. Our day-to-day was transformed overnight, with life and work becoming remote-first and priorities and plans being rethought and reassessed. For retail, with stores being closed, many people under financial pressure and working from home, revenue dropped massively. Not only this but COVID-19 will have a lasting effect on the industry, with experts predicting it accelerated industry change by five years.

Looking Ahead to 2021

But what about looking ahead to next year? Keeping an eye on upcoming trends is always important, this year even more so. While it’s comforting to think that the pandemic will be a thing of the past next year, the reality is it will remain a factor. More significant will be the ‘hangover’ of the post-pandemic, which will have huge implications on the industry and its priorities for the coming year. We explored what these priorities and subsequent trends will be in a recent series:

The Ongoing Digitial Transformation of Retail

We have been calling for, and leading the way in, digital transformation in retail for over ten years, and this year has been no different. Now more than ever, retailers need to innovate and improve their systems and processes to keep up with modern retailing. The benefits that digital transformation can deliver such as reduced costs, increased sales and better online/offline integration will be vital for retailers in the wake of the pandemic and beyond. Retail digital transformation is what Detego does, and this year we’ve been discussing this in more ways than ever before. Whether you’re still discovering why, or need to learn how, we have resources to help you get started.

Building the Supply Chain of the Future

We’ve been innovating and supporting retail stores for over 10 years with RFID. Alongside our customers and partners, we have increasingly been moving upstream and digitising and future-proofing the supply chain. This year, with the focus being on eCommerce and online shopping, supply chain innovation has been front and centre. RFID in the supply chain is an exciting topic and the results and developments from deploying RFID in factories and distribution centres are impressive. Whether its achieving complete supply chain visibility, optimising against shrinkage or building automated DC’s fit for the future, the technology has a lot to offer. Explore it here:

Building Partnerships

This year more than ever, building strong partnerships has been essential. At Detego, we have always prided ourselves on building good relationships and effective collaboration. This year, we have continued working alongside our amazing customers and clients and have even developed new ones to strengthen projects and products in the future.